004 Article 2 Pricing Policies and Procedures 005 Article 3 List of Fees Charged to Each Customer 006 Article 4 Credit Rating Types. European Parliament and Council No. 1060/2009 of 16 September 2009 on credit rating agencies, and in particular Article 21, paragraph 4a, third paragraph. Furthermore, the fees charged for credit rating services to a given issuer should not depend on the results or outcome of the work performed.

ESMA may then conduct investigations to verify that such fees have been set in accordance with lawful pricing policies and procedures and that differences in fee levels based on cost differences are in accordance with fair competition principles, are not due to conflicts of interest and are not dependent of the results or the result of the work performed. www.handbook.fca.org.uk. For reporting purposes and to clearly distinguish each pricing policy and procedure and their respective updates, each version of the pricing policy with its respective compensation schedules, compensation programs and procedures must have an identification number. Credit rating agencies must record all instances where pricing policies, fee schedules, fee programs and procedures have not been applied and all instances of deviations from pricing policies as applied to an individual rating, with a clear identification of the affected rating.

Due to technical difficulties and technical progress over time, ESMA may need to update a number of technical reporting instructions regarding the transmission or format of files to be submitted by registered credit rating agencies and communicate them through specific messages or guidelines. Each credit rating agency on whose behalf such a report is submitted shall be identified in the information provided to the FCA. www.handbook.fca.org.uk. No client), by the credit rating agency and/or any entity belonging to the credit rating agency group within the meaning of Article 22(1)-(5) of Directive 2013/34/EU, as well as any entity related to the credit rating agency or to another to a company in the credit rating agency group through a relationship within the meaning of Article 22(7) of Directive 2013/34/EU;. f) the geographical scope of the application of the pricing policy, price list or compensation program in terms of the location of the customers and the credit rating agency or agencies that apply the pricing policy, price list or compensation program;

1 (g) the names of the persons authorized to set tariffs and other charges under the relevant pricing policy, tariff schedule or tariff program, including those responsible for tariff setting, internal identifier, function and department of internal to which the persons belong.

Commission Delegated Regulation (EU) 2015/1

- List of fees charged to each client

- Credit rating types

- Data to be provided

- Initial reporting

- Ongoing reporting

- Reporting procedures

- Entry into force

Registered credit rating agencies classify the ratings reported in accordance with the categories defined in Article 3 of Commission Delegated Regulation (EU) 2015/2. www.handbook.fca.org.uk.

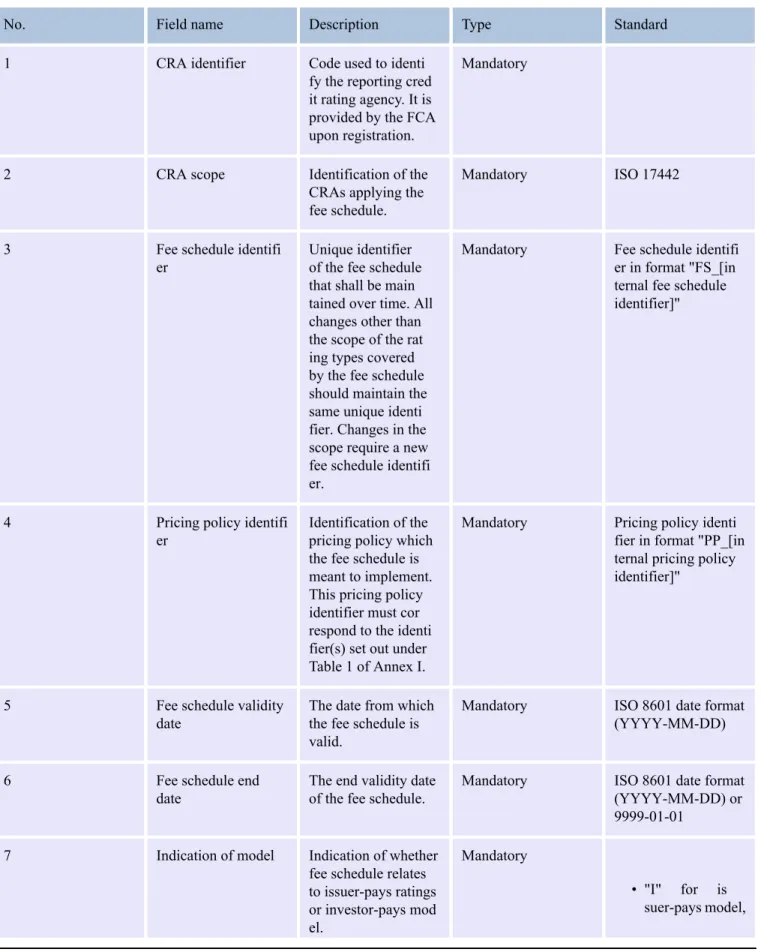

Table 1 Reporting of pricing policies per rating class in force and

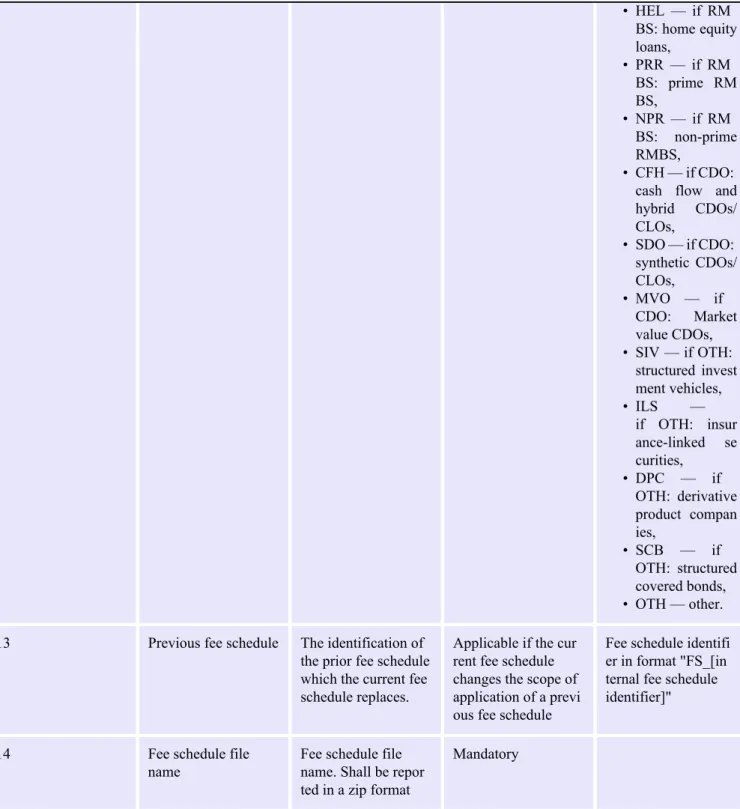

Indication of whether the price policy applies to one or more of:. foreign and public finance ratings indication of whether the pricing policy applies to ratings within one of these segments:. i) State rating; (ii) regional or local authority rating; (iii) supranational organizations (except in international financial institutions); (iv) public entities; (v) international financial institutions. All changes other than the scope of the rating types covered by the fee schedule must maintain the same unique identity. This pricing policy identifier must match the identity(s) set out under Table 1 of Annex I.

Applicable if the current rental rate plan changes the scope of application of a previous rate plan. All changes other than the scope of assessment types or the type of program covered by the fee program must carry the same unique identifier. This pricing policy identifier must correspond to the identifier(s) defined in Table 1 of Annex I. Mandatory pricing policy identifier in the format "PP_[in domestic pricing policy identifier]". date date Date from which. the fee schedule is valid. the date of the fee schedule.

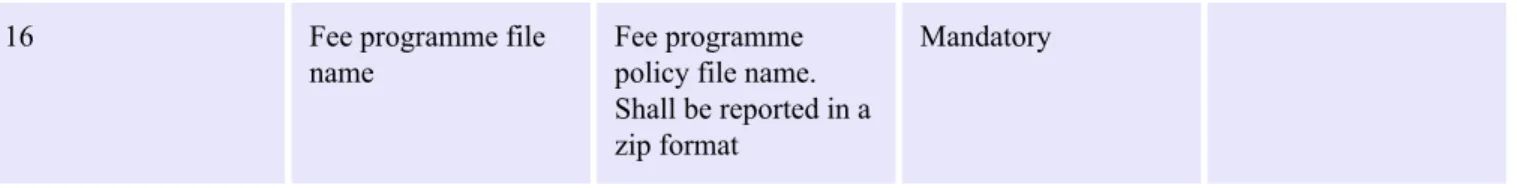

7 Designation of model Designation of. or fee program related to a sur-pays rating or an investor-pays or subscriber-pays model. the fee program Description of the type of ratings or an auxiliary service included in the fee program. the fee program applies to one or more of:. www.handbook.fca.org.uk. 11 Sector of the fee pro. foreign and public finance ratings indicate whether the fee program is applicable. This fee schedule identifier must match the identifier(s) set out under Table 2 of Annex I.

This Pricing Policy Identifier must match the identifier(s) listed in Table 2 of Appendix I. This Fee Schedule Identifier must match the identifier(s) listed in Table 2 of Appendix I. This Fee Schedule identifier must correspond to the identifier(s) listed in Table 3 of Annex I.

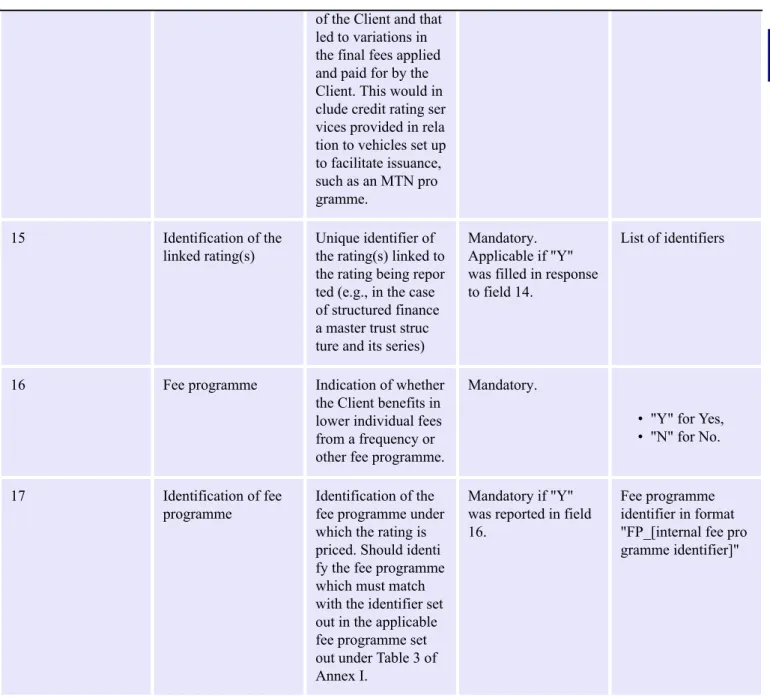

Table 1 Data to be reported to the FCA for each individual credit rating

This pricing policy identifier must correspond to the identifier(s) listed in Table 1 of Annex I. This should typically correspond to the issuer of the instrument or unit, but in no case must it be an SPV. For Structured Finance instruments, the unique code must identify the originator or other entity that, from a financial point of view (eg arranger), directly or indirectly through an SPV or SIV, effectively negotiates the fees with the credit rating agency.

This field indicates whether the individual assessment falls under such an arrangement with the client. If no fee has been paid for the individual credit rating, the amount must be 0 for all but one of the ratings that benefit from the group fee. This includes rating services provided in relation to vehicles set up to facilitate issuance, such as an MTN programme.

It must identify the fee schedule that must match the identifier defined in the applicable fee schedule set out in Table 3 of Annex I. The EU as well as any entity related to the credit rating agency or other company of the credit rating agency loan grouping from a relationship vessel within the meaning of Article 22(7) of Directive 2013/34/.

Table 1 Data to be provided to the FCA for fees received for subscription