This document has been prepared for the European Commission by the members of the Energy Efficiency Financial Institutions Group (“EEFIG”), as identified herein. EEFIG identifies a very strong economic and social rationale for scaling up energy efficiency investments in buildings in the EU, as well as specific barriers;

Framework

Rationale for scaling up Energy Efficiency Investments in Europe

However, despite the "win-win" characteristics of energy efficiency investments, current investment flows in energy efficiency are sub-scale. In 2012, the Energy Efficiency Directive (2012/27/EU) was adopted to help fill the policy gap without which the EU was expected to have missed its 2020 energy efficiency targets by around 11%18.

Introduction to EEFIG and the Scope of this Report

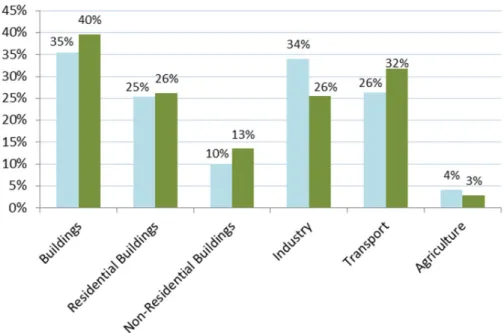

While EEFIG is keen to address energy efficiency investments as a whole, in this interim report the group has focused the scope of its immediate work to cover only the different segments of the building sector in the EU. The group addressed this question by identifying and discussing the main drivers that will enable the development of a vibrant market for energy efficiency investments in buildings.

EU Buildings Market Investment Characterization

Drivers of Demand for and Supply of Energy Efficiency Investments in EU Buildings

Definitions and Introduction

The building energy code within the framework of the national building regulation must support investments in energy efficiency in all types of buildings. Use of standardized legal structures applicable to energy performance contracts and other forms of financial energy performance contracts.

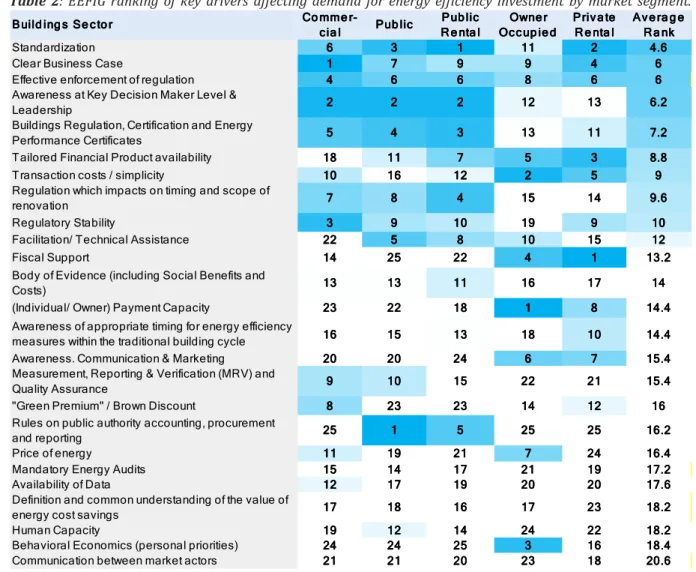

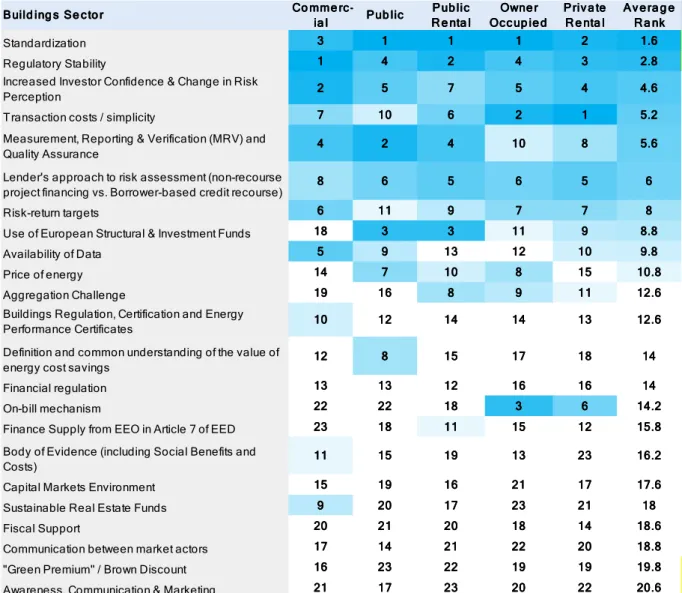

Analysis and Prioritization of the Drivers of Demand for Energy Efficiency Investments in Buildings

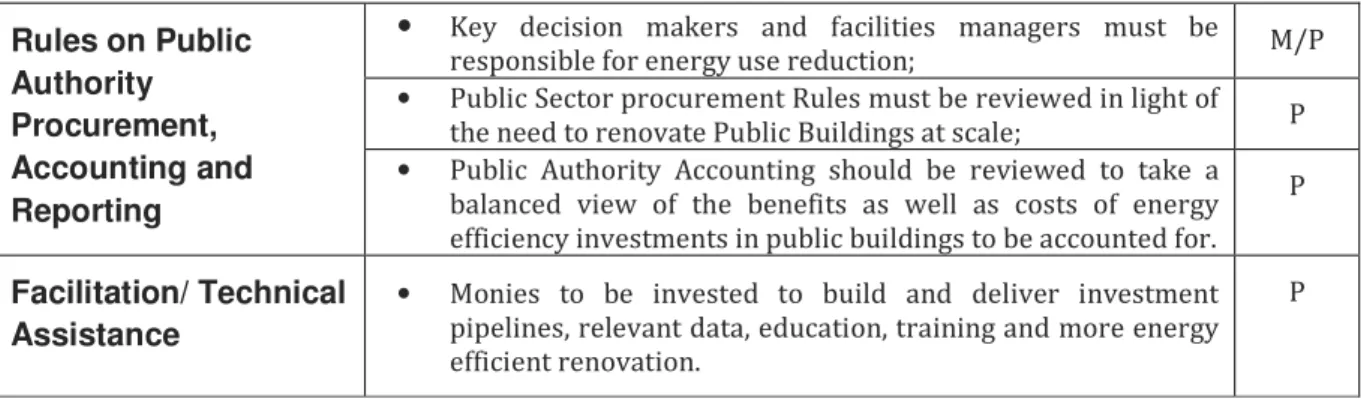

However, a strong regulatory framework with effective enforcement of regulation is the only demand driver that EEFIG sees as a real "cross-cutting" priority across all building segments. There is a high degree of agreement among EEFIG members that the demand for energy efficiency investments in the Commercial and Public Buildings segments is driven by strong leadership and awareness of the opportunities at the key decision maker level; Building Regulation, Building Certification and Energy Performance Certificates and Standardisation. Commercial buildings' key decision makers also require a clear business case as well as assured regulatory stability; while EEFIG members see the rules governing public authority accounting, procurement and reporting and facilitation and technical assistance as having the greatest impact on energy efficiency investment demand for public buildings and clearly having no impact on other segments.

For private residential buildings, EEFIG members collectively saw that demand for energy efficiency investment was more related to individual payment capacities, which in turn is related to behavioral economics and includes personal priorities; ease of undertaking investments (simplicity and the impact of financial and non-financial transaction costs); the need for tailor-made financial products; and the need for budget support in certain circumstances. This suggests that success in unlocking energy efficiency investment demand from homeowners requires a simple, tailored, low-interest (and potentially tax-efficient) retail energy efficiency financing offer that is tailored at different income levels and that is cleverly positioned to reflect the full range of economic opportunities. and non-economic benefits in the context of householders' priorities. Contrary to the initial expectations of the new EEFIG members, the value improvement (“Green Premium”/.Brown Discount) only seems to impact demand for energy efficiency investments in commercial buildings.

Analysis and Prioritization of the Drivers of Supply of Energy Efficiency Investments in Buildings

Perhaps surprisingly for a group of financial institutions, EEFIG members were in much stronger overall agreement about the priority drivers for the supply of energy efficiency investments than the demand for them, and in this case, while the residential sector still shows some divergence , many of the Supply Drivers listed at the top are common across all building segments. EEFIG members see key supply drivers for energy efficiency investment as standardization and regulatory stability – having a strong and stable regulatory environment. While there are clear differences in the use of specific vocabulary between different EEFIG members, the high priority for using ESIF to support energy efficiency investments in buildings is an indication of the need for public support to leverage private sector capital and to share certain risks. .

The group as a whole captures this idea in the "need for increased investor confidence" and "changes in risk perceptions" for energy efficiency investments and believes that ESIFs are more focused on supporting the renovation of public buildings than in all building segments. Finally, the recourse and non-recourse nature of lenders' risk assessment of energy efficiency investments is considered a high priority for all members – but only financial institutions are identifying the importance and impact of financial regulation on investment supply. EEFIG members directly representing financial institutions concluded that capital adequacy requirements under financial regulations (Basel 3 for banks and Solvency 2 for insurance companies) should pay particular attention to their impact on the capacity and ability of financial institutions to generally use long-term funds, especially in real estate.

EEFIG Conclusions and Insights into the Drivers of Energy Efficiency Investments (Demand & Supply)

Approaches and Instruments to Stimulate Energy Efficiency Investments in Buildings

Policy-led Approaches to Drive Investment

After identifying, assessing and prioritizing the necessary drivers of energy efficiency investments, EEFIG members held a structured debate on the approaches and tools through which these drivers can be addressed. Standardization and improvement of building certification and energy performance certificates: coherence, reliability, usability, ease of access and accuracy were all terms used by EEFIG members on their "wish list" for improvements and standardization of energy performance certificates and building certificates in EU Member States . Open Source EU Buildings Energy Database: EEFIG members proposed evaluations of buildings' energy consumption and performance data availability and standardized processes for the collection, organization and open access of data on the existing building stock, in line with Eurostat and Inspire Directive standards.

Some EEFIG members also felt that the EU should prioritize resolving any data ownership and privacy issues that could prevent easy and appropriate access and use of anonymous energy data collected by energy companies for the energy use of buildings. EEFIG felt that both the EU building energy use database reflecting some of the lessons from the California Public Utilities Commission project39 and the US Department of Energy's Building Performance Database would it was useful; and some members felt that each platform could also access social media and crowdsourced content generation approaches to support this goal. National roadmap for industry- and finance-supported building renovation: Long-term planning and engagement in building energy trajectories (taking into account a portfolio and life-cycle approach) should be developed in the context of National Building Renewal Strategies with and supported by the construction industry and financial institutions.

Market-led Approaches to Drive Investment

EEFIG considered it crucial to involve financial institutions, on a voluntary basis, in the design of the data requirements and functional usability of such a database, also taking into account the potential administrative costs. Operational” Energy Performance Database: “Better quality data” for energy efficiency investments is an underlying, but somewhat general request from many financial institutions and industry stakeholders. An 'operational' database for the energy performance of buildings in each of the 28 EU Member States, which adheres to shared data standards and aggregate protocols43 and can be accessed and supported by bespoke portfolio benchmarking analyses, such as those used in the UK44 tested by JLL and in France and Germany by the Green Rating Alliance45.

This database can build on the data increasingly available through the roll-out of smart meters in the EU and the EPISCOPE-TABULA project46. Linking the impact of building energy performance to investment performance: Industry-led initiatives can study the relationship between building energy performance and the impact on building investment performance. Lifecycle portfolio sustainability programs: long-term planning and integration of energy efficiency into portfolio management throughout the lifecycle of building investments, developed and supported by the energy efficiency industry and financial institutions.

EEFIG Assessment of Selected Financial Instruments

- Dedicated Credit Lines

- Risk Sharing Facilities (Guarantee Funds and First-loss Facilities)

- Direct and Equity Investments in Real Estate and Infrastructure Funds

- Energy Performance Contracting (Demand Driver)

- On-Bill Repayment (Supply Driver)

- Green Bonds for Green Buildings (Supply Driver)

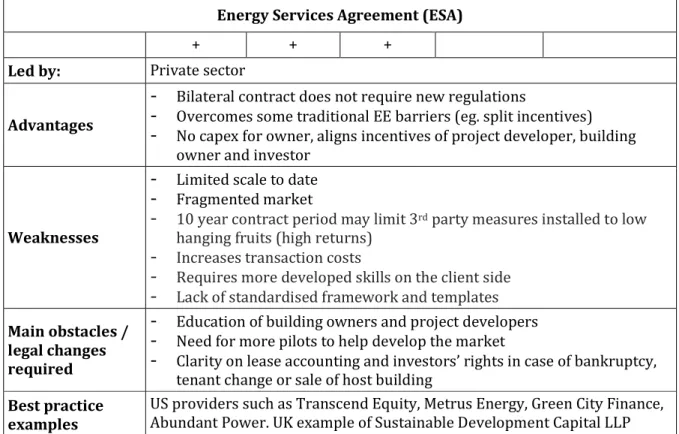

- Energy Services Agreement (Demand Driver)

Committed lines of credit (or soft loans) are a mechanism where public funding lowers the cost of energy efficient building renovation loans. They can be combined with dedicated lines of credit and are a key tool to grow the amount of bank loans for energy efficiency renovations. Property and infrastructure funds already provide a large amount of 'invisible' energy efficiency investments in the building sector.

Real estate investment trusts are a key channel for scaling up financing in energy efficiency in buildings, both through increased equity investment in the funds and through increased fund activity in energy efficiency where this can be facilitated by strong regulatory and market frameworks. Difficult to estimate the share of funds invested in energy efficiency - Limited to cost-effective investment within the investment time frame of. An energy performance contract (EPC) is a contractual arrangement between the recipient and the provider of an energy efficiency measure, verified and monitored throughout the contract period, where investments (work, supply or service) in that measure are paid for in relation to a contractual level agreed for energy efficiency or other agreed energy performance criterion, such as financial savings.

Connecting the Key Drivers with Specific Approaches

EEFIG Recommendations and Conclusions

What are the most imminent challenges to overcome?

The rapid and iterative process of connecting these inputs to improve and strengthen approaches should be a priority, as well as the practical and effective local enforcement of existing regulations, especially minimum performance standards when upgrading, selling or renting. For energy efficiency investments in buildings to enter the mainstream, it must be as easy for a key real estate decision maker to understand and appreciate the benefits of those investments as it is for other comparable decisions. This means that sufficient, accessible, reliable and sortable data on buildings and their actual, measured and verified energy performance must be identified and made available to facilitate the preparation of energy efficiency investment cases.

The data structures must clearly enable the connection and validation of value increases (in the broadest sense of the word) with investments in energy efficiency61. The standardization and adoption of best practices, standard national models for: Legal contracts, acceptance processes, tender procedures, arbitration, measurement, verification, reporting, energy performance (contracts and certificates) and insurance; will add volume to the energy efficiency investment market and reduce financing and transaction costs. Member States should be encouraged to move away from traditional grant financing and focus more on identifying the working models that best meet energy efficiency investment needs in the renovation of their buildings (as expressed in their national building renovation strategies).

EEFIG Conclusions and Recommendations to Policy Makers

Bibliography

Marrë nga: http://www.ceres.org/resources/reports/power-factor-institutional-investors2019- policy-priorities-can-bring-energy-efficiency-to-scale/view. Marrë nga: https://www.db.com/cr/en/docs/DB_Living_Cities_Report_- _Recognizing_the_Benefits_of_Energy_Efficiency_in_Multifamily.pdf. Marrë nga: http://www.joneslanglasalle.co.uk/UnitedKingdom/EN-GB/Pages/Real-Estate- Environmental-Benchmark.aspx.

Retrieved from: http://www.ukgbc.org/resources/publication/uk-gbc-task-group-report-green-deal-finance.

Appendix