Studying the ownership structures of globally listed airlines from 2010 to 2019 has provided a comprehensive study of the relationship between ownership structure and financial performance. Therefore, the initial assumption in this thesis is still that state-owned airlines are inferior in terms of financial performance and value creation.

Structure of the thesis

The general assumption is that state-owned companies underperform those wholly privately owned companies. The theory that state firms underperform private firms has often been explored in state ownership studies, such as Boardman and Vining (1989), Shleifer (1998), La porta et al.

2 LITERATURE REVIEW

Family, institutional and CEO ownership

According to the authors, cash flow ROA is the most relevant measure in their study because it is focused on current performance. According to their findings, an institutional investor's ownership has a positive impact on the firm's cash flow return.

State ownership

The object of the study is the effect of state ownership on the market value of the company. According to the authors, ultimate ownership provides a better definition of the dimensions of state ownership in companies.

Airline industry

Measured by ROA and Tobin's Q, their results show that companies with state ownership do not perform worse than fully privately owned companies. State-owned companies perform no worse than fully privately owned companies measured by ROA and Tobin's Q.

3 THEORETICAL BACKGROUND

Agency theory

- Agency problem between small and large shareholder

In addition, maintaining the control systems and monitoring management activities is an additional cost for the owners. They believe that the top management of the company should not bear a substantial part of the financial consequences of their decisions. According to their research, sharing the decision-making process among the agents of the organization is important for the survival of the organization when important decisions need to be made.

However, the benefits of separating ownership and control depend on the characteristics and size of the firm. As a follow-up, the aforementioned theory was created based on the findings of studies by Jensen and Meckling (1976), Fama and Jensen (1983), Shleifer and Vishny (1997) on the currently recognized Type I agency problem. owner, can be very different depending on the type of owner.

A study by Villalonga and Amit (2006) finds that the previously experienced representation problem between owners and managers is more present in institutions and companies, while representation problem II is a more frequent problem in family firms. The aforementioned research concludes that the problem of representation between owners and managers (problem of representation I) is more widespread in institutions and companies, while the problem of representation II is more widespread in family businesses.

4 OWNERSHIP TYPES AND AIRLINE INDUSTRY

- State vs. private ownership

- Institutional ownership

- Corporate ownership

- History of regulations and privatization impacting ownerships

According to Shleifer (1998), a number of state-owned companies are remnants of the economic ideologies of the 1930s and 1940s period where private ownership was generally considered incapable of implementing socially beneficial activities. However, after the end of World War II, Western economies experienced a rapid transition to privatization and the capitalist incentive of private ownership to innovate and develop the economy was recognized. In addition, it was suggested that institutional owners would be more long-term investors, giving the management of the company a better opportunity to plan operations independently for the long term.

Institutional investors are therefore considered trusting in the eyes of the market because they are assumed to have more inside information about the company's operations. They found that ownership between companies has a significant beneficial impact on the share price of the acquired company, especially when it results in an alliance, joint venture, or other product collaboration. Fee, Hadlock and Thomas (2006) study corporate block ownership from the perspective of the supplier as one of the common goals for ownership relationships between companies is the goal of expanding cooperation with the supplier.

This law eventually led to the split from the Civil Aeronautics Board (CAB), which regulated the US. After the implementation of deregulation, many of the new airlines faced challenges, including financial instability, often leading to bankruptcy.

5 DATA AND METHODOLOGY

Data

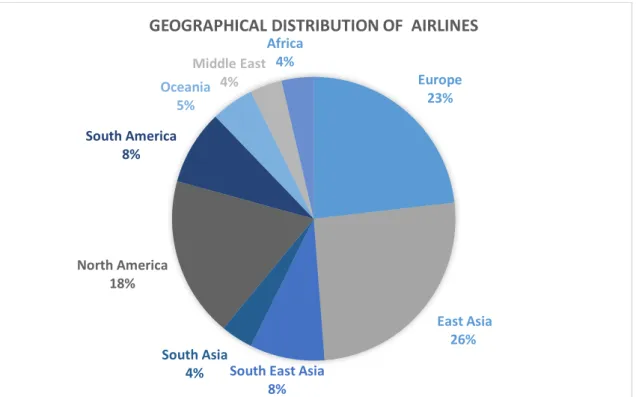

Although the requirement to be listed on the stock exchange, the operation of international flights and the time of establishment significantly limit the number of companies in this study as well. The research period of this study took place between the years 2010 and 2019, which allows for a long-term comparison. In the first half of this period, the economy, especially tourism and air transport, is still recovering from the recession caused by the 2008 financial crisis.

The effects on tourism and air traffic following the 2008 financial crisis were far-reaching, prompting reforms in the airline industry. Consequently, the recovery of the travel and air traffic industry has been relatively slow, and according to some studies, tourism and the airline industry did not fully recover to pre-financial crisis levels until 2014. In the second half of the study period, the economy is expanded rapidly, and tourism along with the airline industry have seen particularly rapid expansion.

Variables

- Measures of financial performance Tobin’s Q

- Ownership variables

- Control variables

If the score is greater than 1, the company appears to be overvalued relative to its total asset replacement cost. Return on assets (ROA) describes how much return the company gets on its equity. The financial ratio can be calculated by dividing the company's profit by its book value, showing how profitable a company is in relation to its total assets.

The first formula calculates the ratio of the company's net income to book value, and the second compares earnings before interest, taxes, depreciation and amortization (EBITDA) to total assets. Tobin's Q is a forward-looking financial performance indicator that incorporates investors' expectations of the company and can reflect information about the company that cannot be discovered by analysis of financial statements alone. Higher ROA value indicates that the company is able to earn more money with a smaller investment.

In previous literature in the same field, firm size defined by total assets has been shown to be a good measure to describe firm growth and reveal its impact on firm financial performance. The company's age is described by the natural log of the years since the company was founded.

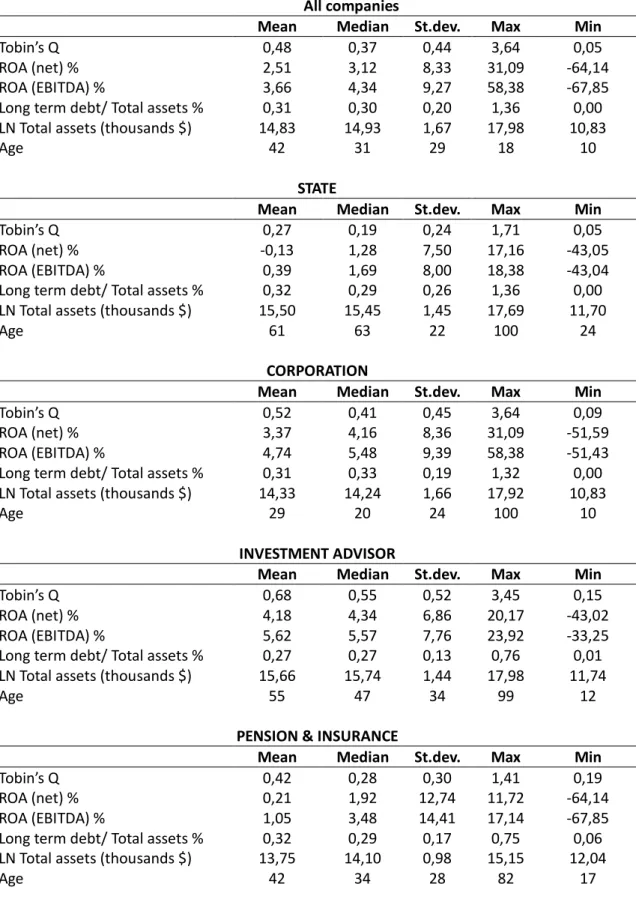

Descriptive statistics

MAJORITY OWNERS OF PUBLICLY LISTED AIRLINES

Methodology and regression model

The aim of this thesis is also to find out how different principal and majority owners affect the financial performance of airlines. In addition, the aim is to determine with the help of control variables the factors that influence financial performance. The regression model was formulated using rate of return on assets and market value based on a key figure Tobin's Q as measures of financial performance.

Tobin's Q is used as an explanatory variable in one model, while the rate of return on assets is used in the other. The different main and majority owner types are defined by binary dummy variables, in addition there are three control variables in the model. Performance = Tobin's Q and return on assets using EBITDA or using net income STATE = Dummy variable that takes a value of 1 if it is in the government ownership category and a value of 0 if it is not in the government ownership category.

CORP = Dummy variable which takes a value of 1 if it is a business owner category and a value of 0 if it is not in a business owner category. INV = Dummy variable that takes a value of 1 if it is an investment advisor ownership category and a value of 0 if it is not in an investment advisor ownership category PNSN&INS = Dummy variable that takes a value of 1 if it is in pension & insurance.

6 EMPIRICAL RESULTS

Regression results

- Results from 2010-2014

- Results from 2015-2019

The results show that measured by Tobin's Q and ROA (EBITDA and Net), higher ratio of debt to total assets has a negative effect on the financial performance of airlines. The results of debt on company performance are statistically significant with Tobin's Q and ROA (EBITDA). The airlines' size, defined by total assets, has a negative effect on the financial performance measured by Tobin's Q and ROA (EBITDA and Net).

The results of Table 8 confirm that state-owned airlines perform worse financially than private airlines, as measured by Tobin's Q and ROA (EBITDA and net). For the dummy variable Investment Adviser, measured by Tobin's Q and ROA (EBITDA and Net), the results show slightly smaller positive values compared to the results in Table 7. For the size and age variables, the results are statistically significant at the measured 1% level by Tobins Q.

Results for Investment Adviser In the latter study period, shows better financial performance measured by Tobin's q and ROA (EBITDA and Net). Regarding pension and insurance dummy, the results show negative financial performance measures compared to state-owned airlines measured by Tobin's Q and ROA (EBITDA and Net).

7 CONCLUSION AND REMARKS

Among the private airlines in the data, corporate ownership airlines performed second best. Investment adviser and pension and insurance categories form the institutional owners in the thesis' data. The airlines in the Investment Advisor category performed best among all the ownership categories in the data.

According to the study by Elyasiani and Jia (2010), a stable and profitable institutional investor also creates investor confidence in the company they own. The results did not change significantly between time periods and the rankings in the different categories remained the same. It's worth noting, however, that all categories outperformed from 2015-2019, as measured by Tobin's Q and the airlines in the investment advisor category with the largest margin.

In particular, ownership structures in the aviation industry are still underrepresented in the literature, which represents a special opportunity for further research. Several airline ownership arrangements change over time, limiting the airlines in the data, making it difficult to conduct an analysis, especially over a longer study period such as this thesis.

Changes in ownership and control of East Asian companies between 1996 and 2008: the primacy of politics. Measuring the productivity changes of Chinese airlines: the impact of the entry of non-state-owned airlines. Canadian Public Policy/Analyse de politiques Study on high-quality development of state-owned enterprises”, China Industrial Economics, Vol.

Available on the World Wide Web: