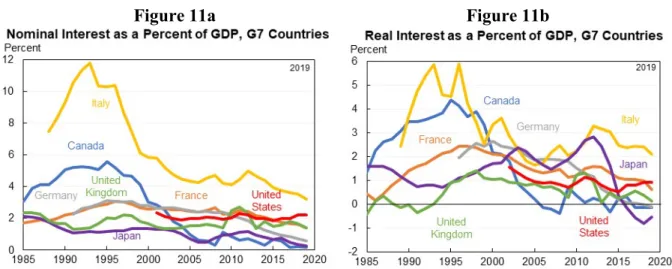

Any discussion of the causes of the fall in real interest rates must begin by noting that the most obvious factors affecting real interest rates—the fiscal position of the country, the expansion of social security, and changes in the after-tax return on capital—have everything. At this point, we find explanations based on the financial crisis, monetary policy decisions, or global factors implausible and explain more than a small part of the decline in real interest rates. There have been very small fluctuations in the current account of the industrialized countries as a group.

Ultimately, however, the exact reason for low interest rates makes little difference to the analysis of fiscal policy, except to the extent that the explanations relate to the persistence of the trend. In 2000, David Reifschneider and John Williams published a paper predicting that the federal funds rate would be at the zero lower bound 5 percent of the time. Since the publication of the paper, it has been at the zero lower bound 38 percent of the time.

And it has been at the border 59 percent of the time since the start of the financial crisis. As Figure 5 shows, interest rates in other major economies, particularly Japan, have also been at an effective lower bound (often negative) for much of the time in recent decades. The importance of setting fiscal policy based on the need to sustain aggregate demand is emphasized by a counterfactual calculation.

Most mainstream macroeconomic models also hold that fiscal expansions in depressed economies at the zero lower bound can improve fiscal sustainability.

Lower Interest Rates Necessitate New Measures of a Country’s Fiscal Situation

At interest rates prevailing in 1992, a country with a debt-to-GDP ratio of 60 percent paid about 5 percent of GDP in interest. The permanent aspect of debt compares debt to the present value of GDP in the indefinite future. The stocks and shares perspective is based on a highly speculative measure of the present value of GDP over an infinite period, a metric that requires knowledge of growth and interest rates for the indefinite future.

From an equity stock perspective, the debt stock is 0 percent of the present value of the GDP stock. Interest rates may rise and growth rates may fall, in which case the present value of GDP may be finite. In the United States, the only regular and systematic measure of GDP over an infinite horizon that we are aware of is produced by the Social Security Trustees.

According to the most recent Social Security Administration Report (2020) the present value of GDP for an infinite future was $3.8 quadrillion on January 1, 2020. For example, a decrease in r – g from 1.0 to 0.5 doubles the present value of GDP—and thus makes twice as much debt sustainable as the future stock of GDP. Real interest rates are adjusted for inflation by comparing the real interest rate paid on debt to the size of GDP.

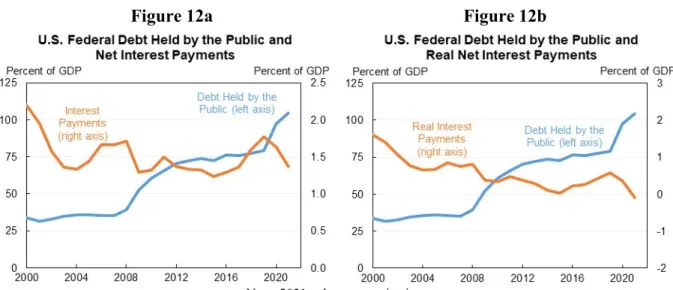

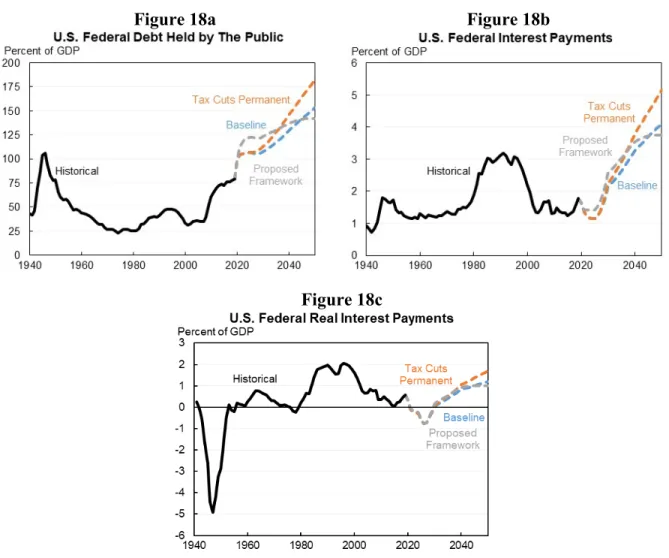

As you would expect, real interest as a share of GDP falls when, all else being equal, nominal interest rates fall, inflation rises, nominal GDP rises, or debt rises. Real interest payments as a share of GDP are more analytically relevant than the more commonly used nominal interest payments as a share of GDP. Since then, the debt-to-GDP ratio has increased almost monotonically, nearly tripling to more than 100 percent of GDP.

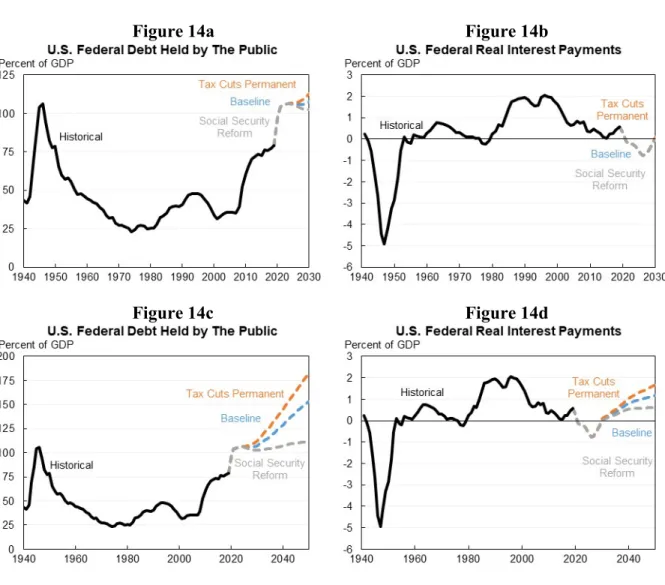

At the same time, both nominal and real interest rates have fallen, so that both nominal and real interest rates as a share of GDP have fallen almost monotonously and are now at the low end of the range as shown in Figures 12a and 12b. Social Security reform was phased in linearly from 0.5% of GDP to 1.7% of GDP over 10 years starting in 2025. Source: Office of Management and Budget; Congressional Budget Office; Macro bond; the authors' calculations. Office (GAO) in 1992, and it expected the debt to reach 177 percent of GDP by the end of fiscal year 2020, which is 77 percentage points above the actual debt-to-GDP ratio by the end of that year, as shown in figure 16.

Note: Social Security reform is being phased in linearly from 0.5% of GDP to 1.7% of GDP over 10 years beginning in 2025. Source: Office of Management and Budget; Congressional Budget Office; Macrobond; calculations by the authors. Note: No changes include Social Security reform, which is phased in linearly from 0.5% of GDP to 1.7% of GDP over 10 years starting in 2025.

The Scope and Need for Public Investment Has Greatly Expanded

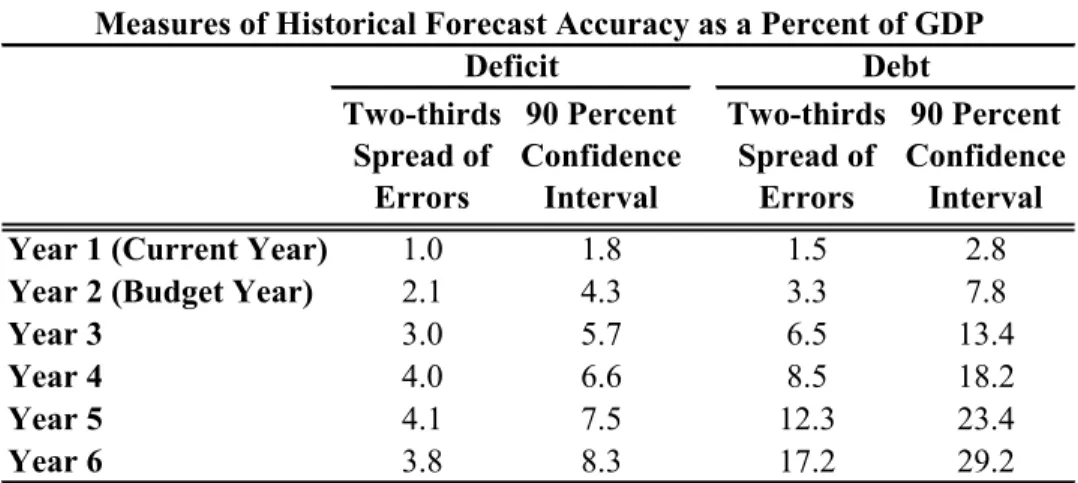

The forward-looking nature of the fiscal gap makes it more informative about fiscal sustainability, but requires forecasts and subjectivity. The result is measured debt increases even as the significant obligations of the Federal government decrease. This happens if they expand output more than they increase debt by increasing the utilization of the economy's potential.

More importantly for a wider set of policies, public investments that have a rate of return greater than the interest rate can be repaid in present value terms. Many of the programs they examined more than paid for their initial costs, including “four major expansions of health insurance for children over the past 50 years. Hendren and Sprung-Keyser used a real discount rate of 3 percent for their analysis, much higher than the current or likely future cost of federal borrowing.

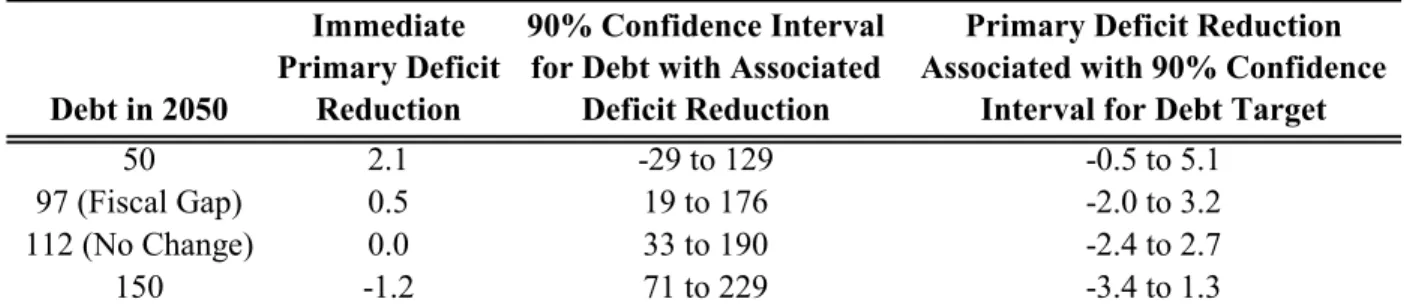

Even the more conventional and misleading measure of the debt-to-GDP ratio is stable over the next decade and assuming current law, which requires both tax cuts and social security reform to expire, will be essentially stable over the next decade are. also three decades, although it is plausible that it could be anywhere from the lowest in post-war history to about 190 percent of GDP. However, the finite value to which the debt asymptotes may be very large - and large enough that the upward pressure it exerts on interest rates makes it unlikely that growth rates will remain above interest rates, in which case the resulting dynamics would trigger an explosion in interest rates. are. debts and interest payments. Conversely, if real interest rates rose to 2 percent, the debt-to-GDP ratio should be lower, as all the problems associated with low interest rates would be reduced and thus a debt-to-GDP ratio of 100 percent would be more reasonable.

Our starting point is current legislation, including the expiration of the 2017 tax cuts and social security reform. We assume that deviations from the CBO baseline debt path lead to deviations from the CBO baseline path of GDP of 0.04 percent lower GDP for each percentage point increase in the debt-to-GDP ratio from the CBO-based baseline in the previous year. Based on the increase, we also assume that interest rates will rise after 2030 in the CBO-based baseline.

For other scenarios, interest rates increase based on the increase in the previous year's debt-to-GDP ratio compared to the value in the CBO-based baseline. Back to Basics: Basic Research Output, Innovation Policy, and Growth." The Review of Economic Studies. Fiscal Policy and Full Employment." In Confronting Policy Challenges of the Great Recession: Lessons for Macroeconomic Policy, edited by Eskander Alvi, 85-106.

The End of the Golden Age of Central Banking?" Is Secular Stagnation More Than the Zero Lower Bound?" Unpublished manuscript. 1989 Annual Report of the Board of Trustees of the Federal Old Age and Survivors Trust Fund and The Federal Disability.