I would like to express my warm thanks to Professor Panagiotis Artikis, supervisor of the diploma thesis, who with his guidance, experience and substantive suggestions contributed decisively to the realization of this study. The purpose of this assignment is to present the basic concepts related to accounting and financial valuation of assets in a company, as it is extremely important that someone estimates the assets of the balance sheet correctly, because it directly affects the decisions of the top management in a company. as well as a tax auditor's judgment on bookkeeping audits.

Introduction - Basic Concepts

- Definition of Valuation

- Ways to Determine the Value of a Company

- Market Efficiency

- Behavioral Finance

- Conclusion

Liquidation value: This is the value of the company's assets if they are to be sold separately. Going concern value: This is the value the company has in the investment community as an active company.

The Theory of the Accounting Valuation

The Concept of Fixed Assets

- The Accounting Valuation of Fixed Assets

- The Accounting Valuation of Fixed Assets – The Initial Recognition

- The Accounting Valuation of Fixed Assets – The Later Time

- Depreciation of Fixed Assets

- Depreciation Carrying Out

- Depreciation Methods

- Fixed Asset Ιmprovement

- Fixed Asset Ιmpairment

- An example of a Fixed Asset Ιmpairment, Improvement & Reverse

- The Fair Value

- Financial and Operating Leasing

By the term 'depreciation' we mean the reduction in the value of a fixed asset due to the damage it has suffered, either through the passage of time (time wear) or through use (functional wear and tear) or through scientific and technical discoveries and inventions (economic obsolescence). The company makes a revaluation of fixed assets based on the research of the certified appraiser.

The Concept of Inventories

- The Accounting Valuation of Inventories

- The Accounting Valuation of Inventories – The Initial Recognition

- The Accounting Valuation of Inventories – The Cost of Producing a Product. 19

- The Accounting Valuation of Inventories – The Later Time

- The Continuous Stocktaking

- The Periodic Stocktaking

- The Inventory Valuation

- Inventory Valuation Prices

- The Inventory Valuation according to the Greek Accounting Standards

- The Methods of Costing or Inventory Valuation

- The Accounting Valuation of Inventories according to the G.A.S.&I.A.S. 28

Cost of goods sold is usually calculated once at the end of the year, after the physical inventory and according to the equation shown above. The indirect cost of production (fixed or variable) of the period is distributed (divided) in a reasonable proportion to the cost of production of individual products or services.

The Concept of Αccounts Receivable

- The Accounting Valuation of Accounts Receivable

- The Accounting Valuation of Accounts Receivable – The Later Time

- Claims Impairment Audit

- Distinction of Receivables according to their Solvency

- Specializing in Accounts Receivable

The book value is significantly higher than the fair value of the items (when the fair value exists) or The present value of the estimated amount to be received from the asset, calculated using the initial effective interest rate; or As part of monitoring the company's operations, double registrations are carried out.

The 'Unearned interest for unrelated customers' account monitors the interest included in the receivables from customers at the end of the year. This account is the opposite of the main accounts receivable account "Customers unrelated entities - nominal amount" and is credited with the amount of the deposit. This account is the opposite of the main account "Customers unrelated entities - nominal amount" and is credited with the amount of the impairment.

The discount applies to the prepayment by the holder of the value of his security that has not yet matured. The present value is obtained when the discount is subtracted from the face value of the invoice. Interest from the day of the discount until the day following the maturity date of the note.

The Theory of the Financial Valuation

- Approaches of Financial Valuation

- Discounted Cash Flow Valuation

- Discounted Cash Flow Valuation – Cash Flows of Equity

- Discounted Cash Flow Valuation – Cash Flows of Firm

- Discounted Cash Flow Valuation – Advantages

- Discounted Cash Flow Valuation – Disadvantages

- Discounted Cash Flow Valuation – When it works best

- Relative Valuation

- Relative Valuation – Advantages

- Relative Valuation – Disadvantages

- Relative Valuation – When it works best

- The Valuation Parameters

- The Valuation Parameters – Cost of Equity

- The Valuation Parameters – The Growth Rate

- The Valuation Parameters – The Terminal Value

- Discounted Cash Flow Valuation – The Dividend Discount Model

- Discounted Cash Flow Valuation – The Free Cash Flow Models

- Relative Valuation

On the other hand, in an efficient market the best estimate of a value is the market price. An estimate of the discounted rate to apply it to the cash flows to get the present value. The present value is thus the value of all claims on the company, as is the value of the entire company.

In the relative valuation method, the value of the asset can be estimated by investigating how the market prices of similar or equal assets. The relative valuation approach is much more likely to reveal market sentiments and perceptions than the discounted cash flow model. As can be seen from the equation above, the slope of the regression corresponds to the beta of the stock, which measures the riskiness of the stock.

It reveals a company's average leverage over a period as opposed to current leverage. Since it is very difficult to predict dividends to infinity, simplified versions of the general equation above are actually used. Α relative valuation model could be defined as a method of business valuation that compares the value of a company with that of its competitors or similar companies in the industry in order to estimate the financial value of the company.

The Company “Plaisio Computers S.A.”

Group Structure

PLAISIO COMPUTERS JSC: "PLAISIO COMPUTERS JSC" is active in the marketing of computers, office supplies and telecommunications equipment. Its share capital amounts to one million two hundred and fifty seven thousand and forty six euros and is 100% owned by "PLAISIO COMPUTERS SA". PLAISIO REAL ESTATE SA: The company "PLAISIO SA REAL ESTATE DEVELOPMENT & MANAGEMENT" has its headquarters in the municipality of Kifissia, 88 Vas.

Othonos Street, and is registered in the Register of Societes Anonymes in the Prefecture of East Attica with number 45649 / 01AT / B / 00/137. PLAISIO ESTATE JSC: The company "PLAISIO ESTATE JSC" is active in the field of purchase, acquisition, marketing, construction, configuration, sale, exploitation, management and development of any type of real estate. Plaisio Real Estate SA" provided to "Plaisio Computers SA" services worth € 747 thousand, related to leasing (rental) and provision of services from real estate leasing (€ 600 thousand and € 147 thousand, respectively).

Plaisio Computers SA” invoiced “Plaisio Computers JSC” for sales of goods to the latter amounting to € 3,735 thousand. It is made clear that the company "Plaisio Estate JSC" for the aforementioned period had income of 120 thousand € from. Plaisio Computers S.A.” priced "Buldoza S.A." for the provision of services and sales of goods in the amount of € 213 thousand.

Evolution of key effect sizes (amounts in millions of euros)

Τhe firm’s Accounting Value of Share

The gross profit margin ratio is shown as a percentage of gross profit over net sales. The net profit margin ratio is a very important indicator of a company's overall financial health. The net profit margin ratio is shown as a percentage of net income over net sales.

Compliance with the state's emergency measures and recommendations was and remains complete. In addition, according to the established practice of the Group, most receivables from customers are insured. It also requires management judgment in applying the group's accounting principles.

Also, according to the Athens Chamber of Commerce, the expected growth rate of the above sectors is -0.4%. Also, this company is rapidly adapting to e-commerce and new market needs. Thus, from the above we conclude that the value of the stock of "Plaisio Computers S.A.".

Financial Analysis of Accounting Statements 2015-2019

- Profitability Ratios

- Activity Ratios

- Liquidity Ratios

- Leverage Ratios

- Conclusions based on Ratios

Prospects - Strategy – Forecasts

- S.W.O.T. Analysis

- Management Εstimates: Strategy & Risks

Since the outbreak of the pandemic in Greece, the adjustment of the company's business continuity plan was implemented immediately. Both during the lockdown and after the measures were lifted, business travel has been reduced to what is absolutely necessary. In addition, the company distributed tablets to students at 87 schools in remote areas of Greece in the middle of the lockdown.

The following shows the sensitivity of the profit for the period as well as the equity to a change in interest rates of +1% or -1%. In any case, the group's limited exposure to borrowed funds makes any upward change in interest rates irrelevant to the group's results. The Group does not have a significant concentration of credit risk with any of the parties, mainly due to the wide spread of the customer base.

The group's operations in Bulgaria do not increase this risk, as the exchange rate of the Bulgarian currency to the euro is stable. The Group's sales are seasonally limited, as approximately 57% of them take place in the second half of the year. However, the competitive landscape could change in the future either by the entry of new companies or by a change in the strategy of existing ones.

The Financial Valuation of “Plaisio Computers S.A.”

Financial Statement Preparation Framework - Accounting Assumptions &

Due to the fact that the company uses International Accounting Standards, no adjustments will be made to the cash flows that are published, as we estimate that they represent the current activities of the company as far as possible, due to the fact that they have been adapted to modern international standards of accounting. Also, the accounting principles followed for consolidation and capital, recognition of income and expenses, tangible long-term assets, intangible assets, goodwill and depreciation, operating or leasing and financial assets are regulated according to International Accounting Standards.

Valuation Model Selection

- Selection of Cash Flow Discount Model

- Valuation of “Plaisio Computers S.A.” using the FCFE – 2 stages Model

- Determination of Parameter Values - Calculation of the discount rate (r e ) 83

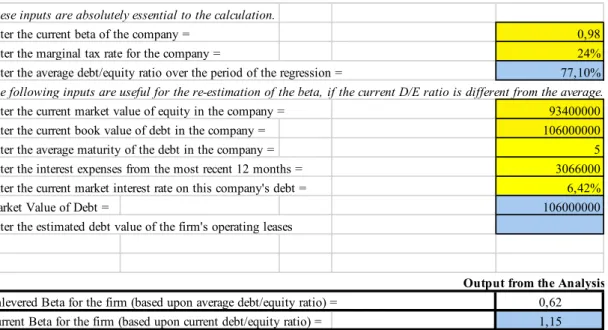

- Determination of Parameter Values - Calculation of the beta coefficient (b)

- Financial Valuation of “Plaisio Computers S.A.” using the FCFE – 2 stages

And we add the country's risk, calculated based on the spread of Greek bonds, which is the interest rate spread between the 10-year Greek bond and the corresponding German bond, which is 1.1 this period. For the entire year of 2020, the total turnover for the entire Greek market of the above-mentioned sectors is therefore estimated at 2 billion euros. If we divide the turnover of "Plaisio Computers SA" with the 2 billion turnover of the above sectors, we have a market share = 15.86%, which we will consider stable in the long term, as the company increasingly adapts to electronic commerce, but it has strong competition from “Skroutz”, “Amazon”, etc.

The long-term growth rate will be equal to the yield on the 10-year Greek bond, which is currently equal to 0.63%. In the following excel, we will equate the market value of debt with the book value of debt, due to the fact that the company has adopted IFRS, which is extremely strict in the presentation of the accounts, in order for the companies not to confuse the shareholders. As for the entered average debt/equity ratio - where debt = total liabilities, equity = total equity - the average of the years' debt/equity ratio is 0.771.

Furthermore, according to the provisions of Article 22 of the Law, the income tax rate for legal entities in Greece is equal to 24%. The following inputs are useful for re-estimating the beta if the current D/E ratio deviates from the average. The current market value of the company's stock is $3.60, which means the company's stock is overvalued. So we do not recommend any investor to invest in this stock.

Epilogue & Conclusions

Damodaran, A., (2013), Investment Appraisal: Tools and Techniques for Determining the Value of Any Asset, John Wiley & Sons, 3rd Edition, New Jersey. Ανακτήθηκε από https://www.eea.gr/arthra-eea/sta-500-ekat-evro-i-agora-ilektrikon-ilektronikon-idon-to-a-trimino-2020/. Ανακτήθηκε από https://www.plaisio.gr/IR/Financial-Information/Financial-Results Pratt J., (2013), Financial Accounting in an Economic Context, Wiley, 9th Edition, New York.