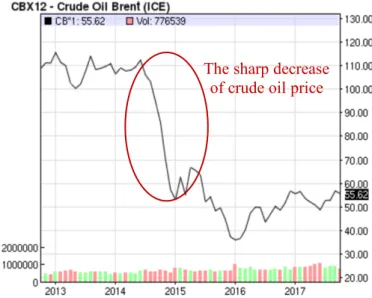

Description of the objective The purpose of this paper is to analyze whether the unexpected drop in oil prices in 2014 correlates with takeover activity in the oil and gas industry. The purpose of the paper is to identify the most important trends in the reaction patterns of the oil companies against the background of low oil prices. Our results suggest that factors of oil price and world crude oil production growth rate show moderate correlation with the number of M&A deals occurring in the industry.

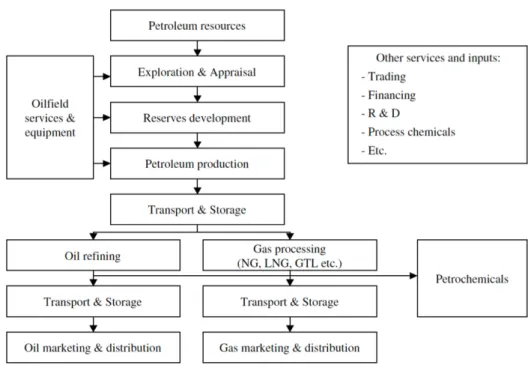

Nowadays oil is one of the main resources, if not the most important commodity in the global economy. The primary interest of this research is to analyze how national and international oil and gas companies (NOCs, IOCs and private oil companies) use acquisition to react to adverse external conditions, especially low international oil prices. We base our research on the assumption that M&A is a means for oil companies to respond to market changes caused by falling oil prices.

Ø Considering the complement approach, we can trace the trends of the whole industry Ø The findings of our analysis will allow us to identify the responses of different types of oil. The expected finding of this paper is to illuminate key trends in the strategic decision-making of oil and gas companies in the context of low oil prices.

Theoretical background

- Introduction to oil and gas industry

- Oil price shock of 2014

- M&A activity in oil and gas industry

- Hypotheses statement

To summarize, the type of ownership and position in the industry value chain matters a lot for oil and gas companies. However, both countries do not follow this trend of behavior: Mexico and Russia significantly increase their supply, OPEC countries (mainly the Gulf countries) increase production to receive larger revenue flows as their budgets are highly dependent from oil exports (Güntner, 2014). In mid-2014, the drop in oil prices resulted in the most dramatic decline in the oil and oil and gas industry in a decade.

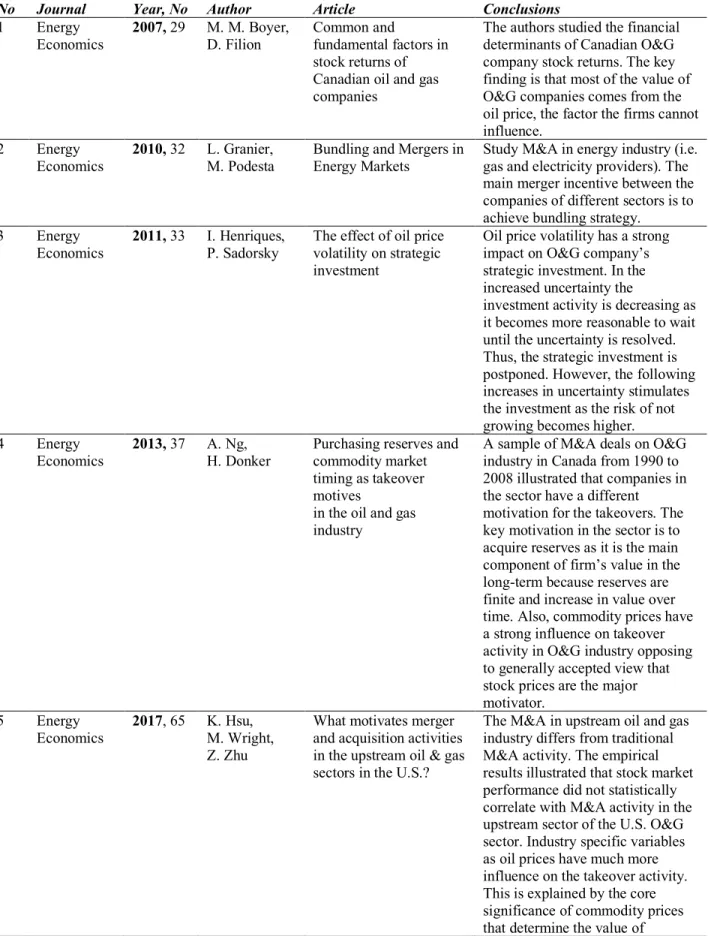

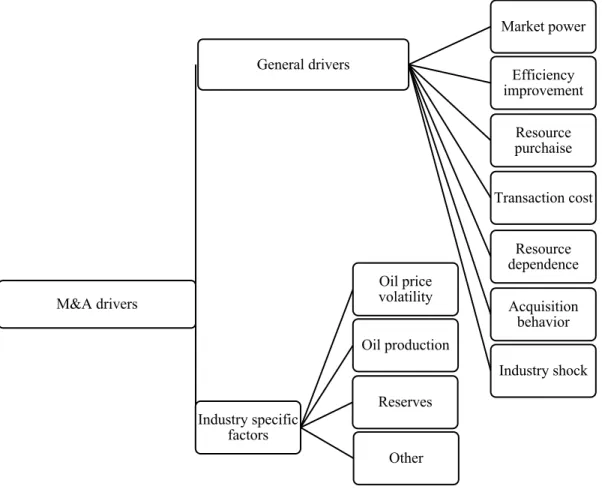

Our primary interest is thus to find out whether in the oil and gas industry there is an effect on M&A activity. Xie, Reddy, and Liang (2017) argue that with the decline in crude oil prices, takeover activity in the oil and gas industry increased noticeably. Previous research on the topic and empirical evidence lead us to claim that low oil price is an indirect factor affecting M&A in the oil and gas industry.

The study of the national oil and gas industry may not be representative for global scale. As proven by Boyer and Filion (2007), the value of oil and gas companies comes from the price of oil, the factor that the firms cannot control. H1: The relationship between sharp drop in oil prices and M&A activity in the oil and gas industry appears with a lagged effect.

However, the researchers conclude that takeover activity in the oil and gas sector is mostly caused by industry-specific factors such as the amount of reserves available to the company.

Research strategy: exploring dataset and hypothesis

- Research strategy

- Research tactics

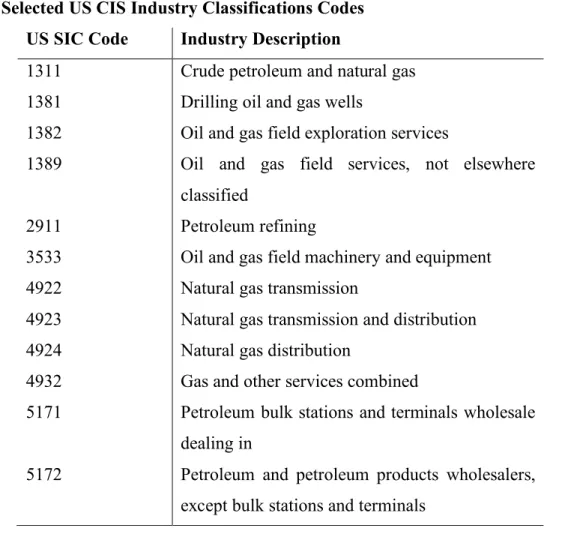

- Exploring dataset

- Methodology

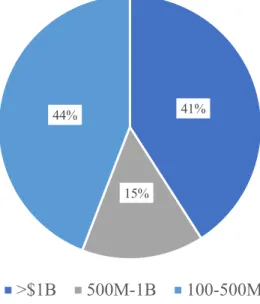

This illustrates the state of the industry as small oil and gas companies consolidate amid low oil prices. As previously mentioned, the oil and gas industry is sensitive to oil price fluctuations. Thus, there is an opinion that takeover activity (both the number of deals and the value of deals) in the industry is related to the rise in oil prices.

We, in turn, introduce the view that dramatic drop in oil prices is also a factor that can affect M&A activity in the industry. H2: The higher the level of global crude oil reserves, the more M&A deals occur in the industry. However, for the period 2014-2016, world proven crude oil reserves only increased by 0.1%, from 1,490 to 1,492 million barrels (OPEC Annual Statistical Bulletin, 2017), which is not a significant increase given the takeover activity in the industry cannot correlate.

H3: The higher world crude oil production growth rate, the more M&A deals take place in the industry. The monthly data on world crude oil production, thousand barrels per day, is obtained from the US. Considering that one of the most important industry factors - world crude oil reserves - cannot be used due to limited period of observation, the more dynamic market indicator is required.

We question whether the amount of M&A deals in the oil and gas industry is related to oil consumption. The main assumption is that oil and gas companies cannot be considered attractive investments in the long term. H4: The higher the global growth rate of crude oil consumption, the more M&A deals take place in the industry.

The monthly data on the world's crude oil consumption, thousand barrels per day, is obtained from U.S.H5: The higher the world oil production and consumption balance, the less M&A deals take place in the industry. The higher level of world crude oil reserves, the more M&A deals take place in the industry.

The higher the growth rate of world crude oil production, the more M&A deals occur in. The higher the growth rate of world crude oil consumption, the more M&A deals occur in

Empirical study

Hypothesis testing

H3: The more world crude oil production growth rate, the more M&A deals take place in the industry. Spearman's non-parametric correlation test showed a moderate positive correlation between number of M&A transactions and world crude oil production growth rate significant at 0.05 level (r=0.343, n=42, p=0.026). In the oil and gas industry, there is a clear connection between oil production and the value of the company.

The higher the growth rate of oil production, the more valuable target the company becomes as the constant increase in output means increase in value of assets. H4: The more world crude oil consumption growth rate, the more M&A deals take place in the industry. The relationship between changes in consumption and number of M&A transactions in the industry is not present.

In fact, global oil consumption is an important measure of the industry, but it is not related to the amount of takeovers. H5: The more the world's oil production and consumption balances, the fewer M&A deals happen in the industry. We assume that in the years of low oil prices the producers have endeavored to maintain consumption and production balance, data shows that production and consumption balance fluctuates around zero.

Scatter plot illustrating the absence of a monotonic function between M&A deal counts and the oil consumption and production balance.

Discussion of results

Finds significant relationship between low oil prices and M&A activity in the oil and gas industry. The takeover activity in the sector is influenced by industry-specific factors, one of which is oil price. Our results revealed a moderate positive correlation between M&A deal count and oil prices (lagged 12 months).

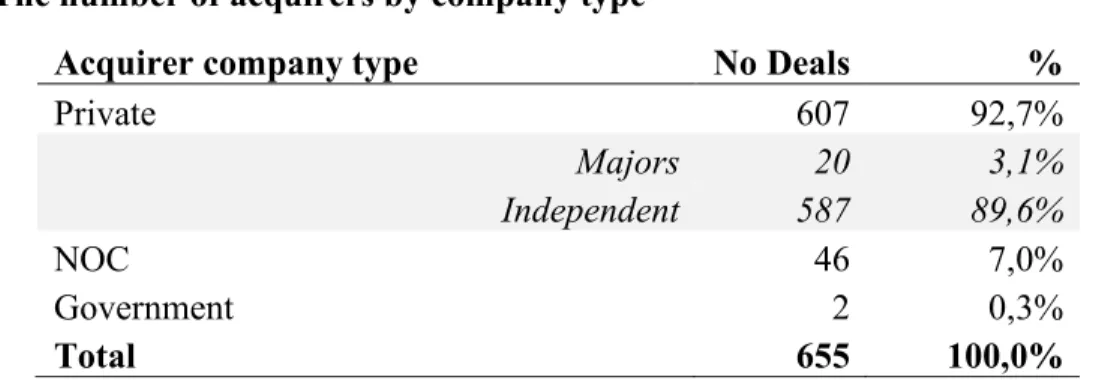

Positive correlation means that, despite our proposal, takeover activity in the petroleum industry actually decreased due to the drop in oil prices. Ø State oil companies or NOCs are not actively engaged in takeover activities during the period of extremely low oil prices. This research complements the previous works by focusing on the context of low oil prices.

In this study, we provide the empirical evidence that the oil and gas industry responds to extremely low oil prices with a 12-month lag. Ø We consider oil prices as one of the factors that correlates with the number of M&A deals. Since mid-2014, one of the fastest and sharpest declines in oil prices has been observed.

Experts still do not agree on the reasons for the current shock in oil prices, but the fact remains, low oil prices are associated with merger and acquisition activity in the oil industry. Our research problem was formulated as follows: How different types of oil companies use M&A to respond to low oil prices. A positive correlation means that takeover activity in the oil industry actually decreased after oil prices fell.

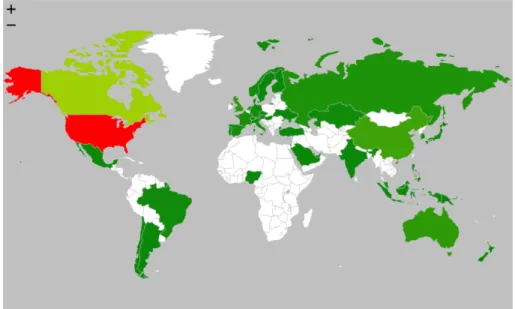

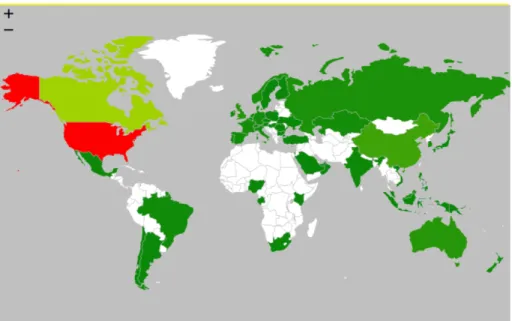

Furthermore, through the analysis of our data set, we found that: 1) NOCs are not actively involved in acquisition activities during a period of extremely low oil prices. The increasing attractiveness of this segment suggests that, in the context of low oil prices, companies are interested in acquiring the latest technologies or capabilities that will lower costs along the value chain. Stock purchasing and commodity market timing as takeover motives in the oil and gas industry.

For example, in the context of extremely low oil prices, oil and gas companies prefer to consolidate on a national basis by acquiring assets from small local companies, rather than going international. For the observed period, the share of M&A deals in the segment increased from 28 to 46%. Not all oil price shocks are the same: disentangling supply and demand shocks in the crude oil market.