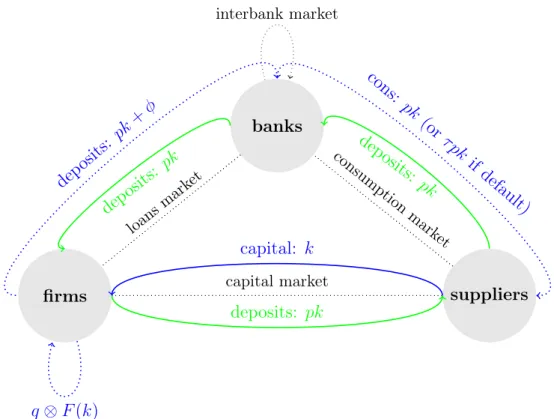

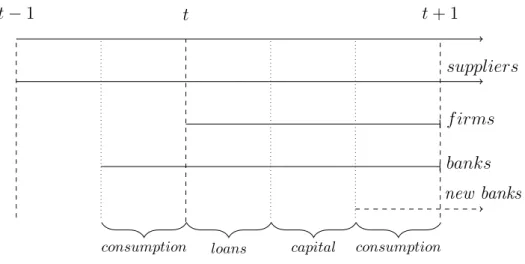

In the first subperiod of each period, the credit markets between bankers and firms are opened. In the third subperiod, successful firms repay their bank loans using their output.7 The bank repays its deposits using reserves and part of the firm's output.

Markets for loans and interbank loans

The right-hand side of (3) is the bank's external option when you hold m: it is the expected payout from lending these reserves on the interbank market. The right-hand side of (3) is the bank's external option when it holds: it is the expected yield from lending these reserves on the interbank market.

Capital market

Banks' participation restriction Now we can define the bank's participation restriction in the given contract (k, φ, q), as. 3) The left-hand side of (3) is the bank's expected profit from lending to the firm. Introducing moral hazard between the firm and the bank would strengthen our result but does not qualitatively change our results.

Consumption market (CM)

The reader should note the existence of a retention problem when there is a reserve requirement and i > r: While bankers face the cost of bringing real balances to the loan market, they do not get any surplus from it. Therefore, if the interbank market were absent, there would be no lending equilibrium because banks would never bear the cost of purchasing real balances, knowing that firms would capture the real surpluses generated.

Moral hazard

It is standard to show that when i > r ≥ 0, suppliers choose not to hold real balances, since their reserves are not rewarded and they have no liquidity needs. The firm must guarantee the bank at least this level of expected profit and it is enough that there is a balance with lending.

Equilibrium

3 Equilibrium characterization

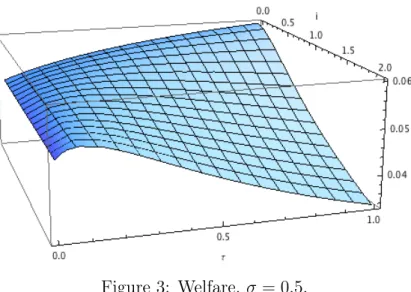

Welfare

Since all agents are risk neutral, welfare is given by aggregate output minus the cost of producing. As Figure 3a shows, the equilibrium level of investment always decreases with the cost of holding reserves. In general, when the cost of holding reserves is small, we can show that investment falls in i when τ = τm = 0.

However, as Figure 3 shows, investment may increase in liquidity requirements τ, orτm starting from τ =τm = 0, if the cost of reserves is small, but will decrease if τ becomes too large. This is intuitive: keeping the cost of reserves small, the cost of increasing the demand for liquidity is small. However, this willingness does not cause more risk when the cost of financing falls more than investment increases.

This result is intuitive: when inflation is low, the costs of increasing reserve requirements for banks are small. If the cost of the reserve requirement (i−r)τ is too low but cannot be changed, it is optimal to require a liquidity requirement for interbank market lending (τm > 0) to increase the cost of bank lending.

4 Extensions

Operating banks α

Proposition 2 highlights the trade-off between quality and output: if the cost of holding reserves is high, investments are already low and reserve requirements increase, while improving quality would also make investments more expensive. Alternatively, if holding reserves is not that expensive, increasing the reserve requirement is optimal because the increase in quality dominates the possible decrease in investment. As the spread widens, the optimal level of reserve requirements decreases, but always remains positive even at spreads of 200%.

In other words, if money is relatively cheap for banks (i ≈r), it is optimal to raise the level of required reserves. Therefore, a lower risk premium for deposits inhibits the increase in corporate financing costs due to higher reserve requirements. The effect of higher required reserves on investment is then either small (if negative) or positive, and for welfare the higher quality dominates over any lower investment.

Welfare is given by the total net product of the cost of producing investment goods and the cost of the firm's effort. Therefore, the optimal investment k∗ and quality Q∗ solve (13) and Q∗ = 1.16 The unit upper bound on quality is related because the planner would demand a higher quality since it absorbs the cost of bank failure.

4.2 (Anticipated) bail-outs

Deposit insurance

We now assume that banks must operate in the CM at birth and commit resources to the deposit insurance fund, as a fraction δ of their deposits. However, it is more than a tax, as the deposit insurance company would then tap the resources to guarantee deposits (but not interbank market loans). The sustainability of the deposit insurance mechanism requires that it has sufficient resources to cover the shortfall, i.e. δpk = (1−Q)pk(1−τ(1 +r)) – where we still assume that all banks have τ pk in their portfolio will continue. reserves.

The fact that the exposures in the interbank market are not covered by the deposit insurance scheme is reflected by the risk premium 1+iQ, while the contribution to deposit insurance – increasing the aggregate risk – is captured by the term 1/Q. Finally, comparing the equilibrium level of investment without deposit insurance (11) we find that k is higher with deposit insurance.17 We summarize this discussion in the following proposition. The average quality as well as the level of investment and welfare are higher with deposit insurance than without deposit insurance.

The deposit insurance system we are introducing achieves better allocation because it is a direct function of the bank's loan size. In these cases, term deposit insurance worsens the economy by reducing quality and investment.

Capital requirements

Then, the first-order conditions from the negotiation problem give (9) and (10) with p= 1, which we can simplify as. The left side is the bank's resources when the firm is successful, and the right side is the return paid to equity holders. In the capital market, suppliers no longer expect banks to hold reserves so that the price of deposits fully reflects the risk of bank failure.

Finally, when E = 0, the firm itself is not stopped by the bank having to raise new shares, and it chooses the first best quality level. Since ρ is the real return on equity, we normalize the price of a bank share in the centralized market to one. When considering how many shares of a generic bank to buy, providers solve the following problem in the centralized market.

In the case of i > ρ, the retention problem implies that there is no equilibrium, since the bank has no incentive to build capital before its lending activity.18 In addition, the higher the more expensive the capital increase (as the higher the return on capital must be, so the lower the investment is. Comparing these two equations with (11) and (12), it is clear to see that setting ε = Qτ+(1−Qττ) (1+r)τ gives us the same equilibrium condition as in the case with re-reserve.

5 Literature review

The idea that interest rate policy affects intermediaries' risk-taking, also called the monetary policy risk-taking channel, a term coined by Borio and Zhu (2012) , has fueled the recent empirical literature. One of the main findings of his literature is the negative relationship between the level of interest rates and bank risk taking. Others use data on nominal interest rates to identify negative attitudes towards bank risk taking in different countries.19.

Our mechanism also plays through an economic externality, but while Chari and Phelan study the effect of consumer loans, we study the effect of corporate lines of credit on the production process. Calomiris, Heider and Hoerova (2015) also use the “intermediation model” but are more related to our question as they analyze the need for liquidity requirements of banks. We also provide a general equilibrium model where banks can create deposits that circulate as means of payment, and we can analyze the effect of monetary policy on banks' risk-taking.

Jakab and Kumhof argue that the main activity of banks is to finance businesses through the creation of money (or deposits). Among many other findings, they show that the banking sector's "funding" model explains why leverage is procyclical.

6 Conclusion

On the theoretical side, Williamson (1999) argues that the creation of marketable deposits allows for productive intermediation and is therefore desirable. In their model, liquidity requirements act as collateral, a disciplinary tool for bankers who would otherwise engage in moral hazard. Our model belongs to the view of bank financing and we focus on risk taking, the optimal reserve requirement policy and its interaction with monetary policy when banks issue marketable deposits.20 Our work is also related to Williamson (2016) who presents the risk moral. the problem of creating low-quality collateral when interest rates are low.

This may seem unrealistic, but this assumption implies that firms' incentives are most in line with a planner's. Second, banks do not take deposits from depositors and they finance their liquidity needs using only (sweat) equity. Therefore, we cannot study issues such as bank runs in the current version of the model.

Nevertheless, it should be noted that the risk premium on deposits gives rise to the idea of a run on banks: if the risk premium increases to infinity, firms cannot trade in deposits. A third aspect missing from the model is the cost of raising equity capital.

7 Bibliography

Banks do not borrow on the interbank market Then, the outside option of banks is to earn interest on reserves

Banks borrow on the interbank market

- No default The no-default condition is

- No default on deposits, but default on interbank loans Banks do not default on their deposits whenever

- Default on deposits and interbank loans

If we relate this expression back to the problem of the young banker in the centralized market, we get im > i (which only holds if the banks do not default on their interbank loans). Again, since the bank does not default on deposits, the reserve requirement limitation is not binding. Using the bank's IC to replace φ in the objective function, the P(mb)≡ max.

This shows that the upper limit of the RHS, and so the RHS itself is less than 1 +i. Did China's anti-corruption campaign affect the risk premium on stocks of global luxury goods firms. Predicting asset market returns in a small, open economy and the influence of global risks.