Case Report

Study the Relationship between Financial Development

Market and Economical Growth in Iran

Najmeh Shahi1, Abbas Dadras2 and Mohammad Mohebi3 1Student Of Financial Management ,

Department Of Commercial Management ,College Of Humanities, Qeshm Branch, Islamic Azad University,Qeshm, Iran

najmeshahi@yahoo.com

2Assistant Professor ,Department Of Management, College Of Humanities,Qeshm Branch, Islamic Azad University,

Qeshm, Iran .abbas_dadras@yahoo.com 3Assistant Professor , Department Of Economic, College Of Humanities,Qeshm Branch, Islamic Azad University,

Qeshm, Iran . mohebimh@yahoo.com

ABSTRACT

According to economical theories of financial system development through the development and also , the diversification of the country's financial markets will be lead to better allocation of resources and, ultimately, it will be leads to faster economic growth. The main aim of this study was to investigate the relationship between financial development and economic growth in the mon-fisc - markets and economical growth in Iran .For this purpose, this research used Auto Regressive Distributed Lag (ARDL) model to estimation the model. Used software is views. Examined time period was between 1991 to 2013 .GDP variable is considered as the dependent variable and capital stock, human power , bank credit volume and stock exchange transactions volume is considered as independent variables. The results of this study indicated uncertainty in positive and significant effect of mon-fisc - markets on economic growth.

Keywords: Economical Growth, Development of Market Funds, Investment Efficiency, Financial Intermediaries

1. INTRODUCTION

The importance of development of financial markets on economic growth has always been one of the key topics in development economics. According to the opinions of economists, financial sector along with the real sector constitute two parts of the economy and to achieving the higher economic growth required to both real and efficient financial , complete and powerful sectors in any society. It seems that in less developed countries, the growth of the financial sector leads to economic growth and then, importance of the

financial sector will be reduced by over time and development of the real sector will be very important. However, researchers and policy makers always faces with an important question on whether is there any relationship between economic growth and financial development? Is more developed financial markets will be improved growth levels?

proper ways according to their needs for saving with less risk. Moreover, through the mobilization of resources from savers and their direction to profitable economic activities with high added value, can increase economic growth. It is important to mention that because of dissimilarity financial structure can not be prescript the same version for the relationship between financial development and economic growth in all countries. One set of criteria apply in order to showing the financial development . One criteria is ratio of public savings in banks or allocated loan portfolio is to the private sector. Financial sector by reducing the transaction costs in the economy , untimely , leads to the promotion of savings level , capital accumulation, technological development and economic growth and such impact can be occur by several different ways. Financial development occurs when the financial market's ability develop [ in order to performing of these functions and decision-making promote for saving and investment and ultimately lead to improvement the economic growth. Financial markets are considered due to the major role in gathering resources through big and small savings in the national economy, workflow optimization of financial resources and lead them to consumes and investment needs in sectors of economic productive. The positive effects of securities on the economic development conclude of increasing the investment incentives through reducing risk, pricing risk and facilitation the liquidity risk and the mobilization and deposits mobilization and ... is so much sensitive which some economists believe that differences between developed and underdeveloped economies is active in the financial markets not only in advanced technology development . These studies shows that the level of development of financial markets, especially the stock market and their impact on financial supply of firms and choose the model of financial supply of firms leaves a great impact on economic growth, finally. Developed financial markets such as financial markets of the

developed countries has a considerable volume of the economy's financial capital. These markets are responsible for savings incentive and converting the savings to investment aimed at capital formation and therefore , play an important role in accelerating economic growth (Khataei et al., 1999). This research while addressing the duties of financial markets in creating the economic growth, is looking for determination the position of financial markets on economic growth of these countries by the comparing the effectiveness level of financial markets on economic growth in Iran .

2. Literature Review 1.2 Financial Market

with wide variety of financial instruments provides opportunities for families in order to saving the various financial assets from efficiency firms. If there is different types of securities in the financial market , a large part of the surplus funds of individuals will be absorbed to the economic units; since in these conditions, people attracted on market with various degrees of risks and also , small saving will be absorbed , too ; also , efficient financial markets leads to the absorption the saving through increasing the liquidity ; since it provides that savers convert their financial assets whenever they need to own fortune. In addition, since the market cost information and monitoring on firms is extremely low in these markets , therefore , making sure from corporations and economical businesses will be obtain for households with the lowest cost, so , existing the efficient financial markets leads to the more equipment is of savings. Another function that is expressed to financial market is that such markets can be help to the process of price discovery because in such a market, prices usually reflect the information that The buyer and sellers need to it and the location and position of traders is established in such a way that trading between the buyers and sellers determine the exchanged asset prices. But it should be noted that real markets are much more complex than we can placed them into form of one or two theories and models and work basis on it in those markets . Complex causes of behavioral, psychological and economic have an much effect on prices of real and financial asset . By assumption the efficient financial market and data entry to the market , incorrect interpretation and analysis of information and even the level of optimism or pessimism to the mentioned information can be impact in determining the price . For example, optimist people behave optimistic with received information and they are ready to offer higher prices and also , they tolerate more risk on unreliable future. Also , weakness in interpretation of data and the lack of

interpretability of financial statements is effective about bidding .

2.2 Factors Affecting on the Development of the Financial Sector

In recent years, many studies is done about factors affecting on the development of the financial sector. These studies have been emphasized , mainly , on the role of financial and legal institutions , government policies in the financial sector and other macro policies of government and also , the role of geographic, regional . In the following , a summary of these factors is discussed.The Role of Legal Institutions: a legal and regulative system consists of protection the ownership law , supervision the execution of contracts and it is proper for accounting system. For example

La Porta et al (1998) point that type of law can be effect on behavior of lenders (financial institutions that lend),stockholders and efficiency of running the contracts . They presented evidence that countries with laws such as the General Law tend to protection the private property rights, while the countries with laws such as the Civil Law of French tend to more protection the government's rights and relatively , less attention to the rights of the masses are concentrated. In short, institutions may be have a great impact on the development of the financial sector in the supply side, and the level of institutional development has the role of determination degree of development of the financial system in a country .

examined the effects of inflation on the development of the financial sector empirically and concluded that economies with higher inflation rate , the banking market and the small market of securities are inefficient and no active . In addition to the above items , in recent decades, many studies is done about the effects of financial liberalization on financial development sector which these studies followed the model of MacKinnon (1973) and Shaw (1973). They have emphasized on the fundamental role of government policies in the financial sector on saving mobilization and its optimized allocation of it on investment. Results of studies showed that all forms of government ‘s controls on financial markets as a means of precious and non-precious leads to financial repression and as a result the rate of financial saving and investment decreases in the economy.

Other Variables: other variables that have been mentioned as affecting economic factors on the development of financial sector in economic literature are economic growing, income level , population, religion, language , racial and cultural features . Stolz and Williamson (2003) emphasized on the role of the cultural differences on financial development . They provided the evidence that culture of countries affected on development of financial sector through the changing in protection and implementation of the rights of investors . Importance the level of national income on development of financial sector has been emphasized in several studies .Jefi and Lonion , (2008).

The experience of financial reforms of countries : The experience of financial reforms of countries teaches many lessons to us so that we set the policies of financial reforms which is consistent to economic structure of country . Performing the reform whenever is successful that the optimal sequence of reforms are observed . In this regard , two important issues should be considered: arrangement the optimal financial liberalization in different economic sectors , macroeconomic

position at the time of financial liberalization. By investigation the financial reform experiences of some important Asian and Middle Eastern countries in two parts of reforms in domestic financial sector (banking sector) and the evolution of accounts, we find that , generally , most countries consider the following items in the process of financial liberalization:

Reforms is conducted whenever economy in terms of stability of macro-position

Reforms in real sector have been implemented proceed of reforms in financial sector

Countries for performing the reforms in domestic financial sector should be liberated the interest rate of bank loans and then interest rates of deposits (primarily in long-term deposits) .

Countries for performing the reforms in International capital developments should be liberated the entrance of capital and liberating the exist of capital was carried out at the final step .

Reforms of the legal and financial institutions should be carry out during the financial sector reform.

2-3- Studied Works

to the study of Gertler and Rose (1994). They examined the empirical relationship between financial development sector and the level of real per capita income by using the annual statistics of 69 developing countries and the result was that there is a negative correlation between rate of revenue growth and growth rate of financial development sector .

Second approach is inspired the theories of Schumpeter (1911): economists as Gold Smith (1969), MacKinnon (1973) and Shaw (1973) believe that financial markets has a key role in terms of economic development and growth and the difference in provided quantity and quality of services can be explain an important part of the differences in growth rates of the country by institutions.

At associated with the second approach, Goldsmith was the first scholars who showed the positive relationship between financial development and economic growth. He attempts to explain the channel which emergence of markets and financial institutions impact on economic development through them . In study of Gold Smith (1960) is clear the severe correlation between the financial system volume and economic growth but direction of causality can not be determined between these two variables. Liang and Tang believe that if a financial system has no optimal performance for allocation of capital and resources , the economical growth will not happen because of the fact that financial system is not supported by the market; so , the economy still remains incomplete and underdeveloped . They concluded that there is a unilateral causal relationship between economic growth and financial development in the long run. By using the information of 69 developing countries and by applying the technique of Muhammad Tripoli , one research was shown that financial development has a serious role on economic growth in the countries. In survey by Muhammad Tripoli concluded financial development has a

positive effect on the economic growth in the surveyed countries . Of course ,this requires to a private sector of entrepreneurship and innovation would be able to collected the savings in this way and convert them into fertilized investors. In addition, his study showed that the financial sector can be effective on the real economy through increasing the productivity of investment.

A survey by SulleyMan and Howells is examined

the relationship between stock market

development and economic growth for four countries Chile, Korea, Malaysia and the Philippines in 2003, This study attempts to explores the affecting channels of stock market development on economic growth in the long run and the hypothesis is that financial development leads to higher economic growth by raising the efficiency of investment in endogenous growth models . SulleyMan and Howells conclude that the expansion of the stock market leads to increasing the economic growth by raising investment efficiency and productivity in these four countries.

growth in Iran is negative and their impact on economic growth is very low in Iran and also , there is no close relationship between financial intermediation and economic growth in Iran. To investigate the effects of different policies on development financial sector in economy of Iran is used the VAR within the framework of co-integration model and the effect of different policies of banks including financial liberalization policy, and also , Macro-economic policies on the development of the banking sector has been examined over the period 1960 – 2008 in the long term framework . The results showed that inflation rate has a significant and negative effect on the development of the financial sector (banking) in long-term and GDP per capita has a positive impact. These results first , indicate the acceptation of the hypothesis based on demand for the Iran’s economy. This means that by developing the country , financial sector will be expand , too. Second, this finding has been approved for Malaysia and Hichycha (2005) for Morocco in many empirical studies such as the study performed by Mack Bin (2007) . Index of financial reforms has a significant and positive effect on the development of banking sector which this findings has been confirmed by past empirical studies such as s Arestis et al (2002) for 6 developing countries, and Demteryadis and Lonintel (1997) for India and Nepal. Results indicates that there is a long term relationship between index of financial development , index of reforms and financial liberalization , per capital production and inflation rate which financial liberalization and per capital production has a positive effect and inflation rate have a negative effect on development of financial and banking sector.

3- METHODOLOGY

For data analysis, both descriptive and inferential statistics is used by software Eviwes. Student-t- Test is used for investigation the research’s hypothesis . Due to This item that time series are

unstable in macroeconomic analysis and their instability provides the possibility of false regression in empirical studies , so , the stability of these variables will be tested by generalized Dickey-Fuller unit root test . Because of the fact that the study aims to investigate the long-term relationship between variables of growth economic and financial development, and also according to the different degrees of co-integration of variables from the Schwartz-Beystian criterion ( SBC ) evaluated the best model by (ARDL) method. Relationship between variables analysis based on the purpose of research in these researches . In the present study used regression model since data of series time used by degree of different reliability and the co-integration vectors method used for estimation the model . Also , Angel Granger test is used for detection the casual relationship between variables . Used software is EVIEWS in this research . In short, we should be say that study the effect of financial markets on economic growth will be estimated over period 1989 – 2013 . The best Interrupts will be evaluated by using the software (ARDL) and by explaining the large interrupts for each of independent and dependent variables .In present research ,variable of GDP is used for calculation the variable of economic growth in Iran so that we will be calculate the GDP and then , it will be considered as dependent variable . Also , we will be used index of stock market for measuring the index of financial development and index of money market will be considered as the volume of banking credits . The expansion of the financial market components , it means money and capital market is evaluated to study the relationship between development of financial markets and economic growth and for this purpose, the model proposed by Levine Beck is used and using of this model is expressed as follows:

LNGDPt =α 0 +α1LNLABt +α 2LNGKFt +α3LNBCRt

In this model, the variables are as follows: LGDP: logarithm of the gross domestic product LLAB: logarithm of the number of workforce LGKF: logarithm of the gross capital formation LBCR : logarithm of the volume of bank credits

LSTOC : logarithm of the volume Stock Exchange

Since the model is logarithmic, the coefficients represent the elasticity of GDP for each of the variables.

4. DATA ANALYSIS

4-1-Static Test of Research Variable

Unit root test is one of the most common tests which is used for detection of stationary of a time series process . For achieving to this purpose , generalized Dickey - Fuller test is used for all variables over period 1990- 2012 which the null hypothesis (unit roots) will be test

against the hypothesis (lack of unit

root) . If absolute value of computing generalized

Dickey-Fuller test is larger than the critical value of table , so , the null hypothesis is rejected and variable will be static . Otherwise , variable will be non-static on the level and stationary test should be done on the Tables (1), (2) and (3) shows the results of the static test of the variables by using the generalized Dickey-Fuller show. Test results on the variables of model is shown in table (1) and (2) at the level and in the case of the intercept and process.

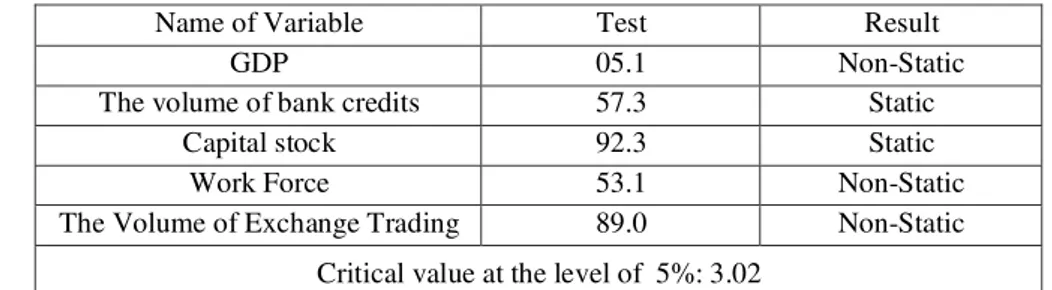

Table 1: Results of the Static Test of Research variables at the Leveland in the case of the intercept (variables are in logarithmic form)

Name of Variable Test Result

GDP 05.1 Non-Static

The volume of bank credits 57.3 Static

Capital stock 92.3 Static

Work Force 53.1 Non-Static

The Volume of Exchange Trading 89.0 Non-Static

Critical value at the level of 5%: 3.02

As observed in the above table , absolute value of generalized Dickey Fuller for GDP variables , work force and the volume of stock trading is smaller than the absolute value of critical value of table . So , stationary or on the other word , static of studies variables is no proven but absolute

value of generalized Dickey Fuller is larger than the absolute value of critical value of table for capital and bank credit volume , so , stationary or on the other word , static of studies variables will be proven .

Table 2: Test results of Dickey - Fuller By subtracting first –order by width of origin (Variables in logarithmic form)

Name of Variable Test Result

GDP 1.53 Non-Static

Work Force 9.37 Static

The Volume of

Exchange Trading 99.3 Static

Critical value at the level of 5%: 3.02

Table 3: Test results of Dickey - Fuller By subtracting second –order by width of origin (Variables in logarithmic form)

Name of Variable Test Result

GDP 3.37 Static

Critical value at the level of 5%: 3.02 According to no – static of the mentioned

variables is necessary to repetition the static test

observed in the above table , absolute value of generalized Dickey Fuller for GDP variables for work force in the subtracting first –order and the volume of stock trading with one subtracting and GDP in subtracting second –order is greater than the absolute value of critical value of table . So , stationary or on the other word , static of studies variables will be proven .

4-2-Estimation the Model based on ARDL According to the results of the Dickey - Fuller test was determined that all the variables is no static in a same rank, therefore, it is better to used the autoregressive pattern with the Lag Distributing (ARDL) for estimation the model . The main reason for choosing this method is that the correlation rank of variables is no significant in desired approach and also , we can be select the appropriate model based on economic theory by determination the lags . In this case, the method of autoregressive will be used for

estimation the long-term relationship

by Distributed Lags . In this stage, we should be make sure about the existing the long – term relationship . Desired model will be evaluated by lags which is determinate by Schwartz- Bayesian by the system. According to the Schwarz-Bayesian , optimal lag of model 2 is selected. Reason of applying the mentioned provision is that Schwartz-Bayesian criterion saves about

determining lags and so , it has a more freedom . Thus , it is more suitable for small samples. 3-4 Test of Long-Term Relationship Model First , we should be make sure that there is a co-integration relationship between variables of model so that we can discuss long-run equilibrium relationship between the variables in the model . If the models accepted to be necessary to confirmed the long-term relationship between the variables to test of long-term relationship. Used methodology in this research is boys Vashon approach (1996). In this method, first , we calculate the f statistic and if the calculated F-statistic was greater than the critical value (1), then the null hypothesis is rejected and there is a long-term relationship between the studied variables . Results of this test are shown in table 4. ARDL method has been provided for determination the co-integration relationship between variables by Hashim boys and at el (1996). In this method ,there is no necessary to knowing the co-integration ranking of current variables against the Johansen approach while the number of co-integration vectors are determined. In this method, two types of equation are estimated to examine the co-integration relationship between variables of .

Dependent variable of in the equation is as follows:

(3. 15)

Where X is dependent variable and Y is the vector of independent variables. Dependent variable of in the equation is as follows:

(3-16)

In relationship which the variable X is the dependent variable, the null hypothesis which is

indicated lack of long term relationship between

the opposite hypothesis by using the F static but distribution of this F static is not standard regardless of I (0) and I (1) of the independent variables . For this purpose, boys and at el (1996) has been provided the appropriate critical values due to number of current independent variables in the model and also , the presence or absence the width of origin or time process .

This statistic includes two sets (column) . By assuming that one collection by all the variables (0) and another collection by assuming I (1) of all variables were calculated. If the calculated F statistic from the high range of critical values which recommended by Boys and at el exceed, the null hypothesis which was indicated that

there is no long-run relationship between the variables rejected. In this case, it can be deduced that from variable X to is a causality relationship . If the calculated F statistic from the lower limit of this range has no exceed, so , the null hypothesis can not be rejected and in this case , there is no casual relationship between variables but if the calculated value F statistic is within the range of critical value , so , the result is

non-specific and non inferred.

As is observed in the table (4) , computational F statistics at the upper limit of critical values will be exceeds at 5% level. Thus , in this case , there is a long-term relationship between the variables at this critical level .

Table 4: Long-term relationship test for non-oil export function Range of Values at Critical

Level at 5% Fهرﺎﻣآ

I(0)

I(1) 5.88 dependent variable of GDP

Since F calculated is more than the critical value I (1) at possibility level of 5%, so long-term relationship between inflation and non-oil exports is confirmed. And we can say that the null

hypothesis based on lack of long-term relationship by 5% can not be accepted. After securing the term relationship can be interpreted a long-term relationship.

Table 5: Estimation the long-term research model

Variable Coefficient Std. Error t-Statistic Prob.

C 0.73 1.123313 0.654764 0.5240

LFK 0.59 0.066152 9.013539 0.0000

LAB 0.33 0.143730 2.317442 0.0374

LBANKC(-1) 0.03 0.007930 3.704214 0.0026

LVOLS 0.01 0.011655 0.377750 0.7117

R2=0.99 Dw=1.77

According to test results of F to investigation the significance of the wholly model, the calculated significant level of model equals to 0.000 and according to the number less than 0.05, the null hypothesis is rejected. So , model is significant . Coefficient’ determination (R2) is a criterion that explain the degree capability of the relationship between the explanatory variables and the dependent variable in the model . In fact , values

of such coefficients determined that a few percent of the variability is explained by the independent variables. In this model R2= 0.99 .It means that 99% of variability of dependent variable (GDP) is explained by the independent variable. In addition to the rejection the hypothesis necessary that

Student, the calculated t-statistic equals to t=4.31 . Also ,related number to Watson camera is 1.77, therefore , assuming no correlation between the errors can not be rejected and can be used regression.

As can be seen in the above table , variable capital has a coefficient of 0.59 and by statistic value of t= 1.09 is significance at the level of 5%. This means that one percentage of changing in the capital stock can be create 59 hundredths of a increase in GDP in the country . Also , based on observed above table , work force variable has a 0.33 coefficient and by statistic value of t= 2.31 is significance at the level of 5%. This means that one percentage of changing in work force can be create 33 hundredths of a increase in GDP in the country .

Results of table determined that the variable of credit volume of banking has a coefficient 0.03 by a lag and by statistic value of t= 3.70 is significance at the level of 5%. This means that one percentage of changing in the credit volume of banking can be create only 3 hundredths of a increase in GDP in the country .According to calculated t value is greater than the critical value

of t , so , is rejected and so , this

hypothesis based on ‘ there is a significance relationship between GDP and changes in money market ‘ is proved . As can be seen in the above table , variable of The volume of exchange trading has a coefficient 0.01 in exchange market and by statistic value of t= 0.37 is no significance at the level of 5%. According to calculated t value is greater than the critical value of t , so , can not be rejected in second

hypothesis and so , this hypothesis based on ‘ there is a significance relationship between GDP and changes in financial market ‘ is doubted .

C

ausal relationship between GDP and the volume of banking credits from the volume of banking credit is confirmed.

ausal relationship between GDP and capital stock from the capital stock is confirmed

ausal relationship between GDP and human resource from the human resource is confirmed.

ausal relationship has not been confirmed Among the other variables.

5. CONCLUSION

There are different views about the relationship between economic growth and financial market development,. First of all , financial development leads to economic growth which is known to supply theory. Second, economic growth create demand for financial services and a need for new financial instruments. Thus, economic growth is a factor for formation the economic development. Third, there is no important relationship between economic growth and financial development. Fourth, the relationship between economic growth and financial development is interactive or on the other word , the theory of supply and theory of demand are running . For accurate diagnosis of these relationships in any economy needs to experimental study. This study has been investigated the relationship between development of money and financial market and auto regression and Distributed Lags, (ARDL) is used over period for the years 1990 to 2012 . Achieved results indicates the lack of certainty in the significant and positive effect of development of monetary and financial markets on economic growth. The results are summarized in this section.

Test results F for investigation the significance of the whole model shows that the model of research is significant.

Coefficient of determination (R2) in this model is 0.99

between the errors will no reject and can be used the regression.

The variable of capital stock is equals to 0.59 and by statistic value of t= 1.09 is significance at the level of 5%. This means that one percentage of changing in the capital stock can be create 59 hundredths of a increase in GDP in the country .Thus , it can be concluded that the capital stock has not reached to saturation point in Iran .

Variable of human resource has a coefficient 0.33 and by statistic value of t= 2.31 is significance at the level of 5%. This means that one percentage of changing in human resource can be create 33 hundredths of a increase in GDP in the country.

In this study, the following four hypotheses is tested :

1. There is a long – term relationship between development of capital market and GDP in Iran.

2. There is a casual relationship between development of capital market and GDP in Iran.

3. There is a long – term relationship between money market and GDP in Iran. GDP in Iran . 4. There is a causal relationship between money

market and GDP in Iran.

As can be seen in the above table , variable of The volume of exchange trading has a coefficient 0.01 in exchange market and by statistic value of t= 0.37 is no significance at the level of 5%. According to calculated t value is greater than the

critical value of t , so , can not be

rejected in second hypothesis and so , this hypothesis based on ‘ there is a significance relationship between GDP and changes in financial market ‘ is doubted .

One of the hypotheses of research is impact of money market on production in Iran .As previously mentioned, we used the volume of banking credits to showing the effect of money market . the variable of volume banking credits has a coefficient 0.03 by a lag and by statistic

value of t= 3.7 is significance at the level of 5%a . This means that one percentage of changing in the credit volume of banking can be create only 3 hundredths of a increase in GDP in Iran .According to calculated t value is greater

than the critical value of t , so , is

rejected and so , this hypothesis based on ‘ there is a significance relationship between GDP and changes in money market ‘ is proved . As observed , the variable of the volume of exchange trading has a coefficient 0.01 in exchange market and by statistic value of t= 0.37 is no significance at the level of 5%. According to calculated t value is greater than the critical

value of t , so , can not be

rejected in second hypothesis and so , third hypothesis based on ‘ there is a significance relationship between GDP and changes in financial market ‘ is doubted . As we mentioned previously , based on results of this research , financial market has no clear impact on production and economic growth .

It can be say that the volume of exchange trading changes by demand of bored of individuals in exchange market and so , increasing in volume of trading can not be cause of injection of financial resource to production sector . Also , achieved results of Ranger causal test shows that second hypothesis of research is confirmed , therefore , causal relationship between GDP and the volume of banking credits from the volume of banking credit is confirmed but the fourth hypothesis is not confirmed. Therefore, causal relationship between GDP and financial market is confirmed .

REFERENCES:

3. Shiva, R., 2001, the long term financing effect on economic growth and development in Iran, Agricultural Economics and Development, No. 34, p .33- 65.

4. GhaniNezhad , M., 1997 , Difference between usury and interest, Criticism , No. 4, 314-327. 5. Qomi, MirzaAbu'l-Qasim, 1996, inclusive

Alshtat, vol. 3, published by Kayhan, Tehran, First Edition.

6. Economics Department of Islamic Propagation Office of Khorasan, 2001, case of poverty and development, Boustan , book Qom, Volume II, pa. 455.

7. Nazifi, F., 2004 , financial development and economic growth in Iran, Economic Journal, 2004 - No. 14, p 97-130 .

8. Ehsani , MA, financial intermediaries and economic growth in Iran, Monetary and Banking Research Institute, 2004 , p. 1-20. 9. Ehsani , MA, nature and functions of banking

and quasi-banking financial intermediaries, Scientific & Research journals of University of Imam Sadeq (AS), the ninth year, No. 20, Winter 2003 , P.1-2 , P. 23.

10.BoroumandFar ,Parastoo , globalization and financial markets, Tadbir magazine, Issue 193, June 2008, p. 56.

11.Beh Kish, M., 2008 , Iran and the new conditions of globalization, Institute for Humanities magazine, Issue 4, Page 48.

12. Big Deli , A., 2008, globalization of opportunities and threats, Kayhan Magazine , Page 9.

13.Tabrizi, H.A., (2004) " capital market of the

driving force behind the economic

development " Capital Markets Conference the

Driving Force behind the Economic

Development , seventh-eighth December , P. 1-13.

14.Tabrizi, H.A., (2004), the impact of

globalization on the economy, Qods

newspaper, Page 8.

15.Hamidizadeh, M .M: financial instruments in the capital market .Tadbir , No. 139, Forth years of December 2003 , Page 40.

16.Khataei , M., development of financial markets and economic growth, Tehran: Monetary and Banking Research Institute, 2009.

17.Rastad, M: financial development, economic development (study of Petroleum Exporting Countries of Southeast Asia) master's thesis in the Planning & Development Research Institute 2001 , p. 1-87.

18. [11] Dadgar , Y., R,, Measurement the indexes of financial development in Iran, Proceedings of the International Conference on financing development in Iran, Sharif University of Technology, Spring 2008, p. 1-35.

19.Davani , GH, stock and procures of pricing the stock , published by Nakhostin , fourth edition , July 2005 , p .1-584.

20.Kashani, Feghi, completed financial institutions in the country, Bank Monetary Institute, Spring 2001.

21.Sadeghzadeh, M. A, .financial development and economic growth, the world economy Press, February 2008 , p. 7.

22.Samadi, S., Nasrollahi ,Kh., KaramAlian , Sichani , M,. the relationship between financial market development and economic growth, Economic Research Journal, Issue 3, Fall 2007 .

23.Senobar , N., Matufi , A., Collection the Articles and Conferences of Financial Management of capital market and Reporting , Financial Management Conference Secretariat, capital market and reporting , 2007 , p . 67-75 . 24.Mousavian, S.A ., : First word: reform of financial markets, Journal of Islamic Economics , Fall 2003 - NO . 11, P. 5.

26.Heybati , F, NikuMaram , RoudPoshti - markets, financial institutions, First Edition, Tehran: Islamic Azad University, Science and Research Branch -2008 , P . 3-80.

27.Nazifi, F,.financial development and economic growth in Iran, Economic Bulletin, No . 14, Fall 2004 , p. 100.

28.AlunDwyfor Evans; Christopher J. Green; Victor Murinde, 2002, Human capital and financial development in economic growth: new evidence usin....International Journal of Finance & Economics; Apr 2002; 7, 2; ABI/INFORM Global, pg. 123.

29.Bodie،Zvi and Kane، Alex and Marcus، Alan J.، 2204، Investment، McGraw-Hill. 1015 Pages.

30.Felix Rioja; NevenValev, 2004, FINANCE AND THE SOURCES OF GROWTH AT

VARIOUS STAGES OF ECONOMIC

DEVELOPMENT,Economic Inquiry; Jan

2004; 42, 1; ABI/INFORM Global, pg. 127 31.Harrison، Paul، 2003، The Economic Effects of

Innovation، Regulation، and Reputation on Derivatives Trading: Some Historical Analysis of Early 18th Century Stock Markets"، Federal Reserve Board، This Draft: February 2003 32.Baier،scott Robert F Tamura Gerald

Dwyer.(2004)"Does Opening aStockExchang

INCREASE Economic Growth?"Federal

Reserve Bank Of Atlanta Journal of

International Money and Finance, 2004, vol. 23, issue 3, pages 311-331

33.Beck, T., A. Demirguc-Kunt and V. Maksimovic, (2005) , Bank Competition and Access to Finance: International Evidence, Journal of Money, Banking, and Credit pages 627-654

34.Bencivenga، Valerie & Bruce D.smith (1991)." Finance: Intermediation and EcdogenousGrowth"REVIEW of Economic Studies

35.Caprio, G. and D. Klingebiel, (1997) , "Bank Insolvency: Bad Luck, Bad Policy, or Bad Banking?", in: Bruno,M.andPleskovic, .(Eds.),

Annual Bank Conference on Development Economics(1996). The World Bank

36.Demirguc-Kunt, A. and E. Detragiache, (1999), "Financial Liberalization and Financial Fragility", In: Pleskovic, B, and Stiglitz, J. (eds.), Proceedings of the World Bank Annual Conference on Development Economics, Washington, DC. No 98/83, IMF Working Papers from International Monetary Fund 37.Dinc, S (2005) "Politicians and Banks.

Political Influences on Government-Owned Banks in Emerging markets ", Journal of Financial Economics vol. 77, issue 2, pages 453-479

38.Dow, James and Gary Gorton. (1997). “Stock Market Efficiency and Economic Efficiency: Is There a Connection?” Journal of Finance vol. 52, issue 3, pages 1087-1129.

39.Ghali, Khalifa H, (1999), Financial Development and Economic Growth: The Tunisian Experience,Review of Development Economics, vol. 3, issue 3, pages 310-22 40.James B. Ang, (2008), What are the

mechanisms linking financial development and economic growth in Malaysia, Economic Modeling, Volume 25, Issue1, January,pp.38-53

41.KenourgiosDimitris and Samitas Aristeidis, (2007), Financial Development and Economic Growth in a Transition Economy: Evidence for Poland, Journal of Financial Decision Making, Vol. 3, No. 1, pp. 35-48

42.King, Robert, and Ross Levine. (1993) “Finance and Growth: Schumpeter Might BeRight,” Quarterly Journal of Economics. 108 (3): 717-737

43.Levine Ross and Demirguc-Kunt, Asli, (2008), Finance, Financial Sector Policies, and Long Run Growth, World Bank, Policy Research Working Paper 4469

44. Robinson, Joan. 1952. The Rate of Interest, and Other Essays. London: Macmillan.

Growth in Regionally Co-Integrated Emerging Markets, Advances in Financial Economics, Volume 12, pp.345-360.

46.Suleiman Abu-Bader, and Aamer S. Abu-Qarn, (2008), Financial development and economic growth: The Egyptian experience, Journal of Policy Modeling, Article in vol. 30, issue 5, pages 887-898

47.Philip Arestis; Panicos O Demetriades; Kul B Luintel2001, Financial development and economic growth: The role of stock markets,

Journal of Money, Credit, and Banking; Feb 2001; 33, 1; ABI/INFORM Global, pg. 16 48.Pilhyun Kim; Kyoobok Lee, The Effects of

Financial Sector Development on Innovation as an Engine of Sus..., Seoul Journal of Economics; Spring 2007; 20, 1; ABI/INFORM Global, pg. 129