BRAZILIAN SCHOOL OF PUBLIC AND BUSINESS

ADMINISTRATION

Thesis Dissertation

Daniel Modenesi de Andrade

The effects of planning and monitoring on day traders’ interday decisions

Submitted as part of the

requirements for a PhD in Business Administration, advisor: Patrick Gottfried Behr

Rio de Janeiro

2017

Andrade, Daniel Modenesi de

The effects of planning and monitoring on day traders' interday decisions / Daniel Modenesi de Andrade. – 2017.

65 f.

Tese (doutorado) - Escola Brasileira de Administração Pública e de Empresas, Centro de Formação Acadêmica e Pesquisa.

Orientador: Patrick Gottfried Behr. Inclui bibliografia.

1.Administração financeira. 2. Mercado de capitais. 3. Investidores (Finanças). I. Behr, Patrick Gottfried. II. Escola Brasileira de Administração Pública e de Empresas. Centro de Formação Acadêmica e Pesquisa. III. Título.

Abstract

This dissertation reports empirical evidence on the impact of planning and monitoring (feedback) on performance/deviation, failure to achieve the goal, and overconfidence. One hundred and eighty-six proprietary day traders participated in an experiment, where they were exposed to interventions before starting trading. Subjects were randomly assigned to one of four groups: planning, feedback, a combination of both interventions, and a control group. The treatment phase lasted one week, constituting a mixed design. The main findings are: a) only the monitoring process can be used as a self-control mechanism oriented to goal achievement, But in situations where traders keep tracking their performances without associate it to a goal, they are sensitive to unfavorable outcomes; b) planning the gain target for the day was not a successful strategy neither toward goal achievement nor to performance; c) traders who use the past day return as a forecasting source became more overconfident in reaching the weekly income.

Keywords: planning, monitoring, day traders.

Introduction

Online trading has led to a new wave of trading in which investors seek to have more self-control. As online investors place orders through the Internet themselves, they feel they are more likely to obtain favorable outcomes, thus creating the illusion of control over performance. Brokers’ online platforms provide supplementary information, such as real-time stock quotes, news, graphs, and financial reports; however, despite these features, they lack mechanisms to support planning and monitoring—both of which could mitigate the illusion of control generated by the autonomy investors have (Wang, 2014).

The autonomy generated by the Internet has boosted trader activity, as shown in two distinct sets of data (Odean, 1999; Barber & Odean, 2000). Garvey and Murphy (2005a) argue that this behavior is caused by an attempt to anticipate trading profitability. However, the average day trader does not achieve positive returns, and

most lose money after paying transaction costs, although some of the active traders are profitable before fees (Linnanmaa, 2005).

Some studies have demonstrated that day traders are profitable (Nicolosi et al., 2009), even after commissions (Garvey & Murphy, 2005a); however, individual stock investors have a tendency to earn poor returns (Odean, 1998a; Barber & Odean, 2000, 2001; Locke & Mann, 2009; Barber & Odean, 2013) or even incur large losses (Barber et al., 2009). “[A]n investigation by the North American Securities Administrators

Association (NASAA, 1999) concluded that 70% of day traders will almost certainly lose everything they invest” (Jordan & Diltz, 2004, p. 192).

Although many works have focused on the behavior of individual investors (Odean, 1998a; Jordan & Diltz, 2004; Garvey & Murphy, 2005a; Nicolosi et al., 2009; Barber & Odean, 2013), few have devoted attention to day traders (Kuo & Lin, 2012), both for lack of available data (Linnainmaa, 2005) and lack of identity and trading history (Kuo & Lin, 2012). Empirical tests on the behavior of day traders have been done predominately in the US (Kim et al., 2007), however some researches with this type of investors were conducted using data set from other countries: Finland (Ginbralatt & Kelorhaju, 2001), Taiwan (Kuo & Lin, 2012; Barber et al., 2014), Australia (Arthur & Delfabbro, 2017).

Day traders are the unit of analysis in this research because a) their trading strategies remain unclear (Barber & Odean, 2001), and b) provided their trading can be evaluated on a daily basis (Coval & Shumway, 2005), it provides support for a longitudinal perspective to cover their sequential decisions.

Inspired on the work of Wang (2014), who identified the lack of planning and monitoring mechanisms on brokers’ online platforms, this dissertation consists in an experiment about the impact of these mechanisms on day traders’ interday decisions. I

ran an online experiment with 186 Brazilian day traders assigned to four groups: a) planning, which represented setting a goal for the day; b) monitoring (feedback), or recall of the previous day’s outcome; c) a combination of both, with feedback coming first; d) a control group, whose subjects only had to cite the main asset traded.

Previous findings on day traders’ decisions have focused exclusively on their decisions about opening and closing positions (Jordan & Diltz, 2004) replicating the disposition effect (Shefrin & Statman, 1985) – tendency to hold losing positions and selling profitable ones quickly – considering decisions made within the same day; or “understanding how previous outcomes affect risky attitudes” (Imas, 2016, p.2086), considering intraday decisions. No research has devoted attention to linking day traders’ planning processes, execution, and goal recalibration on the next day (i.e. sequential interday decisions).

Reinforcing this gap, I found a set of works covering investors’ attempts to compensate for previous losses by taking on higher risks in ongoing trades or just using the past outcome as a reference point for other investment decisions (Coval & Shumway, 2005; Garvey & Murphy, 2005a; Linnanmaa, 2005; Locke & Mann, 2009). However, all focus on intraday financial market trades.

The second gap this dissertation intends to fill concerns the application of self-control mechanisms to trading processes in the short-term and how they link to day traders’ behavior and Goal Theory. Goals are internal representations of desirable states; i.e., cognitive structures that can be represented in terms of movement and progress that people try to attain and undesirable states that they try to avoid (Fishbach & Dhar, 2005; Baumgartner & Pieters, 2008). To the best of my knowledge, this work is the first to relate day traders’ performance to Goal Theory, which Locke and Latham (2006) have

classified as an “open theory,” suggesting that new discoveries and applications should be expected.

Strength of commitment to goals may be influenced by cognitive (e.g., plan-making), affective (e.g., feelings or frustration), motivational (e.g., feelings of energization), and behavioral (e.g., investment of effort) indicators (Bargh, Gollwitzer, & Oettingen, 2010). Ameriks, Caplin, and Leahy (2011) have demonstrated that planning and monitoring are essential skills for achieving long-term financial goals (e.g., wealth accumulation).

The results of this work revealed that only the monitoring process can be used as a self-control mechanism oriented to goal achievement. But in situations where traders keep tracking their performances without associate it to a goal, they are sensitive to unfavorable outcomes. Planning the gain target for the day was not a successful strategy neither toward goal achievement nor to performance. Last, traders who use the past day return as a forecasting source became more overconfident in reaching the weekly income.

Theoretical Background Behavioral Finance

Traditional finance theory reflects the abrupt and overwhelming movement of economists toward mathematical models applied in hard sciences to understand financial markets, postulating that individuals, institutions, and even the market are rational (Barberis & Thaler, 2003; Grou & Tabak, 2008; Ackert, 2014). Most models built to understand asset prices or trading behavior do so according to expected utility, based on the axioms of completeness, transitivity, continuity, and dependence (Barberis & Thaler, 2003).

The classic paradigm of financial theory holds that people make rational decisions (e.g., efficient-market hypothesis [Baker & Nofsinger, 2010] and expected utility [EU; Ackert, 2014]), an assumption contradicted by Tversky and Kahneman (1974), who suggest that biased beliefs lead people to commit errors (Shefrin, 2000). Barberis and Thaler (2003) mention the emergence of some non-EU theories along with prospect theory, including implicit EU, disappointment aversion, regret theory, and rank-dependent utility theories. This movement was dubbed the “behavioral revolution in finance” by Shiller (2006).

Stock investors’ propensity to repeatedly incur losses contradicts the rational models of financial decision-making. Some empirical findings have demonstrated that so-called investor rationality is not absolute, running counter to traditional financial models where the assumption of homo economicus—rational, balanced, emotionless, self-interested maximizers of expected utility—is prevalent. Repeatedly, patterns of irrationality, risk aversion, violation, and forecasting errors have made room for the emergence of behavioral finance as a real-world perspective, where investors make decisions based on bounded rationality, satisfaction, and emotion (Shleifer, 2000; Baker & Nofsinger, 2010; Fairchild, 2014).

Since the 1970s, psychologists have criticized the axioms of finance theory, including expected utility theory, risk aversion, Bayesian updating, and rational expectations (De Bondt & Thaler, 1995). This new movement has its foundation in the intriguing questions about the source of volatility in financial markets and the discovery of some anomalies in decision-making under conditions of uncertainty (Shiller, 2006).

Additionally, the evidence of miscalibrated beliefs has also contributed to the development of the field of behavioral finance (Bossaerts, 2009). Over the past few decades, hundreds of experiments, inspired by prospect theory and its psychological

principles, have shown that economic behavior deviates from full rationality because of heuristic-driven bias and framing effects (Shefrin, 2000; Barberis & Thaler, 2003; Leiser et al., 2008).

Behavioral decision theory is the foundation for behavioral finance, in which individuals take decisions according to the assumptions of bounded rationality (Ricciardi, 2008). McGoun and Skubic (2000) explain that behavioral finance is a term applied to works that rely on psychology literature as a foundation for what Thaler (1991) called “quasi-rational assumptions.” This new field makes appropriations from the neuroscience debate and is based on the assumption that motivations, emotions, and feelings cannot be dissociated from any human decision, including financial ones (Mitroi & Oproiu, 2014).

Behavioral finance is an expanding field that seeks to shed light on people’s economic decisions by combining behavioral and cognitive psychological theory with conventional economics and finance (Baker & Nofsinger, 2010), while also investigating valuation procedures—fundamental, technical, and market analyses—in conjunction with social, psychological, and emotional aspects of the market (Mitroi & Oproiou, 2014).

Individual Traders’ Behavior

Individual investors who trade daily on their own account are known as day traders. A trader’s activity is recognized as a day trade when “a purchase and a sale of the same stock (in any order) on the same day” occurs (Linnainmaa, 2005, p. 8). Kroll and Shishko in 1973 (cited in Allingham, 1976, p. 169) were the first authors to differentiate traders according to their position at close. They subdivided traders into two categories: day traders and position traders. Allingham (1976) observed that day traders reformulated their demand continuously in response to the current price.

These types of investors are also known as active traders and, according to Garvey and Murphy (2005b, p. 630), “the main characteristic that distinguishes an active trader from the traditional investor is their mind-set.” Active traders or day traders count on volatility to make money: “they hold stocks for minutes or hours, seldom overnight, closing out positions for small profits” (Garvey & Murphy, 2005a, p.93). Because “volatility cannot be explained solely by changes in fundamentals” (Foucault et al., 2011, p. 1369), technical analyses are commonly used by investors (Jordan & Diltz, 2003). As markets fluctuate immensely, trading success depends very much on timing (Mussleir & Schneller, 2001).

Garvey and Murphy (2005b) split active traders into two groups: proprietary (professional) and retail investors. Proprietary traders are hired by firms to trade the firm’s capital. Some firms require them to pay for their losses and offer a percentage of their net profits; they are supervised and generally receive ongoing advice and training about trading strategies and techniques. In the US market, it is mandatory to pass the Series 7 licensing exam to become a proprietary trader (Garvey & Murphy, 2005b).

Retail investors trade with their own capital, must bear their losses, and have no training (Garvey & Murphy, 2005b). Some researchers categorize individual investors as retail investors (Garvey & Murphy, 2005a; Kumar & Lee, 2006; Barber et al., 2009; Foucault et al., 2011). These are investors who “spend far less time on investment analysis, they engage in more attention-based trading, and they typically rely on a different set of information sources from their professional counterparts” (Kumar & Lee, 2006, p. 2452).

According to Barber et al. (2009), retail traders tend to inadvertently commit the same kind of behavioral biases at or around the same time, canceling out each other’s actions. Table 1 provides a review of types of traders who trade on their own account.

Table 1. Trader Terminology

Types of traders Work Day Traders vs. Scalpers Silber (1984)

Informed vs. Non-informed Grossman & Stiglitz (1985); Wang (1994); O’Hara (1995) Informed vs. Liquidity Admati & Pfleiderer (1988)

Smart Money vs. Noise Traders De Long et al. (1990); Shleifer & Summers (1990); Kumar & Lee (2006) Price Takers vs. Insiders vs. Marketmakers Odean (1998b)

New Watchers vs. Momentum Traders Hong & Stein (1999) Chartists vs. Fundamentalists Hirshleifer (2001)

Active Traders: Proprietary vs. Retail Traders Garvey & Murphy (2005a); Garvey & Murphy (2005b); Han & Kumar (2013) Source: Adapted from Belhoula and Naoui (2011)

Barber and Odean (2000) were pioneers in researching the stock performance of individual investors who do not receive support from a full-service broker. Jordan and Diltz (2004) offer two reasons for including day traders in the research arena: they tend to have short holding periods and they are advised to cut losses and hold profits. One year before, the same authors (2003) pointed out that there had been dramatic growth in day trading since the mid- to late-1990s because of the perception that it was an easy way of earning a large amount of money, accompanied by sophisticated software and access to real-time stock quotes.

The Internet was an important tool in this shift, because it changed investor behavior. In 2010, Zhang and Swanson already observed that the explosion of online trading was remarkable. Online stock trading, a format where the investor sends their order remotely (Zhang & Swanson, 2010), is now common practice for millions of individuals around the world (Lee & Andrade, 2011). There are several reasons for the popularization of online trading, such as: “lower commission cost for trading, faster trade execution, more control and flexibility over the types of transaction investors choose to conduct, and no time or geographical limitations” (Wang, 2014, p. 71).

On the other hand, Garvey and Murphy (2005a) found that approximately half of the 1,386 clients from one US direct access broker were profitable after commissions.

The characteristics of profitable day traders are experience, past day trading volume, short exposure, and concentration on a few stocks; however, none of these are as powerful as past performance, which is the best predictor of future performance (Barber et al., 2014). Other scholars have attributed trading success to emotional discipline (Lo et al., 2005) and self-control (Bénabou & Tirole, 2004). Mitroi and Oproiu (2014) believe that the investors who succeed and survive in the long term are the ones who make small gains systematically.

Besides the recognition of the volume and volatility day traders create (Benos, 1998; Odean, 1998b), the notion that individual investors’ trades can influence asset prices is shared by Barber et al. (2009) and Foucault, Sraer and Thesmar (2011). Conversely, Zhu (2010) proposes that movements of selling (buying) are canceled by their pairs. This position is shared by Leiser et al. (2008), who believe that the individual investors’ performances in the market are not significant enough to affect the aggregate level of markets, but that individual-level decisions are interesting and salient in their own right.

Day traders deal with risk constantly and routinely, and make their trading decisions under uncertainty. Within the decision-making domain, risk is treated as identifiable, forecasted, and well-known (Ricciardi, 2010). Traders’ risk perception is based on the subjective judgment process they employ when assessing risks and the degree of uncertainty (Ricciardi & Rice, 2014).

When discussing risk management, Ricciardi (2010) differentiates two types of risk: pure and speculative. The former is related to the “occurrence of some uncertain circumstance or catastrophic event” (p. 132), while the latter “incorporates the potential for a gain or a loss” (p. 132), which is applicable to stock market investments.

Ricciardi (2008) describes some different behavioral finance theories and concepts that influence an individual’s perception of risk for different types of services and investment products are: heuristics, overconfidence, prospect theory, loss aversion, representativeness, framing, anchoring, familiarity bias, perceived control, expert knowledge, affect (feelings), and worry.

Trading Process

Financial markets represent a category of multi-agent, fast response systems characterized by complex, interactive, internal data structures, continuous information flows, dimensionality (high levels of data load and computational complexity), noise, and “instantaneous feedback loops” (Taylor & Taylor, 2016, p. 217).

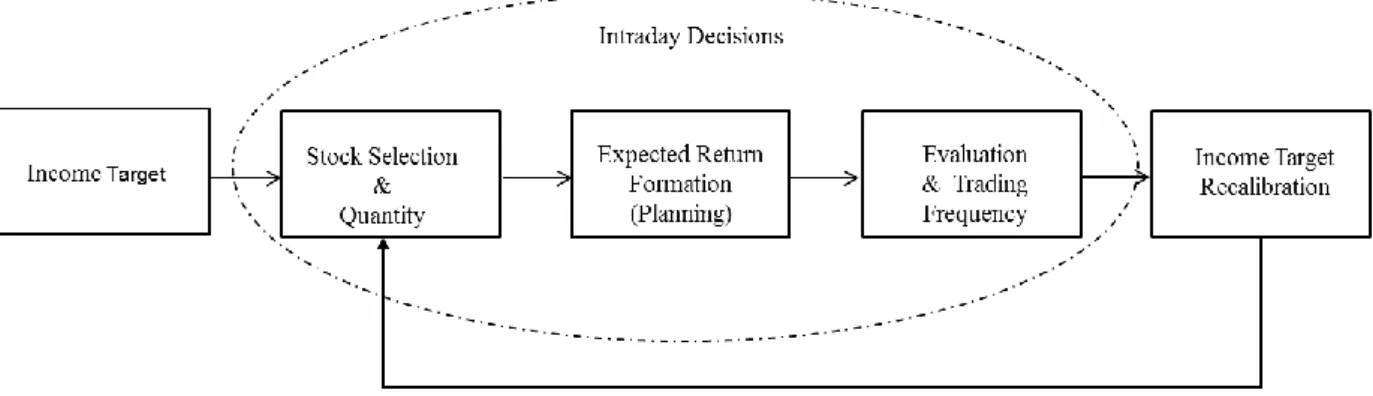

In my attempt to simplify the day trader’s investment process, I found inspiration in the work of Kahneman and Tversky (1979), who divide the choice process into two phases: editing and evaluation. Based on this, I developed a framework to represent the mental processes underlying day traders’ decisions. Based on a review of the literature on investor behavior, I assert that the financial planning and investment management process is based on five stages: income target, stock selection and quantity, expected return formation (planning), evaluation (monitoring) and trading frequency, and income target recalibration. This is shown in Figure 1.

Traders, whether professional or not, share the common characteristic of setting an income target tied to a time frame. As mentioned before, in this work I treat near income targets as being daily and more distant income targets as relating to a week. Thus, traders will have a desired state formed of reference-dependent preferences, and this is what forms the basis for researching their daily income targets. This concept has been tested in the intertemporal labor supply of workers with flexible daily schedules, such as cab drivers (Camerer et al., 1997; Farber, 2005; Faber, 2008; Crawford & Meng, 2008) and stock traders (Coval & Shumway, 2005; Locke & Mann, 2009). All the cited works agree that when people are far to achieve their target income, they increase task effort.

For the first group, cab drivers, when their expected earnings on a “wage day” fell short, they would work more hours: “[i]f a driver earns less money than he expected early in the day, he will be more willing to work later, so as to mitigate the losses from failing the target” (Köszegi & Rabin, 2006, p. 1153). From this insight, the authors formalize the concept of an endogenous daily income target. Camerer at al. (1997, p. 409) posit that “drivers drive as if they had an income target.” However, for the second group, investors, when the return falls short of expectations, they have been found to take on more risk and make a higher number of trades (Locke & Mann, 2009).

The link between the two kinds of occupations is exactly their flexibility in choosing the effort they will expend to achieve their reference level. Self-employed professional traders face the same general time constraints as cab drivers and are free to decide whether they will participate in trading or not, and may arbitrarily or strategically take days or afternoons off (Locke & Mann, 2009). The difference between them is that investors’ return is a result of intraday volume, volatility, and the number of trades.

Day traders usually sequentially trade in a restricted group of stocks (Barber et al., 2014), a phenomenon known as familiarity bias—when an investor holds a portfolio composed of “familiar” assets (Foad, 2010).

As individual investors have a large number of stocks to choose from and selecting the ones to trade in is a complex task (Mitroi & Oproiu, 2014), they may be inclined to apply heuristics to their decision-making process as a simplification device (Schwartz, 2010). One manifestation of this simplification is investors’ reliance on past

stock prices as comparison standards for future investment decisions (Mussweiler & Schneller, 2003). The active trading of common stocks has been found to be another reason for poor portfolio returns (Strahilevitz, Odean, and Barber, 2011), while two studies have identified poor stock selection as a reason for large and persistent biases (Altman, 2014; Howard & Yazdipou, 2014).

The most common types of stock selection strategies are: value, momentum, short- and long-term mean reversion, analysts’ earnings revisions, and size and liquidity (Hart et al., 2003). According to Cohen and Kudryavtsev (2012), the drivers of decisions about stock buying are: expectations, past experience in the capital market, and knowledge about the past performance of selected market indices, all constituting part of a purely rational process.

Among financial contexts, stock selection is the task in which people are most confident (Barber & Odean, 2001). When choosing a stock, a trader may be exposed to poor outcomes in trades where expectations are overly optimistic (Ackert, 2014), which demonstrates a clear manifestation of overconfidence.

Given that a considerable number of day traders use chart depictions as a valuable source of information (Mussweiler & Schneller, 2003), and knowing that stock

prices are correlated with past prices, investors tend to rely on the past to make their financial decisions.

Strahilevitz, Odean, and Barber (2011) found that a traders’ reliance on a stock’s past performance makes them more likely to repurchase a stock that they previously sold for a profit than one previously sold for a loss, guided by familiarity bias. Barber et al. (2014, p. 4) identified that “the most important predictor of future performance is the concentration of trading in a few stocks, which is consistent with the hypothesis that successful day traders focus on a few stocks in an attempt to garner an informational advantage in those stocks.”

Another equally important decision at this phase is the number of contracts or share quantity, which constitutes an arena yet to be explored. Despite the lack of debate about it, one aspect highlighted by Wang (2014) indicates that the amount of money invested in a trade deserves more attention. The author claims that due to the “huge amount of information on the Internet, online investors have to spend much time and effort on their own to seek out the relevant online information and then to use such information to calibrate their final investment decisions” (p. 72).

Formation of Return Expectations (planning)

Attention to this topic emerges as a response to Kaustia, Allo, and Puttonen’s (2009, p.391) suggestion that a fruitful investigation about “how individuals form stock market return expectations” should be made.

As expounded by Kahneman and Tversky (1979), there are situations where gains and losses are coded, or expressed, in reference to an expectation or aspiration. Considering this, it is assumed that a day trader may mentally create an expected weekly or monthly income, which can be divided into an expected daily income. By this mental process, traders may then form their return expectations (i.e., plan).

“Planning can be defined as the process of generating a sequence of behaviors used to translate an individual’s resources into actions aimed at goal attainment” (Diefendorff & Lord, 2003, p.367). Goals affect performance through four mechanisms: a) goals serve a directive function; b) goals have an energizing function; c) goals affect persistence; d) goals affect action indirectly by leading to the arousal, discovery, and/or use of task-relevant knowledge and strategies (Locke & Latham, 2002).

The act of planning can be said to follow the psychological aspect of goal orientation, using self-regulation as a process by which people seek to adjust their behavior with relevant goals (Chernev, 2004).

As day traders must make quick decisions routinely, effective self-control can be reached by setting standards: “goals, ideals, norms, and other guidelines that specify the desired response” (Baumeister, 2002, p.671). Therefore, the inclusion of goal-setting in

trading process may reinforce a trader’s self-control. However, even in cases where the goal is perceived as desirable and feasible, this does not guarantee any commitment or effort towards its realization or accomplishment (Bargh et al., 2010).

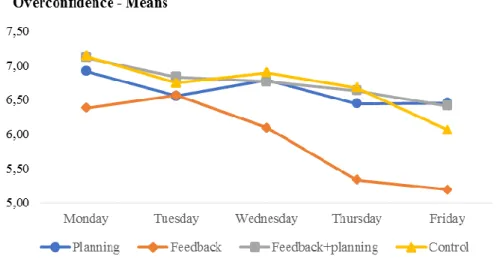

Day trader planning may be influenced by overconfidence, as suggested by Erev, Wallsten, and Budescu (1994). Overconfidence can be manifested as a sense of superiority and the belief that one possesses greater skills and knowledge than others; i.e., the better-than-average effect. It can also be revealed in expectations that are overly optimistic, resulting from an illusion of control, or miscalibrations or overestimations of the accuracy of knowledge (Ackert, 2014).

The roots of the “overconfidence” construct pertain to the field of psychology, beginning with the research conducted by Lichtenstein, Fischhoff, and Philhps (1982) on the calibration of subjective probabilities. De Bondt and Thaler (1995, p. 6) state that “perhaps the most robust finding in the psychology of judgment is that people are

overconfident.” The same interpretation is shared by Bénabou and Tirole (2016), when they affirm that “at an individual level overconfidence is perhaps the most common manifestation of the motivated-beliefs phenomenon” (p.142).

Overconfidence has been applied to economics and finance and it effects have been observed in distinct groups: CEOs (Hribrar & Yang, 2016), managers (Gervais et al., 2011), consumers (Bénabou & Tirole, 2016), analysts (Hilary & Menzly, 2006), and investors (Barber & Odean, 2001).

Cognitive errors in the financial decision-making of individual investors, stemming from overconfidence, have been identified in examples from the US (Odean, 1998a; Barber & Odean, 2000), Germany (Deaves et al., 2010), Finland (Grinblatt & Keloharju, 2000), Israel (Shapira & Venezia, 2001), China (Chen et al., 2007), Taiwan (Chou & Wang, 2011), and Japan (Kim et al., 2007).

Evaluation and Trading Frequency

There is ample evidence from psychological studies that judgments and decisions depend on a comparison of potential outcomes against some reference point, a process known as the reference-dependent model (Tversky & Kahneman, 1974, 1991; Kahneman & Tversky, 1979; Camerer et al., 1997).

Investors change their views or beliefs based on information or data, even if no change in market fundamentals is perceived (Yazdipour & Howard, 2010). As established by Tversky and Kahneman (1981), the choice process has two phases: “an initial phase in which acts, outcomes and contingencies are framed, and a subsequent phase of evaluation” (p. 454).

Previous studies on individual investors’ contexts have considered one-shot decisions that ignore path dependence, an important mechanism in financial decision-making since it attests that future decisions are influenced by decisions made in the past

(Ackert, 2014). Lock and Latham (2006, p.265) reveal that “the key moderators of goal setting are feedback, which people need in order to track their progress.”

The evaluation and trading frequency phase represents a combination of framing and mental accounting. The former concept acts in the trader’s mind offering two alternative approaches to evaluate outcomes: a segregated evaluation (daily basis), where each day of trading is considered in isolation; and aggregated evaluation (weekly basis; Langer & Weber, 2001).

The framing of these two distinct approaches to evaluation can be considered in the context of the concept of choice bracketing introduced by Read et al. (1999), a term that “designates the grouping of individual choices together into sets” (p. 172). Narrow bracketing represents small sets containing one or few choices, while broad bracketing refers to larger sets. The authors are clear, however, in highlighting that both forms can promote utility maximization.

The notion of single-day evaluation is consistent with the evidence that people bracket decisions narrowly (Read et al., 1999). There are some reasons why people adopt a narrow decision frame: limited cognitive capacities or cognitive cost (Kumar & Lim, 2008), perceived utility (Thaler, 1985), or regret avoidance (Barberis et al., 2006). In contrast, an investor who adopts a broad decision frame would integrate it with their existing wealth and evaluate the combined outcomes before making a choice (Kumar & Lim, 2008). So, in an interday evaluation, traders would be induced to look back to their previous outcomes while at the same time estimating their expected return for a given day.

Mental accounting—the second concept involved in this phase—is the process traders use for cognitive operations to keep track of their financial activities, by using certain rules to define how to categorize activities and to monitor the frequency of an

activity and also to organize and evaluate their financial situation (Ackert, 2014), which includes only the direct consequences of the act; i.e., money lost or gained (Yazdipour & Howard, 2010).

Barberis and Huang (2001) suggest that mental accounting can determine which gains and losses investors pay attention to. Among mental accounting definitions, the one that best suits this work is offered by Benartzi and Thaler (1995, p. 74), who say it “refers to the implicit methods individuals use to code and evaluate financial outcomes:

transactions, investments, gambles, etc.”

Thaler (1999) defines three types of mental accounting systems. The first involves how outcomes are perceived and experienced, and how ex ante and ex post cost-benefits are analyzed and evaluated. The second component covers the assignment of activities to specific accounts, which means expenditures are grouped into categories (housing, food, etc.). The third concerns the frequency with which each account is evaluated: they can be balanced daily, weekly, monthly, yearly, and so on, and defined narrowly or broadly.

The third type of mental accounting proposed by Thaler (1999) is intimately connected with how the evaluation of a given decision is framed. Kahneman and Lovallo (1993), when suggesting that people make decisions one at a time, reinforce narrow bracketing as a common way of framing a problem. Ashraf, Camerer, and Loewenstein (2005) include this reasoning in their definition of narrow bracketing, believing it is “the tendency to take decisions one at a time without considering the big picture” (p. 133).

Yet, in defense of narrow bracketing, Barberis and Huang (2001, p. 1248) cite that “numerous experimental studies suggest that when doing their mental accounting, people engage in narrow framing, that is, they often appear to pay attention to narrowly

defined gains and losses.” In the same vein, Barber et al. (2007) believe that mental accounting induces investors to focus on gains and losses from individual stock positions rather than on portfolio returns or total wealth levels.

By contrast, broad bracketing allows people to consider not only all the consequences of their actions, but also the aggregate consequences of the decision, leading to choices that yield higher utility, which means better outcomes (Kahneman & Lovallo, 1993; Read et al., 1999). According to Kahneman and Lovallo (1993, p.20), “decision analysts commonly prescribe that concurrent choices should be aggregated before a decision is made, and that the outcomes should be evaluated in terms of final assets (wealth), rather than in terms of gain and losses associated with each move.”

Gneezy and Potters (1997) studied the impact of the period over which individuals evaluate outcomes on their propensity to invest in more risky assets; however, they carried it out with known probabilities, which means the subjects knew their chances of winning or losing in advance. The authors found that “the more frequently returns are evaluated, the more risk averse investors will be” (p.631). In this work, however, real investors made their decisions dealing with uncertainty (unknown probabilities).

Previous studies analyzing investment evaluation frequency (narrow vs. broad) have presented contradictory findings. For example, a comparison of the results of Thaler et al. (1997) and Gneezy and Potters (1997) reveals that the best practice may be doubtful.

When returns are evaluated frequently, investors become more risk averse (Gneezy & Potters, 1997), which can prevent losses. On the other hand, Thaler et al. (1997, p. 549-550) demonstrate that “investors who differ in the frequency with which

they evaluate outcomes will not derive the same utility from owning stocks. The probability of observing a loss is higher when the frequency of evaluation is high.”

The crux of mental accounting is that the value of multiple events is determined by whether they are mentally integrated or separated before they are subjectively evaluated (Kim, 2006). Thaler, Tversky, Kahneman, and Schwartz (1997) applied mental accounting to a financial transactions context, where concern about aggregation is crucial to how transactions are grouped both cross-sectionally (securities evaluated one at a time or as portfolios) and intertemporally (how often portfolios are evaluated).

For the reasons presented above, feedback is clearly a central issue in investment choices, because it may allow the decision-maker to compare what is with what could have been (Zeelenberg, 1999).

Income Target Recalibration

The dynamics of the market force day traders to make repeated revisions of their targets, a phenomenon that can cause them to review the information upon which they had based previous evaluations (Muthukrishnan & Pham, 1999). When beliefs are revised in the face of new evidence, “individuals update suitably when facing good news, but fail to properly account for bad news” (Bénabou & Tirole, 2016, p. 142).

The influence of past choices on future decisions was addressed by Rabin (1998), who proposed that instead of focusing on the effects of reference points in a dynamic utility-maximization framework, special attention should be placed on how people feel about the effects their current choices have on their future reference points. The author raised two questions: “how current behavior affects future reference points

and how they feel about changes in their reference points” (p. 15). A decade later, Arkes, Hirshleifer, Jiang, and Lim (2008) raised an important question: how is a reference point updated through time as a function of the outcomes of past decisions?

“Overt or covert information evaluation and integration are assumed to underlie the gamut of risk-related decisions” (Loewenstein et al., 2001, p. 267). This process may guide traders to make revisions about the target income previously determined and this, summed with the outcome itself, influences the setting of a new reference point, as defended by Koszegi and Rabin (2006, p. 1141): “the reference point is fully determined by the expectations a person held in the recent past.”

A day trader may be influenced by path dependence, which means they may base their decision on previous outcomes, so that the current position results from active choice (Ackert, 2014). The power of path dependence has been demonstrated by Locke and Mann (2009, p. 817), who observed that “traders take on more risk and execute a higher number of bad trades (buying high and selling low) in the afternoon after they have accrued unusual morning losses.”

Knowing that investors are averse to falling below their target income (Camerer et al., 1997) and the psychological pain of doing so (Chang et al., 2014) may lead them to seek compensation for the previous disadvantage in trading, a simple conclusion is that the outcomes of past choices may contribute to updating investors’ beliefs (Kuhnen & Knutson, 2011).

“Prospect theory also allows for ‘reference shifts’ that may occur when gains and losses are measured mentally against expectations” (Jordan & Diltz, 2004, p. 193). Considering a psychological analysis of value, references are important in determining preferences (Tversky & Kahneman, 1991). The way traders deal with “the realization of a loss serves as a natural point for an individual to internalize the negative outcome, update the reference point and close the associated mental account” (Imas, 2016, p.2092).

“The failure of financial decision-makers to learn from feedback and calibrate predictions accurately is especially intriguing” (Hilton, 2001, p. 42). So, the possibility of planning right after comparing the actual performance with what was expected imposes traders with a scenario that may require “flexible decision making at a later critical situation” (Doerflinger et al., 2017, p.1).

By considering sequential days and their own targets, income target recalibration addresses the impact of an unsuccessful outcome on a day trader’s subsequent planning decision (risk seeking or risk avoidance) in their review of their predetermined “income.” This revision should be based on the discrepancy between past performance and future goals.

Hypothesis Formulation

Planning and monitoring can be used by investors as mechanisms of self-control (Wang, 2014), both individually and in combination. By assessing the effectiveness of goals, individuals compare established performance (i.e., goals) with feedback about actual performance typically obtained through a self-monitoring process (Soman & Cheema, 2004, p. 54). This process of “setting a goal and monitoring progress toward goal achievement is fundamental to theories of self-regulation” (Fishbach et al., 2006, p.232).

Lack of self-control and its impact on performance has also been observed in economics issues, such as: consumption and savings decisions (Thaler & Shefrin, 1981), assets (Laibson, 1997), gambling (Rachilin, 1990), online auctions (Turel et al., 2011), and overtrading (Barber & Odean, 2001; Statman et al., 2006; Mitroi & Oproiu, 2014).

Overtrading may be associated with impulsivity, as explained by Boberti (2004, p. 260): “when impulsivity is combined with a high sensation seeking profile, there may

be less sensitivity to risk and a lack of planning by the individual.” People’s tendency to succumb to short-run impulses at the expense of their long-run interests reflects an internal preference conflict (Bénabou & Tirole, 2004).

Psychologists and behavioral economists attribute impulsive behavior or a personal loss of self-control to present-biased preferences (Pyone & Isen, 2011); i.e., occasions where the individual’s current self outweighs the present relative to the future. To avoid impulsivity, people can bind or precommit their own behavior: “binding behavior is the voluntary imposition of constraints (that are costly to overcome) on one’s future choices in a strategic attempt to resist future temptations” (Ariely & Wertenbroch, 2002, p.219).

Goal adoption and pursuit are effective in regulating self-control (Elliot & Thrash; Baumeister, 2002). Professional traders may develop self-control mechanisms favoring emotional regulation through predetermined exit points, which work in a predictive way for future risk-adjusted performance (Locke & Mann, 2005; Locke & Mann, 2009). The same logic for closing a trade is used to stop trading after reaching a loss/gain limit.

Irrespective of whether a near or distant goal is considered, the use of a reference point can help traders in their pursuit of consistency and, even more importantly, it can drive their behavior towards making their decisions less vulnerable to impulsivity, potentially helping them anticipate their reactions in situations where the greed for a higher outcome leads to risk-seeking. Nevertheless, if the trader uses the near goal as a trading system, his chance of sticking to the plan increases, which may contribute to favorable outcomes. In this sense, the incorporation of planning as a trading strategy should improve performance.

However, due to day traders’ propensity to repeatedly incur losses the main concern should be placed not only in their daily performance, but in the consistency deriving from small systematically gains, as suggested by Mitroi and Oproiu (2014). So, the linkage between planning and self-regulation, previously examined in other contexts (Baumeister, 2002; Chernev, 2004), need to be tested in the trading process. For this reason, I formulated the following hypothesis:

• Hypothesis 1: setting a daily expected return prevents traders to goal

achievement failure.

Besides planning, another form of achieving self-regulation, according to Baumeister (2002), is through a monitoring process: “track of the relevant behavior” (p.672). Independently of whether the trader had received the intervention, the recalling of the past performance is a method capable of being applied by the trader himself before starting another trading day.

Feedback intervention have been extensively researched in other study fields, however, it effects on performance were inconsistent. Even though it is well established that people use feedback (whether provided by an intervention or not) to evaluate their performance relative to their goals, creating a feedback sign, positive or negative (Kluger & DeNisi, 1996), the effects of it on day traders’ behavior may be less influential.

The interpretation of the feedback through affective process is an important mechanism explaining behavioral self-regulation (Ilies et al., 2006). Occasions were traders evaluate their results as a failure are likely to result in lower perceived self-efficacy, leading to demotivation, lower goal commitment and consequently lower performance (Bandura & Simon 1977).

“Feedback information can certainly activate individuals’ behavioral motivation systems, as positive feedback signals reward and negative feedback may lead to punishment” (Ilies et al., 2006, p. 592).

At the same time, by receiving a feedback intervention, it is expected that this practice may serve as a learning reinforcement, in case of negative feedback; and a motivation toward goal pursuit, when positive feedback happens. In contexts involving uncertainty, as in financial market, if a trader evaluates his return as a failure it can contribute to the improvement of his risk management.

• Hypothesis 2: recalling the previous day’s returns (monitoring) prevents

traders from goal achievement failure.

Methodology

Behavioral finance is an eclectic field when it comes to the tools used for observation; data may emerge naturally, be generated from controlled experiments in the lab, or be obtained through surveys (Ackert & Deaves, 2010). For this dissertation, I collected answers through several web-surveys. The whole study lasted three weeks, and the interventions were employed only in the second week. In the treatment week, on Monday the subjects received a general survey (see Appendix A) with eight questions, and from Tuesday on a specific survey without demographics.

Sample

The study was conducted in October 2016 in partnership with a Brazilian proprietary firm. The firm provided access to the subjects—non-professional traders, who numbered approximately four thousand at the time—and data for the weeks before and after the treatment week.

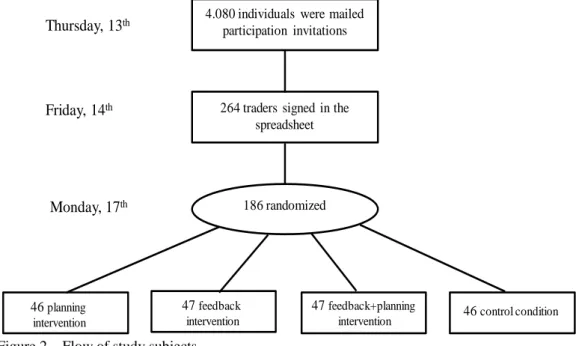

In the first week—October 10-14, 2016—data were gathered to verify investors’ basic behavior; i.e., before the manipulation. The researcher recorded a video invitation

explaining the goals and procedures of the research, which was sent on October 13 via e-mail. Two rewards were offered to stimulate participation: a) one e-book containing traders’ tips (with content developed by the proprietary firm); b) a draw of four video courses (worth R$300.00 each) about trading techniques. These rewards were exclusively for those who answered all five surveys, from Monday to Friday.

4.080 individuals were mailed participation invitations

264 traders signed in the spreadsheet

186 randomized

47 feedback intervention

47 feedback+planning

intervention 46 control condition

46 planning intervention

Thursday, 13th

Friday, 14th

Monday, 17th

Figure 2 – Flow of study subjects Source: author

Below the invitation message there was a link to an Excel spreadsheet, which 264 traders signed voluntarily, authorizing me to send them the surveys (opt-in). On Monday (17th), all the volunteers received an e-mail with a link directing them to the same online survey with eight questions (including demographics). One hundred and eighty-six participants answered the survey on the Monday; these constituted the final sample used in the data analysis (see Figure 2). The percentage of traders who subscribed to participate in the experiment was close to 6.5%, but the final sample represented 5% of all the traders issued the invitation.

Procedure

Bénabou and Tirole (2004) have suggested that individuals may use external commitment devices or internal commitment mechanisms (personal rules) as substitutes

for deficient self-control. Considering the lack of planning and monitoring mechanisms on brokers’ online platforms - external commitment devices – highlighted by Wang (2014), three treatments were created in order to access trader internal commitment mechanisms: a) planning, which represents setting a goal for the day; b) monitoring, informing the outcome from the previous day; c) a combination of both, with the feedback coming first; d) a control group, whose subjects only had to mention the main asset traded. Participants were randomly assigned to one of the four groups.

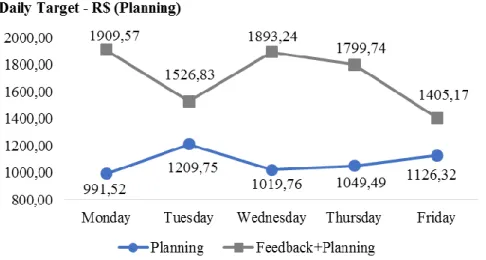

On the Monday, emails were sent out at 7 a.m., two hours before the B3 (Brazilian stock market) opened, which means subjects were exposed to the interventions before they started trading. After presenting the traders with an informed consent form, the first screen of the study, common to all the groups, provided some guidance on planning how much they expected to end up with on the last day of the second week (October 21st). This question was designed to simulate a wage projection (distant target).

After answering this common question, those assigned to the planning group moved to the next screen, where they had to answer an open question: “How much do you expect to earn today?”, inserting their expected return (planning) for that day (near

target). They were aware that their response should be an absolute amount in reais, for which they were not given any lower or upper limit.

The second screen for the subjects in the feedback group was different: they had to disclose information on their previous day’s return. The question to them was: “What was your result on the previous trading day?” They had to post it on a sliding scale

ranging from -R$5,000.00 to +R$5,000.00 (see Appendix A). The absolute amount was given in reais. This intervention was designed to make the previous day’s outcome

salient in their minds. The traders all probably knew the magnitude of their gains/losses, but the real impact of the manipulation was to enhance its salience for this group.

The last treatment group had to answer a combination of both interventions (feedback + planning) on the second screen, with the questions always appearing in that order. The content of the questions was the same as in each isolated intervention.

For the control group (baseline), on the second screen, subjects had to indicate the main asset they traded in by answering the following question: “What is the main asset you trade?” They had a blank space to write it down.

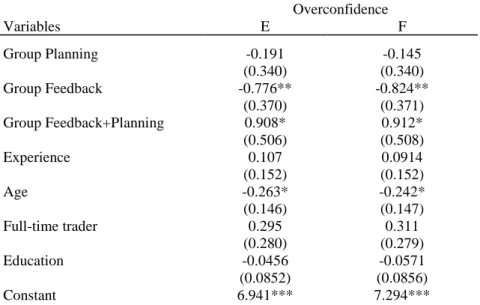

The third screen was also common to all the conditions, and contained the question: “Indicate your level of confidence regarding the achievement of the goal you set for October 21st?” The subjects had to indicate their confidence level on a scale ranging from 1 (not at all confident) to 9 (very confident). Due to content validity, I have treat this as an overconfidence measure, instead of expectation, for example. To operationalize overconfidence as an independent variable, I created a dummy (1=seven or above, or 0=otherwise). The use of self-reporting is well accepted in the literature; according to Grinblatt and Keloarju (2009, p.549), “when traders are studied at the individual level, the results come from self-reported surveys.”

In addition, the general survey contained questions about experience, age, degree of education, and occupation. All demographic information was collected only once, on the first day of data collection. As the answers needed to be identifiable in order to aggregate all the data collected during the five days, the subjects had to provide their e-mail address with each questionnaire they answered.

Every morning, from Tuesday to Friday, only those who answered the first survey received the link corresponding to the group Qualtrics had randomly assigned to them on the previous day. From Tuesday on they received a specific survey according

to the group they were randomly assigned to: planning (three questions), feedback (three questions), feedback+planning (four questions), control (three questions). Each group answered the same manipulation questions, their self-reported level of confidence in achieving their target, and a new open question regarding target recalibration: “How much do you expect to reach on the last day?”, giving the subjects the chance to revise their plans. The only difference from the survey answered on Monday was that the question about planning for the distant target was the last one. This specific survey was repeated from Tuesday to Friday.

Finally, during the third week, the interventions were interrupted, meaning that the traders received no more emails. This procedure was designed to ascertain whether the intervention in the second week changed the investors’ mindsets. Historical data about the daily results of each trader one week before the experiment, during the experiment, and one week after the end of the study were provided by the proprietary firm.

Design

The within-subjects factors are: overconfidence, distant income target (amount accumulated from Monday through Friday), near income target (daily planning), last day outcome recall (feedback), performance and deviation from broad income target. To test whether the addition of features that induced investors to plan and monitor their trades would influence their results, the four groups constituted a between-subjects design: planning, feedback, feedback + planning, and a control group (baseline). As such, the study has a mixed design.

Analyses were run with different dependent variables: daily performances (October 17-21, manipulation implementation), weekly performances (pre, during, and

after manipulation), deviation from income target, and goal achievement failure (binary variable, whether the established income target was not achieved).

Analysis

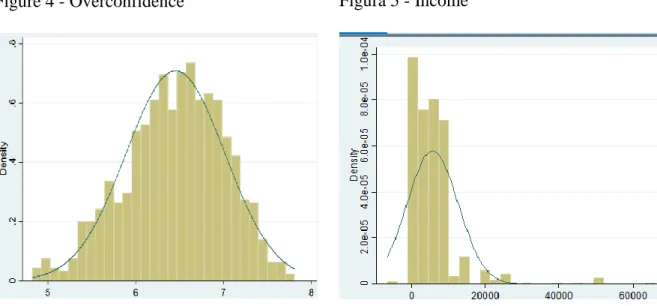

The sample was composed mainly of inexperienced traders. Of the 186 participants, 88% had been trading for less than six months. Despite their limited experience, most of them (69%) were full-time traders. With respect to age, 24% were under 25 years old, 46% were 26 to 35 years old, 20% were 36 to 45 years old, 8% were 46 to 55 years old, and 2% were over 55 years old. Their ages ranged from 18 to 59 (M=32.33, sd=4.67). Regarding education, 41% of the sample had a college degree or some form of higher education. There were no significant differences among the groups with respect to these characteristics. Gender differences were not tested because only ten women participated in the study.

After data collection, I created four dummies to represent the day time-variant effect (1 for the day of the week on which the data was collected and 0 for otherwise), Friday was the baseline. I created two other dummies to represent the presence of treatments, planning, and monitoring (feedback). For the dummy planning traders from both groups: planning and feedback+planning; and, for the dummy monitoring traders from feedback and feedback+planning groups.

Goal Achievement Failure

From the sample (n=186), only 35 traders reached their expected target or had a higher performance. A possible explanation for this low number can be seen in the work of Soman and Zhao (2011, p. 955), who found that “multiple goals evoke trade-off consideration among goals, which retain people in a deliberative mindset and hinder them from goal-related actions’.

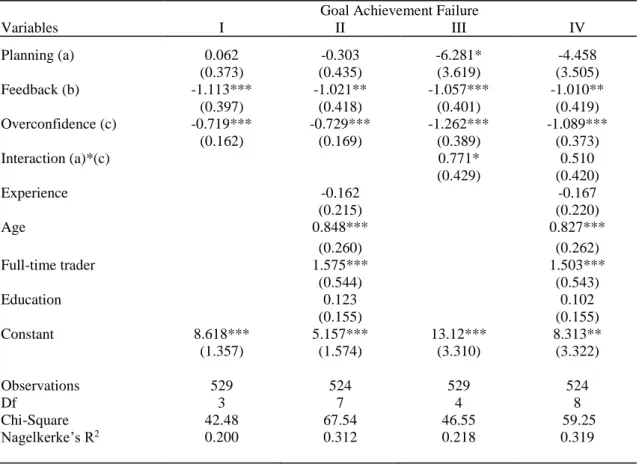

The impact of the interventions on goal achievement failure was tested using a logistic regression analysis, where the dependent variable equaled one when the trader failed to achieve their goal. Thus, traders who reached their planned target income were coded with zero.

As shown in model II from Table 2, the relationship between traders who had to commit to a daily income target and goal achievement failure was negative (β = -0.303, n.s.). It is worth noting that for the act of planning to prevent to goal achievement failure, as hypothesized, the valence of the coefficient should be negative, which happened. However, the planning intervention was not found to have an isolated effect on goal achievement failure due to the non-significant relationship between the variables. Thus, Hypothesis 1 was not supported.

Table 2. Goal Achievement Failure

Goal Achievement Failure

Variables I II III IV Planning (a) 0.062 -0.303 -6.281* -4.458 (0.373) (0.435) (3.619) (3.505) Feedback (b) -1.113*** -1.021** -1.057*** -1.010** (0.397) (0.418) (0.401) (0.419) Overconfidence (c) -0.719*** -0.729*** -1.262*** -1.089*** (0.162) (0.169) (0.389) (0.373) Interaction (a)*(c) 0.771* 0.510 (0.429) (0.420) Experience -0.162 -0.167 (0.215) (0.220) Age 0.848*** 0.827*** (0.260) (0.262) Full-time trader 1.575*** 1.503*** (0.544) (0.543) Education 0.123 0.102 (0.155) (0.155) Constant 8.618*** 5.157*** 13.12*** 8.313** (1.357) (1.574) (3.310) (3.322) Observations 529 524 529 524 Df 3 7 4 8 Chi-Square 42.48 67.54 46.55 59.25 Nagelkerke’s R2 0.200 0.312 0.218 0.319

1.Robust standard errors in parentheses 2.*** p<0.01, ** p<0.05, * p<0.1 Source: author

Traders assigned to groups who received the planning treatment had to plan the distant goal (weekly target) like all subjects from the other groups. Additionally, they had to plan the near goal (daily target) as an exclusive task from their treatment, which lead them to plan twice. The combination of tasks may have generated a conflict in goal pursuit. Even though the income for the whole week could be bracket in 5 smallest goals, the fact of having multiple goals – one for each weekday and a high hierarchical one – could have brought more uncertainty on decisions toward risk. For example, the violation (negative outcome or underperformance) of the goal set for Monday may not only affects the trader emotionally as it can impact his strategy to achieve the higher goal.

Goal setting can be used effectively on any domain in which an individual has some control over the outcome (Locke & Latham, 2006), what clearly does not fit in the stock trading domain. In a consumption context, the failure to achieve a goal and its impact on the subsequent performance, has been shown to contributes to poorer performance (Soman & Cheema, 2004).

The underlying motivation for hypothesis 2 is that, once traders keep track of their past return mentally, the salience evoked by the knowledge of the result could save them from the failure to achieve the goal. Findings shows that the isolated effect of the feedback intervention was negative and significant (β = - 1.021, p<0.05), indicating that the recall of the previous day’s return may serve as a self-control mechanism, which means the monitoring process prevents traders from failing to achieve their goals by allowing them to be more precise in calibrating their expectations. This finding supports Hypothesis 2. As the intervention impose traders to frequently evaluate their returns, this result is contrary to Thaler et al. (1997) findings because they found a higher probability of observing losses, and in accordance Gneezy and Potters’ (1997) results.

Model III (see Table 2) shows a positive and significant effect (β= 0.771, p<0.1) for the interaction between planning and overconfidence on the dependent variable. It is clear, therefore, that when a trader feels more confident in their return expectations, they are more prone to be miscalibrated. Consequently, by pursuing an unattainable or more challenging target, they may adopt more risk-seeking behavior or make decisions driven by impulsivity.

The relationship between overconfidence and the dependent variable was also negative (β= -0.729, p<0.01), indicating that the isolated effect of overconfidence would reduce the likelihood of not reaching the expected return for the whole week. It is interesting to note that age (β=0.848, p<0.001) and working full-time as a trader (β= 1.575, p<0.001) had a positive and significant influence on the dependent variable.

Performance & Deviation

Assuming the influence interventions exert on traders’ self-regulation, I tested the impact of receiving a single treatment (planning or monitoring) on the dependent variables performance and deviation, using OLS regressions with weekdays as fixed effects. To achieve this purpose, the following model was used:

Performance/Deviation= β0 + β1(Planning)+ β2(Feedback) + β3(Overconfidence)+

β4(Income)+β5(Previous day return) +Ui+ it [eq.1]

The next equation accounts for the inclusion of the moderator term that determines the combined effect of monitoring and planning, in this order, on dependent variables (performance or deviation), as shown in the equation below:

Performance/Deviation= β0 + β1(Planning)+ β2(Feedback)+ β3(Overconfidence)+

β4(Feedback)*(Planning) + β5(Income)+ β6(Previous day return)+ Ui+ it [eq.2]

Table 3. Traders’ Performance - Week 2

Performance (R$) Deviation (R$)a

Variables A B C D

Planning -1,089.00 930.50 -0.117 0.222

Feedback -1,600.00* 1,408.00 -0.336 0.182 (964.20) (1,021.00) (0.204) (0.271) Overconfidence 67.81 101.50 -0.0216 -0.0150 (222.40) (209.60) (0.0467) (0.0444) Feedback+planning -5,066.00*** -0.866** (1,780.00) (0.409)

Income 0.0219 0.0296 -5.58e-05*** -5.43e-05*** (0.0480) (0.0460) (1.63e-05) (1.64e-05) Past day return -0.0260 -0.0350 -1.20e-05 -1.29e-05

(0.0476) (0.0464) (1.00e-05) (9.78e-06) Experience 589.90 589.40 0.0898 0.0881 (435.60) (447.60) (0.0968) (0.0988) Age -434.80 -444.10 -0.110 -0.115 (377.20) (392.60) (0.100) (0.101) Full-time trader -514.30 -134.10 -0.0939 -0.0288 (1,021.00) (1,008.00) (0.215) (0.217) Education 520.20** 477.80** 0.0381 0.0302 (236.40) (239.20) (365.90) (362.60) Constant -281.10 -2,183.00 -392.40 -2,418.00 (2,219.00) (2,119.00) (3,288.00) (3,183.00) Observations 315 315 304 304 R-square 0.085 0.140 0.182 0.218 F 1.02 1.20 2.48 2.39 Df 13 14 13 14

Weekday fe Yes Yes Yes Yes

1.Clustered standard errors in parentheses 2.*** p<0.01, ** p<0.05, * p<0.1 3. a standardized coefficients

Source: author

The findings did not show any significant main effect of the near goal (planning) on the dependent variables, performance and deviation (values in reais), despite the negative valence of the coefficients, as can be seen in panels A and C from Table 3, below.

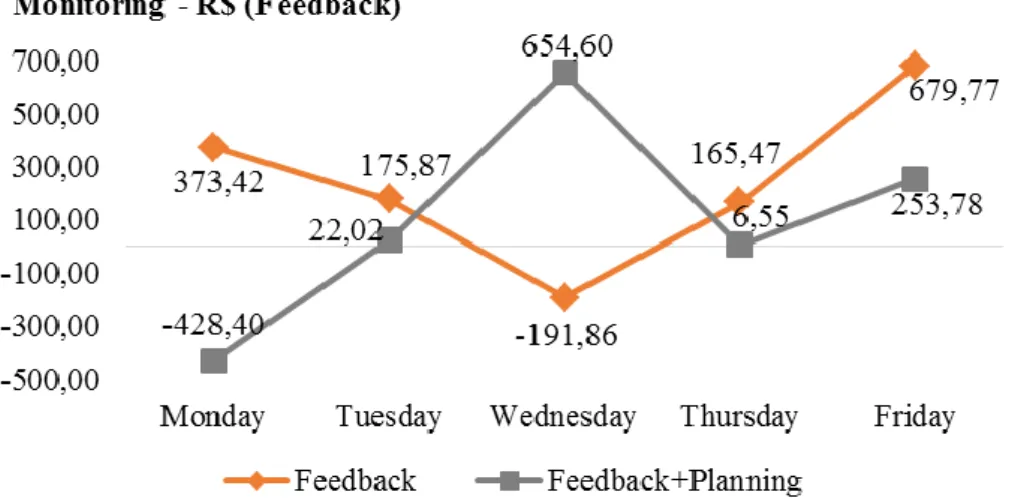

Conversely, the findings demonstrate that the presence of feedback stimuli had a negative impact on trading performance (β = -1.600, p<0.10; see Table 3 panel A). Although this would seem to contradict the confirmation of Hypothesis 2, there is a twofold explanation for this phenomenon. The first is based on the concept of “myopic loss aversion” proposed by Benartzi and Thaler (1995)—a combination of narrow bracketing and loss aversion that inspired the work of Thaler et al. (1997), where the authors found that the probability of an investor observing a loss was higher when the frequency of evaluation was high.

The second explanation could be that individuals who have committed to a certain course of action do not like to make corrections, even if available feedback suggests that the current course of action is futile—a phenomenon known as escalation of commitment. For them, receiving negative feedback means admitting an error, creating a conflict with the need for self-consistency and self-justification (Doerflinger et al., 2017).

As the feedback intervention had a significant impact on performance, could be expected that the past day return had some influence on it. Nevertheless, as intriguing as it may seem, the past day return did not affect performance (β = -0.0260, n.s.; see Table 3 panel A), reinforcing the notion that the implementation of a feedback intervention evokes behavioral changes in traders.

Although previous findings have shown that the overconfident investor lowers his expected utility by trading too much and too speculatively, expending both time and money (Barber & Odean, 2001; Chuang & Susmel, 2011) and consequently incurring in persistent trading losses (Barber et al., 2013), the overconfidence measure had no direct negative impact on traders’ performance.

The performance of the traders assigned to the feedback+planning condition was impacted negatively and significantly (β = -5,066.00, p<0.01) by the combined interventions (panel A, Table 3). The deviation from the distant goal (weekly target) followed the same dynamic (β = -0.866, p<0.05; panel C, Table3). Anchoring and adjustment—a process whereby numerical estimates are often influenced by an initial starting value (Kaustia et al., 2009)—may help the understanding of investors’ behavior after facing unsuccessful trading.

Additionally, to test the impact of interventions on traders’ performance, I did a difference in differences analysis - the basic intuition on this approach rests on the

comparison of the treatment group’s performance pre and post treatment relative to performance of some control group pre and post treatment (Slaughter, 2001). Here, the week is treated as a time constraint instead of a day according to the equation below: Performance= β0 + β1(Treatment) + β2(Weekt) + β3(Weekt+1) + β4(Weekt)*(Treatment) +

β5(Weekt+1)*(Treatment) + [eq.3]

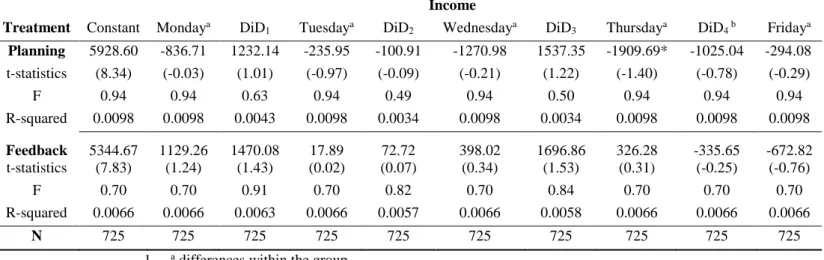

Table 4 presents the regression results for Eq. (3) for each intervention against the control group. Although the effect of feedback on goal achievement failure was found to have the benefit of keeping traders aware of their previous returns, when the evaluation turned to the impact feedback on performance, the intervention had a negative impact, as can be seen by looking at DiD1 (β= -3171.94, p<0.1). The comparison of the treatment week with the post-treatment week did not reveal any statistical differences. No difference was found in the comparison between the planning intervention and the control.

Table 4. Performance Comparison over Weeks

Performance

Groups Constant Week1a DiD1 Week2a DiD2 Week3 a

Planning 761.01 -1044.34 1025.44 -972.29 -3172.84 -1327.83 t-statistics (2.08) (-1.25) (0.38) (-0.86) (-1.16) (-1.32) F 2.50 2.50 2.50 2.50 2.50 2.50 R-squared 0.0223 0.0223 0.0223 0.0223 0.0223 0.0223 Feedback 489.78 -496.55 -3171.94* -633.68 -2585.73 -1607.08 t-statistics (1.25) (-0.60) (-1.65) (-0.54) (-0.95) (-1.40) F 2.13 2.13 2.13 2.13 2.13 2.13 R-squared 0.0183 0.0183 0.0183 0.0183 0.0183 0.0183 N 558 558 558 558 558 558 1. a differences within the group

2. t-statistics are reported in parentheses for robust standard errors 3. *** p<0.01, ** p<0.05, * p<0.1

Source: author

Complementary Findings Income Target