The aim of this paper is to analyze the relationship between the characteristics of the board of directors and the stock market underpricing of Russian companies, listening on the London Stock Exchange (LSE) and the Moscow Stock Exchange (MOEX). The research objective of this master's thesis is to analyze the relationship between various characteristics of the board of directors and IPO results of Russian companies.

An IPO process

Zavarovalna banka determines the share price based on the company's past performance and future performance forecasts or on the basis of comparing the company's performance with the market. The listing can be understood as advertising of the company both for the company's customers and for potential investors;

Specifics of Russian IPOs

Based on these characteristics of Russian IPOs, it is obvious that this research should be conducted using LSE or MOEX/RTS listed companies. In recent years, very few Russian companies have gone public due to the slowdown in the Russian economy.

Theories of an IPO underpricing

The first group of research argues that underpricing can be a managerial tool to maintain some control over the firm by reducing monitoring of their activities. With less significant investors, management control is reduced and managers gain more control over the company.

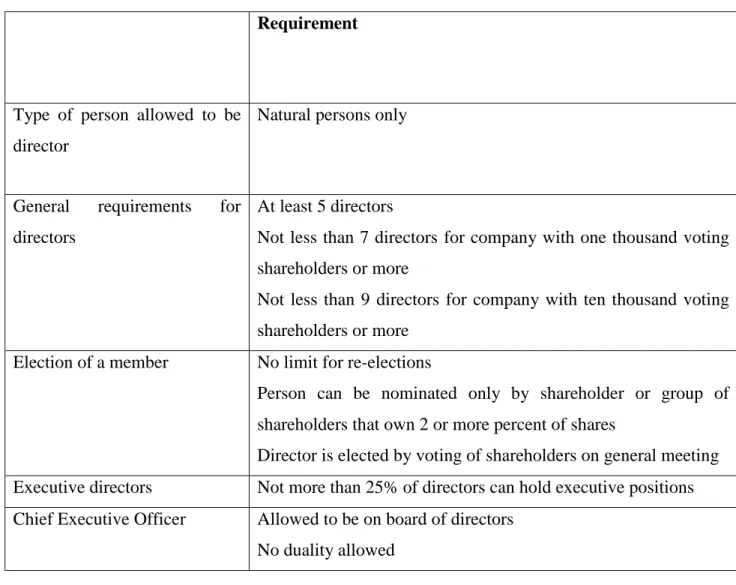

Board of directors

- Place of board of directors in corporate governance structure

- Review of literature on characteristics of board of directors

- Review of studies on relationship between board of directors and performance

- Specifics of Russian corporate goverenance mechanism

H2 There is a negative relationship between board experience of directors and IPO underpricing of Russian listed companies. H5a There is a positive relationship between the number of foreign directors on board and IPO underpricing of Russian listed companies.

Summary of chapter 1

Further, the legal system of the Russian Federation provides relatively weak protection for minority shareholders compared to foreign systems. Russia has a positive trend of increasing the number of independent directors on the board, but it is still not enough to gain the full confidence of foreign investors. These companies represent key sectors of the Russian economy and are on average larger than companies listed on other markets.

In the second part of the first chapter, the specifics of the Russian government, the system and various explored characteristics of the board of directors were examined. Moreover, the concentration of ownership in Russia is high and is associated with the presence of the Russian government in the ownership structure of the largest companies. Based on the review conducted, some characteristics have been eliminated, such as the percentage of women on board as they are likely to be insignificant due to the expected low number of observations.

EMPIRICAL ANALYSIS OF THE RELATIONSHIP BETWEEN IPO UNDERVALUATION AND CHARACTERISTICS OF THE BOARD OF DIRECTORS OF RUSSIAN COMPANIES.

Methodology

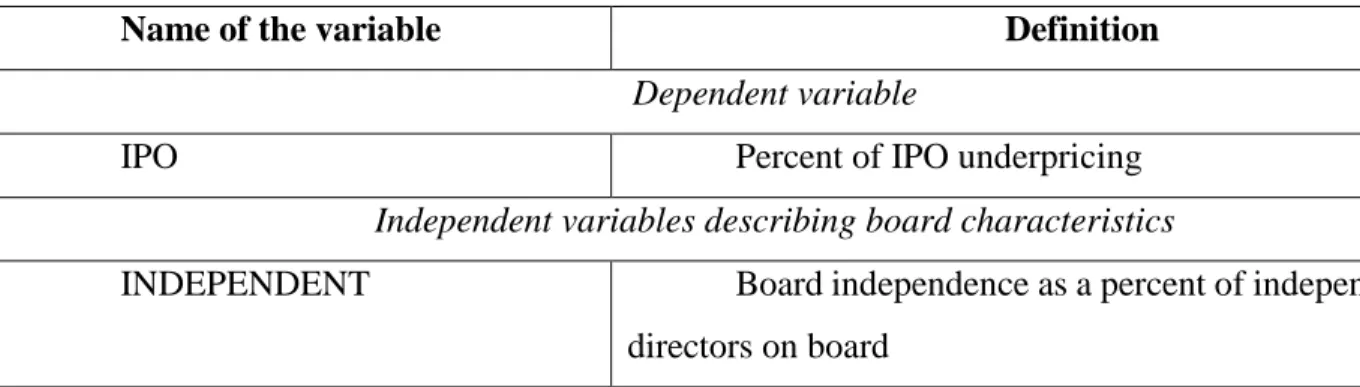

Regression model and variables

EXECEXP An average number of CEOs (if CEO is represented on board) and directorships and management positions of other executives. When examining the influence of the board of directors, the current study should take into account the traditional view of IPO underpricing. According to a large number of empirical studies conducted by (Ljungqvist, 2007; Ritter & Welch, 2002; Ritter, 2011), it can be rightly said that the underpricing of IPOs is positively associated with historical financial measures, size, debt-to-equity ratio and the age of the company. Company.

Additionally, smaller companies generally lack access to the more established bank underwriters who are responsible for the company's actual valuation. Based on this, it is correct to say that the size of the company represented by total assets has a negative effect on the underpricing of IPOs. Finally, according to many studies (for example Mahatidana, 2017) return on assets should be positively related to IPO underpricing.

A plausible explanation for this phenomenon is that companies with higher returns naturally attract the attention of investors, who place a higher value on a company with a high return on assets.

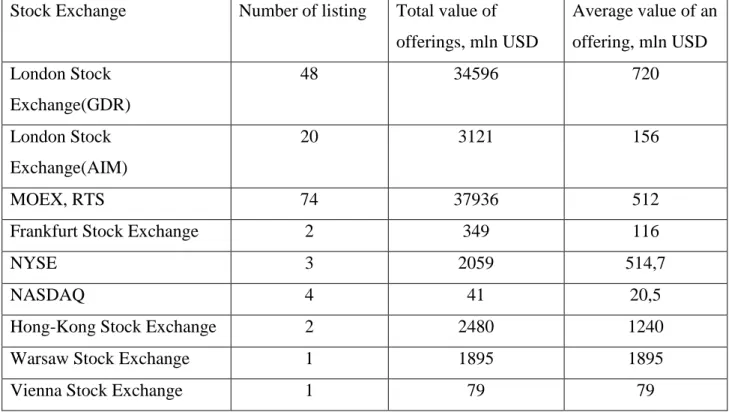

Data sample

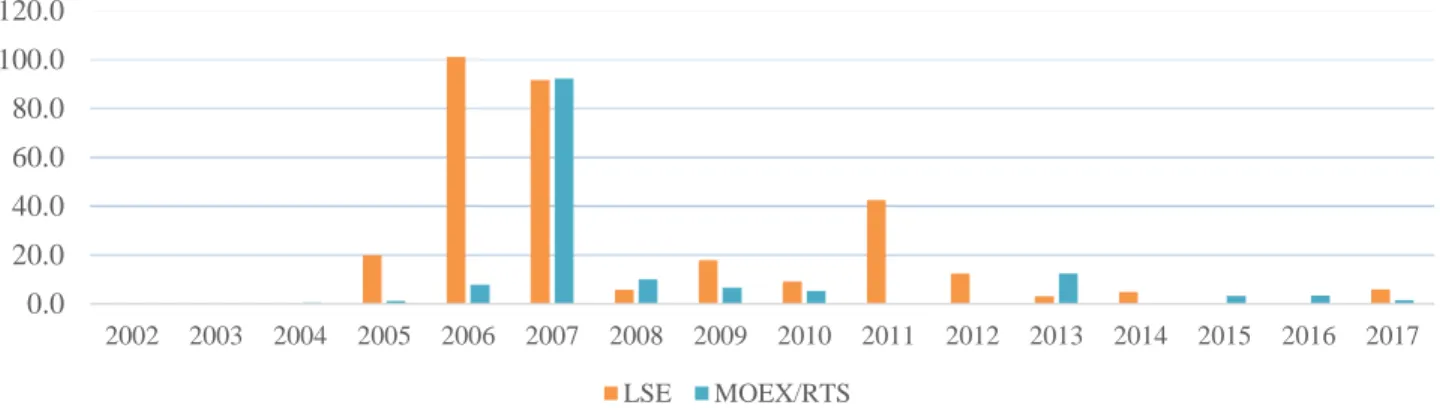

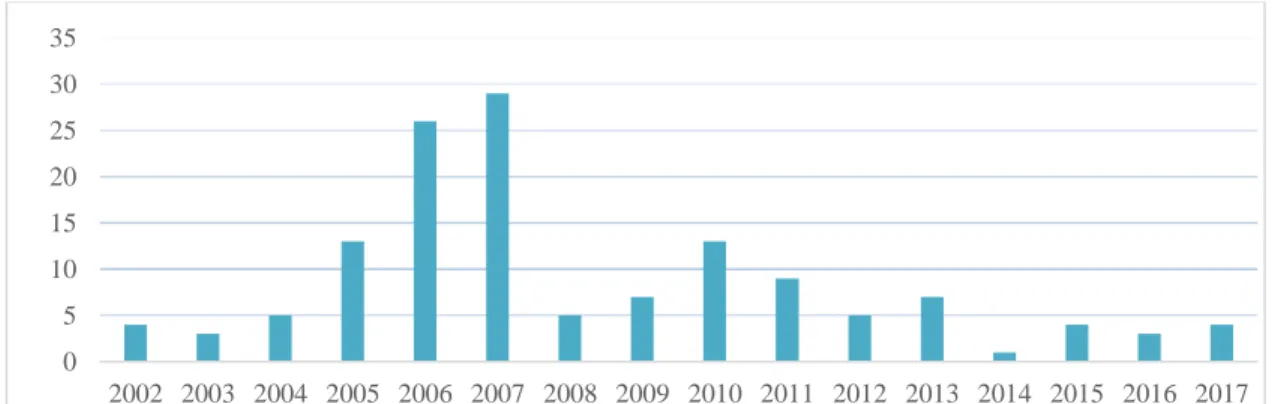

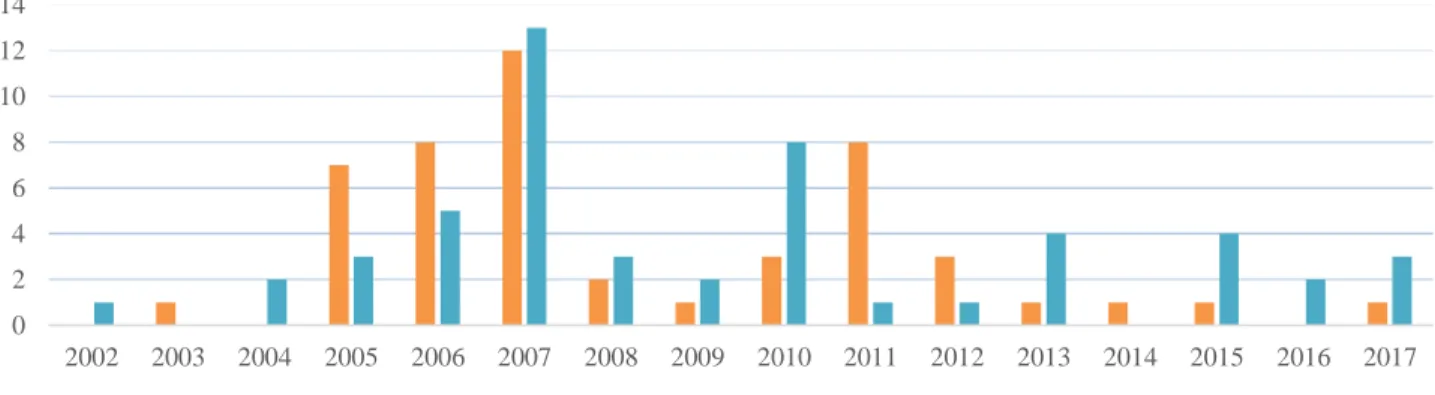

Speaking of Russian capital markets, there are more companies from financial, food and energy sectors. Speaking of Russian food companies that IPO domestic majority of them are relatively small and therefore do not meet criteria of international markets. As can be seen from figure 5, the number of IPOs placed in London and Moscow reached a peak in the period from 2005 to 2007 when a significant number of largest Russian companies went public.

This can be partly explained by either downturn in the Russian economy or by the fact that the majority of oil, gas, metal or mining companies have already gone IPO in previous years. Similarly, with the number of IPOs, total market capitalization of new public companies reached its maximum in 2006 and 2007. As seen on figure 6 after 2014, volume of market capitalization decreased significantly and in proportion to the number of IPOs.

This can be explained by the fact that very few large companies offered their shares to the public after 2014, while a lot of local Russian companies of relatively small size were listed in Moscow.

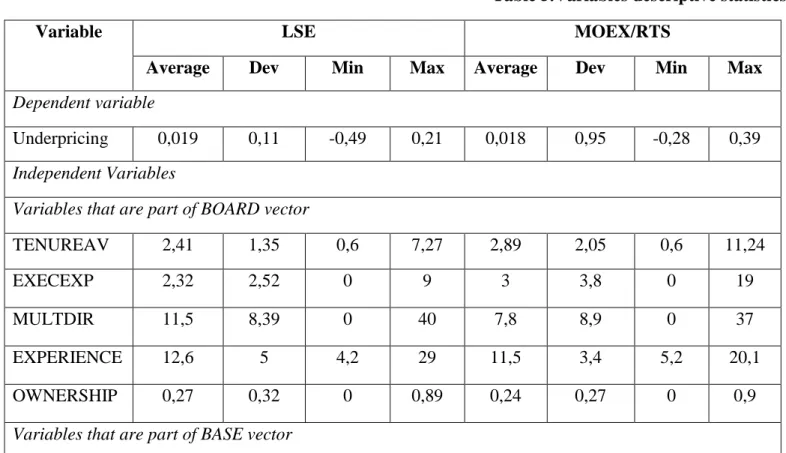

Descriptive statistics

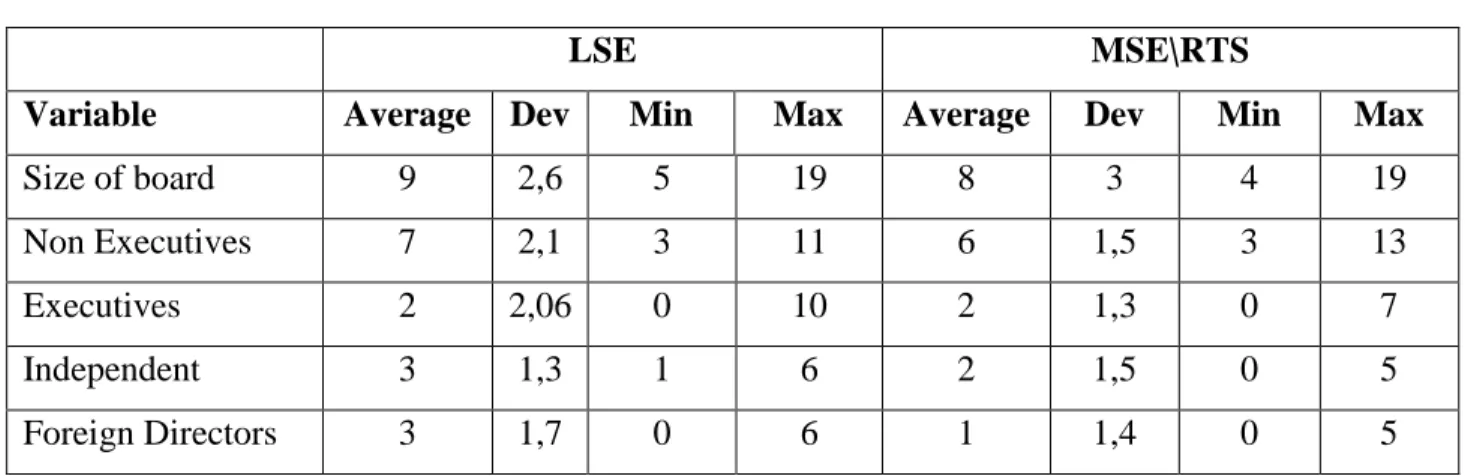

Five London-listed companies had fewer independent board members than the required 3, while 10 Russian-listed companies have no independent directors at all and 8 have less than the required minimum. It is important to note that the number of reported independent directors of the company and actual independent directors may differ due to the fact that an algorithm based on the Corporate Code 2002/2012 was used to identify a truly independent director. Moreover, it is not surprising that companies listed on the Moscow Stock Exchange have significantly fewer foreign directors.

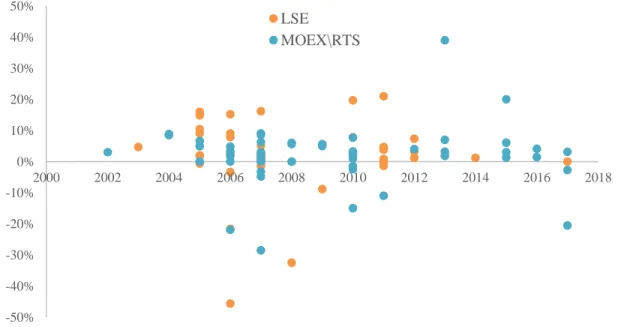

However, it is important to emphasize that the standard deviation on the LSE is significantly lower, and therefore the companies' IPO performance is on average less volatile. In addition, it is interesting that the level of underpricing by Russian companies is very small compared to developing markets, such as the USA (16.2%), Korea (64.2%) or Honk-Kong (21%). Given all this, it is rational to assume that observations with extreme values belong to industries that are more likely to be underpriced and therefore cannot be seen as outliers.

As already mentioned, London-listed companies place more emphasis on the board structure in terms of the presence of independent directors and their experience.

Regression analysis results

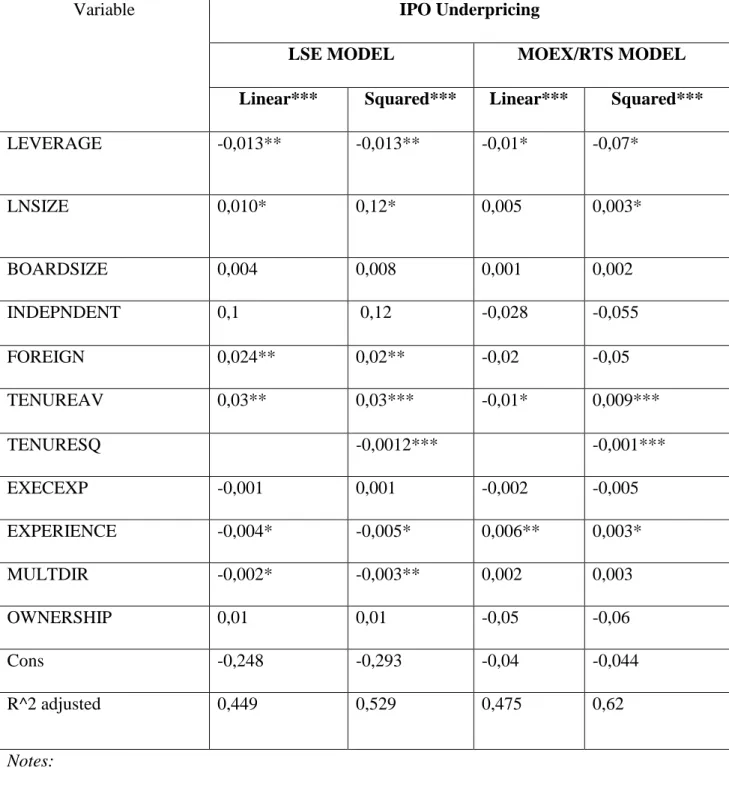

To determine when those variables have non-linear relationship with dependent variable, it is necessary to run a model with non-quadratic variables. Linear relationship models have an explanatory power of 0.45 and 0.47 for LSE and MOEX samples, respectively, while non-linear R-squared is even higher, reaching 0.53 for LSE samples and 0.62 for MOEX samples . Variable INDEPENDENT representing percentage of independent directors on board has a very high coefficient for LSE sample models and rather high yet negative coefficient for MOEX models.

TENUREAV was the only of tested variables with non-linear relationship that proved significant. Regression coefficient for LSE subsample is times higher compared to MOEX/RTS subsample according to regression results. Results of executed model prove Hypothesis 4 for LSE subsample and cannot provide enough evidence to prove or reject Hypothesis 4 regarding MOEX subsample as MULTDIR variable showed no significant association with dependent variable in MOEX models.

As can be seen in Table 9, the two variables show significantly different results for the LSE and MOEX subsamples.

Discussion of results

The next step is to compare the variables that were confirmed to be significantly related to undervaluation in the two subsamples to determine whenever there is a statistical difference between the two stock exchanges regarding the impact of specific characteristics, namely the average tenure and experience of the directors. The mandate is positively and nonlinearly related to the underpricing of IPOs on both exchanges; the strongest association at LSE. This research confirmed the finding of (Hesjadel, 2007) that average director tenure on the board is positively related to IPO underpricing.

Second, according to (Yatim, 2011), it is correct to say that the high managerial burden of directors reduces the value of the company in the eyes of investors and therefore they are less willing to offer a higher price at the end of the first day of trading. There is a negative relationship between the number of outside directorships held by independent directors of LSE-listed firms and IPO underpricing. Finally, it is important to emphasize that there is a large difference between the MOEX/RTS and LSE subsamples in terms of the factors affecting IPO performance.

This is probably because investors buying shares on the LSE pay attention to the same board characteristics, regardless of the company's country of origin.

Managerial implications

In this chapter of the thesis, an empirical study was made, which examined the relationship between various characteristics of the board of directors and the IPO performance of Russian companies in the period 2002-2017. To determine the experience of the directors, the respective average experience of the directors and the number of managerial positions held by the directors were used. All these approaches have been previously used in empirical studies devoted to the board of directors.

To perform the analysis, liner regression with two vectors was used: BOARD vector for board of directors characteristics and BASE vector for general company characteristics. At the same time, there are a number of articles that examine the influence of the board of directors of Russian companies and specific financial measures such as profitability, dividend payout or return on assets. The aim of this study was to analyze the influence relationship between board of directors characteristics on underpricing in IPOs.

Secondly, this thesis is devoted to the basic characteristics of the board of directors and does not consider a number of aspects such as education, gender, reputation of the directors. In: Journal of Financial & Quantitative Analysis, 14, p. 2016) "Determinants of Intellectual Capital Disclosure: Evidence from Indian Banking Sector". In: International Journal of Business and General Management, 3.2, p. 2014) "Board composition and performance in state-owned enterprises: evidence from the Italian public service sector".

Limitations of thesis and suggestions for further research

Summary of Chapter 2

In the thesis, different approaches to the concepts of underpricing and board of directors were adopted, and it was further investigated how different characteristics of the board of directors affect the underpricing of IPOs. New Developments: Women with Height – Exploring the Impact of Female Presence and Leadership on Boards”.

Correlation matrix for MOEX/RTS

Algorithm of identifying independency of director

List of literature used in literature review