Also, I ask if all ESG pillars are determinants of credit ratings. My empirical research results show that Refinitiv's ESG scores are determinants of the firm's credit ratings.

The role of information

- Introduction

- Required Information

- Asymmetric information

- Adverse Selection and Moral Hazard

- Tools to help solve asymmetric information problems

- Cost-Benefit Analysis & Statistical Techniques

He must be able to assess the current condition, the outstanding prospects (financial perspectives) and the character of the borrower. The character relates to the borrower's willingness and attitude to comply with the terms of the contract.

Credit ratings

Introduction

Credit Rating Agencies

Specifically, credit rating agencies have become heavily involved in the design of mortgage-backed securities. Requiring credit rating agencies to disclose details of their methodologies, assumptions and achievements in the rating process ensures transparency.

Sovereign credit ratings

In its 2019 Rating Methodology Report, Moody's supports that transparent institutions are an important driver of a country's creditworthiness. The determinants are GDP per capita, GDP growth, and they expect a positive relationship with credit ratings.

Corporate credit ratings

- Corporate Governance

- Conservatism in credit ratings

- Split ratings

- Solicited and unsolicited credit ratings

- Issuer-paid vs. investor-paid ratings – Comparison

Finally, Xia (2014) examines the possible differences in company credit ratings due to their business model. The authors use identical firm-specific variables to identify the effect of the firm's, the industry's characteristics in the rating process. These firm characteristics are the most important factors in credit rating agencies' risk assessments, based on the agencies' disclosures.

Baghai, Servaes and Tamayo (2014) investigate the credit rating agencies' conservatism and the effects of this event in the firm's financial decisions. Additionally, they examine how Japanese corporate governance (keiretsu) affects the firm's decision to obtain a credit rating. In other words, S&P's ratings become more consistent with the company's credit risk after EJR coverage.

ESG ratings

Introduction

In addition, I present a study by Stubbs and Rogers (2013) in which they shed light on the assessment methodology of Regnan, an ESG rating agency. Finally, I present the studies of Tang, Yan, and Yao (2021), who investigate whether the ownership status of the rated companies and the appraiser play an important role in the evaluation of the rating, and Gyönyörová, Stachoň, and Stašek (2021), in which the authors identify the issue of convergent validity among the main actors in to the ESG data industry.

Sources of ESG data and ratings

The authors also categorize the providers as market data providers such as Bloomberg, Thompson Reuters, exclusive ESG data providers such as RobecoSAM, Sustainalytics, and specialized data providers such as Carbon Disclosure Project (GDP) and Institutional Shareholder Services (ISS). In particular, Bloomberg acquired New Energy Finance, Morningstar acquired Sustainalytics, and major credit rating agencies such as Standard and Poor's and Moody's acquired RobecoSAM ESG ratings and Vigeo Eiris, respectively. KLD's data collection is based on various sources, such as government agencies, NGOs, company annual reports, regulatory interpretations, press articles and academic processes.

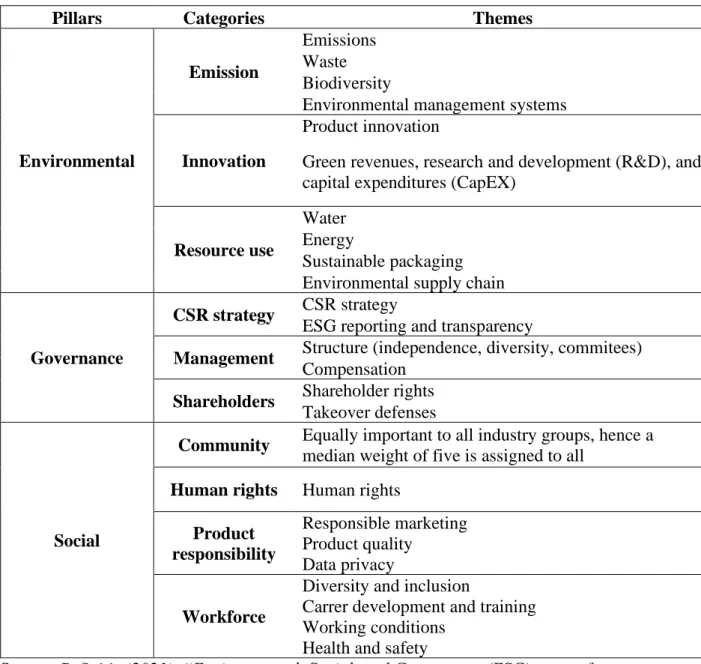

More specifically, ESG data includes information on environmental factors such as carbon emissions, pollution, renewable energy, water and waste recycling, and social factors such as accidents, female workers, health and safety, and the number of accidents. Material ESG issues (such as business ethics, human capital, etc.) can affect the economic value of the company and are at the heart of their methodology. Therefore, the company's exposure to ESG factors is derived from the multiplication of the company's beta and the sector's exposure score for the specific issue.

ESG and firm’s economic value

- Firm’s Sustainability Performance - Cost of Equity Capital, and

- Firm’s Sustainability Performance and Financial Performance

Ghoul, Guedhami, Kwok, and Mishra (2011) examine the relationship between a firm's ESG performance and its cost of equity capital. Equivalently, the authors estimate the relationship between a firm's cost of capital and its involvement in controversial business areas. They also find that ESG performance amplifies the positive impact of economic sustainability performance on a firm's cost of capital.

Similarly, they find that in the various sub-samples of asset classes, most of the results support a positive correlation between ESG and the company's financial value. Their findings support the positive relationship between ESG ratings and a firm's financial value, providing evidence that highly rated ESG firms outperform those rated low. They also argue that each of the ESG components can have a significant impact on a company's financial performance.

Weaknesses of ESG ratings

Also, the current situation in the ESG rating industry may lead to confusion among economic participants, reducing their information value. Overall, the main issues are the inaccuracy and unreliability of ESG data due to differences in the definition and measurement of ESG issues by ESG ratings and data providers. The current situation in the ESG rating industry can lead to confusion among economic participants.

Tang, Yan and Yao argue that the nature of ESG ratings is consistent with some subjectivity. In addition, the authors construct their main regression model to map the relationship between sister companies and ESG ratings. They find the sister variable to be positive and significant, indicating that KLD's ESG ratings to sister companies are higher than Refinitiv's.

Empirical research

Introduction

Data collection and description

- Environmetal, Social, and Governance (ESG) scores from Refinitiv

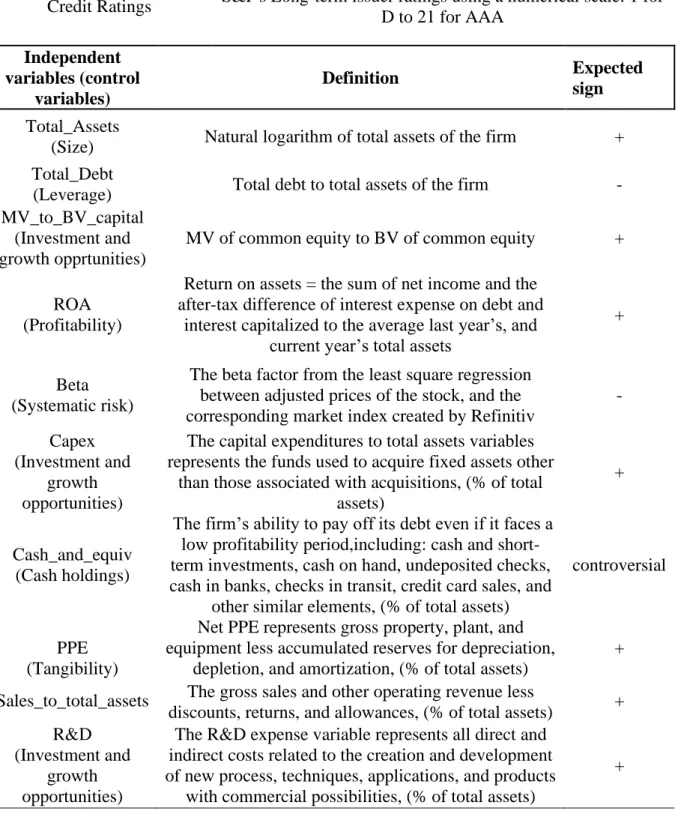

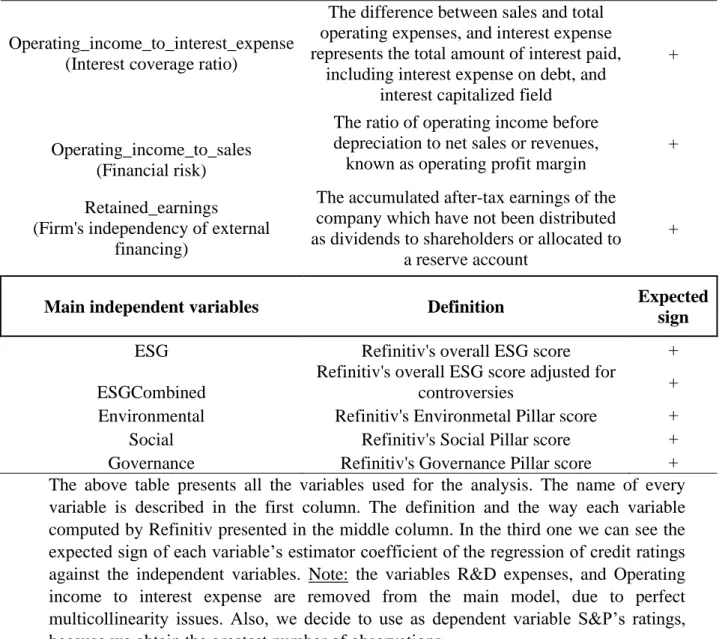

The company's total assets (Total_Assets) are included as a measure of company size. I use the natural logarithm of total assets because of the wide spread in the data. The leverage ratio (Total_Debt) is calculated from Refinitiv as the percentage of the sum of short-term debt and the current part of long-term debt in relation to total assets.

The relationship of beta with the default risk of the firm is expected to be positive. Also, the database is updated continuously and ESG scores are recalculated every week. Finally, the ESGC score is derived from the average of the overall ESG score and the ESG controversy score.

Econometric analysis

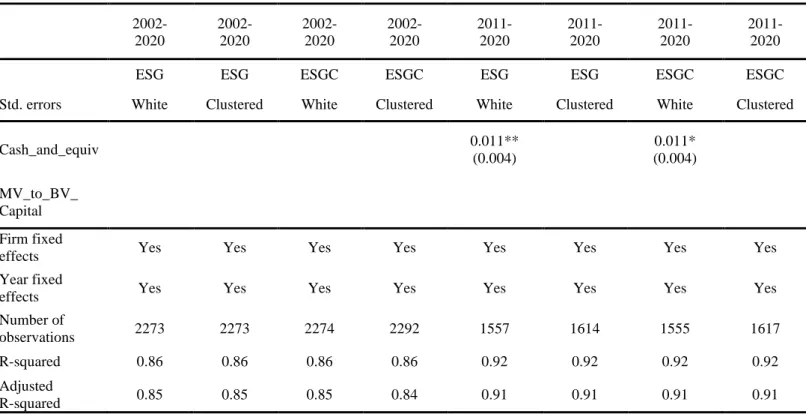

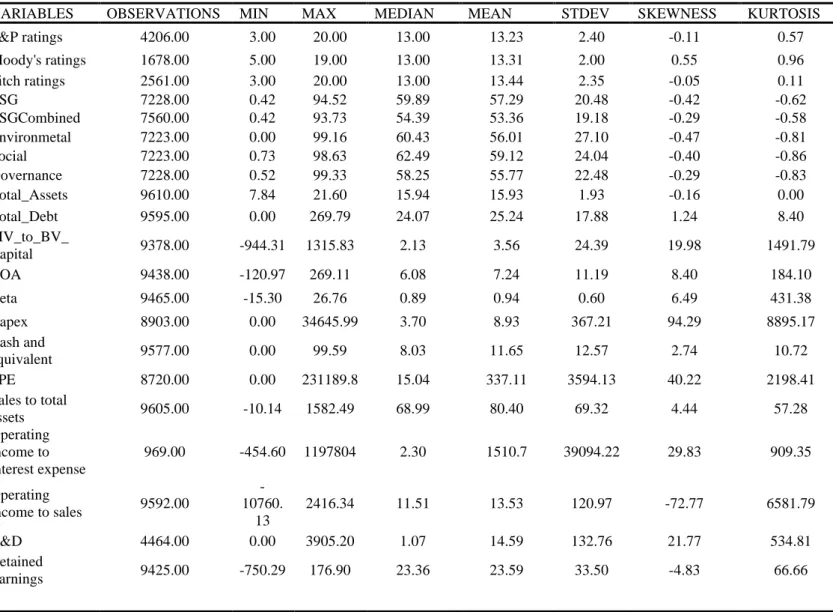

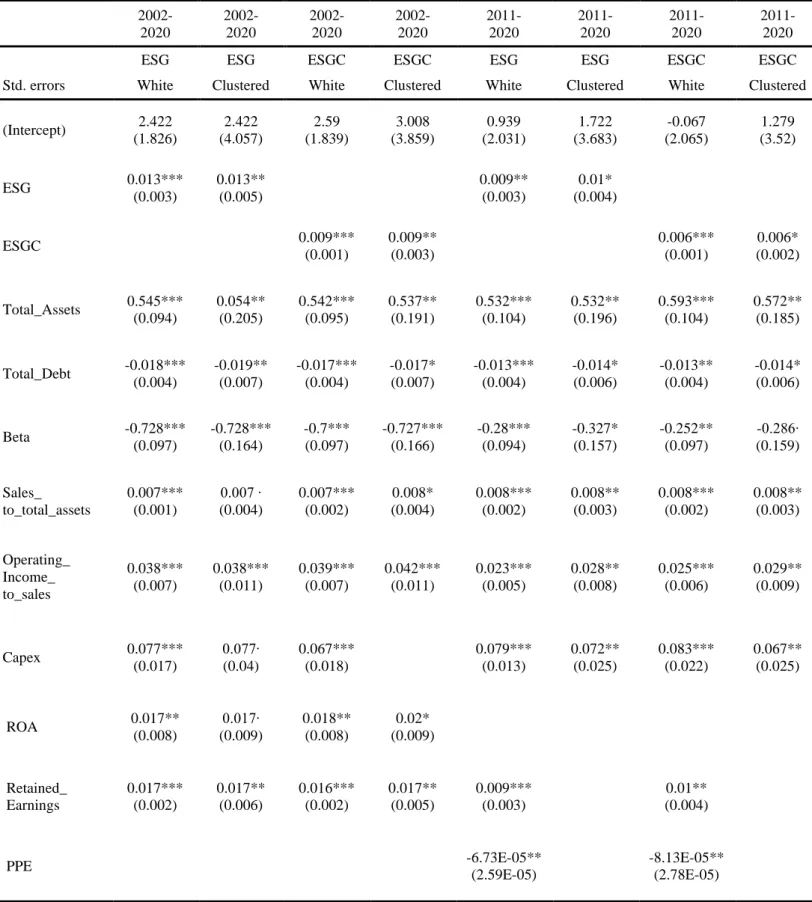

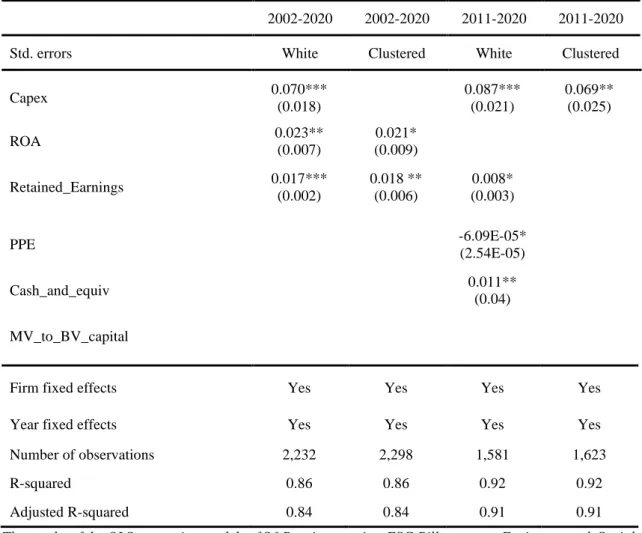

Given the definition of both ESG and ESGC scores, it is important to examine whether these scores have any explanatory power for the company's credit ratings. The cross-sectional part of the data set consists of the 600 companies that make up the Eurostoxx600 index, and we collect time series data for each variable of each of them from 2002 to 2021. I also repeat our analysis of the sub-sample consisting of the period from 2011 to 2020, as interest in a company's ESG performance has increased significantly over the past decade.

The observations belonged below the 1st and above the 99th percentile of the data sample, converted to NAs (pruning). To increase the robustness of the models, I need to handle the error term of the regression. However, to address the complexity of the panel data set, I decide to use cross-sectional clustered robust standard errors.

Results

Introduction

Estimation of Rating Models using ESG scores as independent variables

Refinitiv's ESG score adjusted for controversies (ESGC) is thus a decisive factor for the company's credit ratings. Capital expenditures also appear to be a determinant of credit ratings in the period from 2011 to 2020. In each regression model, I also test the hypothesis that Refinitiv's ESG ratings are related to the company's ESG performance.

The ESGC score is also important to explaining the company's ratings because it confirms that Refinitiv's score captures the company's ESG performance against disputes. For the period 2002 to 2020, we find that ESG is no longer significant, and the ESGC score variable is positive and significant, indicating that ESGC is a better explainer of company credit ratings than ESG score. Overall, the analysis findings confirm that Refinitiv's ESG variables, both the aggregate ESG score and the dispute-adjusted ESG score, are determinants of S&P credit ratings over the period 2002 to 2020.

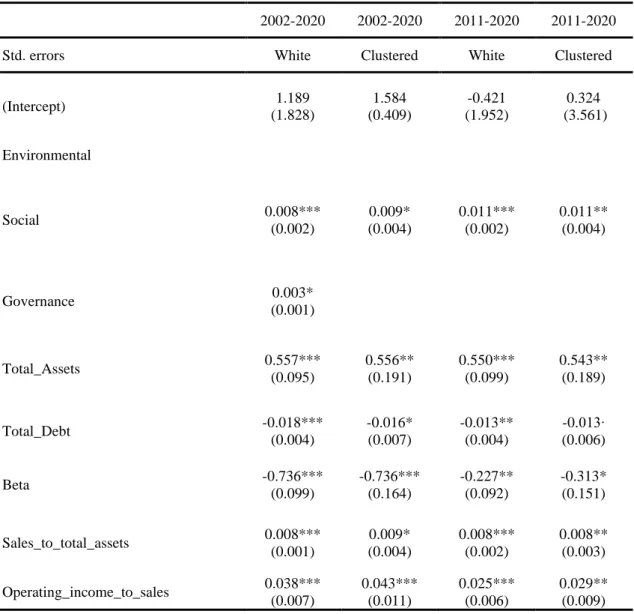

Digging further

However, the explanatory power of ESG results on valuation tasks decreases over the period 2011-2020. However, my findings cannot prove this relationship since ESG scores, ESGC, their variance, and ESG pillars cannot significantly explain split ratings. the need for a larger sample with more firms rated by multiple agencies. Also, we decide to use S&P ratings as the dependent variable because we get the largest number of observations. 2013) "Structural Shifts in Credit Rating Standards", The Journal of Finance, Vol. 2006) “Corporate governance effects on firm credit ratings”, Journal of Accounting and Economics, Vol. 2014) “Rating agencies to become more conservative.

Implikationer for kapitalstruktur og gældsprissætning", The Journal of Finance, Vol. 2014) "Split Ratings and Differences in Corporate Credit Rating Policy between Moody's and Standard & Poor's", The Financial Review, Vol. 2011) "Information Content of Unsolicited Credit Ratings: Evidence from Japanese Firms", Asian-Pacific Journal of Financial Studies, Vol.41, pp The Credit Rating Industry", Quarterly Review Federal Reserve Bank of New York, Vol. 1996) "Determinants and Impact of Sovereign Credit Ratings", Federal Reserve Bank of New York Economic Policy Review, oktober 1996, s. 2014) "Corporate Social Responsibility and Access to Finance", Strategic Management Journal, Vol. 2014) "The Impact of Corporate Sustainability on Organizational Processes and Performance", Management Science, Vol. 2015) "Implied Materiality and Material Disclosures of Credit Ratings", Harvard Business School Working Paper, Vol. 2011) "Påvirker virksomhedernes sociale ansvar kapitalomkostningerne?", Journal of Banking and Finance, Vol. 2021) "Fixing ESG: Are Obligatorisk ESG Disclosures the Solution to Misleading Ratings?", Fordham Journal of Corporate & Financial Law, Vol. International Organisation of Securities Commissions (2021) "Environmental, Social and Governance (ESG) Ratings and Data Products Providers" s. 2019) "Four Things No One Will Tell You About ESG Data", Journal of Applied Corporate Finance, Vol. 2017) "Social, Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility under the Financial Crisis", The Journal of Finance, Vol. Hvad er kreditvurderinger, og hvordan fungerer de?” s. 2013) "Lifting the veil on environment-social-governance rating methods", Social Responsibility Journal, Vol. 2017) "Sovereign credit ratings determinants: a comparison before and after the European debt crisis", Journal of Banking and Finance, Vol. 2010) "The Credit Rating Agencies", Journal of Economic Perspectives, Vol. 2014) "Kan investorbetalte kreditvurderingsbureauer forbedre informationskvaliteten for udstederbetalte kreditvurderingsbureauer?", Journal of Financial Economics, Vol. 2021) "The Determinants of ESG Ratings: Rater Ownership Matters", s. 2020) Banking-Management and Strategy, Diplographia, Athen.

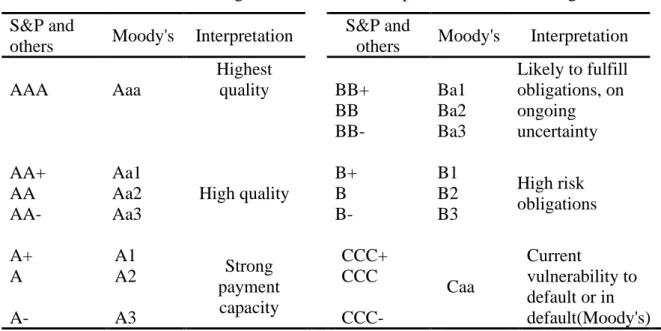

Long-term Issuer Credit Rating 18

ESG pillars and its components 72

Descriptive statistics 74

Ratings Regressions 77

Ratings Regressions-ESG pillars 80

All the variables used in the empirical analysis 86