The pharmaceutical industry is one of the most important pillars of global society because, with the innovative pharmaceutical products it produces, it aims to ensure the health of the world population. Therefore, its role in ensuring the welfare of the population is of crucial importance. Then, the strategic analysis of the pharmaceutical industry is carried out using tools such as the Porter model, the SWOT analysis and the PEST analysis.

In other words, the influence of the industry by factors in the external environment is studied, while creating a connection between the internal and external environment of the pharmaceutical industry in Greece. Then, the financial analysis of the largest companies in the sector takes place using the main financial ratios, leading to useful conclusions regarding the strength of these companies in the Greek market.

Introduction

Immediately after that, the position of the pharmaceutical industry in Greece is analyzed as well as all these factors that influence the determination of this position. In addition, there is an extensive analysis of the financial ratios used in the economic analysis of the industry. The results present both the strategic analysis of the pharmaceutical industry that was carried out and the financial analysis.

In the same part, the discussion and interpretation of the exported results is made. In the last part of this work, the results are reviewed and the final conclusions are drawn about the pharmaceutical industry in Greece.

Literature Review

Overview of the pharmaceutical industry sector

- Introduction

- The definition of medicine

- The classification of medicines

- The pharmaceutical industry in international level

- The pharmaceutical industry in Greece

- The pricing policy of the pharmaceutical industry

Of course, in 2020 this number has increased significantly due to the development of the pharmaceutical industry. First of all, the globalization of the pharmaceutical industry has played a vital role in the development of the pharmaceutical industry. As mentioned above, the phenomenon of globalization is one of the most important factors in the development of the pharmaceutical industry at the international level.

In this section, the economic landscape of the pharmaceutical industry in Greece will be analyzed in detail. However, the current study will not make any distinction and will take a holistic approach to pharmaceutical industry analysis. At this point it is wise to analyze the contribution of the pharmaceutical industry to the Greek economy.

Then the contribution of the pharmaceutical industry in the fight against unemployment will be analysed.

Bussiness strategy: theoretical background

- Strategic Management

- Analysis of internal and external environment

- Internal and external environment analysis tools

If managers do this consistently, they will be more aware of industry trends and challenges. Factors in the microenvironment of a company can be considered as suppliers, customers, intermediaries in the market in which the company operates, its financiers, and the public image of the company. On the other hand, the macro environment of the company consists of five main factors that influence the operation of the company (A. Mihiotis, 2005).

A typical example of a social factor that practically affects a company's external environment is the income per capita for the inhabitants of an area. The managers of a company to analyze both the internal and external environment of the company use useful analysis tools that allow them to distinguish between possible changes in both the internal and external environment. The SWOT analysis is related to the identification of a company's strengths and weaknesses by its managers, as well as to the identification of opportunities and threats that the company faces.

In terms of the opportunities that a firm may have to grow, these are characteristics of its external environment. This fact may favor a company entering the market in that country, resulting in increased profits for the company. The social environment has to do with the structure of society, the perception of the inhabitants of a particular society, the demographic, psychographic and other criteria that clearly affect the business that operates in that society and is therefore studied in.

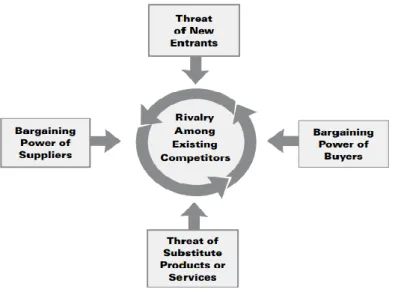

None of the above environments should be considered more important than the others as they all play a vital role in the operation of one business. The nature of the members of an industry and their bargaining power determine the structure of the industry and the overall profitability of doing business in the industry's specific environment. A supplier's product is very different, that is, the quality of the final product has increased greatly.

Methodology

Data analysis

Strategic analysis of the pharmaceutical industry in Greece

Financial analysis of the pharmaceutical industry in Greece

This is a time analysis of the various indicators for the investigated company (trend analysis). This study makes it possible to determine whether the financial situation of the company in question improves or worsens over time. This study makes it possible to determine whether the financial situation of the company in question is better or worse than that of the competing companies.

This is a time-consuming study of the average indicators of the industry of the company in question. This research makes it possible to determine whether the financial situation of the company in question is better or worse than the average of the industry of the company in question. The longer the average collection time of the company's receivables, the greater the risk of bad debts.

When the equity is higher than the net worth, it means that part of the working capital comes from its shareholders. Owner's equity to total assets ratio: This ratio calculates the portion of the company's total assets that is financed by its shareholders (ie, owners). When it is higher than one, the owners of the company participate in the company with more funds than its creditors.

Additionally, in the case of a mortgage asset, you subtract the value of the encumbered assets from the total assets to calculate the net fixed assets. Earnings per share: The specific ratio shows the level of net profit for each share of the company, and is influenced by both the total amount of profit of the business, and the number of shares. Current Dividend Yield: The specific ratio shows the performance investors enjoy from dividends from the stocks they have invested.

Results and Discussion

Strategic analysis of the pharmaceutical industry in Greece

- SWOT analysis of the pharmaceutical industry in Greece

- PEST analysis of the pharmaceutical industry in Greece

- Porter analysis of the pharmaceutical industry in Greece

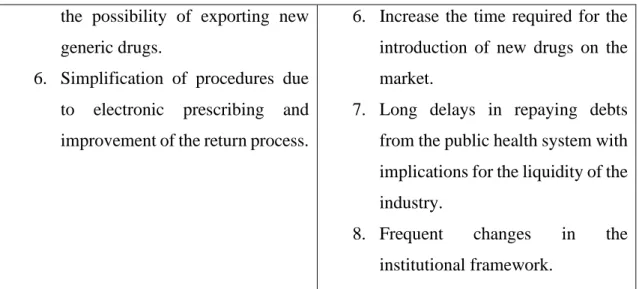

Stagnation with a decrease in the size of the domestic market and an increase in competition, which leads to a decrease in profits in the industry. Long delays in repayment of debt from the public health system with consequences for the industry's liquidity. The pharmaceutical industry is by no means cut off from the international business environment, it is one of the largest arms of the global economy and national economies.

The continuous development of a company in a highly competitive and volatile environment, such as that of the pharmaceutical industry, is not an easy task. As mentioned earlier, the main tool used for analyzing the external environment is the PEST analysis. The external environment of the pharmaceutical industry in Greece is important to study as it has a direct impact on every company in the industry.

Pharmaceutical companies must be fully aware of the legal framework governing the production and sale of medicines in Greece. Greece's social environment shows that the country's population is growing older. As the years pass and the rapid development of technology, the way of working in many sectors of human life has changed.

Thus, with the help of technology, the way the pharmaceutical industry operates has been modernized, both at the level of production, promotion and sale of medicine, as well as the way research and development takes place in the pharmaceutical industry. In this subsection, an analysis of the Greek pharmaceutical industry will be carried out based on Porter's five forces model. Bargaining Power of Customers: The customers addressed to the pharmaceutical industry are mainly hospitals as well as pharmacies in the country.

Financial analysis of the pharmaceutical industry in Greece

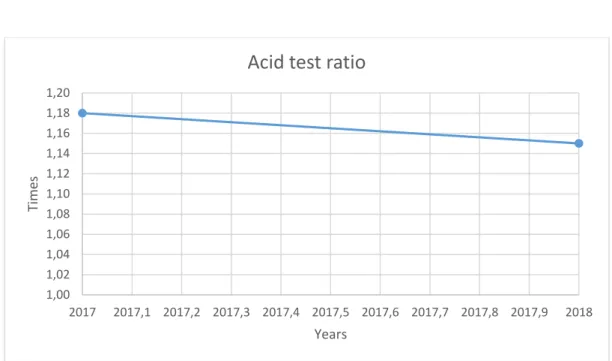

As can be seen from the figure, over the years and in this case there is a static situation with a tendency to decrease. This is probably due to the decrease in the direct liquid assets of the companies in the sector. As shown in the figure, there is stability for the years 2017-2018, but with a downward trend.

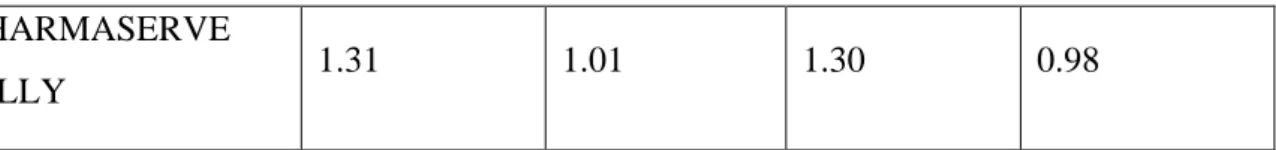

This practically means that companies in the pharmaceutical sector have increased their profits and have a good growth trend. The following figures show the activity ratios and more specifically the asset turnover ratio and the equity turnover ratio for the years. Specifically, for 2017, the average asset turnover ratio of companies in the pharmaceutical industry was around 0.98, and for 2018, the price is 0.94.

This is probably due to the fact that companies in the industry have not properly utilized their resources in relation to sales. It is logical that this decrease is due to the fact that the managements of companies in the pharmaceutical industry did not use capital properly. The following figures show the course of companies in the industry in terms of financial structure and viability ratios.

More specifically, the ratio between equity and total assets and the ratio between total liabilities and equity are shown. This is due to the reduction of equity in the companies in the sector. Regarding the ratio of total liabilities to equity, the index is stable at satisfactory levels in both years (0.48) and shows that there are not many companies in the pharmaceutical sector in Greece that overborrow to repay their liabilities, but do it from own funds.

Conclusions

Retrieved from https://www.sanofi.com/en/investors/reports-and-publications/financial-and-csr-reports.