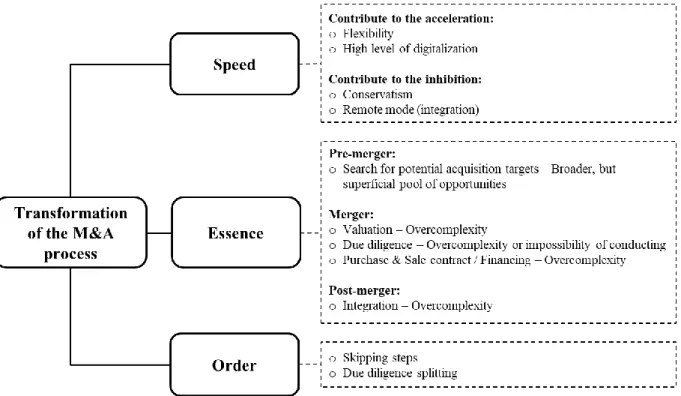

The main findings of this work include evidence of how the stages of the M&A process have changed in terms of their speed, nature and sequence. As subjects of study, we will consider the problems that arise at all stages of the process.

LITERATURE REVIEW

Basic concepts and definitions

The terms "merger" and "acquisition" themselves are often confused and used interchangeably by business and CFOs. In takeover transactions, there is thus always one party – the buyer – who buys the seller's assets or shares.

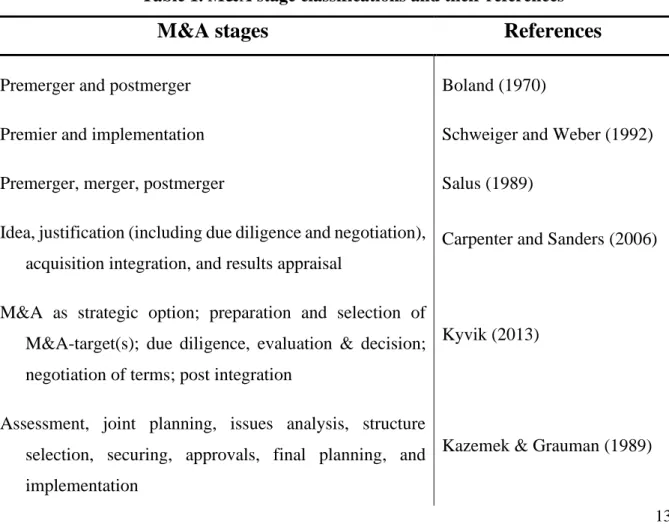

Merger and acquisition phases

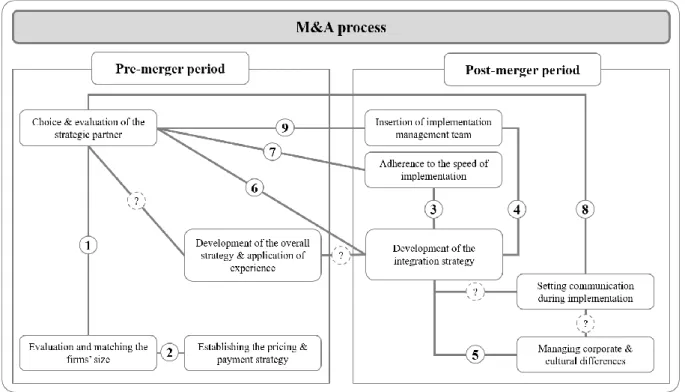

In general, we see that there is currently discussion in the scientific community about a unified approach to determining the stages of the M&A process. One of the first papers to critically examine post-acquisition speed and integration strategy (3) was the work of Angwin (2004).

Pandemic effect on M&A phases

One of the major changes in the post-merger phase is undoubtedly virtual integration (Leach . & Kaske, 2020). Perhaps in the future this change will be perceived as one of the main problems for mergers in a pandemic era.

Reasons behind M&A failure

- Unrealistic expectations

- Principal-agency problem

- Overconfidence

- Regulatory and political headwinds

M&A is one of the most unpleasant events in the life of today's manager (Lochmann & Steger, 2002). In addition, we see conflict and inconsistency in the ultimate goals of each of the parties in the M&A process.

M&A challenges

- Challenges of a pre-merger stage

- Challenges of a merger stage

- Challenges of a post-merger stage

- Challenges throughout the entire process

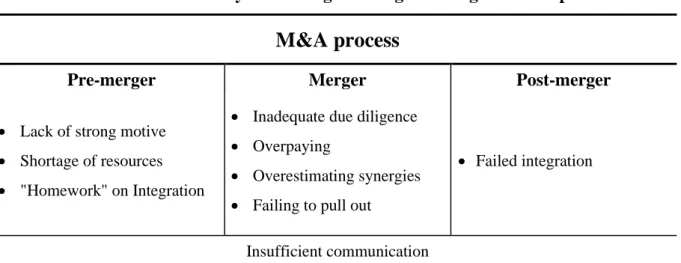

However, the M&A process worsens and becomes even more complex due to the challenges that each phase of the process presents to managers and deal-makers. One of the challenges in the first phase can be summed up as "Lack of strong motive for M&A", and it can arise long before the first work in connection with the deal is done. Undoubtedly, one of the most important problems in this phase is the overpayment to the company.

On the one hand, this may be the result of an incorrect assessment of the company's assets or its potential. This provides a smoother transition and mitigates the aspect of cultural differences that can lead to failure in the M&A deal. In all phases, and especially in the integration stage, employees feel the weight of the uncertainty.

Conclusion

Price is one of the most important criteria for assessing the success of an M&A deal (Kitching, 1967). Many researchers agree that it is important to accurately evaluate the target's assets to justify their market value; this thorough assessment will help the acquirer offer a fair purchase price and maximize the benefits of the deal (Calipha et al., 2010). As mentioned earlier, the closer to the actual signing of the agreement, the harder it is to abandon it.

Due to the complexity of integration approaches in M&A, different contingency frameworks or typologies have been created (Gomes et al., 2013). One of the commonly used post-merger integration frameworks was developed by Haspeslagh and Jemison (1991). Potential solutions to challenges are also partially explored and are usually in the form of practical advice from people in the M&A industry.

RESEARCH METHODOLOGY

- Research design and methodology

- Data sample

- Data collection

- Interview design

- Data analysis

- Limitations of the research

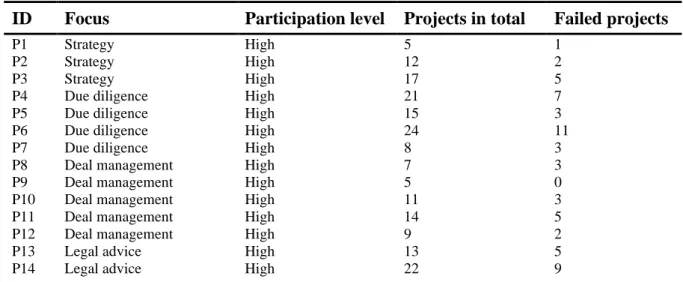

The interview guideline was based on the results of the reviewed literature, which is presented in the relevant chapter of this thesis and presented in appendix 1. 38 Following this approach, the author continued in the first phase of the analysis to immerse himself in the obtained data and in the accompanying context. The third stage of the analysis involves giving the raw data an initial rough shape.

Furthermore, following the guidance, the author prepared a series of quotations to illustrate particular aspects of the research topic and developed a direct and clear "story" for each topic to be presented in the next chapter of this thesis. Despite the fact that the author of this work has taken all measures to improve the validity of the obtained results, the use of qualitative research methods implies some limitations. This is due to the fact that the results cannot be checked for statistical significance (Ochieng, 2009), which is one of the main disadvantages of this method.

FINDINGS

Mutation of M&A phases

- Speed and pace of the M&A steps

- Essence of the M&A steps

- Order of the M&A steps

In the pandemic, they [dealmakers] thought about the efficiency of the process and reconsidered their fundamental approach to transactions.” But it depends on the flexibility of the structure, for example, conservative companies find it difficult to switch to a new format”. Experts also highlight new opportunities that have appeared on the market as one of the reasons why the process has accelerated.

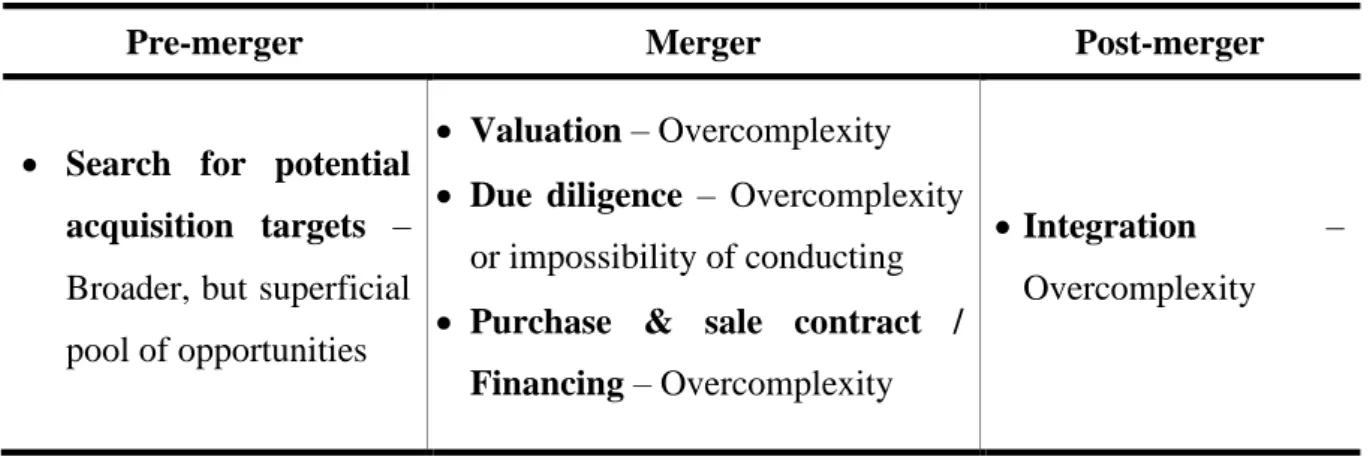

The order of the entire M&A process itself has not changed; the basic principles have remained the same". Thus, we can say that the speed has increased due to the acceleration of the decision-making process, some stages have become even more complex, others have undergone fundamental changes in their essence. The order of the main steps within the process remains stable and fixed, but minor transformations occur.

Challenges to the New Normality of deal making

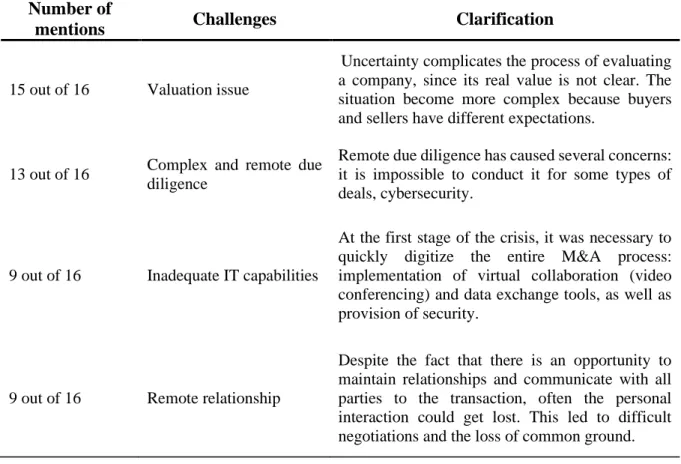

- Valuation issue

- Complex and remote due diligence

- Inadequate IT capabilities

- Remote relationship

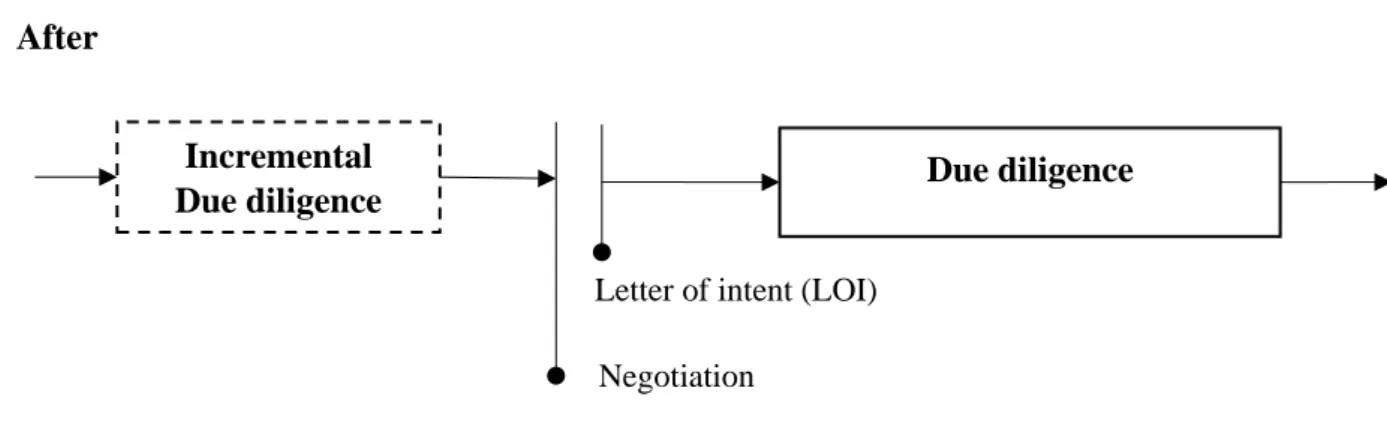

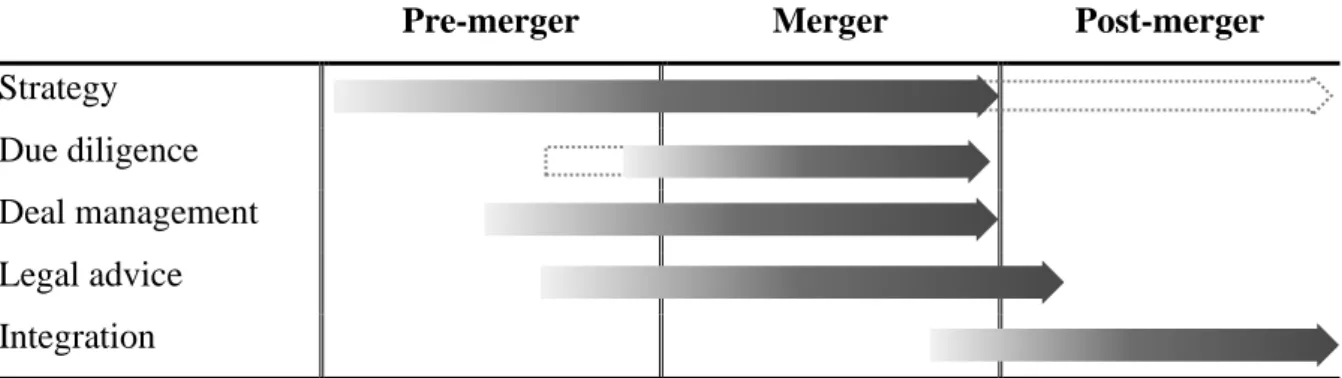

48 Figure 6 shows the classic arrangement of the due diligence phase in relation to the negotiation phase and the signing of the letter of intent. According to experts, the main reason for this is the overestimated expectations of the management of the two companies. The buyer says the target has dropped a lot due to Covid and the target disputes the fact that it has dropped, but that means it will go up even sooner and then.

Some of my colleagues were going to go at the very beginning of the lockdown, and in the end they postponed the trip for several months”. If this basis is not sufficiently advanced, it may cause delays and delays in the completion of the transaction, or even its cancellation”. Overall, we can say that the different level of technical equipment of all parties involved in the process can significantly complicate the life of the agreement makers.

Potential solutions to problems

- Bridging valuation gap

- Remote and profound due diligence

- IT-driven approach to M&A deals

- Creating virtual relationships

Well, you understand that we should first understand this and only then explain the parties of the M&A agreement. Today, when making deals, it is very common for companies to try to bridge the valuation gap by tying possible future success to the price of the deal. In addition to the fact that in a pandemic era it is really difficult to calculate the real value of the business from which the price of the transaction is formed, on this background the actual negotiations and interpersonal communication between the parties have become much more complicated.

We were very fortunate that most of the data we use for due care was already in a format that allowed us to work with it remotely, so we were able to create virtual clean rooms." Once we had to inspect a large factory, which was located in another country, and due to the blockade, we did not have the opportunity to come ourselves. The two extremes [those who work only during working hours and those who work 24/7] have become closer to each other, have the same background and have accepted the rules of the game”.

CONCLUSION AND DISCUSSION OF FINDINGS

Discussion of the findings

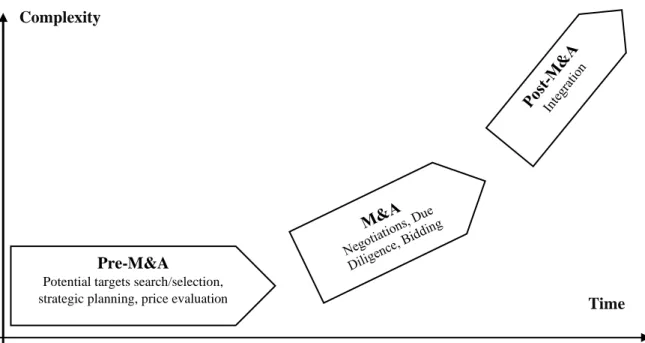

62 for example, the increase in speed is influenced by the flexibility of the parties and the level of digitization, while conservatism leads to a decrease in the pace. As for the essence, we can say with confidence that in addition to the fact that most of the stages have fundamentally changed in their essence, and have become remote. Also, a change in the complexity of the stages of the transaction has been noticed many times, many experts talk about over-complexity in negotiations, valuation, due diligence, and structuring, and integration.

With regard to changing the order of the process steps, no indications for significant changes were found. Due to the changing circumstances of the M&A market participants, many players were initially not ready to work in new difficult circumstances, making due diligence even more complex. The next challenge is related to the very onset of the crisis and lies in the fact that some parties lack IT capabilities to close deals in new circumstances.

Theoretical and practical implications

However, given the urgent need to restore the market, practitioners have developed a number of best practices to overcome these issues. This feature prompts further, more detailed study of the nature of transaction-related challenges, and requires the problem to be viewed on a smaller scale, presumably within one country or even one industry. Given that a qualitative research methodology has been used in this study, it is difficult to say which challenges are of the utmost importance and pose the greatest threat to dealer makers, but numerous references indicate that these are precisely in the current crisis.

Therefore, managers can use their knowledge of the context in which they operate to change their approach to an M&A transaction and, if necessary, change the order of steps to ensure greater efficiency. By using the knowledge gained as a result of the crisis and understanding the challenges associated with it, practitioners will be able to predict potential directions and industry changes for future shock events. This framework has been validated in many illustrations from the experiences of respondents to this work and clearly shows how companies are currently overcoming the challenges specific to covid.

Direction for future research

Furthermore, considering the relatively small sample of respondents, further improvement in the quality of the results obtained could be achieved by increasing the number of respondents. First, this can be achieved by including in the sample the managers of the company who are directly involved in the management of mergers and acquisitions. Alternatively, it is possible to collect a sample of respondents consisting only of managers and compare the results obtained with the results of this study to determine possible differences in the vision of the situation from different angles.

In this respect, the not fully formed phenomenon has the potential for new research after the direct impact of the crisis has passed. The interview begins with an explanation of the purpose of this research, and the author formulates the relevant research questions. Critical success factors through the mergers and acquisition process: Revealing pre- and post-M&A linkages for improved performance.