The aim of the current research is to explore the possibility of developing approaches for self-regulation of microfinance organizations. Therefore, the aim of the present study is to explore the possibility of developing approaches for self-regulation of microfinance organizations.

Regulation of Moral Issues in Microfinance Industry: Theoretical Framework

- Moral issues in microfinance sector

- Extant research of ethics in microfinance

- Theoretical approaches to self-regulation of market participants

- Regulation and Self-Regulation in microfinance industry

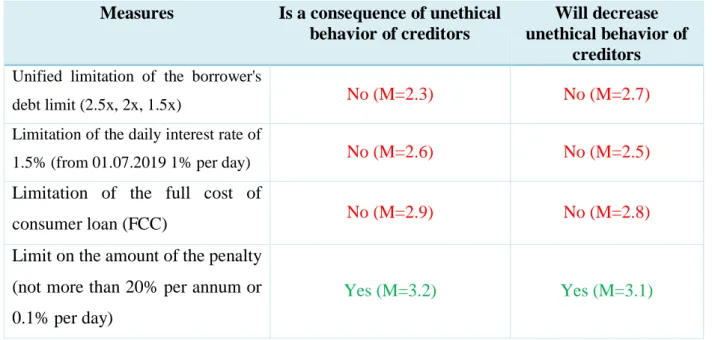

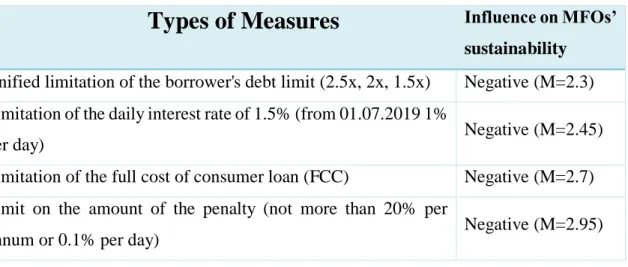

For the second task, we will review the existing literature related to the self-regulation of MFIs. Therefore, we can expect that an effective combination of regulation and self-regulation of the industry will be directed at the following measures.

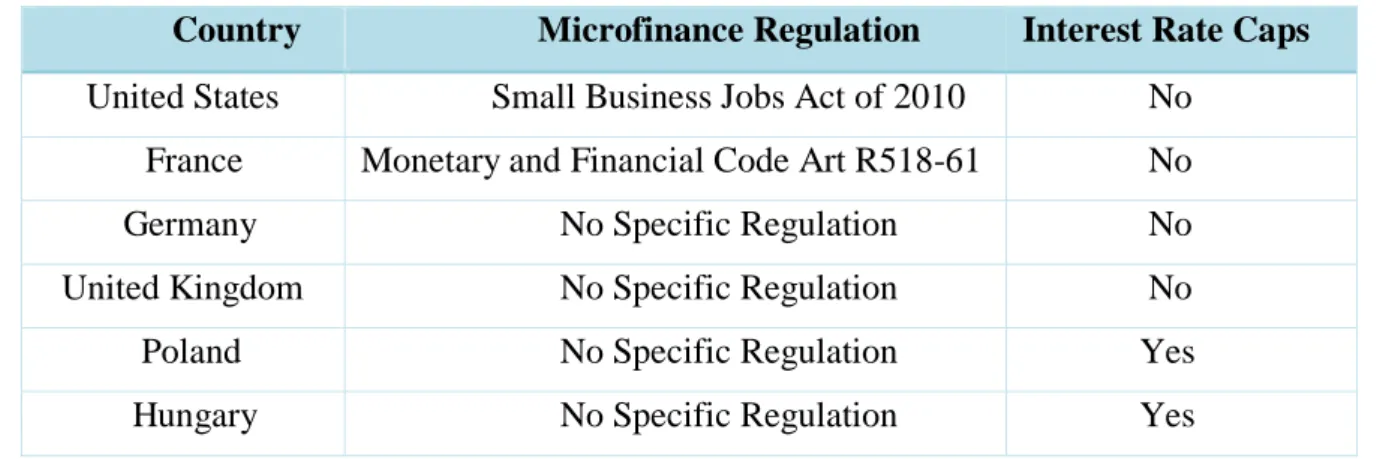

Regulation of microfinance institutions in other countries: historical overview

- Main models of microfinance institutions’ development

- Regulation of microfinance institutions in United States

- Regulation of microfinance institutions in European Union

- Regulation of microfinance institutions in Southeast Asia

With the growth of small businesses, the importance of microfinance in the country also grew. Currently, the major MFIs in the United States implement microfinance activities in one of three forms: (1) non-profit organizations that act as distributors of federal money, (2) non-profit organizations that operate independently of the government, and (3) for-profit organizations (Pierce). The law was enacted to allow small loan lending at “the lowest rates practicable by recognized and transparent lenders” (Mann R.J., 2012).

Later, Yunus launched his own Grameen Bank, which has disbursed $6.38 billion to 7.4 million borrowers as of July 2007.25 Only after nearly 30 years, in 2006, Yunus was awarded a Noble Prize for his contribution to "economic development and social from the bottom". Every MFI must obtain a license from the MRA to conduct microfinance activities in the country. In the Middle Ages, due to the rapid growth of trade between India and Asian countries, merchant banking also grew.

Various legislative acts were adopted to regulate the activities of informal microlenders already in the second half of the 20th century.

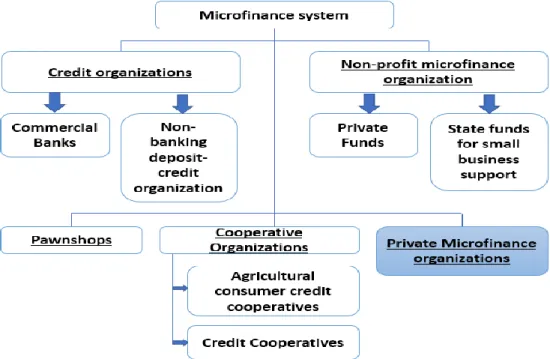

Regulation and self-regulation of microfinance organizations in Russia

- The history of microfinance development in Russia

- Microfinance industry overview and existing ethical issues

- Main legislation affecting microfinance organizations in Russia

- The role of self-regulated organizations in microfinance industry regulation

32 Average market values of the full cost of consumer credit (loans) for the period from 1 October to December used for consumer credit contracts (loans) concluded in Q2 2018 by microfinance organizations with individuals. The situation of self-regulation of the activities of microfinance organizations has changed in connection with the adoption and entry into force of Law No. According to Law № 223, MFОs are obliged to join one of the Regulated Organizations.

Currently, one of the priorities of the state in the microfinance industry is to fight microfinance organizations that operate illegally. This task is relevant because such creditors do not contribute to the development of the microfinance market and discredit the activities of bona fide microfinance organizations. 34;Microfinance and Development" (NP "MIR") was created by the largest participants in the microfinance market.

Work with complaints from clients of MFIs, including involving the financial ombudsman.

Research Methodology

Research philosophy, approach and design

RQ2 – What should be an effective approach to industry self-regulation to prevent unethical behavior by MFOs. This type of design is usually used when the researcher aims to understand the nature of the phenomenon and gain deep insight into the research problem. Since our study aims to find out solutions and effective approaches for self-regulation of microfinance organizations, an exploratory strategy will allow us to investigate the field more deeply and answer the questions of what, why, how types.

Another reason why such a research strategy fits our study is the fact that the concept of effective self-regulation in microfinance is still poorly defined and explored. Afterwards, we tried to reduce the scope of research in order to be able to give more thorough and comprehensive answers to the research questions. As we strive to gain more insight into the research problem, qualitative research will enable us to explore the possibility of developing conceptual framework for more effective self-regulation of microfinance organizations.

In our research, we want to answer questions such as what kind of ethical practices exist in the industry and how these practices relate to MFOs' self-regulation.

Sample strategy

For current research, we chose a purposive sampling method, as the research problem requires that the participants of all interested parties should be included in the research process. Since incorrect sampling method could lead to the problem of poor representation of the whole population, we not only included the representatives of all stakeholders, but also differentiated the participants according to their representativeness, influence on relevant fields, position, size, the attitude and interest in the research problem. One type of purposive sampling method is maximum variation sampling, also known as heterogeneous sampling.

As the name of this type of sampling clearly indicates, it is a technique used to capture a wide range of viewpoints regarding the research problem. Also, maximum variation sampling helps researchers look for variation in opinions and conditions that are seen as more extreme in nature to the researcher. The reason is that sampling error is inversely proportional to the square root of the sample size.

For this study, we adhered to the sample saturation point technique for the interview portion of our study, as the latter has a strongly exploratory character.

Data collection methods and procedures

The preliminary part of the research is presented in the form of semi-structured interviews, which allows us to draw a relatively small but targeted sample of interest groups, including: representatives of the Russian Microfinance Association, representatives of self-regulatory organizations and representatives of microfinance organizations. The questions also focused on participants' attitudes and rational judgments towards industry regulation, and how self-regulatory organizations can develop more effective approaches to prevent industry participants from engaging in unethical lending practices. Questions related to whether the Bank of Russia's regulation of the sector is beneficial to both MFOs and clients.

The fourth block is related to the activities of SROs, and how effectively these associations implement their functions. The fifth block is related to the justification of the policy managed by Bank of Russia towards the industry. There are questions aimed at evaluating the attitude of MFIs towards policies of the regulator.

As subtype 1 of the purposive sampling method, the maximum variation was chosen, which allows us to capture a wide range of perspectives related to the research problem.

Data analysis and discussions

Discussion of empirical findings and explicit answers to research questions

Let's say that the original assumption regarding the most effective approach to self-regulation was the one with the largest role of the SRO and the minimum role of the state in the process of regulating the industry. We were inclined to believe that in a highly competitive market, government regulation could be very harmful and that self-regulation would be the most effective approach to industry. SROs do not perceive MFOs as institutions that could regulate the industry and set appropriate restrictions and measures that will prevent unethical behavior of participants.

Low sense of unity among industry participants - MFOs do not act with concerted efforts and do not have unified policies for industry development (piggyback problem). SRO could regulate the industry; however, the tools would be more or less the same as those of the Bank of Russia. State intervention to the industry is justified by the fact that the industry is growing dramatically (with 30-40% annual growth) and is not stable to self-regulation.

And only 3 respondents believe that SROs are able to self-regulate the industry without government intervention.

Theoretical and managerial implications

MFOs understand but do not acknowledge that there are ethical issues in the industry - In fact, MFOs believe that the current level of ethical issues is minimal. The policy of the Bank of Russia is aimed at transforming microfinance activities into social business, but the government does not offer any incentives and support to MFO. Regarding the managerial implications of the current study, MFOs should first consider the main unethical practices discussed in this research in their operations and try to reduce the instances of such behavior in their companies.

Second important management implication from current study for MFOs should be the improvement of staff training and education of employees to ethical standards, which will help MFOs to prevent the general ethical issues of the industry that may arise from unethical behavior of employees who are directly with customers communicate. . Finally, since the main goal of the present study is to find effective approach to self-regulation of the industry, the results of this research can be used by MFOs to understand their role, functions and expectations of SROs, which their main actions should be directed on influence on the measures and other regulatory instruments used by the regulator. Currently, the majority of MFOs do not understand their role in the process of self-regulation, and therefore see no value in their participation in the process of regulation.

This study shows what can be the most efficient and workable approach to self-regulation, and how MFOs and SROs, by clarifying their positions, can jointly represent and protect the interests of participants in interaction with the regulator.

Limitations and future research

The main research questions relate to topics such as the ethical issues of the microfinance industry that are subject to regulation, as well as self-regulation and regulation of the industry. As for the most effective approach to industry self-regulation, the research results showed that industry self-regulation without state intervention is not applicable to the Russian microfinance industry for several reasons: (1) SROs are not perceived by MFO- as institutions that can regulate the industry by setting appropriate restrictions, (2) SROs are perceived by participants as a commercial body, which represents the interest of the industry, while the Bank of Russia primarily represents and protects the interests of clients, (3) SROs do not properly use the enforcement and punishment mechanisms they have to prevent MFOs from unethical practices, (4) Low sense of unity among industry participants, etc. However, currently the role of SROs is quite low and there are some important steps (stated in section 5.2) that SROs should implement to improve their approaches to industry self-regulation.

Weaknesses and gaps of self-regulation in the prevention of over-indebtedness: the case of the Dominican Republic. The Microfinance Market in Russia: Institutional Failures in the Payday Loan Segment and the Tasks of a Mega-Regulator, S. Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations, Oxford: Oxford University Press, p. .

Basic standard on "Protection of the rights and interests of individuals and legal entities - recipients of financial services provided by members of self-regulatory organizations in the financial market uniting microfinance organizations", Approved by the Bank of Russia on June 22, 2017.

Guiding questions for in-depth interviews with Russian Microfinance Center and

Guiding questions for in-depth interviews with microfinance organizations’

Questions from survey that were used in the process of analysis

Please indicate the average percentage of approved loans in your company. Accusations of unethical behavior against MFOs are often heard, but it is difficult for society to understand the validity of these allegations. In what ways, in your opinion, can the behavior of the MFIs that behave insufficiently ethically be improved?

Please rate how effectively the SRO of which your company is a member carries out its activities in each of the following areas.