David Dyker is the author of the introduction (Chapter 2) and the analysis of service sectors (Chapter 7). A deep free trade agreement+ with the EU could become one of the carriers/triggers of these reforms; however, the country's own efforts in transitional reforms remain paramount.

Introduction

The next chapter provides some more empirical evidence on the status of non-tariff barriers based on research conducted for the purposes of this study in late 2007. The final chapter is devoted to a diagnostic analysis of the implications of the FTA for the further expansion of trade and investment in sectors key to the Armenian economy.

The most recent trade and economic developments in Armenia

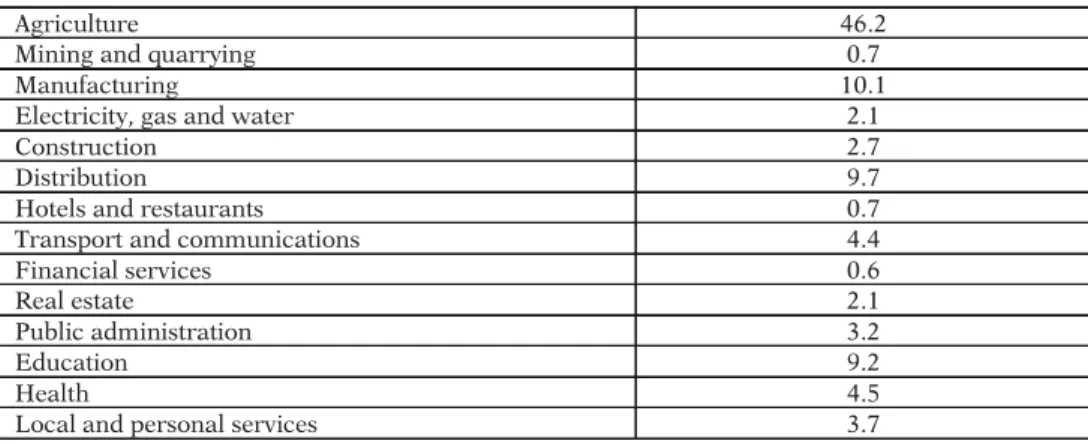

These peculiar structural features of the Armenian economy help us understand how politics and economics interact in the country. There is considerable scope in the Armenian economy for redeployment of underutilized labor and diversification of the export structure.

Armenia and regional integration scenarios

Thus, only a resolution of the Nagorno-Karabakh conflict will change the prospects for trade relations between Armenia and Azerbaijan. Indeed with Bulgaria, Romania and Turkey half of the Black Sea coast is already in the EU customs union.

Assessing the potential welfare effects of an EU-Armenia FTA using

Introduction

The higher the initial tariffs, the greater the likelihood of both trade creation and trade diversion. Shallow integration is usually accompanied by both trade creation and trade diversion, which have opposite welfare effects.

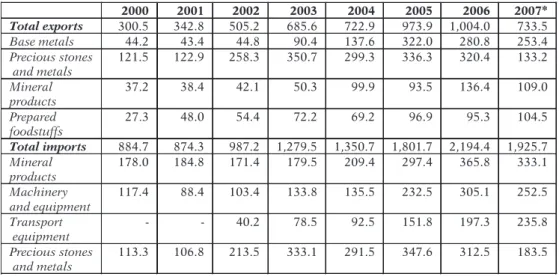

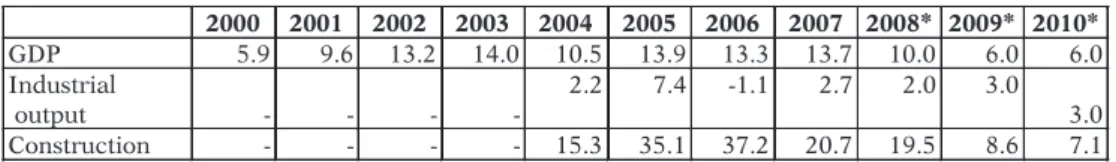

Armenia’s foreign trade dynamics

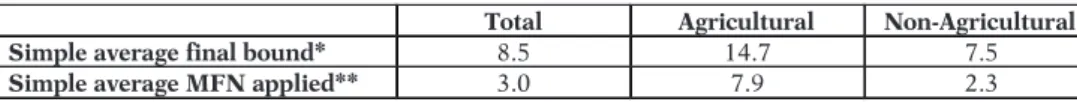

Armenia’s trade policies and market access

Compliance with quality standards in the EU is considered one of the most important constraints by Armenian food processors. As EU tariffs are already low for Armenian goods, trade creation and trade diversion effects of the future EU-Armenia FTA are not expected to be significant for the EU as well.

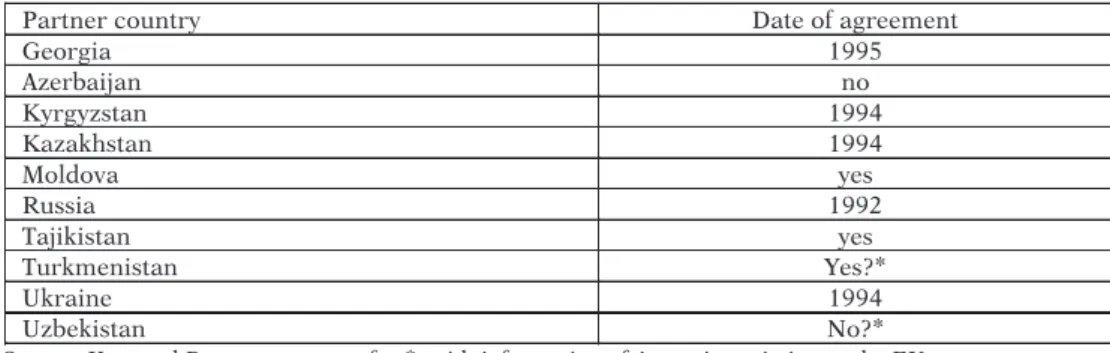

Existing FTAs

Exporting to other CIS countries is more favorable compared to other destinations due to close historical ties and geographical proximity, proximity of product standards and mutual recognition of mandatory trade documentation and standardization. Considering the lack of strong economic incentives and political will of the CIS countries to integrate, the prospects of full implementation of the CIS plurilateral FTA seem rather weak.

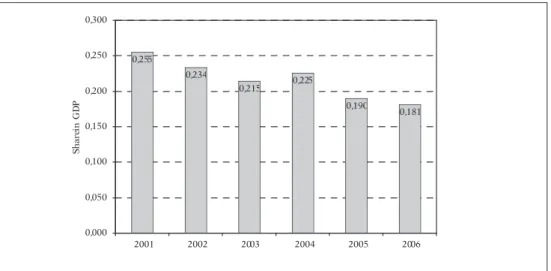

Trade Openness

At the same time, in order to become fully functional and more efficient, CIS bilateral FTAs require strengthening their administration, adapting the legal and institutional framework in accordance with WTO rules regarding the essential coverage of the agreement, transit rules, the implementation of SPS and TBT measures, the application of protective and anti-dumping measures, as well as dispute resolution mechanisms. In addition, the creation of the BSEC FTA requires all members to have FTAs with the EU (as some counties, Greece, Turkey, Bulgaria and Romania, are already members of the EU customs union), which does not it is a short-term perspective for some. of them (eg Russia).

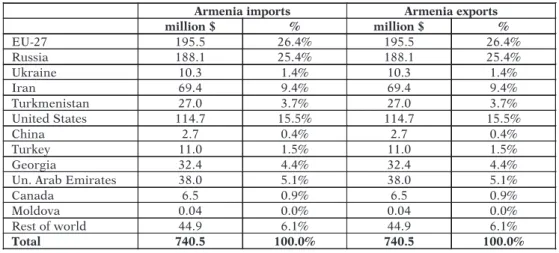

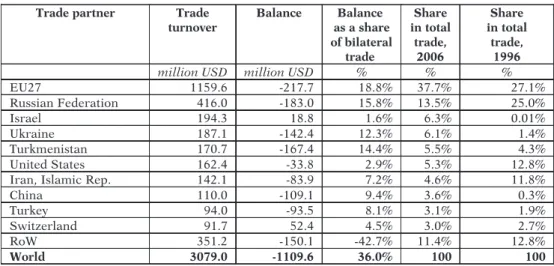

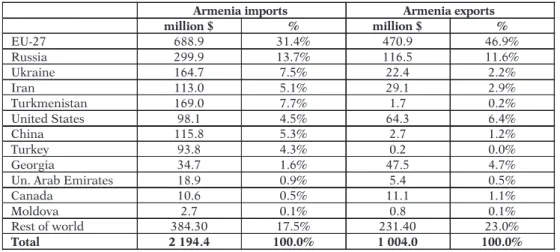

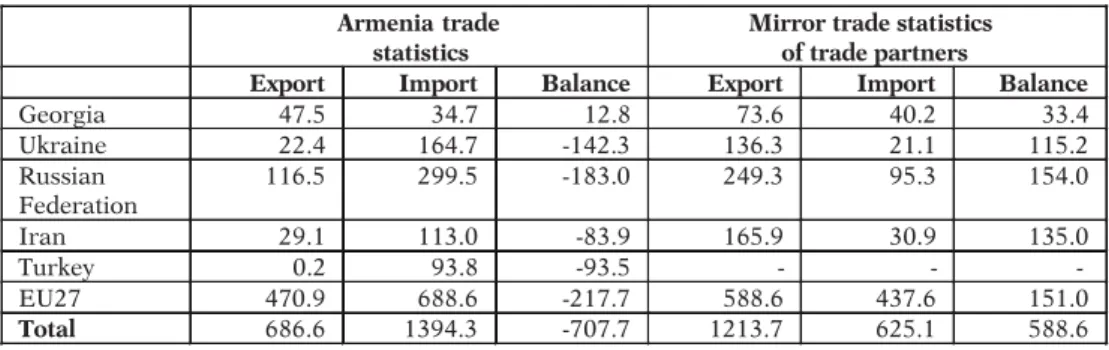

The geographical composition of trade

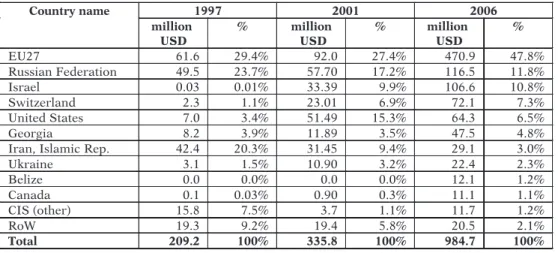

- Export Structures by Main Trading Partners

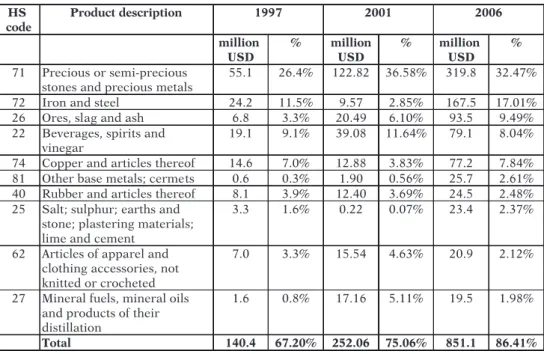

- Export Structures by Commodities

- Import Structures by Major Trading Partners

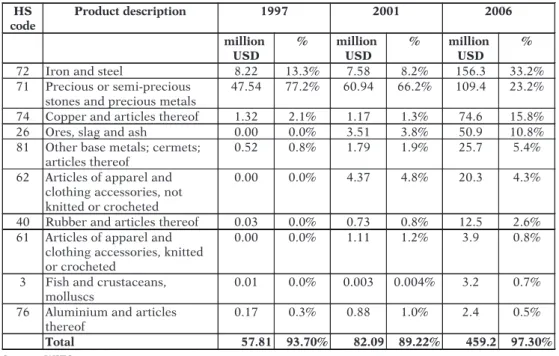

- Import Structure by Commodities

Bilateral trade with the EU is even more concentrated compared to Armenia's total trade, although Armenia has diversified its exports to the EU to some extent over the past decade. The EU is Armenia's most important trading partner on the import side, accounting for about a third of Armenia's imports (32.9% in 2006) (see Table 4.9).

Finger-Kreinin Indices

The FK index for Armenia and EU exports is about 2.5 times less than that for Armenia and Georgia and is equal to 7.58 at the 6-digit HS level and 10.72 at the 4-digit HS level, suggesting a low level of similarity of exports between them. Therefore, according to the fourth rule, there is not much evidence for trade creation on the production side under the future Armenia and EU FTA.

Revealed Comparative Advantage

The high concentration of Armenia's exports is also true of Armenia's non-agricultural exports (the top 15 export sectors accounted for 84% of total non-agricultural exports in 2006). It is worth noting that Armenia's top 15 exports to the EU revealed on average a higher comparative advantage than total exports to world markets (see Annex 1 Table 1 and Annex 1 Table 7).

Deep integration and Grubel-Lloyd index

If we use EU mirror trade data to calculate the IIT index between Armenia and the EU, the index is equal to 18.5% at the 6-digit HS level. As already described, in 2006 significant data discrepancies were found between Armenia and Georgia, Turkey and the EU.

Conclusions

The low level of IIT between Armenia and the EU confirms the previous considerations about the non-significant overlap between Armenia's and the EU's trade patterns (captured by the FK index) and competitiveness (captured by RCAs). Due to the low levels of EU tariffs before the FTA (General Agreement of the GSP) and non-tariff protection measures (such as quantitative restrictions), the direct impact of the FTA on Armenian exports to the EU will decline. significant;.

Product standards

In the EU-Armenia PCA and the ENP Action Plan for Armenia (hereinafter ENP AP), Armenia committed to model its new product standards and technical regulations based on EU directives. 23This number includes technical regulations approved by the Government of Armenia, as well as mandatory standards approved by line ministries (e.g. Ministry of Health, Ministry of Urban Development, etc.).

Customs

The majority of Armenian companies have yet to switch from GOST standards to international standards, otherwise they will have little prospects in the EU market. The World Bank, DFID and other donors are providing support to modernize customs, including risk assessment training and post-clearance audits.

Competition policy

Although SCPEC is part of the executive branch of government, it is an independent body that is not subordinate to any other government agency or cabinet of ministers. The provisions of the PEC Act regarding state aid are generally in line with EU requirements, but are not as specific as in the EU; consequently, the current legal framework on state aid in Armenia is considered to be quite insufficient (this is stated in the AP ENP).

Property rights, corporate governance and accounting standards

One of the most essential gaps in corporate governance in Armenia is the absence of a "Code of Corporate Governance". Clear delineation of the functions of corporate governance bodies, including the executive, directors and annual general meeting;.

Intellectual property rights

Furthermore, Armenia is not a member of the Lisbon system for the international registration of appellations of origin. Furthermore, the Intellectual Property Agency does not have its own legal department, and the legal department of MTED instead provides legal services to the agency.

Public Procurement

ENP AP contains a provision on improving the administrative capacity of the State Procurement Agency. The FTA would increase the openness and attractiveness of the public procurement system for European companies.

Rules of origin

Meanwhile, the ACCI reports that the procedures for issuing certificates of origin have been improved and shortened to just one day on average. However, field interviews indicate that the majority of exporters have to wait 3-5 days for the issuance of the certificate of origin.

Sanitary and Phytosanitary Measures

In 2006, on the basis of the new edition of the Act on Safe Food, responsibilities in this area were also transferred to the Ministry of Agriculture and its structural part, the State Inspection for Safe Food and Veterinary Medicine36. The Ministry of Agriculture regulates issues of animal and plant health care, while the procedures before placing on the market and market control are carried out by the State Inspection for Food Safety and Veterinary Medicine and the State Inspection for Plant Quarantine and Agriculture.

Institutional capacity to negotiate and implement commitments under an FTA . 97

Given the state of the sanitary and phytosanitary products system in Armenia, its agri-food products would not be able to benefit effectively from the free trade agreement with the EU. The European Commission should be well aware of the implementation problem if and when it negotiates a free trade agreement with Armenia.

Survey method

Certifying origin of goods

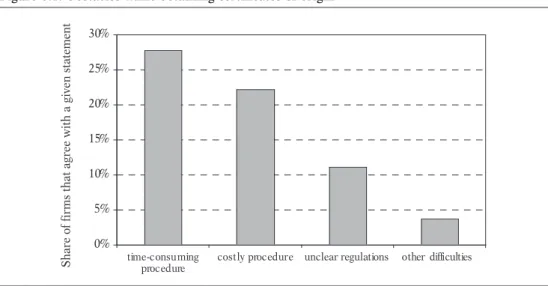

Firms were also asked to rate the importance of the costs of obtaining certificates of origin. Asked about difficulties related to obtaining certificates of origin, 28% of the 54 relevant firms complained about the procedure being time-consuming and 22% rated the procedure as costly.

Customs procedures

In summary, it appears that although Armenian exporters widely used EU trade preferences, they had some difficulties in obtaining certificates of origin.

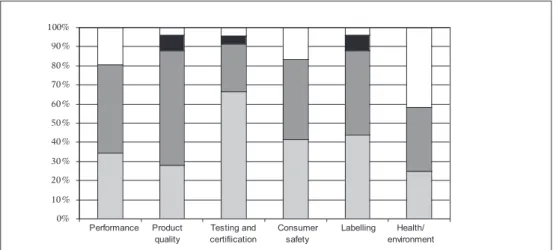

Technical regulations

The costs of domestic technical regulations for most companies appear to be lower than or at least equal to the costs of relevant foreign regulations (Figure 6 3). However, the subjective assessments of the companies were slightly different: one company considered the costs of compliance with EU sanitary and phytosanitary regulations not important at all, three companies as important and one company as very important.

Conclusions

In some cases, the costs of the certificate of origin are even borne by the European partner. The development of domestic (ICT-based) business services will be particularly important.

Services in Armenia

- Tourism

- Introduction

- Tourist infrastructure

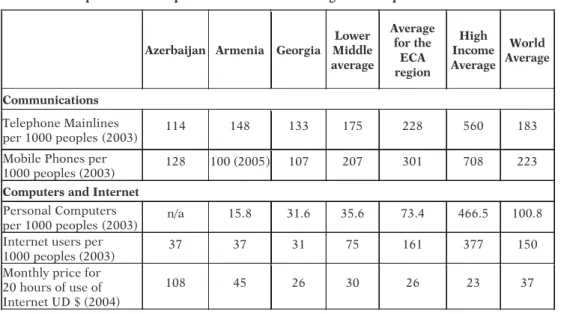

- Information and Communications Technology (ICT)

- Introduction

- The sector in outline

- The ArmenTel case

- Construction and Engineering services

- Financial services and banking

- Introduction

- The banking sector in Armenia

- The insurance sector in Armenia

- The Armenian stock exchange

- The financial regulatory framework

- Energy-related services

- Likely changes to investment climate due to FTA

- MFN pre-establishment

- National treatment

- Market access restrictions

- Conclusions

It will also have to include a thorough reform and improvement of the Armenian competition and monopoly authority. Much of the construction currently taking place in Armenia is financed by remittances from abroad.

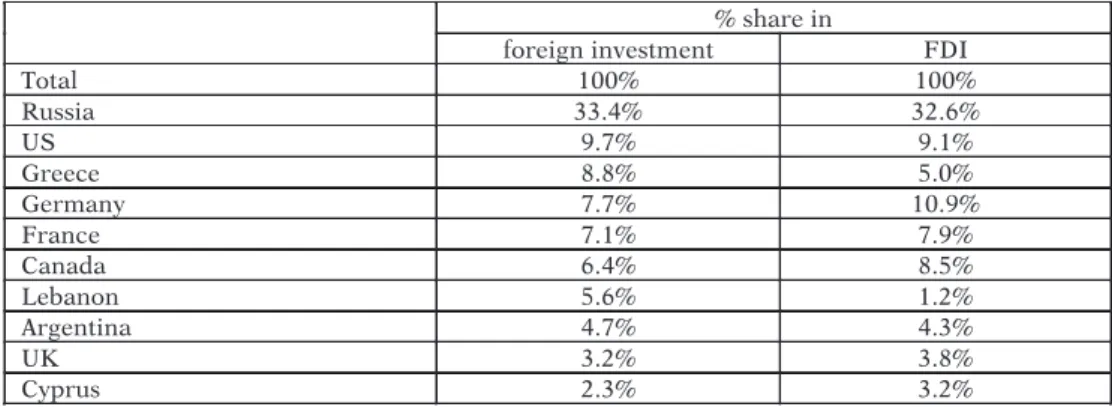

Likely changes in FDI flow due to an FTA

- Motives driving foreign investment

- Black Sea regional integration and future FDI flows

- Perspectives for spillovers from FDI in Armenia

- Potential FDI in Armenia

- Summary

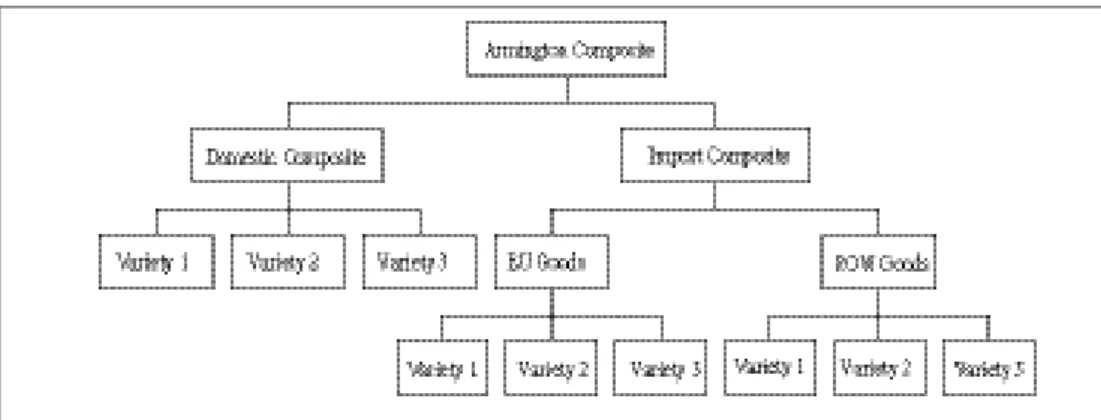

Furthermore, we have estimated the impact of Deep FTA+ with the EU on the FDI stock in Armenia until 2020. In the case of imperfect competition, firm varieties enter the bottom of the CES function.

CGE Model and Simulations

- CGE Model

- Tariffs

- Non-tariff barriers

- Border costs

- Standards costs

- Barriers to trade in services

- Implications of the 2006 scenario, Simple and Deep FTAs

- Simple and Deep FTA scenarios

- Conclusions

Since its inception, the European Community has been concerned about the removal of technical barriers to trade. The impact of the liberalization of access to the service sector appears to be very small.

Sectors of importance

Agro-food sector

- General Performance and Current Issues

- Relations with the EU

- Potential Impact of an FTA

The production structure of the agricultural sector in Armenia has been, at least for the major product groups, quite stable since 1992. In the former case, the average tariff according to the WTO is above the maximum limit of the final bound tariff of 15 .

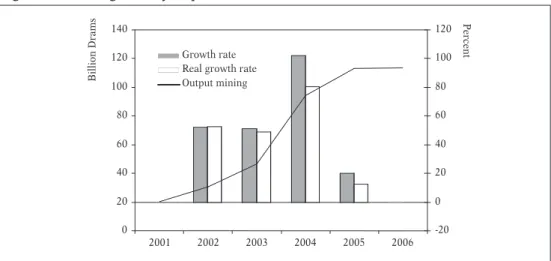

Mining

- General Performance and Current Issues

- Relations with the EU

- Potential Impact of an FTA

According to the latest available UNCTAD country profile, FDI stocks in the "mining of metal ores" sector. The Deep Free Trade Agreement+ could therefore be seen as essentially a supplement to the further implementation of the ENP Action Plan.

Summary

- General Performance and Current Issues

- Relations with the EU

- Potential Impact of an FTA

Conclusions

If economic, institutional and political reforms are anchored and strengthened along with the implementation of the Deep FTA+, the country could benefit from a significant increase in foreign direct investment inflows. Creating a level playing field and market economic conditions are prerequisites for realizing the benefits that could arise from deeper integration with the EU.

Sussex Framework – Additional Tables

Sussex Framework – Additional Tables

Top 15 export sectors of Armenia’s main partners: by export share

Description of the sample and questionnaire

FDI in Armenia

The Model of FDI

CGE Model Equations

CGE Model Results – Armenia

Table 5. Top 15 export sectors by export share in 2006, non-agricultural

Table 6. Top 15 export sectors by RCA in 2006, non-agricultural

Table 7. Top 15 export sectors to the EU27 by export share in 2006,

Table 8. Top 15 export sectors to the EU27 by RCA in 2006,

Table 9. Top 15 export sectors to the EU27 by export share in 1997,

Table 10. Top 15 export sectors to the EU27 by RCA in 1997,

Table 11. Top 15 export sectors to the EU27 by export share

Table 12. Top 15 export sectors to the EU27 by RCA in 2006,

Table 14. RCA correlation coefficients, HS 6 digit, export, 2006

Table 1. Armenia’s tariffs by product group under the WTO

Table 2. Top 10 Armenia’s imports and exports sectors by major

Table 1. Top 15 export sectors of Georgia, 2006, HS 6 digit

Table 2. Top 15 export sectors of Russia, 2006, HS 6 digit

Table 3. Top 15 export sectors of Turkey, 2006, HS 6 digit

Table 4. Top 15 export sectors of Ukraine, 2006, HS 6 digit

Table 5. Top 15 export sectors of Iran, 2005, HS 6 digit

Figure 1. Distribution of firms by size

Figure 2. Distribution of export shares by firm size and share of exports217

Figure 4. Export destinations of surveyed firms vs. geographical

Figure 5. Duration of trade relations

Table 1. FDI inflows to Armenia and other countries,

Table 2. FDI stock per capita in Armenia and other countries,

Table 3. FDI inflows in percent of domestic investment in Armenia

Table 4. Selected indicators of trading across borders in Armenia

Table 1. Estimates of the Gravity Model for FDI inflows into CEE

Table 1. Data on CDR values

Table 1. Welfare, GDP and factor returns results

Table 2. Armenia - Output changes (%)

Table 3. Armenia - Price changes (%)

Table 4. Armenia - Change in exports to all regions (%)

Table 5. Armenia - Change in imports from all regions (%)