FUNDAÇÃO GETULIO VARGAS

ESCOLA BRASILEIRA DE ADMINISTRAÇÃO PÚBLICA E DE EMPRESAS MESTRADO EXECUTIVO EM GESTÃO EMPRESARIAL

PROJECT PORTFOLIO MANAGEMENT: AN

ANALYSIS FROM THE INSURANCE INDUSTRY IT

AREA

Case Study

DISSERTAÇÃO APRESENTADA À ESCOLA BRASILEIRA DE ADMINISTRAÇÃO

PÚBLICA E DE EMPRESAS PARA OBTENÇÃO DO GRAU DE MESTRE

Fabio Pitorri

2

Ficha catalográfica elaborada pela Biblioteca Mario Henrique Simonsen/FGV

Pitorri, Fabio

Project portfolio management: an analysis from the insurance industry IT area /

Fabio Pitorri. – 2013.

63 f.

Dissertação (mestrado) - Escola Brasileira de Administração Pública e de Empresas, Centro de Formação Acadêmica e Pesquisa.

Inclui bibliografia.

1. Administração de projetos. 2. Escritório de gerenciamento de projetos. 3.

Planejamento estratégico. 4. Investimentos – Administração. I. Escola Brasileira de

Administração Pública e de Empresas. Centro de Formação Acadêmica e Pesquisa.

II. Título.

4

Table of Content

Table of Content ... 1

Figures List ... 6

Chart List ... 7

1 Introduction ... 8

2 Theoretical Reference ... 11

2.1 Main Concepts for Portfolio Management ... 11

2.2 The Standard for Portfolio Management(SPM) ... 14

2.2.1 Structure... 14

2.3 Management of Portfolios (MoP) ... 19

2.3.1 Structure... 19

2.4 Key Portfolio Roles... 21

2.4.1 Portfolio Direction Committee ... 21

2.4.2 Portfolio Manager ... 21

2.5 Portfolio Definition Best Practices ... 22

2.5.1 Understand ... 23

2.5.2 Categorize ... 24

2.5.3 Prioritize ... 25

2.5.4 Balance ... 29

2.5.5 Plan ... 31

2.6 Portfolio Delivery Best Practices ... 32

2.6.1 Benefits Management ... 33

2.6.2 Financial Management ... 34

2.6.3 Risk Management ... 35

2.6.4 Resource Management ... 35

5

2.6.6 Management Control ... 36

2.6.7 Organizational Governance ... 37

2.7 Discrepancies between the References ... 38

3 Research Methodology ... 39

3.1 Research Strategy... 39

3.2 Research Protocol ... 40

4 Case Study ... 44

4.1 Company Profile ... 44

4.2 Practices for Portfolio Definition ... 45

4.3 Practices for Portfolio Delivery ... 49

5 Conclusion ... 55

6 Abbreviations and Acronyms ... 58

7 Appendix A - Interview transcription ... 59

6

Figures List

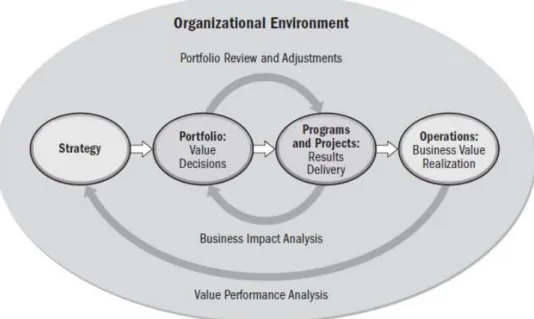

Figure 1: PPM organizational context ... 12

Figure 2: PPM processes and process groups ... 15

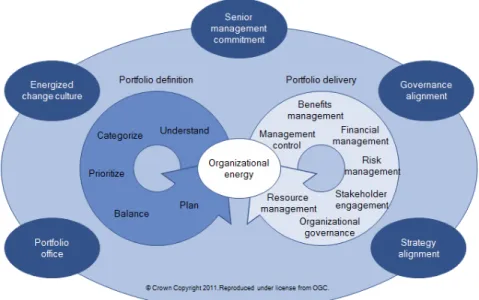

Figure 3: MoP structure - principles, cycles and practices ... 20

Figure 4: Portfolio components separated by business area ... 24

Figure 5: Single qualitative criteria prioritization model (comparison between projects) ... 27

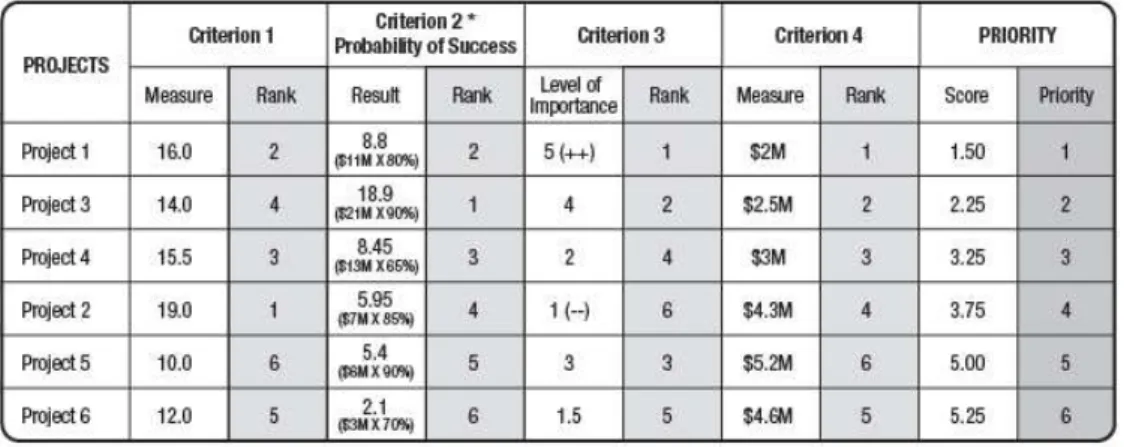

Figure 6: Multi-criteria prioritization model (comparison between projects) ... 28

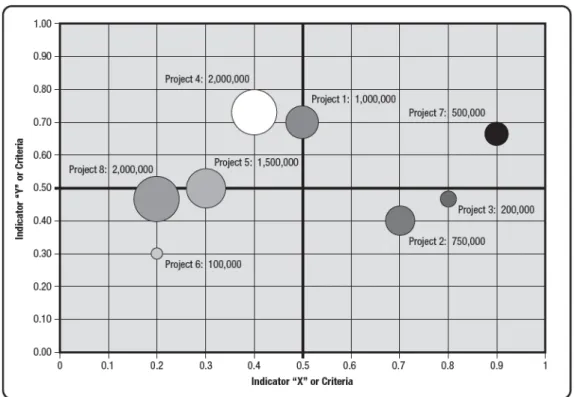

Figure 7: Bubble graph ... 29

Figure 8: Bubble graph (depicting categorization and category) ... 30

Figure 9: Portfolio Roadmap ... 30

Figure 10: Capacity and Demand ... 31

7

Chart List

Chart 1: Relationship between Processes and Tools & Techniques (part 1) ... 16

Chart 2: Relationship between Processes and Tools & Techniques (part 2) ... 17

Chart 3: Relationship between Processes and Inputs & Outputs... 18

Chart 4: Interrelationships between MoP practices and SPM processes ... 22

Chart 5: Prioritization criteria for IT Portfolio ... 27

Chart 6: Interrelationships between MoP practices and SPM processes ... 33

Chart 7: Research questionnaire ... 41

Chart 8: Interview transcription - understand practice ... 45

Chart 9: Interview transcription - categorize practice ... 46

Chart 10: Interview transcription - prioritize practice ... 47

Chart 11: Interview transcription - balance practice ... 48

Chart 12: Interview transcription - plan practice ... 49

Chart 13: Interview transcription - benefits management practice... 50

Chart 14: Interview transcription - financial management practice ... 50

Chart 15: Interview transcription - risk management practice ... 51

Chart 16: Interview transcription - resource management practice ... 52

Chart 17: Interview transcription - stakeholder engagement practice ... 52

Chart 18: Interview transcription - management control practice ... 53

Chart 19: Interview transcription - governance practice ... 54

8

PROJECT PORTFOLIO MANAGEMENT: AN ANALYSIS FROM THE INSURANCE INDUSTRY IT AREA

Introduction

The essence of a company is its strategic initiatives. These components will determine where the company will be in the future and, therefore, whether this company will achieve its own vision and mission. The abovementioned strategic initiatives are the strategy related operations, projects and programs that are a part of a group called Portfolio, which must be properly managed to ensure that their benefits will be delivered and objectives will be met (OGC, 2011). This path begins with selecting which components (operations, projects and programs) will be chartered to constitute this Portfolio and finish with the delivering each of its components including, among others, adequate delivering the communications, properly managing the risks and appropriately controlling the resources.

Due to the strategic importance of this topic, any failure in the selection or execution of these projects can lead to a significant impact in the future results of the organization. In this context, several institutions (Project Management Institute, Office of Government Commerce, among others) develop and maintain guidelines that can help these corporations to better convert their vision and mission into reality, thru well managed operations, programs and projects. These guidelines are composed by a collection of best practices designed to help them to enhance their probability of success in the field of Project Portfolio Management (PPM).

A recent study published by Project Management Institute and The Economist (2013) shows that just 56% of the strategic initiatives have been successful in the last three years. The same research acknowledged that only 62% of the strategic initiatives received the required resources. These datas show that organizations are underestimating their Portfolio and, probably, are having difficulties to deliver their proposed strategies.

9

warn that only 25% of the researched companies measure the ROI of the projects after its deployment, depicting the deficiency of control over these initiatives.

Furthermore, Brown (2008, p. 2) declared that "leaders now look to innovation as a principal source of differentiation and competitive advantage" and that "need for transformation is greater now than before". Nevertheless the importance of the PPM to deliver these innovations, studies done in the past 25 years indicate that 60% to 80% of companies fall short of the success predicted from their new strategies (Kaplan & Norton, 2008).

Based on all this arguments (lack of adoption, deficiency of control and pace of change), the main goal of this research is to evaluate how well IT areas of the insurance organizations are managing its Portfolios. Within this context, the following question can be highlighted: How IT areas of insurance companies are, in the present moment, defining and delivering their strategic initiatives Portfolios?

To address the question above, two (02) assumptions will be the starting point of this study:

Assumption 1: IT areas of these organizations are applying the best practices in the definition of their strategic initiatives Portfolios.

Assumption 2: IT areas of these organizations are applying the best practices in the delivery of their strategic initiatives Portfolios.

It is hoped that this study contribute for the understanding of how PPM is established in the organizations, compare this information with existing theory and find gaps between theory and practice. It is not intended to find answers to the gaps found, which will result in new studies. Furthermore, this research focused only in the insurance industry information technology area to narrow the scope and to improve the knowledge about how PPM is done inside this specific extract of the largely population.

This master thesis, to adequately answer the question and verify the presented assumptions, will be structured on the following topics:

Introduction: present the objective to the reader;

Theoretical reference: in-depth study about the theme (Portfolio management);

Research methodology: explain the methodology that was applied and the research protocol;

10

Final results and conclusions: where conclusions will be made and suggestions for future work will be presented;

Abbreviations and acronyms: explains all the abbreviations and acronyms contained in this thesis;

Bibliography: showing all reference sources used in this thesis;

11

Theoretical Reference

The aim of this chapter is to study and comprehend the main concepts, publications and articles covering the Portfolio Management theme. The searching for theoretical references will be concerned about their scientific legitimacy and the quality of the publication. Due to this, the main references will be the articles published in the renowned journals covering this field and, another important source of references, will be the well-known books and authors covering this theme.

Main Concepts for Portfolio Management

There are some concepts and acronyms that need to be described for proper understanding of the content and to establish a standardized lexicon for this study - and this topic will be dedicated to it.

The first item to be discussed should be the heading of our topic of study: Portfolio management. The acronym that is adopted to represent this field in most of the academic papers (Castro & Carvalho, 2010) and, therefore, will be used to denote strategic initiatives. Portfolio management in this study will be the PPM acronym (meaning Project Portfolio Management). The main benefit of adopting this nomenclature is that it differentiates the strategic initiatives Portfolio management in relation to Portfolio management of other disciplines (finance, marketing and so on), since Portfolio is not only adopted by this management field to describe their collectives. Regarding the meaning, Cooper, Edgett e Kleinschmidt (1998) define PPM as:

Project Portfolio Management is a dynamic decision process wherein a list of active development projects is constantly revised. In this process, new projects are evaluated, selected and prioritized; existing projects may be accelerated, killed or reprioritized, and resources are allocated and reallocated among the projects in the Portfolio

Furthermore, PMI (2013b, p. 21) describes PPM as: "Portfolio management is a discipline that enables executive management to meet organizational strategy and objectives through efficient decision making...". And OGC (2011) includes the PPM definition in this context:

12

To better understand the abovementioned concept, it is important to comprehend the meaning of some related and cited ideas. The figure 1 presents some of these main topics related to the PPM area.

Figure 1: PPM organizational context

Source: PMI (2014)

The first element is the meaning of the isolated Portfolio word for the PPM context. The Standard for Portfolio Management, published by the Project Management Institute (2013b, p. 3), describes Portfolio as: "A Portfolio is a component collection of programs, projects, or operations managed as a group to achieve strategic objectives". And complements this definition with the following sentence: "A Portfolio should be a representation of an organization's intent, direction and progress".

Another explanation of the same expression comes from OGC (2011, p. 131), and it defines Portfolio as: "An organization's Portfolio is the totality of its investment (or segment thereof) in the changes required to achieve its strategic objectives".

Since a Portfolio is established to enable the company's strategy, it is imperative to understand what strategy is: "a careful plan or method for achieving a particular goal usually over a long period of time" (Merriam-Webster, 2014).

13

development of this content. PMI (2013b, p. 180) describes Program as: "A group of related projects, subprograms, and program activities that are managed in a coordinated way to obtain benefits not available from managing them individually".

In addition, PMI (2013a, p. 3) describes Project as: "A project is a temporary endeavor undertaken to create a unique product, service, or result".

However, to group all these concepts (programs, projects and operations) into just one denomination, PMI (2013b, p. 176) introduced the notion of Components, meaning: "A discrete element of a Portfolio that is a program, project, or other work". For a similar purpose, OGC (2011, p. 130) adopts the concept of Initiative, that excludes operations from this list and denotes just a program or a project. Moreover, Kaplan and Norton (2008, p. 7) described a discretionary project or program, of finite duration, designed to close a performance gap as a Strategic Initiative (Kaplan & Norton, 2008, p. 7)

Since PPM is a way to improve the creation of Value to the organization, another important concept that is usually linked to its theory is the Value notion. PMI (2013b, p. 10) states that Value:

[...] may be created through the effective management of ongoing operations [...] however, through the effective use of Portfolio, program and project management, organization will possess the ability [...] to meet strategic objectives and obtain grater business value from their project investments.

And it also defines the meaning of Value: "[...] the entire value of the Business - the total sum of all tangible and intangible elements [...] business value scope can be short, medium or long-term."

To sum up to the same concept, Levine (2005, p. 34) states that: "Definition of value will certainly differ in accordance with the firm's focus, strategies, and types of projects."

In order to deliver value to the business, the Portfolio components must deliver its benefits. Benefits that are described by OGC (2011, p. 129) as: "The measurable improvement resulting from an outcome perceived as advantage by one or more stakeholders."

With the intention to describe the value of the initiatives and the benefits that will be accrued with each components, a document called business case should be developed for each of them (OGC, 2011). OGC (OGC, 2009) declares that it contain justifications for a project like financial feasibility for what is to be made and why it should be done.

14

[...] the organizational capability to (1) form and govern a project Portfolio such that the Portfolio aligns with the organization’s strategic direction, addresses risks and opportunities, and is adaptive to the internal and external changes in order to provides short and long-term value or benefits to the organization, and (2) to manage projects in the Portfolio to promote transparency, process consistency, visibility and predictability of projects in the Portfolio, and to promote integrity, cohesion, and the morale of the project community.

The Standard for Portfolio Management1 (SPM)

The Standard for Portfolio Management (SPM) is a document composed of a collection of Portfolio management best practices cataloged and compiled by the Project Management Institute (PMI). PMI was founded in 1969 and it is the world’s largest not -for-profit association for the project management profession. Among PMI's core values, is the intent to engage the community and facilitate the growth of the profession (PMI, 2013d) and, to accomplish this objective, the SPM is reviewed by PMI's volunteers at every 4 years to ensure its validity for the practitioners (the last edition was published on January 1st, 2013).

SPM intends to depict Portfolio management processes generally recognized as good practices and promote a common vocabulary, unfolding a guide rather than a methodology that is valid to most Portfolios on the most of the time. It focuses on processes that are unique to the Portfolio management field and its relationships with allied disciplines. Regarding its application, the standard recommends an adequate adaptation of its content to the given context to maximize the benefits of its adoption (tailoring its content to the reality of the situation). With the adequate tailoring, the knowledge provided by this reference can be applied by all type of organizations (profit, nonprofit and government).

Structure

This standard organizes the best practices (Portfolio management processes) into a two dimensions matrix: process groups and knowledge areas. The best practices are represented by processes and each one belongs only to one knowledge area and one process group as depicted in figure 2.

1

15

The first aspect that organizes the best practices are the process groups and it cluster the best practices based on its purpose for the PPM.

The Defining process group contains the process that are responsible for converting the organizational strategy and its related objectives into a group of policies describing how the components (operations, projects and programs) will be identified, authorized and managed.

Figure 2: PPM processes and process groups

Source: Standard for Portfolio Management (PMI, 2013b)

Moreover, the Aligning process group executes the processes necessary to manage and optimize the Portfolio. Among the activities that occurs during these process group are: the management and report of the Portfolio components (operations, projects and programs), the Portfolio value management and the fine-tuning between resource supply and demand. These activities should respect and align to the standards established during the Defining process group.

The last process group, Authorizing and Controlling, is responsible for the authorization of the Portfolio components and for the ongoing Portfolio oversight. In the same way as the Aligning process group, these activities should respect and align to the standards established during the Defining process group.

16

The first knowledge area is the Portfolio Strategic Management, is related to the strategic aspects of the Portfolio, ranging from alignment with corporate strategy to the realignment necessary due to changes in initially established assumptions;

The second knowledge area is the Portfolio Governance Management, which is responsible for the decisions related to the Portfolio, also including the completion of the studies necessary for this to occur properly;

After is the Portfolio Performance Management knowledge area and this segment contains the processes that set out how to measure the efficiency and effectiveness of the Portfolio and, also, it comprises the effective implementation of these practices;

Chart 1: Relationship between Processes and Tools & Techniques (part 1)

Source: Standard for Portfolio Management (PMI, 2013b)

Next is the Portfolio Communications Management knowledge area, which develop the communications plan and implement the guidelines established;

P ro c e ss G ro u p P ro c e ss N u m b e r

Process / Tools & Technique

S tra te g ic A li g n m e n t A n a ly si s P ri o ri ti z a ti o n A n a ly si s S c e n a ri o A n a ly si s Ca p a c it y a n d Ca p a b il it y A n a ly si s In te rd e p e n d e n c e A n a ly si s Co st /b e n e fi t A n a ly si s S ta k e h o ld e r A n a ly si s Re a d in e ss A ss e ss m e n t P o rt fo li o O rg a n iz a ti o n a l S tru c tu re A n a ly si s G ra p h ic a l A n a ly ti c a l M e th o d s Q u a n ti ta ti v e a n d Q u a li ta ti v e A n a ly si s V a lu e S c o ri n g a n d M e a su re m e n t A n a ly si s Be n e fi t Re a li z a ti o n A n a ly si s Co m m u n ic a ti o n Re q u ire m e n t A n a ly si s G a p A n a ly si s

4.1 Develop Portfolio Strategic Plan x x

4.2 Develop Portfolio Charter x x

4.3 Define Portfolio Roadmap x x x

5.1 Develop Portfolio Management Plan x

5.2 Define Portfolio

6.1 Develop Portfolio Performance Management Plan x

7.1 Develop Portfolio Communication Management Plan x x

8.1 Develop Portfolio Risk Management Plan x x

4.4 Manage Strategic Change x x x

5.3 Optimize Portfolio x x x

6.2 Manage Supply and Demand x x x

6.3 Manage Portfolio Value x x

7.2 Manage Portfolio Information x

8.2 Manage Portfolio Risks x

5.4 Authorize Portfolio

5.5 Provide Portfolio Oversight

T h e S ta n d a rd fo r P o rt fo li o M a n a g e m e n t (P M I) Defining Aligning Authorizing and Controlling

Tools & Techniques

17

The last knowledge area is Portfolio Risk Management, which is responsible for increasing the exposure of the Portfolio to positive uncertain events and to reduce the exposure to adverse uncertain events.

The last element of these matrix, representing the best practices, are the sixteen processes that are distributed in the intersections between process groups and the knowledge areas. To adequately accomplish its objectives, each of these processes contains inputs, tools & techniques and outputs (called ITTOs). The premise adopted by the standard is that the appropriate use of these tools & techniques to transform inputs into outputs will maximize the likelihood of successful PPM initiative.

Chart 2: Relationship between Processes and Tools & Techniques (part 2)

Source: Standard for Portfolio Management (PMI, 2013b)

There are twenty four tools & techniques recommended by this standard and they are distributed between the sixteen processes (as depicted by chart 1 and 2) based on their utility

P ro c e ss G ro u p P ro c e ss N u m b e r

Process / Tools & Technique

P o rt fo li o Co m p o n e n t In v e n to ry P o rt fo li o Co m p o n e n t Ca te g . T e c h n iq u e s W e ig h te d Ra n k in g a n d S c o ri n g T e c h n iq u e s P o rt fo li o A u th o ri z a ti o n T e c h n iq u e s P o rt fo li o Re v ie w M e e ti n g s Co m m u n ic a ti o n M e th o d s E li c it a ti o n T e c h n iq u e s P o rt fo li o M a n a g e m e n t In fo rm a ti o n S y st e m In te g ra ti o n o f P o rt fo li o M a n a g e m e n t P la n s

4.1 Develop Portfolio Strategic Plan x

4.2 Develop Portfolio Charter

4.3 Define Portfolio Roadmap

5.1 Develop Portfolio Management Plan x x

5.2 Define Portfolio x x x

6.1 Develop Portfolio Performance Management Plan x x

7.1 Develop Portfolio Communication Management Plan x

8.1 Develop Portfolio Risk Management Plan x

4.4 Manage Strategic Change

5.3 Optimize Portfolio x

6.2 Manage Supply and Demand

6.3 Manage Portfolio Value x

7.2 Manage Portfolio Information x x x

8.2 Manage Portfolio Risks x

5.4 Authorize Portfolio x x

5.5 Provide Portfolio Oversight x x

Tools & Techniques

18

related to the transformation of the input into the output. For example: it is extremely important to do a Stakeholder Analysis while developing the Portfolio Communication Plan. Some of these tools & techniques are adopted by more than one process and they are grouped into four categories based on its usefulness:

Analyzing: create additional information;

Selecting: select the appropriate components;

Meeting: provide information and decision making during a reunion;

Informing: collect and disseminate consistent information.

Chart 3: Relationship between Processes and Inputs & Outputs

Source: Standard for Portfolio Management (PMI, 2013b)

Moreover, the artifacts generated or required as inputs or outputs of these sixteen processes are the documents that will help to accomplish the PPM activities. There are twelve

P ro c e ss G ro u p P ro c e ss N u m b e r

Process / I/O

O rg a n iz a ti o n a l S tra te g y a n d O b je c ti v e s In v e n to ry o f W o rk P o rt fo li o P o rt fo li o Ro a d m a p P o rt fo li o Ch a rt e r

EEF OP

A P o rt fo li o P ro c e ss A ss e ts P o rt fo li o S tra te g ic P la n P o rt fo li o M a n a g e m e n t P la n P o rt fo li o Re p o rt s P o rt fo li o Co m p o n e n t Re p o rt s

4.1 Develop Portfolio Strategic Plan I I O I I I O

4.2 Develop Portfolio Charter O I I/O I/O

4.3 Define Portfolio Roadmap I O I I

5.1 Develop Portfolio Management Plan I I I I I/O I/O O

5.2 Define Portfolio I/O I/O I I I I/O

6.1 Develop Portfolio Performance Management Plan I I I/O I/O

7.1 Develop Portfolio Communication Management Plan I I I/O I/O I

8.1 Develop Portfolio Risk Management Plan I I/O I/O I/O

4.4 Manage Strategic Change I/O I/O I/O I/O I/O I/O

5.3 Optimize Portfolio I/O I/O I/O I/O I/O

6.2 Manage Supply and Demand I/O I/O I/O

6.3 Manage Portfolio Value I O I/O I/O

7.2 Manage Portfolio Information I I/O I/O I/O I

8.2 Manage Portfolio Risks I I I/O I/O I/O I/O

5.4 Authorize Portfolio I/O O I/O I/O

5.5 Provide Portfolio Oversight I/O I I/O I/O I/O

T h e S ta n d a rd fo r P o rt fo li o M a n a g e m e n t (P M I)

Input / Output

19

documents (as depicted by chart 3) cited by the SPM and, in the same way as the tools & techniques, they are organized into four categories based on its purpose:

Guiding: high-level direction to the PPM;

Supporting: facilitate the operation of the PPM;

Planning: provide guidelines on how to execute the PPM activities;

Reporting: grant PPM communication.

Management of Portfolios2 (MoP)

This British collection of PPM best practices is on its 2011 edition and it is part of a bigger collection of standards developed by the Office of Government Commerce (OGC) and published by The Stationery Office (TSO).

The author (OGC) is an independent office of the British government's economic and finance ministry and it was established to support it to optimize their investments (Office of Government Commerce, 2009). OGC responsibilities encompasses the effective use of sixty per cent of the overall British government spending (OGC, 2013).

To help the government to accomplish this, OGC developed and regularly reviews seven interconnected standards related to Portfolio, program, project and service management: PRINCE2, MSP, MoP, M_o_R, MoV, ITIL and P3O (OGC, 2011) - and Management of Portfolios (MoP) is one of these. These standards set the government expectations in relation to how the British government and its supplier should manage its initiatives and operations.

Structure

Management of Portfolios (MoP) has its structure based on five principles, two management cycles (delivery and definition) and twelve processes distributed among these two management cycles as depicted by the figure 6.

One main aspect about this guide of best practices is how it highlights the relevance of five principles as prerequisites for the success of the overall PPM: strategy alignment, governance alignment, senior management commitment, energized change culture and

2

20

Portfolio office. OGC states clearly that these principles are pre-requisites to an effective Portfolio management and it also declares that they should be adapted to the level of the goal that is trying to be achieved.

The first one of these principles is the strategy alignment, highlighting the importance of aligning the Portfolio and PPM with organizational goals and values. The second principle is governance alignment, demanding transparency about the PPM decisions and consistency with the organizational governance model. Next principle is the senior management commitment, advocating that proactive and visible senior management involvement is a valuable asset to a PPM initiative. Energized change culture is the fourth principle and it embrace the human aspect, declaring that people must be engaged, focus on the goals and work as a team. The last principle is the Portfolio office, stating that a PPM corporative function is very important inside an organization and that this area can be labeled as Portfolio Office.

Figure 3: MoP structure - principles, cycles and practices

Source: Management of Portfolios (Office of Government Commerce, 2011)

To implement a reliable PPM framework, MoP presents a set of twelve practices that should be tailored to the reality of the context and it groups this set of processes into two cycles: the Portfolio definition cycle and the Portfolio delivery cycle.

21

accomplish this cycle goal, these practices are usually performed in sequence, for example: it is necessary to understand a Portfolio before categorize them.

Furthermore, the Portfolio delivery management cycle contains the practices accountable for the benefits management, financial management, management control, risk management, stakeholder engagement, organizational governance and resource management in the Portfolio level. In this management cycle the practices are not performed sequentially, they can overlap to deliver the value proposed by the Portfolio.

Finally, in the center of the principles and the practices, are an element called organizational energy, which means: "The extent to which an organization has mobilized its emotional, cognitive and behavioral potential to pursue its goals".

Key Portfolio Roles

Portfolio Direction Committee

The Portfolio direction committee is the PPM government council, and it is charged with the responsibility for the key decisions that affect the project Portfolio (Levine, 2005). Usually these decisions are made at relevant points in time through gate-reviews, with ad-hoc reunions scheduled for high severity issues or during periodic Portfolio management meetings programmed to discuss recurrent themes or new issues (OGC, 2011).

Portfolio Manager

According to PMI (2013b, p. 14) , the Portfolio manager is: "...responsible for the execution of the Portfolio management process".

The main difference between Portfolio, program and project managers is that Portfolio managers must be worried about doing the right work, the program manager are concerned about delivering their benefits and project managers are concerned about delivering the scope according to the constraints (PMI, 2013b).

The role of a Portfolio manager can be occupied by an individual, a group or a governing body, depending on the organizational needs and on the Portfolio size and its responsibilities may include (PMI, 2013b):

22

Ensure that Portfolio components are aligned to the company strategy;

Progressively elaborate the Portfolio;

Measure and monitor the value;

Support Portfolio related decision making;

Engage and influence stakeholders.

Portfolio Definition Best Practices

The Portfolio definition best practices will be separated, for research purposes, adopting the OGC (2011) practices model (as described on section 2.3): it will be composed of the Understand, Categorize, Prioritize, Balance and Plan practices. Each practice will be studied along with its goals, tools and techniques to ensure the proper development of the research protocol and adequate consistency during the data collection.

Chart 4: Interrelationships between MoP practices and SPM processes

Source: author

Since we are adopting the OGC (2011) recommended practices to organize this section content and, relied on the assumption that MoP and SPM are the main references for

Management Cycle

Practice Number 1 2 3 4 5 6 7 8 9 10 11 12

P ro c e ss G ro u p P ro c e ss N u m b e r

Process / Practice

U n d e r sta n d C a te g o r iz e P r io r iti z e Ba la n c e P la n M a n a g e m e n t Co n tro l Be n e fi ts M a n a g e m e n t F in a n c ia l M a n a g e m e n t Ri sk M a n a g e m e n t S ta k e h o ld e r E n g a g e m e n t O rg a n iz a ti o n a l G o v e rn a n c e Re so u rc e M a n a g e m e n t

4.1 Develop Portfolio Strategic Plan W W W W

4.2 Develop Portfolio Charter

4.3 Define Portfolio Roadmap S S

5.1 Develop Portfolio Management Plan S

5.2 Define Portfolio S S S W

6.1 Develop Portfolio Performance Management Plan W

7.1 Develop Portfolio Communication Management Plan W

8.1 Develop Portfolio Risk Management Plan W

Aligning 5.3 Optimize Portfolio W S

Auth. and Cont. 5.4 Authorize Portfolio W

S

W

Management of Portfolios (OGC)

23

this study, it is relevant to understand the relationship of the MoP practices with the SPM processes. These interrelationships are depicted in the chart 4.

The group of Portfolio Definition best practices are carried out in sequence at specific times of PPM (OGC, 2011), i.e., there is an arbitrary dependence between these practices to ensure effectiveness in their implementation.

Understand

The aim of the Portfolio Understand practice is to appreciate what constitutes the current Portfolio and to obtain information to comprehend these components (Levine, 2005) in order to permit the Categorize, Prioritize, and Balance and Plan practices to be executed properly. This practice covers the identification and data collection not only of components that are candidates to be chartered, but also the components that are ongoing and, often, of the closed components (PMI, 2013b).

Since the main output of this practice is a list of components that constitute the Portfolio (also called pipeline) and their data, a best practice that is suggested is the adoption of a template for the proper recording of these components. The sponsor must fill this document to request the inclusion of the new component, a change in a current component or to add an ongoing component to the Portfolio (OGC, 2011).

To be effective, the abovementioned document should include some relevant descriptors for the PPM processes. The main descriptors cited by SPM (PMI, 2013b) as relevant to be detailed at the time of component inclusion into the Portfolio are: Portfolio component number, Portfolio component code, and Portfolio component description, type of Portfolio component, strategic goals supported, quantitative benefits, qualitative benefits, Portfolio component customer, Portfolio component sponsor, key stakeholders and resources required. Furthermore, OGC (2011) recommends the addition of the following data to this list: key deliverables, risk level, business changes required, key dependencies, current status (for ongoing components) and key milestones to be accomplished.

24

originated only by top management and, in the bottom-up method, the requests are made by lower corporate levels (Office of Government Commerce, 2011).

Categorize

The Categorize practice, according to OGC (2011, p. 53) has as its main goal: "[...] organize changes initiatives into groups, segments or sub-Portfolios based on the strategic objectives or other grouping as required". These groups, segments or sub-Portfolios help to perform an appropriate comparison between the components that cover the same strategic goal or organizational need.

A visual diagram or a spreadsheet is a useful tool to help to evaluate how the components are separated between the categories. The figure 4 shows an example of how a graph can be built to depict it. Thanks to this evaluation and comparison, the Portfolio components categorization also allows the balancing of risks and investment between these strategic goals and organizational needs (PMI, 2013b).

Figure 4: Portfolio components separated by business area

25

Additionally, OGC (2011) recommends that the categories have entry criteria to help to adequately place the components into them. The entry criteria must be set accordingly the related category, for example: to be allowed to incorporate the Compliance category of Portfolio initiatives, the project must include evidence of the legislation and provide an explanation that links it with the component deliverables.

Number of categories should be limited (not infinite) and some examples are (PMI, 2013b):

Increased profitability (revenue increase, generation, cost reduction and avoidance);

Risk reduction;

Efficiency improvement;

Regulatory/compliance;

Market share increase;

Process improvement;

Continuous improvement;

Foundational (e.g., investments that build the infrastructure to grow the business), and

Business imperatives (e.g., internal toolkit, IT compatibility, or upgrades).

Prioritize

After the components are identified and categorized, the next step is to prioritize them (OGC, 2011). This best practice is recommended to be adopted by the PPM because the corporations probably will have more identified Portfolio components than capacity to implement them (Castro & Carvalho, 2010). Based on this assumption, the challenge of PPM during this practice is to filter the inventory of components so that the programs and projects that pass though the funnel into the Portfolio best serve the long-term interests of the firm (Levine, 2005, p. 32).

26

manage them more effectively, show some quantifiable characteristics and compete for company's resources (PMI, 2013b).

Being comparable, the Portfolio components should be prioritized accordingly to your relevance and contribution to the organization strategy, in a comparative way with the other future or actual components (Castro & Carvalho, 2010). However, if this comparison is not possible due to lack of common characteristics, the Portfolio components can be prioritized by their segments or categories (OGC, 2011).

To provide a solid background for the abovementioned comparison, relevant metrics ought to be selected and adopted (PMI, 2013b). It is important to evaluate not only the financial benefits, but the ancillary benefits too (Levine, 2005) and, for this reason, some of these metrics are qualitative and some of them are qualitative. Examples of metrics classes may include, but are not limited to (OGC, 2011):

Organizational strategy alignment;

Goals and objectives;

Benefits, financial and nonfinancial;

Market share, market growth, or new markets;

Costs (lost opportunity costs);

Dependencies, internal and external;

Risks, internal and external;

Legal/regulatory compliance;

Human resources capabilities and capacities;

Technology capabilities and capacities; and

Urgency.

In accordance to the abovementioned criteria categories, Jolly (2003) developed a more detailed list of criteria pertinent to IT Portfolio that is listed in the chart 5. A number of these items justify a particular attention because of its strategic relevance, for instance the mandatory group of criteria encompassing regulatory or operational requirements (PMI, 2013b). In addition, apart from the type of criteria, it is very important that each of these factors should be tailored to the reality of the firm (Levine, 2005) to adequately reflect its intents.

27

account for just one metric and another ones takes into account more than exclusively one variable.

Chart 5: Prioritization criteria for IT Portfolio

Source: Jolly (2003)

Single criteria prioritization models can be qualitative or quantitative. Qualitative models include the single criterion prioritization model, which compares all the components and shows the priority between them as shown in the figure 5 (PMI, 2013b). Within the same context, one of the quantitative single criteria existing alternative is the financial analysis of the components, encompassing the NPV, IRR and Payback calculation and analysis.

Figure 5: Single qualitative criteria prioritization model (comparison between projects)

28

Another prioritization tool alternative is the multi-criteria analysis of the Portfolio prospective components (PMI, 2013b). The adoption of multi-criteria generates more reliability than adopting just one criteria but it requires more team effort to implement. One of the strengths of this tool is that it can include qualitative and quantitative data into just one analysis.

Figure 6: Multi-criteria prioritization model (comparison between projects)

Source: SPM (Project Management Institute, 2013)

Conquering even more reliability in its application, the multi-criteria prioritization model can also include weights for each criteria. Weights are applied since different criteria does not have the same strategic relevance, for example: if ROI is more significant than resource capabilities it should be confirmed in the weights assigned to both (the weight of the ROI should be proportionately larger than the weight of the resource capabilities).

29

Figure 7: Bubble graph

Source: PMI (2013)

Finally, to adequately pursue this objective, two additional conditions are also fundamental: the first is to formalize a process and a policy to accomplish this set of tasks in order to eliminate any common political, power or emotional bias (Levine, 2005) and, the second one, is to request and store evidences that supports the information provided before and during this decision making process (OGC, 2011).

Balance

30

As abovementioned, there are several items that are recommended to be evaluated during this practice. The first item is the balance of the Portfolio (OGC, 2011) and it can be measured regarding any criteria collected and analyzed in the aforementioned practiced, for instance: the balance among various types of projects, i.e. maintenance, opportunity, competitive edge, among others (Levine, 2005). The figure 8 shows a graphical depicts the investments separated by categories and business unit and it is very useful to detect GAP's in the prioritized Portfolio.

Figure 8: Bubble graph (depicting categorization and category)

Source: PMI (2013)

Furthermore, the second item is to ensure that interrelationships between components are identified (PMI, 2013b). Sometimes, one component is dependent of another one and it must be adequately detected to avoid any problems during the Portfolio delivery. To accomplish this analysis, PMI (2013b) recommends the confection of a Portfolio Roadmap depicting the relationship between the programs, projects and operations.

Figure 9: Portfolio Roadmap

31

The third aspect that must be accounted for during this practice is the availability of resources, since several components share the same resources (Castro & Carvalho, 2010). Some organizations assume unlimited resources and some organizations are resource constrained. Organizations that assume unlimited resources, usually outsource their components to be able to deliver them (PMI, 2013b).

Figure 10: Capacity and Demand

Source: SPM (Project Management Institute, 2013)

Finally, an important decision that should be made during this practice is in relation to the compromise between the speed of Portfolio components’ delivery and the number of active programs and projects. Based on this, Levine (2005, p. 39) states that:

There is significant feedback from successful firms that tends to show that doing fewer projects actually improves the bottom line. Limiting the amount of work in the pipeline so that the projects can be completed as quickly as possible results in increased profits or savings and more satisfied clients.

Plan

PMI (2013b, p. 39) describes the main deliverable produced during this practice, the Portfolio Management Plan, as:

The portfolio management plan describes the approach and intent of management in identifying, approving, procuring, prioritizing, balancing, managing, and reporting a portfolio of programs, projects, and other work to

meet the organization’s strategic objectives.

32

sight during the Portfolio delivery and describe the steps and measures needed to effectively manage performance as a whole (PMI, 2013b)

Furthermore, it is recommended that this Plan should be tailored to the specific needs of the Portfolio. To be able to add more value to the PPM, its adaptation must consider the stakeholder expectations, the size and complexity of the portfolio, its purpose and the environment (PMI, 2013b).

To sum up all these definitions, PMI (2013b, p. 39) recommends that the Plan should contain the following topics:

Governance model;

Portfolio oversight;

Managing strategic changes;

Change control and management;

Balancing portfolio and managing dependencies;

Measuring and monitoring performance and value;

Portfolio performance reporting and review;

Communication model as part of the communication management plan;

Portfolio risk management planning (ABNT NBR ISO, 2009);

Procurement procedures;

Managing compliance;

Portfolio prioritization model.

Another relevant purpose of this document, is the mission of motivating all the stakeholders to the delivery of shared goals of the PPM initiatives (OGC, 2011). To conclude, it is imperative that, to be valid for all the organization and be recognized as a baseline, the Portfolio Management Plan must be approved by the portfolio direction committee (OGC, 2011).

Portfolio Delivery Best Practices

33

Governance practices. Each practice will be studied along with its goals, tools and techniques to ensure the proper development of the research protocol and adequate consistency during the data collection.

Since we are adopting the OGC (2011) recommended practices to organize this section content and, relied on the assumption that MoP and SPM are the main references for this study, it is relevant to understand the relationship of the MoP practices with the SPM processes. These interrelationships are shown in the chart 6:

Chart 6: Interrelationships between MoP practices and SPM processes

Source: author

The group of Portfolio Delivery best practices are not needed to be carried out in sequence during the PPM (OGC, 2011), ie, there is a no arbitrary dependence between these practices to ensure effectiveness in their implementation (it may overlap).

Benefits Management

As mentioned in section 2.1 of this document, a Portfolio exists to deliver benefits that enable the organization to achieve the goals that was set in its strategic plan (PMI, 2013b). Based on the assumption that the benefits are the drivers to conquer what was

Management Cycle

Practice Number 1 2 3 4 5 6 7 8 9 10 11 12

P ro c e ss G ro u p P ro c e ss N u m b e r

Process / Practice

U n d e rs ta n d Ca te g o ri z e P ri o ri ti z e Ba la n c e P la n M a n a g e m e n t C o n tr o l Be n e fi ts M a n a g e m e n t F in a n c ia l M a n a g e m e n t R is k M a n a g e m e n t S ta k e h o ld e r En g a g e m e n t O r g a n iz a ti o n a l G o v e r n a n c e R e so u r c e M a n a g e m e n t

4.4 Manage Strategic Change S

5.3 Optimize Portfolio W S

6.2 Manage Supply and Demand S

6.3 Manage Portfolio Value S

7.2 Manage Portfolio Information S

8.2 Manage Portfolio Risks S

5.4 Authorize Portfolio W

5.5 Provide Portfolio Oversight S W

S

W

Management of Portfolios (OGC)

34

contemplated in that strategic plan, they need to be properly monitored and controlled using the components' baselines as a reference and this is the main goal of this practice (OGC, 2011).

However, there are some elements to be observed to be able to implement this practice effectively. The first item to be considered is the fact that the benefits can often be delivered even after the end of the components (Barcaui, 2012), and this will demand an extra effort of the Portfolio management team to adequately assess the results achieved. The second and more complex item, relies on the fact that sometimes the component can affect two or three value areas (PMI, 2013b), which increases the effort and difficulty to measure the achieved benefits.

An important aspect of the benefits management practice is the fact that, for the proper use of the benefits delivered by components, the transfer of deliverables generated for the associated operations must be managed effectively (PMI, 2013b).

Financial Management

The first thing that must be done to establish a financial management process is to seek advice from the company’s financial department that is hosting the Portfolio. It is critical that the financial department is fully consulted (OGC, 2011) because the Portfolio financial management must be tightly linked to the organization governance.

Two different moments should be part of this step: the initiatives initial appraisal and the Portfolio control. During the appraisal, it is important to select the appropriate investment criteria and tailor it to the organization, to describe rules for business cases analysis, to adjust the optimism bias (for the costs and the benefits), to consider the risk of the components as a business case modifier and to establish thresholds (OGC, 2011). For the moment of Portfolio control, it is relevant to consider staged release of capital and to evaluate the consolidated portfolio financial budget (OGC, 2011).

35

Risk Management

The Risk Management practice aims to increase the probability and/or impact of positive risk events happen and to decrease the probability and/or impact of negative risk events become fact (PMI, 2013a), reducing the overall exposure of the Portfolio to the risks. This definition explains why the Chinese ideogram for risk shows these two aspects for the risk: the opportunities and the threats (Damodaran, 2008).

Figure 11: Chinese ideogram for Risk

Source: Gestão Estratégica do Risco (Damodaran, 2008)

In order to accomplish this goal, it is relevant to first understand the approach of the stakeholders in relation to the risk: they may be risk-averse or risk-takers and this will influence the way in which this practice will be implemented. Once you understand them, the risk management processes should be designed and implemented so that the goal could be accomplished. According to ABNT (2009), this risk management process must follow a process of identification, analysis, evaluation, and treatment.

It is noteworthy that the risks discussed in each context (portfolio, program and project) are different, because they must be identified and treated in relation to the objectives of each level (PMI, 2013b), and they are different. In a Portfolio, risks that cover all components will be addressed, being under the responsibility of each initiative treat localized risks.

Resource Management

36

practice, encompasses not just human resources but all the resources required to deliver the Portfolio components.

Different types of organization, Portfolio goals and resources allocation strategies require tailored management approaches. If one of the Portfolio objectives is the effective and efficient use of resources, it will demand for a stable workforce to be achieved, since it will be easier to schedule all the available resources with a minimum non-scheduled periods under this situation (Levine, 2005). In addition, transient resources may be used by the initiatives to meet specific needs but it is best to avoid this as a standard source of resources. Furthermore, the mix of components should be balanced, as declared by Levine (2005, p. 38):

The mix of projects the mix of resources should be manipulated to best use the firm's resources on work that is well matched to the available strengths and skills.

Stakeholder Engagement

PPM is a set of practices that involves the company as a whole and requires the involvement of a large number of stakeholders (Levine, 2005) and, because of this, this structure demands a strong and visible sponsorship.

To increase the chances of Portfolio success, stakeholders should be properly recognized and prioritized so that their expectations and requirements are identified, communication strategies are developed and objectives are appropriately discovered (PMI, 2013a). The key factor in this practice is the detection and monitoring of key executives and change agents of the corporation to make sure that these leaders are part of the PPM leadership. (Levine, 2005).

Management Control

Kaplan and Norton (2008, p. 7) declare that "if you don't measure progress toward an objective, you cannot manage and improve it" and this is the main purpose of this practice: obtain transparency regarding what is happening with the Portfolio (OGC, 2011). By establishing a closed loop management system, the Portfolio manager can avoid shortfalls and be proactive toward their objectives (Kaplan & Norton, 2008).

37

majority of the Portfolio metrics are the result of the aggregation of the initiatives metrics with a periodicity not necessarily equal (Barcaui, 2012). Feeding these metrics into these components are very important, as cited by Levine (2005, p. 91):

Feeding the results of project status and performance back into the Portfolio management system provides a loop ensuring that the project selection process encompasses both proposed and active projects.

An important point to note, seeking proper implementation of this practice, is the fact that not only the consolidated the aspects of components should be monitored, but also the internal and external environment (OGC, 2011), evaluating whether the assumptions initially established remain valid:

During the selection process, we make assumptions about the value of candidate projects. But the project and business environments are not cast in

concrete. Projects don’t always go as planned. The assumptions may become

less valid with time. (Levine, 2005, p. 44)

The observation of this Portfolio aspect is very important because a change in strategic direction or in the external environment may result in components categorization and prioritization changes, which will generate the need to balance again the Portfolio (Barcaui, 2012).

During these practice, valuable information are produced by the Portfolio management team and these information should be used to alter strategies and investment decision during the Organizational Governance practice (OGC, 2011).

Besides all the managerial elements of this practice, it is very important that the Portfolio Manager motivate everybody in order stimulate them to deliver the best performance (Goleman, 2000).

Organizational Governance

Decisions must be made during the Portfolio management because this set of activities are dynamic and encompasses processes that requires recurrent judgments (Barcaui, 2012). The basis for the decision-making are the data generated by other practices and compiled by Management Control practice (OGC, 2011). To optimize this practice, it is recommended that thresholds are agreed during the institution of the Portfolio:

38

project stays within the boundaries, the project team will control most of the action and decisions. (Levine, 2005, p. 49)

Two management strategies are widely used for the governance of Portfolios: the adoption of management committees (Barcaui, 2012) and the creation of stage gates for the components (Castro & Carvalho, 2010). Sometimes both management approaches are adopted and, if it happens, it is recommended to integrate them in a harmonic way (Castro & Carvalho, 2010).

Portfolio committees are regularly spaced meetings conducted with the presence of key stakeholders to present the status of the Portfolio and where decisions or directions are collected (Merrow, 2011). The frequency of these events is determined according to the characteristics of Portfolio being managed. A special committee, outside the regular schedule, can be performed if an event with a huge impact happens.

Stage gates are control points (milestones) established in the components baselines to discuss and decide whether if it should stop, recycle or proceed (Merrow, 2011): "At the end of a stage, a cross-functional team evaluates the status against the pass/no-pass conditions" (Levine, 2005, p. 48). The Portfolio initiatives should continue active while they remain valid for the strategy and while it presents an adequate performance (Levine, 2005).

Discrepancies between the References

39

Research Methodology

This chapter of this research contains the theoretical insights and the description of the strategy that was developed for the case study as a means to deliver meaningful findings for the scientific community. Its main objective is to define the logical sequence that connects the empirical data and the study question with the conclusions, guaranteeing that this paper deliver the initially proposed goal (Yin, 2010).

Research Strategy

As aforementioned, the aim of this thesis is to answer the following question: How IT areas of insurance organizations are, in the present moment, defining and delivering their strategic initiatives Portfolios? To accomplish this, Yin (2010) describes that when a question such as "how" or "why" is being done on a set of contemporary events (similar to the question we aim to answer) and in a situation where the researcher has little or no control over behavioral events, the use of the case study method is appropriate.

In order to deliver a meaningful case study it is recommended that, during its development and deployment, the case study follows a set of steps (Gil, 2010). This case study will respect the following steps to ensure its integrity and validity:

Question statement;

Theoretical revision;

Research strategy;

Study protocol development;

Data collection;

Data analysis.

For this purpose, the question statement was introduced in the first chapter and the theoretical review of the related contents was developed and presented into the second chapter. Also, the research strategy and the study protocol will be presented in this chapter and information regarding the data collection and data analysis will be available in the subsequent chapters (chapter 4 and 5 respectively).

40

Holistic single case: contains a single case and a single unit of analysis;

Integrated single case: contains a single case and several units of analysis;

Multiple holistic cases: contains several cases and each case contains only one unit of analysis;

Integrated multiple cases: contains several cases and each case contains several units of analysis.

For the purpose of this study and attendance to the proposed objectives, this case study will adopted the holistic single case approach and, to ensure the quality, validity and integrity of the data collection, this research will implement the following strategies during this step (Yin, 2010):

Use of a protocol for the case study (presented in the section 3.2);

Use of multiple sources of evidence (documents and interviews);

Adoption of 1 interviewee;

Have key stakeholders to review the draft of the report.

To ensure proper execution of this research, it was established that the case study should be realized in a company that meets the following criteria:

The company should have more than 4000 employees;

Must be situated in São Paulo;

Should already make use of project management practices;

Have availability and agreement of the company and participants to collaborate with this study, including granting access to documents.

In addition, the selection criteria for the survey respondent and the reviewers were created as follows:

Be an employee of the company for more than one year;

Be in constant contact with the PPM practices;

Have access to evidentiary documentation of the implemented practices.

This study does not want to exhaust the subject, so there are limitations on it which does not allow to make generalizations or the development of new theories. Otherwise, this study aims to stimulate the search for understanding about the way that Portfolios are managed and implemented in the organizations.

41

Yin (2010) orients that the protocol is an important way of increasing the reliability of the research and is intended to guide the investigator in carrying out the data collection for a case study. For this purpose the research protocol presented in chart 7 will be applied during the data collection. These questions were designed based on the literature review and aims to make the connection between this stage of the study and the data collection.

Chart 7: Research questionnaire

C Management

Cycle Process Question

Q1 Definition Understand Is the Portfolio scope clear?

Q2 Definition Understand Is there a template to introduce the components into the Portfolio? Q3 Definition Understand Are business cases adopted / required?

Q4 Definition Understand Are the components presented to the Portfolio in a bottom-up or top-down way?

Q5 Definition Understand Are all the components identified and registered (programs, projects and operations)?

Q6 Definition Categorize Are categories established?

Q7 Definition Categorize Are these categories related to strategic objectives? Q8 Definition Categorize Are entry criteria set for these categories?

Q9 Definition Categorize Are visual diagrams adopted?

Q10 Definition Prioritize There are financial analysis of the components?

Q11 Definition Prioritize Is it clear how each component contributes to the corporate strategy?

Q12 Definition Prioritize Is risk of achieving the desired result evaluated? Q13 Definition Prioritize Are prioritization models adopted?

Q14 Definition Prioritize Are the prioritization criteria and their weights aligned with the strategy?

Q15 Definition Prioritize Are prioritization criteria tailored to each category?

Q16 Definition Prioritize Are supporting evidences provided with the projects' evaluation? Q17 Definition Prioritize Are visual diagrams adopted?

Q18 Definition Balance Do investment decisions consider individual projects or it analyses all components of the Portfolio together?

Q19 Definition Balance Are bottlenecks considered (resources and finance)? Q20 Definition Balance Are inter-dependencies identified?

Q21 Definition Balance Are visual diagrams adopted (roadmap, graphics, etc.)? Q22 Definition Plan Is there a Portfolio governance model?

Q23 Definition Plan Is there a change management process for the Portfolio? Q24 Definition Plan Is there a communication plan for the Portfolio? Q25 Definition Plan Is there a risk management framework for the Portfolio? Q26 Definition Plan Are KPIs aligned with the strategic objectives?

Q27 Definition Plan Is clear to everyone their individual responsibilities to allow the success of the Portfolio?

42

Q29 Delivery Benefits

Management Do estimates (baselines) of the components exists and are reliable?

Q30 Delivery Benefits

Management Is the measurement regularly made?

Q31 Delivery Benefits

Management Are the information validated?

Q32 Delivery Benefits

Management Are trends and deviations evaluated?

Q33 Delivery Benefits Management

Is the analysis of inter-dependencies between different components done?

Q34 Delivery Financial

Management Do estimates (baselines) of the components exists and are reliable?

Q35 Delivery Financial

Management Is the measurement regularly made?

Q36 Delivery Financial

Management Are the information validated?

Q37 Delivery Financial

Management Are trends and deviations evaluated?

Q38 Delivery Financial Management

Is the analysis of inter-dependencies between different components done?

Q39 Delivery Risk

Management Are risks to the Portfolio identified?

Q40 Delivery Risk

Management Are risks to the Portfolio qualified?

Q41 Delivery Risk

Management Are risks to the Portfolio quantified?

Q42 Delivery Risk

Management Are responses to the risks to the Portfolio planned?

Q43 Delivery Risk

Management Are risks to the Portfolio controlled?

Q44 Delivery Risk

Management Are trends and deviations evaluated?

Q45 Delivery Resource

Management Do estimates (baselines) of the components exists and are reliable?

Q46 Delivery Resource

Management Is the measurement regularly made?

Q47 Delivery Resource

Management Are the information validated?

Q48 Delivery Resource

Management Are trends and deviations evaluated?

Q49 Delivery Resource Management

Is the analysis of inter-dependencies between different components done?

Q50 Delivery Stakeholder

Engagement Are stakeholders mapped?

Q51 Delivery Stakeholder Engagement

Are communications planned (based on the profile of the Stakeholders)?

Q52 Delivery Stakeholder Engagement

Is there a proactive and bi-directional communication with stakeholders?

Q53 Delivery Stakeholder

43

Q54 Delivery Management Control

Is the Status of the Portfolio disseminated using appropriate channels of communication?

Q55 Delivery Management

Control Are the components' budget provided in incremental stages?

Q56 Delivery Management

Control Are deviations and risks treated or addressed?

Q57 Delivery Management

Control Are interdependencies between components managed?

Q58 Delivery Management

Control Are lessons learned collected and disseminated?

Q59 Delivery Management

Control Are internal and external environment monitored?

Q60 Delivery Management Control

Is there a components' reassessment to verify that the results were achieved (at the end of the component)?

Q61 Delivery Governance Are there "gates" for Portfolio decision making? Q62 Delivery Governance Are there committees established?

Q63 Delivery Governance Are there rules for convening an emergency committee?