!

"

!# $%

!!%

&

&

&

' !

(

% (

)

*

(

+

* +

, )

!

-./

*

./00

&

&

&

' !

(

% (

)

*

(

+

1

2 1 (

3

*

!'+ +

4

./00

* + , )

!

-&

&

&

' !

(

% (

)

*

(

+

2

&

555555

555555555555555555

5555555+

-

6 * - 13

!

+ + 55555555555555555555555555555555555

5555555

!

+ + 55555555555555555555555555555555555

5555555

!

+ + 55555555555555555555555555555555555

5555555

(

(

)

)

* +

,

-

(

!

(

!

!

(

)

.

!

)

7

5555555555555555555555555555555555555555555555 8

5555555555555555555555555555555555555555555555555 9

55555555555555555555555555555555555555555555555555555 0:

!

"

#

$

"

55555555555555555555555555 0;

3.1.1. O modelo de regressão múltipla11111111111111111111111111111111111111111112355555555555555555555555555555555555555555555555 .0

3.2.1. Os modelos ARIMA11111111111111111111111111111111111111111111111111111443.2.2. Identificação de modelos ARIMA11111111111111111111111111111111111111111145

3.2.3. Estimação dos modelos ARIMA 111111111111111111111111111111111111111111145

3.2.4. Os modelos de previsão1111111111111111111111111111111111111111111111111145

3.2.5. Os modelos ARCH/GARCH 111111111111111111111111111111111111111111111146

"

5555555555555555555555555555555555555555555555555555 .;

3.3.1. Os modelos gráficos1111111111111111111111111111111111111111111111111111473.3.2. As regras de filtragem11111111111111111111111111111111111111111111111111154

3.3.3. Validação da análise gráfica 11111111111111111111111111111111111111111111155

3.3.4. Os modelos gráficos simulados1111111111111111111111111111111111111111111156

3.3.5. O critério de escolha para o ajuste dos melhores modelos de previsão para as técnicas fundamentalista e econométrica 11111111111111111111111111111111111111111111111111158

% &

55555555555555555555555555555555555555555555555555555555 80

55555555555555555555555555555555555555555555555555555555555 80

555555555555555555555555555555555555555555555 8<

555555555555555555555555555555555555555555555555 <;

"

555555555555555555555555555555555555555555555555555555 ;=

'

&

(

55555555555555555555555555555555555555555555 =0

#

'

)*

*

+ ,

- -

"

..

/012 '

.)

+

&

"

3 &

5555555555555555555555555555555555 0/=

+

&

55555555555555555555555555555555 898

Figura 1 Formato de escolha racional...20

Figura 2 Autor...28

Figura 3 Autor...29

Figura 4 Autor...31

Figura 5 Modelo de Lorenzoni et al. (2007) ...33

Figura 6 Modelo proposto pelo autor ...34

Figura 7 Quantidade de vezes que os parâmetros foram significativos para a amostra total...48

Figura 8 MSE 1,2 e 3 passos à frente...52

Figura 9 MAE 1,2 e 3 passos à frente ...53

7

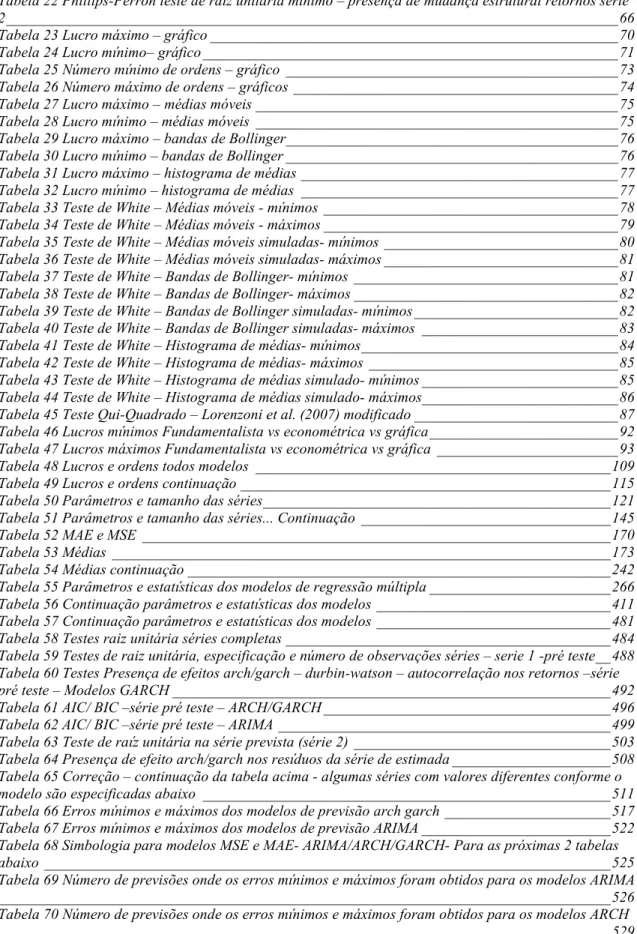

Tabela 1 Tabela dos principais índices utilizados___________________________________________37 Tabela 2 Empresas componentes da amostra ______________________________________________42 Tabela 3 Rendimentos Ibovespa ________________________________________________________44 Tabela 4 Datas iniciais e finais da amostra das empresas da amostra___________________________45 Tabela 5 Quantidade de vezes que as séries foram significativas para a amostra total ______________47 Tabela 6 r2máximos série de estimação __________________________________________________49 Tabela 7 r2mínimos série de estimação __________________________________________________50

9 : . ! .

) " ) ( ; +) ( :

. < ) =

< ! > ( ;

) ? @4AA7B ) C )

+ ; !

D + ( ( (

! ( ) : + ( (

( ) E E (

) F @2G6GB

+/ % + ) ) + ) (

stepwise, : 26 ) + ; )

< ,$- ,HI ; Jlags K+ + +)

) ; L ( ! ; '

( ) 2824 < )

; * ? # MD2AA

@ L 4AAGB $ @ L ' ? 4AAGB ? 24G

! A5 A2 4AAA ; 5A AG 4AAG *

+) ? ! ( + ) ) +

; % ( ? ; L

) ? ! >

+ +) ! ) ; L

( C ! ; )

% + ) ( + ?( = )

C . + )

+ ; ) L

$ ( ! +

) +) * + ) /

( : ?

This thesis looks for empirical evidence of the performance for three categories of asset pricing: the fundamentalist, econometrics and graphics, considering the fitting and the profitability of the three categories based on equations specified in an autonomous system to trigger orders to buy and sell shares via homebroker, also present a modified methodology for the Lorenzoni et. al (2007) test to check the presence of informational content in technical analysis. The main contribution of this work is to compare the performance of interAand intraAanalysis, concurrently, and considering human behavior. For this, mathematical models were fitted considering waste, stationary, presence of serial correlation, the significance of parameters and profitability, when coupled to a modified routine of rational choice constant in Arrow (1959) expecting maximum profit. In fundamental analysis we selected the most significant independent variables via stepwise regression, combinations of 15 factors for each action. For econometric analysis were compared all combinations of models ARIMA / GARCH up to four lags. For technical analysis models were tested moving averages, Bollinger bands and histogram of averages. In this sense, we tested 1612 different combinations of orders coupled with rational behavior for each series being tested. The data used were companies listed in FGVA100 index (theoretical portfolio of 2009) and Ibovespa (theoretical portfolio of Sept. / Dec 2009) a total of 129 companies in the period from 03.01.2000 until 09.30.2009. The main results show that technical approach produced the best and worst results, followed by fundamental and finally by econometric. Clearly, the use of moving averages with some rational choice to buy/sell behaviors produced superior results to those obtained by the benchmark. For technical analysis the best results were obtained by moving averages followed by Bollinger bands, and finally by histograms, that was not efficient in most cases. In fundamental analysis, the variables Liquidity, Equity and EPS were the highest significant variables into data parameters and perform good results with these models. For econometric analysis the results were unsatisfactory but positive and larger than the Ibovespa, but with smaller percentage gains as compared to fundamental analysis and graphics. Another feature of this analysis was the finding of an excess of orders triggered for both models that generate earnings and for models that have generated losses.

0+

*

/

?

?

)

;

6A(

!

I

N - > F ? @2G64B

)L

(

;

H

-(

O

'!

@2G8JB(

?

9

(

(

,

@2G78B

@

B

:

+

)

L

<

)

!

!

L

9

)

!

)

;

3A

!

)

E

9

@2G34BP

@2G38B( %

@2GG2BP I

N

'

@2GGG( 4AAAB(

( K

!

,

>

@2GG5BP ,

:

Q >

@2GG5BP Q >

@2GGJBP

>

@4AA6B(

H

-

@4AA8BP

(

+

;

( .

;

!

?

)

;

análise fundamentalista

(

<

?

+

)

?

C

)

(

(

!

<

:

+

*

?

+

/

<

)

@

(

,9(

( # /

H /

B

%

=

<

)

278

R 8 JAJ 78

?

R

2A 5A5 A2( 22 853 A7

22 GJ2 AG

<

(

(

"

?(

(

(

;

?

<

)

;

;

!

análise gráfica

(

;

!

+

;

(

?

!

)

+)

4

+)

;

L

(

!

;

(

Bollinger

(

)

(

+

( #

(

@

candlestick

B(

.

;

?

;

econométrica

9

;

?

;

+

<

:

S

;

)

(

;

(

)

)

"

+

)

)

!

;

T

@

$D HB

2<

*M9'

;

)

!

T H

) .

@

−

B

4

(

;

/

?

?

T

H

(

!

:

)

D

)

/

!

+

?

?

+

)

(

)

)

*

:

)

)

.

.

;

?

)

)

<

*M9'

(

) ?

#

#

! @2GG5P 2GG6P 2GG8B

+

+

)

(

H F)

#

@4AA5B

H

@4AA7B

,$- D

,HI

%%D'%% @

Nearest Neighbor e Simultaneous Nearest Neighbor

B

+

;

P

'

(

O!

@2GGGB(

+

+)

)

/

?

<

;

)

"

+

)

(

+

;

+

+)

?

C

(

2

$D H ) ! ( )

! ( 9 ( (

. - ! 5( 5 2

4

) . +( (

− @ ) B

H / D /

− ? / ; ) ? % (

! ; ) ( )

@238GB(

D

;

L

D

,$- (

/

K

>

@2G78B(

E

D

,HI

,HI(

9

@2G34B

@2G38B(

+)

;

L

(

!

;

H

:

+

!

)

!

(

) .

(

!

F @2G6GB

)

< (

<

)

) +

?

(

;

+

+)

*

)

<

! ;

)

;

+D

(

)

.

(

(

.

) +

:

(

? (

;

!

L

<

?

24G

# MD

2AA

$

L

A5 A2 4AAA

; 5A AG 4AAG(

;

+

)

S

+

;

+)

+

)

9

!

?

)

"

4 ;

S

)

L

)

:

%

5

D

;

?

(

!

(

(

?

:

<

%

J

)

;

+)

%

6 ; )

J

.+

? #

*

L

)

?

!+

(

%

(

?

+

=

(

)

+

'

5?

<

)

)

@-

?? @4AA5B( ,

@4AA4BP

@2GG3B(

B

<

D

<

(

( S

)

(

?

#

#

! @2GG5P 2GG6P 2GG8B )

) ?

+

+

?

!

%

(

+

)

< "

(

(

(

! @

B

book to market

*

(

.

+

(

! ( M -M @

book

to market =

@ M U

+

-MU

BB

( )

/

9

;

)

)

( -N

'F

!

@2GGGB( H!

@4AA2B(

( !

N( - % !

@4AA2B( H!

K

@4AAAB

H

!

@4AA4B(

( -N

'F

!

@2GGGB

)

(

M -M(

(

@

B

) /

/

@

/

)

B

*

(

C

M -M

/

(

.

?

/

? @

TABill

B(

( )

!

)

5

,

?

;

:

<

;

!

L

!

(

.

)

!

S

( !

N( - % !

@4AA2B

> !

H!

@4AA6B

<

.

+

"

(

/

/

:

@

;

?

> !

H!

@2GG7BB

)

< B

*

) /

/

/

L

)

!

:

(

!

. )

#

#

! @2GG8B

( !

N( - % !

@4AA2B

<

)

)

#

#

! @2GG5B

*

)

<

)

(

!

book to

market

;

)

)

<

(

L

+

<

L

/

%

(

D

+

D

(

)

(

*

.

estratégia momento

@ <

/

/

L/

B

?

(

!

@2GG7B

K

!

@4AA4B

5

24

(

D

)

:

9

;

(

?

)

/

H!

K

@4AAAB 9

)

)

.

)

"

H (

> !

H!

@2GGGB

@4AAAB(

?

M

@M B(

( -N

'F

!

@2GGGB

?

book/market

@ M -MB(

#

#

!

8

@4AA2B(

+

J(

/

(

!

*

(

;

(

<

?

@ /

?

M

;

;

?

B

<

<

D

V

W K+

<

? <

:

!

9

!

@H!

K

@4AAAB( H!

@4AA2BB

#

#

! @2GG5( 2GG6( 2GG8B )

)

M -M

M

!

(

; (

)

)

)

S

;

9

<

!

(

)

!

:

(

;

*

)

)

?

:

!

( )

#

D-

! @2G75B(

!

)

H

S )

*

H

;

!

:

?

:

K+

H!

@4AA2B(

+

( )

!

:

(

;

!

*

smallAcaps

@

! B

(

)

(

< (

?

:

(

:

)

< (

(

!

#

#

! @2GG5B(

)

J

! ) ) ( :

@2G85B( 9 @2G7AB( @2G74B( > @2G78B( ! ! @2G7GB( - ' !

@2G34B( ? , F N @2G34B( ! - @2G35B( - ! N M @2GG8B(

@2GG8B( , @2GG7B( ' @2GG7B( ) Q F @2GGGB( M @2GGGBP > ( M F

@4AA2BP - ! N @4AA4B( - ; , @4AA5B( X ! ' @4AAJBP ( , H !

@4AAJBP > X ! @4AA6B , ! ) ( " H @2GGAB(

H ! @4AA4B( H @4AA4B( # @4AA5B( N I @4AA5B(

N M @4AA5B( H! @4AA6B( % @4AA8BP ( N

;

. )

"

(

!

@

H

K

@2GG7B( ,

@4AAABP %

@4AA5B(

,

'

'

@4AAJBP -+

'

@4AAJB( *

H

@4AA6BB

%

! (

/

)

Y.

)

"

+

@MHB(

@M-B(

?

(

(

(

(

(

9 $

(

,' (

(

MH M-(

(

?

< (

(

) /

/

(

*

+

;

)

+

(

H

-(

,$-

@-

K

@2GGGB( ,

@4AAAB(

Z

@4AA2B(

,

@4AA5B( %

@4AA5B( -+

'

@4AAJBB(

!

)

S

*

.

+

)

.

(

(

<

!

(

<

(

(

!

*

;

!

(

<

)

@-

? @4AA6BB

+

(

(

S

(

:

)

<

Y

S

)

@

%

K @4AAABB(

(

<

@-

K

@2GGGB( ,

'

'

@4AAJBB *

@

B

)

)

(

?

-

@4AA6B

#

(

; (

+

)

: <

( /

+

?

< (

/

;

;

(

; ;

.

3

)

?

:

@

Z

@4AA2BB(

)

D

? @

H

K

@2GG7BB

? @

Z

@4AA2BB

)

)

?

2(

?(

(

(

<

;

( !+

.

)

?

C

(

F!

@4AA8B( H!

K

@4AAABP H!

@4AA2B ( -N

'F

!

@2GGGB(

;

)

%

(

;

)

)

+

?

:

<

)

M

(

; (

(

(

cross

D

sectional

@

)

B(

+

;

@

+

B

+

9

!

.

+

;

!

=

;

/

K

>

@2G73B

6<

)

+

;

(

)

<

C

E

(

+

;

!

+

*

,$-

@

autoregressive integrated moving average

B ;

D

;

L

8D

;

L

"

q t q t

t p t p t

t

y

y

u

u

u

y

=

φ

2 −2+

+

φ

−+

−

θ

2 −2−

−

θ

−[2\

6 ) D V " ) W( 2G73 9 / - K >

φ θ

E

u

t;

H

+

)

y

t(

< (

D

(

!

, @ B(

)

u

t;

L

(

!

-

@ B

%

(

,-

@ ( B )

(

(

I

)

)

*

(

,$-

@ ( ( B( ;

/ "

7q t q t

t d p t d p t

t

y

y

u

u

u

y

=

φ

2 −2+

+

φ

+ − −+

−

θ

2 −2−

−

θ

−[ 4 \

, @ B

;

/

"

t p t p t

t

y

y

u

y

=

φ

2 −2+

+

φ

−+

[5\

*

, @2B ;

D

(

t t

t

y

u

y

=

φ

2 −2+

(

y

t(

(

y

tA1L

t

;

φ

<

1

K+

-

@ B ;

"

q t q t

t

t

u

u

u

y

=

+

−

θ

2 −2−

−

θ

−[J\

(

;

;

(

-

@2B ;

;

L

(

y

t=

u

t−

θ

2u

t−2%

!+

<

E

;

L

:

+

*

,$-

)

)

;

:

)

+

!

<

: -

!( O

/( X ?

!

X

! @4AAABP %

N @2GG3B(

% F

@2G35B

-;

@4AAAB(

C

;

?

%

;

3A( 9

@2G34B

,HI @

Autoregressive

Conditional Heteroskedasticity

B S

)

9

E

+

;

9

)

/

E

+

)

*

9

)

"

2A

∑

= − −=

=

+

=

qi i t i t t q t t t t

u

y

E

N

u

y

2 4 A 4 4B

@

B

2

(

A

@

]

α

α

σ

σ

[6\

9

) ?

<

α

A>

A

α

i>

A

( U 2( 4( (

q

:

)

M

L/

α

i+

.

!

L

;

9

.

(

;

!

( )

!

clusters

(

%

;

(

@2G38B

,HI(

?

,HI

%

(

,HI

,HI(

) .

%

E

)

"

∑

∑

= − = −+

+

=

pj j t j q

i i t i

t

u

2 4 2 4 A4

α

α

β

σ

σ

[8\

%

(

E

;

;

E

*

,HI @ ( B

S

<

:

A(

2( 4(

( P

A(

2( 4(

(

i

i

q

j

p

α

>

=

β

>

=

α

i+

β

j<

2

:

E

:

,HI @ ( B

@

α

2+

β

2B

.

!

L

M+

L

!

9

@2G34B

)

9

,HI( 'O

,HI(

,HID-(

,HIX( $

,HI

(

?

)

(

!

?

+

#

!N

@4AA7B

!N

( ' >

M >

@4AA7B

;

<

)

)

?

(

,$- (

)

Y.

?

<

E

C

!

+

)

>

@4AA6B

< "

^

A t

t

y

u

y

=

+

(

u

^t=

λ

tu

t(

u

t]

t

v(

∑

∑

= −

= −

+

+

=

pj j t j q

i t t i

t

u

2 4 2 4 ^ A4

α

α

β

σ

σ

(

( )

∑

∑

= − = − −+

+

=

pj t j

q

i t i

i t

t

u

k

k

2 4 2 4 4 J ^ 2 Aφ

σ

φ

φ

(

5

B

5

4

@

4

−

−

=

t t tk

k

v

(

4 2 4B

4

@

−

=

t t t tv

v

σ

λ

[7\

*

E

D +/

!

< "

v

t>

J

(

α β α β

A(

A(

2(

2>

A

(

4

(

4A

α β

≥

(

h

> ∀

A

t

k

t> ∀

5

t

)

)

:

;

(

/

(

@4AA7B

=

,HI

?

?

)

E

@% M 'B

;

,HI

,HI

;

<

+

!

? (

/ )

Y.

@

(

O

@4AA6BB

?

(

? (

)

Y.

@

(

N

@4AA2BB

(

N

@4AA2B

!

,HI

VIX

@

Implied Volatility Index

B(

#

@2GG3B(

<

'_ 6AA(

!

?

4A

*

!

!

)

VIX

+

D +

@6

B(

D +

)

)

<

,$-

,HI

,HI )

)

(

H F)

#

@4AA5B(

+

P '

>

`

@4AA8B(

<

!

P

O

??

@4A2AB(

X

P

@4AA3B(

)

P ,

!

!

?! @4AA8BP

/

:

(

:

%

)

?

)

.

<

24

@2GG3BB

,HID- @

C: (

@4AAJBB(

?

@, , a

real

time recurrent learning

B @*

'

@4AAJBB

?

wavelets de Haar

,$-

@

@4AAJBB

;

)

!

H

-

H

-,HI

,HI

)

.

!

!

@

#

@4AA6BB

K+

;

<

E

,HI

!

)

@H!

X

>

@4AAJBB

!

@2GGGB

@4AA5B

<

+

-

-

@4AAJB

!

:

E

-

E

@9

,HIB

;

)

?

)

.

overreaction

underreaction

;

$

=

E

@$ H ( $

/ '9 $HB @#

%

H

@4AA8BB(

?

S

9

;

)

)

?

;

8A )

/

)

+

@H

. ( - !

'

K

@4AA6BB

-

M

> @4AA8B

<

;

<

$

%

( )

E

%

,HI @2(2B

<

)

)

)

,HI

.

*

)

)

! L

<

@

-

M

> @4AA8BB

9

.

!

'

,

@4AA3B

!

)

@ %%B

L

(

,$-

,HI

*

%% )

?

D

-

(

(

,HI

,$-

)

)

L

(

.

;

! :

C: (

@4AA6B

;

)

!

?

hedge

;

+

+)

/

(

(

L

!

9 F

-

@2G88B( -

!N @2G38B

N

#

@2G36B

)

)

?<

;

(

)

(

/

(

! L

<

)

( K

! @4AAAB( ;

+

+)

S

+

)

;

!

(

?

)

( ;

;

L

(

.

!

N @2G56B 9

;

;

;

;

)

;

(

;

/

;

;

)

(

(

(

/

(

!

?

'

(

O!

@2GGGB

?

;

4( 5( J( ( 5AA

9

)

;

bootstrap,

!

)

<

)

?

)

!

*

+)

?

cabeçaAombro, topos largos, topos

triangulares e retangulares e topos duplos e fundos

9

+)

)

)

/

( -

N >N

O

@4AAAB(

2J

*

;

?

)

) +

)

< (

<

%

9

!

)

L

+

K

! @4AAAB

!

+)

)

)

)

?

(

D

t.

'

(

O!

@2GGGB

;

)

(

.

(

;

(

;

L

(Channel Breakouts).

+

;

L

:

@4( 5( J

6

B )

!

:

(

;

;

!

;

:

#

>(

X

QF

@4AA6B

;

)

)

benchmark

L

+)

castiçais

;

D +

@6

B

#

b @

b #

>

/B

:+ *

"

?

!

.

;

)

)

<

)

)

<

(

( )

! L

)

.

)

D)

(

)

#

@2G7AB( :+

H F

@2G55B

'

@2G86B

'

(

"

2

H

!

) F

9/

-4

% 9/

)

)

+

?

O!

@4AAAB(

?

@4AA7B(

D

)

(

+

+)

(

(

! (

<

/

9

M

@

9/

B )

)

-

9/

+

)

;

)

:

9/

;

)

) +

+

H

)

(

/

( 6AA +

)

.

)

5

H

(

output

-

)

9/

)

;

+/

;

.

+

J

;

)

.

< (

%

( 2824

<

)

<

)

248A

;

)

564

+)

@2824U58/55c564

:;

@)

28

@,-BB

,$-

,HI ,- @

C

B( c

:<.

+)

@G8

;

L

( c2JA

!

;

(

c228

B

;

(

L

)

(

/ (

.

;

)

)

C

<

*

)

9

)

!

)

!

%

D

)

)

(

+

)

"

!

+

)

) E

E

(

:

)

+

;

"

)

!

:

;

$H

$H

+

+)

"

!

S

S

$

"

+

)

)

<

C

)

)

(

) .

-

@4AAJB(

> @4AA4B(

:

@4AA5B( H

(

- X

N @2GG7B(

@4AA7B

H

!

@4AA2B

?

+

!

<

)

"

(

(

(

(

=

(

( M

( 9 $

(

?

( -

9 $ ( 9M 9 $

(

?(

H

(

9

( H #

'

)

2

<

)

+

;

( M

;

( 9 $

@9

)

$

/B

!

.

@

?

B(

H

? (

(

H #

;

)

<

)

?

) ?

)

(

: (

S )

:

( )

@9/

-

B

−

@

S

<

x

−y

y

−x

x

−y y

−z

x

−z

(

x

(

y z

∈

A A

;

:

(

F @2G6GB

)

B

/

?

?

*

+

)

)

"

)

,d 2AA(AA

( !

;

)

!

(

−

"

P

;

P

f;

L/

@

(

.

B(

P

fe

P

?

C

X

< (

)

+

(

,d 2AA(AA

?

( L

S

P

ft+nf

P

t+n.L

?

P

f t+ne

P

t+n.*

: ?

)

<

!

L/

L

)

L

S

;

+

(

)

*

)

<

)

!

$D H(

: (

)

.

(

d2AA

!

d2AA

: ?

)

;

10

S )

(

: (

P

f1e

P

/

(

P

f1,P

f2...e

P

/

(

; 2A

)

<

)

(

(

: (

P

f1f

P

/

(

P

f1,P

f2...f

P

/

D

)

D

D

23

)

)

.

+

)

+

g

(

$D H

)

!

(

:

)

) /

9

;

+

;

?

;

) /

)

;

)

)

)L

3.1.1.

O modelo de regressão múltipla

(

@238G( 2336(

2G37B

/

!

@23AGB

@23G8( 23G3B

C

)

?

)

;

H

-(

O

'!

@2G8JB

,

@2G78B

@

B H

(

- X

N @2GG7BP H

!

@4AA2BP

@4AA7BP -

@4AAJBP

> @4AA4B

:

@4AA5B ) ?

)

C

)

! )

/

?

!

%

(

?

+

)

( )

?

<

C

y

i=

β

2x

2i+

β

4x

4i+

β

5x

5i+

+

u

t<

;

?

@

E

(

u

iy

2i(

y

4i(

y

5i(

y

ni)

=

A

i

B

,

!+

.

@

COV

(

u

i(

u

j)

=

A

i

≠

j

B(

!

+

@

VAR

( )

u

i=

σ

4B( !+

.

E

+

@

COV

(

u

i(

x

4i)

=

COV

(

u

i(

x

5i)

=

COV

(

u

i(

x

ni)

=

A

B

!+

.

+

@

ϕ

2=

x

2ix

4i(

ϕ

4=

x

2ix

5i=

ϕ

n=

x

nix

n+2ih

6

≤

−

value

p

.

(

ϕ

nU

B $

(

+

)

)

;

?

+

;

(

(

?

D

;

*

E

<

)

+

;

t

@

B

@

i i

n i n

SE

t

β

β

β

−

=

(

β

iUAB

testeAF

)

;

?

+

)

2(

(

)

/

* :

)

)

)

) E

/

+

)

6h

)

!

;

9

DO

@2G62B

;

)

?

E

#

* H ;

)

)

)

;

?

Matlab

;

E

)

(

)

pAvalue (teste t).

+

pAvalue

)

; G6h

)

)

(

)

/

)

!

)

)

4

<

;

stepwise

+

)

;

C

D

E

(

L

+

stepwise.

9

)

?

<

)

(

: (

<

)

(

<

S )

<

.

S )

<

)

)

)

5 4 J(

(

<

;

)

(

;

)

:

*

+

!

;

L )

)

C

)

"

2 HU['9@9@ 2e P 2@ D2Bf @ D2BB\P

4 HU['9@9@ 4e P 4@ D2Bf @ D2BB\P 5 HU[ '9@9@ 5e P 5@ D2Bf @ D2BB\P

4A

6 HU[ '9@9@ 2e P 4 e P 5 e BP 9@ 2@ D2Bf @ D2BP 4@ D2Bf @ D2BP 5

@ D2Bf @ D2BB\P

8 HU['9@ 9@ 4 e P 5 e BP 9@ 4@ D2Bf @ D2BP 5@ D2Bf @ D2BB\P

7 HU[ 9@ 2e P 5 e BP 9@ 2@ D2Bf @ D2BP 5@ D2Bf @ D2BB\P

3 HU['9@9@ 4 e P 5 f BP 9@ 4@ D2Bf @ D2BP 5@ D2Be @ D2BB\P

G HU[ '9@9@ 4 f P 5 e BP 9@ 4@ D2Be @ D2BP 5@ D2Bf @ D2BB\P

2A HU[ '9@9@ 2 f P 5 e BP 9@ 2@ D2Be @ D2BP 5@ D2Bf @ D2BB\P

22 HU[ '9@9@ 2e P 2@ D2Bf @ D2BP 4e B\P

24 HU[ '9@9@ 2e P 2@ D2Bf @ D2BP 4e P 5e B\P

25 HU[ '9@@9@ 2e P 2@ D2Bf @ D2BP 4e P 5e BP9@J HU B\P

2J HU[ '9@9@ 2e P 2@ D2Bf @ D2BP 4e P 5e BP9@J HU P

6 HU B\P

26 HU[ '9@9@ 2e P 2@ D2Bf @ D2BP 4e P 4@ D2Bf @ D2BBP 5f P 5@ D

2Be @ D2BB\P

28 HU[ '9@9@ 2e P 2@ D2Bf @ D2BP 4e P 5e BP9@J HU) BB\P

27 HU[ '9@9@ 2e P 2@ D2Bf @ D2BP 4e P 4@ D2Bf @ D2BP 5f P 5@ D

2Be @ D2BBBP9@J HU) B\P

23 HU[ '9@9@ 2e P 2@ D2Bf @ D2BP 4e P 5f P 5@ D2Be @ D

2BBP9@J HU) P6 HU) B\P

)

;

/

?

(

F @2G6GB

/

?

?

%

H

(

j(

j

U [2(4 ( 2A\(

j

S )

(

tAn(

t

U [2( 4 ( \

t

;

,

série original E

;

L

n

<

)

)

)

/

<

)

)

<

23

)

23

(

?

58

<

H

/

(

2 HU [9@ 2e P 2@ D2Bf @ D2B\;

?

)

(

< "

) F

+

<

)

)

! :

:

M

(

;

(

buy and hold

;

)

?

(

!

(

) F

)

?

)

!

;

)

/ "

%

)

)

)

%

;

) .

)

;

*

/

)

)

(

(

L

/

+

;

C

<

)

;

?

S )

;

)

!

?

+

)

(

: (

)

;

;

(

(

P

f1e

P

(

)

H

P

f1f

P

)

/

)

(

: ?

)

<

)

*

!

;

;

/

(

;

:

) .

( )

(

; (

<

;

)

*

?

)

,$- (

,HI

,HI $

/

?

?

(

(

(

?

?

:

:

;

)

?

"

j

/D

@2G7AB

:

D

/ @2G73B @

residual squared

44

(

> N

#

@2G7GB

!

D

@2G37( 2G33B

?

+

;

(

;

)

> > @2G7JB @

AIC

B

;

N

@

BIC

B

!

(

9

@2G34B

)

,HI

9

)

)

)

"

;

"

> N

#

@2G7GB

!

D

@2G37P 2G33B

;

;D

@ ;

B"

> N

#

@2G7GB

!

D

@2G37( 2G33B( j

/D

@2G7AB

:

D

/ @2G73B( 9

@2G34B(

DO

@2G62B(

> > @2G7JB

;

N

@ $H

$HB

%

;

;D

" j

/D

@2G7AB

:

D

/ @2G73B(

9

@2G34B

%

;

"

> N

#

@2G7GB

!

D

@2G37(

2G33B( j

/D

@2G7AB

:

D

/ @2G73B( 9

@2G34B( -'9 @

Mean

squared error

B

- 9 @

Mean Absolute error

B

;

;

5 4 J

3.2.1. Os modelos ARIMA

<

(

/

(

:

,$-S

+

%

( )

)

@

;

E

E

(

<

/

(

(

;

;

(

E

N ;

U

σ

2COV

@

y

t(

y

t+KB

=

E

[@

y

t−

yB@

y

t+K−

yB

U

∀

y

tmy

tc +kB

$

(

;

+

@

;

)

"

t

1, t

2, t

3,..., t

T∈

Ζ

,

k

∈

Z

(

T=1, 2,3...

∞

D

)

Fx

2(

x

4(

x

5(

x

t@

x

2( (

x

TB

T

B

( (

@

( (

(

(

4 5 22 K t K t k t K T

t

x

x

x

x

x

Fx

+ + + T+=

F

;

;

B

(

<

B

@

t t=

E

y

[

4]

4

@

B

y t

y

E

y

σ

=

−

B

(

@

B

(

@

y

ty

t KCOV

y

t my

t m K)

(

+ /

,$-

E

;

(

E

E

(

3.2.2. Identificação de modelos ARIMA

H

)

@

/

K

>

@2G78B(

N

% F

@2G3ABB(

;

<

<

( )

;

AIC/BIC

(

;

) +

(

?

@% F

@2G35BB(

H

@2G74B

+

:

(

(

(

?+

(

!

)

k

l

?

AIC/BIC

3.2.3. Estimação dos modelos ARIMA

,$- (

,HI

,HI )

)

+/

!

(

?

N

% F

@2G3A( 2G32B(

>

@4AA6B(

I

@2G7GB(

;

+

9

D

(

(

backforecasting (

?

!

:

)

)

) +

(

;

)

!

3

3.2.4. Os modelos de previsão

3

4J

*

)

:

(

)

)

"

*

;

)

)

:

;

@

(

!

)

D

/

.

)

?

)

@

@2GG7B

K

!

@4AA4BB

(

!

!

(

+ ) ?

+

<

)

S )

*

)

+

9

<

)

"

[3\

*

f

t(s=

y

t(s(

s

≤

A

P

u

t+s=

A

(

s

>

A

P

u

t+s=

A

(

s

≤

A

:

;

L

(

/

)

(

J

B

9@N

)

B

9@N

)

B

9@N

)

B

9@N

)

B

9@N

)

B

9@

B

9@N

)

( ( J (J ( 5 5 (5 ( 2 5 4 4 (4 ( 4 5 2 4 2 2 (2 ( 2 4 5 2 4 2 2 (2 (≥

∀

=

=

=

=

+

=

=

+

+

=

=

+

+

+

=

=

+

+

+

+

=

=

+ + + − + − − + + − − +s

u

u

u

u

u

u

u

u

u

u

s t t t t t t t t t tθ

θ

θ

θ

θ

θ

θ

θ

θ

[G\

D

(

/

)

"

! ;D !

;

)

∑

∑

= − + = −+

+

=

qj j t s j p

i i ts i s

t

f

u

f

2 2

(

4 4 2 ( 2 ( ( 4 ( 4 5 ( 2 J (J ( 2 ( 4 4 ( 2 5 (5 ( 4 2 ( 2 4 (4 ( 2 4 2 2 (2 ( 2 2 4 2 2 (2 (

B

9@N

)

B

9@N

)

B

9@N

)

B

9@N

)

B

9@N

)

B

9@

B

9@N

)

− − + + + + − + + − ++

+

=

=

+

+

=

=

+

+

=

=

+

+

=

=

+

+

=

=

+

+

+

=

=

s s tt s t t t t t t t t t t tf

f

f

f

f

f

y

f

y

y

u

y

y

θ

θ

θ

θ

θ

θ

θ

θ

θ

θ

θ

θ

[2A\

*

9@N

+2B

=

y

t;

;

;

!

L

3.2.5. Os modelos ARCH/GARCH

9

)

4 4 4(

(

(

(

( :

<

*

)

,HI

,HI

?

;

9

!

,

N @2G8GB(

' @

>(

!

( ' !

>

@2GG8BB(

I

! @2G34B(

,HID - @-

B

9

@2G34B(

(

D

!

(

,HID - ;

?

(

;

) F

(

D

E

)

)

;

+/

!

(

?

D% F

III @

( I

( I

I

B

?

-E

E

)

@

@N

N

D2(

N

D4B

=

@

D2(

D4B

B #

+

(

(

)

<

4 2 4

4

2

B

9@

+#

t=

σ

T+(

9@

B

4 2

#

t48

t

#

)

!

t

(

2( 4( 5( (c

∞

)

)

"

(

)

(

) (

)

(

)

(

)

∑

= − −+

+

+

=

+

+

+

+

=

+

+

=

+

+

=

2 D 2 4 ( 2 2 2 2 2 A 4 ( 4 ( 2 4 2 2 A A 4 ( 5 4 ( 2 2 A 4 ( 4 4 4 2 A 4 ( 2 f T s i f T s f T f T f T f T T T f Tu

σ

β

α

β

α

α

σ

σ

β

α

β

α

α

α

σ

σ

β

α

α

σ

βσ

α

α

σ

[22\

,$-

,HI

)

(

"

2 HU[9@ 2e, P 2@ D2Bf, @ D2B\P

4 HU[9@ 4e, P 4@ D2Bf, @ D2B\P 5 HU[9@ 5e, P 5@ D2Bf, @ D2B\P

J HU[9@ Je, P J@ D2Bf, @ D2B\P 6 HU[9@ 6e, P 6@ D2Bf, @ D2B\P

8 HU[9@ 8e, P 8@ D2Bf, @ D2B\P 7 HU[9@ 7e, P 7@ D2Bf, @ D2B\P

3 HU[9@ 3e, P 3@ D2Bf, @ D2B\P G HU[9@ Ge, P G@ D2Bf, @ D2B\P

2A HU[9@ 2Ae, P 2A@ D2Bf, @ D2B\P 22 HU[9@ 2e, P 2@ D2Bf, @ D2BP 4e, \P

24 HU[9@ 2e, P 2@ D2Bf, @ D2BP 4e, P 5e, \P

25 HU[9@ 2e, P 2@ D2Bf, @ D2BP 4e, P 5e, P Je, \P

2J HU[9@ 2e, P 2@ D2Bf, @ D2BP 4e, P 5e, P Je, P 6e, \P

26 HU[9@ 2e, P 2@ D2Bf, @ D2BP 4e, P 5@ D2Bf, @ D2B\P

28 HU[9@ 2e, P 2@ D2Bf, @ D2BP 4e, P 5e, P Jf, \P

27 HU[9@ 2e, P 2@ D2Bf, @ D2BP 4e, P 5@ D2Bf, @ D2BP Jf, \P

23 HU[9@ 2e, P 2@ D2Bf, @ D2BP 4e, P 5@ D2Bf, @ D2BP Jf, P 6f, \P

H

(

j(

j

U [2(4 ( 2A\(

j

S )

( ,

tAn(

t

U [2( 4

\

t

;

,

série original

E

;

L

n

<

)

:

)

/

<

)

)

<

23

)

23

(

?

58

<

"

)

S ;

+)

(

)

;

%

(

+)

!

)

)

+)

H

+)

;

L

(

/

( )

/

!

.

;

L

?

!

;

/ (

<

!

J 2 8 9

;

;

:

3.3.1. Os modelos gráficos

-

+)

;

L

)

>( >

! >

@2GG4B( '

(

O!

@2GGGB( O

H!

@4AA7B(

!

XF

@4AA7B(

%

! (

+)

;

L

( )

?

)

>( >

! >

@2GG4B(

?

@

L T

t

MA

P

>

( t−2<

MA

t−2(L(

∑

−

= −

=

2A 4 (

2

-L

j j T L

t

P

L

(

B(

?

5

4

;

L

E

(

)

#

D2

.

9

)

(

.

;

( )

9

;

"

;

(

+

(

)

7( 42

54

<

;

(

+

)

)

(

)

(

;

L

28

;

(

+

" .

*

+

n

P

P

P

P

E

n i n in − −−

+

+

=

4 2B

@

;

< "

'

"

B

@

P

cE

B

/ P

/ (

f

)

@

B

2

@

B

@

P

If

E

P

cE

>

+

@

B

2

@

B

@

P

If

E

P

LE

>

+

'

"

;

?

@

B

2

@

B

@

P

cf

E

P

IE

>

+

@

B

2

@

B

@

P

Lf

E

P

IE

>

+

%

(

)

"

2 HU[ 2Ae 4\ 1 MU[ 2Af 4

J HU[ 25e 6\ 1 MU[ 25f 6

7 HU[ 28e 3\ 1 MU[ 28f 3

MU[ 23f 2A\P 2A HU[ 2Ge 2

24 HU[ 52e 5\ 1 MU[ 52f 5

43

;

L

)

)

n

P

n

i t i

∑

= −

=

2;

4

54

)

)

D

"

;

+

@

E

@

P

IB

B

?

;

@

E

@

P

LB

B

?

;

)

5 5 4 ,

"

B

cU

B

LU

"

;

+

?

;

?

;

+

B

IP

U

B

IP

U

(

)

:

4\P 4 HU[ 22e 5\ 1 MU[ 22f 5\P 5 HU[ 24e J

6\P 6 HU[ 2Je 8\ 1 MU[ 2Jf 8\P 8 HU[ 26e 7

3\P 3 HU[ 27e G\ 1 MU[ 27f G\P G HU[ 23e 2A

e 22\ 1 MU[ 2Gf 22\P 22 HU[ 54e 4\ 1 MU[

5\P 25 HU[ 5Ae J\ 1 MU[ 5Af J\P 2J HU[ 4Ge 6

54

?

;

@

+

"

P

)

J\ 1 MU[ 24f J\P

7\ 1 MU[ 26f 7\P

2A\ 1

U[ 54f 4\P

26 HU[ 43e 8\ 1 MU[ 43f 8

23 HU[ 46e G\ 1 MU[ 46f G

4A HU[ 45e 22\ 1 MU[ 45f 2

44 HU[9@ 26e ; P 26e JB\ 1 M

45 HU[9@ 26e ; P 26e JB\ 1 M

4J HU[9@ 26e ; P 26e JB\ 1 M

46 HU[9@ 26e ; P 26e JB\ 1 M

48 HU[9@ 26e ; P 26e JB\ 1 M

47 HU[9@ 26e ; P 26e JB\ 1 M

43 HU[9@ 26e ; P 26e JB\ 1 M

4G HU[9@ 26e ; P 26e JB\ 1 M

5A HU[9@ 26e ; P 26e JB\ 1 M

52 HU[9@ 28e ; P 28e 6B\ 1 M

54 HU[9@ 28e ; P 28e 6B\ 1 M

55 HU[9@ 28e ; P 28e 6B\ 1 M

5J HU[9@ 28e ; P 28e 6B\ 1 M

56 HU[9@ 28e ; P 28e 6B\ 1 M

58 HU[9@ 28e ; P 28e 6B\ 1 M

57 HU[9@ 28e ; P 28e 6B\ 1 M

53 HU[9@ 28e ; P 28e 6B\ 1 M

5G HU[9@ 28e ; P 28e 6B\ 1 M

JA HU[9@ 28e ; P 28e 6B\ 1 M

J4 HU[9@ 23e ; P 23e 7B\ 1 M

JJ HU[9@ 43e 6P 43e 26B\ 1

J6 HU[9@ 4Ge 8P 4Ge 28B\ 1

J7 HU[9@ 52e 3P 52e 23B\ 1

H

;

L

;

L

)

<

(

?

G8

*

;

?

+

" :*

+

n

t

t

t

E

n i n in − −−

+

=

,

,

4B

@,

4

54

@

E

@,

8\P 28 HU[ 47e 7\ 1 MU[ 47f 7\P 27 HU[ 48e 3

G\P 2G HU[ 4Je 2A\ 1 MU[ 4Jf 2A\P

f 22\P 42 HU[9@ 26e ; P 26e JB\ 1 MU[ Je@2c2hB^ ;

\ 1 MU[ Je@2c4hB^ ; \P

\ 1 MU[ Je@2c5hB^ ; \P

\ 1 MU[ Je@2cJhB^ ; \P

\ 1 MU[ Je@2c6hB^ ; \P

\ 1 MU[ Je@2c8hB^ ; \P

\ 1 MU[ Je@2c7hB^ ; \P

\ 1 MU[ Je@2c3hB^ ; \P

\ 1 MU[ Je@2cGhB^ ; \P

\ 1 MU[ Je@2c2AhB^ ; \P

\ 1 MU[ 6e@2cA(6hB^ ; \P

\ 1 MU[ 6e@2cA(76hB^ ; \P

\ 1 MU[ 6e@2c2(6hB^ ; \

\ 1 MU[ 6e@2c4(46hB^ ; \P

\ 1 MU[ 6e@2c4(6hB^ ; \P

\ 1 MU[ 6e@2c5(46hB^ ; \P

\ 1 MU[ 6e@2c5(6hB^ ; \P

\ 1 MU[ 6e@2cJ(46hB^ ; \P

\ 1 MU[ 6e@2cJ(6hB^ ; \P

\ 1 MU[ 6e@2c6(46hB^ ; \P J2 HU[9@ 27e ; P 27e 8

\ 1 MU[ 7e ; \P J5 HU[9@ 2Ge ; P 2Ge 3

\ 1 MU[ 26e 6\P

\ 1MU[ 28e 8\P J8 HU[9@ 5Ae 7P 5Ae 27B\ 1 M

\ 1 MU[ 23e 3\P J3 HU[9@ 54e GP 54e 2GB\ 1 M

( M

(

ii

série original

(

serie

;

;

n(número de condições)

<

J3

)

<

?

)

!

;

*

+

/

;

)

)

n

t

t

ni t i

∑

= −

=

+

2 24

,

,

(

B

@,

t

nB

.

3\ 1 MU[ 48f 3\P

; \P

8B\ 1 MU[ 8e ; \P

3B\ 1 MU[ 3e ; \P

\ 1 MU[ 27e 7\P

\ 1 MU[ 2Ge G\

i

U [2( 4

54\

E

<

J3

*

+)

(

)L

)

5A

;

(

!

;

( )

)

D

< "

'

"

;

+

@

E

@,

t

nB

B

/

B

@

retsérie

E

(

;

;

,

"

B

@

B

2

@

B

@,

t

f

E

retsérie

E

n<

+

U

'

"

;

+

@

E

@

P

nB

B

?

B

@

B

2

@

B

@,

t

f

E

retsérie

E

n>

+

U

(

)

"

2 HU[DA(6h^-,e 4\ 1MU[ 4eA(6h^-,\P 4 HU[DA(76h^-,e 5\ 1MU[ 5eA(76h^-,\P

5 HU[D2(6h^-,e J\ 1MU[ Je2(6h^-,\P J HU[D4(46h^-,e 6\ 1MU[ 6e4(46h^-,\P

6 HU[D4(6h^-,e 8\ 1MU[ 8e4(6h^-,\P 8 HU[D5(46h^-,e 7\ 1MU[ 7e5(46h^-,\P

7 HU[D5(6h^-,e 3\ 1MU[ 3e5(6h^-,\P 3 HU[DJ(46h^-,e G\ 1MU[ GeJ(46h^-,\P

G HU[DJ(6h^-,e 2A\ 1MU[ 2AeJ(6h^-,\P 2A HU[D6(46h^-,e 22\ 1MU[ 22e6(46h^-,\P

22 HU[D2h^-,e 24\ 1MU[ 24e2h^-,\P 24 HU[D4h^-,e 25\ 1MU[ 25e4h^-,\P

25 HU[D5h^-,e 2J\ 1MU[ 2Je5h^-,\P 2J HU[DJh^-,e 26\ 1MU[ 26eJh^-,\P

26 HU[D6h^-,e 28\ 1MU[ 28e6h^-,\P 28 HU[D8h^-,e 27\ 1MU[ 27e8h^-,\P

27 HU[D7h^-,e 23\ 1MU[ 23e7h^-,\P 23 HU[D3h^-,e 2G\ 1MU[ 2Ge3h^-,\P

2G HU[DGh^-,e 4A\ 1MU[ 4AeGh^-,\P 4A HU[D2Ah^-,e 42\ 1MU[ 42e2Ah^-,\P

42 HU[DA(6h^-,e 44\ 1MU[ 44e2h^-,\P 44 HU[DA(76h^-,e 45\ 1MU[ 45e4h^-,\P

45 HU[D2(6h^-,e 4J\ 1MU[ 4Je5h^-,\P 4J HU[D4(46h^-,e 46\ 1MU[ 46eJh^-,\P

46 HU[D4(6h^-,e 48\ 1MU[ 48e6h^-,\P 48 HU[D5(46h^-,e 47\ 1MU[ 47e8h^-,\P

47 HU[D5(6h^-,e 43\ 1MU[ 43e7h^-,\P 43 HU[DJ(46h^-,e 4G\ 1MU[ 4Ge3h^-,\P

4G HU[DJ(6h^-,e 5A\ 1MU[ 5AeGh^-,\P 5A HU[D6(46h^-,e 52\ 1MU[ 52e2Ah^-,\P

52 HU[D2h^-,e 4\ 1MU[ 4e2h^-,\P 54 HU[D4h^-,e 5\ 1MU[ 5e4h^-,\P

55 HU[D5h^-,e J\ 1MU[ Je5h^-,\P 5J HU[DJh^-,e 6\ 1MU[ 6eJh^-,\P

56 HU[D6h^-,e 8\ 1MU[ 8e6h^-,\P 58 HU[D8h^-,e 7\ 1MU[ 7e8h^-,\P

57 HU[D7h^-,e 3\ 1MU[ 3e7h^-,\P 53 HU[D3h^-,e G\ 1MU[ Ge3h^-,\P

5G HU[DGh^-,e 2A\ 1MU[ 2AeGh^-,\P JA HU[D2Ah^-,e 22\ 1MU[ 22e2Ah^-,\P

J2 HU[DA(26h^-,e 2A\ 1MU[ 2AeA(26h^-,\P J4 HU[DA(46h^-,e 22\ 1MU[ 22eA(46h^-,\P

J5 HU[DA(56h^-,e 24\ 1MU[ 24eA(56h^-,\P JJ HU[DA(86h^-,e 25\ 1MU[ 25eA(86h^-,\P

J6 HU[DA(36h^-,e 2J\ 1MU[ 2JeA(36h^-,\P J8 HU[DA(G6h^-,e 26\ 1MU[ 26eA(G6h^-,\P

J7 HU[D2(46h^-,e 28\ 1MU[ 28e2(46h^-,\P J3 HU[D2(56h^-,e 27\ 1MU[ 27e2(56h^-,\P

JG HU[D2(86h^-,e 23\ 1MU[ 23e2(86h^-,\P 6A HU[D2(36h^-,e 2G\ 1MU[ 2Ge2(36h^-,\P

62 HU[DA(6h^-,e 24\ 1MU[ 24eA(6h^-,\P 64 HU[DA(76h^-,e 25\ 1MU[ 25eA(76h^-,\P

65 HU[D2(6h^-,e 2J\ 1MU[ 2Je2(6h^-,\ 6J HU[D4(46h^-,e 26\ 1MU[ 26e4(46h^-,\P

66 HU[D4(6h^-,e 28\ 1MU[ 28e4(6h^-,\P 68 HU[D5(46h^-,e 27\ 1MU[ 27e5(46h^-,\P

67 HU[D5(6h^-,e 23\ 1MU[ 23e5(6h^-,\P 63 HU[DJ(46h^-,e 2G\ 1MU[ 2GeJ(46h^-,\P

6G HU[DJ(6h^-,e 4A\ 1MU[ 4AeJ(6h^-,\P 8A HU[D6(46h^-,e 42\ 1MU[ 42e6(46h^-,\P

82 HU[D2h^-,e 44\ 1MU[ 44e2h^-,\P 84 HU[D4h^-,e 45\ 1MU[ 45e4h^-,\P

85 HU[D5h^-,e 4J\ 1MU[ 4Je5h^-,\P 8J HU[DJh^-,e 46\ 1MU[ 46eJh^-,\P

86 HU[D6h^-,e 48\ 1MU[ 48e6h^-,\P 88 HU[D8h^-,e 47\ 1MU[ 47e8h^-,\P

87 HU[D7h^-,e 43\ 1MU[ 43e7h^-,\P 83 HU[D3h^-,e 4G\ 1MU[ 4Ge3h^-,\P

8G HU[DGh^-,e 5A\ 1MU[ 5AeGh^-,\P 7A HU[D2Ah^-,e 52\ 1MU[ 52e2Ah^-,\

*

H U

( M U

( -,U

;

;

(

ii

U [4( 5

54\

;

L

i

série de retornos

;

<

7A

)

7A

(

?

2JA

<

C

;

+)

)

(

" 8

* +

U

BCσ

U

;

< "

'

"

/ P

B

@

B

2

@

BCi

f

E

P

P

>

+

U

BC

P

U

'

"

/

B

@

B

2

@

BCi

f

E

P

P

>

+

ior

BandaSuper

=

erior

Banda

)

=

P

E

i n∑

=

B

@

)

)

)L

/ "

n

4

4A

(

( )

)

"

?

/

)

(

U

"

?

(

)

U

BCal

Bandacentr

+

×

σ

=

4

BC

al

Bandacentr

−

×

σ

=

4

n

P

ni t i

∑

=2 −