In the first chapter, we will discuss the description of different types of risks for financial investors. In the second chapter, the author examines the theoretical background of the research subject and its aspects. At the same time, environmental events are highlighted in the second chapter with the aim of including them in empirical research.

The author lists the events that are most likely to affect stock performance and that should be included in the event study analysis. In the first part of the paper, the author describes the rationale behind choosing the sample companies for an empirical study. A more detailed review of this paper will be made in the next chapter.

Risk management overview: main financial risks and mitigation techniques

Since the universe of risk management is quite broad, it must somehow be structured into mutually exclusive and mutually exhaustive categories. However, it is also known that nowadays there is a risk of extremely high oil price volatility, so after this risk is recognized by the company's risk managers, various measures can be implemented. However, due to the fact that it is so rare that assets can be perfectly negatively correlated, investors usually use derivatives for this task.

However, this is not always possible, because most of the time assets, especially assets of the same class, e.g. To estimate the market risk of an asset, it is necessary to calculate covariance of an asset and fully diversified portfolio, in practice it is often considered market index, such as S&P 500. It is necessary to say that it ' an important step in the research, because to fully understand the research problem, it is necessary to understand the whole background behind the term "risk" and how investors deal with it.

Environmental factors as a criterion for investment

ESG factors

As can be seen, there is a lot of qualitative data to be collected about environmental factors. Plastic waste is the focus of the largest FMCG companies, which plan to reduce it. Since it is obvious that social factors also play a decisive role in the risk profiles of companies and the value of companies, it is necessary to outline them.

The fact that the oil and gas industries along with metals and mining are one of the largest employers in the country, therefore, means that they are responsible for a large sample of the working population. This paper attempted to analyze which company dispositions have an effect on firm value. At the time, Enron was one of the largest energy companies in the world.

Climate Risk

Krueger et al. decided in their 2019 article to take stock of whether and how institutional investors deal with climate risk. However, this low relative ranking does not mean that climate risks are considered financially immaterial. IIGCC calls for better reflection of climate risks to accommodate potential opportunities and capital shifts.

Regarding the climate risk factor, it was critically reviewed in terms of how investors assess these risks and further exploration of risk appetite and time horizon for realization of such risks. In addition, since the events of the study were on a global scale (they affected the whole world), it would bring another dimension to this research in terms of the difference between two stock markets - the United States as a result, with all the answers to the aforementioned questions it will be possible to reach the final research goal of finding sectors that are less affected than others in relation to environmental events.

Empirical study of environmental events’ impact

Research methodology overview

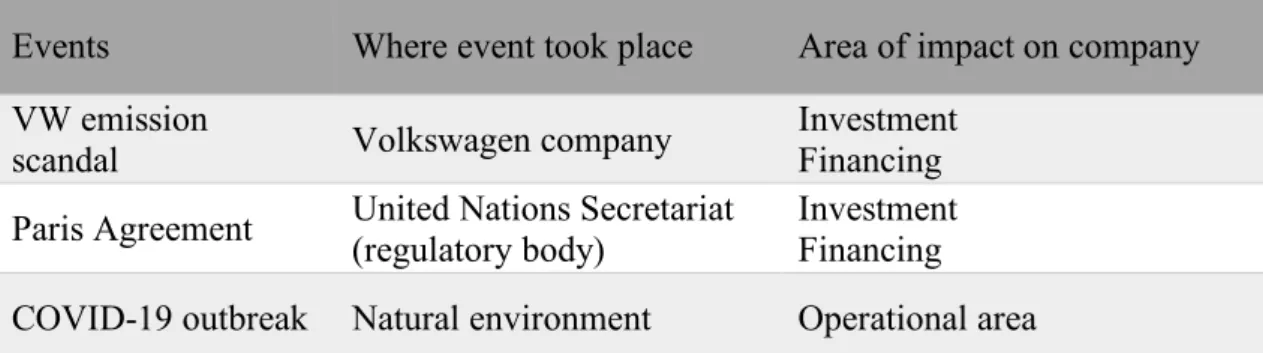

Initial questions would make it possible to understand whether the events outlined actually had any impact on companies' stock performance. This would be a big help in understanding (i) where returns are less affected and (ii) in which sectors. Overall, the research model will test the implications of events related to climate change and environmental issues, such as the Paris Agreement, the outbreak of COVID-19 in China and the Volkswagen AG emissions scandal.

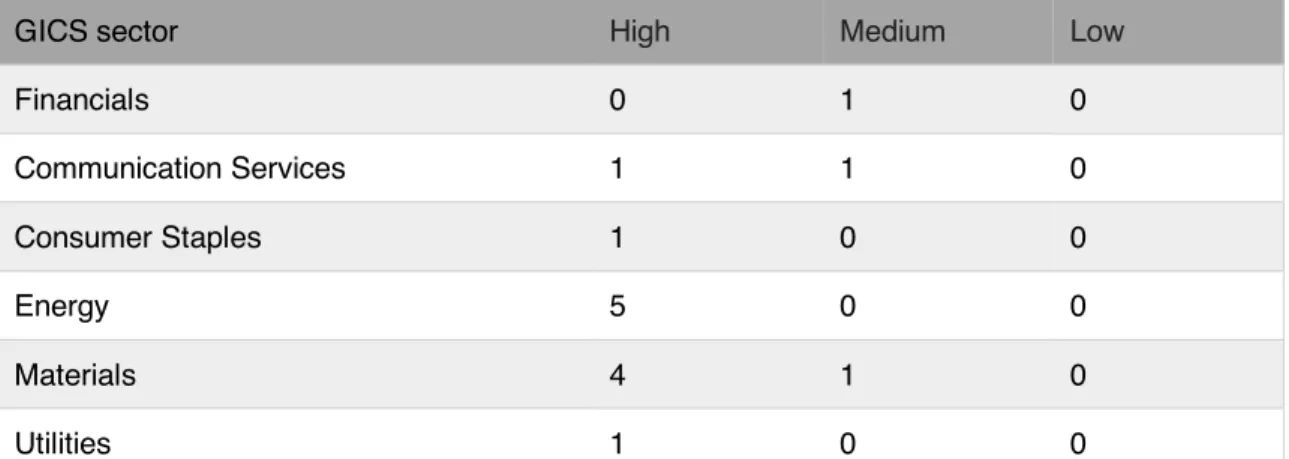

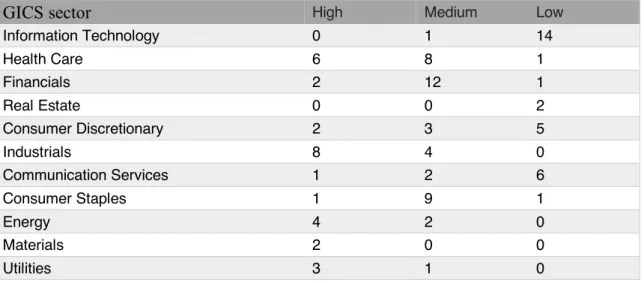

The author suggests using event studies in this thesis to analyze stock performance and hedging opportunities for companies. This will be the primary source of financial data, because Bloomberg Terminal will not be available to the author during the time of quarantine. As for the group of companies whose performance will be evaluated, the author suggests ranking stocks according to their ESG scores, because in this way it is possible to test how companies with different approaches to ESG value drivers are doing are affected by significant environmental events. .

Proposed research methodology

In terms of impact, it is necessary to understand that such an event affects not only the company itself, but also the market in general. So it is reasonable to conclude that there is a possibility of spillover effects to other industries, due to the fact that large companies are paying more attention to emissions. It is clear that such goals at a global level would eventually lead to reactions in the equity markets.

In addition, it is necessary to understand that not only these events can influence stock returns for companies within the data sample. When it was confirmed that the Russian stock market e.g. are negatively affected by dividend announcements, it is reasonable to conclude that such events are most likely to have an effect on firms within this data sample. In addition, since this study assesses an effect on a sector as a whole, it is fair to say that individual company events are unlikely to have a significant impact on the final outcome of the study.

Research design

To capture the impact of the events, it is necessary to include such a measure as Abnormal Return. In order to accept or reject the second research question of the thesis – namely whether different industries react similarly to environmental events or not, it is necessary to not only make a study on individual stocks, but rather on the industry as a whole. Therefore, it is also fair to conclude that such a sample of companies from Moscow Exchange is representative to draw conclusions about the market trends.

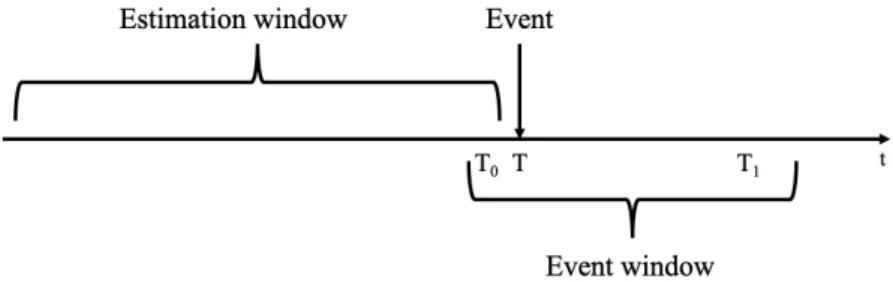

Engle used Sustainalytics' ESG rating for the companies in his study. Since this yielded meaningful results, it is reasonable to conclude that this rating can also be used in this study. In order to arrive at a sound reasoning of the study, it is necessary to identify both the estimation window and the event window. An interval of 6 months has been chosen for the Paris Agreement event because the author assumes that there was already a discussion about the agreement, therefore it is necessary to include a longer period to allow for possible information spillover about to accommodate the investors.

Empirical study

- Event study analysis

- Discussion of results

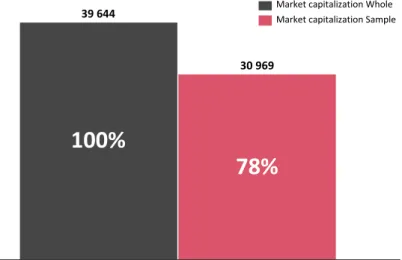

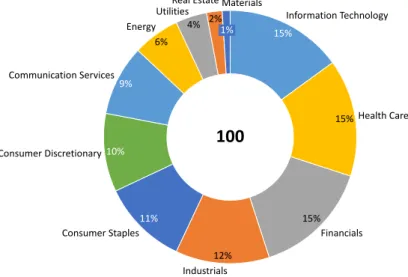

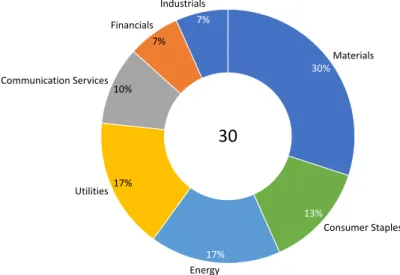

Regarding the estimation window, 51 days estimation window is taken, to account for the possible insider trading taking 25 days before the event itself and the possible delayed reaction of the markets taking 25 days after the event. According to Okulov's study, the event window should be determined due to the economic nature of the event and the purpose of the research. As for the Russian stock market, 30 companies were selected, which contribute to almost 80% of the total market capitalization of the Moscow Stock Exchange.

If we take the Energy sector, which is already the most affected by environmental news, this is a sector that explores, produces and trades oil and gas products, which have been described as one of the main contributors to CO2 emissions. The performance of the stock is taken on a daily basis in the form of the adjusted closing price of the stock. Such a time interval has been chosen because all events lie within its limits, so it will be enough to understand the stationarity of the time series within these limits.

It should be emphasized that 5 stocks from the original sample were dropped due to limitation of the aforementioned estimation window of 250 days before the event window. However, such a wide event window can be considered a little vague, but since the main objective is to see the reaction of the entire sector, it is wise to include such a large interval to capture all possible abnormal returns across the board. To analyze the impact of the event on the stock return, the method has already been identified.

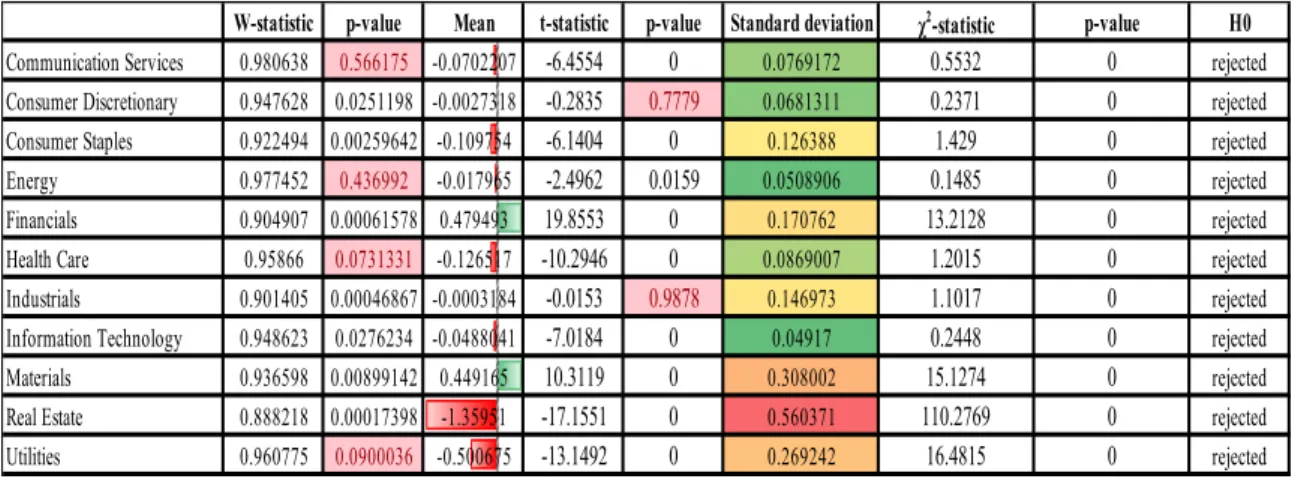

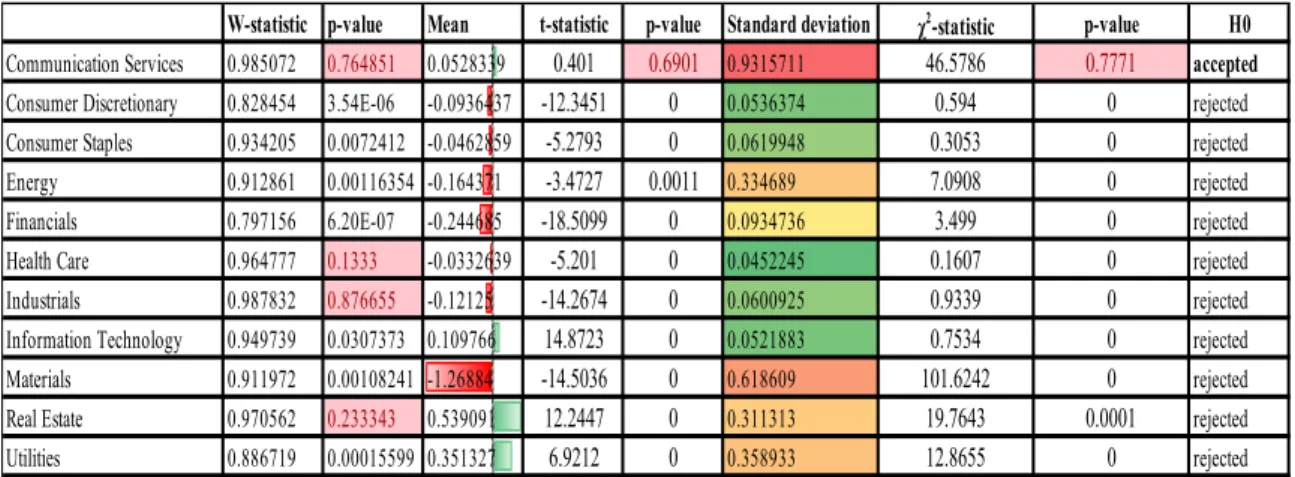

However, the test of the hypothesis that 𝜃̅K has a standard normal distribution has much more statistical power than the t-test. This part of the paper will discuss main findings from the empirical study and will be structured by (i) geography, (ii) event, (iii) impact of the event on the sector. As can be seen from Table 5, the VW emissions scandal actually affected all sectors of the economy, but not the consumer sector.

Since the environmental events of the study did not affect the performance of US stocks either positively or negatively, as a result of the research, the following conclusion is reached - the research events affect the average stock performance of the selected data sample, and since this data sample is quite large and quite representative in terms of sector involvement, a conclusion can be drawn for the entire stock market. First, this study explores the response to one of the most important events of this century – namely, the outbreak of COVID-19 – and provides insights into the performance of stocks across different sectors.

Second, the environmental nature of all events of this study and the real impact on almost all sectors during most of the events shows the extreme importance of climate change subject and forces investors to take it into account in their future investment decisions. Vitaly L Okulov, Study of the Russian stock market efficiency: the market reaction to the publication of analysts' forecasts // Vestnik (Herald) of the University of Saint Petersburg.