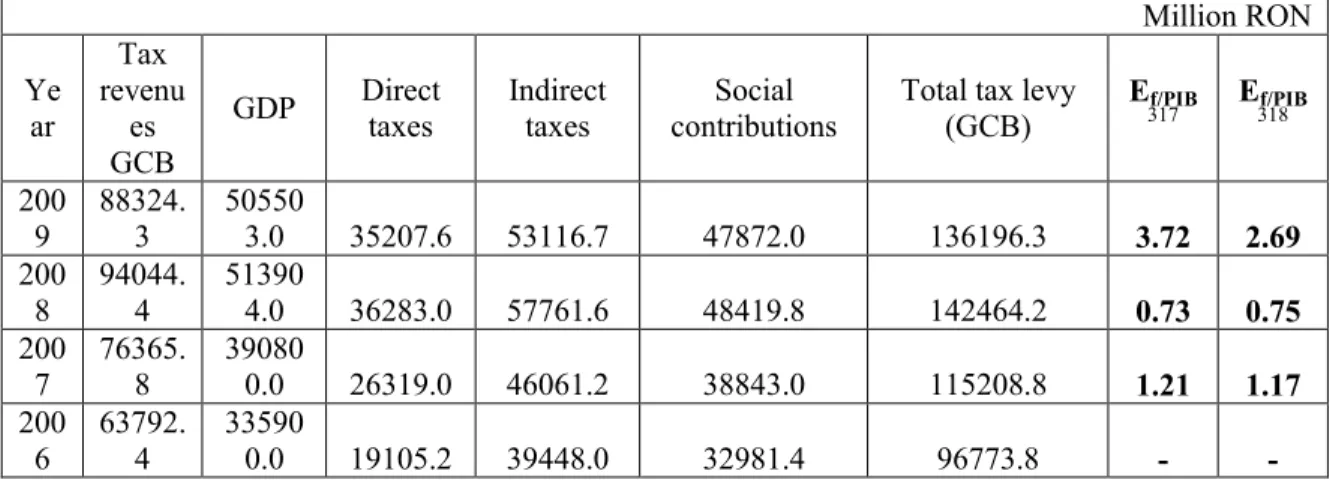

A SHORT ANALYSIS ON THE SENSITIVITY OF TAX REVENUES IN ROMANIA DURING 2000 - 2009

Texto

Imagem

Documentos relacionados

These recent changes in the National Tax Code are part of the implementation of the Brazilian commitment to the Global Forum on Transparency and Exchange of Information for Tax

In this paper we assess the critical determinants of VAT revenues in the European Union. We divided our explanatory variables into groups for different categories: 1) VAT

The public finance data used was taken from the Tesouro Nacional, namely the variables used as dependent variables: total agreed transfers; municipal tax

Internacional; ofreciendo un sintético juicio: «La gran debilidad de la Inquisición consiste en haber querido defender la verdad con medios violentos». Esta posición es

Proceedings of the Second Inter- national Workshop of Malacology and Marine Biology, Vila Franca do Campo, São Miguel, Azores. Conchas Marinhas de Portugal,

[r]

In the newly admitted countries to the European family (last ten), indirect tax revenues come mainly from VAT and excise duties, while in developed countries, other taxes on

Starting with an analysis of panel data models, developed using a range of indicators specific for tax systems (budget revenues, budget expenditures, public investment,