iv

Table of

Contents

1. Introduction ... 1

2. Literature Review ... 2

2.1 Customer Experience Definition ... 2

2.2 Managing Customer Experience ... 3

2.3 Measuring Customer Experience ... 4

2.4 Creating clues that leads to positive experience ... 5

2.5 Re-establishing loyalty and trust after service failure ... 6

2.6 Switching costs in liberalized energy markets ... 7

3. Methodology ... 10

4. Managing the Project ... 11

4.1 Planning and Scheduling ... 11

4.2 Client Expectations and Quality Management... 11

4.3 Final Presentation of the Project ... 11

5. Regulated Market versus Liberalized Market ... 13

5.1 Definition of Regulated Markets ... 13

5.2 Definition of Liberalized (Deregulated) Markets ... 13

5.3 Differences between Regulated and Liberalized Markets ... 13

6. Transition Period of Market Liberalization ... 14

6.1 Electricity Market ... 14

6.2 Natural Gas Market ... 14

7. Galp Energia´s Current Customer Care Services ... 15

7.1 Written Communication Channel – SIBS PROCESSOS ... 15

7.2 Phone Communication Channel – Teleperformance ... 15

7.3 Balcão Digital – Digital Counter ... 16

7.4 Galp Energia Websites ... 16

7.5 Galp Stores ... 17

8. Communication Channels Observations ... 18

8.1 SIBS Observations... 18

8.1.1 Invoice and Billing ... 18

8.1.2 Contract Activation and Connection ... 18

8.1.3 Payment Methods ... 18

8.1.4 Things to keep ... 19

v 9. Survey Results ... 20 10. Recommendations ... 23 10.1 Discovery ... 23 10.1.1 Didactic Channels ... 23 10.1.2 Publicity ... 24 10.1.3 Google Keywords ... 25 10.2 Using Service ... 26

10.2.1 New cutting warning process via Sms/E-Mail ... 26

10.2.2 Sms-Email Care ... 27

10.3 Paying for Service ... 28

10.3.1 Invoice Layout ... 28

10.4 Solving Issues and Complaints ... 29

10.4.1 Online Customer Care Centre ... 29

11. Conclusion ... 31 References ... 32 Appendices ... 35 Appendix 1 ... 35 Appendix 2 ... 36 Appendix 3 ... 38 Appendix 4 ... 39

Consulting Project Report ... 39

Table of Figures

Figure 1 Communication channels preferred by respondents ... 20Figure 2 Customer Experience Cycle……… ... 23

Figure 3 Current Warning Process ... 26

Figure 4 Proposed Warning Process ... 26

1

1. Introduction

Monopolies dominated many European energy markets, are now exposed to free market competitions. One of the countries that has been liberalized recently is Portugal and it is going through the transitory stage. The electricity market was nationalized in 70s and became a monopoly of Energias de Portugal or commonly known as EDP. The natural gas was introduced in Portugal in 1997 and Portugal, having no resources of natural gas, it was supplied with the pipelines from Algeria and Nigeria. The monopoly of natural gas was controlled by Portuguese petroleum company Galp Energia. The first steps of liberalization of electricity had been taken in the year of 1995 with series of decree laws and by September 2006, most of residential consumers in Portugal (Mainland) were able to choose their supplier freely. Currently there are five suppliers in the market that consumers can choose from which are EDP Comercial, Endesa, Galp Power (Galp Energia), Iberdrola and Gas Natural Fenosa. Since January 2010, residential consumers are free to choose their natural gas supplier and there are currently eight suppliers in the natural gas market which are EDP Comercial, Endesa, Galp Power, gasNatural Fenosa, Gold Energy, Iberdrola, Incrygas, Molgás.

As Energy market in Portugal is now open to free competition and new suppliers are entering the market, it’s likely the price of the utilities to decrease and be more advantageous to the consumers. With new companies entering the market, customers are looking for alternative providers that will fit their needs best in terms of price and service quality. In recent liberalized energy markets, customers show switching behaviour and incumbent energy companies focus on customer satisfaction and loyalty, since gaining new customers in domestic energy markets (residential clients) can be more expensive than retaining the existing clients - Nesbit (2000) ; (Pesce 2002).

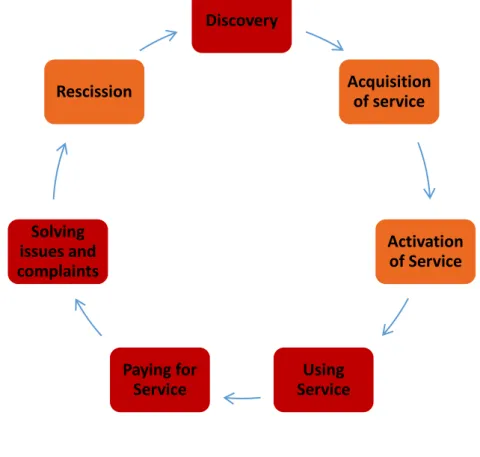

The purpose of this consulting project was to improve Galp Energia´s existing customer care services and strengthening them in order to increase customer satisfaction and loyalty. By doing so Galp intends to retain existing client base in natural gas regulated market and increase its market share in residential electricity market in the transitory stage of liberalization. The project started with an analysis of client´s experience cycle starting from discovery until cancellation of the contract. The second challenge was focusing on certain points on the cycle that were considered more critical and recommendations to Galp Energia to enhance existing customer care services.

The project was conducted by a group of 2 students, research of the study and recommendations were done by me and my colleague Duarte Almeida Costa. Even though the project was done together, dissertations are done individually and weight on the focusing points was different.

2

2. Literature Review

2.1 Customer Experience Definition

Nowadays, consumers have much more choices and these choices are getting more complex and being delivered through more channels than ever before. In such conditions the winning solutions for consumers will be the ones that are simple, integrated to problems and less burdensome - Meyer and Schwager (2007).

Customer experience can be defined as “result of the customer's interpretation of his or her total interaction with the brand and perceived value of this encounter.” -Biedenbach and Marell (2010). In the research conducted by Meyer and Schwager (2007), customer satisfaction is explained as result of a series of customer experiences and to understand how to achieve satisfaction, company must break it down into its component experiences. Satisfaction is one of the most important attribute that plays a role in the customer’s loyalty - Ibáñez, Hartmann and Calvo (2006).

Even though satisfaction is a set of experiences, each experience has a different impact on customer and one of the articles written by Lax (2012) states the following; “Customer experiences must be designed and evaluated in terms of their contribution to strengthening loyalty and creating value for the company. Customer’s loyalty is more than the simple sum of all experiences.”

The experience of a product or a service begins when customers start searching and evaluating them -Hoch (2002). Experience of the product or service can be direct or indirect depending on the customers’ level of interaction with them. Customers are exposed to direct experience where there is actual physical contact while indirect experience happens with an advertisement, when the product is presented virtually or by word of mouth recommendations or criticisms, news, reviews - Hoch and Ha (1986); Kempf and Smith (1998); Meyer and Schwager (2007). When the experience journey begins apart from company’s control, the role of the companies should be delivering a value proposition rather than delivering a value which is created during the customers use of company’s products and services - Vargo and Lusch (2004); Verhoef, Lemon, Parasuraman, Roggeveen, Tsiros, Schlesinger (2009). In service businesses like utilities, a good personal interaction between the consumer and the provider company results in a positive experience which increases the level of customer’s loyalty and brand awareness - Berry, L.L (2000).

Customer or the business itself can be analysed through the collection of experiences at “touch points” which are customers´ direct experience with company or the service itself. The experience is a series of touch points and meaning of touch points is different for each customer’s stage of life. “For a young family with limited time and resources, a brief encounter with an insurance broker or financial planner

3 may be adequate. The same sort of experience wouldn’t satisfy a senior with lots of time and a substantial asset base.” - Meyer and Schwager (2007).

The intention of this research is to improve Galp Energia customer care program and to understand the different attributes that may have positive impact in customers’ experience and its relation with satisfaction and loyalty. Therefore the following review will focus more on experience and loyalty through satisfaction.

2.2 Managing Customer Experience

According to Meyer and Schwager (2007) in order to manage customer experiences, experience patterns must be analysed in 3 points;

Past Patterns which captures a recent experience and the data can be collected by surveys (web-based or phone), user forums and blogs on persistent basis by attaching electronic surveys to high volume transactions or automatically triggered by the completion of a transaction.

Present Patterns, which includes tracking current customer relationship and experience matters on periodic basis to identify future opportunities. Data collection is suggested to be done by web-based surveys, direct personal contact or by phone and focus groups and other regularly schedule formats.

Potential Patterns that targets explorations to discover and test future opportunities which are driven by specific group of customers or unique problems. The collection of data needs to be much focused and needs to include existing customer experience relationship.

Customer experience influences the purchase intention. The intention of purchase highly depends on the customer´s desire to buy a product and the greater the intention the greater the desire of customer - Schiffman and Kanuk (2000). The customers who are having negative experience and emotional responses, have a strong trend of brand switching behaviour - Roos (1999). Nasermoadeli, Ling and Maghnati (2013) argue that the customer experience is partly created by sensory experience, emotional experience and social experience. Findings from the research concludes that only emotional and social experience are positively related with the purchase intention. The research also asserts that sensory experience has positive impact on purchase intention through emotional experience since emotional experience has positive impact on purchase intention. In the case of an energy provider the emotional and social experience might happen during a bill payment process at the store, or during a phone call with the help centre or listening to a friend´s experience with the provider.

4

2.3 Measuring Customer Experience

Maklan and Klaus (2011), measures customer experience through exploratory factor analysis (EFA). These factors are:

Product experience referred as customers’ needs to compare products and having other choices. Without choices, customers are likely to reject offers no matter how beneficial they are.

Outcome focus is referred as customer’s transaction costs, such as search and information cost of switching to a new provider.

Moments of truth is explained by Tax and Brown (1998) as the importance of service recovery in case of unpredictable problems and the interpersonal skills of the employees that are facing customers such as customer service operators, sales people or an employee in a store that represents the company.

Peace of mind, includes attributes mainly related with emotional aspects of service based on the level of expertise and competence of the provider recognized by customers and supervision provided throughout the process - Bendapudi and Berry (1997).

The results of the research - Maklan and Klaus (2011) show significant information about customer satisfaction and loyalty. Peace of mind associated with the emotional aspects of the service show significant correlation on outcome variables, customer satisfaction (0,90) and customer loyalty (0,72). As mentioned before by Roos (1999), customers having negative emotional experience with service providers tend to have strong brand switching behaviour. These 3 researchers agree that positive emotional experience with the company leads to a higher customer satisfaction and therefore increases consumer loyalty. Moments of truth also show positive relation with loyalty (0,13) and slight positive relation with word of mouth (0,09). Outcomes focus has positive relation with loyalty (0,20) and word of mouth(0,20). The product experience dimension shows the second highest relation of all constructs with customer satisfaction (0,10) and medium relation with loyalty (0,09). These results support the statement of Meyer and Schwager (2007) which claims that each touch points are different in value and interactions during the service is more important when the core business of the provider is a service.

Another study in the area of customer experience is conducted by Biedenbach and Marell (2010) in which customer experience effect on different brand attributes is analysed. The research conducted by Rossiter and Percy (1997) states that, brand awareness is seen as one of the most important aspect of customer´s readiness to choose a brand. “Because of a more vivid and intentional nature, customer

5 experience causes multiple traces in memory, which lead to higher levels of brand recall and recognition.”- Hoch (2002). The findings of the study of Biedenbach and Marell (2010) shows that a good customer experience can improve brand awareness, brand associations, perceived quality and brand loyalty through all these attributes.

There are many different approaches to study loyalty and its relation with experience management. In the Maklan and Klaus (2011) review, the results show that emotional aspects of the service have high relevance with customer´s loyalty. An earlier research done by Berry and Carbone (2007) suggests focus on customer´s feelings and emotions and states “Emotional connectivity is an opportunity for all types of organizations.” A closer relationship with customer also can be used as a leverage to differentiate the company from the competitors. The authors state that even though companies cannot manage the emotions of their customers, they can control the messages and clues they want to deliver to customers and give information about the company.

2.4 Creating clues that leads to positive experience

Until now the review summarized: what customer experience is, how it is managed, how to measure it through certain factor analysis and its relation with brand equity. Following to these topics, Berry and Carbone (2007) brought a new understanding to how to create different types of experience clues to evoke positive emotions and behaviours in consumers. Consumers evaluate each new experience, positive or negative and compare it to their past experiences - Meyer and Schwager (2007). That is why experience quality management needs to create clues and deliver certain types of feelings consistently that create experience - Berry and Carbone (2007). This type of works requires constant monitoring in order to solve clue relevance. According to Berry and Carbone (2007) there are 3 types of clues that play a role in the customer experience:

Functional clues are related with the technical quality of the services which catches the trustworthiness and functionality of the service or the product. Anything that impacts customer´s impression of technical quality of the service or product is related to functional clues;

Mechanic clues represents the physical dimension of the intangible service such as furniture in stores, sounds, music, illumination, building design that interacts with customers without talking;

Humanic clues represents the clues which come from the attitude and appearance of the service provider or the company representative in some cases. Humanic clues include tone of

6 voice, enthusiasm, body language and convenient dressing. Interacting with customers personally in the service business provides opportunity to meet and exceed their expectations and strengthen the emotional bound in between.

After understanding these clues and how they function, Berry and Carbone (2007) explains further steps about how to create these clues.

1. Identify emotions that evoke customer commitment.

Feelings and emotions that customers would like to have during an experience and connected

with customers desire. 2. Establish an experience motif.

Emotions that customers desire are unified and aligned in the same direction. 3. Inventory and evaluate experience clues.

Current experiences should be seen from the customer´s perspective and break down into components of experience clues that evoke desired emotions.

4. Determine the experience gap

Difference between what customers want to feel during an experience and what they actually feel. Companies should improve the motif and clues accordingly.

5. Close the experience gap and monitor execution.

Usually companies identify different opportunities, modify the clues aligned with overall experience addressed to one customer´s needs. During the monitoring process clues that are creating negative emotions should be removed from the motif.

2.5 Re-establishing loyalty and trust after service failure

Insufficient recovery after service failure usually leads to unfavourable and critical customer perception against the company. These customers can damage the reputation and spread unfavourable word of mouth which might be very harmful and even take legal action sometimes. However successful recovery after service failure, increases unsatisfied customers loyalty even more than before - Maxham and Netemeyer (2002a), (2002b),(2003).

The results of the research conducted by La and Choi (2012) shows that “Customer trust carries over even after service failure and recovery. However, we found that customer affection and loyalty intention did not carry over after the mishaps, implying that customer affection and loyalty intention may be more fragile than customer trust.” When service failure occurs, the first thing companies should do is to regain customers trust. The results also show that affection assists as an antecedent to

7 customer´s trust and influences loyalty before and after service recovery. Affection has bigger impact on customers trust after the service failure and recovery that should be the first area to be handled in the process.

When companies fail to keep promises such as service failure, might jeopardize company reputation and lead customers to other emotions like doubts, uncertainties which might change the perception of quality toward a service and company and affect their loyalty intentions - Boon and Holmes (1999). After a service failure customers become more sensitive about their re-encounter decisions in the future with the company. Customers begin to be suspicious, if their expectations will be met mainly due to experience of error from the service provider.

“Greater impact of trust on future behavioural intention, less impact of affection’s direct influence on future behavioural intention, and greater impact of affection on trust restoration.” - La and Choi (2012).

2.6 Switching costs in liberalized energy markets

Most of the energy companies are focusing on satisfaction and loyalty since gaining new customers in domestic energy markets (residential clients) can cost a lot higher than retaining the existing clients - Nesbit (2000); Pesce (2002).

According to Burnham, Frels and Mahajan (2003) switching costs in energy markets are constructed by 3 types of components. Procedural switching costs which are cost of time, search and effort. Customers who are seeking for a new provider are facing an economical risk therefore they need to evaluate all alternatives. Second component is financial switching costs which consist in financial costs (switching fees etc.) and benefit loss. The third and the last component of switching costs in energy market is relational switching which is the loss of personal relationship and emotional bond between clients and the employees of the current provider. When the relationship is lost, customers also lose the time and effort while developing such relationship with provider even though there is no financial loss.

Walsh, Groth and Wiedmann (2005), argue that switching provider includes financial and non-financial costs which customers will try to avoid. Customer satisfaction can be examined as a non-financial switching cost and energy providers that do not retain high level of satisfaction likely to lose customers due to low switching costs. Clemmer (1993) claims that energy products such as electricity and gas are homogeneous products that can be seen as low involvement products. For this reason it is acceptable

8 to consider that the dissatisfaction arises not from the product itself but more likely to driven by the process of service delivery and experiences that include personal interaction with the company employees.

Many authors suggest that energy providers should take advantage of every chance of personal interaction with the customers in order to increase the perceived value and quality of the services delivered therefore increasing the level of satisfaction, by doing so companies will establish a more stable relationship with their clients.

-

Lewis (2001); Coyles and Gokey (2002). Trust to provider explained by Mayer, Davis and Schoorman (1995) as having the feeling of security, according to expectations that the service provider does not intend to lie or exploit customer´s vulnerability.The research done by Walsh, Groth and Wiedmann (2005), finds out 3 different types of dissatisfied customer clusters.

Cluster 1 exhibits older dissatisfied customers, whom show a non-specific dissatisfaction or do not trust the energy supplier anymore. Customers in this group are generally self-employed and have relatively low income. One of the reasons why this cluster would be the first one to switch their energy provider is because some energy providers will offer better prices.

Cluster 2 exhibits relatively satisfied customers that are seeking change. These customers are willing to switch their energy providers by curiosity or by recommendations from their friends or family.

Cluster 3 represents the largest and youngest cluster of all whom are dissatisfied customers seeking change.

By analysing these clusters, authors suggest that results show a group of customers who were low monetary motivated switching behaviour. The cost and the price of the service was secondary discussion due to low involvement nature of the service. They value more the process of the service delivery than the product itself and willing to pay higher prices if the service delivery is stable and reliable.

Service process quality and trust play a significant role in building positive satisfaction and increasing customer loyalty in energy industry - Ibáñez, Hartmann and Calvo (2006).

Service process quality can be described as:

Employees being polite, well dressed;

Immediate customer service without waiting time (phone queues and lines in customer service centres;

9

Requests of the customers are solved immediately.

As final comments, Walsh, Groth and Wiedmann (2005), suggest managers to strengthen the satisfaction and loyalty in the 3 types of clusters. For cluster 1 (customers with non-specific dissatisfaction and low income), authors suggest to implement some advertisements in order to improve the perceived reputation of the current energy provider or express their price competitiveness among their main competitors. For cluster 2 (relatively dissatisfied customers seeking change) are high likely response positively to price discount or facts that the current provider is cheaper than the other providers in the market. The last cluster, cluster 3 authors suggest that provider should express their utilities own flexibility in terms of dealing with customer requests and future challenges. Since this cluster is more educated and the youngest among all, emphasizing the risk of changing provider and transaction costs would help this cluster remain loyal.

10

3. Methodology

In order to get a better understanding of Galp Energia´s existing customer care services, we have requested some documents from our sponsors in the company about their products and services. Also we have requested a Galp Energia´s premium services report (Comfort Care and Comfort Home) and a detailed list about what reasons clients contacted the company. After analysing all documents, we have requested visits to Galp´s communication centres to learn more about not only premium service clients but all residential clients in mainland Portugal.

The first visit was to the outsourced written communication channel SIBS Processos, which all written requests and complaints are treated. We have interviewed some of the operators who are responding to clients on a daily basis.

Another visit was made to the outsourced call centre company Teleperformance and we have listened calls during the day in various departments such as Inbound, Outbound, Contract, Activation and Connection, among others.

The results of these visits revealed major problems to deal with in segments “Invoice and Billing” and “Activation & Connection”. We have learnt about how the respond processes works, what are the service level agreements (SLAs) and client answering guidelines for responding to clients (most usual complaint topics). In addition to these, we interviewed operators about service improvements for clients’ benefits since they are the ones dealing with clients´ requests and problems all day long. During our project we had several meetings with our sponsors from Galp Energia and received more materials about several processes. Besides all the interviews, we have created a survey to get an insight of customers’ knowledge about the energy providers in the market, general information about liberalized market and transition period. Survey also included some questions about customers´ perception of trust on their energy providers, the expertise and overall satisfaction with the current energy provider.

Due to restricted time period of the project, we only had been able to send the survey to over 100 clients of the energy market randomly, mainly friends, family members and colleagues. However survey was delivered to Galp Energia as framework to distribute it to a larger sample in a near future. We have collected 50 valid answers. It was interesting to realize that most clients didn’t even know if they were a client of regulated or liberalized market. The results of the survey will be analysed and discussed in following parts of the dissertation in detail (See Section 8).

11

4. Managing the Project

The consulting project was developed by Duarte Almeida Costa and Eser Eren, coordinated by dissertation advisor Rute Xavier. Our contact in Galp Energia was Mafalda Costa Ferreira and later presented us to Joana Felino Rodrigues who supported us along the project.

In our first meeting, our sponsors defined the scope of the project which was improving the existing customer care program in liberalized market. On following meetings we have presented our improvement ideas in the area of customer care. Our dissertation advisor guided us through the project with weekly meetings and through e-mail.

4.1 Planning and Scheduling

Along the project, we had five meetings with our sponsor at Galp Energia Headquarters. We scheduled our meetings whenever we had progress in the project to consult with our clients and receive their feedback. In addition to that we have visited the written and phone communication channels under the supervision of our sponsor from Galp Energia.

4.2 Client Expectations and Quality Management

Based on our client´s needs and expectations, we have presented several proposals along the project and received their feedback. In order to ensure the quality and meet our client´s expectations, we held weekly group meetings and meetings with our dissertation advisor. Whenever we had progress in the project, we have scheduled meetings with our client. In addition to that, we have requested visits to Galp Energia´s communication channels to get a better understanding of the customer care program and customers´ problems. In each step we made sure to inform our client about project evolution. Some of our proposals like partnership with real estate agencies and new counter meter reading methods were discussed and denied. Partnership proposal was denied because Galp Energia has already researched the matter and did not need any further research. The reason why counter meter reading proposal denied was because the readings for electricity consumption is done by EDP and it will always stay like that since EDP is the owner of the electricity network.

4.3 Final Presentation of the Project

In the final presentation, we presented our seven proposal in for different segment of customer experience cycle. In the presentation, besides from our sponsors, there were other people from related departments of Galp Energia. Our proposals were;

Discovery: Didactic Channels, Publicity and Google Keywords;

12

Paying for Service: New invoice layout;

Solving Issues and Complaints: Online customer care centre.

At the end of the presentation, we have distributed customer satisfaction surveys. We have received a very positive evaluation from Galp Energia in terms of quality and management of the project. Our most preferred proposal were indicated as: Didactic Channels and New Invoice Layout. Galp Energia was very satisfied with the overall project and offered assistance if there are future projects related with customer care.

13

5. Regulated Market versus Liberalized Market

5.1 Definition of Regulated Markets

A Regulated market is the market in which supply of goods or services is controlled by government (or any other superior entity). The control may require compliance of supplier companies in terms of labour laws, taxation, environmental standards and information disclosure. Regulations also include the terms of supply and price allowed to be charged to the customers. Common regulated markets are utility monopolies such as water, telecommunications, electricity and natural gas markets.

5.2 Definition of Liberalized (Deregulated) Markets

A Liberalized market is the market in which the control and power of the government body over supply of good or service is reduced in order to create more competition in the market. Consumers are free to choose any provider in the market.

5.3 Differences between Regulated and Liberalized Markets

In the regulated energy market of Portugal, the sales prices of the electricity and natural gas for final consumers are fixed quarterly by the regulator of the market “ERSE”- Entidade Reguladora dos Serviços Energéticos. These tariffs are applied by end supplier energy providers. The suppliers of natural gas are Galp Energia and EDP gás Serviço Universal and EDP Serviço Universal for the electricity. Regulated markets provide certain protection to customers but they may also bring unnecessary costs, burdens of monopoly and inefficiency in terms of competition and productivity of the suppliers.

In the liberalized Portuguese energy market, the utility prices are defined by each energy provider company with respect to the competitive rules and commercial relation regulations.

The energy providers of liberalized electricity market are EDP Comercial, Endesa, Galp Power (Galp Energia), Iberdrola and Gas Natural Fenosa. The energy providers of liberalized natural gas market are EDP Comercial, Endesa, Galp Power, gasNatural Fenosa, Gold Energy, Iberdrola, Incrygas, Molgás. Liberalized markets increase the level of competition between energy providers and offer more competitive prices to the customers. One role of the regulator at this point is to prevent companies from colluding to set same prices against customers across the market and abuse their freedom of price setting.

14

6. Transition Period of Market Liberalization

Regulated tariffs for end users ended at the end of 2012 for the whole of Portuguese consumers of electricity and natural gas. New consumers can never be client of regulated market and existing regulated market consumers have 3 years of transitional period to decide the energy provider of their choice. During the transitional period, consumers who remain in the regulated market, will continue to be supplied with transitory tariff by end supplier of regulated market (EDP for electricity & natural gas and Galp Energia for Natural Gas). The prices of the transitory tariff is decided by ERSE and will be subjected to quarterly review depending on the market conditions. The change of energy provider is free and consumers do not need to change their energy counters.

During the transitory period of liberalization, consumers are expected to learn who the providers are, observe, evaluate and compare the offers of existing energy providers and choose the one that they believe will best satisfy their needs. If consumers decide to change their energy provider, they will continue using the services and will be changed to the new provider in pre-determined deadlines. If needed consumers can compare prices of the energy suppliers by providing them with their consumption history in previous invoices.

6.1 Electricity Market

There are 4.7 million customers in the residential electricity market in Portugal. For customers who contracted potency equal or higher than 10.35 kVA, regular tariff ended in 30 June 2012 and customers should start searching for new energy providers. The transition period will end at the beginning of year 2015. The regulated tariff for customers who contracted potency lower than 10.35 kVA ended in 31 December 2012. Consumers can start looking for new energy providers and the transition period will end at the beginning of 2016.

Consumers who did not switch to liberalized market, will continue with their current energy provider with transitory tariff prices fixed quarterly by ERSE.

6.2 Natural Gas Market

There are 1.1 million customers in the residential natural gas market in Portugal. For consumers with consumption higher than 500 m3 and equal or lower than 10.000 m3, regular tariff ended in 30 June

2012 and customers should start searching for new energy providers. The transition period will end at the beginning of year 2015. The regulated tariff for customers with consumption lower or equal to 500 m3 ended in 31 December 2012. Consumers can start looking for new energy providers and the

transition period will end at the beginning of 2016.

Consumers who did not switch to liberalized market, will continue with their current energy provider with transitory tariff prices fixed quarterly by ERSE.

15

7. Galp Energia´s Current Customer Care Services

7.1 Written Communication Channel – SIBS PROCESSOS

SIBS Processos was founded in 2002 as a part of SIBS Group. Their main objective is to establish, implement and manage innovative business outsourcing solutions while increasing the efficiency of their clients. Galp Energia is one of the clients of SIBS Processos(SIBS) that help them manage their written communication channel.

The operations of Galp Energia are divided into two parts at SIBS; Regulated Market and Liberalized Market. The processes of the regulated market are more complex than liberalized market in terms of number of templates for responses and formal language used comparing to liberalized market. Operators at SIBS respond to many types of written complaints or information requested by clients that are delivered by mail as well as online through Galp Energia´s various websites. Second copy of Invoices for natural gas and electricity are also created at SIBS and later delivered to clients by mail if requested.

7.2 Phone Communication Channel – Teleperformance

Teleperformance is one of the leading customer experience and contact centre management provider in Portugal and leader in multi-lingual customer experience management in Europe. Teleperfomance has 3120 employees and operates in 24 different languages in their five centres in Portugal. Their goal is to provide their clients a differentiated value added service with the support of their four operating areas; innovative approaches on strategically and operational level, flexible and cutting-edge technology solutions, client-oriented human resources management and quality system that considers every phase of customer relationship. Teleperformance Portugal is part of Teleperformance, the largest global company in the industry, with annual revenue of over €2,3 billions and 145,000 employees.

As it is in SIBS, the operations of Galp Energia are divided into two parts; Regulated Market and Liberalized Market. The Liberalized market operations are Inbound, Outbound, Contract and Activation & Connection. Inbound department receives the information requests, counter readings and complaints. Also the calls which are meant for Contract and Activation & Connection received in inbound department and later re-directed to the related departments. Clients of Galp Energia are able to leave their contact number and time preference to be contacted later about any subject and that’s where outbound department gets involved. Outbound does not work only when clients want to be contacted but also for other subject that remains incomplete. Activation & Connection department

16 arranges scheduling of technical visits for activation and connection means. They can also contact clients to receive their feedback after the technical visits. Contract department is the department where customers of other providers contact Galp Energia either to know about prices and promotions or switch to Galp Energia´s energy services.

7.3 Balcão Digital – Digital Counter

Digital Counter is a service Galp Energia provides to their customers that is available for 24 hours a day. Clients can create an account on the online platform with their tax number, e-mail address and supply number. Clients can consult their invoices and consumptions on the platform and compare to the previous months or years. They can also enter their counter readings on periodic basis depending on their invoicing period. It allows clients to alter their personal data and request information from Galp Energia. Digital counter also contains information about recent promotions and clients are able to subscribe for different types of payment methods like direct debit and “conta certa”. Currently only available for regulated market clients.

7.4 Galp Energia Websites

Galp Energia has two websites that clients can get information from; General site of Galp Energia

(http://www.galpenergia.com) and GalpOn (http://www.galpon.pt/) which is dedicated to liberalized

market clients.

The general website has information about Galp Energia as company, their products and services, investor area, Galp Energia in media and Galp Energia careers. In addition to these information clients can contact Galp Energia through this website with suggestions or complaints. Website also contains a search bar for quick search with related topic. At the bottom of any page there are links that directs customers to the contacts page, suggestions & complaints and frequently asked questions. The only drawback of this last feature is it is very hard to notice, written with very small font size and the light grey colour. It is not well noticeable on white background.

Galp ON website is dedicated to clients of liberalized market. The website contains information about advantageous of choosing Galp Energia as a provider and discounts with their Galp On plans. Clients can also create a new contract with Galp ON online with their personal, supply and invoice information. Another functionality in the website is the simulation that show clients how much they are going to save if they switch to liberalized market and use Galp On services which provides extra discounts. Also the website contains frequently asked questions about liberalized market, Galp On plans and the process of switching energy providers. There are several contact channels on the

17 website such as phone, e-mail address and address list of Galp Stores around the country for clients to find nearest to them.

7.5 Galp Stores

Galp stores are mainly located inside “Loja do Cidadão” buildings together with public service stores such as social security, taxes services, telecommunication company offices and notary services.

In Galp Stores, clients can pay their bills with credit or debit cards, cheques or get their refunds. They can also present their complaints about services, create or cancel contracts and give their counter readings. If requested, clients can get analysis of their consumption and billing history. The system of liberalized market and the database is separated from regulated market, it requires new POS machines at stores for clients of liberalized market to be able to pay their bills which is being installed in Galp Stores at the moment. Liberalized market clients usually pay their bills with bank reference, direct debit or “conta certa” since POS machines and cash payment system are not available in all Galp Stores, which is a serious drawback.

18

8. Communication Channels Observations

8.1 SIBS Observations

The first thing got our attention was the difference in number of templates for each market. Liberalized market has many less templates for complaints and information requests comparing to regulated market. The following topics and bullet points are from our interview with operators that were indicated as most complaint.

8.1.1 Invoice and Billing

Wrong consumption estimations that is usually above the usage of clients and leads to a higher value in their bill. The difference between real and estimated value is later refunded to clients in following invoices when the company takes the counter readings themselves. The invoices are sometimes too complicated for clients to comprehend and even for the

operators. The cause of this is the refunds and adjustments in between real and estimated value and the language used in the invoices. Many clients who contact Galp indicated that they do not know the meaning of debiting and crediting.

Many clients complain that they do not receive any invoices for a certain period of time and once they receive it, there is a huge amount to pay that might not be affordable by some of them even though Galp Energia divides that big amount in to separate payments. In extreme cases clients may not receive any invoice for a year because of some faults in the operating information system.

8.1.2 Contract Activation and Connection

Some new clients are not able to use their electricity or gas for long time because of not having the technical visits. The scheduling of technical visits are done right away for the closest day possible but if clients are not at home at the scheduled time, another visit scheduling becomes more complicated and can take very long time.

8.1.3 Payment Methods

Clients cannot pay with cash at Galp Stores

Liberalized market clients have difficulties because not all stores have POS machines for liberalized market.

19

8.1.4 Things to keep

If the client is right about some complaint or an error admitted by Galp Energia, Clients receive an email to choose a bonus gift among 3 choices. Clients like the method of correction and it creates a positive impact on them.

8.2 Teleperformance Observations

The most complaint topics were the same as our observations at SIBS. The topic caught our attention was the time period between changing electricity providers from EDP to Galp Energia. The owner of the electricity network is EDP and all the technicians work to them. The process of technical visits and activations may take a very long time because we were told EDP neglects these type of duties not only for Galp Energia but also for other energy providers and Galp Energia has no control on that.

Also changes for potency of electricity and changes to bi-hourly tariffs (also needs the change of the counter) can take up to 3 or 4 weeks which is a very long time period for clients.

Operators receive a lot of calls during the day for simple procedures such as counter readings and information about Galp Products discount and promotions. These types of services can be easily made online on “digital counter” and information may be obtained from Galp Energia´s websites. The digital counter needs to gain awareness among customers and be available to liberalized market clients. Galp Energia´s also needs a customer service centre online page where all kinds of information exist all together. By doing so Galp Energia can reduce the amount of call received and also reduce their operating costs.

20

9. Survey Results

We have received 52 responds to our survey and 50 valid responses were analysed. The average age of our survey respondents was 41 years old. The 40% of the respondents are still clients of regulated market and 24% are clients of the liberalized market for both electricity and natural gas. Surprisingly 18% of the respondents do not even know which market they are in. We can assume them as clients of the regulated market since if they have changed from regulated to liberalized market, they would had contacted with their energy providers. The 42% of the respondents also indicated that they don’t have enough knowledge and information about liberalized market. Following to this question we have asked our respondents if they have would like to know more about differences between two markets and they have responded with 94% of “Yes”.

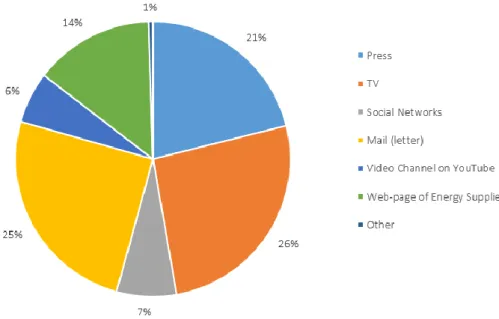

Moreover, when we asked “In which way you believe is more efficient in order to inform the clients about liberalized market?” total responds we have collected for this question indicated 21% Press, 26% TV, 25% cards and flyers and 14% wanted to have information in their current energy provider’s website.(Respondents were able to choose more than one option).

Figure 1 Communication channels preferred by respondents

In the natural gas segment of our survey, 57% of the respondents are clients of Galp Energia, 21% are clients of EDP and 19% of the respondents are clients of bottled gas that does not have access to natural gas.

21 Overall satisfaction with the natural gas supplier was 47% and 39% of the respondents chose the answer “indifferent” which we assume due to low involvement nature of the utility service, clients are not concerned with their providers. 5 out of 30 clients (16.6%) of Galp Energia who responded the survey indicated that they would like to change to another natural gas provider. 30% of the total respondents do not believe in their energy providers’ expertise and 33% thinks that they cannot reach their energy provider with ease. A very interesting question in the survey related with the current literature is if energy providers care about their clients and show affection which was not agreed by 44% of the clients and 41% indifferent responds. When we asked the respondents if their energy provider only worries about monetary benefits of the service provided 30% (12) of the clients respondents agreed and 10 of them were clients of Galp Energia. Clients indicated that price is a determinant factor in choosing a provider by 76% but 61% of total respondents agreed that even though price is a determinant factor, customer service have more influence in choosing a provider. 38% of the customers who responded to our survey thinks that liberalized market does not have advantages for them and 38% of them feel neutral or indifferent.

In the second part of our survey which contains questions about liberalized market of electricity, we found out that 91% of our respondents are clients of EDP and the rest are clients of Galp Energia. The percentage of overall satisfaction with electricity providers were 41% and indifferent responds are 40% of the total participants. 10 over 48 clients of EDP responded that they would like to switch to another provider which can be an advantage for Galp Energia since they are second biggest provider in electricity market in terms of number of clients. 26% of the total respondents do not believe in their energy providers’ expertise and 26% thinks that they cannot reach their energy provider with ease. 38% respondents indicated that they do not feel like their energy provider care about them and we also received 37% “indifferent” responses. Another important statement was “I feel like my energy provider only cares about monetary benefits” which was agreed by 47% of the participants. As it was in natural gas segment, 30% of the respondents do not believe that liberalized market has advantages for customers and 45% indicated neutral or indifferent for this statement.

Price is a major determinant factor in the energy market for choosing an energy provider which was agreed by 86% of respondents but even though the price is a very important factor, 76% of the respondents agreed that customer service is more important factor than the price.

In the last segment of our survey we asked respondents if they would like to have same energy provider for natural gas and electricity and they have agreed by 83%. Their motives to have same

22 provider for electricity and natural gas are different. 56% of the respondent stated that being able to receive one invoice for both services, 58% indicated the ease of having only one contact number to resolve problems or request information and 68% of respondents indicated being able to have discount & promotions. Respondents were able to choose more than one motive.

In many questions and statements, majority percentage of answers we have received was “indifferent”. We may assume that this is due to low involvement nature of the utility services itself. Customers do not feel attached to services, just demand stable supply of electricity and gas and do not concern about other aspects of the service.

From the survey we have drawn some conclusions presented and discussed with our client about both natural gas and electricity markets.

Customer do not have enough knowledge and information about liberalized energy market;

Reasonably high amount of customers think that they cannot contact their energy provider easily;

Majority of the customers believe that their providers do not care about them and feel lack of affection. They also believe that energy providers are more interested in monetary benefits of the services;

Customers believe that liberalized energy market does not have big advantages for them;

Price is a determinant factor for customers choosing an energy provider;

Customer service and customer care is the most important part of the service according to clients´ responses.

23

10. Recommendations

The recommendations are based on our interviews (communications channels), meetings with our sponsors from Galp Energia, results from survey and our own researches. Recommendations are focused on different segments of client experience cycle but instead of covering the whole cycle, after discussing with our client, we have worked on certain components that were interesting to focus on.

Figure 2 - Customer Experience Cycle Source: Galp Energia

10.1 Discovery

As we have analysed in the survey results, consumers in energy industry miss major information about liberalized market. Galp Energia can increase the knowledge of the consumers and in return consumer spread good word of mouth about the company which will affect the company´s reputation positively. It´s really hard for petroleum companies like Galp Energia to create a humanistic reputation due the nature of the industry. Companies are focusing on sustainability and green energy to improve their reputations and for Galp Energia to inform all clients in the market objectively without expressing their prices, discounts would improve their image of social responsibility.

10.1.1 Didactic Channels

Our first proposal is to create a didactic channel on various online platforms where watching videos are possible. We have thought about most famous video platform “Youtube” as our focus point but

Discovery

Acquisition

of service

Activation

of Service

Using

Service

Paying for

Service

Solving

issues and

complaints

Rescission

24 since once the video is created, there is no cost of putting it on other video platforms. The more channels the video exists, there is more possibility that consumers will engage with these videos. The idea is to show that Galp Energia “cares”. The reason why we have not considered social network as our informing platform is because of the clients who had bad experience with Galp Energia, have attacked company with negative comments and the control over a public page is very hard and needs 24 hour attention. Company already suffered from this type of experience and shut down their social network page.

In the context of the didactic videos we would like to transmit to clients; what liberalized energy market is, who the providers are, what the advantageous are in terms of competition, what the differences are compared to regulated market, transition period. Consumers do not believe that liberalized market has advantageous which is wrong because since 1 January 2013, regulated tariff ended and the prices in regulated market is higher than the prices in liberalized market. It was a strategic decision taken by ERSE in order to push consumers to liberalized market and speed up the process. We have created a demo video for Galp Energia to show the main context of what they need to transmit objectively. It is very important the video to be dynamic and animated in order to keep consumers attention on the video and not become a negative customer experience. In the video, we have gave information about what regulated and liberalized market is, who the providers are in the liberalized market and what are main differences between two markets. We ended the video by giving an example of liberalized market of telecommunications (TV-NET-PHONE) and how companies compete each other in terms of products, features, prices that leads to benefit of consumers.

10.1.2 Publicity

Our proposal includes two segments; Indirect and Direct publicity.

For Indirect publicity, we saw the opportunity of the space of Galp On invoice and included a box that shows the discount gained by client for the period and another line with the total savings gained with GalpOn plans(relatively to regulated market). We would like reinforce the decision clients took by choosing Galp On and increase their influence on third-parties. Our proposal is to add a line on invoice for example “With Galp On you saved X Euros in Liberalized Market! Tell to your family and friends and let them save too!” Our intention is to spread good word of mouth about advantageous of Galp On plans compared to regulated market.

25 For Direct publicity we have used the information from survey and the majority of our survey respondents preferred to be informed by TV, press and mail. Our second proposal is to use direct and indirect publicity to increase brand exposure and inform clients about liberalized market.

Press

Galp Energia has an opportunity to use this channel to advertise their products and promotions while informing the clients about liberalized market. 455 millions of journals were circulated in Portugal in the year of 2011 (PORDATA: Base de dados Portugal Contemporâneo) and it is a very effective way for direct advertising and informing clients about the process of liberalization and neutralize the advantageous of other competitors in the market.

Our proposal is to send mails to inform all clients of regulated market without any advertising and publicity because of the regulations of ERSE. The cost is high in case of not selling the services, that is why we propose to send flyers to all residents without discriminating liberalized market or regulated market in order to pass through the advertising barriers of ERSE.

Television

It is an efficient and effective way to create an impact on clients and advertise but the cost of this action is a little too high, depending on the length of the video and time of the day. For that reason we did not propose this channel to be used for publicity and informing clients about liberalization of the market.

10.1.3 Google Keywords

Our last proposal in discovery segment in the customer experience cycle is about Google Keywords. The Portuguese language orthographic agreement has changed recently and the word “electricidade” is now written as “eletricidade”. When the word is searched on Google according to new orthographic agreement Galp Energia is second on the results list. The word “eletricidade” was searched 49.600 times, in April 2013 according to Google keywords database. On the other hand the old word “electricidade” was searched 74.000 times, in April 2013 and when it is searched the results show the regulator ERSE and the competitors like EDP. Galp Energia doesn’t seem to be found anywhere on front page.

We proposed Galp Energia to consider adding the word “electricidade” to their keywords database in order to gain more exposure because there are still many people using the word according to the old agreement. This proposal is very easy to execute, very low or no cost at all and it will increase the exposure of Galp Energia and its services to consumers and other people that are searching on the internet.

26

10.2 Using Service

10.2.1 New cutting warning process via Sms/E-Mail

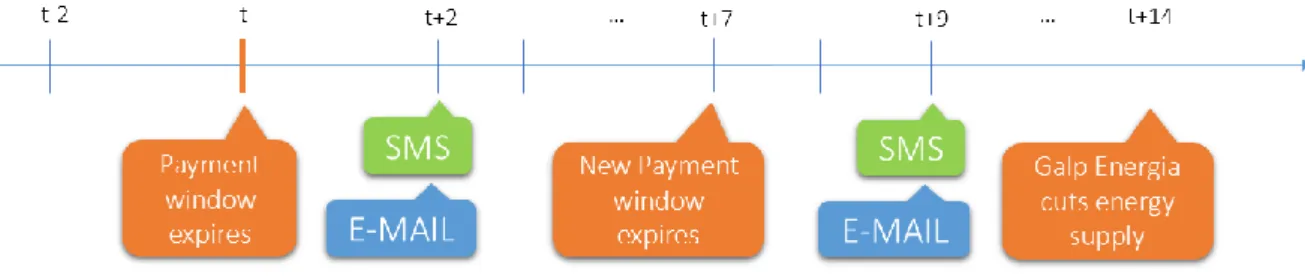

In our discussions with our sponsors from Galp Energia´s, we have found that Galp is having problems with the payments and cutting process. Below is the current process of warnings before energy cuts in case of missing payments. Galp Energia´s contacts the client 4 times via Sms/E-mail before the

energy cuts.

Figure 3 Current Warning Process

The contract is between two entities, Galp Energia and the client. If Galp Energia is responsible for the supply of the utility, clients are obligated to pay for the service and if not Galp Energia has to make sure to cut the supply of the energy. Galp Energia is taking all responsibility by contacting the client 4 times before cut and after our long discussions in the group we have reduced the responsibility of Galp Energia and number of contacts with the clients. Following scheme is our proposal for the new warning process.

Figure 4 Proposed Warning Process

We have reduced the number of warnings to two and overall energy cutting time is reduced 1 week. The warning before expiration day seems unnecessary since the clients already have the invoice and are obligated to pay in time. If not, Galp Energia contacts the client 2 days after original expiration date with a new bank reference to remind that the bill is not paid and client needs to pay in 5 days. If the bill is still not paid, 2 days after the second expiration date, Galp Energia contacts the client and warns that the supply of energy will be cut in 5 days. In order to rectify the situation Galp Energia suggests to the client to go the nearest Galp Stores or contact call centre. After 2 weeks from the original payment deadline, Galp Energia cuts the energy supply.

27

10.2.2 Sms-Email Care

The 44% respondents of the electricity market and 38% of the natural gas market indicated that they don’t believe their energy provider care about them. Around 45% of the total respondents indicated that energy providers only care about the monetary part of the service and not about other aspects of customer’s experience. Our mission is to improve the customer care in the project and increase their overall satisfaction and loyalty. The challenge is how to increase the relationship between company and clients with such low involvement service.

Affection assists as an antecedent to customer´s trust and influences loyalty before and after service recovery. Affection has bigger impact on customers trust after the service failure and recovery that should be the first area to be handled in the process. (La and Choi 2012)

In order to strengthen the bound between client and the company we came up with the promotion idea of celebrating customer´s birthday with sms/e-mail while offering them that day´s consumption of electricity. Sending just a sms/email would not create the same amount of affection as offering something as a gift and we wanted show clients that Galp Energia actually cares about them. It’s a good way to create a strong bound with the clients, increase their loyalty and make them spread good word of mouth to their friends and family about the company. It´s important for Galp Energia to show clients that it not only their money Galp cares about. We have calculated the budget as 258.000€ annually with the assumption of 2€ cost per client for total of 129.000 Galp On clients. This is a very rough calculation and we assumed the average cost of electricity per month per client is 60€. More likely there are more clients under this value than above. May need further analysis of Galp Energia since they have more accurate information.

Our other proposal inside Sms/E-mail care is to send messages to clients with current promotions and opportunities with Galp On products without being invasive. This service currently does not exists. Clients receive the Sms/E-mail with promotion or a new service with the phone number of call centre´s related department. Galp Energia´s feedback was positive for this proposal but it would be more effective for them and clients if the promotions are replied and registered with the same channel (Sms/E-mail) right away. The analysis of impact of responding with same channel needs to be further investigated by Galp Energia or in a posterior project.

28

10.3 Paying for Service

One of the most received topic at communication centres is the information about invoices. Some invoices are very complicated to understand for client and even for operators. Especially when there are estimations and refunds of charging more than the real consumption, promotion discounts and taxes, much more lines can be found in the invoice. These are all written in the invoice in accounting terms debiting and crediting which not all consumers understand. It might even get more confusing when there is a refund of discount or promotion which mean a money out of clients pocket and it is hard to understand. Our recommendation to this point is to change the invoice layout

10.3.1 Invoice Layout

We suggested to improve the layout of the invoice and presented a new layout easy to understand and more “consumer friendly”. We searched for best practices (benchmarks) of invoices of energy companies around the world and we found out one that caught our and our client´s attention. It is an energy provider called E-On from United Kingdom that provides their clients with very clean, easy to understand and with a cleaner view. (Appendix 1)

Figure 5 Evolution of current invoice to our proposal

Before we change the invoice layout we have to keep in mind that legal restriction of the Galp Energia´s invoice that cannot be removed or changed. Current invoice of Galp Energia also contains a space for advertising banner for promotions like “conta certa”, electronic invoice and direct debit and space for bank reference. So with respect to all of these we have adopted some of the visual features

29 from e-on invoice. In addition to that we added a line at the bottom of the discount box that expresses the total savings earned with Galp On services. It’s a good and easy way to show clients the benefit of the services and increase their perception of loyalty with increasing value of savings earned with each invoice. Also we recommend Galp Energia to add a short glossary at the end of the invoice in order to increase the understanding of the abbreviations and terms used in invoice.

This proposal of new invoice layout was the “star” of our final presentation and was very appreciated by Galp Energia, requested additional information after final presentation meeting. For entire invoice proposal see appendix 2.

10.4 Solving Issues and Complaints

10.4.1 Online Customer Care Centre

Galp Energia do not have any online customer care centre and Galp On site does not even have a search bar for clients. They only have contact numbers for communication channels and frequently asked questions. We searched for best practices in terms of customer support and we have analysed two examples that are known internationally. Ebay and Amazon has one of the best customer support centre which is easy to guide and rich in terms of content and frequently asked questions. We proposed to create an online customer care centre for Galp Energia with inspiration from both E-bay and Amazon. (Appedix 3)

We proposed to create a platform that should answer many of the client´s questions and doubts. It is important to solve client´s problems without contacting Galp Energia to reduce phone and e-mail traffic. Our idea is a support centre that will be almost self-sufficient for solving problems which need to be very well organized and to be rich in terms of content.

The care centre will have a search bar that will search through topics and previously asked questions that already have been answered by operators. Galp Energia already have database for frequently asked questions but clients cannot do a search inside that database. They need to scroll though topic by topic in order to reach the desired topic which is very inconvenient.

Also, we proposed to adopt the structure like from Amazon´s support centre. Whenever a client wants request information or make a complaint, it will follow this structure.

30 2nd level – Select the type of information: Suggestion, Request or Complaint;

3rd level – Select the subject of the issue or type the subject (system will later match with frequently

asked questions);

4th level – System provides results for the issue related that client could not find with keyword search;

5th level – Client chooses how to contact with Galp Energia: Phone or E-mail (If the phone is chosen,

the subject stays registered for the operators at call centre).

After consulting with informatics engineers and research on the internet, the calculated budget for this customer care centre is between 10.000€ and 15.000€ and considered as an acceptable value by our client. In addition to that customer care centre needs more staff to work on this channel which will cost extra human resources costs.

The care centre should be able to help clients´ requests and have everything they need from Galp Energia in a unique website without searching through several pages on the internet. We proposed to create an experience that should answer clients´ needs without spending too much time searching. It should give an edge to Galp Energia in the liberalized market against its competitors.

31

11. Conclusion

In this project we considered that client is the one who knows the business. We focused heavily on communication with our client Galp Energia and communication within the project group and our advisor. In each step of our analysis and recommendations we have considered our client´s and advisor´s opinions to provide the best results in our presentation. Several meetings were held during this period with Galp Energia and we have visited some communication centres of Galp Energia´s customer support, Teleperformance and SIBS Processos.

We believe that the current customer care program of Galp Energia is innovative and efficient which made it difficult for us to improve some elements in the customer care program during the research process. Based on our interviews, meetings with client and dissertation advisor, best practices and survey results, we have provided seven proposals with moderate implementation cost (financial, time and human resources). Some of our proposals like sms/e-mail care needs further analysis by Galp Energia or posterior projects about customer care.

We based our proposals on the dynamic modern identity of Galp Energia aligned with social responsibility and vision of the future.

At end of our final presentation for our client, we have distributed customer satisfaction surveys. Among seven proposals we have presented in the final presentation, new invoice layout and didactic channel were indicated as most preferred by our client. Overall, Galp Energia was very satisfied with our project in terms of quality and management. We can say that the proposal of new invoice layout was the star of all our proposals and was very appreciated by Galp Energia, requesting further information after the final presentation meeting. Galp Energia offered assistance if there are future projects related with customer care. The positive feedback we have received, created an opportunity for master students of our university.