The banking industry has woken up to the importance and impact of the Internet on the operations and competitiveness of banks, and for this reason e-banking is now considered essential for any bank. Although the use of the Internet and e-banking in Greece is still quite limited, Greek banks have invested generously in e-banking systems. The most important success factor of e-banking services is the efficient and quality online support service.

The definition of e-banking

History and evolution of e-banking

The tremendous growth in the new bank's customer base was overshadowed by the fact that online bank customers eventually had to turn back to traditional banks to cover what electronic banks could not fulfill. These banks had to respond to this, so they quickly began to develop alternative service networks to the standards of electronic banks. It is clear that any attempt to predict the moment when the scales will tip in favor of electronic banking while simultaneously significantly shrinking the role of the branch is risky.

E-banking classification

- Telephone Banking

- Internet (Online) Banking

- Mobile Banking

To use the telephone banking service, if he/she is a bank card and telephone customer. The system is integrated with the bank's host computer system so that the remote banking customer can access other automated services of the bank. The method of the invention includes the steps of entering a customer banking request from a banking request menu on a remote PC over a network, receiving the request on the host computer, identifying the type of customer banking request received , automatically logging the service request, comparing the received request against a stored table of request types, where each of the request types has an attribute to indicate whether the request type can be fulfilled by a customer service representative or by an automated system; and depending on the attribute, sending the request to a queue for processing by a customer service representative or to a queue for processing by an automated system.

- The services offered by e-banking

- The services offered by the Internet banking

- Financial transactions

- Transfers within the bank

- Domestic and international remittances

- Loan payments

- Credit cards payments

- Payments to the State

- Public Corporations and Organizations (DEKO) bill payments

- Payments for fixed and mobile telephony

- Insurance payments

- Payments to third-parties

- Bulk payments – Payrolls

- Status of orders

- Commissions for transactions

- Information transactions

- Accounts’ information

- Cards’ information

- Information on checks

- Information on loans

- Applications

- Support services

- The services offered by Phone banking

- The services offered by Mobile banking

- Available applications from the banks

Own credit card payments: The user chooses the bank debit account and the number of the credit card he/she wants to pay with. He/she then enters the amount he/she wants to transfer for the credit card payment and the date on which he/she wants the payment to be made. He/she then enters the amount he/she wants to transfer for the credit card payment and the date on which he/she wants the payment to be made.

- Advantages and disadvantages by using e-banking

- Advantages and disadvantages of e-banking services

- Benefits for banks

- Disadvantages for banks

- Benefits for customers

- Disadvantages for customers

The manufacturer's security codes, which are displayed on the screen of the user's mobile phone, can be entered in addition to his username and password when he accesses his Alpha Web / Mobile Banking profile, as well as in any case similar to a physical device (i.e. login, transfer to non-login accounts, adding/changing banking products such as accounts/cards/loans). They can take advantage of the reduced cost of e-banking instead of opening a new branch in a rural or remote area. Cost of time and money: Banks should spend time and money to promote the use of e-banking services, especially in the case of Internet and mobile banking.

There should also be training programs for staff working in branches to acquire the skills and background required to promote the use of e-banking to customers in their branch. No time limits: Customers of e-banking services are free to carry out their transactions 24 hours a day throughout the year. Companies can use their employees' time more productively, as the accounting department can use e-banking services to automate various procedures, such as salary payments.

Security: Although security concerns are of paramount importance for adoption of e-banking services, increased security of alternative channels is beneficial to customers. 24 hour support: Usually, banks have a help desk dedicated to support e-banking customers 24 hours a day all week. Security concerns: This is probably the most critical factor that adversely affects potential customers of e-banking services.

Each e-banking channel has its own security issues, but it can be argued that when someone is concerned about the security of e-banking, the Internet is the first thing that comes to his or her mind.

- E-banking security

- Opportunities and threats

- General security policies

- Strengthen of e-banking services

- The step to OTP devices

- Algorithms for producing OTP

- Advantages of OTP devices

- Distribution & activation

- Threats and risks by using e-banking

- Threats which a user may deal with

- Bank’s suggestions for the users

For example, using a username and password is one factor, it's something users know, and it's the most common usage. The second is always something that “the user has” (see basic factor 2), it can be a security device or, for example, a code sent to the mobile phone registered with the bank. In addition, the financial institutions offer the same user authentication with Mobile Banking as with Telebanking and Internet Banking.

The bank's system first decodes the information it receives with the same key (as defined at the beginning of your online session) and then processes it. The bank's systems follow the same encryption process to send the information to you. It guarantees that no one else can impersonate the bank and gain access to the user's personal data.

Access filters to the Bank's IT systems, hardware and software devices are placed between the Internet and the Bank's IT systems. It filters incoming data according to security policies defined by the Bank's security group and international models. Time-based operation: In the case of time-based operations, the security appliance allows you to choose between different granularities.

In the event that they are not, they can visit a bank's branch to fill out an application form to activate their account's e-banking capabilities.

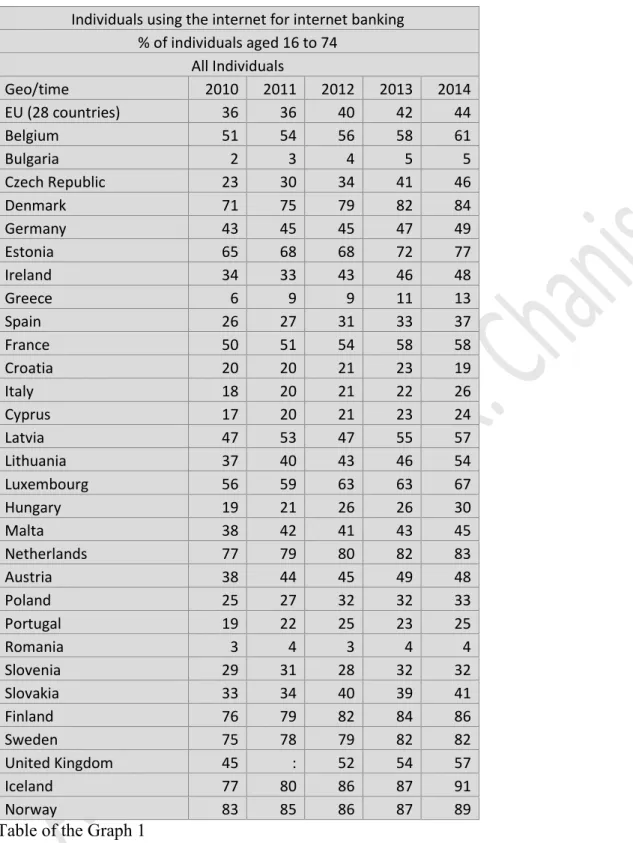

- Analysis results of Eurostat

- Methodology

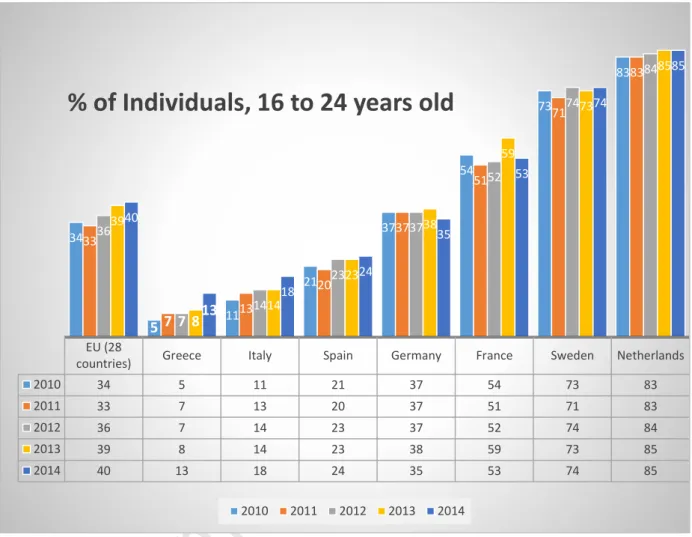

- Individuals 16-24 years old

- Individuals 25-54 years old

- Males and females 16-74 years old

- Individuals depending on formal education

Bron:http://ec.europa.eu/eurostat/tgm/mapToolClosed.do?tab=map&init=1&plugin=1&languag e=en&pcode=tin00099&toolbox=types. 7Eurostat: https://ec.europa.eu/digital-agenda/sites/digital-agenda/files/scoreboard_digital_skills.pdf 38. Bron:http://ec.europa.eu/eurostat/tgm/refreshTableAction.do?tab =tabel&plugin=1&pcode=tin00099&taal=nl.

Source: http://ec.europa.eu/eurostat/tgm/refreshTableAction.do?tab=table&plugin=1&pcode=tin00099&language=en. According to Eurostat, formal education has a very close relationship with the use of the new technologies8. 8 https://ec.europa.eu/digital-agenda/sites/digital-agenda/files/scoreboard_digital_skills.pdf EU (28 . countries) Greece Italy Spain Germany France Sweden Netherlands.

Source: http://ec.europa.eu/eurostat/tgm/table.do?tab=table&plugin=1&language=en&pcode=tin00099 Source: https://ec.europa.eu/digital-agenda/sites/digital-. The proportion of people with no or low formal education is really low for all the countries even for the northern countries, which are generally really high. Source: http://ec.europa.eu/eurostat/tgm/table.do?tab=table&plugin=1&language=en&pcode=tin00099 37.

Source: http://ec.europa.eu/eurostat/tgm/table.do?tab=table&plugin=1&language=en&pcode=tin00099.

EMPIRICAL RESEARCH – QUESTIONNAIRE

However, there are still people of both genders who are not yet convinced about the features of E-banking, as we can see in the diagram/graph. As we can see, the user's education level seems to be one of the most important factors. According to the data available so far, e-banking is expected to have a positive impact on the profitability and development of the banking sector and contribute to a better level of service for customers.

Most banks are currently able to offer a plethora of services via the Internet. The financial results of such implementations are not always what banks expect, as some of them have suffered or are suffering from losses due to the low acceptance of their services and products by customers and due to the increase in the cost of investments in the development of e-banking services. Also, customer loyalty to the bank increases, as they develop relationships through the Internet with each other, and synergies are created with other companies in the broad field of electronic transactions and payments.

At the same time, the reduction of the service cost due to alternative electronic networks will gradually lead to privileged prices of the products and services offered, making them even more attractive to customers. A major problem is the sensitivity of the relationships built between electronic banks and customers. On a daily basis, banks must make good use of models that analyze the behavior and transactions of their customers for all their products and across all networks, thus becoming aware of the whole picture of their banking relationship.

Today, profitability and competitiveness are measured not only by numbers, but also by knowledge. customers to create long-term relationships that lead to loyal customers. In addition, the result of the above is the fact that today banks are considered one of the most advertised, with high costs. Especially in recent years, banks have been spending too much money on promoting e-banking, which contributes to a better understanding of e-banking among the general public.