Many large member states are in the latter group, which explains the downward trend of the EU weighted average. The aim of the tax was to reduce consumption and obtain funds for investments in water infrastructure. Households and businesses - the impact on the water consumption of businesses was greater than that of households.

The burden of the tax is small, as it only applies to a handful of producers and importers. The aim of the tax is to mitigate the impact of extraction on the environment, reduce demand and encourage recycling and the use of alternative materials. Trees are a key part of the world's ecosystem, particularly because of their role in the carbon cycle.

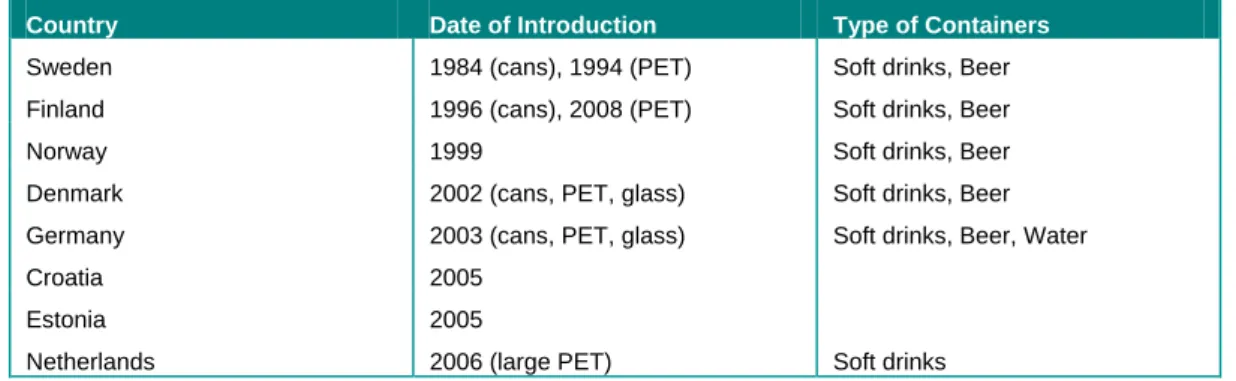

Container deposit schemes charge a small deposit on a container (e.g. bottle) upon purchase which is then refunded when the bottle is returned - the container can then be reused or recycled, reducing waste and litter. In the other cases, the revenues were generally used as part of government spending or for wider environmental policy (i.e. the plastic bag levy in Ireland) and no double dividend was observed.

1 Introduction

The EU has proposed seven flagship initiatives to catalyze progress for each of the main objectives. Two of the seven flagship initiatives are of special interest in light of resource efficiency. To achieve these objectives at EU level, the initiative will focus on mobilizing EU financial instruments, improving the use of market-based instruments, modernizing and decarbonising the EU transport and infrastructure sector, completing the internal energy market, promoting renewable energy and upgrading Europe's networks.

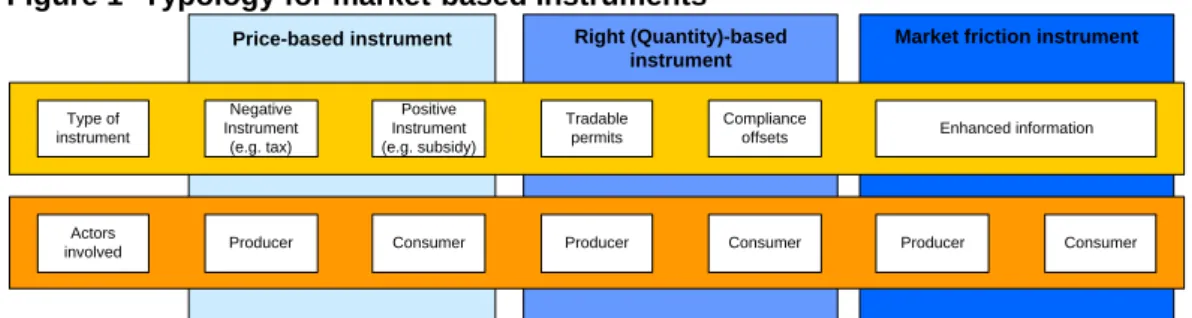

In addition, EU Member States are encouraged to reduce environmentally harmful subsidies, use market instruments such as tax incentives and public procurement to adapt production and consumption methods, develop smart, upgraded and fully interconnected transport and energy infrastructure, and make full use of ICT. 7 The national poverty line is defined as 60% of the median disposable income in each EU member state. Market-based instruments are supposed to guide industries in the direction of efficient use of resources and environmentally friendly performance, thereby ensuring international competitiveness.

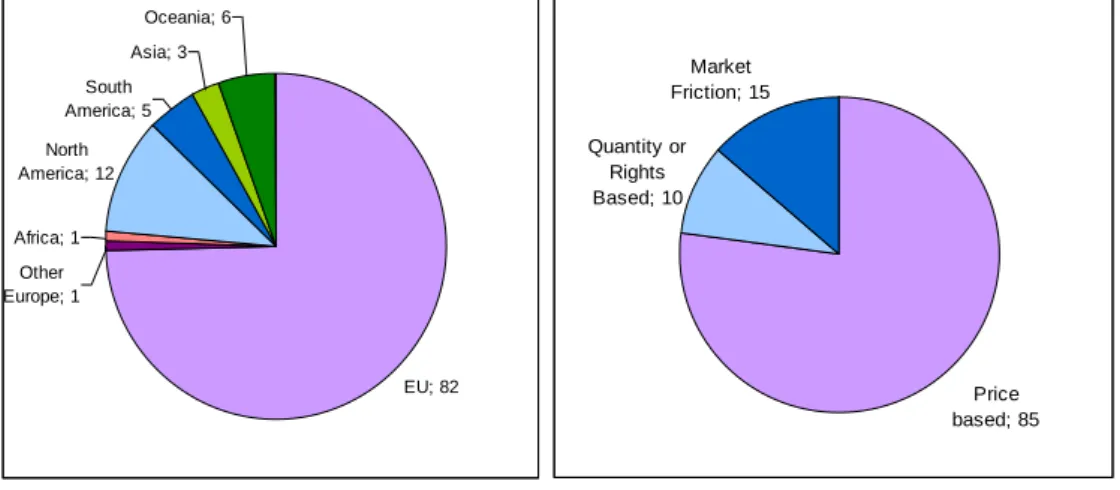

Although they are mostly used as instruments of (economic) environmental policy and efficient use of resources, it is somewhat difficult to distinguish between them. At EU level, the most commonly used market instruments are taxes, levies and tradable permit systems.

2 Our approach

The cases were examined with respect to a variety of economic, social and environmental impacts and the results are presented in Chapter 4. The analysis of these different tasks was then continued to form our conclusions, with an emphasis on the lessons to be learned from the case studies and modelling. We used the following research tools to achieve the best possible results within the resource and time constraints of the study.

This data was obtained in various ways, through individual communications and networks, as well as through information searchable databases, magazines and portals. Used hand-in-hand with data and information mining, desk-based research and analysis were central to this study, drawing on the diverse expertise and specializations within the research team. In preparing the case studies and various other aspects of the study, contact was made with various stakeholders, including EU officials, representatives of Member State governments, industry associations, non-governmental organizations and national environmental agencies.

The information from these interviews was used to validate, verify and expand the case studies and to provide, where possible, a more balanced view. E3ME was used to evaluate the demand for six groups of materials (including minerals and biomass) plus water, resulting from different patterns of economic development and the effects that changes in the price and use of these materials have on economic growth.

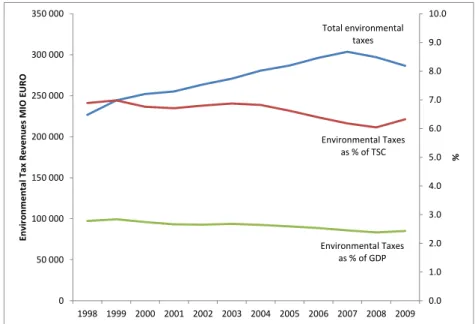

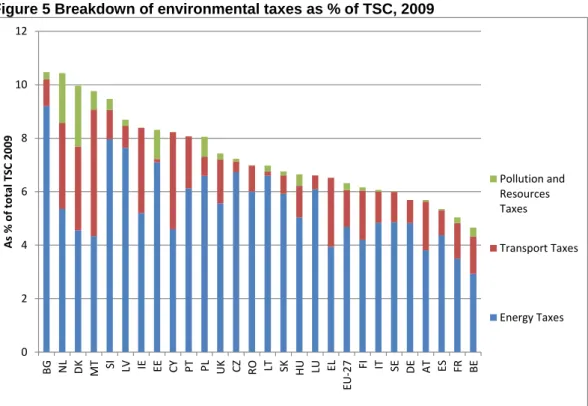

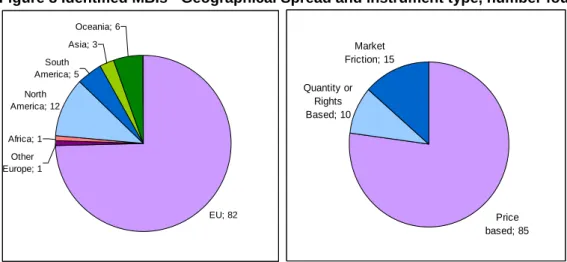

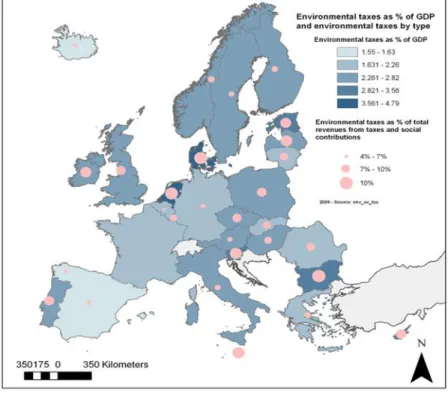

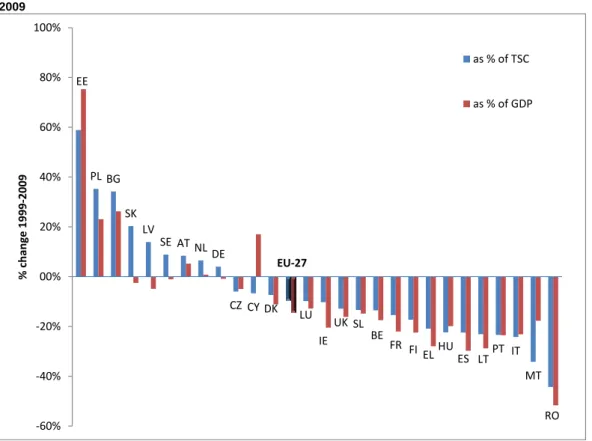

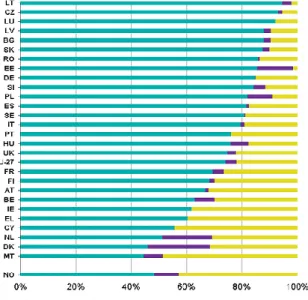

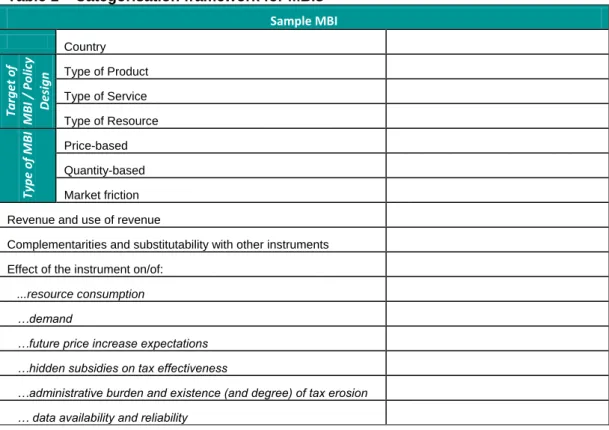

3 Findings: typology and overview of MBIs

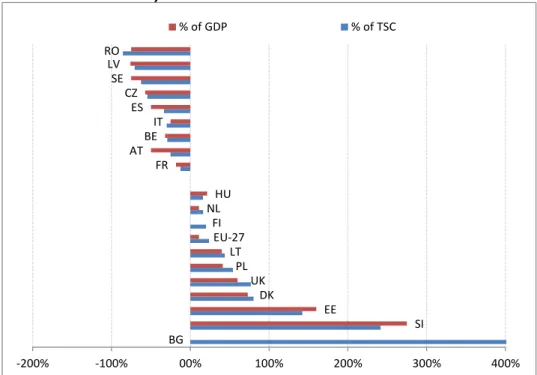

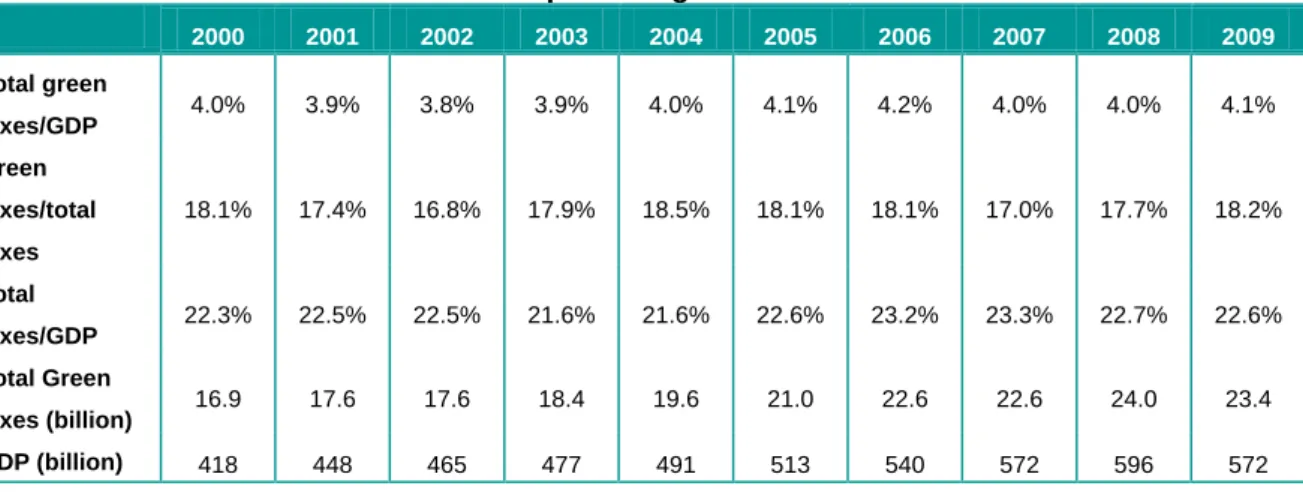

The other MS have all seen environmental taxes decrease in importance, this includes some of the larger (UK, FR, IT) and perceived environmental strong (DK) MS. Therefore, most of the best practices regarding environmental taxation are currently focused on energy and transport. This is equal to about 30% of the energy tax and about 14% of the total Green tax base.

According to the Ministry of Taxation, this also contributed to the reduction of the green tax21. However, it is not possible to comment on the overall environmental effect of the Green Taxes. The basis for the current green tax system in the Netherlands was established in 1988 with the introduction of the General Environmental Provisions Act.

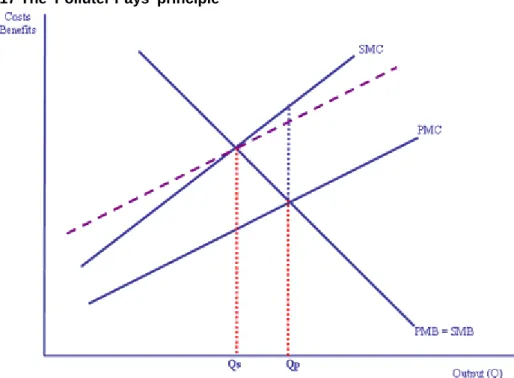

The purpose of environmental taxes is to reduce activities that are harmful to the environment by raising the price of these activities26. The 201032 report on the state of the Dutch tax system addresses the impact environmental taxes have had.

4 Findings: case studies of MBIs in practice

An effect from the introduction of the tap water tax cannot be clearly discerned, mainly because the tax is relatively small. Water supply increased from 2001 onwards, mainly due to the use of new desalination plants. In the case where the tax is directly related to the size of the family, it is not.

Around 75% of the revenue from the pesticide tax is returned directly to farmers in the form of reduced land tax. Three-quarters of the tax revenue is returned to farmers through a reduction in property tax. The primary effect of the tax has been a decrease in the extraction of aggregates from 2002 and ongoing.

The price of aggregates in the UK at the quarry gate is of the order of EURO 5.7 per tonne (average delivered prices are EURO 9 per tonne) although the price varies depending on quality and volume purchased (Legg 2007). This is also reflected in the progress of the case study which is based on a limited number of sources. Plan or sketch of the noted location of the tree(s) to be felled, the proposed replacement tree planting and for all other trees (four times).

The Waste Hierarchy

Paradoxically, recycling rates for plastic and aluminum packaging waste fell after the introduction of the container deposit scheme. 726 million was incurred through the scheme, mainly in the purchase and installation of the reverse vending machines. To get a better impression of the real effects of the container deposit scheme on environmental protection, the recycling rates should be.

The total amount of packaging waste is not observed to decrease significantly since the introduction of the container deposit scheme. The provisions of the directive also make it illegal to unilaterally ban plastic bags. There is little specific evidence on the impact of the levy on disposal methods for plastic bags.

However, it is more difficult to separate the improvement in the sustainable behavior of consumers after the introduction of the tax. It is expected that after the introduction of the tax, recycling has increased. The wider economic impact of the levy on companies operating in the sector is unclear.

Annual operating costs are charged to the environmental fund each year and in 2008 totaled €392,000, or approximately 1.5% of the tax revenue collected. Today, Denmark is known for having some of the world's most expensive plastic bags. As part of the wider packaging tax regulations, no specific information is available for the burdens associated with the plastic bag tax.

One of the financial instruments to address these challenges is the application of effluent charges. The burden of the levies on the industrial sector is considered to be very small, falling in the range of less than 1% (for the automotive industry) and 9% (for the water-intensive pulp and paper industry).