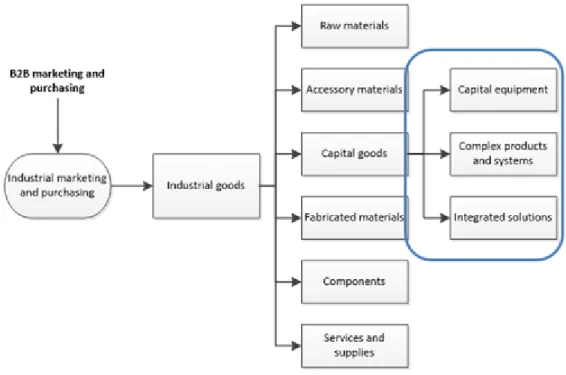

Keywords: Purchasing process, capital goods, configuration, pricing and quotation system, business-to-business markets, integrated solutions, information sourcing. The case study is a Finnish construction company that supplies construction equipment in business-to-business markets.

INTRODUCTION

- Background of the study

- Research setting

- Objective of the study and research questions

- Structure of thesis

The final part of the decision model is post-purchase behavior, which includes the evaluation of the decision made to solve the problem. Chapter 3 provides the methodology of the research, providing the details of how the research was conducted and tools used to extract the information.

THEORETICAL BACKGROUND

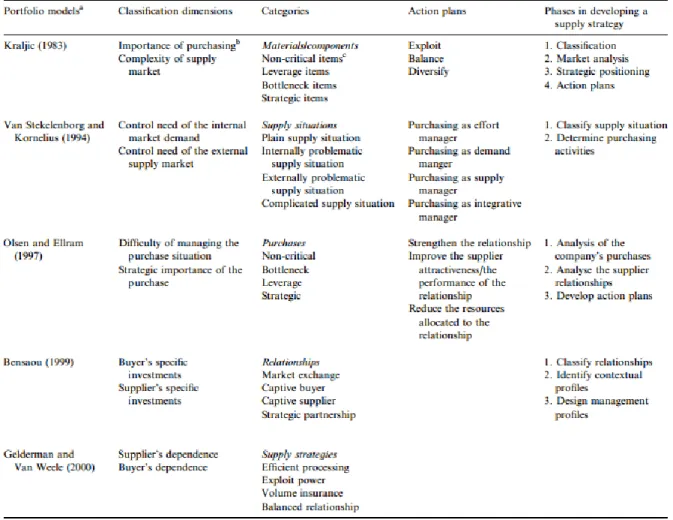

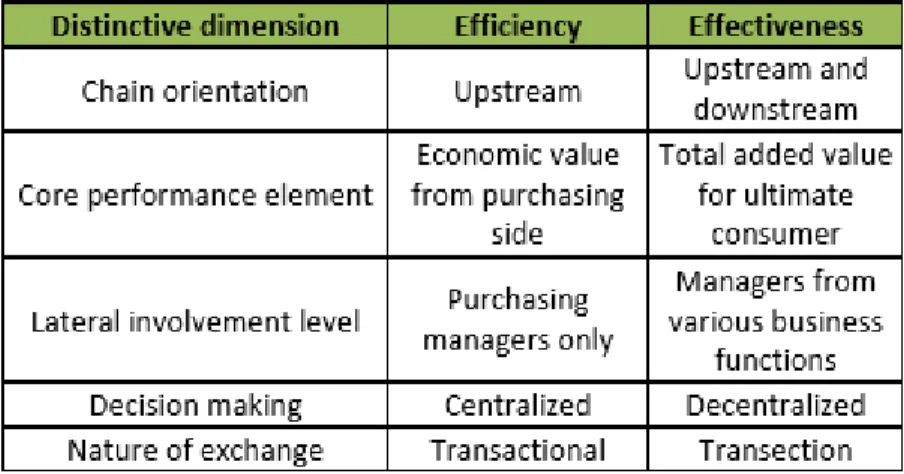

Business to business purchasing

- Management of purchasing process

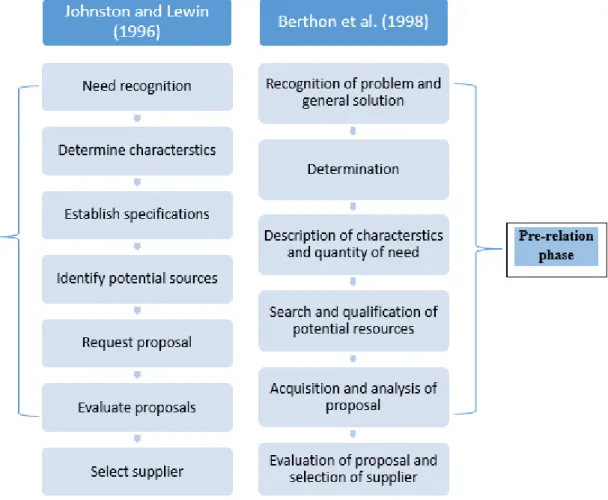

- Purchase decision making process

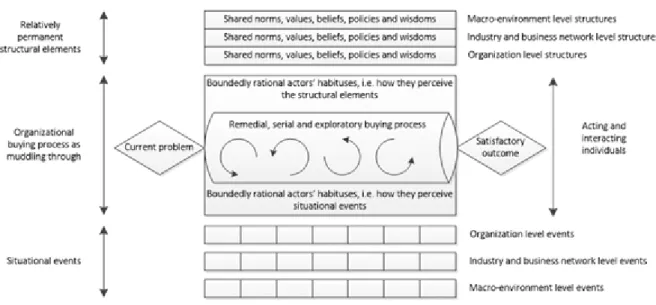

- Purchase behavior of capital goods

This model also emphasizes the importance of the buyer's decision based on the value generation of the purchase. The structural elements of the model indicate the norms and attitudes that prevail in the organization while the buying decisions are made.

Information sources and e-commerce

- Digitalization in purchasing processes

- Information sources and their impact on purchase decisions . 14

- Preferred Sources for business-to-business information

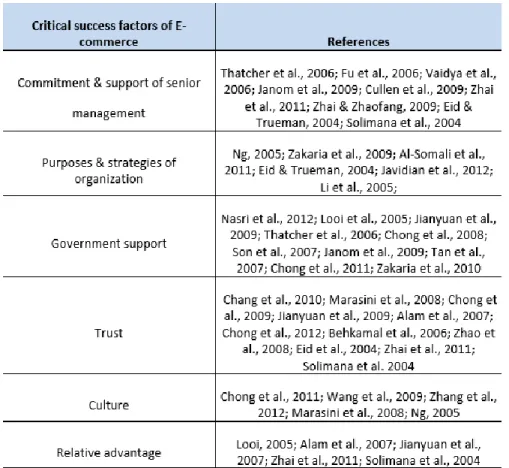

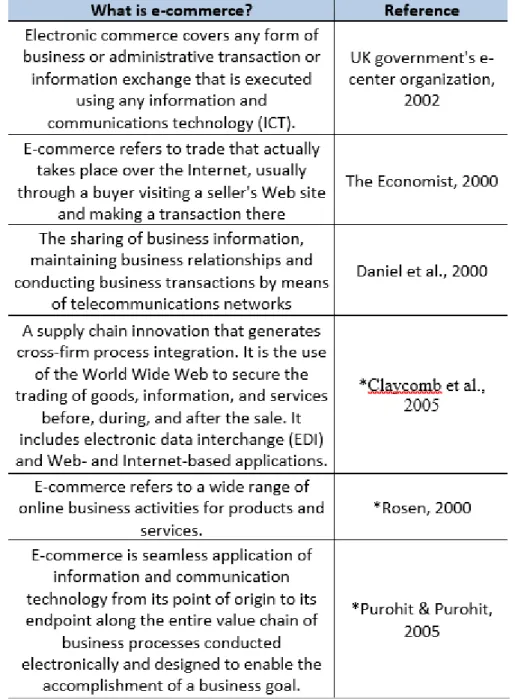

Jianyuan et al., 2009) According to Beige & Abdi (2015) there is a hidden success factor for e-commerce integration, i.e. According to the proposed framework, electronic marketing can be integrated with business processes (Chong et al., 2010).

E-marketplaces

- E-marketplaces and business

- Sales management in business-to-business context

- Sales channels

- The effect of digitalization to business-to-business sales

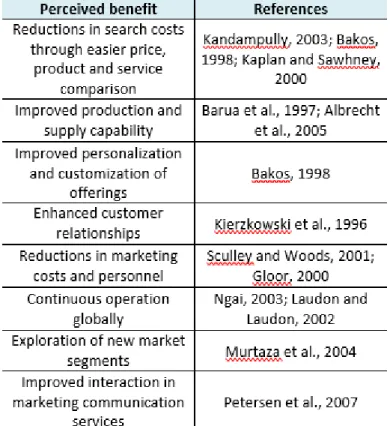

Since it is a virtual platform, trust issues thus arise, and for that purpose it is important that the (Chong et al., 2010) chosen marketplace is secure and meets the needs and wishes of the buyer and seller. Sales management is now more about creating and forming long-term relationships with the customer than focusing on the sale of the product. Similarly, Kuruzovich (2013) is of the opinion that the ever-growing use of the Internet in the sales world has greatly influenced the business conditions to increase sales productivity, which is very beneficial to the organizations.

Due to the advancement in the use of the Internet, the competition around the world has increased significantly. Another advantage of using technology in business is better information flow and more dynamic pricing tools resulting in more time for other value-adding services.

Online selling

- Characteristics of a good online selling website

- Role of social media

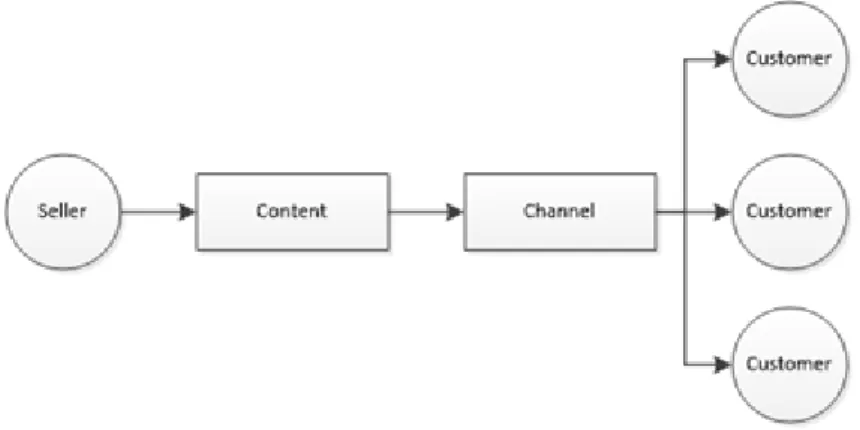

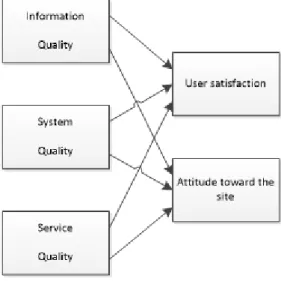

Websites are the face of the company in electronic markets to improve the relationship with the buyer a good website can improve the impression (Hsu et al., 2013). According to research, the characteristics of a website are very important to send an accurate message to the buyer and develop the relationship (Hsu et al., 2013). To increase buyer satisfaction and commitment, reliable information transfer and easy access play a vital role (Hsu et al., 2013).

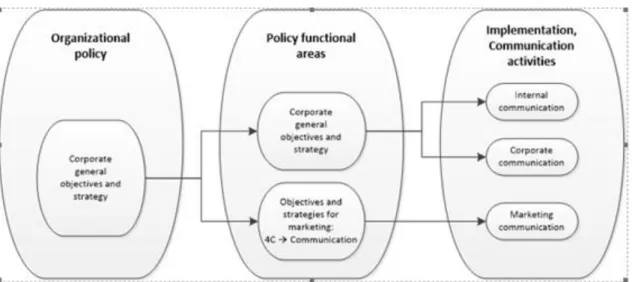

Based on this information system Chen et al. 2013) provided the framework for better understanding of the e-commerce website (figure 2.5.1.). According to Chakraborty et al., (2002) the way in which the information is presented determines the success of the website.

Sales configurators

- Purpose of sales configurator

- Effect of sales configurator

According to Rapp (2013), there is a trend of positive contribution of social media to business performance, brand recognition and customer-retailer loyalty. According to Trentin et al. 2013) with careful use of the sales configurator, this paradox can be avoided and the goal of increased operational efficiency can be achieved. Correct integration of sales configurators is important to get the best results for the company, Abbasi et al. 2013) explains that a company's ability to deliver a customized product at the right price is a must to gain competitive advantage to have.

In support of Tiihonen et al. 2013) says that integrated solutions enable the company to respond efficiently to the customer. According to both, the researcher's configurators can bring efficiency to the business, but it is necessary to understand that the product involves such predetermined variations.

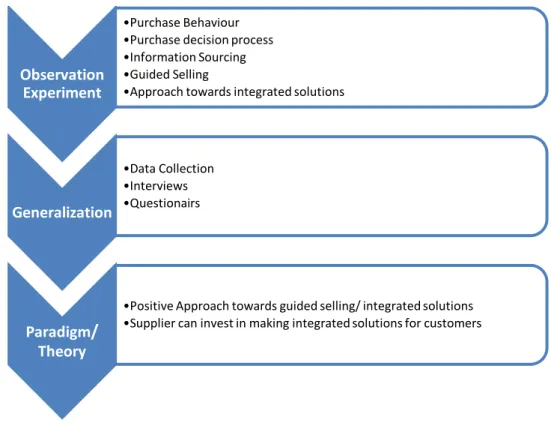

RESEARCH METHODOLOGY

Case company

Survey objectives and structure

Type of research

- Data collection

- Sampling

- Data Analysis

Type: The data will be collected both qualitatively and quantitatively, through interviews and questionnaires on the three dimensions of the research, Investment decision, and information acquisition and guided selling/integrated solution. There are two instruments used for the data collection, questionnaire and interviews with representatives of the firms. The questionnaire was developed with the guidance of the supervising manager of the Company (Scanclimber).

The interviewed firms included firms from different regions, the questionnaire and interviews were done by different clients based on language preferences and ability to understand the purpose of the research. The study presents its results in the form of graphical and numerical representations as it was the preferred way of the company.

EMPIRICAL RESULTS

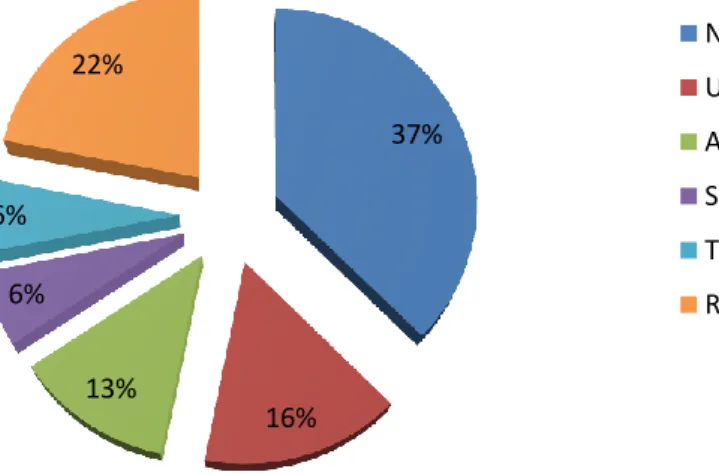

Introduction and demographics

The study was focused on the niche market of the construction industry, i.e. related to the construction industry and machinery rental companies; it was ensured that the survey reached the right audience. As shown in Fig.: 4.1.3, the majority of respondents were from machine rental companies, which was optimistic to see as we could count on them. As shown in fig. 4.1.4 it turned out that most of the participants were connected to the construction industry for over 10 years.

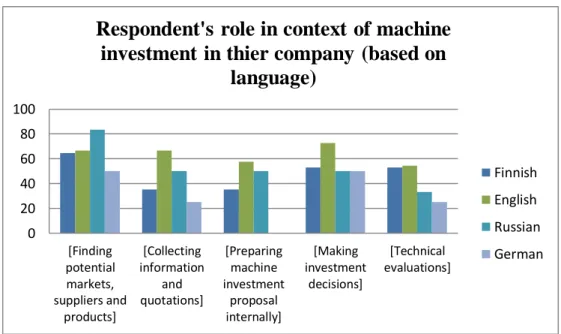

Investment decisions

- Role of respondent in machine investment process

- Machine investment procurement process

In general, when we look at the total response to the machinery investment procurement process, most of the participants have chosen the planned process, but this number is only slightly dominant than improvised investments. However, in Russia, the results say that the preparation for the investment of machines is based on the customer's requirements and order. Until customers have placed or confirmed any order, the investment is not taking place as 83% of their machinery investment process is totally improvised (procurement is done only when needed).

The nature of machinery investment process division based on language When we compare the machinery investment process between car rental companies and construction companies, the aspect is different. As shown in fig: 4.2.2.3, it is clear that the nature of the machinery investment procurement process for rental car companies is more planned, budget-based and project-based.

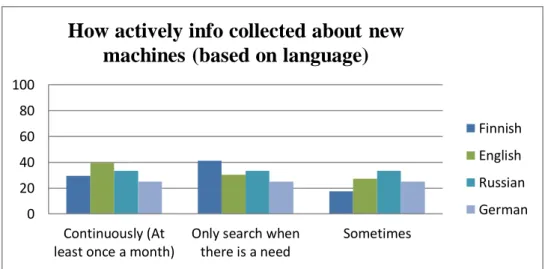

Information search & management

- Collection of information regarding new machines

- Ways to collect information regarding new machines

- Likelihood of searching new information from internet

Again, it is very difficult to come to a clear conclusion about how often companies are asking for information about new machines. In general, information sources such as email newsletters, advertisements, procurement portal are less important in the construction industry. Different sources of information used by respondents to gather new car information (disaggregated by language).

In fig: 4.3.2.2, the aggregated response shows more or less the same picture of utilization of different sources of information, but here we can clearly see categorization of the preferences in three ways, ie. it has been noted that from the results (fig: 4.3. 3.1) that using internet resources is most likely for gathering NEW information.

Suppliers, newsletters & configurator

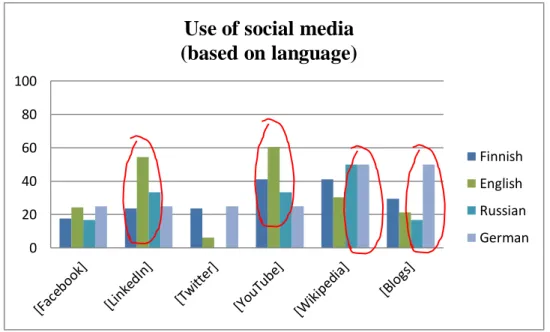

- Social media for business

- Role of social media in investment decisions

- Email newsletters

- Web based configurator

Social media use with responses categorized by language Car rental companies use social media in different ways than construction companies, which is evident when total responses are broken down into these two aspects. Comparing the use of social media in machinery investment preparation between the car rental and construction industries. It can be seen (fig: 4.4.2.1) that in the Russian and German markets, the role of social media in investment decisions is important.

When the response is divided in terms of machine rental and construction companies, the role of social media in investments is somewhat similar (fig: 4.4.2.2). There is no aspect that stands out clearly when it comes to the role of social media.

Interview results

Overall response to the most useful features of the web-based configurator Survey respondents were asked about their expectations of the configurator provided by Scanclimber. From the responses it was also noticed that most companies even though they have a central database, but not everyone from the company is used to updating and sharing information there. It was clearly observed that companies working with less than 10 suppliers were in favor of receiving electronic newsletters, while the more suppliers the companies worked with, the more they lost interest in reading the newsletters.

In terms of comparison between trade journals and e-newsletters, it was again reversed as 50% favored trade journals but the rest did not and here it was noted that larger companies preferred trade journals over e-newsletters. It was even more helpful when some of the respondents suggested some areas that could be improved, such as mentioning educational material regarding Scanclimber machines on the website, allowing dealers to upload project pictures and details, active presence on social media for dealers to post pictures using Scanclimber machines.

DISCUSSION

The research shows that the collected data on new machines in companies is mostly stored on a personal computer. The overall responses show that YouTube is the most important resource used by businesses. It was found that most companies use social media to publish information about new products and projects, promote recent achievements and various campaigns (more than 75%).

The last part of the survey covered the topic of web-based configurator. It turned out that about 45% of the total number of respondents were only familiar with configurator services and the majority of them shared their positive opinion that its implementation in the rental construction sector would prove useful.

CONCLUSIONS

Answer to research questions

As shown in fig 4.4.4.4, the construction industry is already aware of the idea of the integrated solution, but the response to the help of the system is mixed. Almost equal percentage of responses were for and against the implementation of CPQ. Thus, there is a place for research to create the idea that with the generational change that will occur due to technological advances, there may be potential of CPQ and other integrated systems that cannot yet be defined. Digitalization has evolved business activities and company processes are becoming stronger, but there are still a large number of companies that rely on business references to find potential suppliers.

The trust and reliability element of e-marketing is still in question for companies as they seek new B2B relationships. This study will provide academia with insight into researching the use of integrated systems such as CPQ and how other companies are using these solutions to gain competitive advantage and reduce the time spent gathering initial information for purchasing decisions.

Limitations of the study

Contributions

The World Wide Web as an Industrial Marketing Communication Tool: Models for Identifying and Evaluating Opportunities, Journal of Marketing Management, Vol. 34;Why relationships do not fit purchasing portfolio models - a comparison between portfolio and industrial network approaches." European Journal of Purchasing & Supply Management. An empirical investigation of information resources used during the industrial purchasing process, Journal of Marketing Research, vol.

This part of the survey includes some questions related to the process of making investment decisions. 11] Which of the following social media do you use for business purposes when preparing for machine investments. 15] Please give an estimate of the number of machine manufacturers your company currently works with.

Scanclimber thanks you for your participation in the survey and hopes to serve you efficiently as always.