This dissertation assesses the impact of a mixed capital structure model on the valuation of early stage technology companies (ESTCs). The model results show that a company's valuation is related to its capital structure, and the case study provides a valuation of Fitbit's equity in line with its market value. Keywords: early stage companies; Real Options Analysis (ROA); Structural model; Arithmetic Brownian Motion (ABM); Analysis of investment projects; Capital structure.

A tese examina o impacto da estrutura de capital mista na avaliação de empresas de tecnologia em estágio inicial (ETFIA). O modelo é desenvolvido assumindo uma estrutura de capital estática que limita a emissão de dívida a uma fase. Palavras-chave: Empresas em fase inicial de operação; Análise de Opções Reais (AOR); Modelos estruturais; Movimento Browniano Aritmético; Análise de projetos de investimento; Estrutura Capital.

Acronyms List

Introduction

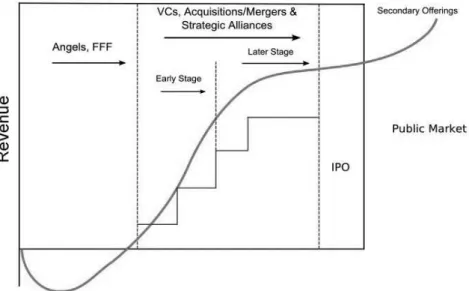

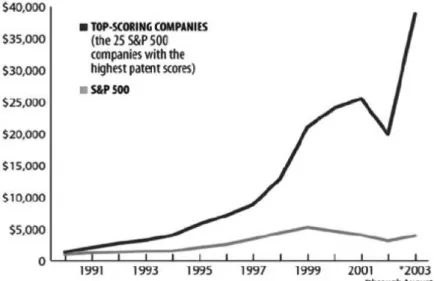

The capital markets and financial system evolved in tandem with this profound transformation in the nature of corporate assets and structures. The increasing dependence on intangible assets, which is particularly relevant in high-tech companies, creates a lag effect between the development of those assets and the integration of their value into the valuation of the companies. With this work, the author expects to contribute to the literature related to the research on the valuation of ESTCs.

Instead of developing a dedicated IP valuation method, the model to be developed and tested in this work values the company in relation to the growth of its cash flows, specifically earnings before interest and taxes (EBIT). Real options analysis also provides features suitable for the study of ESTCs including volatility in the model, which reflects the inherent uncertainty of the underlying assets in the valuation results. For the field of study of Structural Analysis of Real Options, a case study will add to the available literature with special properties that, within the scope of the author's knowledge behind the research, have not yet been explored, particularly the application of a structural model to a ESTC. .

Problem Definition

Literature Review

The asset's value is what other market participants thought it was. The method assumes that the value of IP is determined as the royalty that other companies would pay to use it. This right can be exercised at any time, up to the expiration date of the option.

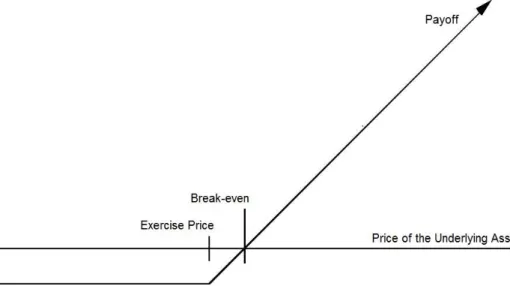

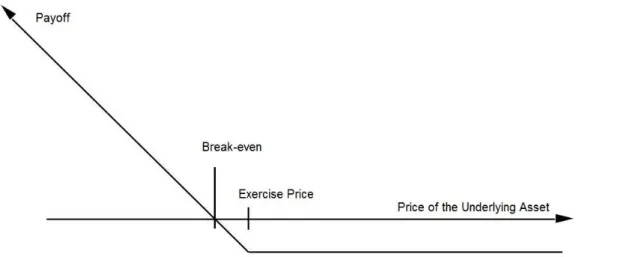

The option is only exercised if, at expiration, the value of the asset is higher than the exercise price. Otherwise, it expires and the buyer of the option loses the price paid for it. Consequently, the exercise of the option depends on the price of the underlying asset falling below the strike price.

Variance in the value of the underlying asset – Since variance is a measure of risk, and usually has an inverse effect on valuation, this does not happen with options. Although counterintuitive, both call and put options increase their value with an increase in the variance in the value of the underlying asset. Dividends paid on the underlying asset – this is a derivation of the effect on the value of the underlying asset.

With call options, the value of the call will decrease as the exercise price increases. Time to expiry – the effect is similar to what was said about the deviation in the value of the underlying asset. Second, the risk-free rate participates in the valuation of the option in the calculation of the present value of the exercise price.

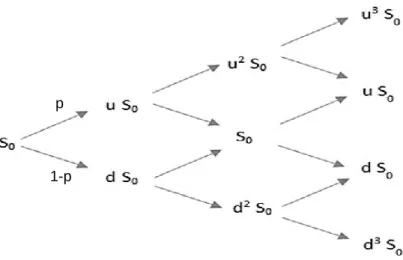

A positive variation in the risk-free rate results from an increase in the value of a call option and a decrease in the value of a put option. The Binomial Option Pricing Model (BOPM) follows a simple formulation for pricing an asset. The value of the option comes from the ability to generate increased returns enabled by the strategic action associated with it.

Methodology

The maximization of the value of the company is achieved due to the tax benefit to debt, this makes it possible to calculate an optimal capital structure for the company in the circumstances of the valuation model. The value of the company is considered the present value of the claims on equity, net of taxes and closing costs, in the unlevered case and up to the sum of equity and debt in the leveraged company. Two further modifications must be made before the differential equation is reached which describes any claim on the EBIT of the firm, and for which a closed form solution can be found.

At this point it is already clear that to maintain economic relevance at all times 𝐴2 must be equal to 0, otherwise the value of the claim would grow exponentially with cash flows (Ammann and Genser, 2004). A proper examination of the boundary conditions suffices to solve for all remaining unknowns. To achieve this, the distributed cash flows must equal the EBIT value, or: 𝑚𝑥 + 𝑘 = 𝑥, which is true if 𝑚 = 1 and 𝑘 = 0. Conditions in which the value of the company is zero, denote the threshold at which the model recommends that equity owners abandon their investment, 𝑉(𝑥𝑎) = 0.

When EBIT reaches the threshold 𝑥𝑎, the costs associated with terminating the investment are incurred and borne by the shareholders. To achieve this, it is necessary to find the conditions under which the partial derivative of the stock value, 𝜕𝐸𝑢(𝑥). This financial distress, in the context of the leveraged business, can be defined as the prerequisite for bankruptcy.

The model assumes that a default occurs when EBIT falls below a threshold 𝑥𝑏, at this level creditors are entitled to the residual value of the company, after bankruptcy costs, 𝐵𝐶(𝑥𝑏), and taxes are deducted. At this level, the claim attributable to creditors is the remaining part of the value after payment of 𝐵𝐶(𝑥). The cost of the investment dictates that it only makes sense to invest when EBIT reaches a level.

The value of the option to invest, 𝐼, follows that of a differential equation, defined similarly to the one introduced in subsection 4.2.

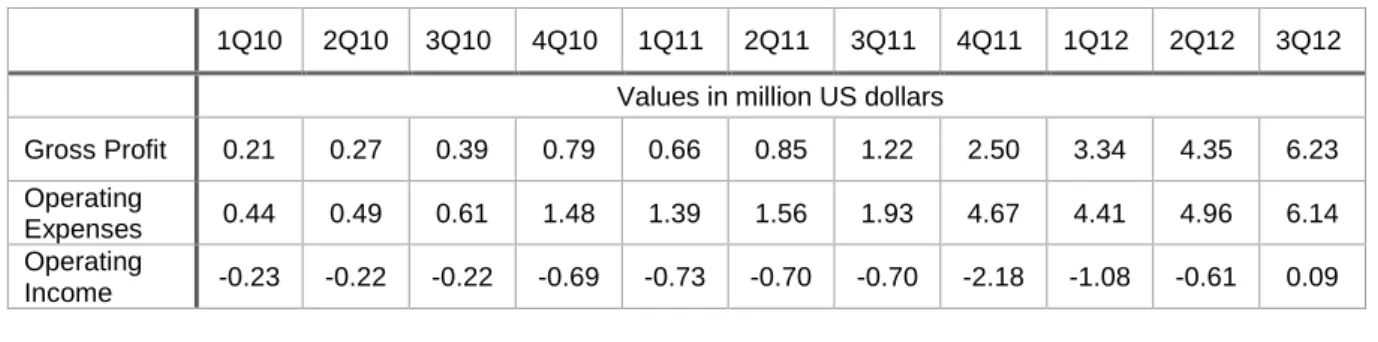

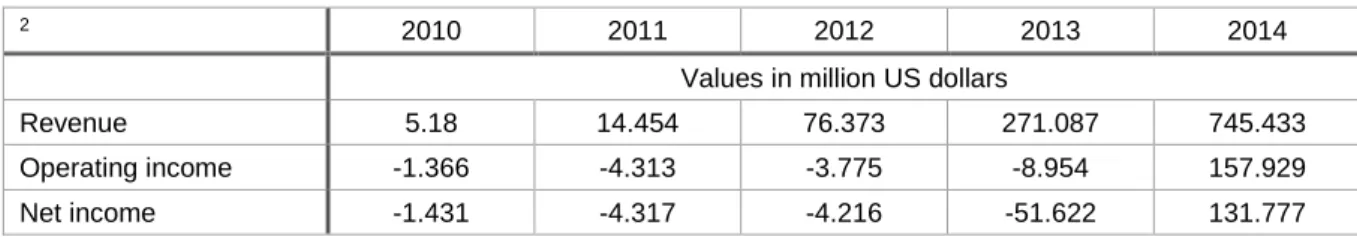

Case Study – Fitbit Inc

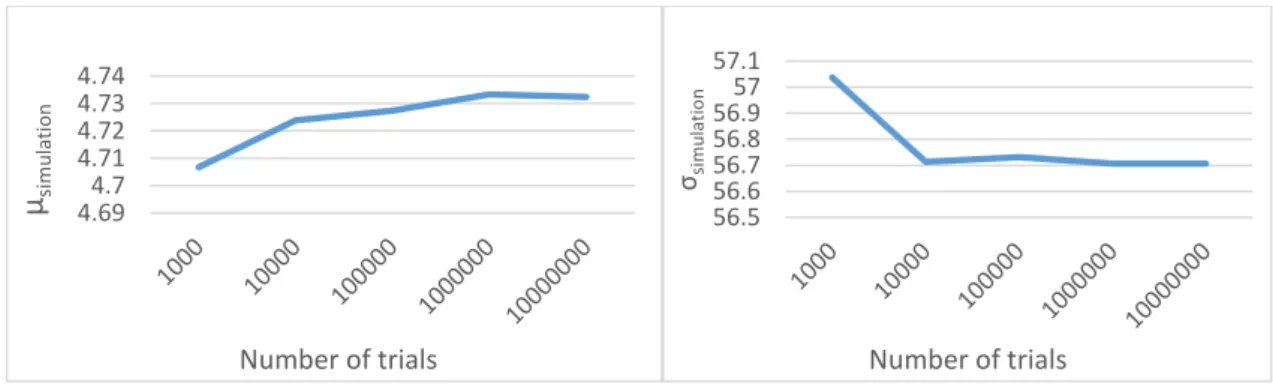

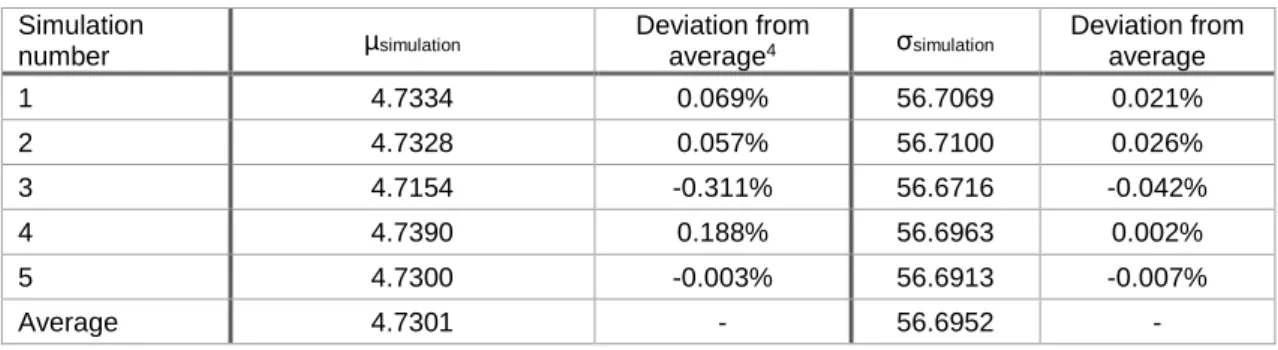

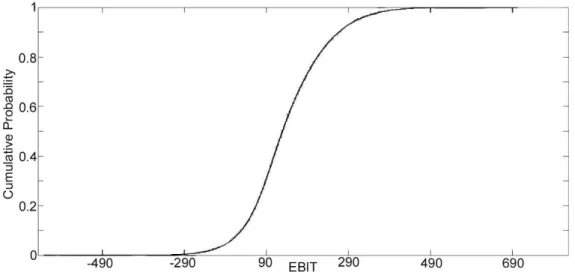

The yield rate was calculated as 𝑟 = 3.09%, which is the average value of the daily yield for the mentioned week. One of the impracticalities of the model is that the risk premium cannot be perceived as a return requirement. The results, which are discussed below, have been obtained through an implementation of the model in Matlab software.

The value of the outstanding equity, 𝐸𝑢, can be compared to the market value of the equity of Fitbit Inc. 7 Debt-to-equity ratio – this financial ratio will be used in the following sections as a measure of the company's leverage. The lowest future EBIT value that is tolerable before the model recommends a default is also raised with the increase in the value of the coupon, reflecting the greater stress induced by the debt.

The higher risk expressed through a higher standard deviation lowers the value of the company and of the debt as a result of lower leverage. This effect shows the impact of risk in the valuation of the receivables, which is emphasized by the increasing values of bankruptcy costs. The value of the company and of all the damages varies inversely to the risk-free rate.

The government claims that there is a transfer of the wealth created by the company to the state in the form of taxes. Higher taxes imply that less of the returns generated by the capital invested will be returned to investors. Another effect of the increase in the tax rate is that optimal leverage increases substantially, because debt is exempt from taxes.

The bankruptcy share is the portion of the residual value that is consumed by default costs. Lowering the coupon lowers the value of the debt claim, resulting in lower leverage. This value does not affect the value of the company, only affecting the return the investor receives from the venture.

Conclusions

An interpretation of the results of this model, which brings it closer to reality, is to treat the optimal coupon as a limit, increasing the debt to reach it as the company develops, and not as an initial and fixed value. The implementation of the model in a reality-based environment is an important contribution to the available literature, as it is, to the author's knowledge, the first case study for a structural model based on a real ESTC. The results show that there is a relationship between the value of the company and its capital structure, as a result of the fiscal advantage over debt.

Bibliography

Patent Valuation: A Review of Patent Valuation Methods Considering Option-Based Methods and Opportunities for Further Research. Available at:

Increasing access to startup funding through intellectual property securitization, Journal of Computer & Information Law, 27, 4, pp.613-646.

Annexes

This is an inhomogeneous differential equation of the second order, the solution to which is the sum of the general solution for the homogeneous case with a special solution.