Next, we examine a variant in which the tax cut is financed by an increase in indirect tax rates. In the event of a reduction in the contribution rate, we consider two variants. Next, we consider a version in which ex ante tax cuts are financed by increases in indirect tax rates.

In the first version of the third section, we examine the case where the loss of tax revenue is ex ante financed by a general reduction in public expenditure.

I Introduction and summary

Third, the reduction in the rate of social security contributions increases potential output through its impact on the natural rate of unemployment. In this variant, the increase in indirect taxes moderates the fall in natural unemployment. In the previous variant, the fall in public demand caused an immediate drop in GDP.

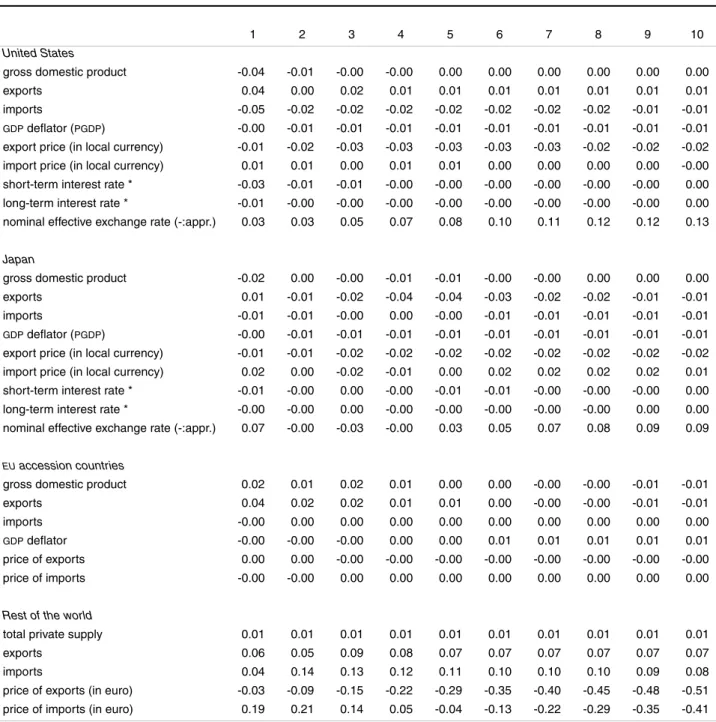

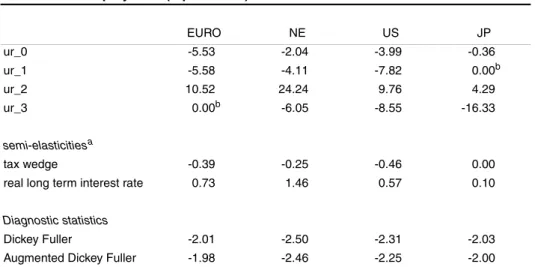

There, for example, we see that a reduction of the tax wedge by 1 percentage point reduces the natural rate of unemployment in the euro area by about 0.4 percentage point.

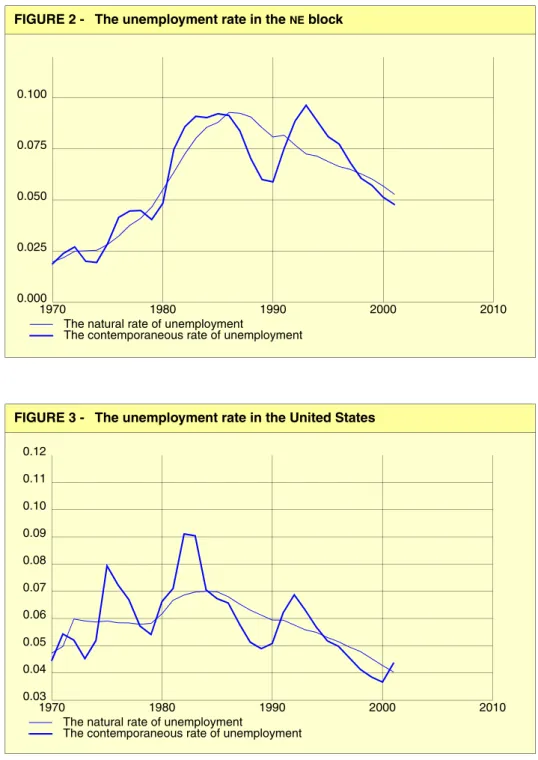

II The NIME model

The reserved salary is determined by unemployment benefits, income from the informal sector of the economy and income outside of work. In the long run, the real wage is a weighted average of labor productivity and the reserve wage, with the weights determined by the relative bargaining power of the household sector. In the euro area, the natural rate of unemployment rose until the early 1990s, after which it only gradually declined.

In Japan, there has been a gradual increase in natural unemployment since the seventies.

III A cut in the social security contribution rate

Introduction

Second, in the case where the reduction in the rate of social security contributions is financed by a reduction in public expenditure, it should be noted that the reduction in public expenditure reduces domestic demand directly through the reduction of public investment and expenditure on goods and services, and indirectly . through the reduction of employment in the public sector and public transfers (in the household sector). At the same time, the reduction in the rate of social security contributions causes a permanent increase in output through its impact on the natural level of employment. As a consequence, private demand will have to increase to restore the long-term balance between demand and supply1.

This increase will be induced by the income effect of the tax cut and by the income and price effect of a fall in the relative price of private consumption. Note also that in the event that the reduction in the social contribution rate is financed by a reduction in the indirect tax rate, whereby public demand is almost unaffected, the adjustment in the relative prices of private consumption will be smaller. Third, expectations are an important transmission channel for the shock because households discount the long-term gains in employment and take home wages for the present and adjust their spending plans immediately.

Fourth, it is beyond the scope of the current version of the NIME model to measure the effect of taxes on trend growth, so the following analysis will focus only on the level effects. We start with a discussion of the variant where the reduction of 1 percentage point in the social contribution rate is financed by a cut in public expenditure.

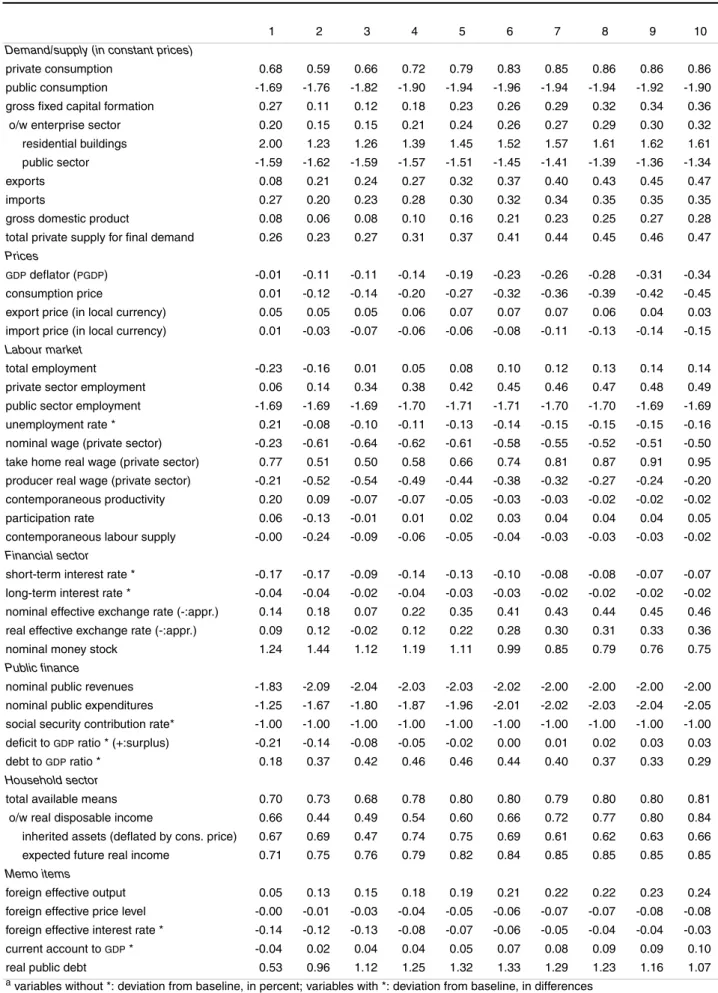

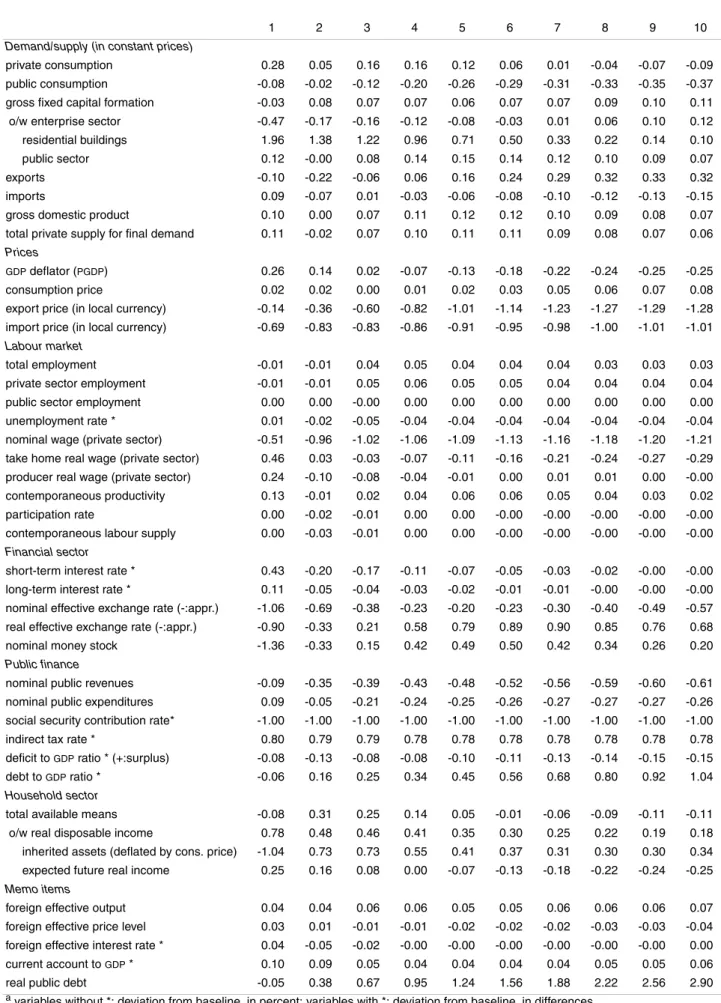

A cut in the social security contribution rate and a cut in public outlays

In the long run, real net wages will rise as the income tax rate and relative consumer price fall. Private consumption rose by 0.32 percent in the first year, mainly due to higher (expected) income from labor and available resources, and lower interest rates. Gross fixed capital formation by businesses increased by 0.38 percent in the first year as a result of the interest rate cut and the increase in production.

In the short term, the euro depreciation is reinforced by the reduction in the short-term interest rate. The money supply increases by 1.8 percent in the first year due to the increase in the total disposable funds of the household sector and the decrease in interest rates. The increase in exports is explained by the increase in the foreign effective production level and the depreciation of the real effective exchange rate.

In the following years, exports continue to increase in line with the increase in effective foreign production and the depreciation of the euro. For example, in the first year, private consumption increases by 0.68 percent compared to 0.32 percent in the euro area. The parameter wrp_l1 is related to the relative bargaining power of the household sector in the labor market.

In the euro area, this feedback from the lag in unemployment to labor supply is negligible. A reduction in the social security contribution rate and an increase in the indirect tax rate.

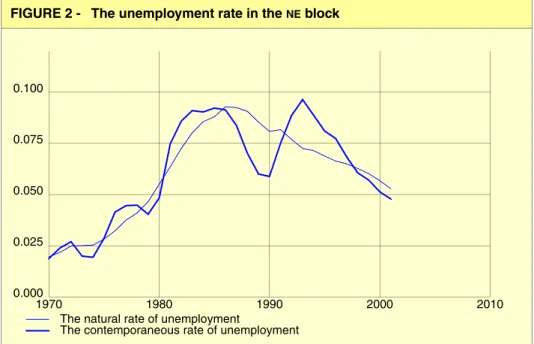

A cut in the social security contribution rate and an increase in the indirect tax rate

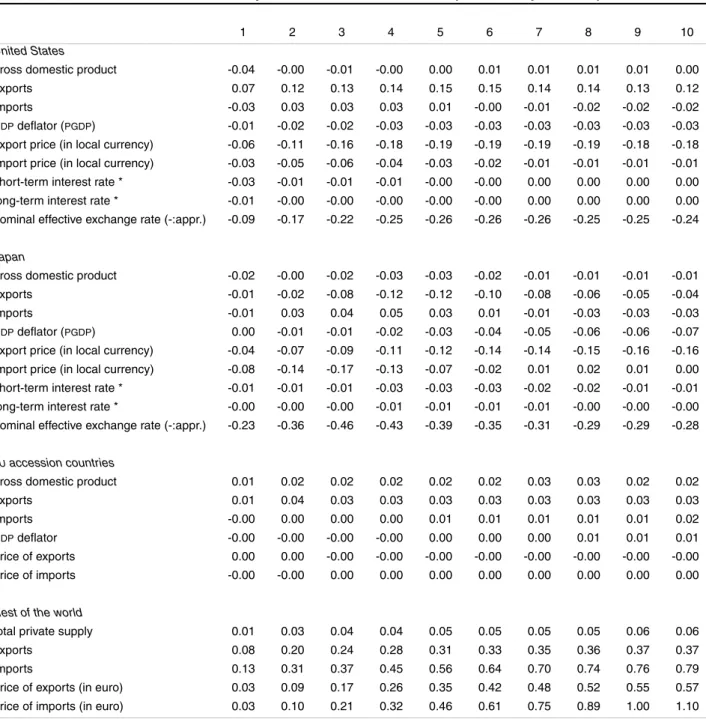

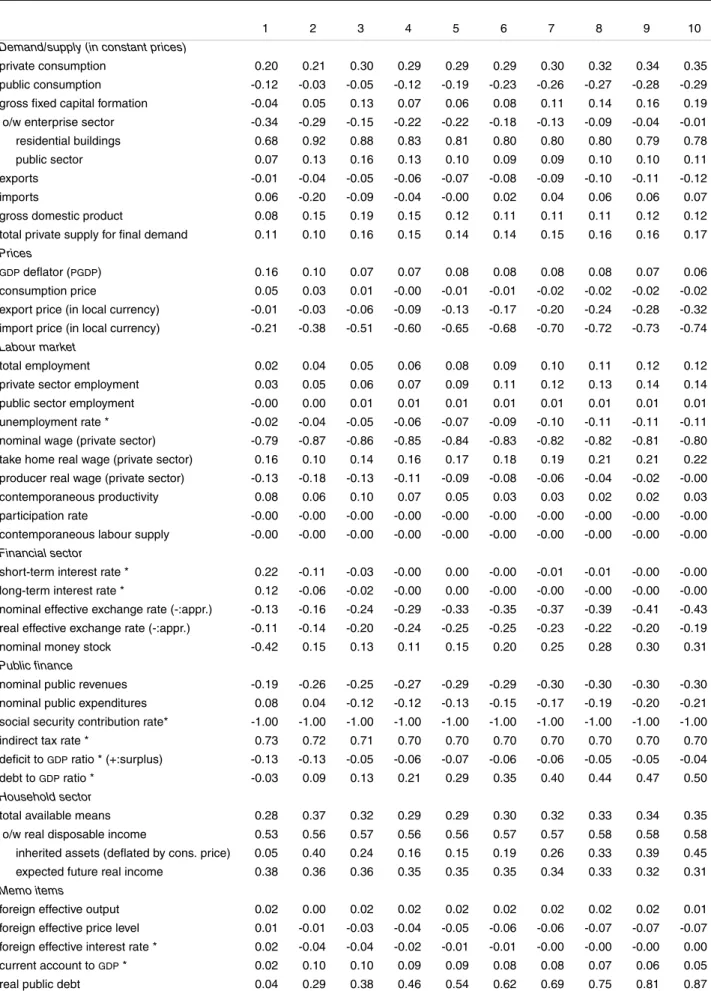

At the same time, consumer prices fall by 0.02 percent after ten years, against 0.54 percent in the previous version. Total employment increases by 0.02 percent in the first year against a decrease of 0.19 percent in the previous variant. Private consumption increases by 0.20 percent in the first year and by 0.35 percent after ten years.

These increases are smaller than in the previous variant, where private consumption increased by 0.32 percent in the first year and by 0.98 percent after ten years. The price of private consumption falls 0.02 percent below the base level after ten years, against 0.54 percent in the previous variant. Overall, the GDP deflator rises by 0.16 percent in the first year, primarily due to the fall in import prices.

The effective nominal exchange rate appreciates by 0.13 percent in the first year and by 0.43 percent after ten years, mainly reflecting an appreciation of the equilibrium nominal exchange rate. The real effective exchange rate appreciates somewhat less because export prices, expressed in local currency, fall by 0.01 percent in the first year and by 0.32 percent after ten years. After ten years, the ratio of public deficit to GDP is set at 0.04 percentage points below the baseline, compared to 0.16 percentage points above the baseline in the previous variant.

Total employment is almost unchanged in the first year and increases by 0.03 percent after ten years. The ratio of fiscal deficit to GDP falls by 0.08 percentage points, compared to 0.21 percentage points of the previous variant.

IV An increase in the labour participation rate

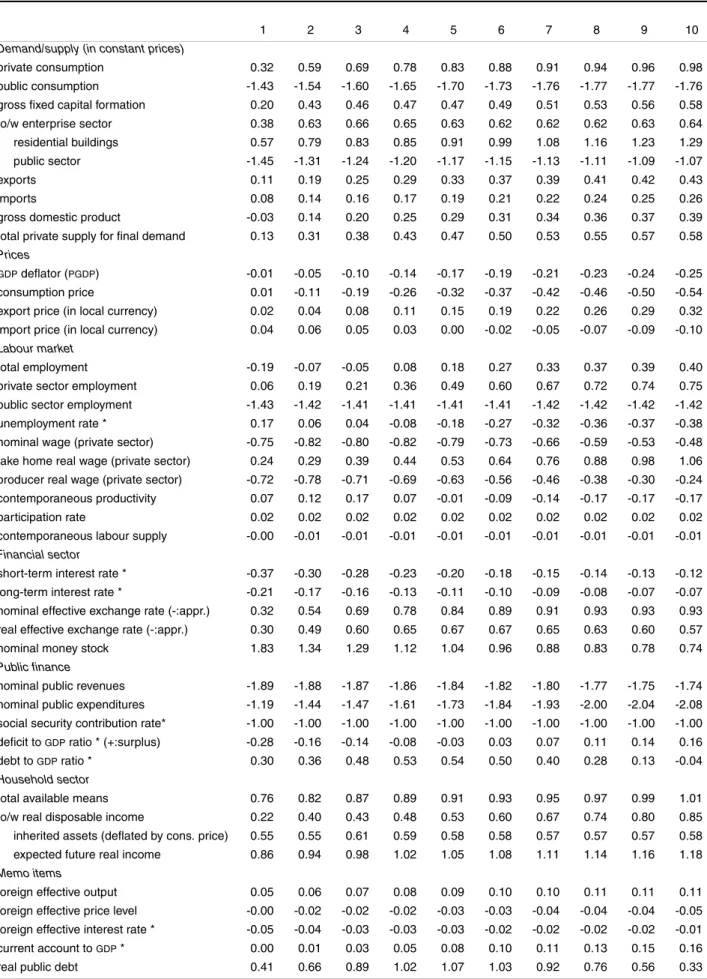

The simulation results

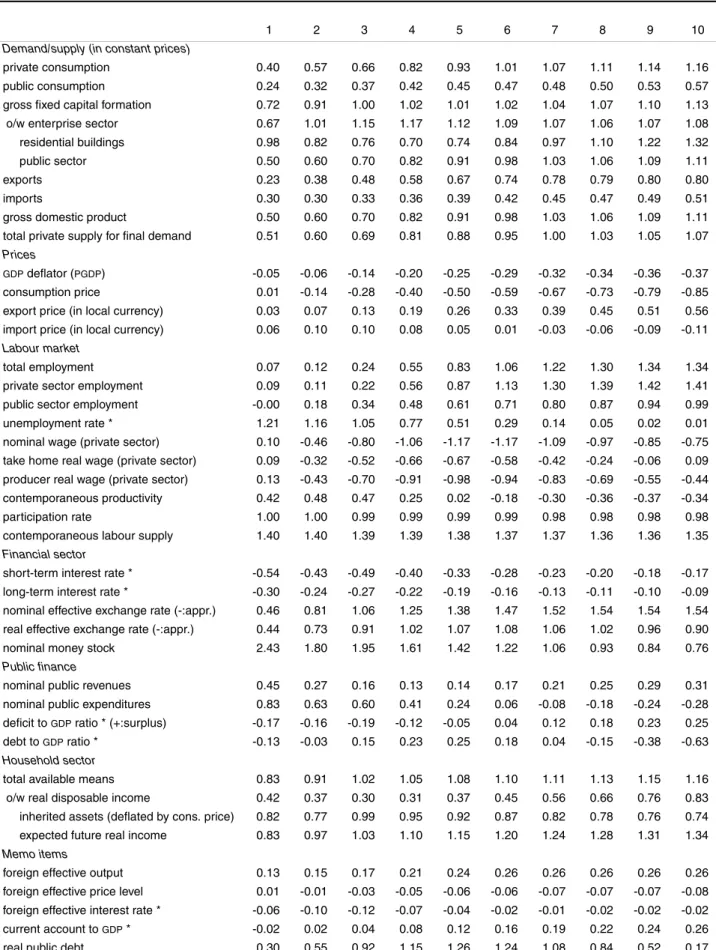

An increase in the labor force participation rate increases potential output, bringing higher income to the household sector and fiscal authorities. In the first year, the participation rate increases by 1 percentage point, implying a 1.4 percent increase in labor supply. In the first year, real GDP increases by 0.50 percent, while the GDP deflator decreases by 0.05 percent.

Investments in housing will increase by 0.98 percent in the first year, mainly because real disposable income and the total available resources of the household sector will increase. As a result, the consumer price will fall by 0.50 percent after five years, against a fall in the GDP deflator of 0.25 percent. Imports rose by 0.30 percent in the first year, mainly due to the 0.51 percent increase in private supply for final demand and the increase in import prices.

Exports increased by 0.23 percent in the first year, which is a result of increased competitiveness and a 0.13 percent increase in the volume of effective foreign production. In the first year, the producer's real wage increases by 0.13 percent, mainly because the simultaneous labor productivity increases by 0.42 percent. In line with these deficits and higher nominal GDP, the debt-to-GDP ratio decreases by 0.13 percentage points in the first year.

In the labor market, the unemployment rate increases by 1.10 percentage points in the first year, while the real wage of the producer remains almost unchanged. The share of the public deficit in GDP rises to 0.31 percentage points above the starting point in the first year.

V Appendix A: Modifications to the NIME

- The natural rate of unemployment

- Public transfers to the household sector

- Labour supply

- The EU accession countries block

Based on these new assumptions about the reservation wage, we derive an equation that determines the natural unemployment rate as a function of the tax wedge, the real interest rate and the companies' market power on the product and labor markets. When the real interest rate increases, the unemployed person's non-labour income increases, and the unemployed person will be more reluctant to accept a job offer, so the natural unemployment rate increases. PCIP: price of capital held by firms, PMP: price of (intermediate) imports.

Equation (5) states that the unemployment benefit is proportional to the net real wage earned in the formal sector of the economy. Finally, equation (7) states that real non-labour income is a function of the real interest rate. Equation (19) shows how the natural rate of unemployment is determined by the tax wedge, the real interest rate, and the market power of employers in the goods market.

As the market power of employers in the goods market increases, the level of output decreases and the demand for labor decreases, so the natural rate of unemployment increases. Equation (27) explains the change in the real wage by the deviation of the lagged wage from the trend productivity plus markup on the goods market, the deviation of the lagged unemployment rate from the natural unemployment rate, the change in labor productivity, and the change in the tax bracket. In the empirical part, the market power of TR_MP is measured by the openness of the economy, i.e.

Equation (32) makes explicit some of the dependencies that were implicitly present in the previous specification. A higher supply of labor will be induced by a higher participation rate of the people of the ODTEPEN type. These twelve countries were previously included in the rest of the world (RW) block of the NIME model.

EFEX: effective nominal exchange rate of the EC bloc, number of domestic currency per unit of foreign currency1.

VI References