This study examines the possibilities offered by insurance-linked securities from the point of view of the investor. This is done by means of a mean variance analysis, which compares a portfolio optimization including and excluding insurance-linked securities.

B ACKGROUND AND SIGNIFICANCE OF THE STUDY

Barrieu and Albertini (2010) argue that the introduction of insurance-linked securities to a wider range of participants and transparent discussion of the subject is necessary to improve market popularity, accessibility and transparency. Therefore, I believe that further research on the subject is absolutely necessary to enhance understanding of the market and the products involved.

R ESEARCH MOTIVATION AND OBJECTIVES

In an efficient portfolio, how much of the capital should be allocated to insurance-linked securities. Are there any particular risk-return profiles that benefit more from insurance-linked securities than others.

R ESEARCH METHODOLOGY AND DATA

This, in terms of the accuracy and validity of the data, seemed like a natural choice given that the US. The rationale for each element of the research design had to be consistent with the research questions and objectives set.

K EY CONCEPTS AND PREVIOUS LITERATURE AND STUDIES

For this particular thesis, the existing theory is assumed to be correct or sufficient to explain the results of the study. Capital markets are part of financial markets, include riskier and longer-term securities, and can be further divided into four segments: long-term bond markets, equity markets, and derivatives markets for options and futures contracts.

T HEORETICAL FRAMEWORK AND STRUCTURE OF THE STUDY

This thesis is focused on insurance-linked securities and through the theoretical part of the thesis a hypothesis is formed about the advantages and disadvantages of the asset class. The empirical part of the study is focused on the introduction of the data, descriptive statistics as well as a general introduction to the data used and finally the analysis of the data in an attempt to answer the research paper.

F INANCIAL THEORY

- Risk and expected return

- Diversification, covariance, and correlation

- Non-normality

- Different financial instruments

In statistics, variance is defined as the expected value of the difference between the variable and the mean squared. Correlation (formula 8) is related to the covariance of the expected return of any two assets.

P ORTFOLIO SELECTION

- Asset allocation

- Markowitz portfolio theory

- Variance-covariance matrix

- Portfolio performance measures

- Limitations of mean-variance analysis

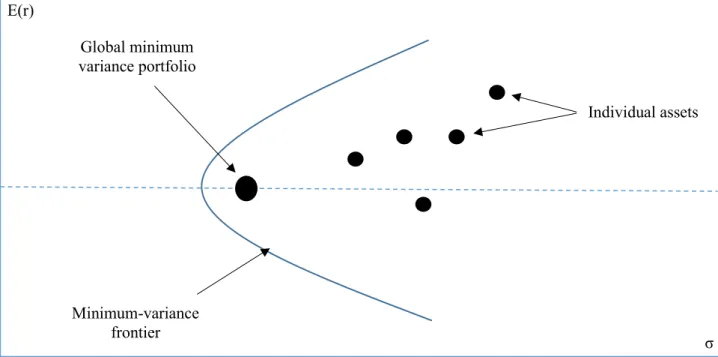

When constructing a portfolio, the asset allocation decision appears to be one of the most important decisions in terms of maximizing returns. The part of the border that lies above the global minimum variance of the portfolio is thus called the effective border of risky assets. When optimizing portfolios, it must be understood that covariance is often present in the return on assets.

Then the portfolio is built by maximizing the probability that the return will be above the benchmark.

T RADITIONAL AND ALTERNATIVE RISK TRANSFER

Traditional risk transfer methods

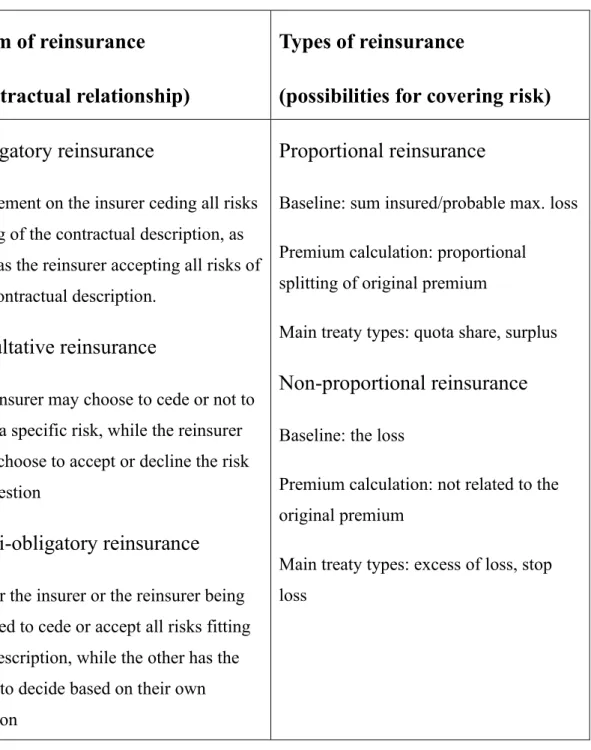

The insurance company can choose to cede or not cede a specific risk, while the reinsurance company can choose to accept or reject the risk in question. Either the insurer or the reinsurer is required to waive or accept all risks that fit the description, while the other has the right to decide as it sees fit. Compulsory reinsurance (or treaty insurance) is based on a contract where the primary insurer is required to cede a share of a risk they have insured to the reinsurer.

Facultative reinsurance differs from mandatory insurance in that the primary insurance company decides on a case-by-case basis whether to transfer the risk to the reinsurer.

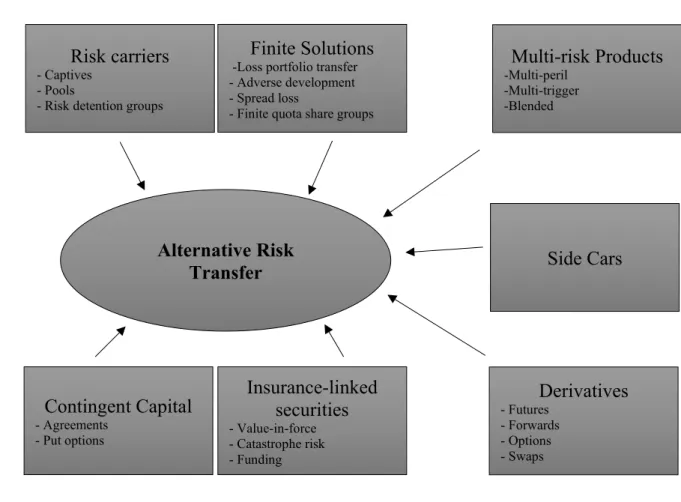

Alternative risk transfer methods

This type of reinsurance can be considered more costly and time-consuming compared to compulsory reinsurance, but the insured risks also differ from the compulsory reinsurance practice. -compulsory reinsurance is very similar to compulsory reinsurance, except that one of the two parties is free to choose the risks it wishes to waive or accept. Captives are typically set up in countries with favorable tax laws to increase the effectiveness of risk transfer and a form of self-insurance.

The reinsurer then uses the premium income of the cedent to purchase assets, the expected income of which is then used to calculate the price of the reinsurance.

S ECURITIZATION

The structuring of securitized assets

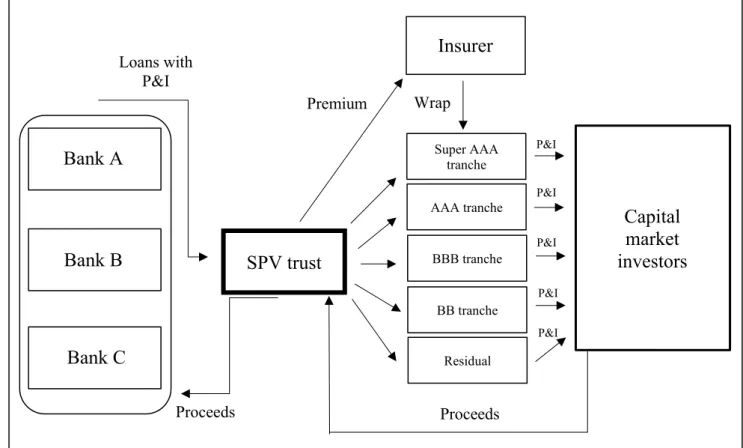

According to Fabozzi and Kothari (2008, p. 27), the sole economic objective of the structurer in a securitization is to maximize the total proceeds from the sale of all bond classes backed by the pool of assets. Firstly, ABS is issued through a special purpose entity, also called a special purpose vehicle, which will be described in more detail below. Fourth, ABS credit is largely defined by fixed assets, i.e. property insurance.

The SPV redirects cash flows and is responsible for the payment of the interest and the repayment of the principle (P&I).

The advantages and disadvantages of securitization

This can then lead to a rating arbitrage, as securitization allows the issuer's corporate rating to remain the same, as the transaction is rated based only on the strength of the assets and credit-enhancing features of the structure of the transaction. Information difficulties arise when the investor cannot sufficiently assess the borrower's creditworthiness. Finally, the investor's perception of the risk will be based solely on the borrower's credit when there is no possibility of spreading the risk to several investors.

However, securitization fills many of the holes left without financial intermediaries or public debt markets.

I NSURANCE -L INKED S ECURITIES

Non-life insurance securitization

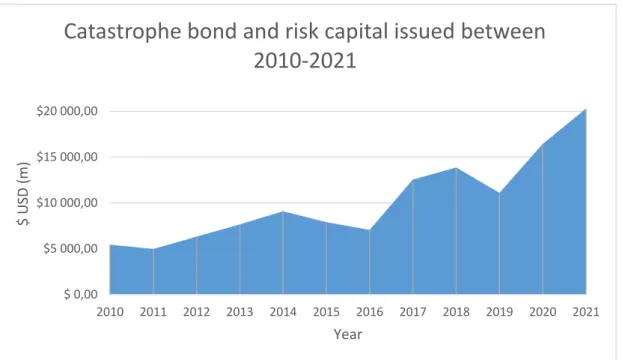

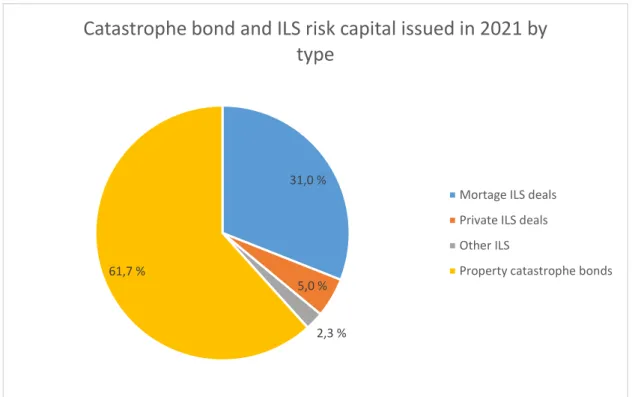

When the losses caused by a specified catastrophic event exceed a certain amount, the proceeds from the cat bonds are used to cover the compensation payments. Furthermore, because the proceeds from the bond issue are kept in the security, the insurance company is not dependent on the reinsurance company's solvency. Industry loss triggers are considered more transparent and it is easier for investors to calculate the correlation between cat bonds and other instruments.

Unlike the catastrophe bonds described earlier, the typical characteristic of the risk associated with non-catastrophe insurance securitizations is high frequency but low severity.

Life insurance securitization

Since the operation of a life office is quite risky, it is therefore obvious that securitization and risk transfer of part of the risk may be appropriate from a risk management perspective. Most of the deals found exceed USD 100m and perils covered range from extreme mortality to medical benefits claims that pose inflation risks. Although it appears that life insurance securitizations are not extremely common, the size of the deals as well as the continuity suggest that they provide benefits for some issuers and cedants.

They believe securitization can be used from an investor's perspective to create non-redundant securities that enable improved portfolio efficiency.

Insurance related CDOs

On the other hand, longevity is a risk for a life insurer as an increase in longevity would naturally lead to more annuity payments in the long run. Based on information found in the Artemis deal directory, life insurance incentives are usually based on an index or a certain parameter. For example, in 2017 a pandemic disaster bond was issued, which with the emergence of the Covid-19 coronavirus pandemic was later triggered leading to massive payments of USD 195.84 million, distributed to 64 of the world's poorest countries with reported cases of COVID-19.

Cowley and Cummins (2005) note that regulatory requirements are particularly a major contributor to underwriting in the life insurance industry.

D ATA AND METHODOLOGY

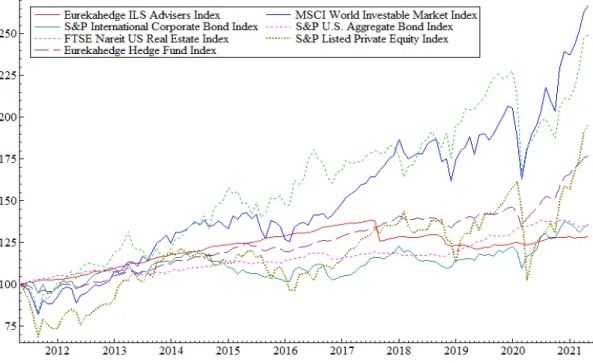

It contains private equity companies that fit the criteria set for the index in terms of size, liquidity, exposure and activity. The index includes only companies that are in the primary business of private equity investment with a minimum total market capitalization of USD 150 million, are listed on developed market exchanges and are liquidly traded. It was naturally chosen as the index representing ILS in this study, given that it is the first benchmark that compares the performance of different ILS fund managers in the market.

However, the index provides a reasonable assessment of the performance of fund managers by focusing on the ILS markets specifically.

D ESCRIPTIVE STATISTICS

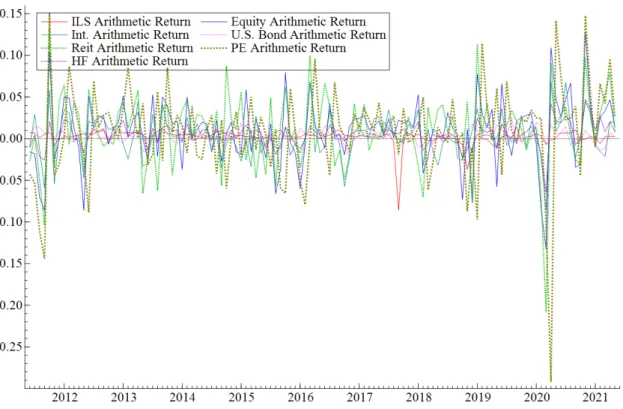

To better understand the data used for the study, a look at the descriptive statistics for each asset class is required. The negative skewness can be seen when returns are concentrated on the left side of the distribution. In particular, you can notice the excess kurtosis that characterizes ILS returns, with the left side of the distribution peaking with returns around -9% and -4%.

Thus, it appears that the arithmetic returns for most of the assets selected for the study are not normally distributed, as is typical of financial instruments.

E FFICIENT FRONTIER , PORTFOLIO SELECTION , AND V ALUE AT R ISK

Since the ILS index selected for this study has a low return, it should come as no surprise that the efficient frontier only includes ILS to a certain extent. As mentioned earlier, the efficient frontier only includes ILS up to a point, which may be difficult to see in the traditional efficient frontier shown in Figure 12. The results suggest that the portfolio with ILS has lower risk than the one without ILS, at least from a VaR perspective.

These results suggest that the downside risk of a portfolio with ILS included appears to be smaller.

A NSWERS TO THE RESEARCH QUESTIONS

The research found that the mean variance framework does include insurance-linked securities on the portfolios in the efficient frontier to approximately 4.5-5.0% annual expected return. The research found that the lowest volatility portfolios per given return level did include insurance-linked securities, indicating that the assumed low correlation with other assets had a significant effect on the volatility of the portfolios. The research suggests that higher Sharpe ratios were obtained by including insurance-linked securities in the portfolio.

This suggests that for an investor trying to minimize risk and maximize returns per unit of volatility, insurance-linked securities may be a good choice.

C ONCLUSIONS

Using mean-variance portfolio optimization, we found that when imposing no constraints on the optimization model other than the total portfolio weight to be 1, with no short selling allowed, the optimization model consistently included ILS in the portfolios' efficient frontier at lower rates of return. In addition, we achieved lower volatilities when including insurance securities in the portfolio optimization within the mean variance. The low risk of the asset has some drawbacks, as the effective asset limit has ceased to include collateral-linked securities somewhere around 4.5-5.0% of expected returns.

This cannot be understated because for investors who recognize and accept the potential downsides that come with the asset class, they also get extremely reliable returns with low volatility.

E VALUATING THE STUDY AND SUGGESTIONS FOR FURTHER RESEARCH

Fortunately, the mean variance analysis is performed with annual returns and using a monthly or annual VaR is typical, but there is still room for improvement in, for example, the descriptive statistics. Strategic asset allocation: determining the optimal portfolio with ten asset classes.” The Wealth Management Magazine 12, no. A note on using modified Value-at-Risk.” The Journal of Alternative Investments 14, no.

Modified Average Value-at-Risk Optimization with Hedge Funds." Journal of Alternative Investments 5, no.