In the course of the work, the existing literature on the subject of entrepreneurship and institutional factors that influence the aspirations of entrepreneurs to grow were analyzed. The aim of the paper is to analyze institutional factors that influence the share of high growth entrepreneurs. Many works study the influence of institutional factors on entrepreneurial activity and on various aspects of the aspirations of entrepreneurs.

Analysis of the literature related to the impact of entrepreneurial culture on the economy and institutional factors influencing this impact.

THEORETICAL BACKGROUND

E NTREPRENEURSHIP AND TYPES OF ENTREPRENEURSHIP

- Impact of entrepreneurship on economic growth

- Impact of institutional factors on entrepreneurial activity

Additionally, the author states that employment generated by small businesses is growing faster than the overall US economy. For example, (Almeida & Kogut, 1997) based on an analysis of the US semiconductor industry in the 1990s found that new market entrants generate fewer patents than incumbents. They found that in the US, in the industries mentioned above, the time between patents decreases with time and the age of the firm.

For example, in the aforementioned article (Arvanitis, 1997) assessed the importance of innovations (ordinal variable, 1 to 5 where 1 is very low importance to the company/industry). 13 based on the number of employees in the company (i.e. entrepreneurs — small companies in terms of personnel). In their analysis of OECD countries, the authors found that a higher start-up rate leads to direct GDP growth in the long run.

R ESEARCH OF ENTREPRENEURIAL ASPIRATIONS

The most relevant and recent papers were examined in the first round: they are devoted to the analysis of the factors (macroeconomic, cultural, cognitive, etc.) that influence entrepreneurial aspirations in different regions. Finally, some papers that study entrepreneurial aspirations that are not from an institutional point of view are also examined to gain a better understanding of methodology used. They used data on entrepreneurial aspirations from GEM dataset and analyzed the three-year period across 29 countries.

Despite the fact that the researchers found no correlation between macroeconomic factors and entrepreneurial aspirations during the 2008 financial crisis, macroeconomic conditions play a significant role in entrepreneurial ambitions. Entrepreneurial aspirations (whether the product is new for all or some customers, whether more than 25% of the customers are from abroad). At the same time, (Kaya, 2017) investigated the impact of macroeconomics (namely "Recession Push" and "Prosperity Pull"7 hypotheses) on entrepreneurial aspirations using GEM data.

The author measured the average level of variables representing entrepreneurial aspirations during the period of economic expansion) and using the Mann-Whitney-Wilcoxon test compared the means. As a result, the author did not find any evidence to prove that during the period of economic expansion affected entrepreneurial desires in any way. Later (Kaya, The Impact of the 2008-2009 Global Crisis on Entrepreneurial Aspirations and Attitudes., 2019) examined the impact of the 2008 global financial crisis on entrepreneurial aspirations and motivation and again found no significant change in any of the aspirational variables.

The second hypothesis states that the risks are lower for entrepreneurs in good times, which is why the decrease in entrepreneurial desires during a crisis is expected. Authors investigated the effect of bankruptcy laws on entrepreneurial desire by analyzing the difference in entrepreneurial desire across countries with different bankruptcy laws and found a strong correlation between such laws and the overall level of high growth expectations.

R ESEARCH GAP FOR EMPIRICAL STUDY AND HYPOTHESES STATEMENT

In addition, high-growth entrepreneurs are more often affected by property rights than regular ones. High-growth entrepreneurs, if successful, have more to lose and may also attract the attention of potential expropriators due to the higher cost of their assets. Additionally, high-growth entrepreneurs are driven primarily by opportunity, so they will pursue a new business location.

As mentioned by (Stenholm, Acs, & Wuebker, 2013), the availability of capital is an important factor affecting growth entrepreneurs. The higher the degree of corruption, the lower the proportion of growth entrepreneurs. The easier it is to start a business, the greater the proportion of growth entrepreneurs.

The easier it is to get financing, the greater the proportion of growth entrepreneurs. The greater the proportion of people who know an entrepreneur, the greater the proportion of growth entrepreneurs. The higher the estimate of one's own skills by the entrepreneur, the greater the proportion of growth entrepreneurs.

The higher the perceived status of an entrepreneur, the greater the share of high-growth entrepreneurs. The better the image of entrepreneurship in the media, the greater the share of high-growth entrepreneurs.

METHODOLOGY AND EMPIRICAL EVIDENCE

R ESEARCH METHODOLOGY

Finally, the purpose of the research is not to identify the causes of entrepreneurship. For the reasons stated above, quantitative research is the most suitable method for answering the research questions posed in the paper. This study uses regression analysis (OLS) as the main tool to test the hypotheses generated from the analysis of the theoretical base.

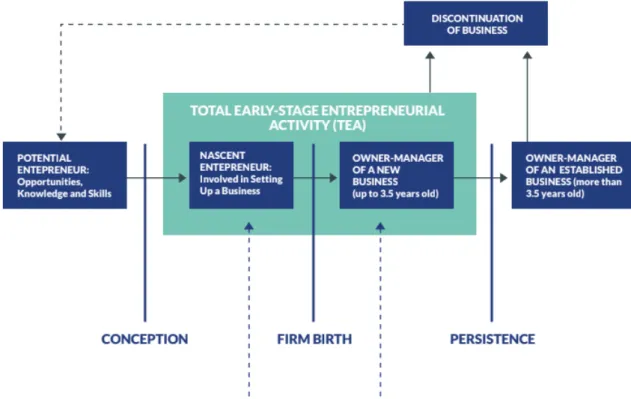

We used the grounded theory approach to determine the factors to be tested. But to avoid the problem of bias and increase the reliability of the collected data, as the main source of empirical data we will use the Global Entrepreneurship Monitor (GEM) data. The number of countries in the survey is increasing every year, and in 2019 GEM reported profiles of 49 economies.

The first deals with entrepreneurial attitudes and behaviour, the second deals with the socio-economic environment in the country. National-level data for the countries of Eastern Europe for population aged 18-64 and country rates (e.g. the proportion of high-growth entrepreneurs among all entrepreneurs) will be used. Some scholars define the region as a cultural entity, while during the Cold War this region was named the Eastern Bloc and the list of countries in the bloc was political.

To avoid these problems, we use the definition of the United States Department of Statistics8. To capture the dynamics of indicators, we will use the period since the economic crisis.

R ESEARCH DESIGN

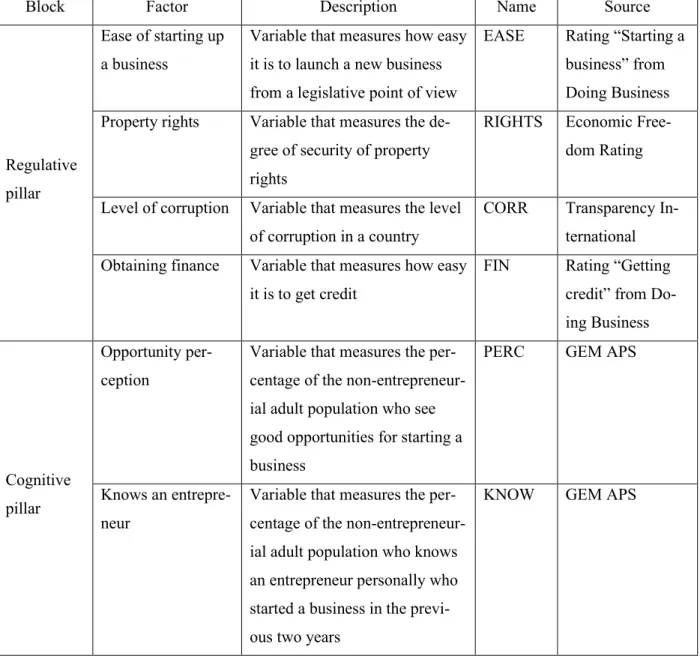

Despite the fact that Transparency International was criticized for its methodology by some researchers, this ranking was chosen because of the amount of data it combines. The changes in the method were mitigated by using the position in the rankings instead of raw scores. Variable that measures how easy it is to start a new business from a regulatory point of view.

Variable that measures the percentage of the non-entrepreneurial adult population that sees good opportunities to start a business. Variable measuring the percentage of the non-entrepreneurial adult population who know an entrepreneur personally who started a business in the previous two years. High status Variable that measures the percentage of the adult population who agree with the statement that people in their country attribute high status to successful entrepreneurs.

Media coverage Variable measuring the percentage of the adult population who agree with the statement that they will often see stories in the public media about successful new businesses in their country. Dependent variable in the model — the share of entrepreneurs with growth ambitions (entrepreneurs who expect to have at least five employees in five years, while the total number of employees increases by more than 50%). We could not use the country scores in the model, because organizations that compile rankings of interest have changed their methodology several times over the past ten years, making these scores incomparable.

Negative coefficients are also expected for such variables: the lower the country's position in the ranking, the better. It was impossible to invert rankings to transform variables into positive coefficients because the number of countries in these rankings changed over time (e.g. Austria took first place in the Corruption Perceptions Index two years in a row, but the first year the number of countries in a ranking was 100, and the following year 115.

EMPIRICAL STUDY

- M ODELS

- R ESULTS

- D ISCUSSION

- C ONCLUSION

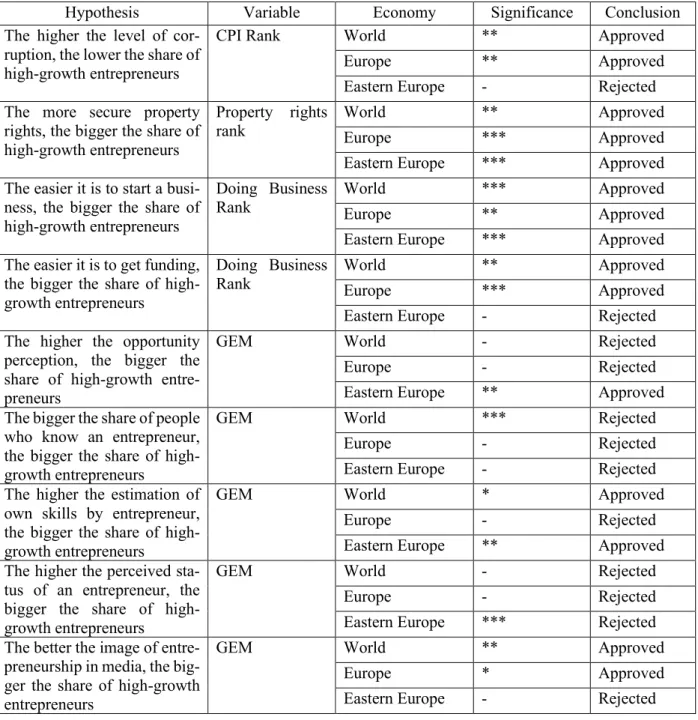

Therefore, if the country moves by 1 place in the ranking, the share of fast-growing entrepreneurs decreases. Corruption affects the share of fast-growing entrepreneurs only in the global and European samples. This can be interpreted as follows: to increase the rate of high-growth entrepreneurs, significant improvements in the CPI are needed, not small steps.

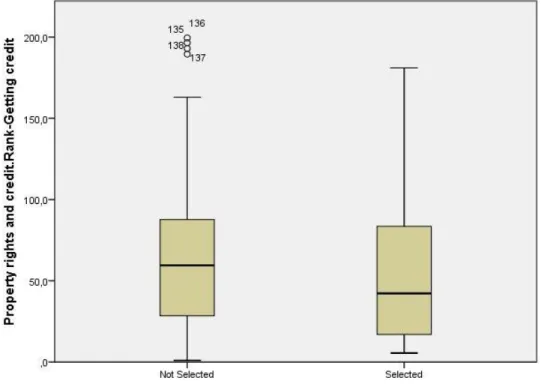

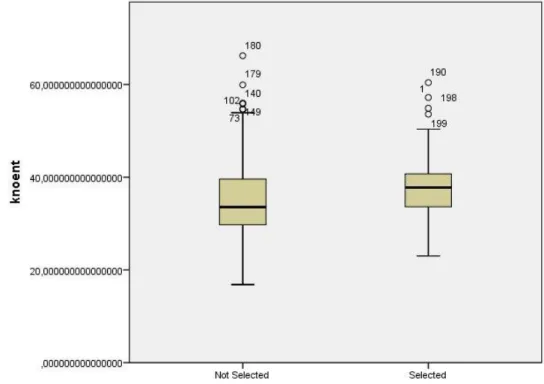

42 Property rights, on the other hand, is one of the most important factors in the model (due to individual statistical significance of the variable plus beta coefficient). In general, this result can be interpreted in the following way: availability of funds plays a significant role in the share of high-growth entrepreneurs, but not in Eastern Europe. As can be seen in the figure above, despite the fact that the mean and median share of respondents who know an entrepreneur is higher in Eastern Europe, the difference is not statistically significant, and this variable is not significant not in the model.

It is worth noting that in the global model the effect of this variable is actually negative and statistically significant, which could be interpreted as the larger the proportion of respondents who know an entrepreneur, the smaller the proportion of fast-growing entrepreneurs. The hypothesis that the perceived status of entrepreneurship in society has a positive effect on the share of high-growth entrepreneurs is also rejected: in the Eastern European model, the connection is negative and statistically significant, while in the European and global models this variable is not statistically significant. Finally, the hypothesis that the image in the media has a positive effect on the share of fast-growing entrepreneurs is partially confirmed: in the global model and the European models, this variable is statistically significant and has a positive effect.

In addition, this study provides the ground for future discussion, namely the longitudinal changes in the factors. What's more, specific changes in the variables can affect the overall results of the modeling. It is expected that there are significant differences at the country level in the level and type of entrepreneurial activity.

Importantly, the ease of obtaining funds and the perception of corruption are significant in the Europe and World models, but not in the Eastern Europe model.