The role of FDI in the transition process of selected CIS and Eastern European countries. In the transition process, FDI can play an important role in restructuring the economy. The role of FDI in the transition process of selected CIS and Eastern European countries1.

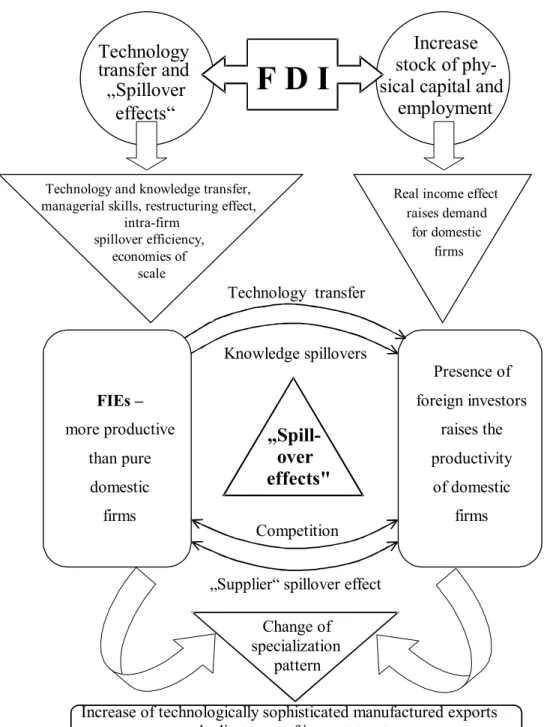

The first part analyzes the positive impact of FDI on economic growth in economies in transition.

Negative Impact of FDI on the Economies of Host Countries

Since FDI is directed to regions with abundant factor resources, human capital and technology, the spillover effects in these regions strengthen their economic growth. FIEs limit local R&D activity, as highly skilled human resources are reallocated to MNCs and competition for high-quality products within MNCs is much stronger than domestic firms (HUNYA, 1999). .

FDI Trends and Fluctuations in the Investigated Economies

The Impact of the Russian Financial Crisis on FDI in Investigated Economies

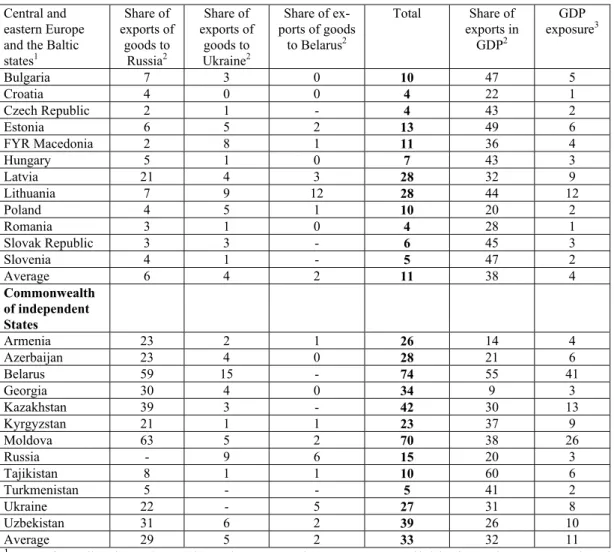

Although Hungary and Poland, during the period of transformation, reoriented their economies towards trade mainly with the West, the impact of the Russian crisis through trade links on these countries was still remarkable (GDP exposure for Hungary 3% and for Poland 2% with the total share of the export of goods to Russia, Belarus and Ukraine-7% and 10% respectively). In Poland, there is significant trade exposure through cross-border trade that is not reflected in the trade statistics. The other channels of impact of the Russian crisis such as banking sector exposure, capital markets and a potential world economic slowdown are discussed in the literature.

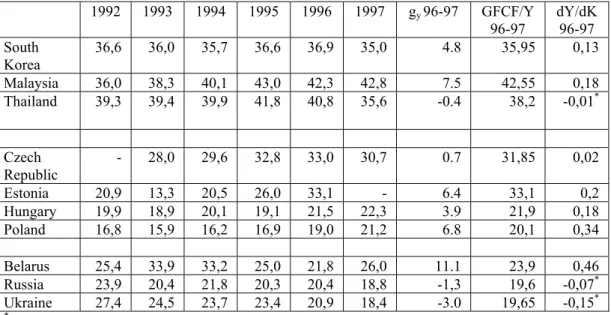

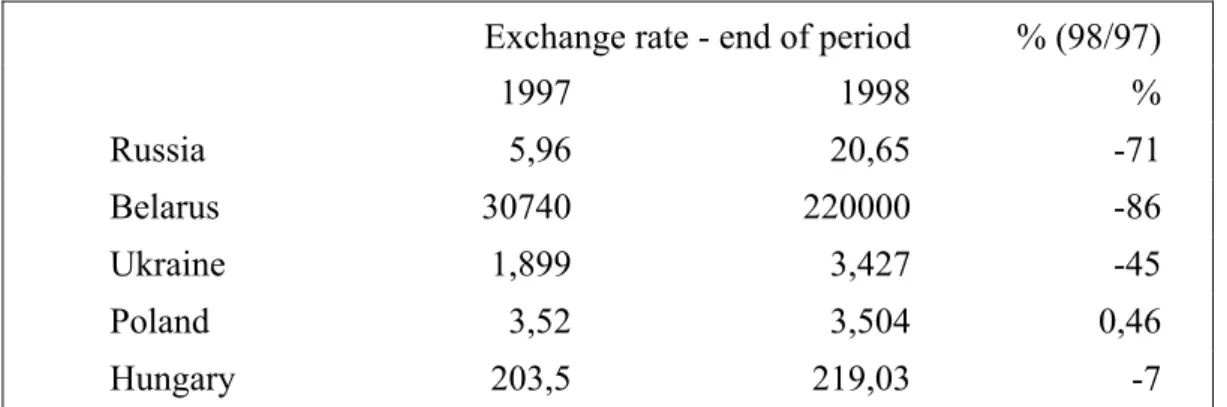

The Russian financial crisis also had a negative impact on exchange rate movements in many transition economies. The sharp devaluation of the Russian ruble caused a parallel depreciation of exchange rates against the dollar in the most surveyed countries (see Table 1). Thus, in 1998, compared to 1997, with exchange rates taken before the end of the period, the depreciation of the Belarusian ruble was higher than that of the Russian ruble by 86% and 71% respectively, followed by the Ukrainian hryvnia by 44% .

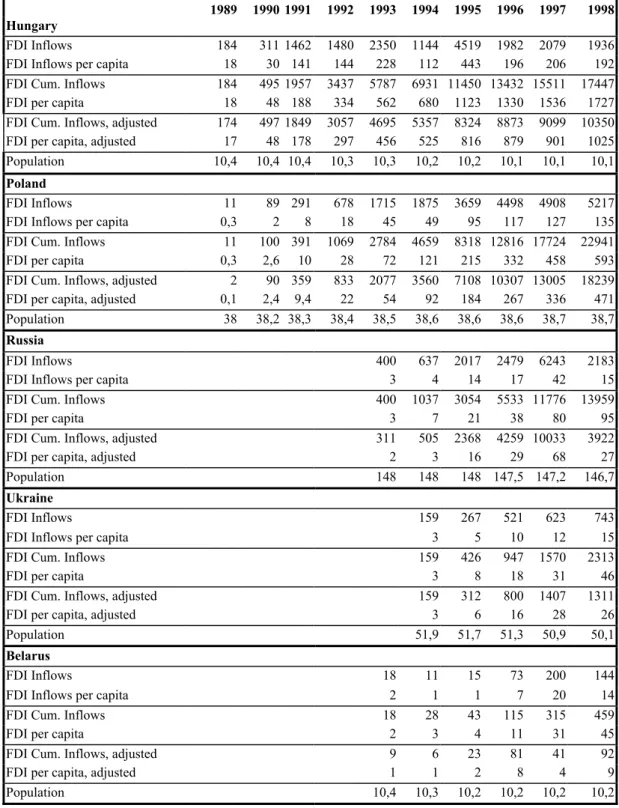

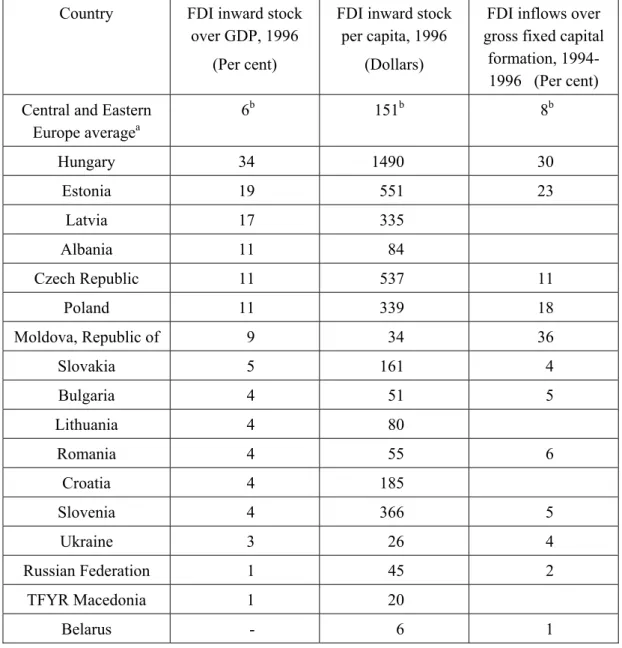

For example, Hungary announced a depreciation of only 7%, while in Poland there was no major negative impact on the exchange rate, except for 0.46%. Exchange rate movements are important because year-end FDI stocks reported in dollars include a depreciation of the exchange rate and lead to capital losses according to official inventory statistics. In table 2 one could clearly see the impact of the Russian crisis on the inflow of foreign direct investment.

Comparison of Country’s FDI

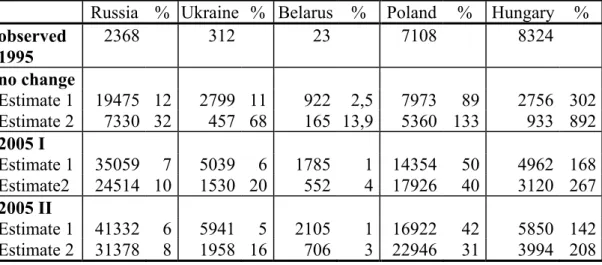

However, one should mention that FDI in Russia peaked in 1997 and in previous years the amount of FDI was close to $2 bill. 6 billion, the outflow from the OECD countries based on OECD figures - at the same time fell to only about a $1 bill. The large difference is proof of the fact that Russia significantly overestimates the inflow of FDI into the country (DOEHRN/GANUSCHTSCHENKO, 1999).

Measuring FDI in Russia: National and International Sources, 1993- 1997; US-$ mill

Comparison of Stock of FDI in Russia and Cumulative Inflows, 1994- 1998, US-$ mill

Privatization and FDI

Based on the definition of FDI, it is definitely in the interest of foreign investors to have long-term cooperation with substantial influence on the management of enterprises. The reason for the privatization-related FDI lies in the fact that FDI was primarily attracted by the possibility of participating in the privatization of state-owned enterprises rather than by the existing GDP growth. The privatization of both small and large enterprises as well as infrastructure privatization was almost completed in Hungary in 1999.

In Poland, foreign investors bought 45.1% of the total number of state-owned enterprises in the period from 1990 to 1996. It was planned to intensify the privatization in 1999, where many sales would represent strategic interests for foreign investors. At the same time, Poland has made great progress in creating favorable conditions for foreign investors to participate in the privatization of state-owned enterprises.

In Russia, the privatization of major oil companies under the 1998 privatization program has been postponed. Attracting strategic foreign investors was difficult because of the relatively high share prices and the lack of transparency in the procedure. The lack of a market-oriented country code and restrictions on land sales prevented privatization in the agricultural sector and hindered urban and rural land markets (EBRD, 1999).

Sectoral Aspects

Ukraine shows some slight signs of change with 9% of FDI made in the machinery and equipment industry and 7% in the chemical industry (Table 3). But on the other hand, the food industry is still the main recipient of FDI in Ukraine. In Belarus, FDI was based on the number of firms in the food industry, textiles, and wood industry sectors, where the latter accounted for 11% of FDI.

The contribution of FDI remains small in Belarus when it comes to machinery, equipment and chemical industries. Some FDI has been made in transport and telecommunications, as well as in business services (including engineering and information services) which are supposed to support successful transition. With the exception of Russia, where FDI in the primary sector accounts for a large share, FDI in the other investigated countries of equal importance has been made mainly in the secondary and tertiary sectors.

So far, foreign direct investment in the investigated CIS has been mainly directed to traditional sectors that were already very well developed and are also called upon to play an important role in the economy. There is a slight improvement trend in the service sector of Ukraine and Belarus (in the banking sector in Ukraine; in the transport and telecommunications sector in Ukraine and Belarus). Russia's high FDI in the banking sector was not supported by FDI in manufacturing, chemicals and other services necessary for balanced development.

Empirical Investigation of the FDI Potential

- Specification of the Gravity Model for FDI

- Gravity Model Results

- FDI and Capital Formation

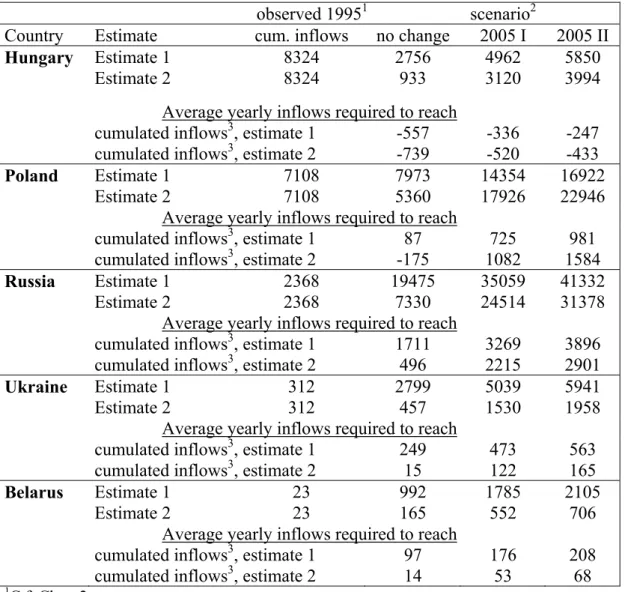

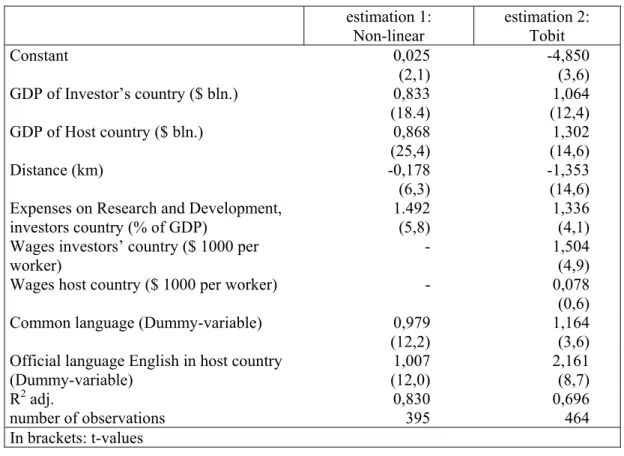

The impact of wage levels on investors and host countries on FDI was argued in the literature. The impact of the wage level in the host country on FDI according to the linear estimation also shows very low results. 6 FDI inflows needed to reach Hungary will not be negative, but FDI inflows to Hungary.

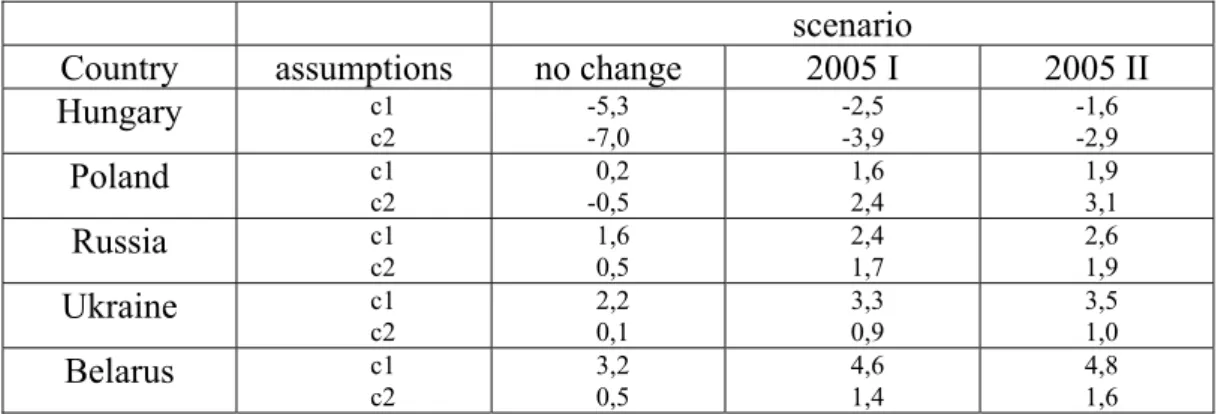

There is no reliable information on the size and structure of capital stocks in the countries studied. To analyze the role of FDI in the restructuring of economies in transition, the contribution of FDI to long-term gross fixed capital formation needs to be estimated. The results of the gravity model for Poland show that FDI in gross fixed capital formation can range from 0.2% to 3.1% over the long term.

The real share of gross fixed capital formation in GDP is also significantly lower for these countries, as admitted in the gravity model. In general, throughout economic history, there have been widely differing experiences across countries regarding the importance of FDI in transforming and restructuring the economy. The share of foreign direct investment in gross fixed capital formation in Austria still remains quite low: only 1.8% in the mid-1990s.

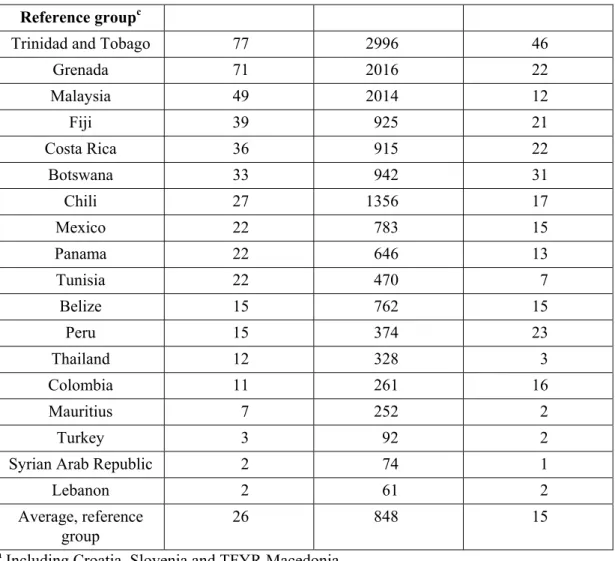

High ratios of FDI over gross fixed capital formation are more typical for the countries in the early stage of their transformation where the countries have at the same time attractive incentives, which can cause high FDI inflows. The experience also shows that the importance of FDI for small countries appears to be greater than for large countries at their transformation stage as well as in the long term.

Conclusions

The share of FDI in gross fixed capital formation is not high for CIS countries, for the reasons that legal and regulatory problems, long situation of recession, related to political instability as well as prolonged privatization process are factors that inhibit FDI inflows to this CIS -countries limited. The Asian countries such as China, Malaysia and Singapore reported high figures that even reached 60% for Singapore in the period from the mid-eighties to the beginning of the nineties. In this period of transformation, the countries have low savings rates and do not need enough capital for the restructuring of the economy. play the primary role.

Sectoral analyzes for more advanced transition economies testify that they have already surpassed the first stage of investment in the traditional sectors of the economy and moved up to the sectors that contribute significantly to the restructuring of the economy. This paper also examines the potential for FDI inflows to studied transition economies with the gravity model. However, according to the gravity model, the contribution of FDI to gross fixed capital formation in the long run tends to be moderate.

Thus, the contribution of FDI in the formation of gross fixed capital and consequently in the restructuring of the economy during the transition period can be high after the countries create attractive conditions for foreign investors, but in the long term the contribution of FDI in the formation of gross fixed capital. will be moderate and a country's saving rate is assumed to play a more decisive role. Even with very optimistic projections for GDP growth, the role of FDI, although important, cannot initiate a process of sustainable growth in the long term, and the significant part of capital formation must still be financed by savings internal. . in Russia-An Engine of Structural Adjustment?, prepared for the Bonn workshop: Restructuring, Stabilization and Modernization of the New Russia: Theoretical, Institutional and Empirical Issues, June, 25-27, Bonn.