Master's thesis Title The role of knowledge and technology in the internationalization of Chinese enterprises in Russia. This article aims to explore the role of knowledge and technology in the internationalization of Chinese enterprises in Russia.

Introduction

- Background

- Research problem

- Purpose

- Research questions

From recent literature, we recognize that for multinational corporations (MNCs), the main benefit of foreign direct investment (FDI) is the transfer of knowledge and technology to local firms in host countries. For our research problems, we will first clarify the demarcation of knowledge and technology in the context of internationalization strategy.

Literature review

- Definition of Knowledge

- Types of knowledge

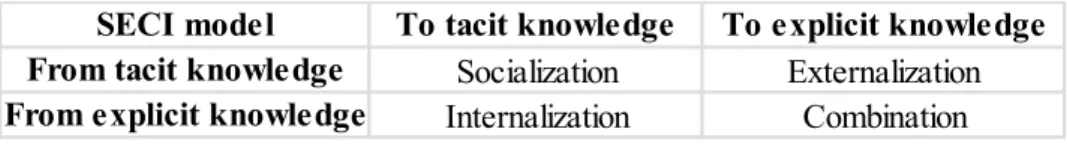

- Knowledge creation process

- Technology

- Technology spillover

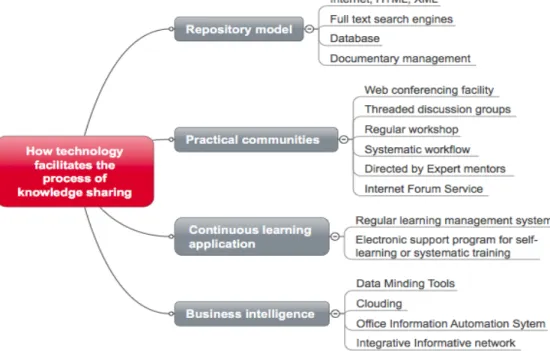

The definition of knowledge is very broad, but according to the study of Pascarella (1997), knowledge definitely drives the conclusion, 99 percent of the work people do is based on knowledge (Wab, 1999), although it is invisible. Undoubtedly, knowledge and technology are playing an irreplaceable role in the growth of an expansion-oriented company from developing countries, in the previous study we have selected all the possible content and function of knowledge &.

Industry overview

- Current situation of Chinese multinational firms in Russia

- Overview of index of foreign trade of Russian Federation with foreign countries from

- Common barriers of FDI from China to Russian

- Continuous overview of cooperation framework between Russian and Chinese government 26

- Uppsala model (Johanson & Vahlne, 1977)

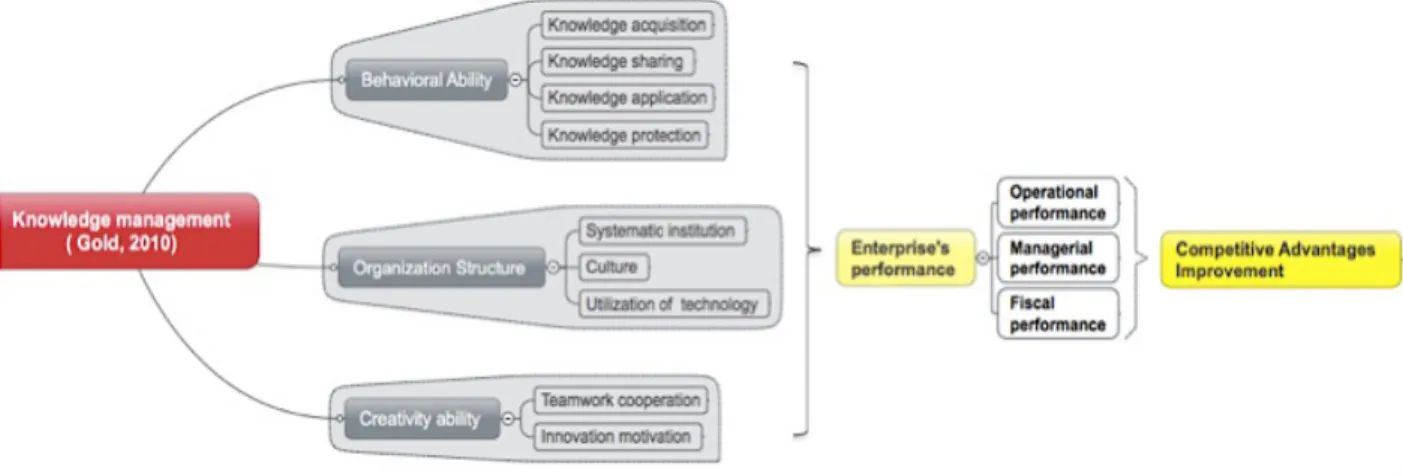

- Conceptual framework of interaction between knowledge management and performance of

- The model of absorptive capacity

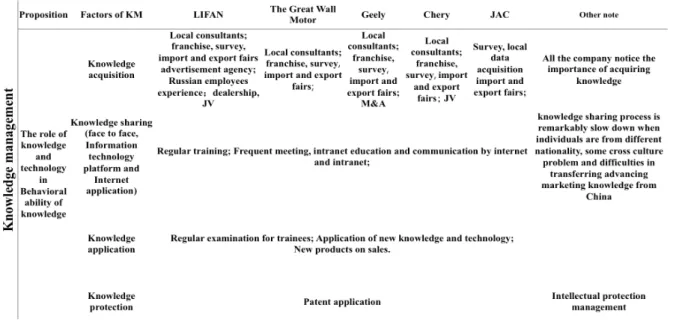

According to EY's latest 2015 report, "The Investment of Chinese in Russia", only 6% of Chinese respondents out of 142 interviewees announced that they are proficient with Russian market knowledge, regulations and legislation. In 2003, the superintendent of "The Great Wall" corporate strategy research institution - Delu Wang pointed out a concept called "Simple Knowledge Management", mainly stating that in the enterprise, all business activities and common problems are related to knowledge creation and knowledge innovation.

Research methodology & data description

Multiple case study approach

Thus, the absorptive capacity model is a very useful scientific tool to help us study how Chinese firms use the optimized role of knowledge and technology in the context of AC to strengthen their competitive advantages in the process of internationalization in Russia. The role of knowledge and technology could have different levels of importance, involving their international strategy and performance and competing with other rivals.

Multiple sources of evidence

Based on the criterion sampling strategy, we selected 5 Chinese automobile companies (Lifan, The Great Wall Motor, Geely, Chery, JAC moto) and 5 Chinese high-tech companies (Huawei, ZTE, Lenovo, Hytera, Haier, Amur Sirius Power Equipment limited company) for our qualitative study. Most of them are happy to provide time and multiple resources to interview for our study.

Analysis and quality of case study

Empirical findings and discussions

Characteristics of selected companies

Finally, we combine the inductive analysis data with our theoretical building codes to obtain our conclusion. The other 5 selected Chinese automobile companies have already entered Russian about 10 years on average, almost all of them have encountered and overcome the financial crisis in the Russian market in 2009, as a result, they have more experience and knowledge in the Russian market, faced financial crises in an international environment. We chose these companies because they have impressive performance in the Russian market, even in the period of the financial crisis, they also have a very promising reputation at the global level due to their product quality, brand image, innovative service and excellent sales strategies. internationalization, application of KM. , AB and government involvement is supposed to be found in their companies.

In the following study, we will provide an overview of their current situation in Russia, and then seamlessly stick to our fundamental topic that revival in a highly risky and untouchable market requires a virtuous combination of knowledge management, absorptive capacity, government involvement and wise internationalization require. strategy. So we will also have an in-depth analysis on applications of KM, AB and government involvement of each firm, combine with their international strategy in Russia. First, we have an in-depth analysis in both the Chinese automotive industry and high-tech industry, then we will have a comparative analysis.

Overview Chinese automotive market in Russia

So, more and more Chinese car companies chose to enter Russia, some of them even intended to build local factories in Russia. But all the promising vision was broken by terrible slump in 2014 due to the economic sanction, although many Chinese car companies boldly continue to invest directly in the Russian market. Although the market share of Chinese car brands in Russia is very small, the performance can still be considered a legend.

But especially, facing the same deteriorating business environment, these measures push Chinese automobile companies into a worse situation, facing much more losses, as the price of their products became twice as expensive for due to currency devaluation and customers will have less interest in Russian cars. , which has better car loan interest. Some Chinese companies have withdrawn from the Russian market with 0 sales, even Great Wall companies, which is one of the earliest Chinese automobile companies, have encountered failure in their sales, and the rest of the companies still have to worry about the unpredictable future in Russia, which could still get worse in the coming years. Currently, the market share of Chinese automobile brands in Russia is about 4% (in 2015 it decreased due to the negative economic environment, but it is believed that it will soon exceed 6%, or even 10% in the near future. ) In addition, Chinese automobile companies began to focus on improving the quality of service for the Russian customer, they established the after-sales service network in Russia and aimed to establish the production and assembly center in Russia, which are favorable for the development of the Chinese. automobile in Russia.

Overview of Chinese high-tech industry in Russia

At present, the market share of Chinese car brands in Russia is about 4% (in 2015 it decreased due to the negative economic environment, but it is believed that it will soon break through 6% or even 10% in the near future). . It is quite impressive that even under this depressed economic environment, Chinese high-tech companies are still having increasingly good results in Russia. Good evidence can be discovered in the fact that the breakthrough market share of smartphones in Russia was dominated by Chinese brands with more than 30% in Russia, according to the telecom operator Vimpelcom.

Chinese smartphone market share in 2015:24%, in 2014:14%) China Telecom Company – Huawei was the largest foreign investor and captured more than 50% market share of broadband in Russia. The market share of Haier also achieved the first place in the Russian white goods market. Even with an economic depression in Russia, their performance and market share in Russia are still moving forward promisingly.

Analysis of empirical findings

- The comparative analysis of application of knowledge management between selected Chinese

- The comparative analysis of application of absorptive capacity of Chinese firms confirmed in

Thanks to our improvement of the products driving power of motor and cheap price, we took a place in the Russian market. Huawei could proudly say that Huawei is the biggest contributor to the innovation process in the world. Meanwhile, Haier carefully guarantees cost control and the quality of its human resources.

In particular, Haier is one of the world's premieres, which perfectly utilizes the role of innovative technology in the management of knowledge management and the internationalization process. Our experience in the Russian market is being transferred to the whole world as a classic case study now. The reason why we explore the role of knowledge and technology in relation to absorbent.

According to the THOMSON REUTERS report, namely “The state of innovation in the. Confirmed by a famous consulting company, Haier was listed in the top 50 of "The Most Innovative Company in the World".

Conclusion

- In - depth analysis in Chinese automotive industry

- In-depth analysis in Chinese high-tech industry

- Comparative analysis of the role of knowledge and technology in internationalization

- The final conclusion based on empirical finding

- Key findings

Unlike the Chinese automobile industry, the Chinese high-tech industry has not faced overt discrimination or protectionism from the Russian government. China's high-tech industry is enjoying the preferential policy confirmed by the Sino-Russian cooperative partnership. Chinese high-tech companies have stronger alliance with the domestic industry to get knowledge and consultancy from the domestic market.

Thus, the knowledge acquisition ability of Chinese high-tech companies is higher than that of Chinese car companies;. And the use of technology was optimized when sharing knowledge in China's high-tech industry. In addition, the absorptive capacity of China's auto industry is still generally lower than that of China's high-tech industry.

Theoretical implication

In the face of the decline of the Russian economy, Chinese companies are urgently required to show additional actions to increase its ability against risk. Based on the previous theoretical framework, the function of knowledge is reflected in the internationalization strategy, which requires the adoption of knowledge management with optimized adoption of information technology in the global environment, on the other hand, absorptive capacity evidenced the importance of technological innovation, which it is embedded in competitive competencies (Zhou and Wu 2010; Fernhaber and Patel 2012). In addition, to do business in a high-risk country, the government role is also an important part for companies from developing countries such as market knowledge.

Especially for companies from developing countries, when they probably do not have enough capacity to compare with rivals, but the preferential policy implemented by government involvement will help them survive in another developing turbulent business environment. This is also the underlying logic of our study to study the performance of knowledge and technology, whose contribution fills a theoretical gap on how to increase the competitive advantages of developing country firms in the internationalization process established in another high-risk developing country. According to our findings, all elements of this framework are indispensable to each other in terms of strengthening competitive advantages at the most optimized level.

Managerial implication

Ten Chinese companies selected from the automotive and high-tech industries are perfectly suitable for our research design, as these companies were found involved in absorptive capacity and knowledge management during their internationalization process, doing business in Russia. The best combination of knowledge management, absorptive capacity and good Guanxi with local authorities to have a competitive advantage in Chinese high-tech industry. Appendix2. The Case of the Best Utilization of the Technology Used in Haier's Internationalization From "Informatization Strategy" to "Informative Enterprise".

The positive effects of relational learning and absorptive capacity on innovation performance and competitive advantage in industrial markets. The Effects of Alliance Portfolio Characteristics and Absorptive Capacity on Performance: A Study of Biotechnology Firms. 2015) Absorbency and Performance: The Role of Customer Relationship and Technology Capabilities in High-Tech SMBs.