Nguyễn Thị Thảo Duyên

Bancassurance and the new EU Insurance Distribution Directive: Difficulties faced by banks when selling insurance products

Dissertation for Master in Law and Financial Markets

Supervisor:

Professor Margarida Lima Rego.

PLAGIARISM STATEMENT

I declare on my honour that the work I present is original and that all my citations are correctly identified, under article 20-A of the Regulation of the Second cycle of studies at NOVA School of Law. I am aware that the use of elements unidentified others constitutes a serious ethical and disciplinary fault.

ACKNOWLEDGEMENT

I would like to express my gratitude and appreciation to my advisor Professor Margarida Lima Rego for her expert advice and support me during this Master course.

I also would like to deliver special thanks to professors at the Master in Law and Financial Markets program for knowledge, skills and especially their enthusiasm and kindness helping me to understand well the lectures in Portuguese.

I wish to express my deepest acknowledge to my family for their unconditional support and encouragement throughout the lengthy period. Especially, I would like to thank my husband, Nguyen Tuan Hung who gives me a chance to study at NOVA University of Lisbon and who always spends the best things for me. His unconditional love and encouragement that makes me feel stronger. I also would like to thank Ms Nguyen Thi Phi Yen, Ms Nhu Hoa Quynh Nga and Mr Nguyen Bin for their encouragement and support.

I would like to thank my classmates in NOVA School of Law, especially, Wylian Almeida, Belarmino Cardoso, Desidério César, Ana Henriques, Nayda Almeida, Isabelle Gomes, Antonio Jorge, Luzolo Manuel, Kátya Caveto, José Lumango, Laura Olival for their warm welcome that help me to quickly adapt and feel comfortable with a new environment.

Finally, I would like to thank Ms Patrícia Nascimento and all staffs of Academic Service and Library at NOVA School of Law for their enthusiastic assistance during the time I study here.

RESUMO

Esta dissertação estuda o impacto da nova Diretiva da Distribuição de Seguros da UE (2016/97 / EU, DDS) na bancassurance, que se refere à venda de produtos de seguros por instituições bancárias. O principal objetivo é estudar, sob os novos requisitos da DDS, quais os desafios legais que os bancos enfrentam na distribuição de produtos de seguros. Para esse fim, estudamos os novos requisitos impostos pela DDS e comparamos com a anterior Diretiva da Mediação de Seguros (2002/92 / EU, DMS) em relação aos seguintes aspetos: requisitos de informação, conduta dos negócios e requisitos profissionais e organizacionais.

Descobrimos que, em geral, em comparação com a DMS, a nova DDS impõe requisitos mais rigorosos que os bancos devem cumprir. A DDS restringe as atividades de distribuição de seguros através dos bancos, proibindo os bancos de distribuírem produtos de seguros sob a forma de mediadores de seguros ligados ou auxiliares. De acordo com a nova DDS, os bancos agora são considerados mediadores de seguros e devem cumprir todos os importantes requisitos da DDS, incluindo: (i) realização de pelo menos 15 horas de formação profissional por ano para os seus funcionários; (ii) divulgação aos clientes de informações sobre remuneração (iii) cumprir requisitos de supervisão e governança de produtos, em particular, os bancos devem manter e organizar uma política de supervisão e governança de produtos ou acordos de distribuição de seguros, a fim de garantir que os seus produtos ou a sua distribuição de seguros atendam aos melhores interesses dos clientes e (iv) no caso de venda cruzada, os bancos devem especificar as necessidades e exigências dos clientes em relação aos produtos de seguros e oferecer aos clientes a capacidade de comprar produtos de seguros e outros produtos separadamente. Particularmente para os produtos de seguros baseados em investimentos (IBIPs), os bancos devem: i) fornecer aos clientes mais informações, incluindo relatório periódico de avaliação da adequação dos IBIPs, uma declaração de adequação e relatório periódico sobre a distribuição dos IBIPs; ii) estabelecer uma política de conflitos de interesse, (iii) avaliar os incentivo ou esquemas de incentivo; e (iv) avaliar a adequação ou inadequação dos IBIPs.

Palavras-chave: Bancassurance, Diretiva da Distribuição de Seguros, Insurance Mediation Directive.

ABSTRACT

This dissertation studies the impact of the new EU Insurance Distribution Directive (2016/97/EU, IDD) on the bancassurance which is referred to the selling of insurance products by banking institutions. The main objective is to study under the new requirements of the IDD what legal challenges banks will face in distributing insurance products. To this end, we study the new requirements imposed in the IDD and compare with the previous Insurance Mediation Directive (2002/92/EU, IMD) with respect to the following aspects: requirements on information, the conduct of business, and professional and organisational requirements.

We found that, in general, in comparison with the IMD, the new IDD places stricter requirements that banks must comply with. The IDD tightens the activities of insurance distribution through banks by prohibiting banks distributing insurance products under the form of tied or ancillary insurance intermediaries. Under the new IDD, banks are now considered as insurance intermediaries and must comply fully important IDD’s requirements, including: (i) conducting at least 15 hours of professional training per year for their employees, (ii) disclosing customers with information concerning remuneration in relation to insurance contracts, (iii) conducting requirements of product oversight and governance, in particular, banks must maintain and arrange whether a products oversight and governance policy or insurance distribution arrangements in order to ensure that their insurance products or their insurance distribution will meet the best interest of customers, and (iv) in the case of cross-selling, banks must specify the demands and needs of customers in relation to insurance products, and offering customers the ability of buying insurance products and other products separately. Particularly, for insurance-based investment products (IBIPs), banks must i) provide customers with more information, including periodic report of assessment of the suitability of IBIPs, a suitability statement, and periodic report concerning distribution of IBIPs, ii) establish a conflicts of interest policy, (iii) assess inducement or inducement scheme, and (iv) assess the suitability or appropriateness of IBIPs.

Keywords: Bancassurance, Insurance Distribution Directive, Insurance Mediation Directive.

TABLE OF CONTENTS

PLAGIARISM STATEMENT ... ii

ACKNOWLEDGEMENT ... iii

RESUMO ...iv

ABSTRACT ... v

LIST OF ABBREVIATION ... iii

CHAPTER 1: INTRODUCTION ... 1

CHAPTER 2: BANCASSURANCE IN EUROPE ... 5

2.1 The principle concepts of bancassurance: ... 5

2.2 Bancassurance models:... 6

2.2.1 Partnership: ... 7

2.2.2 Joint venture: ... 7

2.2.3 Captive model: ... 8

2.2.4 The advantages and disadvantages of the bancassurance models: ... 9

2.3 The advantages and disadvantages of bancassurance: ... 10

2.4 Bancassurance products: ... 12

2.5 The development of bancassurance in Europe: ... 15

2.6 The recent European Insurance and Banking Regulatory Framework concerning Bancassurance: ... 21

2.6.1 The Capital Directive: ... 21

2.6.2 The Financial Conglomerate Directive: ... 21

2.6.3 The Solvency Directives: ... 22

2.6.4 The Insurance Distribution Directive: ... 23

CHAPTER 3: THE NEW EU INSURANCE DISTRIBUTION DIRECTIVE ... 25

3.1 Introduction to the Insurance Mediation Directive: ... 25

3.2 The scope of the Insurance Mediation Directive: ... 26

3.3 The main requirements of the Insurance Mediation Directive: ... 27

3.3.1 Registration requirements: ... 27

3.3.2 Professional requirements:... 28

3.3.3 Information requirements: ... 30

3.3.4 Insurance-based investment products: ... 30

3.4 Reasons to revise the Insurance Mediation Directive: ... 31

3.5 Introduction to the Insurance Distribution Directive: ... 34

3.7 The main new requirements of the Insurance Distribution Directive: ... 38

3.7.1 Registration requirements: ... 38

3.7.2 Professional and organisation requirements: ... 40

3.7.3 Information requirements and conduct of business rules: ... 41

3.7.4 New additional requirements concerning IBIPs: ... 44

3.7.5 Rules on cross-selling: ... 50

3.7.6 Oversight and governance insurance products: ... 51

a. Designing: ... 52

b. Monitoring, reviewing and corrective actions: ... 53

c. Distributing: ... 55

3.7.7 The competence between the home and host Member State: ... 56

CHAPTER 4: DISCUSSION ... 57

4.1 The scope of the IDD: ... 57

4.2 The rule on cross-selling: ... 58

4.3 The professional and organisation requirements:... 59

4.4 The information duties and conducts of business requirements: ... 60

4.5 Product oversight and governance: ... 61

CHAPTER 5: CONCLUSION ... 63

LIST OF ABBREVIATION

CEIOPS Committee of European Insurance and Occupational Pensions Supervisors

EIOPA European Insurance and Occupational Pension Authority IBIPs Insurance-based investment products

IDD Directive (EU) 2016/97 of the European Parliament and of the Council of 20 of January 2016 on Insurance Distribution

IMD Directive (EU) 2002/92/EC of the European Parliament and the Council of 9 December 2002 on insurance mediation

MiFID II Directive 2014/65/EU of the European Parliament and the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU

1 CHAPTER 1: INTRODUCTION

Bancassurance is an arrangement between a bank and an insurance company that allows the insurance company to sell its products to the bank's client base. This partnership arrangement can be profitable for both companies. Banks earn additional revenue by selling insurance products, and insurance companies expand their customer bases without increasing their sales force or paying agent and broker commissions.

Although bancassurance can benefit both banks and insurance companies, it has been developed differently in the world. In Europe, bancassurance has been developed since the 1980s and has been a major distribution channel of life insurance products in some mature insurance markets, such as France, Italy, Portugal and Spain. However, bancassurance has been not been received much attention in Canada.1 On the other hand, bancassurance has gained a great interest in some countries in Asia-Pacific, the Middle East, Africa and Latin America.2 Especially, for developing countries, bancassurance is considered as a valuable tool of insurance distribution and becoming the second distribution channel of life insurance products followed by insurance agents. Experts in the insurance and financial market believe that bancassurance will keep developing and gaining more market shares in such countries, such as Vietnam.

However, in the legal aspect, there exist some issues that arise in the context of selling insurance products through bancassurance. For instance, minimum deal term or exclusivity; authorisation; customer ownership and privacy, miss-selling exposure; risk-free and profit-related income; pricing, product and underwriting flexibility;

1Lyle Adriano (2018), IBAC commends separation of banking and insurance, Insurance Business Canada,

https://www.insurancebusinessmag.com/ca/news/breaking-news/ibac-commends-separation-of-banking-and-insurance-106278.aspx

2 Swiss RE (2007), ‘Bancassurance: Emerging Trends, Opportunities and Challenges’, Sigma, no. 5/2007. Zurich: Swiss Reinsurance Company, Economic Research & Consulting, p.411.

2 investment in infrastructure; and contractual flexibility.3 In addition, banks were known as the main reason leading to the global financial crisis in 2008.4 In the context of strengthening customer protection in the financial industry sector, this raises a question of whether the activity of insurance distribution through banks should be strictly and differently regulated from other insurance intermediaries. To answer this question, we look into Europe that is in the second largest global insurance market.5 Europe is also the place bancassurance has the longest journey of formation and development with great success.6

Since 2008, the European Union has changed some important regulations on the insurance sector. Especially, the Solvency Directive II (2009/138/EC)7 and the Insurance Distribution Directive (2016/97/EU)8 (IDD) was issued in 2009 and 2016, respectively. On 1st October 2018, the European Member States completed the implementation of the IDD. The IDD officially replaced the Insurance Mediation Directive (2002/92/EU)9 (IMD). This arises a question of how the new regulations in the new IDD impact on the activity of insurance distribution in Europe in general and bancassurance activities in specific. The main concern is whether the European Commission will treat banks stricter than other insurance intermediaries.

3 Martin Membery and Sean Keyvan (2014), The global bancassurance market, Sidley Austin LLP, p. 29-31, https://www.sidley.com/~/media/files/publications/2014/06/the-global-bancassurance-market/files/view-article/fileattachment/1406-sidley-austin.pdf.

4 Wikipedia, Financial crisis 2007-2008,

https://en.wikipedia.org/wiki/Financial_crisis_of_2007%E2%80%9308. 5European Insurance-Key Facts (2019), p.7,

https://www.insuranceeurope.eu/sites/default/files/attachments/European%20insurance%20%E2 %80%94%20Key%20facts.pdf

6 This can be seen in part 2.5 of chapter 2 of this dissertation.

7 In full: Directive (EU) 2009/138 of the European Parliament and the Council of 25 November 2009 on the taking-up and pursuit of the business of insurance and reinsurance (hereinafter referred to as Solvency II)

8 In full: Directive (EU) 2016/97 of the European Parliament and of the Council of 20 of January 2016 on Insurance Distribution (hereinafter referred to as IDD)

9 In full: Directive (EU) 2002/92/EC of the European Parliament and the Council of 9 December 2002 on insurance mediation (hereinafter referred to as IMD).

3 Motivated by the above considerations, this dissertation discusses the changes in the new European Directive on insurance distribution of bancassurance operators, especially of banks. The main objective of this research studies whether banks in Europe might face any difficulties in selling insurance products under the new regulations. To this end, the dissertation will analyse and compare important requirements stated in the IMD and the IDD for banks on insurance distribution in Europe. In addition, the dissertation will compare the IDD’s requirements for banks with other insurance distributors.

The dissertation is organized as follows. Chapter 2 provides an overview of bancassurance in Europe. First, the chapter introduces the basic definitions of bancassurance and discussing the advantages and disadvantages that bancassurance brings to insurers and bankers. Then, to understand the core principle of bancassurance and how bancassurance works, the dissertation studies the common bancassurance models that have developed in Europe, as well as their advantages and disadvantages. Next, we discuss popular bancassurance products based on the link between insurance and banking products. We also study the recent development of bancassurance in Europe through analysing data and information collected by European Insurance.10 The last part of this chapter introduces generally the European regulatory framework on bancassurance including the relevant Directives on the banking and insurance sector, for instance, the Capital Requirement Directive IV (2013/36/EU)11, the Financial Conglomerates Directive (2002/87/EC)12, the Solvency

10 Insurance Europe is the European Insurance and Reinsurance Federation. Through its 37 member bodies — the national insurance associations — Insurance Europe represents all types of insurance and reinsurance undertakings, eg pan -European companies, monolines, mutuals and SMEs.

https://www.insuranceeurope.eu/about-us.

11 In full: Directive (EU) 2013/36/EU of the European and of the Council of 26 June 2013 on access to the activity of credit institution and the prudential supervision of credit and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC

12 In full: Directive (EU) 2002/87/EC of the European Parliament and of the Council of 16 December 2002 on the supplementary supervision of credit institutions, insurance undertakings and investment firms in a financial conglomerate and amending Council Directives 73/239/EEC, 79/267/EEC, 92/49/EEC, 92/96/EEC, 93/6/EEC and 93/22/EEC, and Directives 98/78/EC and 2000/12/EC of the European Parliament and of the Council.

4 Directive II, and the IDD to understand how bancassurance operators have been regulated in Europe.

Chapter 3 presents an insightful overview of the two recent important the European regulations on insurance distribution, namely, the IMD and the IDD. The chapter aims to have a general picture of the IMD and the IDD. In particular, it highlights the new provisions in the IDD to understand what are the main differences between the two Directives. To this end, firstly, we analyse the main requirements of the IMD and its limitations. Then, we will only focus on the new provisions of the IDD to understand how the IDD changes the activity of insurance distribution in Europe.

Chapter 4 studies further how the IDD’s provisions affect directly to the insurance distribution activity of banks in Europe. This chapter focus on analysing the scope of the IDD, the rules on cross-selling, the professional and organisation requirements, the product oversight and governance, and the additional requirements concerning insurance-based investment products. The last part of the chapter indicates the important changes for the insurance distribution activities of banks.

Chapter 5 concludes under the new Directive, whether or not the banks might face more difficulties when distributing insurance products.

5 CHAPTER 2: BANCASSURANCE IN EUROPE

2.1 The principle concepts of bancassurance:

The term of bancassurance was originated from France and is used to indicate the simple distribution of insurance products through bank branches. Although the use of this term was started from the mid-1980s until now there is no formal and common legal definition of bancassurance.13 Consequently, the bancassurance concepts differ from one observer to another.

Some of the bancassurance definitions focus solely on distribution and cross-selling of insurance products in between banks and insurance companies, such as:

“Bancassurance refers primarily to banks entering the insurance sector by offering insurance products to their retail customers”.14

“Bancassurance is the process of using a bank’s customer relationships to sell life and non-life insurance products.”15

“It is generally considered as encompassing the partnership or relationship between a bank, acting as an insurance agent or broker, and an insurance undertaking whereby the insurance undertaking uses the bank sales channel (namely, bank branches) to help drive the sale of products supplied by an insurer.’’16

While other definitions underline the integration of banks and insurance companies in a single entity:

13EIOPA (2017), The Report on Evaluation of the Structure of Insurance Intermediaries Markets in Europe, p.12.

14Tobias C. Hoschaka (1994), Bancassurance, p.1.

15 Serap O. Gonulal, Nick Goulder, Rodney Lester, Bancassurance: A Valuable Tool for Developing Insurance in Emerging Markets, Policy Research Working Paper 6196, The World Bank - Financial and Private Sector Development Non-Bank Financial Institutions, 2012, p.2

16 EIOPA (2018), The Report on Evaluation of the Structure of Insurance Intermediaries Markets in Europe, p.12.

6

“Bancassurance is the provision of and selling of banking and insurance products by the same organisation under the same roof.’’17

“It is a business strategy – most initiated by banks – that aims at associating banking and insurance activities within the same group, with a view to offer these services to common customers who, today, are mainly personal customers.”18

And finally, other broader definitions realise both the interlinkages of different financial services and distribution of these products.

“As a rule, bancassurance can be described as a strategy adopted by banks or insurance companies aiming to operate the financial market in a more or less integrated manner. In practice, the term ‘bancassurance’ is consistently used to describe a new strategic orientation of financial institutions in private customer business.’’19

“In France, the word ‘bancassurance’ refers to credit institutions which have created an insurance activity.’’20

The bancassurance concepts stated abovereflect the different degrees of integration of insurers and bankers that can vary from a simple distribution model to some types of a capital link between the two activities.21

2.2 Bancassurance models:

Banks and insurance companies can cooperate in many different models to conduct insurance business. The main two variables that distinguish the cooperation form are the percentage of financial ownership and the level of integration from strategies and

17 Elkington, W., Bancassurance, Chanered Building Societies Institute Journal, March 1993, 2-3, p.2 18 Tribune de l'Assurance, Bancassurance Les Conquerants, hors serie, Paris, 1993, p.6

19 Swiss Re, Bancassurance, No.2, Sigma, 1992, p.4.

20 Yanick Bonnet and Pierre Arnal (2000), Analysis and prospects of the French bancassurance market, p.3.

7 management perspective.22 In the next follows we will discuss the most popular models adopted for the cooperation of the bank and insurance company in Europe, namely, partnership, joint venture, and captive.23

2.2.1 Partnership:

A partnership also called as a cross-selling arrangement in the literature is a formal arrangement by two or more parties to manage and operate a business and share its profits.24 Among the three models, the partnership is the simplest one in which a bank plays the role of an insurance intermediary that is similar to insurance agents or brokers. Through its branches, the bank sells insurance products for one or more insurance companies. In return, the insurance companies pay selling commissions or fees to the bank.

Diagram 1.1 The partnership (cross-selling) model.

2.2.2 Joint venture:

In general, a joint venture model is one kind of cooperation between independent partners in the literature, is a business arrangement in which two or more parties agree to pool their resources to establish a “joint venture company” to conduct a specific task.

22 Davis, S.I. (2007) ‘Bancassurance: The Lessons of Global Experience in Banking and Insurance Collaboration’, VRL Knowledge Bank Ltd

23 Massimo Caratelli, The Bancassurance Market in Europe, in Bancassurance in Europe: Past, Present and Future, Franca Fiordelisi, Ornella Ricci (ed.), 2nd ed., Palgrave Macmillan, 2012, p.71.

24 Investopedia, Partnership, https://www.investopedia.com/terms/p/partnership.asp.

Insurance company Distribution agreement Bank

Shares customer base Pays commission/ frees

8 A specific task can be a new project or other business activities that all parties are interested in. In this model, each participant is responsible for profits, losses and costs associated with it. However, the venture company is its owns entity, separate from the participants’ other business interest.25 In the context of bancassurance, the joint venture is the result of the cooperation of a bank and an insurance company to constitute a new entity that is devoted to a bancassurance business. The venture company distributes insurance products only through the network of its banking parent.26 In return, the joint venture company pay the distribution commissions and benefits from dividends to the bank.

Diagram 1.2. A bank and an insurance company constitute a new entity in the joint venture.

2.2.3 Captive model:

In the captive model, the banking and the insurance activities are under the direction of a common owner. There are two possible cases that are illustrated in Diagram 1.3. In the first case, a bank establishes an insurance company as a subsidiary to realise an insurance business, or acquires a majority of an insurance company already operating on the market, with share ownership typically very high, often 100 per cent. The banking parent can control fully the insurance business and use the information at its disposal, designing products suitable for well-known customer's

25 Investopedia, Joint Venture¸ https://www.investopedia.com/terms/j/jointventure.asp, August 2019. 26 Mark Teunissen (2008), Bancassurance: Tapping into the Banking Strength, The Geneva Papers, 33, p.2

Insurance company Bank

9 needs and avoiding the danger of new insurance products take sales away from the older insurance products (cannibalization).27 In the second structure, the same holding company owns a bank and an insurance company with different levels of integration that are either a unique strategic design or little effort to coordinate the two activities.28

Diagram 1.3. The different integration between banks and insurance companies in the captive model.

2.2.4 The advantages and disadvantages of the bancassurance models:

In practice, there is no country in which bancassurance relied on a single form.29 The specific socioeconomic, cultural and regulatory environment of the host country, as well as of the market framework and consumer preferences that are main factors affect the choice of the bancassurance models.30 Furthermore, the major advantages and

27 Berghendal, G. (1995), The Profitability of Bancassurance for European Banks, International Journal of Bank Marketing, XIII, 1, p. 27.

28 Massimo Caratelli (2012), The Bancassurance Market in Europe, in Bancassurance in Europe: Past, Present and Future, Franca Fiordelisi, Ornella Ricci (ed.), p.20 and p.87.

29 Same book, p. 84. 30 Same book, p. 84. Holding company Bank Case 1 Case 2 Bank Insurance company Insurance company

10 disadvantages of each bancassurance model are bases for bankers and insurers to choose sufficient structures that are briefly presented in Table 1.1:

Table 1.1: The main advantages and disadvantages of alternative bancassurance models.

The models Advantage Disadvantage.

Cross-selling agreement

Quick, simple and reversible.

Provision of basic products.

Partners remain

independent.

Limited exploitation of synergies.

Possible conflicts of interest.

Cooperation between independent partners Enhancement of specific competences.

Possibly clashing cultures

Partners remain

independent.

Problems of coordination and value sharing.

Control by

ownership.

Unique strategic design. Long term capital commitment.

The maximum potential for synergies.

Complexity and agency problems.

Source: Franca Fiordelisi, Ornella Ricci (ed.), Bancassurance in Europe: Past, Present and Future, 2nd ed., Palgrave Macmillan, 2012, p.2

2.3 The advantages and disadvantages of bancassurance:

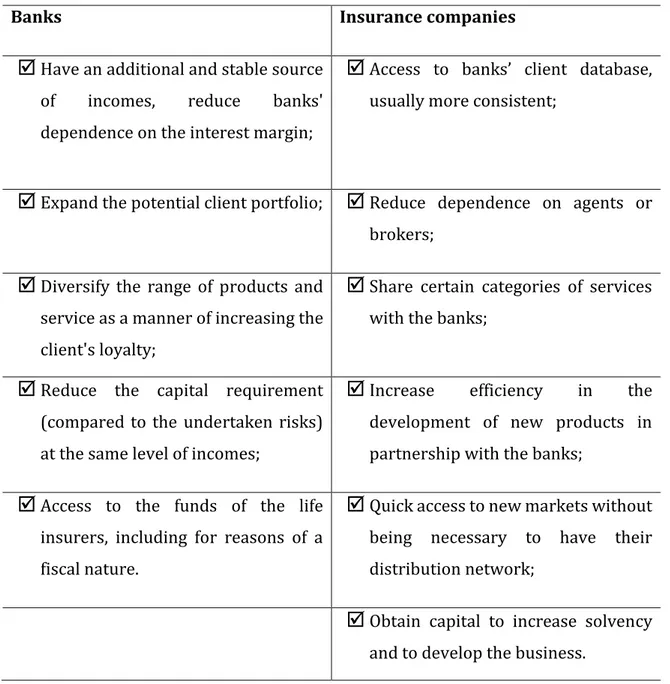

Bancassurance can be profitable for both banks and insurance companies. Banks earn additional revenue from broadening of products, while insurance companies can

11 approach potential customers without expanding their sale forces or pay commission to insurance agents or brokers. Additionally, banks and insurance companies can obtain the following attractive benefits, see Table 1.2.

Table 1.2: The benefits of bancassurance for banks and insurance companies: 31

Banks Insurance companies

Have an additional and stable source of incomes, reduce banks' dependence on the interest margin;

Access to banks’ client database, usually more consistent;

Expand the potential client portfolio;

Reduce dependence on agents or brokers;

Diversify the range of products and service as a manner of increasing the client's loyalty;

Share certain categories of services with the banks;

Reduce the capital requirement (compared to the undertaken risks) at the same level of incomes;

Increase efficiency in the development of new products in partnership with the banks;

Access to the funds of the life insurers, including for reasons of a fiscal nature.

Quick access to new markets without being necessary to have their distribution network;

Obtain capital to increase solvency and to develop the business.

31 Wong, C., Cheung, L. (2002), Bancassurance development in Asia – shifting into a higher gear, Sigma No. 7/2002, Swiss Re. p.3-38.

12 However, the cooperation between banks and insurance companies to sell insurance products can rise the typical risks that are related to specific aspects of bancassurance activities. One of the most obvious risk that is banking staff lack sufficient knowledge about insurance products. Some insurance products, especially non-life insurance, are more complex and very different from banking products. Meanwhile, banking staffs are trained to mainly distribute banking products rather than insurance products. This risk can lead the customer to buy insurance products that are inappropriate with the customer’s demands and needs. In addition, there are other risks that are shown in the following list:32

Investment risk in the bancassurance without a subsequent increase in revenues from this activity.

Risk of losing a good brand.

Risk of customer relationship management and the customer’s needs identification.

Risk of financial settlements between the cooperation entities.

Risk of substitutability and complementarity of the products offered under bancassurance.

Risk of solvency and liquidity loss as well as risk transfer, liquidity and solvency problems between cooperating banks and insurers.

Risk of extensive competition between distribution channels.

Risk of lack of acceptance for the bancassurance model by employees of cooperating companies.

2.4 Bancassurance products:

Bancassurance products are insurance products distributed by banks, as tied with banking products or standalone products. In general, a bancassurance product

32 D. Szewieczek (2013), The risk of cooperation between banks and insurance companies, Studia Eknomiczne, 127, p. 147.

13 includes can be classified as low insurance content and high insurance content. A bancassurance product has high insurance content if it belongs to the non-life business. This type of product provides protection to the insured against unexpected events, such as accidents, disablement, critical illness, or unemployment. On the other hand, bancassurance product with low insurance content is also known as life insurances with investment elements. This type of insurance product plays a role as a saving product that is capable of providing the insured a return in the form of (i) reserve in the cases of death, life, surrender, or (ii) the transformation of the accumulated funds into annuities.

Based on the link between banking products and insurance content, bancassurance products can be divided into three main groups, including (i) products are directly linked to banking products; (ii) products are packaged with banking products, and (iii) products are non-bank-related.33 They are discussed as follows.

The first type of insurance products is similar to the asset management service of banking products, for example, life assurance, traditional policies, or complimentary with banking products such as payment protection policies. Life assurance and traditional policies are the ones that satisfy the investment or pensions needs of customers with a high-saving and low-insurance content.34 The policies normally provide a life or death coverage and pay-out guaranteed amount at the end of the policy according to the conditions set out in the contract. However, there are main differences between the asset management of life assurance and traditional policies. For life assurance, based on the usage of the premium pool and the value of policies depends on whether the performance of funds or share index, the life insurance assurance products can be formed as unit-linked or index-linked policies. Unit-linked life policies are policies in which their premium pool will be managed as (i) investment funds that are trusted by investment firms, or (ii) internal funds that are managed by insurance

33 Maria Grazia Starita (2012), Bancassurance products, in Bancassurance in Europe: Past, Present and Future, Franco Fiordelisi and Ornella Ricci (ed.), p.42.

14 companies and the value of the unit-linked policies will depend on the performance of such funds. Whereas, index-linked life policies are policies that their value is linked to the performance of financial markets, particularly, a share index. For the traditional policies, these bancassurance products are directly linked with-profit funds that are managed by the smoothing policy and the assignment of a series of regular bonuses. Particularly, insurance companies try to avoid changes in the size of the bonuses from one year to the next. Therefore, they hold back some of the profits from good years to boost the profit in bad years.35

On the other hand, payment protection insurance is considered as products that are directly linked to banking products. Although this product does have a similar assessment service with banking products as life assurance or traditional policies, it is complimentary with banking products. Particularly, payment protection insurance ensures repayment of a credit that can be offered by a bank in the case of the insured dies, becomes ill or disabled, lose a job, or faces other circumstances, thus it may prevent the insured from earning income to service the debt.36

The second is that packaged with banking products. Typical examples of this type of product include car insurance or home insurance. Thanks to their restricted insurance content, these products can provide a basic cover and linked with a banking account or mortgage. Particularly, car insurance provides linked with a banking account,37 whereas home insurance can be packaged with a mortgage.38

The last is bancassurance products that are non-bank-related products, such as travel insurance, health insurance, and pet insurance. In comparison with life assurance or traditional policies, these bancassurance products have high-insurance contents. However, the same with car insurance or home insurance, these

35https://en.wikipedia.org/wiki/With-profits_policy

36https://en.wikipedia.org/wiki/Payment_protection_insurance

37 Maria Grazia Starita (2012), Bancassurance Products, in Bancassurance in Europe: Past, Present and Future, Franco Fiordelisi and Ornella Ricci (ed.), p.46.

15 related products have restricted insurance content, thus, banks can offer their customers such products linked their banking account.

2.5 The development of bancassurance in Europe:

Bancassurance was developed originally in France. The French law 1984 early allowed credit institutions to widen their activities, banks thereby have been able to carry out activities related to the insurance sector.39 The bancassurance development into three different periods: up to 1980, during the 1980s, and the 1990s.40

Before 1980, banks started extending their activities by providing insurance guarantees which were linked to banks' activities rather than insurance, for instance, credit insurance for consumer credit and other loans (in France), building insurance and contents insurance for a mortgage (in Great Britain), insurances coverage for thefts at the point of withdrawals (in Italy).

After the 1980s, saving products were benefited from advantageous tax regimes and classified as life insurance products. The bank provided life insurance products with a saving function, such as annuity policies, endowments contracts.

Around the 1990s, the bank started providing insurance products linked to investment funds, pure life insurance and whole-life insurance policies. Figure 1.1 shows that during a decade from 1990 to 2000, the proportion of premium of life insurance distributed through banks in France increased continually and reached 61 per cent in 2000

39 C. Blot, J. Creel, A. Delatte, F. Labondance, and S. Levasseur (2014), Structure evaluations and reforms of the French banking and financial system since the 1980s: Relationship with the legal process of European integration, Working Paper Series, No 66, Journal of Economic Literature, p. 9.

16 Figure 1.1. The premium of life insurance products distributed by banks in France from 1990 to 2000 (%).

Data Source: from French Insurance Federation.41

In recent years, bancassurance is still a major distribution channel of life insurance in some European countries, whereas, for the distribution of non-life insurance products, it is less common.42 Figure 1.2 shows that, in 2016, the Gross Writing Premium (GWP) of life bancassurance which accounted for more than 60 per cent, for instance, Turkey (83 per cent), Malta (82 per cent), Italy (76 per cent), Portugal (71 per cent), and France (65 per cent) whilst, the proportion of the GWP was less than 20 per cent. In the term of bancassurance products, unit-linked policies are the largest written contracts in many markets, with a penetration rate reaching more than 50 per cent in Italy, Belgium and France,43 meanwhile, property insurance has observed penetration

41 Y. Bonnet, P. Arnal (2002), Analysis and prospects of French bancassurance market, p.2.

42 EIOPA (2018), Insurance Distribution Directive - Evaluation of the Structure of Insurance Intermediaries Markets in Europe, Luxembourg Publications Office of the European Union, p.12.

43 Massimo Caratelli (2012), The Bancassurance Market in Europe, in Bancassurance in Europe: Past,

Present and Future, Franca Fiordelisi, Ornella Ricci (ed.), p.62.

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000

French life insurance market 1990-2000 (%)

17 rates higher than in the other non-life sectors for the majority of the European markets.44

44 Massimo Caratelli (2012), The Bancassurance Market in Europe, in Bancassurance in Europe: Past,

Present and Future, Franca Fiordelisi, Ornella Ricci (ed.), p.62.

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Life insurance distribution channels

18 Figure 1.2. The proportion of the gross written premium (GWP) of life and non-life insurance distribution channels in Europe, 2016.

Source: Insurance Europe45. https://www.insuranceeurope.eu/insurancedata

From the data mentioned above, bancassurance has developed differently among European countries. In Western Europe, bancassurance has been an important distribution channel for life insurance products, and it is now a growing vehicle for the non-life sector (Figure 1.3). In contract, in many Central and Eastern European countries, the share markets of bancassurance do not exceed 40 per cent for life insurance, and 10 per cent for non-life insurance, for instance, two of the largest

45 Insurance Europe is the European insurance and reinsurance federation. Through its 37 member bodies — the national insurance associations — Insurance Europe represents all types of insurance and reinsurance undertakings, eg pan-European companies, monolines, mutuals and SMEs.

https://www.insuranceeurope.eu/about-us 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Non-life insurancedistribution channels

19 European insurance markets that are Germany and the United Kingdom. To understand this, we can use three significant reasons indicated by Gilles Benoist:46

The first and most important is the differences in legislative and regulatory standards.

Significant differences in tax systems and the structure of pension systems. For example, in France, life insurance products are very similar to banking products and also qualify for tax incentives. This makes them easy to sell insurance products by banking networks;

Differences in the role of banks in the financial system. Bancassurance has made the biggest inroads into the market in countries where the banks play a significant role in the financial system, such as in Belgium, France and the Netherlands. Meanwhile, bancassurers have a smaller market share in those countries where everything revolves around the stock market, such as the United Kingdom.

In addition, the figures mentioned above show that bancassurance has been more typical and successful with life insurance than non-life insurance. The key reason is that life insurance products are easy to commercialize for banks’ sales personnel because of its similarity to investment and savings contracts provided by banks.47 Furthermore, life instruments, for example, unit-linked policies, are also frequently guaranteed and supported by favourable tax treatment to encourage private provision for protection or retirement planning.48 Nevertheless, figure 1.3 shows that bancassurance is developing constantly not only for life insurance but also for the non-life sector.

46 Gilles Benoist (2002), Bancassurance: The New Challenges, The Geneva Paper on Risk and Insurance. Issues and Practice, Vol.27, No.3, pp. 296-303, p.297.

47 Massimo Caratelli (2012), The Bancassurance Market in Europe, in Bancassurance in Europe: Past,

Present and Future, Franca Fiordelisi, Ornella Ricci (ed.), p.65.

20 Figure 1.3. The proportion of the premium of life and non-life insurance distributed through bancassurance channel in Europe, 2011 and 2016. Data Source: European Insurance in Figure, 201449 and 201950.

49 Insurance Europe (February 2014), Statistics No 48 European Insurance in Figure, p.61, http://www.biztositasiszemle.hu/files/201402/european-insurance-in-figures-2.pdf.

50 The data available: https://www.insuranceeurope.eu/insurancedata

0 2 4 6 8 10 12 14 16 18

Non-life premiums by bancassurance channel in 2011 and 2016 (%) 2011 2016 0 10 20 30 40 50 60 70 80 90

Life premiums by bancassurance channel in 2011 and 2016(%)

21 2.6 The recent European Insurance and Banking Regulatory Framework concerning Bancassurance:

2.6.1 The Capital Directive:

The opportunity to develop the bancassurance model was offered by the Second Banking Directive (89/646/EEC)51 which removed the existing barriers between different sectors of the financial services industry so that a credit institution can become a distribution channel of financial and insurance services.52 (Cranton 2000) At the moment, the rules on the activities of bank and banking prudential requirements are regulated by the Capital Requirement Directive IV.53

2.6.2 The Financial Conglomerate Directive:

In the captive model of bancassurance, banks and insurance companies can be controlled by the same holding company. This integration of two sectors known as financial conglomerates which are financial groups including credit institutions, insurance undertakings and investment firms which provide services and products in different sectors of the financial markets.54 The Financial Conglomerates Directive (2002/87/ECC) regulates financial activities of banks and insurance companies in financial conglomerates.55 In particular, the Directive lays down rules for

51 In full: The Second Council Directive 89/646/EEC of 15 December 1989 on the coordination of laws, regulations and administrative provision relating up and pursuit of the business of credit institutions 52 Ross Cranton (2002), Principles of Banking Law, p. 32.

53 Article 1 of Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC.

54 Recital (2), Directive (EU) 2002/87/EC of the European Parliament and of the Council of 16 December 2002 on the supplementary supervision of credit institutions, insurance undertakings and investment firms in a financial conglomerate and amending Council Directives 73/239/EEC, 79/267/EEC, 92/49/EEC, 92/96/EEC, 93/6/EEC and 93/22/EEC, and Directives 98/78/EC and 2000/12/EC of the European Parliament and of the Council.

55 Recital (5) of Directive (EU) 2002/87/EC of the European Parliament and of the Council of 16 December 2002 on the supplementary supervision of credit institutions, insurance undertakings and investment firms in a financial conglomerate and amending Council Directives 73/239/EEC, 79/267/EEC, 92/49/EEC, 92/96/EEC, 93/6/EEC and 93/22/EEC, and Directives 98/78/EC and 2000/12/EC of the European Parliament and of the Council.

22 supplementary supervisory on European financial conglomerates, such as solvency, risk concentration and intra-group transaction. The Directive was adopted on 16 December 2002, applied from 11 February 2003. European Union countries had to incorporate into national law by 10 August 2004. On 16 November 2011, it is amended by Directive 2011/89/EU. 56

2.6.3 The Solvency Directives:

Solvency Directives lay down rules on the taking-up the business of insurance and reinsurance. The first Directive on Solvency (73/239/EEC) was adopted on 24 July 1973 and then it was repealed by the Solvency Directive II. The second Solvency Directive was amended by the Directive 2014/51/EU57 and became fully applicable to European insurers and reinsurers on 1 January 201658. The Solvency Directive II introduces a harmonised, sound and robust prudential framework for insurance firms in the European Union.59 The Directive primarily provides the minimum capital requirement including a minimum amount and a standard formula for the calculation of solvency capital that European insurance and reinsurance companies must hold to reduce the risk of insolvency; establishes requirements for governance and supervision for risk management; and details requirements for disclosure and transparency.60 Under the Directive, European insurers and reinsurers now comply with a higher capital requirement to permit timely intervention61; submit to supervisor

56 Article 2, Directive 2011/89/EU of the European Parliament and Council of 16 November 2011 amending Directive 98/78/EC, 2002/87/EC and 2009/138/EC regards the supplementary supervision of financial entities in a financial conglomerate.

57 Article 2 of Directive (EU) 2014/51/EU of the European Parliament and Council of 16 April 2014 amending Directive 2003/71/EC and 2009/138/EC and Regulations (EC) No 1060/2009, (EU) No 1096/2010 in respect of the powers of the European Supervisory Authority (European Insurance and Occupational Pensions Authority) and the European Supervisory Authority (European Securities and Markets Authority).

58 Article 2(83), Directive (EU) 2014/51/EU.

59 European Commission, Solvency II Overview – Frequently asked questions. 60 Recital (65), Recital (70), and Article 129 of the Solvency II.

61 Article 17(2), Directive 73/239/EC of the European Parliament and the Council of 24 July 1973 on the coordination of laws regulations and administrative provisions relating to the taking-up and pursuit of the business of direct insurance other than life assurance; and Article 129 (1, d) Solvency II.

23 authorities the necessary information for supervision62, and disclose some information to the public63.

2.6.4 The Insurance Distribution Directive:

The rules for the taking-up and pursuit of the activities of insurance and reinsurance mediation regulated by the Insurance Mediation Directive (IMD) which was adopted on 9 December 2002, then amended by the Market in Financial Instrument Directive (2014/65/EU)64 (MiFID II). However, since 1 October 2018, the activities of insurance and reinsurance distribution in the European Union has been regulated on the Insurance Distribution Directive (IDD). To enhance the single European insurance market and guarantee the highest level of customer protection, the IDD covers not only insurance undertakings or intermediaries but also other market participants who sell insurance products on an ancillary basis.65 Under the IDD, insurance distributors must comply with additional requirements on information, organisation and disclosure. In addition, the European Commission also issued several regulations supplementing the specific provisions of the IDD:

Commission Delegated Regulation (EU) 2017/2358 of 21 September 2017 supplementing Directive (EU) 2016/97 of the European Parliament and of the Council with regard to product oversight and governance requirements for insurance undertakings and insurance distributors (Commission Delegated Regulation (EU) 2017/2358);

Commission Delegated Regulation (EU) 2017/2359 of 21 September 2017 supplementing Directive (EU) 2016/97 of the European Parliament and of the Council with regard to information requirement and conduct of business rules

62 Article 35 of the Solvency II.

63 Section 3, Chapter IV of the Solvency II.

64 In full: Directive 2014/65/EU of the European Parliament and the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU. (hereinafter referred as to MiFID II).

24 applicable to the distribution of insurance-based investment products. (Commission Delegated Regulation (EU) 2017/2359).

25 CHAPTER 3: THE NEW EU INSURANCE DISTRIBUTION DIRECTIVE

3.1 Introduction to the Insurance Mediation Directive:

For a long time, insurance intermediaries have been playing an important role in the distribution of insurance products.66 However, in Europe, until the appearance of Insurance Mediation Directive (IMD, 2002), there was still substantial differences between European Member States’ provision on regulating the activities of insurance and reinsurance intermediaries.67 Thus, IMD aims to introduce a single passport in which the insurance intermediaries can be easier to offer cross-border services or establish a branch operation; enhance the customer protection at European level; and establish good cooperation between the competent authorities of the home and host Member States.68 The IMD was fully into force on 14 January 2005 and repealed the Insurance Agents and Brokers Directive (77/92/EEC).69

The IMD laid down the rules for the taking-up and pursuit of the activities of insurance mediation by a natural and legal person which are established or wish to become established in a Member State.70 The Directive aims to guarantee not only the freedom of insurance intermediaries to establish and provide services but also the equality of treatment between operators and customer protection requires.71 The IMD set down significant requirements on registration, professional and information for insurance intermediaries.

66 Recital (1) of the IMD.

67 Recital (5) of the IMD.

68 CEIOP (2007), Report on the Implementation of the Insurance Mediation Directive’s Key Provisions, p.3. 69 In full: Directive 77/92/EEC of 13 December 1976 on measures to facilitate the effective exercise of freedom to establish and freedom to provide services in respect of the activities of insurance agents and brokers.

70 Article 1(1) of the IMD.

26 3.2 The scope of the Insurance Mediation Directive:

The Insurance Mediation Directive (IMD) regulates insurance mediation activities carried out by insurance intermediaries and tied insurance intermediaries. In particular, insurance intermediary is any natural or legal person, for remuneration, taking up or pursuing the following insurance mediation activities:72

Introducing, proposing or carrying out other work preparatory to the conclusion of contracts of insurance, or of concluding insurance contracts, or

Assisting in the administration and performance of insurance contracts, in particular in the event of a claim.

A tied insurance intermediary can be defined as follows: 73

A person who carries out the activity of insurance mediation for and behalf of one or more insurance undertaking in the case that insurance products are not in competition. However, this person does not collect premiums or amounts intended for the customer and acts under the full responsibility of the insurance undertakings for insurance products which concern them respectively.

A person who carries out the activity of insurance mediation in addition to his or her principal professional activity if the insurance is complementary to the goods or services supplied in the framework of this principal professional activity. In addition, this person does not collect premiums or the amount intended for the customer.

Additionally, the IMD excluded the following activities which are not considered as the insurance mediations:74

72 Point (3) and (5), Article 2 of the IMD 73 Article 2(7) of the IMD.

27

Insurance undertakings or employees who act under the responsibility of insurance undertakings carry out the insurance mediations;

The provision of information of professional activity that is not to assist the customer in concluding or performing an insurance contract;

The management of claims of an insurance undertaking on a professional basis, and loss adjusting and expert appraisal of claims.

Furthermore, the IMD does not apply to the persons who carry out the insurance mediation activities for an insurance contract that meets all the following conditions:

The insurance contract only requires knowledge of the insurance cover that is provided;

The insurance contract is not a life insurance contract;

The insurance contract does not cover any liability risks;

The principal professional activity of the person is other than insurance mediation;

The insurance is complementary to the product or service supplied by any provider and such insurance covers: (1) the risk of breakdown, loss of or damage to goods supplied by that provider, or (2) damage to or loss of baggage and other risks linked to the travel booked with that provider, even if the insurance covers life assurance or liability risks, provided that the cover is ancillary to the main cover for the risks linked to that travel.

The amount of the annual premium does not exceed EUR 500 and the total duration of the insurance contract, including any renewal, does not exceed five years.

3.3 The main requirements of the Insurance Mediation Directive:

3.3.1 Registration requirements:

Insurance intermediary and tied insurance intermediary must register with a competent authority of its home Member States when carrying out the activity of

28 insurance mediation within the Community.75 In particular, insurance undertakings or associations of insurance undertakings must take responsibility to register for tied insurance intermediaries. The IMD did not apply registration requirements for natural persons who work in insurance undertakings and pursue the insurance mediation activities.76

Under the IMD, the Member States established more than one register for insurance intermediaries. The Member States also established a single information point that provides the identification details of competent authorities of each Member States. This single information is compiled electronically and kept updated that allows insurance intermediaries to access information quickly and easily from these various registers.77

3.3.2 Professional requirements:

The professional requirements include (i) the requirements on appropriate knowledge and ability concerning insurance products; (ii) a good repute; (iii) the professional indemnity insurance, and (iv) necessary measures on protecting the customer against the inability of insurance intermediary in transferring a premium and claim money between undertakings and the customers.

The IMD requires insurance undertakings to verify the knowledge and ability of insurance intermediaries if the principal professional activity of the insurance intermediaries is not the insurance mediation.78 Furthermore, if necessary, the insurance undertakings need to provide those intermediaries with a training on insurance products.79 Persons work in insurance undertakings, especially, (i) who are responsible for the mediation of insurance products, and (ii) who are directly involved

75 Article 3(1) of the IMD.

76 Article 3(1) of the IMD. 77 Article 3(2) of the IMD. 78 Para. 2, Article 4(1) of the IMD. 79 Para. 3, Article 4(1) of the IMD.

29 in the insurance mediation must demonstrate their knowledge and ability necessary for the performance of their duties.80

Insurance intermediaries must be a good repute. This means that they must have a clean police record regarding serious criminal offences that are linked to (i) crimes against property or other crimes related to financial activities and (ii) should not have previously been declared bankrupt unless the insurance intermediary is rehabilitated under national law.81 Besides, the insurance intermediaries must hold (i) the professional indemnity insurance that covers the whole territory of the Community or (ii) some other comparable guarantee against liability arising from professional negligence.82

Furthermore, the IMD stipulates necessary measures to protect customers against the inability of insurance intermediaries regarding (i) the transfer of the premium to insurance undertakings or (ii) the transfer of the amount of claim or return premium to the insured. In particular, money that are paid by a customer to an insurance intermediary must be treated as having been paid to an insurance undertaking. Secondly, money that are paid by the insurance undertaking to the insurance intermediary must be not treated as having been paid to the customer until the customer receives them. The money of the customers are transferred via strictly segregated client accounts and these accounts are not used to reimburse other creditors in the event of bankruptcy. Furthermore, the insurance intermediaries are required to have a financial capacity amounting permanently.83

80 Para. 4, Article 4(1) of the IMD. 81 Para. 1, Article 4(2) of the IMD. 82 Article 4(3) of the IMD. 83 Article 12(4) of the IMD.

30

3.3.3 Information requirements:

Prior to the conclusion of any specific contract, insurance intermediaries must provide to their customers with the following information:

The identity and address;

The register;

The information concerning the ownership between the insurance intermediaries and undertakings;

The procedures enabling customers and other interested parties to register the complaint and the out-of-court complaint and information on redress procedure.

In addition, the insurance intermediaries also inform the customers whether:

They will advise the basic of a fair analysis of a sufficiently large number of insurance contracts available on the market;

They are under or not under a contractual obligation to conduct insurance mediation business exclusively with one or more insurance undertakings. In this case, if customers require, the insurance intermediaries must provide the name of those insurance undertakings.84

The IMD requires the insurance intermediaries to specify the demands and needs of customers. Regarding requirements on advice, the insurance intermediaries must provide the customer with the underlying reasons for any advice on a given insurance product.

3.3.4 Insurance-based investment products:

On 12 May 2014, the Market in Financial Instrument Directive II (MiFID II) was adopted and it amended the IMD regarding insurance-based investment products (IBIPs). The MiFID II provides the definition of IBIPs. According to that, the IBIPs means

31 that insurance products (i) offer a maturity or surrender value that is wholly or partially exposed, directly or indirectly, to market fluctuations and (ii) do not include non-life insurance products, life insurance contracts only cover death, injury, sickness or infirmity, pension products, occupational pension schemes, and individual pension products. 85

Furthermore, the IMD includes additional requirements to protect customers who buy IBIPs. Firstly, an insurance intermediary or undertaking must act honestly, fairly and professionally following the best interest of its customers. All information and marketing communication thereby shall be fair, clear, and not misleading. Secondly, to prevent conflicts of interests, the insurance intermediary or undertaking must maintain and operate effective organisation and administrative arrangements by taking all appropriate steps to identify the conflicts of interest between (i) their managers and employees, or any person directly or indirectly linked to them by control, and (ii) their customers or between one customer and another.86 If the arrangements are insufficient, the insurance intermediary or undertaking must disclose customers the general nature or source of the conflicts of interest before undertaking business.

3.4 Reasons to revise the Insurance Mediation Directive:

Finance turbulence from the global financial crisis in 2008 had raised the need of protecting customer’s benefits across all financial sectors.87 In November 2010, the G20, an international forum for the governments and central bank governors from 19 countries and the European Union, asked the Organisation for Economic Co-operation and Development (OECD), the Financial Stability Board, and other relevant services to strengthen the customer protection. The G20 underlined the need for proper regulation, supervision of all financial service providers, and agents that deal directly

85 Point (b), Article 91(1) of the MiFID II. 86 Article 91(2) of the MiFID II.

87 Point 1 of Proposal for a Directive of the European Parliament and of the Council on Insurance Mediation (recast) /* COM/2012/0360 final - 2012/0175 (COD) */.

32 with consumers.88 This organisation also provided principles in which customers should always benefit from comparable standards of customer protection. Therefore, in order to ensure an adequate level of customer protection across the EU, the European regulation concerning insurance distribution should be more uniform,89 and the IMD need to be reviewed along the line of these guideline and international initiatives.

On the other hand, revising the IMD aims to make it more appropriate with the new EU Directive regarding insurance. In particular, during the discussion in the European Parliament on the Solvency Directive II, adopted in 2009, a specific request was made to review the IDM. Some members of the Parliament and some consumer organisations considered that (i) there was a need for a further improvement in policyholder protection and (ii) in selling practices for different insurance products. Especially, some strong concerns have been raised regarding the standards for the sale of life insurance products with investment elements. To ensure cross-sectoral consistency, the European Parliament requested that the revision of the IMD should meet the same consumer protection standards as mentioned in the MiFID II.

In March 2007, the Committee of European Insurance and Occupational Pensions Supervisors (CEIOPS)90 published a report indicating that there was a need for clarification on some terminology used in the IMD. In addition, some of the IMD's requirements were impractical from day-to-day supervision. The CEIOPS also intended to make suggestions for amending the IMD and the Luxembourg Protocol to (i) improve the regulation of cross-border services, and (ii) enhance consistent supervision of

88 Point 1 of Proposal for a Directive of the European Parliament and of the Council on Insurance Mediation (recast) /* COM/2012/0360 final - 2012/0175 (COD) */.

89 Recital (10) of the IDD.

90 On January 2010, the CEOPS was replaced by the European Insurance and Occupational Pension Authority (EIOPA) by Regulation (EU) No 1094/2010 of the European Parliament and of the Council of 24 November 2010 establishing a European Supervisory Authority, amending Decision 716/2009/EC and repealing Commission Decision 2009/79/EC.