Title of Thesis: The Impact of Social Media and Marketing on the Performance of Financial Institute Firms: An Analysis of Selected Firms in Nigeria. Marketing and social media are increasingly influencing the sustainability and performance of financial institutions.

Research Problem

The previous decade saw a progression of complex, diverse and enhanced entanglements between organizations and their customers through the use of online media. Moreover, there are still challenges that disrupt the incentive to accept online media as a promotional plan.

Aim and Objective of The Study

Negative online media talk can achieve loss of trust and wages; yet it can similarly convey more certified forms of risk. A few studies have shown that financial institutions' use of social media can generate incredible points of interest, e.g. to strengthen the relationship with customers and create awareness.

Research Questions

Research Importance

Research Concept and Definition

In addition, social media has become a place of marketing where different industries can give more value to their customers; especially a financial institution (Dănăiaţă et al., 2014). Despite the favorable and fertile environment provided by social media networks, past research on financial organizations has shown that the effects of social media marketing on overall performance are not compelling (Hassan et al., 2012; Lovejoy and Saxton, 2012; Franco et al., 2016 ).

The Social Media Interaction and Business Value

Social Media Marketing

Social media marketing builds consumer satisfaction, loyalty, offers business awareness information, and generates/builds leads. The social media advertising concept is a massive and complicated part of the company's strategies due to limited characteristics of social media marketing as opposed to different marketing attempts.

Social Network Theory

Social media advertising sells for reasons and social issues are an important part of social enterprise, but the goal is always to really improve advertising projections. Most intercessions are "inaccurately" based on social media marketing norms, regularly incorporating only a few parts of this vast hypothetical and specialized structure, the most notable being audience research (often via survey research), consumer segmentation, and association of society (Sinclaire & Vogus 2011).

Implicit Person Theory

Social media advertising technique is gradually being embraced in all regions of the economic system, mainly the financial institution area. Social media advertising is a necessary activity for any business and the system is vital to Nigeria's financial institutions due to instability, competitions and risks to the marketing environment.

Role of Social Media in Financial Industry

The role of the social media advertising process in the financial region is to help provide choice answers to marketing activity issues. Similarly, social media has both a negative and a positive impact, and as the number of organizations that need the internet increases, so does crime.

Determinant of Corporate Performance of Financial Institutions

Publishing videos on the Internet offers organizations the opportunity to expand their attention through streaming video. The most important thing for a business is the next sale that increases the assets of the organization (Fournier & Avery, 2011). CAC expects a large share of the customer value registration for the association and the resulting return on investment (ROI) of the achievement.

In general, it helps to choose the customer's value to the association. In the context of social media, perils can be skillfully monitored and mitigated by using prior investigation of social information, which can help financial institutions distinguish between potential defaulters and recognize market patterns (McKinnon, 2002).

Interaction of Social Media and Marketing

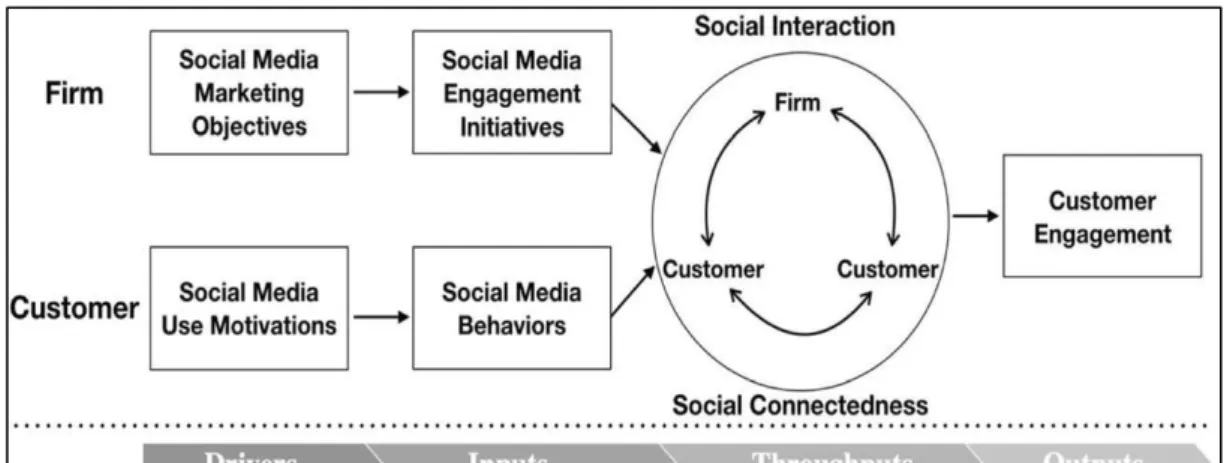

Solis and Li (2013) insist that web-based media, once successfully completed, attend to early danger cues and alleviate the consequences of emergencies after they occur. Drivers: the organization's online media promotion targets and the customers' web-based media use motivations. Firms' web-based media responsibility exercises: Firms take exercises to move and connect with clients so they can make targeted responsibilities that way.

Customers' web-based media practice: Customers' use of web-based media provides different social performances, ranging from inert (e.g. viewing) to dynamic (e.g. co-creation) (Maslowska et al. 2016). Based on hypotheses about uses and fulfillment, Muntinga et al. 2011) also orchestrates customers' image-related practices in web-based media into three assemblages: gossip (e.g., examining a brand's post), contribution (e.g., rating administrations), and production (e.g., dissemination of brand-related matter).

Concept of Financial Performance

Web-based media research indicates that connectivity does influence social impact. The use of "hubs" in viral advertising efforts can be greater possible than frameworks that use fewer associated people. This is due to the fact that internet-based media has, from one factor, attracted customers to be a similar component of the company's and patron's joint efforts via sharing, gaming, delivery, and frameworks that organize, although patron affiliation has emerged as a developing promoting effect, as customers can have an effect on each different in terms of their attitudinal or social changes. If the salary is to be assessed in relation to the increase or decrease in the abundance of an endeavor, a couple of that pile of abundance is unmistakably required.

Akinsulire, (2008) and Pandy, 2003 measure abundance in three characterizations; as monetary capital – the value of the share in a company in real money; authentic financial capital, the value of an effort in real terms (the selective thought); working breaking point capital, the company's limit to maintain its ability to provide work and objects (the material tank). The benefit is the essential concern, as remaining execution assessments are assessed on the benefits as what they can add to the overall utility of the monetary business.

Social Media and Corporate Performance

A non-parametric procedure called information envelopment review has been widely used in assessing usability and creating change in Nigerian banks. For example, Tanko (2006) and Magaji (2008) conducted an information envelope review to assess the presentation of Nigerian cash shops. Platforms have gradually become very popular over the past few years to the point that conventional media platforms have been relegated to the back of business respectability as ubiquity.

Lewis (2009) reaffirmed the predominance of social media over conventional media, highlighting the decline in TV slot advantage, as well as the way some shut everything down. An expansion in the number of accessible networks that expanded to support the trademark checking and promotion platform.

Emphirical Studies

The relapse assessment found that web-based media updated the introduction of the company as it is anything but a promotion stage that differs effortlessly from various available forms of advertising. The final results of the study showed that the use of social media had a more grounded, constructive result on authoritative execution in terms of customer support, information transparency, decrease in promotion costs and client care functions. 2015) analyzed the various explanations behind web-based media utilization and its impact on authoritative outcomes as indicated by a subjective technique.

Taking into account the results of the hidden model, the assessment showed that the use of web-based media influences the presentation of companies, with regard to reduced costs, improved customer relationships and improved accessibility of information. This is because web-based media has become a stage that can be successfully accessed by anyone with internet access.

Introduction

Research Strategy

Sample Size and Sampling Strategies

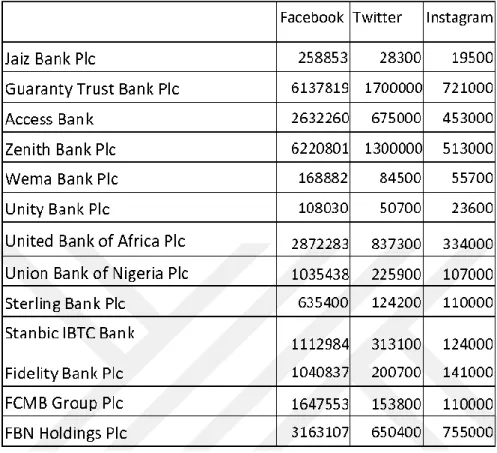

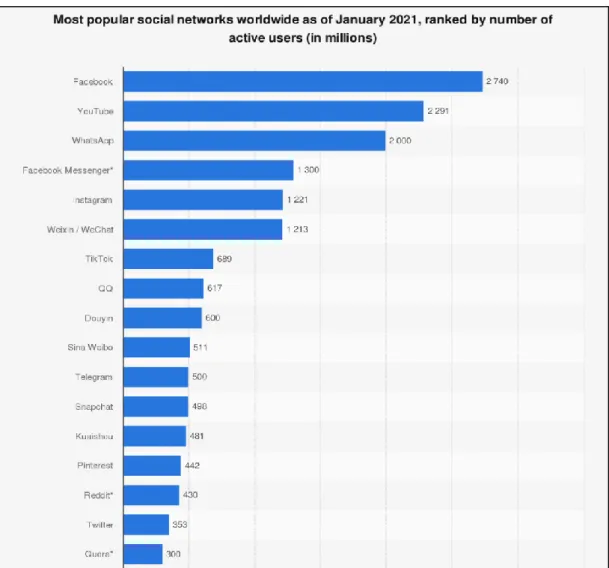

For this reason, Willoughby (2015) has provided numerous unusual techniques that can be used in choosing an example from the general population of the analyst's advantage, including: systematic, simple random, quota, stratified sampling, and cluster. Convenience sampling method can be followed in this research and this includes selecting the companies that can easily get lenient to get their monetary claims and reports. Although there are many social media platforms in the world, this study used data from Twitter, Facebook and Instagram platforms taking into account their number of users.

The results obtained in the research and the evaluations made are not financial investment advice.

Population of Study

Data Collection

Data Analysis

Restatement of Research Hypotheses

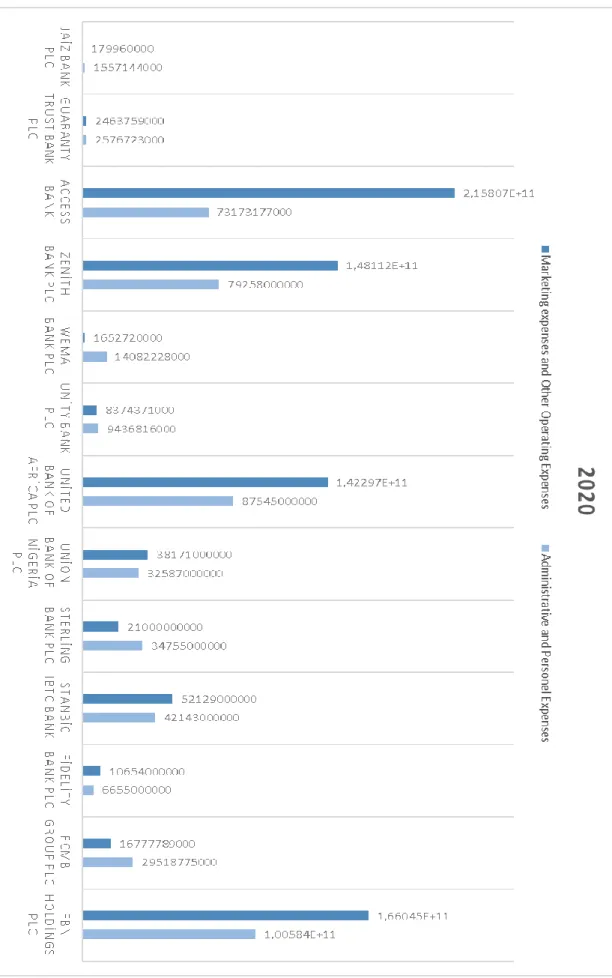

H4a: The number of social media followers of Nigerian financial institutions has a positive impact on the gross revenues of financial institutions along with general administrative costs. H4b: Marketing and other operating expenses of Nigerian financial institutions positively affect the gross profit of financial institutions along with general administrative costs. H4c: General administrative expenses of Nigerian financial institutions have a positive impact on the gross profit of financial institutions.

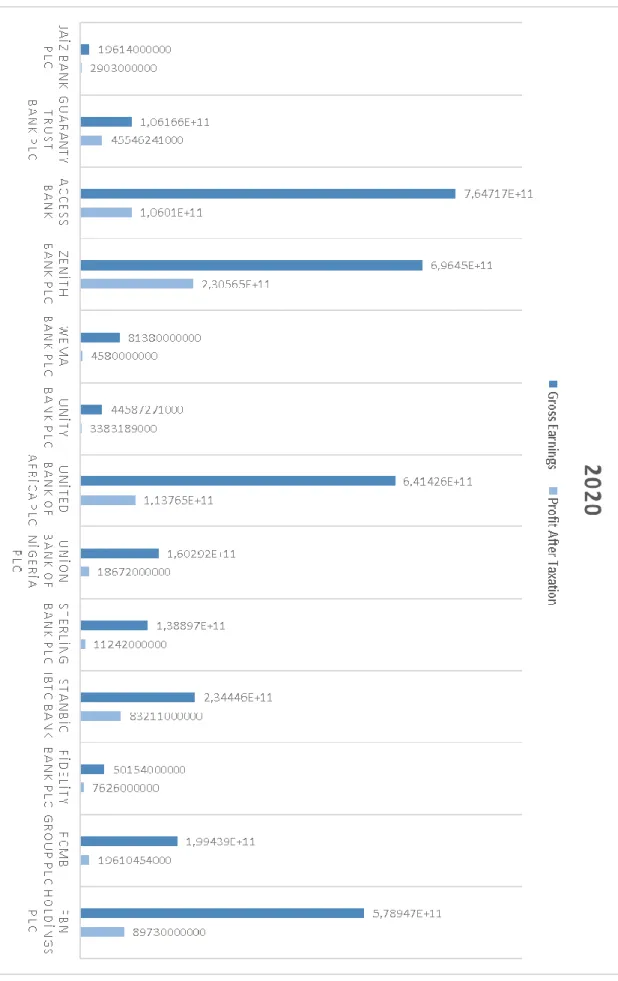

H5a: The number of social media followers of Nigerian financial institutions positively affects the after-tax performance of financial institutions along with general administrative costs. H5c: General administrative costs of Nigerian financial institutions positively affect after-tax profit of financial institutions.

Findings

Social Media Structures of Financial Institutions

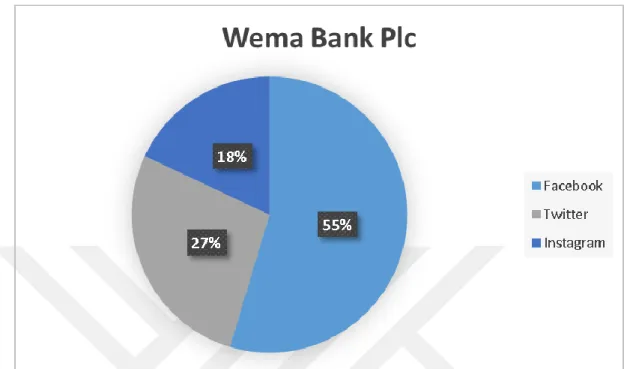

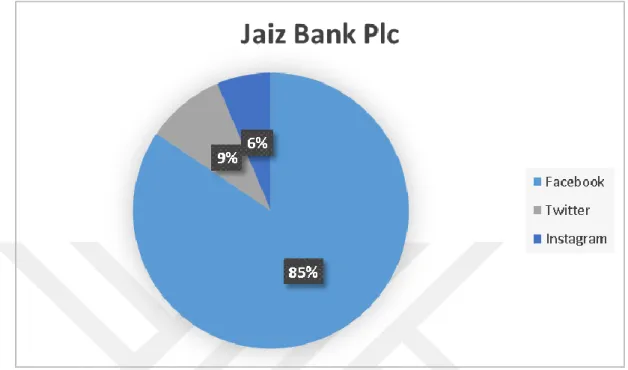

The majority of the FCMB's social media followers are those who follow it on Facebook. The majority of Fidelity's followers on social media are those who follow it on Facebook. The majority of Jaiz's social media followers are those who follow it on Facebook.

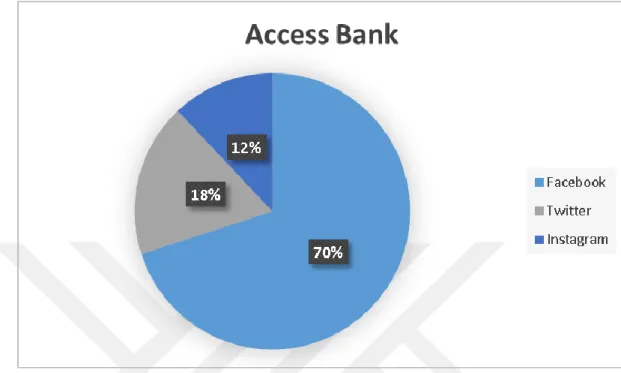

The majority of the Guarantee's social media followers are those who follow it on Facebook. The majority of the Access's social media followers are those who follow it on Facebook.

Hypothesis Tests

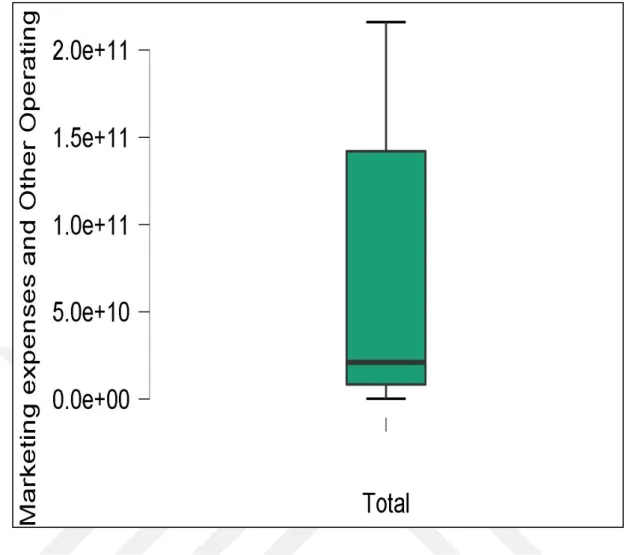

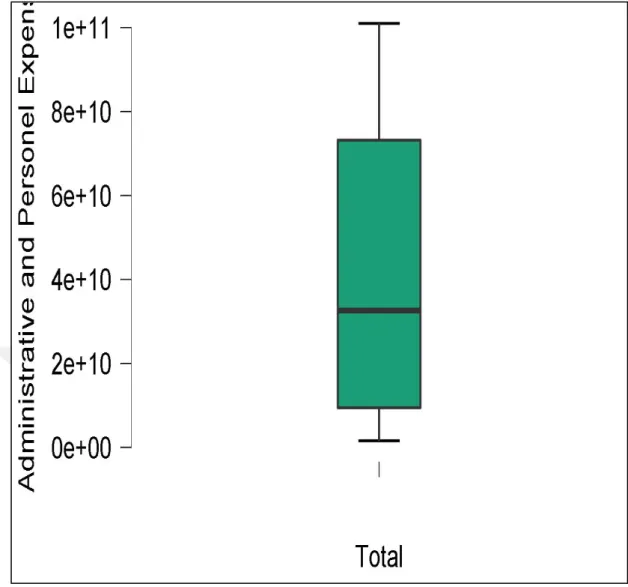

According to the box in chart 20, the number of social media followers shows a large variation from institution to institution. There is a moderate positive correlation between social media followers and gross profit. A positive and strong correlation was found between the number of followers on social media and the profit after tax.

In other words, the number of social media followers is associated with financial institutions' marketing expenditures. In the third regression analysis, the effect of social media and marketing expenses on the after-tax profit was examined. Regression results confirm that there is a significant relationship between the number of social media followers and gross earnings.

In this study, performance analysis was made in the context of social media and marketing expenditures.