A work project, present as a part of the requirements for the Award of a Master Degree in Management from NOVA - School of Business and Economics

INTERNATIONALIZATION STRATEGY OF QUINTA DOS TERMOS TO CHINA

Pedro Pinto da Costa #2967

A Project carried out on the Field Lab of SME competitiveness, under the supervision of: Professor Sonia Dahab

Abstract

The underlying project was carried out with the purpose of conducting an internationalization strategy of Quinta dos Termos to China. Thus, this project focuses on exploiting the competitive advantages resources of the firm, followed by China ranking analysis and then selecting the most suitable city, in this case Hong Kong. Furthermore, an implementation strategy is suggested with the most optimal mode of entry and several of activities for a successful internationalization to Hong Kong wine market.

Table of Contents

1. Quinta dos Termos internal analysis ... 4

1.1 Description of the company ... 4

1.2 Mission & Vision & Strategic objectives ... 4

1.3 Value chain – Quinta dos Termos ... 5

1.4 Competitive Advantage – VRIO ... 7

1.5 Financial Analysis ... 8

2. Market evolution ... 8

2.1 Industry mapping - Quinta dos Termos ... 8

2.2 Portuguese Wine in International Wine Markets ... 10

3. Internationalization process to China ... 11

3.1 Market selection ... 11

3.1.1 China Brief Overview ... 12

3.1.2 China Mainland Wine Market ... 13

3.2 China´s Region Selection ... 14

3.2.1 Hong Kong Wine Market ... 15

3.2.2 Sales Channels in Hong Kong ... 17

3.2.3 Re-exports from Hong Kong ... 18

4. Competitive Analysis of Quinta dos Termos in the Hong Kong Market ... 19

5. Mode of Entrance ... 19 6. Implementation ... 20 6.1 Implementation Plan ... 20 6.1.1 Product ... 20 6.1.2 Price ... 21 6.1.3 Promotion ... 22 6.1.4 Place ... 23 6.1.5 Memo ... 24 7. Financial Analysis ... 25

1. Quinta dos Termos internal analysis

1.1 Description of the company

Quinta dos Termos is a Portuguese family-owned wine company located in Belmonte, on the southern slopes of Serra da Estrela, in Beira interior. Focused on conserving the local fauna and flora, it allows an environmentally sustainable wine production. With a privileged location, sheltered from cold north winds and with sunlight from the south of the mountain, Quinta dos Termos has excellent Conditions for growing vines, producing mature grapes providing aromatic and consistent wines. Acquired in 1945 by Alexandre Carvalho, passed on to his son and current owner João de Carvalho, who rebuilt and restructured it to what it is today. Currently, Quinta dos Termos is located on around 180 hectares with 60 hectares of cultivated vines.

Given its environmental concern, it’s also certified in integrated crop management by Sativa. The wine is produced without using herbicides, pesticides or any aggressive products to the environment and to health, using cultivation practices that help to maintain and preserve the soils, avoiding erosion or any other damage, being a biological wine production a short-term objective. Furthermore, the quality control is ran throughout the whole process: the grapes, the bottles, wine in the vats and even the wine that is no longer in the market, in order to check its capacity of ageing.

Concerned about the future, Quinta dos Termos also focuses in genetic research, having a field of vine clones used to research grape varieties and wine production, oriented by professor Antero Martins from The Instituto Superior de Agronomia in Lisbon.

Quinta dos Termos Selection counts on 20 different wines: 12 red wines, 3 white wines, 1 clarete, 1 rose, 3 sparkling wines and with a price range between €3,76 and €20, allowing to target different segments of the market. The best recognition for this portfolio is the number of awards, regional and international, that so far have been collected – International Wine Challenge, wine Master challenge, Decanter World Wine Awards and Brussels Challenge (Appendix 1)

1.2 Mission & Vision & Strategic objectives

Mission: following the traditional techniques of viticulture and winemaking, envisioned by reputable oenologists, promoting the environmental sustainability and taking advantage of Quinta dos Termos terroir synergies.

Vision: Quinta dos Termos wants to be a family winery producing wine with passion, quality, differing from others by being wines of high quality of Beira Interior terroir and having a great gastronomic aptitude.

Strategic objectives: 1) Revenues & Sales: In a 5 years term, the company wants to reach the minimum of 2.500.000€ in revenues, setting the goal of increasing 30% of the sales each year,

only achievable with the increase of exportation. 2) Size Expansion: The company has enhanced in proprieties and infrastructure investments in the same region, known as Herdade da Bica, in Castelo Branco. 3) Differentiation: the investments are meant for the creation of different types of wine, embellish of the landscape, construction of a dam and the entrance of Quinta dos Termos in Events business, hoping in a three-year time, they can host some clients and provide a better experience.

1.3 Value chain – Quinta dos Termos

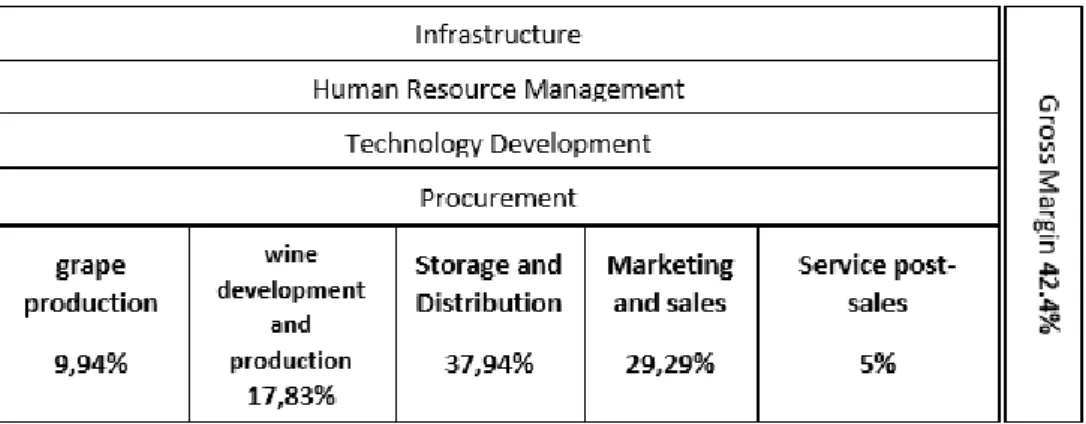

For Michael Porter “Every firm is a collection of activities that are performed to design, produce, market, deliver, and support its product” (Porter, 1985). All these activities represent the value chain, the unique way for a company to deliver value for the consumers to develop the will to pay for what the firm provides. The value chain is composed by primary, support and margin activities. From this framework, it is possible to understand the contribution of each activity within the business performance. Using the information collected from Pedro Carvalho – Marketing and Strategy chief department - it was calculated the proportion that the costs associated with each activity have in total revenues.

In the primary, all the activities involved are listed in the physical creation of the product, the sale and post-sale assistance to the buyer. The grape production is the first step of the chain. The control begins with winter pruning1, followed by green pruning and the cluster thinning in late

June. After the grapes begin to mature, grapes from different kinds are collected, in order to check the degree of maturation2. Once achieved the perfect sugar content, acidity and pH, that day will

be the vintage day. It is also important to mention that 65% of the grapes used are cultivated in Quinta dos Termos vineyards, following a certified integrated crop management regime while the rest is bought from local producers, in which Quinta dos Termos perform a quality control process. Furthermore, the wine development and production, after the collection of the grapes into small boxes of about 15kg (Appendix 2), in the winery, those are destemmed and partially crushed, followed by pre-fermentation maceration, fermentation, post-fermentation maceration and malolactic fermentation in wine vats. Then, João Carvalho and his Oenologist consultants decide the type of wines that are going to satisfy the new trends and specifications of the customer. The ageing is done in French oak barrels, Allier extra fine and Romanian fine, according to the grape variety and the purpose of the wine (Appendix 3). Furthermore, the bottling, the labelling and the packaging take place. Storage and Distribution, the one that has the higher weight, after the bottling, the wine rest in pilled, depending on the classification required for wines with a

1Pruning is a horticultural and sylvicultural practice involving the removal of certain parts of the vine, to remove deadwood, controlling the growth and improving maintaining the health of it.

minimum of 6 months. Later, the bottles are ready to be stored and distributed to various restaurants in Portugal. The company has a main warehouse – Belmonte - and four others strategically positioned- Maia, Coimbra, Marinha Grande e Lisboa (Rio de Mouro) - to minimize the distribution costs in Portugal.

In the national market, the company has it owned distribution channel – with the 6 warehouses, sales team and commission agents – without any other distributor. However, the company started negotiations with potential distributors in areas that are difficult to reach as Azores, Minho and Algarve, hoping to start working with two new distributors.

Regarding international markets, the company always works with local’s distributors. In Brasil, in S. Paulo state, it works with Galeria dos Vinhos, a well-known company in the business that works in different countries. In the Belgium case, it works with Zalou company, with a team composed by one person of Beira-Interior region, who has a bigger know-how in Belgian market. Marketing and sales, represent one of the biggest costs within the company. It is composed by daily basis workers and outsourced workers. In daily basis, the number of workers from the company includes a sales team of nine people – one coordinator and 3 commercials – that are paid by commission, an accountant, a quality manager, an oenologist and a manager partner. The sales agents are paid by commission, according to their performance, maintaining the motivation levels high. Outsourced agents include Eng. Virgilio Loreiro, Eng. Manuel Malfeite andEng Francisco Santos and Sociedade A.T., including 10 men for plantation and construction. Finally, Service well-marked by the post-sale, in case of any plausible complaint, six bottles are offered to the injured consumer proving that as a loyal costumer, they will be well rewarded.

When it comes to support activities, those involve fixed and variable costs. Firm infrastructure, counts on full-time employees dedicated to invoicing and accounting. The company also has a fully modern cellar with the proper conditions for traditional methods of production, that if necessary could expand without affecting the architecture or layout of the infrastructure.

Being a SME, the Human Resources management is made and supervised by the board of Quinta dos Termos, as in addition to internal training, the firm consultants, cited above, give regular training to all internal teams. Due to the good relationship with suppliers and other institutions, some internal members are invited to external trainings. In terms of motivation, the company organizes teambuilding sessions twice a year, with the main purpose of receiving feedback and build stronger relationships with its collaborators. The company is composed by an acclaimed oenologist, two oenologist consultants, one accountant, one chemist, nine sales people and seasonal workers that reach 50 people in the harvest season and less than 5 during the winter. Regarding Technology, the company has a permanent hired oenologist and chemist, who adopt the lasted technology and quality control tools in all stages of production, increasing the efficiency

of the whole process. Concerning Procurement, part of the production is acquired externally; the quality of those grapes is guaranteed by Quinta dos Termos board of directors, who establish local partnership. The grapes evolution is also supervised by the company’s internal teams throughout the year, being consultants of theirs partners. It is important to mention the external production represents 35% of the whole production.

Figure I: Cost Structure of Quinta dos Termos

1.4 Competitive Advantage – VRIO

When analysing the competitive advantage, it is important to know the resources that are capable of exploiting an opportunity or mitigating a threat. In order to conduct such analysis for Quinta dos Termos, the VRIO framework was conducted. This internal tool was developed by Jay B. Barney (2008), classifying the resources has being valuable, rare, inimitable and organizational embedded. Furthermore, those strengths are compared with the competition to understand if there is any sustainable competitive advantage. Moreover, the firm resources platform is composed by core competencies, specialized assets and architecture of relations.

The analysis provided (Appendix 5) by this tool provides strategic implications, such as whether Quinta dos Termos holds a temporarily, parity or sustainable competitive advantage or not. Regarding the analysis, it is possible to conclude that Quinta dos Termos holds resources that combined create synergies, building its sustainable competitive advantages. By looking in detail at Quinta dos Termos resources, its core competencies include Wine making knowledge, Sustainable vine growing knowledge, Genetic Research knowledge and Quality Control Knowledge, which are characterized as being temporary competitive advantages. This means that Quinta dos Termos could perform better than its competitors but only in the short term, not being able of compete in the long term.

By looking in detail to the specialized assets, Terroir must be highlighted. Composed by four elements - climate, soil, tradition and terrain – it’s the only resource capable of being valuable,

rare, inimitable and organizational embedded, giving the sustainable competitive advantage that the company needs on the long term. Quinta dos Termos terroir is located in the southern slopes

of Serra da Estrela – the highest Portuguese mountain - in Beira Interior. Typically characterized by the coldest Portuguese winters and the hottest Summers, the vineyards don’t need pesticides nor chemicals to sustain their health, making wines with unique types of flavors. With its granitic soil composed by orthoclase, quartz and other types of minerals, the soil warms quickly and retains the heat, minimizing the levels of acidity in the produced wines.

Furthermore, Quinta dos Termos is proud of its network, by establishing a close relation with University of Beira Interior, the School of Agronomy of the University of Lisbon and with Comissão Vitivinicola Região da Beira Interior. These temporary competitive advantages, create an intangible asset that allow the company to be promoted in Portugal and around the world, achieving and exploring new ways of production.

Lastly, Quinta dos Termos fails by not having a website as a resource. In a technological world, a website is valuable and the lack of it could lead to a loss of competitive advantage as the company does not also sell online.

1.5 Financial Analysis

In 2015, Quinta dos Termos had a value of 1.512.306€, this note does not include the Assets of Sociedade Agrícola dos Termos Lda, which owns the land. In terms of financing, the company requested a loan for the new project of Herdade da Bica3. Nevertheless, João Carvalho is also

owner of textile factories, having good terms and conditions for all requested loans. From 2015 to 2016, the business grown 30% and since the beginning of the year 2017 until March, the business has grown 17% concerning the previous year.

Quinta dos Termos closed 2016, with a gross margin of 42,40%, has an annual production of 550.000 litters, counting approximately 800.000 bottles with a total sales volume of 826.532€ which 21% represent exports. Furthermore, the company has been facing a production bigger than its sales. If the wine stays in stock 2 years without being sold, the company has to sell the excess certified wine, in bulks to bigger corporations, in order to increase its profitability. So, it has conditions for further efforts to expand to foreign markets, in this case China.

2. Market evolution

2.1 Industry mapping - Quinta dos Termos

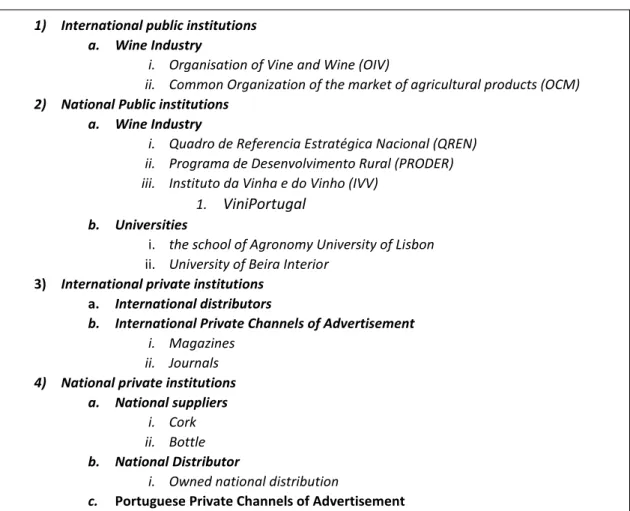

In order to understand Quinta dos Termos supply chain complexity, an Industry Mapping was performed. The Industry map is divided in four main categories: international public institutions, national public institutions, International private institutions and national private institutions.

3 Herdade da Bica with 30 hectares of vineyard in Castelo Branco, it is the lasted land that Quinta dos Termos acquired. The main goal of this project is increase the current production with new types of wines. Furthermore, in three years’ time, Quinta dos Termos wants to enter in the hosting and events business.

Figure II: Industry Mapping of Quinta dos Termos

´

European Union representatives act for the main concern of all EU farmers, “by guaranty[ing] minimum levels of production, so that [they] have enough food to eat and to ensure a fair standard of living for those depending on agriculture”. Those rights are preserved through the International Organisation of Vine and wine (OIV) and Common organization of the market of agricultural products (OCM). OIV ruled the amount of production and consumption of wine in Europe, trying to minimize the surplus. Each country that belongs to OIV, has its own organizations namely Quadro de Referencia Estratégica Nacional (QREN), Programa de Desenvolvimento Rural (PRODER) and Instituto da Vinha e do Vinho (IVV). By inviting renowned international wine critics, limiting the production, controlling the rights of production and certifying the wines according to a list of rigorous criteria, these entities have the mission to promote and oversee the quality control of the Portuguese wine abroad. QREN and PRODER manage European funds to finance agricultural projects that compete for this funding and demonstrate their economic, social and environmental sustainability. Regarding IVV, every region has their own Wine commission. Comissão Vitivinicula da Beira Interior (CVRBI) is the commission that rules Beira interior, which João Carvalho – Quinta dos Termos owner – is the currently President for the third mandate. Lastly, ViniPortugal is also an entity of IVV, it “is the Interprofessional Association of the Portuguese Wine Industry and the entity managing the brand Wines of Portugal. Its

1) International public institutions a. Wine Industry

i. Organisation of Vine and Wine (OIV)

ii. Common Organization of the market of agricultural products (OCM) 2) National Public institutions

a. Wine Industry

i. Quadro de Referencia Estratégica Nacional (QREN) ii. Programa de Desenvolvimento Rural (PRODER) iii. Instituto da Vinha e do Vinho (IVV)

1. ViniPortugal b. Universities

i. the school of Agronomy University of Lisbon ii. University of Beira Interior

3) International private institutions a. International distributors

b. International Private Channels of Advertisement i. Magazines

ii. Journals 4) National private institutions

a. National suppliers i. Cork ii. Bottle b. National Distributor

i. Owned national distribution

aim is to promote the image of Portugal as a wine producing country par excellence by valuing the brand Wines of Portugal.” In the private sector, Quinta dos Termos has a closer relationship with two main Portuguese Universities: the School of Agronomy of the University of Lisbon and University of Beira Interior, helping Quinta dos Termos research. Furthermore, the company is proud to maintain faithful relationships with its current international distributors and suppliers, in the sense that due to the hard competition in the industry of distribution, it can offer a cheaper and higher quality service. It is also important to mention, that the bottling is outsourced by ELA,Lda., which provides the machinery, technology and staff, that guarantee the quality and the hygiene control of the process. People from Quinta dos Termos know how to position themselves and take advantage of the quality of the agents who create value to its chain and promoting agents of the industry that may help them internationalize.

2.2 Portuguese Wine in International Wine Markets

With a drop of 14.4mhl from the previous year, the estimation of 2016 world wine production was 259.5mhl. Following the same pattern of European Union4, Portugal wine production is also

declining. In 2016, it registered a production of 6mhl, a variation of 14% comparing with the previous year. Nevertheless, Portugal preserves its 5th position as a European biggest wine

producer and the 11th position at world wine biggest producer (Appendix 7).

Regarding world wine consumption, since the beginning of the economic and financial crisis of 2008, global consumption seems to have stabilised overall around 240mhl. Portugal ranks 11th

with 5mhl, the same amount since 2011 until 2015, hosting a share of 2% of the total world wine production (Appendix 8). Wine consumption also seems to be decreasing in the most relevant countries in Europe. However, it shows two promising countries outside the Eurozone, namely China and Argentina, both with a variation of 3,2% in 2014 to 2015.

Concerning exports, in 2015 the global market5 reached 104.3mhl in terms of volume, an increase

of 2% compared with 2014, i.e, 28.3bn in terms of value, a rise of 10% comparing with the previous year. Spain has marked by the world leader in wine exportation, together with Italy and France. They represent 57% of the worldwide exports in terms of value and 56% in terms of volume. Despite the variation of -1,2% in terms of volume, Portugal hosts the 9th position in terms

of volume and value of wine exports, with a rise of 1.8% in terms of value, with a constant positive trade balance, in 2015. (Appendix 9 and Appendix 10). Furthermore, all exported wine is divided into 6 types of categories6, where China is the Portuguese wine importer leader, regarding POD

4 E.U. wine production has been decreasing at the mid-range estimated of 158.5 million hectolitres, which is a significant decline of 7.7 million hectolitres compared with 2015’s production.

5 Global market considered as the total exports of all countries.

6 6 categories of wine – PDO wine (Appendix 11), PGI wine (Appendix 11), wine without classification, Liquor wine, sparkling wine, other types of wine.

wines and PGI wines in 2014 to 2015, in terms of percentage variation in value and volume (Appendix 12). These indicators show the potential of the Portuguese wine in International markets, with a continuous growth in terms of value of exportation, it can reveal a promising future for the Portuguese wine and a tremendous opportunity for Quinta dos Termos’s Internationalization.

3. Internationalization process to China

3.1 Market selection

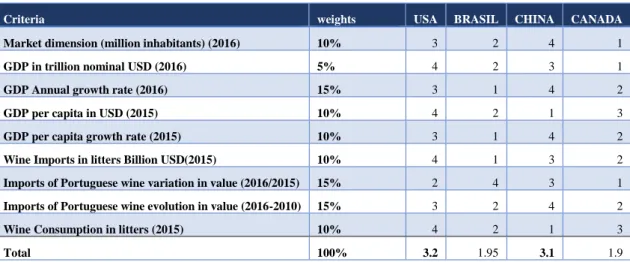

The market selection is one of the main dimensions of the internationalization process. The selection of a new market means risky investments for the company in resources to seize the new opportunity. Therefore, this section will analyse foreign markets for an international expansion of Quinta dos Termos, considering Cavusgil(2008) score methodology, by assigned scores to countries based on their overall market attractiveness. In the selection process, it was considered, as a base of analysis, the top 4 countries that belong to the strategic markets list provided by ViniPortugal. Then, a set of market potential indicators were chosen and different weights were attributed to each criteria, with the purpose of a later rank to each country on each indicator. The score varies from 1 to 4, and the scales used for each indicator were chosen following a contextual and comparative analysis of each indicator. Additionally, those values are then multiplied by their weights and added up in the end. The country with the highest score is the most suitable one for a wine internationalization.

Table 1 – Market Screening Analysis

Criteria weights USA BRASIL CHINA CANADA

Market dimension (million inhabitants) (2016) 10% 3 2 4 1

GDP in trillion nominal USD (2016) 5% 4 2 3 1

GDP Annual growth rate (2016) 15% 3 1 4 2

GDP per capita in USD (2015) 10% 4 2 1 3

GDP per capita growth rate (2015) 10% 3 1 4 2

Wine Imports in litters Billion USD(2015) 10% 4 1 3 2

Imports of Portuguese wine variation in value (2016/2015) 15% 2 4 3 1

Imports of Portuguese wine evolution in value (2016-2010) 15% 3 2 4 2

Wine Consumption in litters (2015) 10% 4 2 1 3

Total 100% 3.2 1.95 3.1 1.9

It has been shown the USA to be the best country for internationalization, but after a meeting with Pedro Carvalho7, Quinta dos Termos showed a greater interest in China. With the second-best

score closest to the USA and currently satisfied with its distributor in Shanghai, Quinta dos Termos wants to increase its share in China. Despite of the sales volume has not grown in

Shanghai, they do not want another distributor in Shanghai because China's business relationships are based on Guanxi. So, in order not to affect the current relationship with its distributor, Quinta dos Termos prefers going to another region. Furthermore, China has two special autonomous regions (Macau and Hong Kong) that aren’t considered in the market selection data. Although these two regions are autonomous in economic terms, they are not autonomous in geopolitical terms. In that sense, those two regions are also considered to be in the Region selection. China is the selected country. The Appendix 17 shows the relevant data that justifies the attribution of the values.

3.1.1 China Brief Overview

The Popular Republic of China is a Socialist Republic composed by 31 administrative areas8,

which 22 are provinces, 5 Autonomous regions (Xinjiang, Mongolia Interior, Tibet, Ningxia and Guangxi) and 4 counties (Beijing, Tianjin, Shanghai and Chongqing), also counting with 2 Special Regions (Hong Kong and Macau). Its area is 9.989 thousand square kilometres, being 2.3 times the European Union size and 108 times bigger than the Portuguese territory. This big Asian country with 1.376 Billion people, is the most populous country in the world and it is expected to reach 1.4billion by 2020. Counting with 26% of young people (under 15 years old), 65% of middle-aged people (above 15 years old and under 65 years old) and 8% of elder people (above 65 years old), with a positive tendency in middle-aged people and in elder’s people. China has the second highest Gross Domestic Product of the world. In 2016, its value amounted 11.3 trillion in nominal dollars and according to the IMF the growth of 6.5% in 2017) and 6.0% in 2018 (International Monetary Fund, 2016) are predicted. In fact, it is the second-largest economy with an increase in consumer spending by 7.3% between 2013 and 2014. In terms of Gross Domestic Product per capita, this has been increasing throughout the years, even though it’s still below the biggest world developed economies. Macau has the 4th biggest GDP per capita, while Hong Kong

stays in the 17th position. China has a Debt to GDP ratio of 43.9% in 2015, with a low inflation

rate of 0.9% and a current high interest rate of 4.35% being considered a stable and prosper economy (Trading Economics,2017).

In 2012, China was the world leader as the world´s top international tourism spenders, having 83 million trips abroad and spending US $102 billion. The number of trips abroad is expected to reach 200 million by the year 2020. By increasing their travels abroad to wine drinking countries, they are improving their taste, knowledge and preference for foreign wines in China (Market Access Secretariat Global analysis, 2016 – The Wine Market in China 2016).

3.1.2 China Mainland Wine Market

As a way of simplifying the data collection, this section only refers to the wine market in China Mainland, not considering Macau and Hong Kong wine market.

The Chinese wine market worth US$ 38.3 billion in 2015 and expected to increase 81%, reaching US$ 69.3 billion by 2019 (Appendix 18). In 2015, China was the 2nd world largest vineyard and

6th world largest producer counting with 830kha of area under vine and 11.5mhl of produced wine.

In the production, foreign castes9 are normally used, with red wine counting 90% of the total wine

produced. In terms of consumption, China is part of the top 5, with a total wine consumption of 16mhl, right after USA, France, Italy and Germany.

In China, the wine consumption decreased 8.42% between 2013 and 2015, comprising 6.48% for the overall wine consumption in the world (Wine Institute, 2017). Moreover, the still light wines category is the most prevalent among Chinese consumers, by conquering share form non-grape wine each year, counting a total of 55% in 2015 in terms of sales of wine by value. Red wine, which represents 73% of the total still light grape wine, is particularly popular because of its perceived health benefits and the significance of the red colour in Chinese culture10, counting with

an increase of 8% between 2014 and 2015. (Euromonitor,2016, Wine in China)

In terms of distribution channels, the HORECA channel is the most used, followed by supermarkets and specialized shops. HORECA channels distribute 70% of the whole bottle imported wine, whereas retail channel distributes the rest. In the HORECA channel, hotels count with 6 to 7 suppliers, with 3 or 4 that are main suppliers and in the restaurants it counts up to 5 distributors, which only two or three are main suppliers. (ICEX, 2015, El Mercado del Vino en China)

Furthermore, Chinese wine market is dominated by a few big distributors that have power all over the country. These few big distributors are Chinese wine producers. Their strength is divided by region. Great Wall is all over China, Dragon Seal has a big strength in the North, Imperial Court has a strong presence in Shanghai and Changyu is leader in many places. The rest of the distribution is complete with small enterprises with low experience. (Wine in China, Euromonitor 2016 )

Moreover, in China there are a few renowned distributors (Appendix 27,28,29,30,31), so great part of the conditions are already pre-determined. If the company also wants to send samples to China, it should send an international mail door to door, stating wine has no commercial value and nevertheless can only send until 3 bottles. Normally, if it is bigger than 3 bottles, the importer

9 Foreign castes – Cabernet Sauvignon and Franc, Merlot or Syrah. 10 Red colour represents wealth, power and good luck.

has to pay for the remainder as commercial merchandise, generating some problems in the customs. The importer has to present all the documentation about the merchandise and pay for the import tax. (ICEX, 2015, El Mercado del Vino en China)

Regarding the price segmentation of still red wines, in 2015, 5.4% of its consumption related to wines priced between 30CNY and 59.99 CNY, while 24.2% were priced between 60CNY to 89.99CNY, and 70.4% had a price of 90CNY and above. (Wine in China, Euromonitor 2016 ) Famous for the quality wine, France has consistently been the main supplier of China but has only experienced a moderate growth of 21% between 2011 and 2015 (World´s Top Exports 2016). Of the top fifteen countries, Chile has increased its wine exports to China the most, with a value growth of 125% in the same period. Portugal is China´s 11th largest supplier of wine contributing

with 0.8% for the total imported wine in China, with an increase of 24% between 2011 and 2015(World´s Top Exports 2016).

These aspects show the promising potentialities of the Chinese market in the present and for the future. Quinta dos Termos only needs a niche of the market to be successful. However, China is huge and Quinta dos Termos should focus on the best city market to expand. So, a region selection is essential.

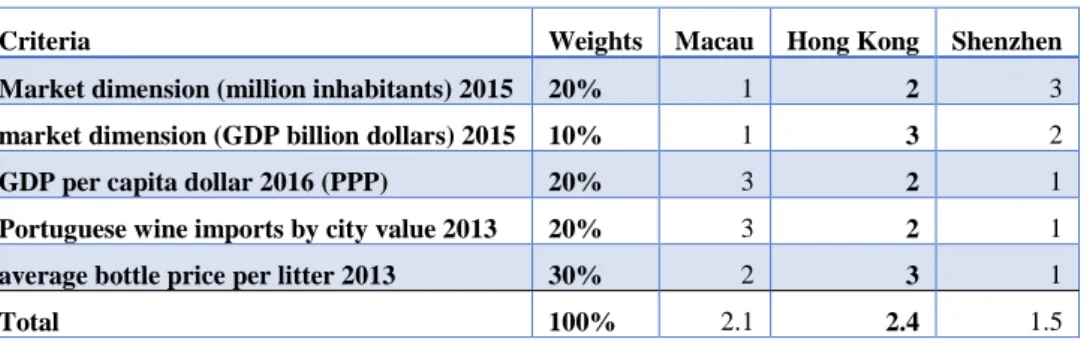

3.2 China´s Region Selection

It is important to characterise China’s regions where Quinta dos Termos may succeed the most, in order to create an efficient distribution network and also to better plan the marketing and promotion activities. To an efficient distribution, the company should aim coastal regions in the first sight, result of the research of Zsombor Sumegi PH.D Wine Market and wine Industry of China in the 21st Century 2011.So, a primary screening was conducted to discover the best cities

to start the Cavugil methodology.

According to the reports “El mercado del vino en China, 2015” and “China Hong Kong Macau Evolução da posição dos vinhos Portugueses de 2008 a 2013”, the East-Coast is characterized by being the leader in importation and consumption, with a higher purchase power and more receptive to western culture. The eastern consumers look for a range of medium and high quality products due to the growth in per capita income. Furthermore, the health benefits of wine are being appreciated by the consumer. In Northeast region coast, the consumers prefer high level alcoholic drinks and beers. In the past years, the consumption of wine has been increasing. The consumption of wine is associated with social status and high purchase of power. The light wines and sparkling wines have a great acceptance in this region and a significant growth is expected. In the South Region coast, the consumers prefer cold beer, because this area is the warmest in China. Nevertheless, wine consumption in this area is one of the largest in China, due to its association with purchasing power and health benefits. These are the most attractive regions

within China for a SME with premium wines as Quinta dos Termos. Moreover, the company should aim to big cities, to have a bigger success in internationalisation. Sales of bottle wines are concentrated in the east and southeast regions around Shanghai, where cities have higher income and growth, this is also where most of foreigners live and work, having a greater acceptance of imported products. The other major consumption is in the south in Shenzhen, Guangzhou, Macau, Hong Kong and in the north of the country, Beijing.

South region is the most promising of all regions, namely Guangzhou, Shenzhen, Macau and Hong Kong. Since Guangzhou is the furthest city between them, on first sight Quinta dos Termos should focus only in Shenzhen, Macau and Hong Kong by being close to each other, this could create a promising potential networking for the next internationalization (Appendix 22). The market analysis will focus on these markets. As Shenzhen has few wine market data and belongs to Guangdong province, some assumptions were considered in order to reach the best estimation possible. Following the same methodology as the market selection and considering the report written by Zsombor Sumegi PH.D Wine Market and wine Industry of China in the 21st Century

2011. After selecting the best regions in China, some criteria were analysed among the 4 selected cities, such as GDP per capita (PPP), market dimension by million inhabitants, market dimension by GDP, wine imports by city, average price of the bottle (Appendix 23).

Table 2 – Chinese Region Screening Analysis

Criteria Weights Macau Hong Kong Shenzhen Market dimension (million inhabitants) 2015 20% 1 2 3

market dimension (GDP billion dollars) 2015 10% 1 3 2

GDP per capita dollar 2016 (PPP) 20% 3 2 1

Portuguese wine imports by city value 2013 20% 3 2 1

average bottle price per litter 2013 30% 2 3 1

Total 100% 2.1 2.4 1.5

3.2.1 Hong Kong Wine Market

Wine consumers are increasing every year. Due to the growing demand for wine in Asia, Hong Kong government removed all duty-related rules and administrative controls for wine in 2008, to a faster development of Hong Kong as a wine trading and distribution centre for the region, particularly the Chinese mainland. With a 5 % raise in the total volume sales of wine in 2015, Hong Kong consumed 15 million litters of wine, spending US$541 million. The belief that wine is beneficial for health and the elimination of import duty on wine in 2008, are the two major factors of wine environment booming in Hong Kong. As a result, Hong Kong wine importation has expanded fast. In 2016, importation amounted to HDK 12 billion more than seven times the value of 2007. In volume terms, Hong Kong imported 62.9 million litres of wine in 2016, which 43% of the imported wines were re-exported in 2016. However, this trend has stabilized due to the decrease in the number of tourists and their spending. (Euromonitor Wine in Hong Kong 2016)

Hong Kong consumers prefer still light wines, accounting a total of 77% of the total wine market in terms of volume and 75% in terms of value in 2015. Moreover, Red wine accounts with the biggest share in value and in volume, 2239 HKD million and 8 million of litters respectively in 2015, being the most consumed wine. However, despite red wine is preferred by consumers, white maintains a steady growth at 6%, which means white wine is rising in popularity. Chardonnay remains the most popular white grape type, accounting for 60 % of total white wines sales at the end of 2015 and in top 3 of red wine, Cabernet Sauvignon Merlot and Shiraz/Syrah are the most consumed. Sake also registered a growth at 4% in volume terms, motivated by the drop in Japanese yen in 2015, driving sales of sake to off and on trade channels. Also, a sake festival was introduced at the largest shopping mall in Hong Kong, with 100 different types of sake from 20 different counties of Japan, being another factor of the Sake sales increment. (Euromonitor , Wine in Hong Kong 2016).

On one hand, regarding price segmentation in 2015, both still red wine and still white wine in price HKD 65 to HKD 135 are the most popular, taking around 30% of the total volume in their respective categories. On the other hand, rosé has a premium price, as the entry fee of tasting rosé wine is higher, being between HKD135 and HKD160. Finally, sparkling wine is even more expensive, falling from the price of HKD175 to HKD200. In Appendix 37, there is a table with the price range of red and white wines in Hong Kong. (Euromonitor Wine in Hong Kong 2016). Old world wines have local consumers’ loyalty. They appreciate the aged of the wine made by using traditional techniques. Old world wines still dominate the wine category in Hong Kong. Portugal occupied the 11th position in terms of volume of importation with 0.3 million litters and

11th position in terms of value of importation with HKD21.2 million. Hong Kong consumers are

more into wine appreciation culture, becoming more educated and knowledgeable regarding wine, reflecting in the growth of sales of wine of 57.5% from 2010 to 2015. Due to the growing demand for wine in Asia and the deregulation of wine imports, all activities within the wine industry have boomed in Hong Kong. International wine companies and their specialists have moved to Hong Kong11. Furthermore, Hong Kong is known as the culinary centre of the region,

matching foreign wine with Asia cuisine, becoming a trend in food and wine appreciation. Public as well as private training institutions are also expanding their appreciation courses and developing training programmes of personnel12. Moreover, the consumer prefers enjoying a

11 “For example, Robert Sleigh, senior director and head of Sotheby's wine department in Asia,

has been relocated to Hong Kong from New York since September 2010. After six years in Singapore, the Regional Council of Burgundy has also moved the only office in Asia to Hong Kong” pg 4 – Wine Industry in Hong Kong - HKTDC

12 “For instance, the Vocational Training Council (VTC) offers trainings to personnel ranging from

bottle of wine with friends in a club or at home rather than in a restaurant, which due to extortionate corkage fees decreases the acceptance of drinking wine during the restaurant meal. Those consumers are a great part of the millennium generation, aged 21 to 37. However, the target should be the older millennials aged 27 to 36, with higher purchase power. (Wine Industry in Hong Kong HKTDC Research, 2017)

In terms of competition, at the end of 2015 there were no local wine brands in Hong Kong and thus International brands are dominating. However, with the increase of the purchasing power customers are changing habits towards premium spirits. Economy wine is also gradually losing share off-trade volume sales as consumers are becoming more demanding regarding wine quality, as result mid-priced and premium wines are becoming more popular. With a strong consumer bases existing in mid-priced and premium wine, there are only few promotions regarding these topics. The distributor prefers spending money on training specialists in order to strengthen their competitiveness. However, economy of wine is facing a strong competition, between brands amid stagnant sales, so promotions such as gifts and lucky draws are expected to be implemented by the major players in wine economy. (Wine Industry in Hong Kong HKTDC Research, 2017). The future has also to be considered, Hong Kong is expected to reach in 2020 18.8 million litters, with a major increase of 29.5 % in still red wine and 27% in still white wine. Moreover, no major discounting or price is expected until 2020 forecast (Euromonitor Wine in Hong Kong 2016).

3.2.2 Sales Channels in Hong Kong

Hong Kong government has signed co-operation agreements with Australia, Chile, France, Germany, Portugal, Italy, New Zealand, Romania, Spain and United States to strengthen promotion activities in wine-trade investments and tourism.

Within the country, wines are sold through off-trade channels such as supermarkets, specialty stores and convenience stores, and on-trade channels such as bars, restaurants and club houses. Off-trade volume sales out-performed on-trade volume sales, accounting 60 % of retail sales in 2015. However, in terms of value on-trade channels have 54 % of the total wine sales by value. On-trade Channels the price points of wine sold in restaurants and bars vary according to the overall price point of the outlet. A low-end wine normally costs below $USD10 a glass, with a medium variety costs USD$10-20 and a high-end option costs above USD$20. (Euromonitor Wine in Hong Kong 2016).

appreciation and other wine-related matters through the International Culinary Institute, its member institute. Meanwhile, the School of Professional and Continuing Education of the University of Hong Kong has partnered with a French institution to launch the first Master of Business Administration’s programme in Hong Kong on wine”. Pg4 - Wine Industry in Hong Kong - HKTDC

Based on the report “Beverage Trade Network research in 2014”, 64% of wine consumers, drink wine a couple of times a week or more and 17% of wine consumers drink daily. Furthermore, for upper-middle tier of wines for off-trade the wine price is around HKD$150-350 equivalent to US$20 - US$45 at retail, it is the segment most retail shops seem to bet on, aligning with consumers preferences at HKD$200-500 equivalent US$25 – US$65. Thus, in terms of supermarket wine consumers, which primarily buy wine in the supermarket, 37% would not spend more than HKD$200 a bottle (USD$25), and their average annual spend is around HKD$2800 (USD$350). However, those outlays per bottle are higher than the average price of supermarket wines, being around HKD$60 (USD$7.50). Supermarket consumers consume less than the whole population, with a mere 58% drinking a couple of times a week or more, compared to 72% for the group, and 10% only drink a few times a year compared with 3% of the whole group. Moreover, contrasting to the “normal” trend in which women are the principal buyers of wines, in Hong Kong market men are the main buyers. Thus, by labelling bottles in a girl friendly way could be the wrong way to increase sales (Beverage trade Network,2014, Hong Kong Wine Market - Wine Industry in Hong Kong).

3.2.3 Re-exports from Hong Kong

In 2006, Hong Kong and the mainland officialised the liberalization of commerce, called CEPA13.

With this agreement came the liberalization of services, goods and easiness of direct investment, in which all products can be exported to China Mainland without taxes. Meanwhile, Hong Kong has been seen as independent from the mainland, “one country, two different systems”, being also seen as one of the most independent economies in the world.

In April of 2008, Hong Kong also cut out wine taxes. Thus, nowadays, it is the only country where this alcoholic drink is not taxed. Furthermore, Macau followed the same path and in August of 2008 abolished all taxes regarding wine and beer. In addition, the local wine merchants arranged some measures to facilitate the export bureaucracy from Hong Kong. With these measures Hong Kong intends to improve transparency to increase wine exports to China. Central Administration of Chinese will allow the procedures to be concluded ten days before it comes from Hong Kong in order to only spend one day at the broader.

Regarding future opportunities, Hong Kong has good forecasts to 2020 in terms of wine consumption, more precisely in red and white wine, the type of wine that Quinta dos Termos is famous for. Moreover, most of the consumption is sustained by imported wines. Due to lack of local producers, the imported wine is not taxed and Hong Kong follows the CEPA conditions to export to China Mainland. After settling in Hong Kong, Quinta dos Termos can think about other internationalization. Shenzhen can be next with better conditions than it already has in Shanghai

(Appendix 22). This next internationalisation is supported by the cost-efficient that the local Hong Kong distributers have.

4. Competitive Analysis of Quinta dos Termos in the Hong Kong Market

Belonging to one of the biggest wine markets in the world, Hong Kong can be very challenging for a SME as Quinta dos Termos. Therefore, a SWOT analysis was performed to access a competitive analysis of Quinta dos Termos in Hong Kong wine market (Appendix 32).

Quinta dos Termos wines are aligned with the Portuguese wine brand, by using traditional methods of cultivation and aging, which also makes Portugal part of the Old-World wine. Within Old-world wine, there are some of the best wine makers, such as France and Italy. However, this could be tricky for Quinta dos Termos as Portugal has been seen as a lower quality wine maker in the world. As a result, ViniPortugal and other entities are trying to change the consumers mind, investing and promoting Portugal brand throughout the world, showing that Portugal can produce great wines, with high quality and unique taste. Quinta dos Termos lines up with this strategy. The company has a high-quality wine portfolio, with traditional and international grapes. With the agents’ help, it could leverage its present in Hong Kong market. This excellence is also supported by the Integrated Crop Management certification that guarantees the wine quality throughout the whole production process. Furthermore, Chinese consumers care much about their health and ecological products certification represents a major advantage for Quinta dos Termos in its internationalisation process.14 Moreover, Quinta dos Termos already exports to Shanghai,

knowing the typical procedures to export to China and probably, could use its local contacts to help finding a local distributor in Hong Kong.

Besides, Quinta dos Termos’s lack of accessible information, without a website it is difficult to be in the future consumers’ selection. Thus, as the consumer searches for recognised wines, it is imperative that the website shows all the wines with their respective awards. The gastronomy represents an important entry point for the wines in Hong Kong, Quinta dos Termos has no brand awareness, no contact with local distributors and Hong Kong has no Portuguese gastronomy, so in order to select the best wine from Quinta dos Termos, it is their concern to try to combine the best wine with Asian food. Lastly, new world wines are earning share in Hong Kong market as consumers are becoming more educated and knowledgeable regarding wine. They realise that they can buy high quality new world wine at competitive prices.

5. Mode of Entrance

Being a SME, Quinta dos Termos pursuits the way to have the lowest commitment of all, the less risk and by being the first time entering Hong Kong, it should be wise to let the bureaucracy to

local’s distributors. That mode is indirect exports (Appendix 33). Furthermore, Old world wines dominate the market. However, New World Wines invest in a strategy which is making them achieve popularity. New World Wines are more user friendly, with English labelled bottles with greater emphasis on their primary grape variety. Besides, Old World wines labels are difficult to read because their focus is on the geographic appellation (the region which the grapes grow) being less appealing for Chinese consumers. Baring this in mind, Quinta dos Termos, after a long and good relationship with the distributor, should adapt to the new culture with the distributer’s help improving the bottles’ labels in terms of cultural assimilation that are going to be export for Hong Kong and letting the distributor take part in the responsibility of local promotion of the product. There are also some documents that need the company’s attention when exporting to Hong Kong: Single Administrative Document, commercial invoice, origin certificate and packing list, all these documents are addressed in Appendix 38.

6. Implementation

In this section, a set of activities that should be developed in order to internationalise Quinta dos Termos in Hong Kong will be presented and specified. To do so, the Marketing tool 4P´s and a Memo will be used. By using those tools, the product, price, promotion and place are going to be explained, jointly with a Memo.

6.1 Implementation Plan

6.1.1 Product

Quinta dos Termos is not going to sell directly to the consumer, however in order to find a good and prosperous distributor, it has to find the most suitable product for the Hong Kong market. Hong Kong is a land of business and Chinese mainland tourism, which means our products should focus on this two targets (Euromonitor 2010, Hong Kong consumers in 2020: A look into the future). Furthermore, Quinta dos Termos should focus its choice in a product that adapts to the life of Hong Kong consumers, to their Asian food (more precisely roasted lamb and duck) as Hong Kong is known as foodie´s paradise, with a mannish design as man are the ones who buy more wine in the supermarkets and combine with their Chinese key success factors15 as they have

embedded in their culture. Moreover, Chinese mainland people and Hong Kongers believe in lucky features as numbers16and colours17. Furthermore, the Chinese consumer likes to drink with

friends, relatives and in business related contexts such as business meetings or dinners with colleagues. The boss expects employees to drink, and employees would not refuse a drink with

15 While in the beginning the growing appetite for red wine was based on the country´s taste for French trends, today the main criteria of foreign importers are the international credence certification, the price and the quality of wine (Ping Quing 2016)

16 Lucky numbers – 0, 2, 6, 8 and 9

their boss because they want to show him respect. Finally, they like to offer gifts in order to show respect and to follow their “Guanxi” culture.

The best strategies for wine exportations in the Chinese market are linked with the exporter country’s status rather than its regions, which are difficult for Chinese people to acknowledge. However, the castes’ names as Touriga Nacional, o Porto or Vinho Verde could be in the label as they are internationally renowned (Dossier de Vinhos AICEP,2011). Quinta dos Termos not having a well-known brand and coming from a country with a low reputation in the market, can only find its compensation in international prizes or local awards. Furthermore, wines were traditionally selected in a menu without the costumers ever seeing the bottle. However, with the increase of off-trade channels, labelling design and bottle enclosure becomes very important. As mentioned above, Quinta dos Termos has a wine portfolio that contains 20 wines, displayed by hyper premium, super premium and premium wines (Appendix 16). In a vast premium market with highly educated people, Quinta dos Termos should present the wines to distributers by narrowing the supply as to highlight their best three wines for this market. The main objective of this strategy is to make the distributor choose the best wine for its consumers. The Chinese market is much diversified, so by presenting only one wine the company could be making a wrong choice and presenting all choices, the company wouldn’t capture people’s attention. It’s known that time is money!

Among Quinta dos Termos’s wine portfolio, only three types of wine are likely to be chosen: Escolha – O Deslize de Virgilio Loureiro 2009, Quinta dos Termos Selecção 2013 and Quinta dos Termos Reserva do Patrão 2009 are the ones that best match the selected criteria of the Hong Kong market, catching the medium and high class costumers’ attention. In Appendix 34 is the description of the wines and the main reasons of their selection.

6.1.2 Price

Regarding the price, the company should be perceived as a hyper (86.67 HKD - 216.68 HKD) or super premium price (43.34 HKD – 86.67 HKD), focused on middle and high class, by having a price that reflects the product quality and a sustainable high quality brand image. The table below shows the price per bottle when it arrives to the distributor. The company should focus only on arranging a distributor, not on the final consumer. The price strategy to the final consumer should be made by the chosen distributor, who knows which numbers should attract more the local consumer and the Chinese mainland tourist. As mentioned above, since 2008 there are no taxes in alcohol importations. There is also no indirect tax that could increase the price of the product.

Therefore, Hong Kong is a free circulation port regarding wine. So, in the computation of the most expensive bottle price, the company has only the CIF18 cost.

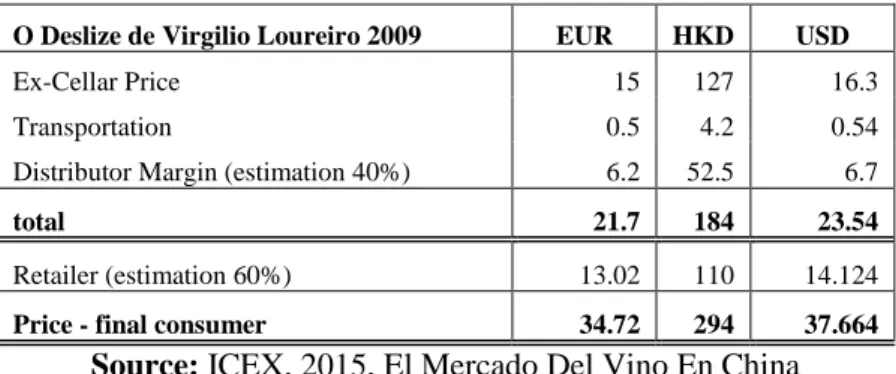

Table 3 – Price of “Deslize de Virgilio Loureiro” at the consumer

O Deslize de Virgilio Loureiro 2009 EUR HKD USD

Ex-Cellar Price 15 127 16.3

Transportation 0.5 4.2 0.54

Distributor Margin (estimation 40%) 6.2 52.5 6.7

total 21.7 184 23.54

Retailer (estimation 60%) 13.02 110 14.124

Price - final consumer 34.72 294 37.664 Source: ICEX, 2015, El Mercado Del Vino En China

As one can see, the price of the most expensive wine stays aligned with the consumer’s preferences at HKD$200 – HKD$500, at the same time in the segment which retail shops seem to be betting on. Furthermore, regarding the payments, the company should follow the procedure that has been following in Shanghai operation. The distributors will be asked to make a total payment of the order before the shipment is made. The financial relationship between the importer, distributor and retailer will be based in agreements between them.

6.1.3 Promotion

The main goal of the company is to be known by the distributers in this competitive market. In order to do so, the company should pursuit some channels capable of leverage its quality and brand. First, the company should participate in the most important wine fairs (Appendix 24) in Hong Kong, in fact, trade fairs have been a good business matching provider, supporting new wines and labels launches. It provides the exhibitors with golden opportunities to establish new connections, namely The Hong Kong International Wine Spirits Fair, Vinexpo, Prowine Asia and Restaurant & Bar Hong Kong. In these fairs, without brand awareness and coming from a country with low reputation, the company should focus on showing the quality recognition of the products and the castes from which the wine was produced. Therefore, Quinta dos Termos should participate in local competitions, such as China Wine & Spirits Awards, Hong Kong International Wine & Spirit Competition, or even in other competitions mentioned in the list of wine challenges and competitions. Awards in local and international events could guarantee the capture of some future partners’ attention. Meanwhile, Quinta dos Termos promotion strategy should be in line with ViniPortugal strategy, promote Portugal brand image as a producer of excellence and highlining the brand Wines of Portugal. In 2015, Portugal was the guest country of the Hong Kong International Wine Spirits Fair, where a series of activities to promote Portuguese wines

took place, including presentations, seminars, wine tastings and gala dinners made by ViniPortugal. By attending these kind of events, Quinta Dos Termos benefits from ViniPortugal promotions by associating its products with the brand Wines of Portugal, which is more popular than Quinta dos Termos brand.

Furthermore, Quinta dos Termos should focus on finishing the company’s website for future partners’ searches and start selling online in the future website. The company could also embrace the new technologies by combining its site with the Vivino application. Vivino is the world´s largest wine app, counting on 23 million users, rating millions of wines around the globe and collectively makes the largest wine library in the world. User reviews have become the unbiased trusted source for consumers. Vivino´s 23 million users have over 40 million wine ratings up to date and continue to rate over 100,000 a day. The company could start a partnership with Vivino by displaying the ratings on its site and start selling online in a world known platform. Associating with Vivino, Quinta dos Termos could start selling online and meanwhile be known for its quality and irreverence.

To deal with all issues related to exportations, Quinta dos Termos has an exportation department formed by João Carvalho and a salesman. Together they are fully dedicated to the external market. They will be the direct representatives of Quinta dos Termos in Hong Kong. The salesman will be the main responsible for keeping in touch with distributors and taking care of all legal procedures. João Carvalho’s presence is crucial in the main promotion actions, as Quinta dos Termos wants to be known as being a family company rather than a large corporation, to give the felling of quality and uniqueness to the consumer.

After settling in Hong Kong and in order to increase the brand’s awareness for a further expansion to Shenzhen (China Mainland – Appendix 22), the company should contact an important local magazine shown in the Appendix 41.

6.1.4 Place

Following the indirect export path, Quinta dos Termos has only two arrangements to put its product in the Hong Kong market: agents and distributors (Appendix 35). The company should only worry about the product production and align the marketing with distributors’ opinion, as they are the ones who know the market.

After finding a reliable Hong Kong distributor and engage to a close relation with them, Quinta dos Termos should think about the next step, throughout China mainland. Hong Kong distributors have better agreements with China than anyone else, called CEPA, minimizing the costs of entry and they are more aware of the Chinese mainland wine market. In Appendix 24, there is a list of selected trade fairs of the industry and in Appendix 27 to 31 there is a list of distributors for Hong Kong, Republic of China and Macau.

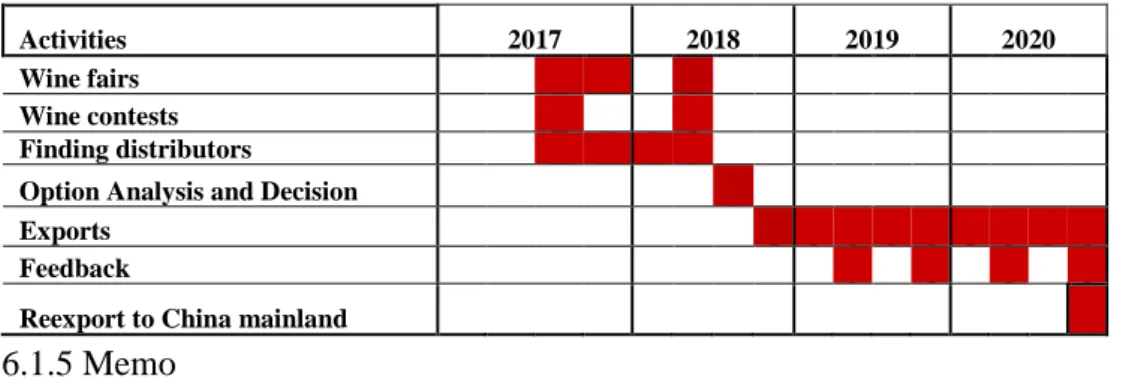

Figure III: Grant Chart

Activities 2017 2018 2019 2020

Wine fairs

Wine contests

Finding distributors

Option Analysis and Decision

Exports

Feedback

Reexport to China mainland

6.1.5 Memo

For a successful internationalisation, an implementation plan is set with specific objectives and ways of measure, to analyse and evaluate the management performance of the project. Therefore, necessary resources are summarized in the table below.

Table 4: Memo for the Hong Kong Market Objectives Measurement Target Initiative

Financial

increase sales Orders from distributors

2018: 15000 bottles 2019:15000 bottles 2021:30000 bottles

Establish relationships with local distributors start with online selling Orders from Vivino 2018: 1000 2019:2000 2020:3000

Create a profile at Vivino and a Partnership Costume r increase brand awareness Number of re-orders Number of visits in the website Awards in wine competitions. Publications in wine Magazines. Invitation for wine Fairs.

Participation in Hong Kong wine competitions, wine fairs and magazines . Finish the website

Hong Kong retailers’ satisfaction Satisfaction survey (carried out by distributors) 70% satisfaction rating

Keep in touch with distributors and give some advises to

promote the product

Consumer Satisfaction

Comments at Vivino and at the

website

70% of positive comments

Ask for comments on the wine labels Internal Establishment of Hong Kong partnerships with distributors Number of contracts with local

distributors

2 distributers after 2 years in Hong Kong

Participation in Hong Kong wine competitions, wine fairs and

magazines

Distributers loyalty

Number of

Development of the website and proactivity in the marketing by social media number of visits in Facebook number of visits in the website

post 2 times per day in social media

contract a programmer stimulate social interaction

Learning Learn with Shanghai experience what to apply to this case

Learn from the distributors

Business Trips Visit Hong Kong: observe the

consumer behaviour

7. Financial Analysis

Finally, in order to evaluate the feasibility of the project, a calculation of the Net Present Value (NPV) was performed assuming a five-year period (Appendix 42). Furthermore, the company should focus on exporting to Hong Kong at first sight and only in 2020 start to Re-export to China mainland. Therefore, to start the brand awareness, the company should made an investment covering at least two important wine fairs in Hong Kong, such as The Hong Kong International Wine Spirits Fair and Prowine Asia, together with two important international awards such as the China Wine and Spirits Award and Hong Kong International Wine & Spirit Competition. For these events the company will need the presence of a family member of Quinta dos Termos and a salesman, summing the costs of a hotel and business trips. The participation on these events is considered in the initial investment and in 2018’s investment. In the end of 2018, Quinta dos Termos would have its first order of 15000 units, following the same amount as Quinta dos Termos’s operation in Shanghai. In the following years, the number of bottles will not increase, as the number of bottles per container cannot exceed 15000. In 2021, Quinta dos Termos finally enters in China mainland with the Hong Kong Distributor, so another container will be needed. Moreover, in Appendix 34, the chosen wine is Escolha – O Deslize de Virgilio Loureiro 2009 (Red), with a price of 15,5 € and with a gross margin of 42,5%. Furthermore, 8% of the revenues represents the amount spent on Marketing, 0,5€ per bottle is the cost of the shipment and a 21% of Portuguese government taxes. The discount rate used is 5.07%. By 2021, if the number of bottles sold stays permanently the same, the NPV of the projected is expected to reach 1,996,288.73€.

8. Conclusion and Recommendations

Quinta dos Termos, as a state-owned family company has the need and capacity to explore new markets, such as Hong Kong. By exploiting its best characteristics, namely terroir and ecological approach, combined with the Chinese market opportunity, the company could minimize its stocks and increase sales. In order to succeed in its internationalisation, the company has to combine its best resources with “Guanxi”, take out the most of the wine fairs to make future connections.

Every business connections are important for the future of the company in China. It is also important to establish a relationship based on trust with Chinese distributors. They are going to reward the company with loyalty, as Chinese people care about loyalty rather quality of the product, with a prosperous and long term relation. Furthermore, China has different regions with different preferences. In order to take the best benefit of the future market knowledge, Quinta dos Termos should focus on the best promising region, aiming to the closest cities and after a successful internationalisation in one of them, expand to the others. Additionally, the company should be aware of the adversities of the market. Being in a competitive market, the company should always keep in touch with its distributors, enlarge its network and customize its bottles’ labels in English with the type of grapes. With an effective implementation plan and a strong management team, Quinta dos Termos could create a sustainable international business.

For future internationalisation, one must be aware that all sources used in data collection have different information regarding the same topic. So, in order to be consistent, try not to combine different sources when topics could be related. For more information, the company should contact the wine associations in China (Appendix 26) and read the wine news (Appendix 25).

References

Websites:

Organizaçao Internacional do Vinho Available at: http://www.oiv.int/

The Guardian - The EU Common Agricultural Policy

Available at: https://www.theguardian.com/world/2003/jun/26/eu.politics1 Instituto da Vinha e do Vinho (2016)

Available at: http://www.ivv.min-agricultura.pt/np4/estatistica/

Wine Institute (2017)

Available at: http://www.wineinstitute.org/resources/statistics

The World Bank (2016)

Available at: http://data.worldbank.org/ Comissão Vitivinicula da Beira Interior Available at: http://www.cvrbi.pt/

ViniPortugal

Available at: www.viniportugal.pt Definition of PDO and PGI

Available at: www.wine-searcher.com/wine-label-eu.lml Statistics about China Imports and Exports

Available at: http://www.customs-info.com/# Macau Statistics

Available at: http://www.dsec.gov.mo/Statistic.aspx?NodeGuid=bd432adf-9594-43f0-87fc-4acefd98005a

Hong Kong statistics

Available at: https://www.censtatd.gov.hk/home/ China Statistical YearBook 2016

Available at: http://www.stats.gov.cn/tjsj/ndsj/2016/indexeh.htm

Hong Kong wine Distribution

Available at: http://beveragetradenetwork.com/en/btn-academy/articles/hong-kong-wine-market-308.htm

Beverage trade network,Hong Kong Wine Market - Wine Industry in Hong Kong Available at: http://beveragetradenetwork.com/en/btn-academy/articles/hong-kong-wine-market-308.htm

The Portuguese Wines

Available at: http://www.theportuguesewine.com/wines/quinta-dos-termos-selection/424 cost of living in Hong Kong

Available at: https://www.numbeo.com/cost-of-living/country_result.jsp?country=Hong+Kong China information and useful contacts

Available at:

http://www.portugalglobal.pt/PT/Biblioteca/Paginas/Detalhe.aspx?documentId=895234e1-6f72-45e6-8f78-f4179b040ed9