There are some incentives that have a more sophisticated impact on the acquirer side of the deal. However, due to the asymmetry of the information, it is less clear what to look for for a potentially beneficial1 investment. Some of the generally accepted procedures for publicly traded companies may be useful for the analysis.

The investor side of the transaction in terms of returns generated and investment performance has been neglected.

Crowdfunding: basic concepts

- Crowdfunding types

- Legislation in crowdfunding

- Investor protection in crowdfunding

- Types of investors

- Tax incentives

- Equity crowdfunding as an investment opportunity

- Summary

Chapel Down can be seen as a pioneer as it is credited as one of the first publicly traded companies to ever participate in an ECF5 campaign. While one of the founders, Chris Wilson, had dropped his stake in the company to 13.17% (Newsbeezer 2018). However, it is important to understand that all methods are equally capable of generating money.

In the context of this study, let's look at the investors, who are not all out of potential.

Identification of company’s characteristics and financial performance indicator

Crowdfunding campaign specifics and post-campaign outcomes

- Equity crowdfunding campaign milestones

- Post-campaign outcomes

Company founder or owner creates a video address and marketing plan with company specific information that is made visible to potential investors. It must be said that while the information is company specific, it does not contain all the necessary numbers or accounts to perform the financial analysis to identify the potential of such an investment. Unfortunately, it is not specified exactly how much initial investment is required to make the campaign public on Seedrs, but Crowdcube requires at least 20% of the target to be reached.

When the campaign reaches 100% of the goal, the fundraiser will receive the funds. For Crowdcube, however, the finalization process begins when companies reach 75% of their target capital (Crowdcube 2020). At this point, the raiser receives all funds raised, less Seedrs or Crowdcube platform fees, and is rewarded with Seedrs Alumni Club membership.

In terms of signaling, it could be said that factors affecting the structure and size of the board (such as the number of directors a company has or the presence of non-executive directors on the board) could play a role in future business prospects after campaign. Therefore, shareholders will be compensated unless the compensation to creditors takes all of the money from the asset sale. On the other hand, it can be considered a necessary assumption, as a loss will occur and, due to the nature of SMEs, shareholders will not receive compensation in most cases.

However, it is often opposed by founding business owners and is therefore a rare opportunity for investors. Additional note, for an equity financing campaign, the business valuation is required for the equity price offered, which constitutes the target capital (target).

Equity crowdfunding: financial performance indicator

- Overview of a company valuation methods and concept of fair value

- Private equity investment decision factors

- Private company performance and financial performance indicator

Despite the fact that the asset-based method lacks the incorporation of the net present value of the company's future cash flows, this can be justified through accounting means, since the result of the formula must be balanced with the equity part of the balance sheet. In other words, this approach is similar to using discounted cash flow analysis in finance to identify the value of the company. Despite the fact that this market-based approach can be used more or less in information-poor scenarios, some specific data of the company of interest would be needed to compare it with its peers and competitors.

Despite the fact that the actual method used to determine the value of the business is unknown, it resembles the importance in terms of the return analysis and, as a result, the analysis of the business performance (Signori A. and Vismara S. 2016). Due to the subjectivity of metrics, and so-called "gut feelings", the knowledge gap grows further. Additionally, most of the research was done through one-on-one interviews as well as survey analysis.

In addition, as the years have passed, the guidelines for evaluating SMEs for crowdfunding investments have yet to be established. The share price could be understood as an approximation of business performance, which in turn enables the inference that more successful companies have higher share prices. The documents filed with Companies House do not contain all the necessary data points for a sufficient DCF calculation.

For example, when considering public companies, stock price can be seen as an indicator of the net present value of all of the company's future cash flows. A similar approach was used previously, regarding total value of the company (Hornuf L. et al 2017).

Summary

34 ROI, as it does not require information apart from the initial and future stock prices.

Empirical study of equity crowdfunding investments

Research hypotheses

36 also indicates less risk associated with the investment for less experienced participants (Decarre M. and Wetterhag E. 2014) regardless of the actual risk of making such an investment. However, the agency's problem could be brought to the fore, that the interests of the directors are not on the same level as the interests of the companies' shareholders. In addition, it can be pointed out that such motivation for CEOs also opens room for share price manipulation (Alsin A. 2017), but private companies' share prices lack information absorption mechanism, they are illiquid.

Following the logic of the benefits of diversification, it can be implied that the more a company diversifies, the lower the risk of bankruptcy, but it should be noted that the opposite is also true (Markides C. 1997). 37 less mature firms, which are assumed to have adequate resources available to operate, therefore, it can be shown that starting too many ventures at the same time spreads the firm's resources and leaves less available to support potentially good incentives (Biggadike R. 1979). Subsequently, it can be directly related to the outcomes explored in this research, for the same reasons as business performance related to investment success.

Diversification reduces the risk of the company, thus increasing its probability of increasing its share price within a year's time of equity crowdfunding campaign. This may be true, as protected ideas can be seen as a firm's success factor (Rajan 2012), as was the story for example with Dyson manufacturer (Dyson 2020). On the other hand, it may also indicate that not all the entrepreneurs use the patenting system.

Moreover, patents can be problematic to profit from if there is no other option than to lease the right. This was seen in Dyson's case (Dyson 2020) as it took some time and ownership of the manufacturing base to exploit the patented technology.

Research methodology

- Variables

- Sample description and descriptive statistics

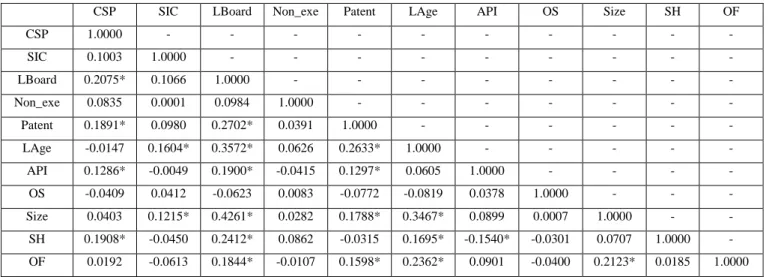

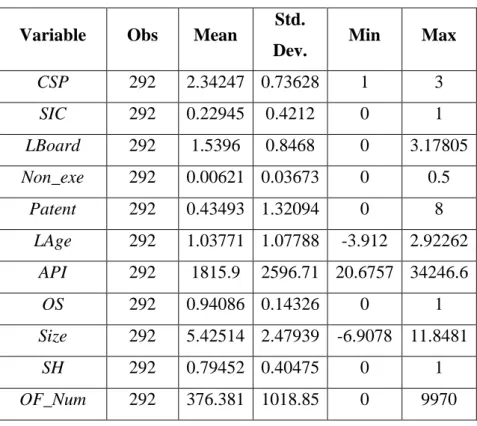

The diversification variable (SIC) is used to indicate the number of different areas the company operates in. Number of directors on a company's board (LBoard) – this variable indicates the total number of directors present on a company's board. The data on the number of directors was taken from the Amadeus database by Bureau Van Dijk.

Fraction of non-executive directors to total number of directors within a board of the company (Non_exe) – variable used to include the effect of non-executive director on the company. Number of patents (Patent) – this is considered as one of the possibilities to measure the intellectual capital of a firm. Number of Ordinary Shares is indicated in conformation statements, statements of capital after allotment of shares and sometimes filed with the company's database.

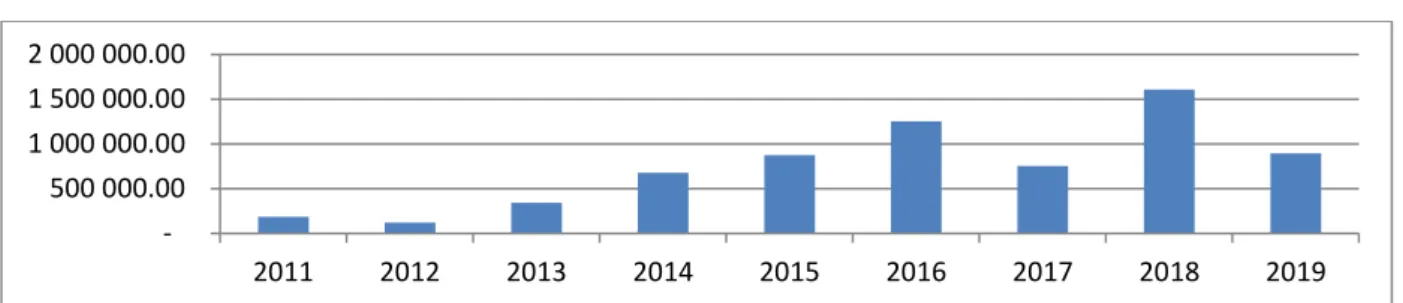

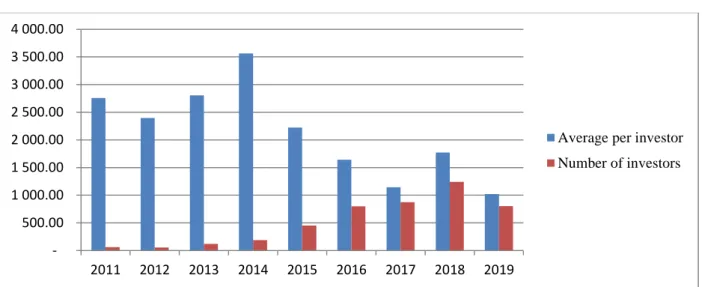

The total number of shares is shown in the conformation statements, share capital statements after allotment of shares and from time to time filed in the company's in-house database. The analysis of the sample showed that the average number of participations in campaigns for companies was 2 camping trips per company. Continuing with the number of directors and the number of non-executive directors on the board of companies, we can find that the lowest number of directors on the board is sample 1.

According to legislation, the minimum number of directors within a board of a private company is 1, for the public it is 2 (Thomson Reuters 2020). However, the emphasis is on company size, although the total number of companies has remained stable, the number of large company entries has decreased by 3.

Empirical results and discussion

Increasing the number of patents owned by a company by 1 corresponds to an increase in the probability of a company's stock price rising over a year period following an equity crowdfunding campaign by 8.78%. Therefore, it could be said that every £1 increase in the average contribution per investor during the equity crowdfunding campaign increases the probability of an increase in the share price by 0.0042%. Finally, hypothesis 5, which implies that patents have a positive effect on the probability of a share price increase within one year of an equity crowdfunding campaign, is accepted.

This leads to the notion that patents indeed have a positive effect on stock price changes within a year period after the capital raising campaign. The research provides valuable information for investors, which factors they should pay attention to in order to have, on average, a higher probability of evaluating the value of the investment within one year of the capital raising campaign. As noted, the equity crowdfunding market behaves rationally (Ahlers et al 2015), so the quality of such documentation is emphasized.

Fourth, data have been collected and empirical analysis conducted to identify factors that may influence the performance of equity crowdfunding investments. Results have shown that companies possessing certain characteristics have, on average, a higher probability of share price appreciation over a period of 1 year from the equity crowdfunding campaign. The board size of a target company is related to changes in the share price within one year of the equity crowdfunding campaign.

In fact, the larger the firm's board during the equity crowdfunding campaigns, the more likely the stock price will increase within a year of the campaign. Crowdfunding Models Explained." Crowdcube.com https://www.crowdcube.com/explore/blog/investing/crowdfunding-models-explained. Small and Medium Enterprises (SME)." Investopedia.com https://www.investopedia.com/terms/s/smallandmidsizeenterprises.asp (accessed March 1, 2020).

On the road to success in equity crowdfunding.” International Conference of the French Financial Association, Liège.