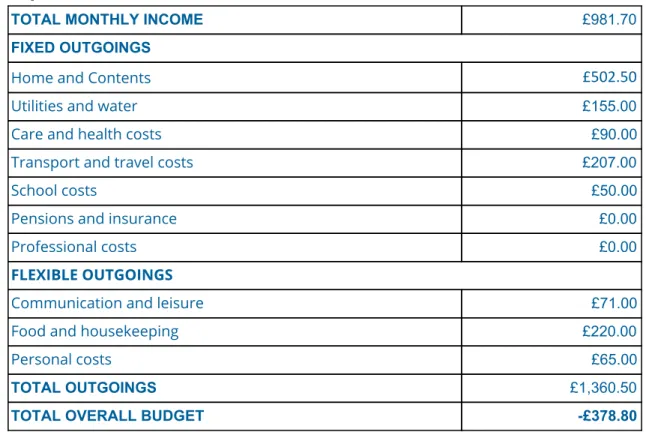

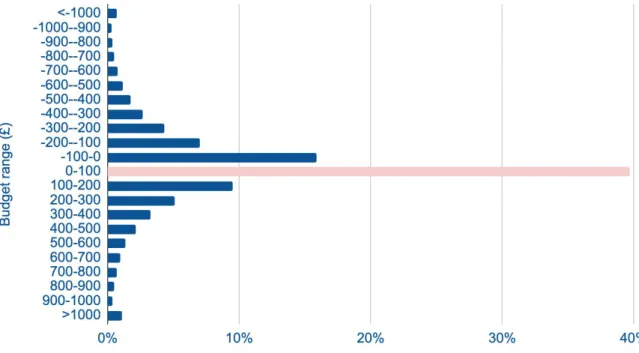

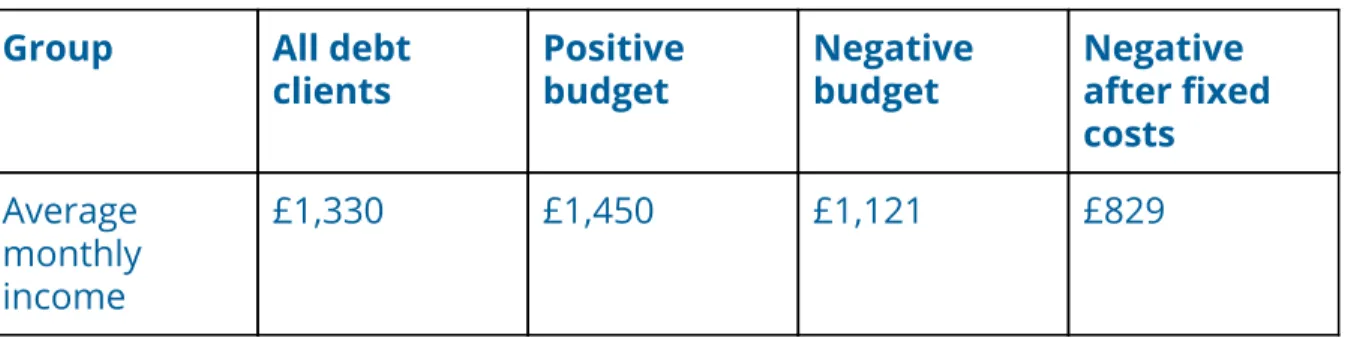

A large number of people are close to falling into a negative budget 9 Fixed costs alone push some people into a negative budget 10. When someone has £0 or less after their spending they are considered to be on a 'negative budget'. This means that on average, those struggling with a negative budget had £203 more than they had coming in as income that month.

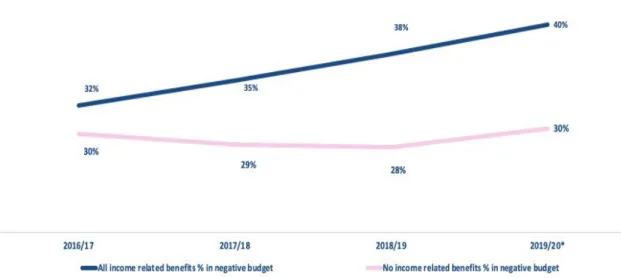

In comparison, the percentage of households with a negative budget that do not claim these benefits has remained largely unchanged. In the long run, households with a negative budget are insolvent - they cannot meet their debt repayments. Entering into a debt settlement or bankruptcy may resolve the current debts, but will not resolve the underlying causes of the negative budget.

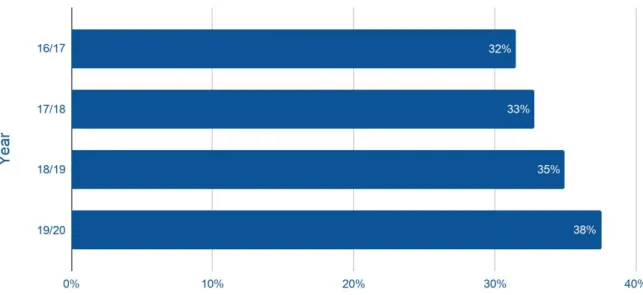

In the past year, 38% of people 12 who came to us for debt help were rated as having a negative budget. Not only has the proportion of people with a negative budget increased in those years, the depth of people with a negative budget has also increased. This means those struggling with a negative budget went out on average £203 more than they came in.

Last year, more than 1 in 10 (11%) of the people we helped with debt had a negative budget even after fixed costs.

Who are the people with negative budgets?

Employment

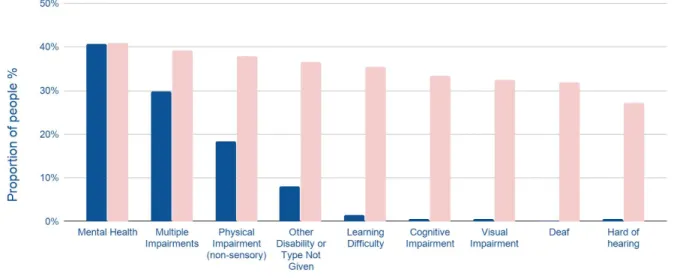

Health

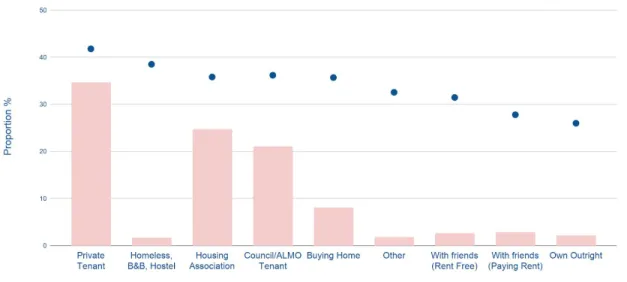

Housing Tenure

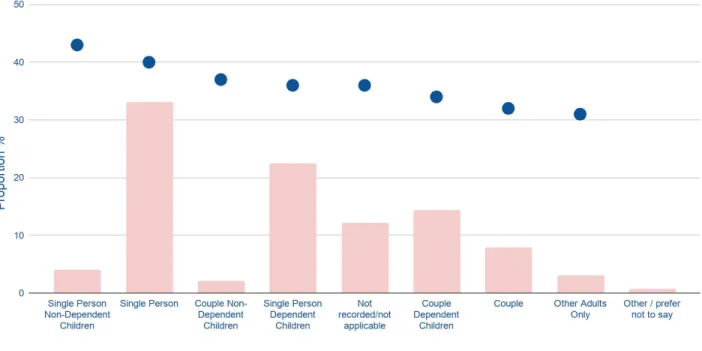

Household type

Causes of negative budgets

For those who have a negative budget after debt advice, this is often even after they have made a budget, cut back where possible, and tried to increase their income by benefit eligibility or more affordable services or utilities as part of their debt advice. For the people we help, their negative budgets are often the result of a combination of events or a change in circumstances. Of the people we help with debt, 9 out of 10 say they are through a recent change in circumstances.

Her income dropped after she was out of work for several months due to a back injury. Lucy then lost her job as a carer when her employer could not accommodate her need for fewer manual work tasks. When Lucy's income was reduced due to her ill health, she notified the DWP of her change in circumstances.

As a family with young children, Lucy and her husband were struggling to manage day-to-day living costs, so they applied for Universal Credit (UC). In the course of Lucy's health and money worries, her relationship with her husband also fell apart. The UC payment was further reduced to reflect the household change, which made Lucy's financial situation even worse.

Lucy was unable to afford basic living expenses for her and her children and gradually fell behind on other bills with repayments which left her in further financial difficulties. As Lucy's experience shows, due to unforeseen changes in circumstances, people can easily get into serious financial difficulties and face a negative budget in a very short time. The effects can be mitigated when people can borrow or build up a savings buffer to use when finances are stressed.

Dan is unable to work as he is awaiting surgery on a back injury. Dan and his wife have fallen behind on their priority bills including rent, energy and council tax due to changing circumstances and complicated changes in their income. Dan has struggled to make full monthly rent payments because their UC payments are not enough to cover all their outgoings.

Income

Being less likely to work and having lower earnings levels are related to a negative budget.

For example, the waiting time of 5 weeks for the first payment, the high deduction percentage for overpayments and prepayments and the fluctuating income for people with an income.

Expenditure

Conclusion and recommendations

Negative budgets can mean people struggle to put food on the table, provide shelter for their family or keep their home warm. Last year 87% of negative budget customers had multiple debts, compared to 82% of non-negative budget customers who had multiple debts. The average person on a negative budget last year had £203 to be able to afford basic household goods and services.

The purpose of budgeting for the people we advise is to help pay off debt. They can't repay the debt, they may struggle to afford debt settlement - for example £680 in bankruptcy tax, and debt settlement will often not help them much. These are not short-term challenges caused by cash flow problems or people not being able to borrow.

Many of the people we help have for a long time faced the difficulties of trying to get by on a negative budget. The reasons for negative budgets are complex - our analysis shows that both low income and high living costs are important. Benefit freezes have had a dramatic impact on the finances of people receiving income-related benefits.

People with a negative budget spend an average of 90% of their income on fixed expenses compared to 62% for those with a positive budget. Policymakers interested in improving household finances must tirelessly seek opportunities to both increase people's incomes and reduce the cost of living. For debt counselors, the growth of negative budgets is challenging the way debt counseling is designed and financed.

The solutions available to people in debt assume that people can either make some payments or would benefit from bankruptcy. Over the coming months Citizens Advice will carry out further analysis to better understand how to help people with negative budgets. We will also be looking to work with other advice providers to identify how advice can be adapted and continue to help people find a way forward.

Recommendations

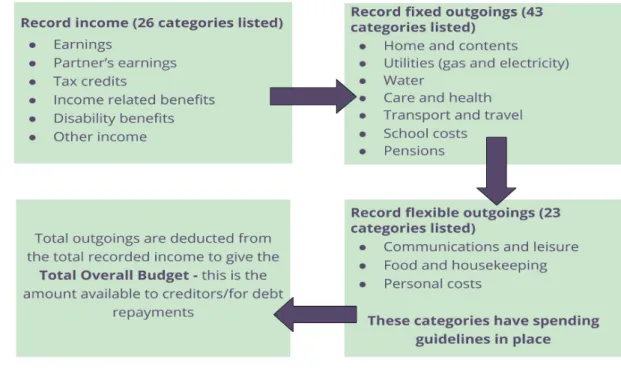

Methodology

Vet bills and pet insurance House Repairs and maintenance Other food and housekeeping expenses Personal expenses.

We help people