Thus, we cannot control for unobserved differences across workers, nor can we rule out the possibility that observed wages reflect compensatory variations with respect to differences along other dimensions of the employer–employee relationship. The problem of small sample size is overcome in Brown et al. 2005), who study nearly comprehensive panels of manufacturing firms in Hungary, Romania, Russia, and Ukraine, and find zero or very small negative effects of privatization.3 But a fundamental problem with all this work using firm-level data is the inability to measure employee characteristics and thus control for the composition of the workforce, especially if changes in composition are correlated with changes in ownership. Unlike other transition economies in the region, Hungary emerged with very little worker ownership and often with strong external blockholders, especially foreign investors.

First, it is likely that the selection of firms and workers across ownership types is nonrandom with respect to unobserved factors such as firm or worker quality. We exploit the firm-side longitudinal structure of the data to control for fixed and trend differences between firms, but because we do not know the form taken by the heterogeneity, we cannot be sure that these methods fully account for selection bias. . Indeed, the wage behavior of each ownership type can be influenced by each of the others through labor market interactions.

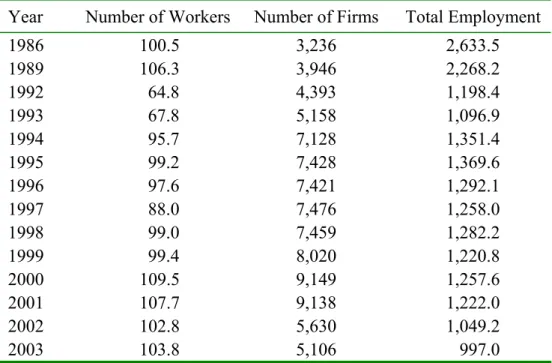

We also use the Tax Authority data to generate some of the fixed characteristics in our analysis. The data from the Wage Survey and Taxation Authority is linked using some common variables.8 The information includes the balance sheet and income statement, the ratio of share capital held by different types of owners, and some basic variables, such as average annual employment, location, and industrial branch of the firm. For the two early years—1986 and 1989—the Tax Authority data are not available, and for these years we use the fixed information from the Wage Survey; ownership in these years is always state, so the share capital variables are not necessary.

Evolution of Ownership, Variable Definitions, and Summary Statistics

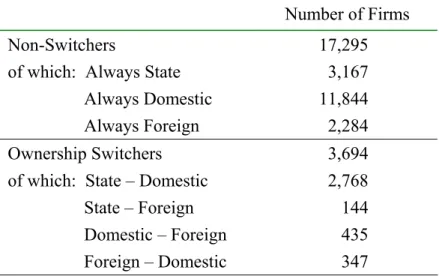

Our database provides the shareholdings of state, domestic and foreign owners at the end of each year (the reporting date). If the foreign share is greater than the domestic one, the company is foreign-owned for the purpose of this article.11 The development of the ownership structure among the companies in our sample is presented in Figure 1, which clearly reflects the early start and the heavy presence of foreign ownership in Hungarian privatization . Although there was only negligible privatization and new private entry in 1989, as early as 1992 about 40 percent of the workers in our sample were working in private firms.

The share of domestically privatized firms grew steadily until 1998, when 54 percent of workers worked for domestic owners. The share of employees in foreign-owned firms is growing steadily in our sample, reaching 29 percent in 2003. The firm-level figures differ from those at the employee level, as about three-quarters and one-fifth of firms are owned by domestic and foreign owners, respectively, but even by this measure, the state has a controlling stake in at least 5 percent of companies, creating a comparison group for the effects of privatization.

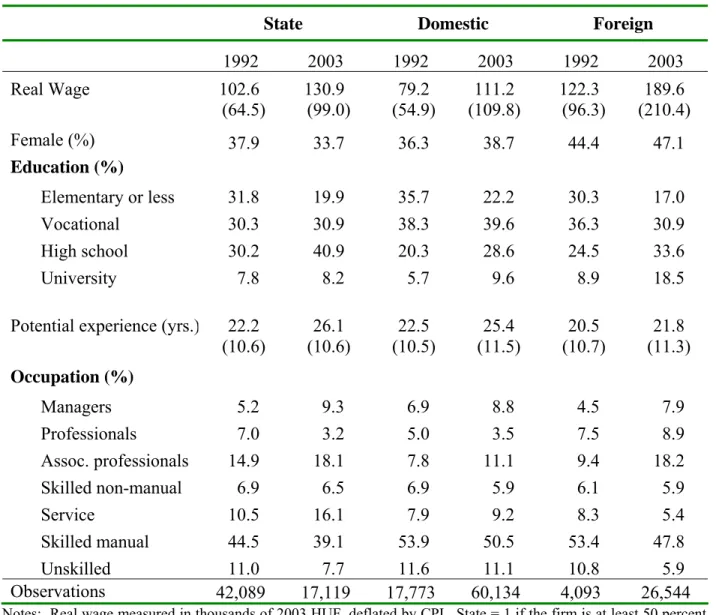

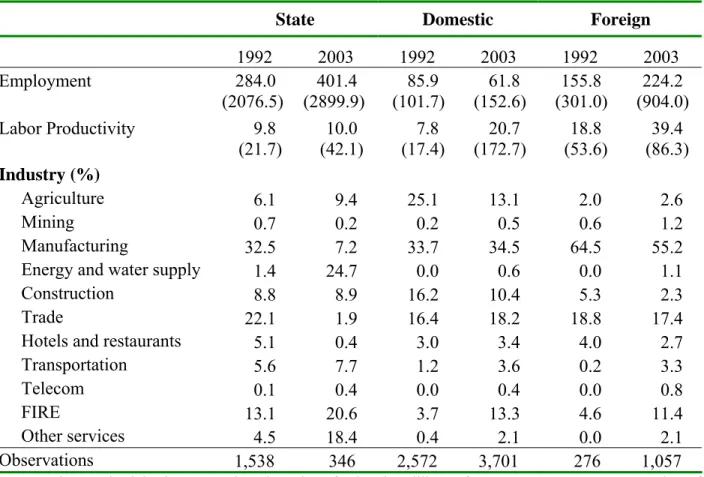

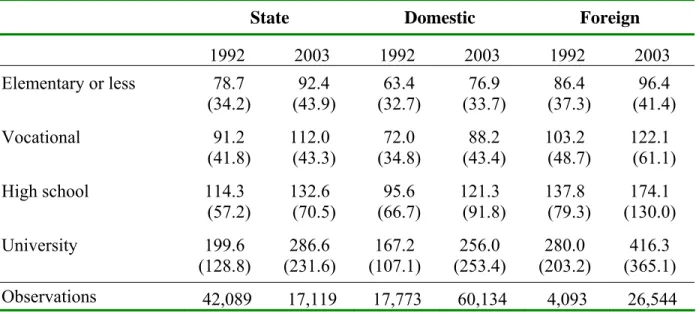

The transition process resulted in far more changes from the state to the private sector than could ever be observed in a non-transition economy, and so does the number of changes involving foreign ownership in Hungary. 2002) contain descriptions of the Hungarian privatization process. 2005) examines the ownership of companies listed on the Budapest Stock Exchange. The reliability of the real wage measure is of course strongly influenced by the quality of the deflator (in this case the CPI), and the large changes in the quality and availability of goods suggest that caution is needed when interpreting these figures. In both years, the unconditional average wage is smallest among domestic private firms, largest among foreign-owned firms, and mediocre among state-owned firms.

13 To maintain comparability over time, the evolution of the average real wage is estimated as year effects in an ln (real wage) equation that controls for firm fixed effects. The composition of the labor force by occupation also varies considerably, with a much higher rate of foreign-owned professional employment and a high rate of skilled manual employment in domestic private firms. For a multivariate analysis of the productivity effects of domestic and foreign privatization in four transition countries (among them Hungary) see Brown et al.

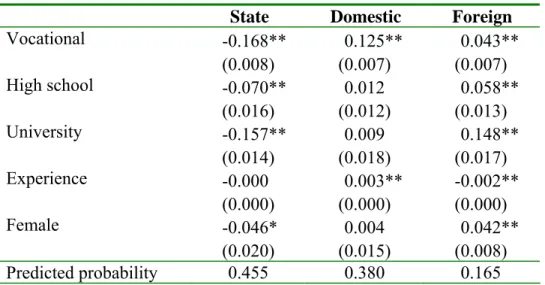

The presence of state ownership in all sectors of the economy helps to identify the wage effect of state ownership, which is often confused with inter-industry wage differences when analyzing data from developed countries. To summarize the discussion of selection of workers in different ownership types, we performed multinomial logit regressions, where we test how individual characteristics affect the ownership type of the employer.

Regression Estimates

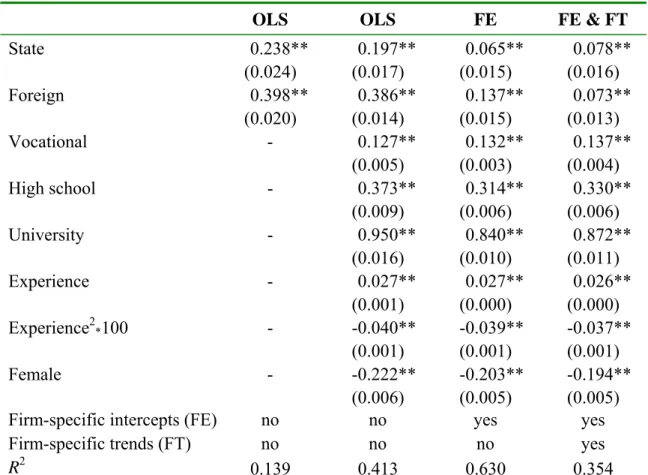

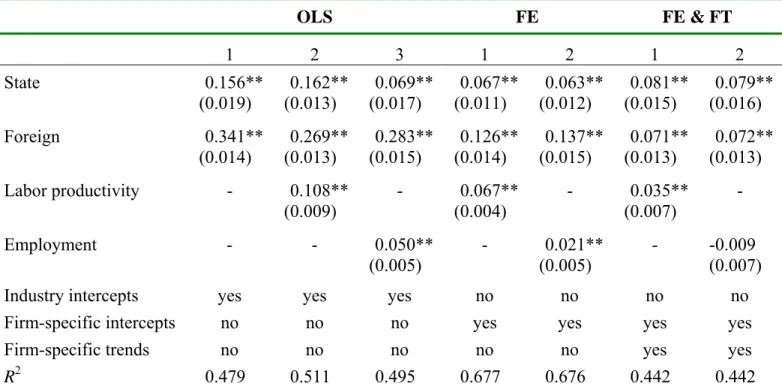

A consequent disadvantage is that the results relate to firms experiencing such changes, not to the broader sample.17 Finally, we use some specification tests to evaluate the performance of the estimators. The next column adds standard worker characteristics—education, experience, and gender—to construct a Mincer earnings function, but with little qualitative change in the results: a small decrease in the estimated foreign coefficient and somewhat larger decreases for state ownership (to 0.39 and 0.39, respectively 0.20). Both coefficients in the FE&FT specification have similar standard errors to those in the other specifications, so the question is not one of precision.

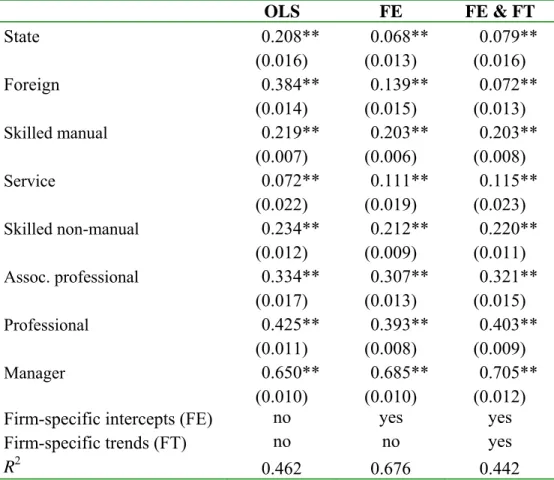

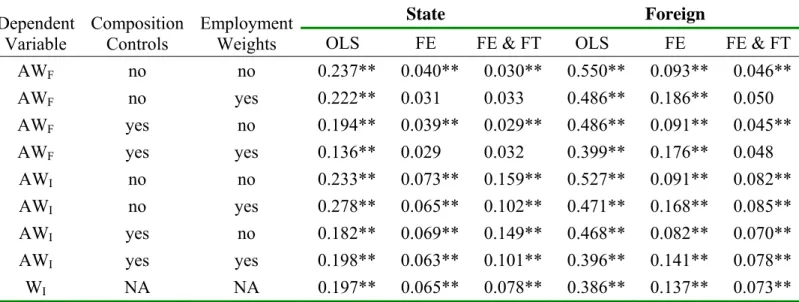

The hypothesis that country and foreign effects are equal is rejected in the OLS and FE specifications, but not in FE&FT, where the point estimates (0.078 for country and 0.073 for foreign) are strikingly similar. As for the coefficient on ownership type in Table 9, the inclusion of industry controls in the OLS specification reduces the country coefficient to 0.16 and the foreign coefficient to 0.34. These observable characteristics of firms thus account for a larger proportion of the crude gap between the government and the private sector than do foreign differences.

An important and somewhat neglected issue in analyzing the relationship between worker wages and firm characteristics such as ownership is the question of the appropriate unit of observation: the worker or the firm. Analyzing firms is appropriate because ownership is an attribute of the firm and may be useful if firm-level wages are better measured than individual-level wages. 20 As firms rarely change industry in our data, we do not control for industry in the FE and FE&FT specifications.

Regardless of the choice of specification, the state and foreign coefficients are always positive and statistically significant (except in one case), and the estimates are highly sensitive to the selection control method used, similar to our previous results. However, the magnitude of the estimated effects varies relatively little depending on the choice of observation unit, wage measurement, labor force composition controls, and weighting.21. First, we assess the joint statistical significance of the fixed effects, and then, provided that the fixed effects are included, of the firm-specific trends.

In any case, the F-tests reject the exclusion of the FE and the FT at significance levels of 0.0001. We then perform Hausman tests of the vector of coefficients of the FE model against the OLS, and of the FE&FT against the FE.

Conclusion

The employee side of the data allows us to measure the wages of individual workers (rather than relying on a firm-level average, as in previous research) and control for individual worker characteristics and changes in the composition of employment that may be related to ownership. These results take into account other employee characteristics, including gender and experience, and region and year fixed effects, but do not assume biased selection into ownership types, which is consistent with much of the literature. The estimated magnitude of the differences varies little when controlling for observable employee and firm characteristics, and there is relatively little variation depending on the unit of observation (firm or employee).

The finding that the OLS estimate of the foreign premium decreases significantly when firm fixed effects and trends are added suggests that foreign investors may systematically acquire firms that already pay relatively high and faster growing wages. Almeida, Rita, "Effects of Foreign-Owned Firms on the Labor Market." IZA discussion paper no. Brainerd, Elizabeth, “Five Years Later: The Wage Impact of Mass Privatization in Russia Journal of Comparative Economics, vol.

Wright, “Effects of Foreign Acquisitions on UK Productivity and Wages”. Journal of Industrial Economics, Vol. Djankov, Simeon and Peter Murrell, "Enterprise Restructuring in Transition: A Quantitative Survey." Journal of Economic Literature, vol. Hanley, Eric, Lawrence King, and Istvan Janos Toth, "The State, International Agencies, and the Transformation of Property in Post-Communist Hungary." American Journal of Sociology, Vol.

Sullivan, “Estimating the Benefits of Community Education for Displaced Workers.” Journal of Econometrics, Vol. La Porta, Rafael and Florencio Lopez-de-Silanes, “The Benefits of Privatization: Evidence from Mexico.” Quarterly Journal of Economics, Vol. Lichtenberg, Frank R. and Donald Siegel, “The Effect of Changes in Ownership on the Employment and Wages of Central Office and Other Employees.” Journal for Law and Economics, Vol.

Lipsey, Robert E. and Fredrik Sjöholm, “Foreign Direct Investment, Education, and Wages in Indonesian Manufacturing.” Journal of Development Economics, Vol. Nguyen, “The Impact of Changes in Ownership: A View from the Labor Market.” International Journal of Industrial Organization, Vol. Netter, “From State to Market: A Review of Empirical Studies on Privatization.” Journal of Economic Literature, Vol.

The evolution of the average real wage is presented as estimated year effects from a regression including fixed fixed effects to control for sample changes (dependent variable = log real wage, normalized to 100 in 1986).