Vol-7, Special Issue-Number5-July, 2016, pp1050-1057 http://www.bipublication.com

Case Report

Assessment the solutions which increase active Internet banking customers

(The case study: MellatBank branch of Kish)

Mehdi Karimi* and Azam Soleimani+

*M.A in Business, Management, Department of Management,

Kish International Branch, Islamic Azad University, Kish Island, Iran

Email address: mkarimi56@gmail.com +

Assistant professor, Department of Management and Accounting, Yadegar-e-Imam Khomeini (RAH) Shahre-Rey Branch,

Islamic Azad University, Tehran, Iran Email address: a.soleymani3278@gmail.com

ABSTRACT

Providing electronic banking services is one of the major requirements in connection with the development of services and customer satisfaction is a top priority, especially customers who are interested to use modern banking services.One glance at the status quo can be realized bank had not achieved much success in customers use e-banking services. Hence this studyidentifies needs, desires, expectations and opinions with e-e-banking customers in order to increase the bank's Internet Banking active customers.And helps banks and activists in the field of e-banking to focus on these factors in the formulation of their strategies. This study aimed to investigate solutions to increase the willingness of bank customers to use electronic services.To examine the purpose and hypothesis Technology Acceptance Model Davis chosen with four attitudes, perceived usefulness, ease of understanding and willingness to use the customer.This population consists of applied research consisted of all those within 6 months of the second and third year94 received the bank's internet banking user ID and password.For example, simple sampling method was used and the sample size has been calculated by Cochran 96.The questionnaire used in the survey questionnaire technology adoption is Davis. By professors and experts approved the validity and reliability by Cronbach's alpha (0.83) obtained and structural equation model was used to examine the hypotheses of the study. Results show that the three hypotheses regarding attitudes, perceived usefulness and willingness to use Verified by accepting internet banking and internet banking relationship with the ease of understanding has been rejected.

Keywords: online banking, technology acceptance model, perceived usefulness, perceived ease.

INTRODUCTION

the development of information technology in various fields, especially in banking, information is the result of the technology capabilities that today's business world is faced with great interest.Man of the third millennium is trying to accelerate the process of development of information technology in different sectors of society away from traditional patternandcreate a new pattern in accordance with the requirements of the information age. In this regard, as in most service providers, the

the need to undertake research to identify the determinants of adoption of Internet banking users.

Statement of the problem

The advantages of electronic banking can be used to save costs and time, reduce human error, lack of long lines and access to multiple channels for banking operations noted during day and night. From another perspective can be features such as creating and enhancing the reputation of banks in innovation, settling time, increase productivity, retain customers despite the spatial variation banks, creating opportunities for Atmospheric Search new customers in target markets, accelerate tasks, Open Range contact and named geographical conditions of perfect competition. As well as the conservation and utilization of cash disappears.The financial sector is subject to changes that have not experienced before in their history, these changes have a tremendous impact on the industry structure and competitive nature.

No wonder that in this turbulent environment with accelerated changes, financial institutions have been forced to change the way your reaction to the market,So that less focus on products and more on customers and to adopt long-term vision instead short-term.Given the increasing banks in developed countries and developing banking services through electronic means to facilitate and reduce the cost of banking services has created the intensive competition in the banking industry and has forced new information and communication technologies.

In line with the objectives and policies of the Government in the course of research, e-government, e-banking as one of the solutions is the e-commerce boom,as a comprehensive service, has been expanding and providing banking and financial services via electronic networks and the Internet in recent years has been unprecedented leap.

Given that electronic banking services is one of the major requirements is associated with the development of services and customer satisfaction is of considerable importance,however, a quick look at the current

situation can be realized banks has not achieved much success in order to use the services of e-banking customers. Hence this study identify needs, desires, expectations and opinions with e-banking customers in order to increase the bank's online banking active customersand activists in the field of e-banking helps banks in formulating their strategies to focus on these factors.

Importance of subject

The increasing use of the Internet and financial innovations in banking to electronic banking has attracted the attention of researchers.In the past traditionally, most research was in the field of technological development of electronic banking services but now scholars have done research on the behavior and user comments.Although millions of dollars have been spent on the construction and processing of e-banking systems, existing reports and evidence are indicative of the factDespite that potential users have access to these facilities are not reluctant to use these systems,This show theneed for research to identify the users. It seems that factors such as education, security, ease of use, usefulness, and lack of awareness of users' willingness to change, including the factors that influence the use of internet banking customers.

Research purposes

The purpose of this research is to identify ways to increase the willingness of bank customers to use electronic services.

Hypotheses

1. Perceived usefulness has impact on the internet banking acceptance.

2. Perceived ease has impacton the internet banking acceptance.

3. Attitude toward function has impact on the internet banking acceptance.

4. Tend to use has impact on the Internet Bank acceptance.

Research model

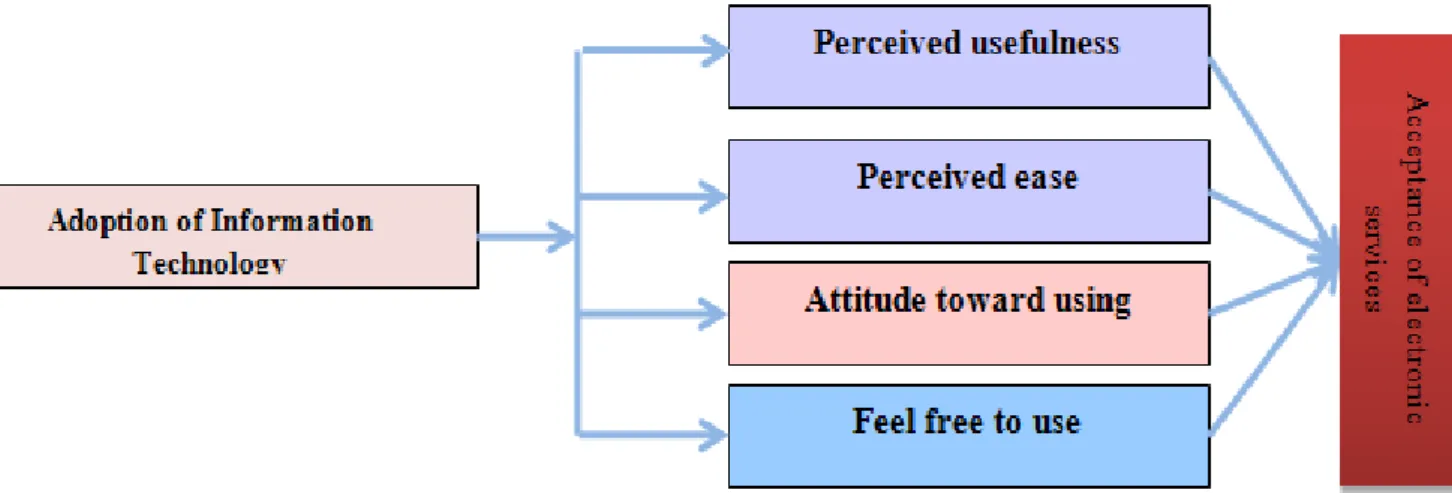

Table 1. Research Model

To check the version of the standard questionnaire Davis consisting of 21 items Likert scale is used.The four main aspects to be included and, finally, the structural equation used to calculate the dimensions of the system.

Research method

This research is applied and the method is a descriptive study.

Statistical Society

The population of this research is that in six months all customers of Bank Mellat branch Kish who received internet banking ID and password.The number is 16 093 people.

Sample

Researchers to collect data to make decisions about hypotheses have attempted to samplingAnd then extended the results with 95 percent of the community. Since in this study population was unknown varianceSo Cochran formula was used to determine the number of samples in the population with a limited number.

2

2 2

(1

)

(

1)

(1

)

NZ P

P

n

d

N

Z P

P

For qualitative variables q and p is usually equal to 50%, e numerically less than 10% is selected

(the number 0.05 is selected) and the 2 / Zα is selected of the normal distribution, usually α is considered, to be 5% (the number that is

calculated 1.96). After calculating statistical sample of 96 patients were identified.

Data collection

In the present study, data collection using the included library of books, articles, journals, research reports, documents as well as the use of the Internet,Also to collect data from the questionnaire is used packets using a standard scaleAnd the method of sending and collecting it done by direct method. In the questionnaire used to measure the main variables 5-point Likert scale was used.

Statistical data analysis method

In this study, according to research methods and hypotheses, in order to generalize the results to the population inferential statistics were used.

Inferential statistics:

Assess construct validity adoption of information technology

Adoption of information technology in the standard model diagram shows coefficients.Due

to the outflow LISREL calculated value is

Table2. Confirmatory factor analysis of information technology in the standard estimate

The next output coefficients and parameters obtained significant part of the measurement model adoption of information technology to show that all coefficients are significant because the significance test of the individual outside of the range is (1.96,- 1.96). These figures reflect the significance of the model is appropriate. In other words, each of the items in their form factors or variables is significant.

Table 3. Adoption of information technology in significant factor analysis parameters

Assessment of construct validity acceptance of Internet bank

The following diagram acceptance of internet banking model in standard mode shows coefficients. Due

to the outflow LISREL calculated value is 2.345that the amount less than 3 times. Output show the

RMSEA = 0.068 for the model.Whatever the level of the index RMSEA is lower model has better fitness, like this model. Measuring in standard mode model to estimate showed the effect of each variable or variables or items in the distribution of variance that the main factor (Table 4).

Table 4. First order confirmatory factor analysis to estimate the acceptance of electronic services in standard mode

A significant part of the next output measurement model coefficients and parameters obtained from reception Internet Bank show that all coefficients are significant because the significance test of the individual outside of the range is (1.96,- 1.96) (Table 5).

Table 5. Internet banking acceptance in significant factor analysis parameters

According to the results of confirmatory factor analysis we can say all questions are significantly is a measure of the hidden variable.

The final model evaluation

As can be seen, the model is composed of 5 latent variables and 25 view state variables. Hidden variables in turn divided to two types of receptors and endogenous variables or the Endogenous or flow variables. Each variable in the system can be both considered as endogenous and exogenous variables. Endogenous variable is a variable that is influenced by other variables in the model. In contrast, variable exogenous variable that has no impact of other variables in the model, but does not receive its determinants. In this study, perceived efficacy variables (X1), perceived ease (X2), attitude toward using (X3), feel free to use (X4) are exogenous and internet banking adoption variable (Y) is an endogenous variable (Table 6).

Table 6. Second order confirmatory factor analysis to estimate the final model in standard mode

All coefficients are positive, which indicates that the relationship between variables is direct. The most effective tend to use the impact of internet banking acceptances equal to 0.66. The perceived beneficial effects of internet banking acceptanceare equal to 0.57. So feel free to use has the greatest impact on the bank's internet reception (Table 7).

Table 7. The final model parameter in a significant second-order confirmatory factor analysis

According to the chart, t-statistic values of the variables perceived usefulness (X1), attitude toward using (X3), feel free to use (X4) are outside of the range (-1.96,1.96). So it can say with 95% confidence that there is significant relationship between perceived usefulness, attitude toward using, feel free to use internet banking and acceptance.

The t-statistics related to perceived ease variable (X2)isnotoutside of the range (-1.96,1.96) with 95% confidence we can say there is no significant relationship between ease of understanding and acceptance of internet banking.

The answer to the hypothesis

First hypothesis: perceived usefulness has an impact on the acceptance of internet banking.

According to the results of path coefficient (0.57) and the statistic t (6.86) that is specified in the chart above, variable perceived usefulness at 95%confidence level has a significant effect on internet banking acceptance variable.

Second hypothesis: Perceived ease has impact on internet banking acceptance.

According to the results of path coefficient (0.67) and the statistic t (0.59) that is specified in the chart above, variablePerceived easeat 95%confidence level has no significant impact accepting internet bank variable .

The third hypothesis: Attitude toward function has impact on internet banking acceptance.

According to the results of path coefficient (0.39) and the statistic t (3.35) that are specified in the above two graphs, attitude towards functionhas a significant impact on the use of internet banking adoption at 95% confidence level.Because the coefficient obtained for these variables is positive and relationship between these two variables is positive and havethe same direction.

The fourth hypothesis: Tend to use has impact on the Internet Bank acceptance.

According to the results of path coefficient (0.66) and the statistic t (7.94) that is specified in the chart above, the variable tend to use internet banking adoption at 95 percent on the variable has a significant impact. According to the index, we can say that the desire to have a

significant positive impact on internet banking acceptance because the coefficient obtained for these variables is positive and relationship between these two variables is positive and the same direction.

Expression of results

Survey results indicate that more respondents perceived usefulness variable to the average believe that technology is useful. They also believe that technology help to increase productivity and expand access to career goals. This view reflects the benefits of efficient use and practical purposes to the extent necessary technology is still unproven respondentsBut they believe that improving the quality effects speed and ease of doing many tasks Technology. This means that in terms of quality, speed and ease of use is quite clear to respondents. Overall results show that respondent perceived usefulness has a direct and positive impact on the internet banking acceptance.

Resultsof perceived ease show that most respondents believe that the perceived ease of variables and easy communicate to use technology and easy learn technology is great. Andthey also believe that easy technology skills the technology,flexibility and ease of use IT in requirements are modest. But the overall results show the impact of perceived ease on the internet banking acceptance is negative. This means that perceived ease has a positive effect, but the effect positive change will not in the attitude of consumers accept internet bank. Results of the attitude toward function show that according to the respondents, usefulness of technology function and IT pleasure and wisdom of Technology is great. This means that the advantages of view, pleasant and obvious interest in the use for respondents is firmly and established.

Results of tend to use variable indicates that respondents tend to use all aspects of the desire to use in the future,Feel free to use if needed, feel free to use on an ongoing basis and tend to use for tasks are very important.

In this respect means that consumers have found that the use of subsidies and related software in today's world is imperativeand in the future cannot do anything without these two.That does tend to increase their use of technology.And the results of the impact of internet banking acceptance and tend to use be positive and direct respondents.

Survey results that the Internet banking acceptance variable show that respondents excessively believe that use of internet banking is beneficial for them.

They also have proposed they use of Internet banks alot and while using their needs have been met to a large extentand their internet banking interface to a large degree is suitable.

Practical suggestions

1. According to the first hypothesis is suggested to managersInternet training classes useful to the bank on the use of Internet technology will be more emphasis bank to its customers,In its advertisements that refer to their customers using internet banking for consumers to increase efficiencyAnd educational materials designed specifically for law firms on internet banking functionality that can be used by law firms emphasize.

2. According to the third hypothesis suggested managers in their advertising messages referring to the well-being of internet banking.

3. According to the fourth hypothesis suggested managers to ease the use of internet banking executives to increase tend the use of the Internet bank.

SOURCES AND REFERENCES:

1. Afzali, Mahmoud.2008.

Mobile Banking and the challenges facing it at the Nineteenth Islamic Banking Conference, Tehran: Center for Monetary and Banking.

2. AllahyariFard,

Mahmoud.2005. E-banking services and administrative needs. Tehran: Center for Monetary and Banking.

3. Junaid Masood.2001.

Survey on Mobile Banking. Banks and housing. Tehran, August 2007. No. 80. P. 16-14.

4. Sheikhan, Said.1999.

e-banking and its strategies in the Islamic Republic of Iran. Tehran: Center for Monetary and Banking.

5. ARDAKANI Fatemi,

H.Seyedvalli,2005. Bank e-banking and its impact on administrative processes. Tehran: Planning Department, Ministry of Economic Affairs.

6. Kotler, Philip and Gary

Armstrong. 1379. Principles of Marketing. Translated by Ali Parsaeian, Tehran: Adbstan.

7. 7.Naqdi , Hashemian,

2004, "e-government concepts", Monthly TEKFA, the first, seventh and eighth numbers

8. Venus, Davarand the

Mithra Safa'ian.2000. Applied methods of marketing banking services to Iranian banks. Tehran: Negahdissemination of knowledge. 9. Fang, K., & Shih, Y.Y. (2004). The use of a

decomposed theory of planned behavior to study internet banking in Taiwan. Internet Research, 14(3),213-223.

10.George, J.F. (2004). The theory of planned behavior and internet purchasing. Internet Research, 14(3), 198-212.

11.Jaruwachirathanakul, B., Fink, D. (2005). Internet banking adoption strategies for a developing country: The case of Thailand, Internet Research, 15(3),295-311.

12. Miller, K. (2005). Communications theories: perspectives, processes, and contexts. New York: McGraw Hill.

13.Pikkarainen, T., Pikkarainen, K., Karjaluoto, H., Pahnila, S. (2004). Consumer acceptance of online banking: An extension of the technology acceptance model. Internet Research, 14( 3), 224-235.

14.Pikkarainen,T.Pikkarainen,K.Karjaluoto,H.& Pahnila,S.(2004): “Consumer acceptance of online banking : An extention of the technology acceptance model”.Internet Research.Vol.14,No.3,pp.224-235.

15.V. Ravi, Mahil Carr, N. VidyaSagar.(2006):“Profiling of Internet Banking Users in India Using Intelligent Techniques”,Journal of Services Research,Vol.6 No.2.