The relationship between the effective tax rate and the nominal rate

Texto

Imagem

Documentos relacionados

Por fim, neste quarto modelo, será averiguado o impacto do auditor selecionado para a certificação das contas nos níveis de divulgação das concentrações de atividades

Com a elaboração da Política Nacional de Habitação ( pnH ) em 2004 (definindo as diretrizes e instrumentos), do Sistema Nacional de Habitação em 2005 (estruturado a partir de

The probability of attending school four our group of interest in this region increased by 6.5 percentage points after the expansion of the Bolsa Família program in 2007 and

A possible interpretation of the disparity between the Pasinettian and Smithian concept of the ‘natural rate of profit’ is that the for- mer is a warranted rate of profit that

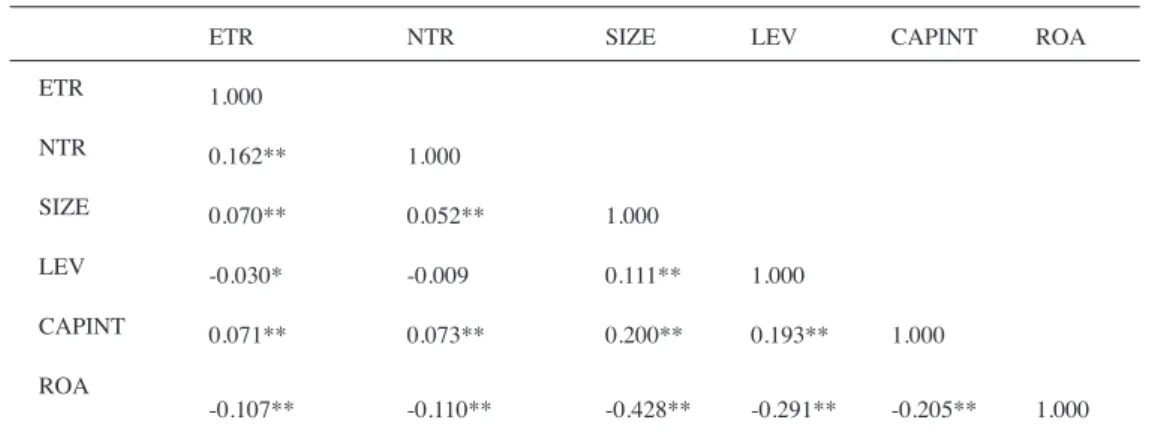

The dependent variables are the 3 measures of tax avoidance, from equation (1) to (3), in which: BETR represents the book effective tax rate, CETR is the cash effective tax

Characterization of extended-spectrum beta-lactamase (ESBL) producing Escherichia coli strains isolated from animal and human clinical samples in Hungary in 2006-2007. Genetic

A cárie e as doenças do periodonto (tecidos de suporte dentário) são mais prevalentes e não se limitam a prejuízos somente na cavidade bucal, podendo gerar

A possible interpretation of the disparity between the Pasinettian and Smithian concept of the ‘natural rate of profit’ is that the for- mer is a warranted rate of profit that