The developing-country debt problem

Texto

Imagem

Documentos relacionados

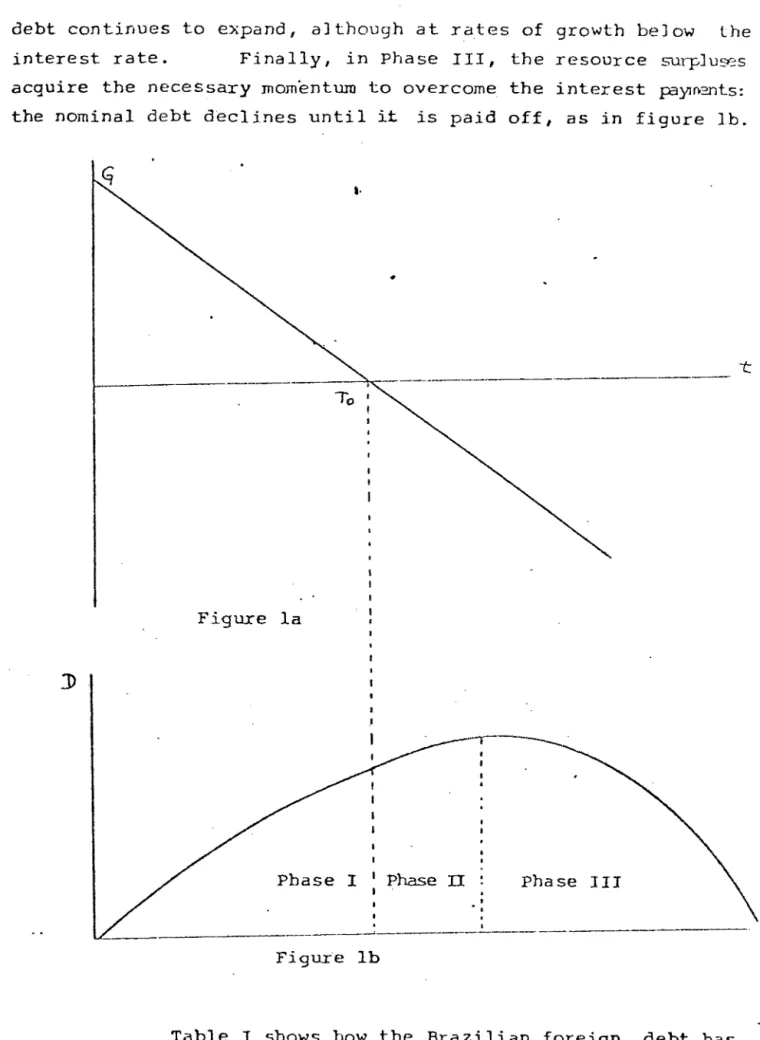

Finally, for the case of the budget balance and real GDP growth (bid ask spread, debt-to-GDP ratio, real effect exchange rate and VIX), the larger (higher) in absolute value

O objetivo geral desse trabalho é avaliar se e como o tratamento criogênico por imersão em nitrogênio líquido a -196°C afeta propriedades térmicas e mecânicas de

In this regard we report a patient with LARC where the need to increase the interval between neo-CRT and surgery in 17 weeks was safe and allowed a complete tumor response in

The impact of size of the firm and exchange rate in the export propensity of domestic and foreign owned firms in a developing country - A study of the Brazilian

used: the debt to GDP ratio, the government balance in % of GDP and the growth rate.. of real

The hypotheses that both the devaluation and volatility of the real exchange rate affect technological innovation and that this effect differs between country groups with mature

as expected, in equation (16a) the rate of change of domestic output is a negative function of domestic inflation rate, since equation (16) refers to the de- mand side of the

It is this tendency to the overvaluation of the exchange rate that has been a major factor not only in causing balance of payment crisis but also ar- tificially high real