The subject of the impact of the factors on cross-border M&A performance is still fresh and studied by the academics worldwide. In particular, the impact of corporate governance on cross-border M&A performance in the Chinese context is one of the most popular research topics for the corporate study. Therefore, the purpose of the study in this paper is to investigate the impact of ownership structure on cross-border M&A performance of Chinese companies.

Fourth chapter, empirical testing and analysis of the impact of ownership structure on cross-border mergers and acquisitions. Therefore, cross-border mergers and acquisitions of Chinese companies continue to attract the attention of scholars and academics. This article discusses the impact of ownership structure on cross-border mergers and acquisitions of Chinese companies from the perspective of corporate governance.

Their results of the impact on M&A performance do not well reflect the comprehensive situation of Chinese firms' cross-border M&A performance. Therefore, the analysis of the cross-border M&A performance mainly focuses on the company and the shareholders. In this paper, firms' cross-border M&A performance is analyzed from micro perspectives, focusing on Chinese SOEs and POEs.

Nevertheless, cross-border mergers and acquisitions are strongly related to the long-term interests of the company.

Empirical study I

Especially in cross-border M&A, the Chinese government provides the crucial support to Chinese POEs. At the same time, the government background of Chinese state-owned enterprises has made them bear more political burdens, and their cross-border M&A behavior often reflects the will of the government. Under these circumstances, it is therefore quite possible that there is a large difference in cross-border M&A performance between Chinese SOEs and POEs.

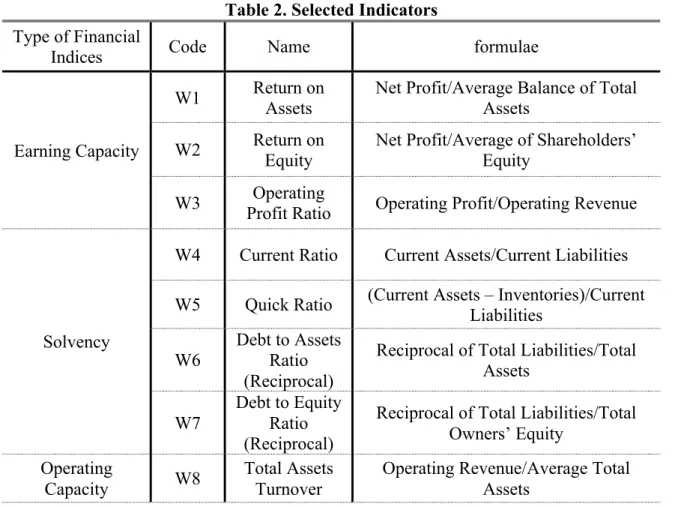

This paper selects all Chinese listed companies in Mainland China that have cross-border M&A activities from 2014 to 2018 as the initial research samples. We collect financial data for 4 years before and after cross-border M&A deals based on selected 10 financial ratios. In this model, y is the relative time for the cross-border M&A event (from 2 years before the M&A deal to 2 years after the M&A deal).

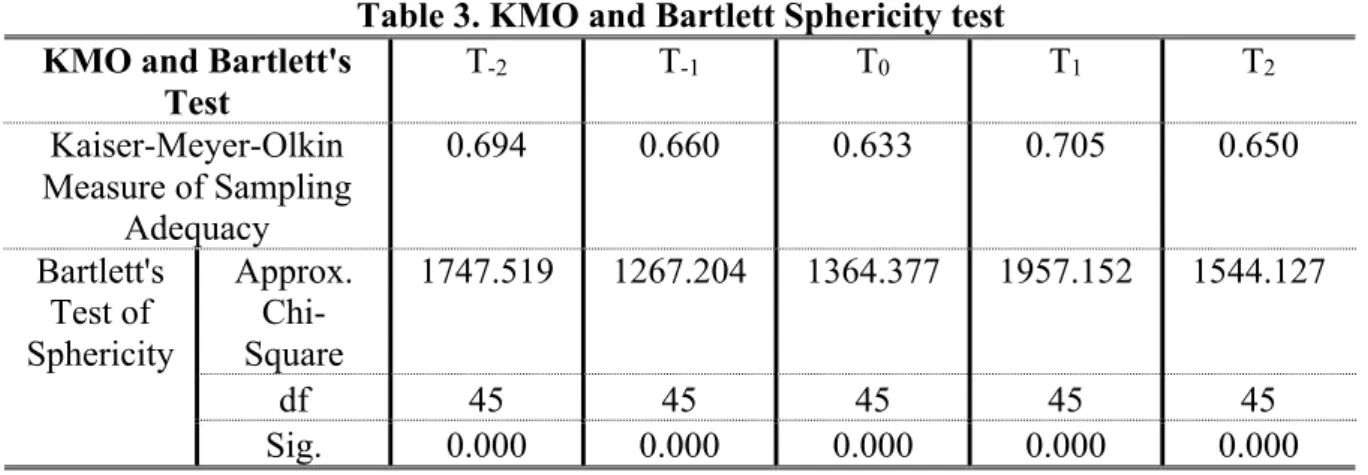

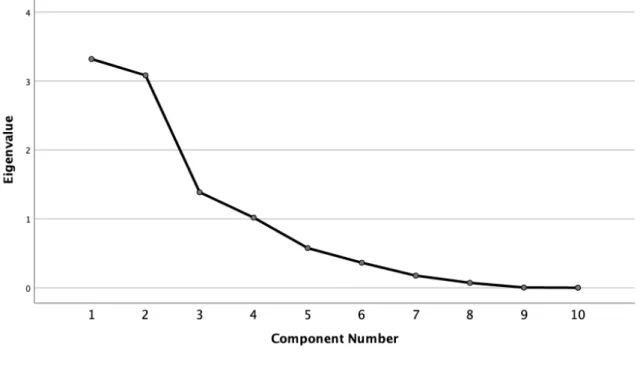

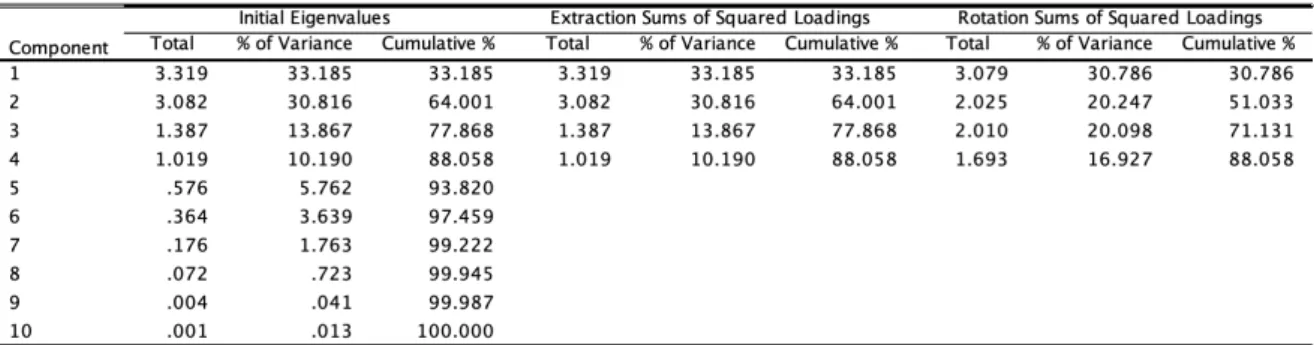

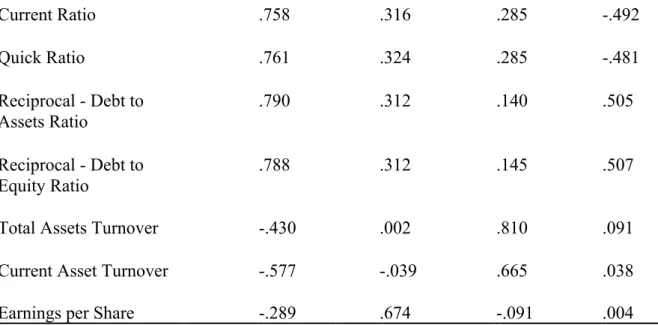

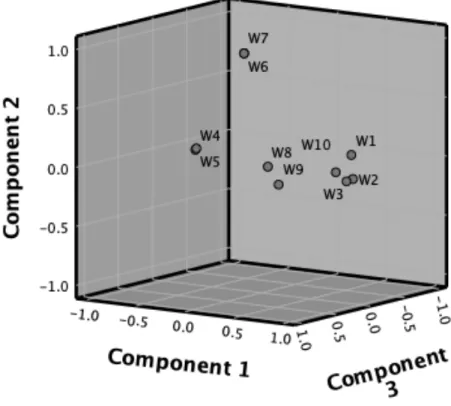

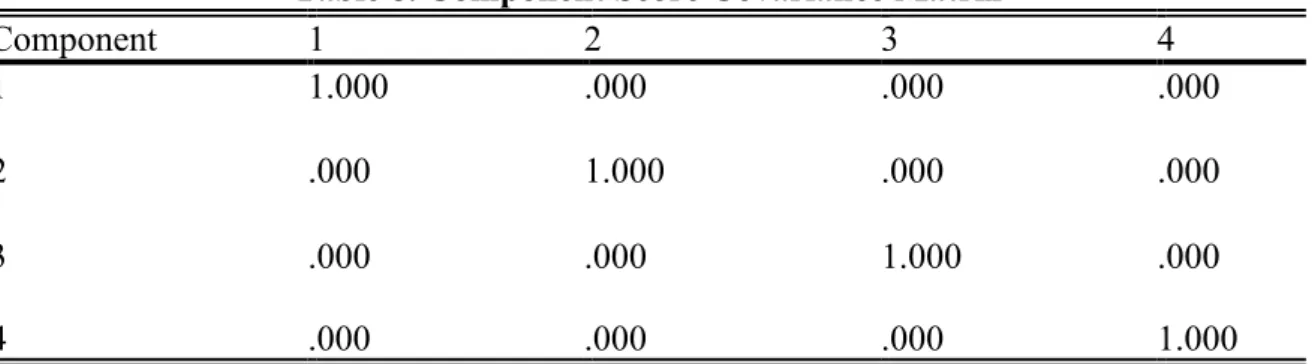

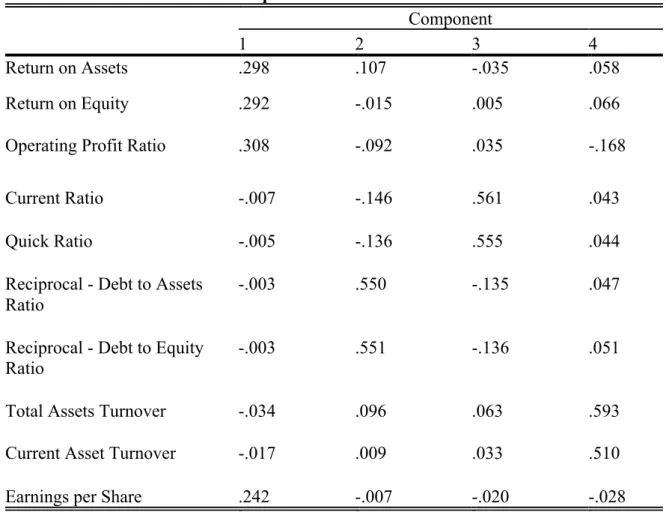

Tiy means the comprehensive cross-border M&A performance result of the ith selected sample company in year y. Principal component analysis (PCA) is used for factor analysis of cross-border M&A performance. Therefore, the design of factor analysis is very suitable for establishing a scoring system for cross-border M&A performance.

From the year the company completes its cross-border M&A event to the second year after the M&A event, the company's financial performance shows a steady upward trend, growing rapidly in the first year and slowing slightly in the second year. . Although the overall performance of cross-border M&A shows a roughly upward trend, China's special needs or state-owned enterprises show a different trend in long-term cross-border M&A performance. The performance trend of Chinese SOEs shown in Figure 6 is basically consistent with one aspect in Hypothesis 4 that Chinese SOEs have an upward trend in terms of long-term cross-border M&A performance.

But the hypothesis is not fully supported by the result in Figure 6, because the cross-border M&A performance of Chinese POEs does not show an upward trend in the longer term. In terms of the result, this can actually prove that the Chinese government's economic reform of Chinese state-owned enterprises in terms of cross-border mergers and acquisitions is effective. The cross-border mergers and acquisitions have brought substantial positive changes to the long-term performance of Chinese state-owned enterprises.

Therefore, considering the context of China's reforms, the empirical result reflects that the corporate reform under the leadership of Chinese President Xi has brought enormous positive effects on the cross-border M&A performance of Chinese SOEs. The next chapter is devoted to analyzing the impact of ownership structure on cross-border M&A to explain the reason that leads to the different performance of Chinese state-owned enterprises and public enterprises in terms of cross-border M&A transactions.

Empirical study II

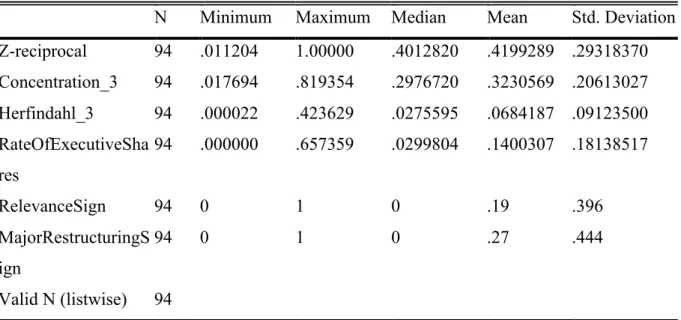

The balance of power in ownership is reflected by the comparison between the shares of other major stakeholders and the largest shareholder. The executive share ratio indicates the executive ownership situation in the company and is the basis for research on the effect of the capital incentive plan. Ownership concentration = the sum of the squares of the share ratios of the top three major shareholders (Herfindahl-Hirschman Index). 3) Rate of Executive Shares (Executive Ownership) (ROES) Rate of Executive Shares = Total Executive Shares/ Total Shares (4) Nature of Equity (ENT).

In this paper, the Herfindahl-3 variable is the sum of the squares of the stock ratios of the top three major shareholders. The Herfindahl-Hirschman index, the sum of the squares of the share ratios of the top three major shareholders. Therefore, BOP negatively affects the performance of cross-border M&A, the controlling right/power of the largest shareholder is more limited by other large shareholders, the performance of M&A will be more negatively affected.

The ratio of the shareholdings of the second- and third-largest shareholders to the largest shareholders is replaced by the ratio of the shareholdings of the second-, third- and fourth-largest shareholders to the largest shareholder, the sum of squares of the share ratio at the top. In general, the results of robustness confirm hypothesis 2 and reject hypothesis 1, hypothesis 3 and hypothesis 6, consistent with the results of the empirical analysis of the influence of ownership structure on the cross-border M&A performance. The ratio of the second, third and fourth largest shareholder's shareholdings to the largest shareholder.

This basically proves that the insider of the Chinese company plays an important role in the M&A transaction of the company in terms of M&A success, if the largest shareholder has relatively high control power compared to other large shareholders, the largest shareholder will be able to lead the company to accept a reasonable M&A decision, where the company is more likely to benefit from a cross-border M&A transaction, indicating high M&A performance. For major shareholders in Chinese SOEs, they are indeed the decision-makers, but in most SOEs in China, it is the largest shareholder or real owner (commission for the supervision and management of state-owned assets of the municipal government, provincial government, or central government) who is the actual stakeholder of the company does not make any decisions about the company's business. The decision-making power of the largest shareholder in China is effectively transferred to the executives from the beneficial owner under the Provisional Regulation on the Supervision and Administration of State-owned Enterprises promulgated by the State Council of China on May 27, 2003 (revised in 2011 and 2019 respectively).

In other words, the limitation of the controlling right/power of the largest shareholder by other large shareholders leads to the consequence of the failure of the internal mechanism of corporate governance. Then, the impact of the degree of control/power of the largest shareholder on cross-border M&A performance from the perspective of Chinese POEs is well explained. As analyzed in the previous work, the largest shareholders in Chinese POEs are generally constrained by other large shareholders, very possible internal conflicts among large shareholders in Chinese POEs lead to the failure of the internal governance mechanism.

Coordinating relationships between the largest shareholder and other major shareholders to avoid excessive internal self-interest disputes and reach consensus on cross-border mergers and acquisitions. Currently, the Communist Party Committee's supervision mechanism in Chinese state-owned enterprises has actually proven successful.

Conclusion