JCDecaux New Business

Plan

Natacha BOBET

Dissertationsubmitted as partial requirement for the conferral of

Master in Finance

Supervisor:

Prof. António Manuel Corte Real de Freitas Miguel, ISCTE Business School, Finance Department

JC

D

eca

u

x

N

ew

B

u

si

n

es

s

P

lan

N

a

ta

cha

BO

BET

I

Table of content

Greetings ... IV Abstract ... V List of abbreviations ... VII Index of figures ... VIII Index of equations ... IX

Introduction ... 1

I. JCDecaux presentation ... 1

1. The history ... 2

2. The product ... 3

3. The key figures ... 6

4. The presence abroad ... 7

5. The competitors ... 9

II. JCDecaux recent projects in Middle East & Africa ... 9

III. Why investing? ... 11

1. Why going in Egypt? ... 11

2. The offer ... 14

3. Why this offer? ... 15

4. Challenges linked to this offer ... 16

IV. Choice of method for the Business Plan ... 17

1. Full cost vs marginal cost approach ... 18

2. Cash vs P&L approach ... 19

3. NPV, IRR, DPB ratios ... 19

4. WACC determination (or required rate of return) ... 21

V. JCDecaux media plan and revenue ... 25

1. Basic information ... 25

2. Media offer ... 27

3. Revenue ... 31

4. Concession fees ... 33

VI. JCDecaux CAPEX ... 34

1. Advertising CAPEX ... 34

2. Vehicle CAPEX ... 37

3. IT CAPEX ... 38

4. Other CAPEX ... 39

VII. Revenue/CAPEX analysis ... 39

VIII. JCDecaux OPEX ... 40

II

a. Technical costs ... 41

b. Sales and marketing costs ... 42

c. Administration costs ... 44 d. IT costs ... 45 e. Corporate overhead ... 46 f. Start-up costs ... 47 2. OPEX analysis ... 48 a. Technical costs ... 49

b. Sales and marketing costs ... 49

c. Administration costs ... 50

d. IT costs ... 50

IX. Depreciation, dismantling and maintenance ... 50

1. Depreciation ... 51

2. Provisions ... 52

3. Maintenance and spare parts ... 52

X. Cairo Metro project financing ... 53

XI. Cairo Metro project P&L projections ... 56

XII. Cairo Metro project financial indicators ... 57

XIII. Cairo Metro project sensitivity analysis ... 59

Conclusion ... 66

Bibliography ... 68

Appendixes ... 73

Appendix 1: Different assets of the group ... 73

Appendix 2: Inflation in Egypt ... 83

Appendix 3: Evolution of the External debt between January 2014 and January 2017 ... 84

Appendix 4: Map of Cairo Metro ... 85

Appendix 5: Example of advertising we could put in the Cairo Metro stations ... 86

Appendix 6: Detailed growth over 10 years ... 88

Appendix 7: Detailed revenue for year 1 ... 89

Appendix 8: Detailed revenue for the 10 years ... 92

Appendix 9: Revenue share and MAG distribution over the 10 years ... 95

Appendix 10: Detail of the CAPEX estimation ... 96

Appendix 11: Summary of the costs per assets ... 99

Appendix 12: Investment phasing and depreciation of vehicles ... 100

Appendix 13: Investment phasing and depreciation in IT & Warehouse ... 101

Appendix 14: Phasing for routers & switches, investment and depreciation ... 102

III

Appendix 16: OPEX forecast over 10 years ... 104

Appendix 17: Other administration costs ... 105

Appendix 18: P&L over the 10 years ... 106

Appendix 19: Working Capital Variation over the 10 years ... 108

IV

Greetings

First, I would like to thank my school for letting me enter this international program and for giving me the chance to build my future and differentiate myself through exceptional experiences abroad. Thank you for the patience and accompaniment of all the pedagogic teams (Lisbon, Ottawa, and Bordeaux) who supported me when it was hard to adapt, to know who to contact and how to deal with issues in a different context. Thank you to all the teachers and professionals who made me understand what my vocation was, who encouraged my motivation and boosted my desire for learning and studying. A last thank you to Professor Antonio Freitas Miguel who accepted to guide me through this work.

Thank you to Jean-Daniel Jooris who acted as a mentor, and still does today, who gave me the opportunity to show my competencies and let me develop my financial skills. Thank you to JCDecaux for this opportunity and for making me understand the global functioning of a multinational.

Miriam, Carlos, Shreya, Ali, Sanjay, Surika, Raksha, Bas, Lila, Alfredo, Martin, Marc Antoine, Gonzalo, Sébastien, Maude, Mathilde, Pauline, Julie, Clara, Caroline, Laure, Marion, Genevieve, Sarah, Lalo, Jesus, Pepe, Sacha, Thomas, Marine and many others, you all shared a part of my life and allowed me to construct myself, understand other cultures and develop my curiosity. I will never forget what we shared.

Finally, nothing would have been possible without the support of my sister Tatiana, my parents Valérie and Jean-Louis who were here in the worst moments. A last thank you to Rémi for listening to all my complaints and supporting my work every day.

V

Abstract

After 60 years of history, to keep a number one position, a company must innovate all the time and find new ways to keep the attention of the audience. JCDecaux has a long history but it is not sufficient as the outdoor advertising is a very competitive market. To remain profitable, choices need to be made. Such a Group innovates every day with new products: digital, new contracts but they need to go further and conquer new markets. The group is the only one in the market to operate in all continents but some very interesting markets are still available. Egypt is a growing country, in turmoil, but it is actually the best moment to invest as the ones who will survive such a crisis will be even better after. Egypt benefits from a huge transportation system and 6 million of passenger use it every day. The audience is there, the advertisers also; we only need to educate the market to our way of working, that is a new challenge for JCDecaux. To make the choice about investing or not, we will make a business plan using a full cost approach and look at the profit and loss accounts. The indicators are key figures but the sensitivity analysis is also paramount as it is only a project and nothing is static. Even once launched, a project is still in motion and needs efforts, implementations and this implies changes every day. According to that, our recommendation is clear: go there!

JEI Classifications: G31 (Capital Budgeting) – G32 (Value of firms). Keywords: Business plan, Egypt, JCDecaux, investment.

VI

Sumário

Após 60 anos de história a manter uma posição de número um, uma empresa tem de inovar constantemente e encontrar novas maneiras de manter a atenção do público. A JCDecaux tem uma longa história, mas tal não é suficiente, uma vez que a publicidade ao ar livre é um mercado muito competitivo. Para continuar a ser rentável, há escolhas que precisam de ser feitas. A JCDecaux inova todos os dias com novos produtos: digital e novos contratos, mas é preciso ir mais longe e conquistar novos mercados. O Grupo é o único no mercado a operar em todos os continentes, mas há ainda mercados disponíveis muito interessantes. O Egito é um país em crescimento. É um país ainda em tumulto, mas este é realmente o melhor momento para investir, pois os que sobreviverão a essa crise serão ainda melhores depois. O Egito beneficia de um enorme sistema de transportes utilizado por 6 milhões de passageiros todos os dias. O público está lá, os anunciantes também; só é preciso educar o mercado e esse é um novo desafio para a JCDecaux. Para analisar a decisão de investimento, elaboramos um plano de negócios usando uma abordagem do custo total, analisando as contas de ganhos e perdas. Os indicadores e variáveis são determinantes, mas a análise de sensibilidade também é primordial, pois é apenas um projeto e nada é estático. Mesmo uma vez iniciado, um projeto está em constante movimento e precisa de esforços, implementações que mudam todos os dias. Tendo em conta tudo isto, a nossa recomendação é clara: investir!

Classificações JEI: G31 (Projectos de investimento) - G32 (Valor das empresas). Palavras-chave: Plano de negócios, Egito, JCDecaux, investimento.

VII

List of abbreviations

AED: Arab Emirates Dirham BP: Business Plan

CAPEX: Capital Expenditures CEO: Chief Executive Officer CF: Cash Flow

CIP: City-Light Information Panel DMS: Digital Management System DPB: Discounted Payback

EBIT: Earnings Before Interests and Taxes EGP: Egyptian Pound

GDP: Gross Domestic Product HR: Human Resources

IMF: International Monetary Fund IRR: Internal Rate of Return IT: Information Technologies LED: Light-Emitting Diode

MAG: Minimum Annual Guarantee MD: Managing Director

NOPAT: Net Operating Profit After Tax NPV: Net Present Value

OM: Operating Margin OOH: Out of Home

OPEX: Operating Expenses PBP: Payback Period P&L: Profit and Loss

PRO: Public Relation Officer RPI: Rail Project Investments RS: Revenue Share

UNCTAD: United Nations Conference on Trade and Development WACC: Weighted Average Cost of Capital

WC: Working Capital

VIII

Index of figures

Figure 1: Timeline of JCDecaux History Figure 2: Worldwide presence of JCDecaux

Figure 3: Summary of the assets depending on their location in the metro station Figure 4: Summary of total revenue and distribution per type of asset

Figure 5: CAPEX amount and quantity per asset Figure 6: Revenue/CAPEX ratio analysis

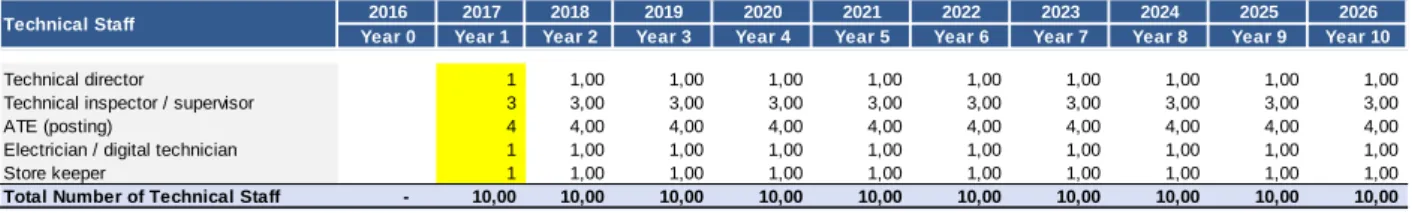

Figure 7: Headcount for each category - Technical

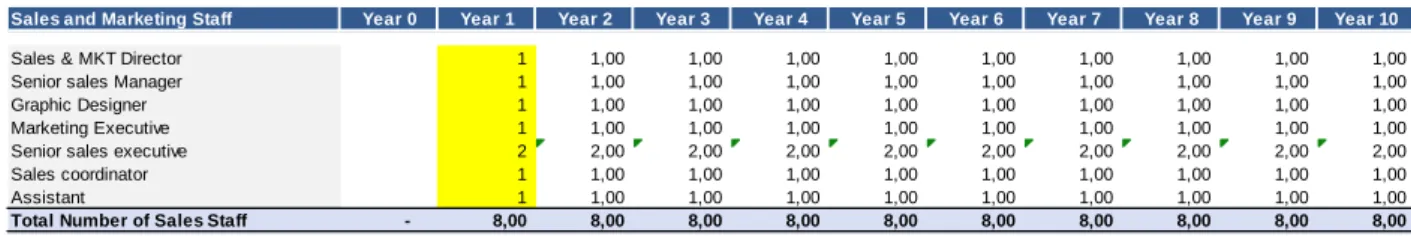

Figure 8: Salary table per year in EGP (incl. inflation & headcount) - Technical Figure 9: Headcount for each category – Sales & Marketing

Figure 10: Salary table per year in EGP (incl. inflation & headcount) – Sales & Marketing Figure 11: Headcount for each category - Administration

Figure 12: Salary table per year in EGP (incl. inflation & headcount) – Administration Figure 13: Headcount for each category - IT

Figure 14: Salary table per year in EGP (incl. inflation & headcount) - IT Figure 15: Middle East benchmark for each nature of OPEX

Figure 16: Interest calculation according to the financing needs Figure 17: Key indicators of the project

Figure 18: Sensitivity parameters Figure 19: Revenue/CAPEX sensitivity Figure 20: Revenue/RS sensitivity Figure 21: Revenue/OPEX sensitivity Figure 22: Revenue/Fx sensitivity

Figure 23: Revenue/Additional inflation sensitivity Figure 24: Historical inflation in Egypt

IX

Index of equations

[1] Formula for the calculation of the NPV

𝑵𝑷𝑽 = −𝑰𝒏𝒊𝒕𝒊𝒂𝒍 𝒊𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕 + 𝑪𝑭𝟏 (𝟏 + 𝒓𝟏)𝟏+ 𝑪𝑭𝟐 (𝟏 + 𝒓𝟏)𝟐+ 𝑪𝑭𝟑 (𝟏 + 𝒓𝟏)𝟑+ ⋯

[2] NPV cancellation with the IRR

𝑵𝑷𝑽 = −𝑰𝒏𝒊𝒕𝒊𝒂𝒍 𝒊𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕 + 𝑪𝑭𝟏 (𝟏 + 𝑰𝑹𝑹)𝟏+ 𝑪𝑭𝟐 (𝟏 + 𝑰𝑹𝑹)𝟐+ 𝑪𝑭𝟑 (𝟏 + 𝑰𝑹𝑹)𝟑+ ⋯

[3] Formula for the calculation of the WACC

𝐖𝐀𝐂𝐂 = 𝐄

𝐕× 𝐑𝐄+

𝐃

𝐕× 𝐑𝐃× (𝟏 − 𝐓𝐜)

[4] Formula for the calculation of the required return of equity

𝑹𝑬 = 𝑹𝒇+ 𝜷(𝑹𝒎− 𝑹𝒇)

[5] Formula for the calculation of the net revenue in year 1

𝑵𝒆𝒕 𝒓𝒆𝒗𝒆𝒏𝒖𝒆 = 𝑮𝒓𝒐𝒔𝒔 𝒑𝒓𝒊𝒄𝒆 × 𝒏𝒃 𝒐𝒇 𝒖𝒏𝒊𝒕𝒔 × 𝒏𝒃 𝒐𝒇 𝒏𝒆𝒕𝒘𝒐𝒓𝒌 × (𝟏 − 𝑫𝒊𝒔𝒐𝒄𝒖𝒏𝒕) × 𝑶𝒄𝒄𝒖𝒑𝒂𝒕𝒊𝒐𝒏 𝑹𝒂𝒕𝒆 × (𝟏 + 𝑮𝒍𝒐𝒃𝒂𝒍 𝑮𝒓𝒐𝒘𝒕𝒉)

[6] Formula for the calculation of the global growth

𝑮𝒍𝒐𝒃𝒂𝒍 𝒈𝒓𝒐𝒘𝒕𝒉 = (𝟏 + 𝒐𝒄𝒄𝒖𝒑𝒂𝒕𝒊𝒐𝒏 𝒓𝒂𝒕𝒆 𝒈𝒓𝒐𝒘𝒕𝒉) × (𝟏 + 𝒊𝒏𝒇𝒍𝒂𝒕𝒊𝒐𝒏 & 𝒂𝒅𝒅𝒊𝒕𝒊𝒐𝒏𝒏𝒂𝒍 𝒊𝒏𝒇𝒍𝒂𝒕𝒊𝒐𝒏 + 𝒄𝒓𝒊𝒔𝒊𝒔 𝒊𝒎𝒑𝒂𝒄𝒕) − 𝟏𝟎𝟎%

1

Introduction

When you go to Bangkok international airport you can see advertising on JCDecaux panels, go in New York city and you can shelter under a JCDecaux bus shelter, look at a city map in Madrid and it will be on a JCDecaux asset, look at the time on the roads in Rio de Janeiro you might encounter a JCDecaux clock, take advantage of the newspapers booths or public toilets in Paris, you have high chances to be in a JCDecaux property. In short, it does not matter where you are, you are surrounded by the worldwide leader in outdoor advertising.

To grow, this 53 years old company is always innovating with new products such as touch screens to be in phase with the digitalization that is today happening all around the world. To keep their number one position, JCDecaux is also looking for new markets to conquer to enlarge their geographical presence and ensure the continuity of the business. Present in all continents, some countries are still not equipped with JCDecaux assets and might be an opportunity for the company. In this paper, we will take the example of the Egyptian market and show it might be an excellent idea to set some activities there. The main question is: would it be a promising investment for JCDecaux to go in Egypt?

To answer this question, we will first present the company, its presence abroad and its core activities; followed by the recent projects of the company in the region. Then, we will show why investing in Egypt would be a desirable choice and why this contract specifically. The method used will be explained and followed by the estimation of the revenue, capital expenditures and operating expenses. After that, we will be able to determine the profit and loss account to analyze it using the financial indicators of the project. We will conclude with the sensitivity analysis of the project to determine the core elements and the financing of such a project.

I.

JCDecaux presentation

For this report, it is important to understand how the company is operating around the world. JCDecaux is a French company and contributes to the well-being of French citizen but also other countries where they are operating. Also, it is a company that is listed on the French stock exchange (Euronext Paris: DEC) and part of the Euronext 100 index, showing that the company has sufficient resources to expand both its geographical presence and its range of services.

2 1. The history

JCDecaux is a familial company, mainly owned by the family itself. The second

generation is today at the head of the company (2 of the 3 sons of the founder are co-CEO1).

The story starts in 1953 in Beauvais (France), where Jean-Claude Decaux, the founder, realized that advertising brands in the city actually helped to increase the sales of the stores. The only issue was the financial law in France that taxed a lot this kind of advertising. Moreover, the competition was intense within the cities. It generated a new idea, a new economic business model: the provision and maintenance of bus shelters financed by

advertising for the users that are waiting for the bus (JCDecaux website, 20172). In 1964, the

business starts as the mayor of Lyon, a big city in France, accepts the business model and allows Jean-Claude Decaux to install bus shelters for free. Since then, the group has continued to grow, constantly innovating and creating new street furniture (CIP: “City-Light Information Panel”, public sanitary facilities, moving advertisements, bicycles…). The group is today exporting the concept in more than 75 countries.

Below are the major historical events that got the company from a “town business” to a

worldwide leader in advertising (JCDecaux website, 20173).

1 CEO: Chief Executive Officer

2http://www.jcdecaux.com/group/history

3

Figure 1: Timeline of JCDecaux history (Source: JCDecaux, 2017)

The success of the company shows the capacity of JCDecaux to conquer new markets

thanks to an innovative approach and a pioneering spirit since 1964 (JCDecaux website, 20174).

Today, the company is a worldwide leader and they kept this position for decades because of the constant innovation. The main project for the group for the next years is to digitalize big cities such as: London (already partially done thanks to the digitalized bus stops), New York, Berlin, Sydney and other big cities where they are currently implanted.

2. The product

As we stated in the presentation of the company, the business model of the group was initially to offer some free bus shelters to communities in exchange of the exploitation of advertising content. Then, they developed the business and they are today able to offer a wider range of products to their clients. Moreover, if at first, cities were the main interlocutor of JCDecaux, it is today extended to airports and transport companies. To facilitate the offer for

the clients, the company has decided to divide the activity into 3 categories5:

• Street furniture: this segment includes all the commercial activity we can see in the streets but also in the malls (plus the renting of assets, its maintenance and other services). It represents 43.4% of the group revenue, mainly in Europe (70% of the commercial faces). In 2015, 66 countries (which represent more than 2,148 cities of more than 10,000 inhabitants) and 2,000 commercial centers could welcome such structures. Street furniture is composed of the following assets: bus shelters (10 different ones), columns (9 types), kiosks (5), poles with ad-case (9), City-Light Information Panel (CIPs) (15), backlit ad-cases (4), backlit canvas (2), backlit totems (2) and the “best seller”: the seniors (10 distinctive styles). To picture more the kind of assets we are talking about and have a clear idea of what the products are, please refer to: “Appendix 1: Different assets of the Group”. All

4 Ibid

4 the assets previously presented can be named “standard” assets. With globalization and technology changes, JCDecaux created “digital” assets that are presented below:

o Indoor ones: Digital multi screens (4 formats), digital poles (5), digital totems (7), LED cabinets (3 formats) and some others.

o Outdoor ones: digital seniors (8 and 9m²), digital poles (2 and 8m²) but also digital totems (72” and 84”).

o Services: Live touch6 (totem and bus shelters) and e-village7.

In this segment, the spokesperson is the municipality. In order to sign a contract between JCDecaux and them, they can ask for two types of benefits in return:

o Free products, that will be described after, it can be trash cans, benches and so on. It means that JCDecaux will pay for the assets that will benefit to the community in exchange of the exploitation of the advertising in other locations.

o Revenue share: it means that JCDecaux will give back a certain percentage of the revenue they make thanks to the posting of advertising content to the city. In 2015, the revenue share (RS) represented 23.4% of the revenue of street furniture, meaning on average a 23% revenue share. The length of such contracts usually varies from 10 to 25 years.

• Transport: 42.3% of the group revenue, it is the sector that knows the biggest growth with an increase of 26% of the revenue between 2015 and 2016. The assets of this category are the exact same as the ones of the street furniture. The biggest difference is not the type of assets but the location. In the transport segment, assets are located in airports but also in metros, trains (including express trains going to international airports), buses and any transit system. In total, JCDecaux has 231 contracts with airports and 282 contracts with other types of transports in the world. Contracts generally vary from a length of 3 to 25 years (renewable in most cases); for airports, it varies from 3 to 15 years (with an average of 5 years). The revenue share offered in the airports is way more important than in the cities

6 Live touch = “The first out-of-home information and content touchscreen platform” (JCDecaux Australia, 2017)

7 E-village: quite the same concept as Live touch. It is an open touch interface that offers an all universe of apps

(mobile apps, internet website, RSS flow, twitter lives, and so on), works under Android. It allows the city to offer to their citizen all the information liked to the city such as events, weather or any specific news (JCDecaux website, 2014)

5 because of the premium of the location. The airports in which the group is present represent 28% of the worldwide traffic. Also, in most of the contracts there is an “exclusive right” clause meaning that JCDecaux will be the only advertiser allowed to put assets in the area, giving even more premium to our offer.

In this segment, the interlocutor can be any transport authority. In order to sign a contract between JCDecaux and them, they can ask for two types of benefits:

o MAG: Minimum Annual Guaranteed revenue. It means that, every decided period, (from every month to the length of the contract), JCDecaux agrees to grant a certain amount, no matter the revenue the company will make. It ensures revenue to the clients that will for sure receive the MAG, no matter the performance of JCDecaux.

o Revenue share (RS): same principle as for the street furniture but with higher amounts, as they generally offer between 50 and 70% of their revenues.

• Large format/Billboards: 14.3% of the group revenue. Different assets: glued poster of 12 m² (4 types), premiere (5), large format < 36 m² (9 types of 18 and 36 m²) and large format < 36 m² (4 types). This kind of advertising is actually included in the street furniture segment but usually have private contracts in which assets are way bigger. A private contract is, for example, when they install a billboard in a private garden, on a building or in the area of a company such as gas stations. In France, such contracts last for 6 years but it depends on the local law so in some countries there is no restriction.

The Group offers a wide range of services to enhance the quality of the life of the people but where the company can still put advertising. That is the case for recycling containers (3 types) and automatic public toilets (10 types) where the group can put some stickers or advertising spots that they can sell or offer to clients.

JCDecaux is also offering services for free and that do not contain any advertising property. The only goal is to enhance the everyday life of citizens by offering them services such as: litter bins (7 styles), benches (5), clocks on the road or inside buildings, EIB (Electronic Information Board) for municipal announcement or road traffic, fences (5 types), anti-parking (3), lamp posts (5), city history furniture, city maps, bus stops, signage or administrative

6 posting. This furniture is offered for the comfort of the community. All these products are mainly offered in the case of Street Furniture contracts.

It is important to note that JCDecaux is also printing content, renting space and providing digital content for the clients depending on their needs and not only renting the space. This is

what the group calls non-advertising revenue. The “Velib’8” solution is also considered as a

non-advertising revenue. The subsidiaries print the advertising content in France for most of the orders because they want to ensure the quality of the content. For the digital content, the client generally provides its own video but JCDecaux can also assist them in this task especially when the content is not technically adapted to the screen (size, language, subtitles, additional message for example). For this, the Group has some digital teams at the regional level that can handle such projects.

To manage all these activities, the company has a full team in each country they are operating in (which include sales team, technical team and all support functions such as marketing or finance), enhancing the communication between them, the community and their customers. Then, there is a regional management: North America, South America, Asia, Middle East, Africa, a few divisions in Europe and one for France. Finally, the headquarters are all located in France, in Paris. All the core departments such as research and development, network security or general direction of production and operations are located in the headquarters in order to foster the quality and to innovate faster.

3. The key figures

JCDecaux can count on more than 524,580 advertisings faces in the “street furniture” category that enables the company to be number one worldwide in the “street furniture”; they serve 1,785 cities in 56 countries. Also, the company owns 395,770 advertising faces in the “transport” category that also make them number one worldwide in this category. They have contracts with more than 230 airports in 22 countries. Finally, more than 177,760 advertising faces in the category “Large format” that lead them to the position of European number one in this category; covering 2,800 cities in 38 countries. In total, more than 1,1 million advertising faces spread in more than 75 countries and that touches 390 million customers a day. This allows the group to be number one in external communication around the world.

8 Velib’: this is a concept of JCDecaux, the Group is providing some bicycles in many stations around the city for

7 Thanks to these locations, it generated revenues of 3,208 million € in 2015 which represents an increase of 14% compared to the previous year and €3,393 million in 2016 or an

increase of 6% compared to 2015 (Annual results, 20179). It is important to note that between

2000 and 2014, the company has multiplied by 2 their revenue. The net result in 2015 reaches 241 million € and 333 million € of cash flows were available.

JCDecaux is a huge employer in the word with 12,850 employees (more than 3,000 of them are working in France). We can feel the “familial” aspect of the company as the employees

stay in the company in average for 13 years10 which is huge in our current economic situation

with an increasing turnover (JCDecaux website, 201711).

4. The presence abroad

JCDecaux has a worldwide presence and is present in all continents. More than 75 countries benefit from JCDecaux installations including North America, most parts of Europe, South America, Australia, North Asia and recently some countries in Africa. Below we can see the presence of the Group on a map:

Figure 2: Worldwide presence of JCDecaux (Source: JCDecaux website, 201712)

9http://www.jcdecaux.com/press-releases/full-year-2016-results-version-published-march-24th-2017

10 Figure for France only. The group average stay is 9 years with some zone such as Asia or Africa and Latin

America where people usually stay 5 years, North America and United Kingdom 7 years and Rest of Europe 11 years.

11http://www.jcdecaux.com/fr/Quelques-reperes

8 The expansion of the group started in Brussels in 1967. In 1971, they signed a contract with Lisbon in Portugal for 300 bus stops and at the time, many local medias underlined that during the revolution, the JCDecaux furniture were the only thing to be clean and maintained all the time, showing the image of quality the brand already wanted to have at the time

(JCDecaux Website, 201713). It took some time to develop more abroad because of the

economic situation in Europe. From 1982, the two oldest sons of Jean Claude Decaux, the founder, started to look for new markets and conquered Germany (it was, at the time, the first company to acquire such a contract and a few years after, for the reunification, the group proudly wrote “Good luck Germany” in all the advertising spots, showing the interest of the company in helping and caring about the communities). Then, came England, Finland, Island, Norway, Sweden and Denmark followed by Austria, Bulgaria, Croatia, Czech Republic, Slovakia, Slovenia, Estonia, Latvia, Lithuania, Poland and Ukraine. In 1989, Jean Charles Decaux, one of the sons of the founder, implanted the company in Spain and Italy. 4 years later they went outside Europe for the first time, in the United States with San Francisco. In the 90’s, they expanded in Latin America (Argentina, Chili, Brazil and Uruguay) and in Australia (in 1997, opening the market for the company to the Olympic Games in 2000) giving the opportunity to open the door of Asia (Korea, India, Japan and Malaysia). In the 2000’s, it is time for the company to go to China and Russia but also to the Middle East (Saudi Arabia, United Arab Emirates, Israel, Qatar and Oman) and Africa (Algeria, South Africa and Cameroon).

The main market of the Group is Europe as it represents the biggest part of the revenue but the CEOs are giving more and more importance to markets such as South America, Middle

East and Africa to expand. Moreover, in 2015, more than 80%14 of the turnover of the company

was made outside of France showing the importance the group gives to the other locations. More than 4,435 cities of more than 10,000 inhabitants have signed contracts with the group allowing the country branches to develop activities all around and spread the Group Innovation and Design.

Such a company obviously failed sometimes. We can give the example of the shopping malls in the United States of America where the company invested but the activities were not sufficiently sustainable so JCDecaux was obliged to take all of assets off. There is in fact very

13http://www.jcdecaux.com/group/history

14 Here is the turnover per region: 1st: Europe (excluding France and United Kingdom) with 26%; 2nd: Pacific-Asia

with 24%; 3rd: France with 19%; 4th: Rest of the World (Africa, Middle East, Latin America) with 12%; 5th: United

9 few examples of countries and activities in which the company failed and this is due to the very conservative approach that the company adopts when building a business plan to choose to invest or not in a contract. That is this conservative approach as well as the accuracy of every business plan that helped the company to be in that many countries today, leading the outdoor advertising in the world.

5. The competitors

We can see two distinct types of competitors: the direct competitors that are operating in the same area and the indirect competitors that are represented by the other means of communication.

Worldwide, JCDecaux is ranked first with revenue of $3.6 billion. The competitors are the next companies in the ranking15 such as: Clear Channel Outdoor with $2.8 billion of revenues and that operates in the USA, Canada, Europe, Pacific Asia and Latin America. Then, we have Outfront Media with $1.5 billion revenues and operating in the USA, Canada and Latin America; Lamar in the USA and Canada with $1.4 billion turnover and finally Focus Media in China with revenues of $1.2 billion. As we can see JCDecaux is still far ahead in terms of revenues compared to the other competitors. Moreover, speaking about operating area, the Group clearly has the biggest presence all around the world.

If we focus on the Pan Africa competitors, we can find: Alliance Media, Primedia, Global Outdoor Media, Outdoor network and Provantage. In Middle East: Arabian Outdoor, Saudi Signs, Kassab Media, Al Arabia Outdoor, GMI and Rotana Hypermedia.

Finally, the indirect competitors are embodied by the other medias such as television, radio, newspapers, magazines, cinema and with globalization, the biggest competitor is the Internet with advertising on every single page and social network.

II. JCDecaux recent projects in Middle East & Africa

JCDecaux, as a dynamic company is always financing new projects all around the world and using the cash they can make with existing projects or to implement existing ones or to create new ones. They consider all the opportunities and evaluate them through business plans in order to foster their presence and keep their status of leader.

10 Middle East and Africa are part of the “rest of the world” category in the annual analysis of the group. Nevertheless, we can see that it is the part of the world that also knows the second biggest growth lately. We can confirm this thanks to the number of employees: +16% of the human force in Middle East and Africa compared to +13% in Europe, +2% in Asia or even 0% in France.

As these countries know a huge growth, the Group is giving more and more importance to this area and is granting more and more investments for this zone in order to foster their presence in such areas. In 2012, we signed a contract in Muscat (Oman) for 20 years. In 2015, JCDecaux signed a contract with Madinah airport in Saudi Arabia for 10 years ensuring exclusivity. Sticking to the idea of design, quality and innovation and to follow with the idea of digitalization, JCDecaux is now working on “Smart cities” and is trying to implement it in Dubai. They are currently running some tests to implement e-village solutions downtown and the city center should be fully equipped by the end of 2018. We can also give the example of the acquisition of Continental Outdoor Media, the number one of the outdoor communication in Africa. Thanks to this new acquisition in 2015, the Group gained presence in 13 new

countries (Angola, Botswana, Lesotho, Madagascar, Malawi, Mauritius, Mozambique,

Namibia, Swaziland, Tanzania, Uganda, Zambia, and Zimbabwe), and more than 36,000 advertising panels (JCDecaux website, 201716). After this acquisition, JCDecaux became the number one in outdoor communication in Africa.

Recently we can note the evolution in transport, for example, thanks to exhaustive acquisitions and fusions, JCDecaux went from 140 airports in 22 countries in 2015 to 231 in 34

countries in 2016 (JCDecaux Reference document, 201517). In Middle East, they are present in

26 airports in Saudi Arabia, 3 airports in the UAE, 2 in Oman; all this presence represents 60% of the traffic in Middle East. In Africa, after the Continental merger, they are present in 30 airports in this region. In total, Middle East and Africa represent 71 airports, meaning that it is the second biggest region in terms of number of contracts in the transport segment (after Europe, including France and the United Kingdom with 107 airports).

Considering the importance that the group is giving to the Middle East and Africa and the growth in the transport segment, it might be logical that JCDecaux is carefully looking for opportunities in this area and segment. There are a few countries that might answer to these criteria but we need a country with a certain economic and politic stability but also a country that would be educated to receive such assets. Egypt might be a desirable choice for JCDecaux

16http://www.jcdecaux.com/press-releases/jcdecaux-has-completed-acquisition-continental-outdoor-media 17http://www.jcdecaux.com/studies-documents/2015-registration-document

11 with a huge airport and railway network. Also, it is right in between Middle East region and African region. We are going to study this decision in the following part.

III. Why investing?

Whenever a company is reaching a certain maturity, they need to invest to continue to grow; otherwise they would lose their advantage and stop being competitive in their market. Investment can be done through different medium: they can enhance the quality of their existing product through research and development; they can enlarge their range of products or enlarge their geographical area. JCDecaux is working every day on research and development with a full department dedicated to this, it is a sort of “permanent” and “constant” investment. For the range of products, they are in advertising and are working on digital now so it is also something that is being developed everyday by the company. Finally, the geographical growth, it is the main solution that JCDecaux is using to keep their “number one” position. To invest in other geographical areas, they have two main solutions, either buying their main competitor (what they did in Africa with Outdoor Media) or answering to tenders. In some cases, the business development team is even going in the country in which we would want to invest to spontaneously offer our services.

As we showed, investing is paramount in business in order to keep a competitive advantage. JCDecaux is investing in innovation, enlarging the range of products, but in our case, we will focus on investing to start a business in a new country. The country we chose is Egypt and we will explain why in the following part. We will also explain the offer we had and why we chose such an offer.

1. Why going in Egypt?

The choice of the Group to expand in Egypt can be explained by a few factors: strategic choice, demographic choice and economic choice.

Egypt as a strategic choice: the location of the country is a perfect fit for the Group. In fact, JCDecaux is already present in African countries and in Middle Eastern countries. Egypt is located right in the middle of the two geographic zones. It would allow the Group to have a bridge between the two regions. Also, as we can see on the map of the presence abroad (Part I-4), the countries around Egypt are not yet conquered, apart from Saudi Arabia and Israel, but there are still several countries left such as Sudan, Libya or Jordan. Then, Egypt could also be

12 a hub to expand the activities in the neighboring countries. Finally, Egypt is both supported by the countries of the Gulf but also politically and financially by Occidental countries which gives a certain stability to the country. The last argument is that the project is followed directly by the Ministry in Egypt and that the negotiation would be an “exclusive bilateral negotiation” giving more power to JCDecaux but also having a quality spokesperson in the country.

Egypt as a demographic choice: the country benefits from a 3% average growth which shows a good economic growth, even more compared to European economies that grow at a slower pace (1,2% in France, 1,7% in Germany) (World Bank, 2017). Moreover, the growth is expected to continue until 2050 (African Development Bank Group, 2012). The inflation in

Egypt is not stable since October 2016. At that time, it was 14%18; but, since February 2016, it

is almost reaching 30% (AFP & Figaro, 2017). This is the result of a decision of the International Monetary Fund (IMF) to lend money to the country that conducted to a floating rate and then, an increase in prices (inflation). Both the inflation and the growth will increase the cost of the structure on site but also, allow an increase of the price of our services. The impact would be quite neutral and would potentially foster the growth of the business. Also, with worldwide urbanization, 90% of the transport development will happen in the developing countries of Africa (JCDecaux Reference document, 2016). Some analysis also states that between 2010 and 2025, African urban population will double (African Development Bank Group, 2012) or even triple (Anderson M. & Galatsidas A., 2015). Thanks to this change there will be a growing audience; companies will be more and more interested into attracting purchasing desires and the need for advertising assets will automatically increase. Also, transport is the Group segment that has known the biggest growth in 2016: 26% increase

(JCDecaux Reference document, 201619). Therefore, the direction in which JCDecaux is going

and the direction in which Egypt is going coincides and such a business could work.

Egypt as an economic choice: first, we can say that the external debt20 is reasonable allowing investments that support the economy. In January 2017, the external debt was

estimated to be $67 billion (Trading economics, 2017), compared to 48 in January 201621. We

can see that the external debt increased a lot in the last year, but this was linked to the economic shock in Egypt at the end of 2016, with the huge change in exchange rate that obviously affected the external debt a lot. In fact, during the last quarter of 2015/2016 fiscal year, the external debt

18 Please refer to Appendix 2: “Inflation in Egypt”

19http://www.jcdecaux.com/studies-documents/2016-registration-document

20 The external debt allows us to define the difference between the value of the exported and imported values of

goods. A positive external debt means that the country imports more than they export.

13 was $55.8 billion; it increased by 7.8% in the first quarter of 2016/2017 fiscal year according to the Central Bank of Egypt. But, considering this change, the government is implementing measures, “game changing” reforms, to attract investments based on the reception of loans from international institutions, so, it is still an opportunity (Middle East Monitor, 2017). Second, there are a lot of Foreign Direct Investments (FDI). In fact, the country benefits from its geographical position, a cheap but qualified labor, a lot of tourism, reserves of energy and a large market making it a first choice for investment. The importance of the liquidity coming from the Gulf countries is also an advantage and makes the country even more attractive for investments (Santander, 2017). The importance we grant to the FDI is linked to the attractiveness of a country, so if there is a lot of investment, it probably means that it is a flourishing or very developed economy. A review of Santander in 2017 stated that according to the UNCTAD 2016 World Investment Report, Egypt is both in the top five of Africa in terms of FDI reception and number one recipient in the sub-region. This shows that Egypt might be an attractive developing country. Talking about evolution of the FDI, in 2014, Egypt was receiving $4,612 million (representing 12.1% of the GDP), in 2015, $6,925 million (an increase of 50.2%, representing 15.3% of the GDP) and one year later of $8,107 million (or an increase of 17.1% compared to the previous year, representing 30.8% of the GDP) (UNCTAD, 2016). According to the figures, we can see that the amount is increasing every year. Still linked to the FDI, the General Authority for Investment and Free Zones (GAFI) has established in 2004 some economic decisions in order to be more attractive such as a reduction of 35% of the custom duty and a tariff simplification, making it easier to set up some businesses in the country but also the enlargement of the sectors in which investment was possible (agriculture, mining, tourism, and so on plus the private sectors). The third aspect is that Egypt has one of the largest advertising markets according to Zenith Optimedia in September 2015, estimated at $330

million (including OOH22) in the region just after Saudi Arabia ($561 million) and the United

Arab Emirates ($456 million) in terms of size. It is the only growing market in the Middle East according to the agency. Finally, more linked to JCDecaux directly, the revenue of the “rest of the world” zone is also the one knowing the biggest increase: +24% between 2015 and 2016 so, it shows the economic opportunity that the company can have in Egypt.

Obviously, Egypt is not an “El Dorado” otherwise, all the businesses would already be there. There are some cons in taking such a decision. An example of con would be the tourism.

14 Lately, because of the terrorist attacks/risks, many foreigners do not want to spend their vacation in such a country, considering it as too risky. Therefore, the tourism sector is under pressure and the brands that are paying JCDecaux counts on both local audience and tourism; if tourism is in danger, then, it could be a risk for JCDecaux as brands will spend less. Also, in Egypt, there is a very low level of change, meaning that the reserves in other currencies are very low (that is by the way the main reason the IMF lent money to Egypt). The consequence is that Egypt does not allow the exit of capital. That could be a problem for JCDecaux if they want to send the excess cash in France. What reduces this risk is the fact that, in order to make money, and because of the amount of investment needed, our Egyptian subsidiary would need a few years to be able to have a positive cash flow and then, to send back money. In several years, regulations can change and the IMF, if reimbursed, can give more flexibility to the country. Also, there is an excessive bureaucracy for investments and access to local credit is very limited. Currently, the country is facing a shortage of skilled labor, meaning that JCDecaux could have some trouble in finding the best employees. Finally, the bank system is vulnerable. The recent change in the exchange rate shows a certain vulnerability of the country to economic shocks and we cannot predict if such an event will happen again or not and even less predict when it will happen.

We can see in this analysis that Egypt is having a good growth rate, that the market is ready to welcome foreign investment and that it would be a good strategic choice for JCDecaux. We stated some cons but most of them can be avoided with a good management of the resources and a sufficient protection (against the exchange rate for example). According to these information, it would be an excellent idea for JCDecaux to invest in such a country.

2. The offer

Considering the opportunity of going in Egypt, the development team of Middle East approached some partners in Egypt and had numerous meetings with government officials. M. Ali M., our partner in Egypt, introduced us to a government owned company called Rail Project Investments (RPI) operating under the umbrella of the Ministry of Transport. RPI, which has no experience in outdoor advertising, has won the advertising concession for the metro in early 2016 for 5 years and has been looking for ways to monetize this concession. Until now, they still have not chosen a company to operate. The 5 years contracts are not the ones that JCDecaux prefers, especially when it means investing in a country where the company is not yet implanted but, it is still possible to discuss the details of the offer with the rail authorities.

15 The metro has a ridership between 3 and 4 million people per day ranking it among the top 5 JCDecaux metros. The metro has 100 trains operating on 3 lines and 64 stations (26 are underground and the rest are aerial). The advertising territory of the metro includes the stations, the train bodies and interiors in addition to outdoor locations in premium areas such as the busy 6 of October Bridge. The metro has never been properly positioned as a media on the market. The agencies do not consider it in their plans as no proper offering has ever been made.

3. Why this offer?

Outdoor is the king of media in Egypt with high traffic and long commute hours capturing

around 20% of the advertising market and estimated at around €46 million23. In the context of

the highly fragmented and cluttered outdoor advertising market (OOH markets), the metro is an opportunity to show our know-how in a relatively safe environment where our fundamentals of duration and exclusivity can be respected. The Cairo Metro is one of two assets on the fragmented Egyptian outdoor market to have an exclusive territory, knowing that the other one is the airport.

The biggest advantage of this offer is that it is not yet publicly presented so, it means that there are no competitors yet. In addition, as the offer is not yet public, the requirements they gave us act as a guideline but not as obligations we should meet. The proposal does not depend on the requirement of a bill of specifications but only on discussions we had with authorities. Then, for now we can avoid the tenders. And once the proposal is “accepted”, they will publish a public offer in which they will grant us some extra point because of our pioneer approach.

Also, we can underline that RPI has other rail assets available, allowing JCDecaux to increase its presence once this contract has been won. That has been the case in previous contracts in other countries. We can give the example of Dubai, where we first won Dubai airports, then Abu Dhabi airport, and then some street furniture advertising and billboards. It could be the same case in Egypt. The airport is also available and is a project in which JCDecaux is already interested, such as the other rails of RPI. Once JCDecaux is implanted in a country, it is way easier to add more contracts as people know who we are. In addition, this can give the advantage of diluting the structure cost of the company. RPI would allow JCDecaux to have its first step in Egypt, probably followed by other projects.

16 Finally, such an offer meets a request of the population. JCDecaux asked Lawes Gadsby

Semiotics24 to drive an analysis about advertising in metro stations. The results were exploited

by Gfk25 and then by Global Metro Stories26. It resulted that passengers consider advertising in

the metro stations as a “plus”. 95% of the users actually see the advertising and 50% of the users asked said that advertising in metro reinforce the “prestigious” image of a brand. It appears clear that, having some assets in metro stations would attract some brands and that JCDecaux would not have any issue is renting such spaces.

4. Challenges linked to this offer

As in any project there are some pros and cons. It is important to be able to identify the pros as we just did in order to be able to develop a competitive advantage and to be able to grow. Knowing the cons would help to know what to negotiate with the partner, what to be careful with or, in some cases, what are the reasons not to invest. The metro project presents a few challenges for JCDecaux.

Advertising in metro stations in Egypt has never been properly set on the advertisers and agencies radars. This can be a threat as it means that the public is not that educated to such advertising. Also, it means that the execution of such a contract might encounter some issues as it has never been properly set up in the country. Moreover, evaluating the viability is complex as it does not exist yet. As in every “new concept”, the execution can be very successful but can also lead to numerous issues that the company must deal with and that were not planned. Nevertheless, JCDecaux was already a pioneer in some African countries and they have always been able to react to the differences and issues they faced. The teams on site, the regional hub and the headquarters of JCDecaux, thanks to their constant contact were able to find solutions to all issues they encountered.

Another issue might be the important level of competition in Egypt. In fact, even if advertising in the metro station is not yet done, the advertising in bus shelters, streets and different spots is already very well exploited by the competitors. The high competition implies price competitiveness so, a lot of low cost competitors. JCDecaux believes in the premium of its assets and locations in general, implying a higher cost for the client. Finding clients able to

24 Lawes Gadsby Semiotics: an advertising agency.

25 GFK: a market research company, website: <http://www.gfk.com/>.

26 Global Metro Cities: agency, worked to “visualize how Global city metros have become urban channels of

communication”, a video of the result is available at: <https://www.youtube.com/watch?v=TwOHfVVouX8>, last view on the 9th of July of 2017.

17 pay such a price might be challenging for the sales team. From the Group experience in other countries, we can see that the discounts granted in competitive countries are high, going up to

50% of the book value27. But even considering the discount, we can usually observe that the

price JCDecaux asks for is still higher that the competition, showing that high competition has already been faced by the company and that they already found a way to react to it, so there is no specific reason for it not to work in Egypt too.

Corruption in Egypt is very high, making an enormous difference with the “JCDecaux model” of transparency. It requires educating the market to make it fit with our way of working. In 2016, the Group Transparency International ranked Egypt 108 over 176 countries, with a mark of 34 over 100 (100 being the less corrupted economies) (Transparency International, 2017). The company is already implanted in Cameroon that was ranked 145 over 176 countries in 2016 (Transparency International, 2017). This shows that the group can still operate in a country with an elevated level of corruption, while keeping its core value of transparency.

The last challenge is about the local team. Such a project would require numerous assets that need to be handled by a team. In Egypt, as in many countries in the same zone, the law obliges us to have at least 90% of the employees who are local ones. This means that JCDecaux would have to train local people in order for them to be ready to work on our assets and with our way of working. But once again, that would not be the first time the company is going in a new country and the local teams always succeeded in adapting to the new rules so there are no reasons that it would not be the case in Egypt.

We just showed the 4 main challenges that JCDecaux would need to face with going in Egypt, and for each of them, there is a solution, even if its application is not necessarily easy.

IV. Choice of method for the Business Plan

Now that we proved that there is a real opportunity to go in Egypt, it is necessary to design the financial part of the business plan. As in every project, it is paramount to be able to determine the financial outcome of it as the final decision is not only strategic but also financial.

27 At JCDecaux, in every country, the local team defines a “book value” for each asset or for each package of asset.

Then, the “gross price” would not vary from one client to another. The adjustable factor is the discount rate that varies from one client to another depending on the frequency and the quantity the client accepts to sign for.

18 1. Full cost vs marginal cost approach

To drive the financial part, there are a few options: we can use a full cost approach or a

marginal approach28. In the marginal approach, the goal is to determine the additional revenue

we could have compared to the additional costs incurred by the activity. Such an approach gives an idea of the potential of a project ignoring the fixed costs of the structure. There are some disadvantages to this technic as it ignores a part of the fixed costs but also the sunk costs or opportunity costs that should be considered. In our case, it would mean considering only a part of the structure cost as we already have some businesses all around the world. JCDecaux often uses this method when there is already a branch in the country, when the structure is already set on site. The second option is the full cost approach29. It consists in considering the project as if we were starting from scratch, as if there were no structure on place. This second technic is easier as it consists in adding up all the costs, but it is also risky as all the costs need to be compensated by a higher revenue. A common mistake would be to put higher prices to be sure that the operating expenses would be covered. By using full cost strategy, we must be very careful with the construction of the revenue and be sure that the price is not decided depending on the revenue the company wants to reach but, on the revenue it can really generate. In short, the company should be realistic about the money they can make. In Egypt, there is no branch yet so the full cost approach seems to be the most adapted one. Even if JCDecaux might consider trying to win both the contracts for the airport and the metro, the Group usually prefers to remain careful until the contracts are signed. By having the two structures, we would obviously have some synergy and avoid almost half of the structure cost, but, considering that none of the project is sure, it is more secure to consider the full cost approach for each of them. In our case, it would be more accurate to have 3 scenarios: one for each project separately and one for both projects at the same time to see the impact. JCDecaux always choose to have a conservative approach in order to be sure of the outcome once they take the decision, then, full cost will be a better choice. Note that the approach we choose is not that important as, theoretically, the break-even is supposed to be the same, no matter which approach we take.

28 « Marginal analysis is an examination of the additional benefits of an activity compared to the additional costs

incurred by that same activity. Companies use marginal analysis as a decision-making tool to help them maximize their potential profits. Individuals unconsciously use marginal analysis as well, to make a host of everyday decisions. » (Investopedia, 2017).

19 2. Cash vs P&L approach

When building a business plan, we must choose between a cash approach and a P&L approach. The cash flow statement would allow us to have a cash approach that give the picture of the cash that the company generates every year or every determined period. In many companies, that is the view they prefer as it really represents what they will have in the bank account at the end of the day. Moreover, it helps to determine the investment they need in accordance with the phasing of the needs (depending on the schedule of installation of the assets, the date of arrival of the employees and so on). The second approach we can take is the P&L approach, meaning evaluating the net result we would reach more than the cash the company would have. The idea is to estimate the sales, deduce from it the fixed and variable costs; then, deduce the deprecation to get the earnings before interest and taxes. Subtract the taxes and interest to get to the net income (it is also called “pro forma financial statement”). The advantages of this second approach are that you can classify the different operating cost to determine the operating margin (OM). Then, you can identify the depreciations, maintenance and spare parts to have the earnings before interest and tax (EBIT) and finally the net profit once we have paid the interests, taxes and other financial expenses. Many companies give a huge importance to the EBIT and the OM as they are key indicators. They can compare it to the existing structures and therefore, have an idea of the performance of the project. It also allows the company to set some objectives at every stage of the P&L and then, know where they have to make efforts if needed. Another advantage is that it gives some steps to control the accuracy of our model. According to JCDecaux habits, it is more common to focus on the P&L approach. The reason is very simple, even if Egypt would be a new business, the company as a whole already exists so, they already have other subsidiaries that can provide with cash during the first years of the project. The real question is: is it profitable or not? The easiest way to know it is to have the net result at the end of each year.

3. NPV, IRR, DPB ratios

After choosing full cost and P&L approach, we should determine what kind of indicators we are going to use in order to judge about the profitability of a contract. Many indicators exist such as: net present value (NPV), internal rate of return (IRR) or discounted payback ratio (DPB); we are going to see how to interpret each of them but also their strengths and weaknesses.

20 NPV: we can have a positive NPV if the market value for the project exceeds its cost. It results from netting the initial cost of the investment with the sum of discounted cash flows that the project generates. The formula for NPV is the following:

𝑁𝑃𝑉 = −𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 + 𝐶𝐹1 (1+𝑟1)1+ 𝐶𝐹2 (1+𝑟1)2+ 𝐶𝐹3 (1+𝑟1)3+ ⋯ [1]

Where: CF1: Cash Flow Year 1, r1: discount rate…

The goal is to have a positive NPV; as when NPV is equal to zero, it is the equivalent of the financial break-even, meaning that the project generates an operating cash flow that, when discounted at the required rate of return, results in a zero-loss game. We still need to be very careful with such an indicator as the projection is only based on what we know today. Errors in projected CF will lead to incorrect decisions so we need to evaluate the risk. It happens when we are overly optimistic about the future. We should try to assess the economic “reasonableness” of our estimates. We will also be wondering how much damage will be done by errors in those estimates. That is the reason why we have some sensitivity analysis in order to capture the impact of bad estimates. The advantage of the NPV is that it is quite easy to compute once we get the required rate of return and when the P&L is ready. Also, it gives you the present value of the project, so it means that we compare the value of money today to the same value in the future, considering inflation and return; meaning that the time value of money is taken into consideration. It gives a clear view of the potential revenue over years. Finally, the NPV allows us to take into consideration easily the risk of uncertainty as, by discounting every cash flow, the first years of the project have a higher weight than the following ones.

IRR: Internal Rate of Return, it is the rate of return that results in an NPV equal to zero. The financial break-even is reached when the IRR equals the required rate of return. This indicator can be seen as the discount rate where the NPV of CF is zero. Then, the formula is the same as the NPV, with the discount rate actually being the IRR:

𝑁𝑃𝑉 = −𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 + 𝐶𝐹1 (1+𝐼𝑅𝑅)1+ 𝐶𝐹2 (1+𝐼𝑅𝑅)2+ 𝐶𝐹3 (1+𝐼𝑅𝑅)3+ ⋯ [2]

As a rule, the higher the rate is, the more profitable the project can be and a company should accept any project that has an IRR that is equal or greater than the WACC (also called required rate of return). The advantage is that the time value of money is taken into account like for the NPV. If the calculation is made properly, it can be an excellent measure for the profit that can be made, considering the risk associated with the project. Also, the required rate of return needs to be constant over the years - which might not be the case in some projects -

21 otherwise we cannot compare it to the IRR and we cannot take the decision of rejecting or not the project. The last disadvantage is that if we have two different projects with two different IRR, when combining the two projects we cannot add up the IRR, unlike it is for the NPV. To do so, we need to start the calculations from scratch.

DPB: Discounted Pay Back Period, the goal is to know how long it will take to reimburse the capital expenditure involved in the project thanks to the revenues it generates. The huge advantage is that it is easy to understand for management and easy to picture for anyone. Also, as we are talking about the discounted payback period and not the simple payback period, it takes heed of the time value of money. But, if we use only the payback period, it might be complex to take a decision to invest or not as it just tells us when the project is going to break-even and does not quantify what is going to happen after. In this method, we do not consider the required rate of return, meaning that we do not consider the other investments the company could do with the money while the NPV and the IRR do consider it.

In a business such as JCDecaux, the indicator that we will focus on the most is the IRR as it gives a rate of return for a given project and we can easily compare it to 1) the required rate of return in the given country, 2) the return we already have in similar businesses. Also, the NPV will give an amount in a certain currency that might not be comparable to another project. We do not have this issue with the IRR. Still, the second most important indicator is the NPV. In fact, the reason is that we can quantify how much money we will make after we break-even. Also, we can compare this figure to the initial investment and it can help us rationalize the cash we can make with the project. But what if the NPV is 50 K€ after 20 years of operation and that the initial investment was 1 M€, we can question the return. Once again, the IRR can help us have an idea of the return. That is the reason why both NPV and IRR are paramount. Every disadvantage of one is compensated by the other and combining both gives more hints about the decision we should take. Finally, we also look carefully at the DPB as it gives an idea about the number of years of operation necessary to start making money. For example, if the DPB is 4.5 years but the project is over 5 years, the decision will probably not be the same as a DPB of 4.5 years and a 20 years contract.

4. WACC determination (or required rate of return)

To compute these different ratios, it is paramount to first determine the WACC: Weighted Average Cost of Capital. The goal of such a figure is to set the hurdle rate for capital investment and projects decisions. The firms’ WACC is the overall required return of the firm as a whole. It is the appropriate discount rate to use for the cash flows (CF), similar in risk to those of the

22 overall firm. The cost of capital varies from one company to another as it depends on factors such as its operating history, its profitability and its credit worthiness. As a rule, newer companies with limited experience and history will have higher WACC than established companies that already experienced investment choices. It is logical since lenders and investors will demand a higher risk premium for new entrants. As we just saw, the WACC is used to compute the NPV and the IRR. Then, to have an idea of the profitability of a project, it is necessary to have this indicator. For this, we need to value the firm equity and debt, the formula for the WACC is the following:

WACC =VE× RE+

D

V× RD× (1 − Tc) [3]

« V » the market value of the firm, « E » is the market value of equity (number of shares * price per share), « D » the market value of the debt (number of bonds * price of bonds), « Re » the required return on equity, « Rd » the required return on debt and « Tc » the tax on capital. We use the (1-Tc) only for debt as it is a tax shield/tax deductible (interest expenses reduce our tax liability) and because we are concerned with after-tax cash flow. As dividends are not tax deductible, there is no tax impact. « E/V » is the percentage of the firm’s financing that is equity, and « D/V » the percentage of the firm’s financing that is debt.

“Re” is the required return for the shareholders, given the risk, on a given firm. A firm’s risk profile can be seen in terms of two risks: business risk and financial risk. The first risk is relative to the activity of the company, the riskiness of the firm’s operation and assets, the riskiness of the operating cash flows, inherent to the firm’s operations. On the other side, the financial risk represents the extra risk for shareholders that arises from debt financing. In fact, in case of default, creditors and banks are going to be paid before the shareholders; so, if something goes wrong, having debt will delay the payment of shareholders (they can even never be paid). The formula for Re is the following:

𝑅𝐸 = 𝑅𝑓+ 𝛽(𝑅𝑚− 𝑅𝑓) [4] 𝑊ℎ𝑒𝑟𝑒: 𝑅𝑓: 𝑟𝑒𝑡𝑢𝑟𝑛 𝑤𝑒 𝑐𝑎𝑛 𝑒𝑥𝑝𝑒𝑐𝑡 𝑜𝑛 𝑎 𝑟𝑖𝑠𝑘 𝑓𝑟𝑒𝑒 𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝑅𝑀: 𝑟𝑒𝑡𝑢𝑟𝑛 𝑜𝑛 𝑡ℎ𝑒 𝑚𝑎𝑟𝑘𝑒𝑡 𝑝𝑜𝑟𝑡𝑓𝑜𝑙𝑖𝑜 𝑅𝑀 − 𝑅𝐹: 𝑚𝑎𝑟𝑘𝑒𝑡 𝑟𝑖𝑠𝑘 𝑝𝑟𝑒𝑚𝑖𝑢𝑚 𝛽: 𝑠𝑦𝑠𝑡𝑒𝑚𝑎𝑡𝑖𝑐 𝑟𝑖𝑠𝑘