NOVA School of Business and Economics

23

rdMay 2014

WORK PROJECT REPORT

HEALTH CONSCIOUS SEGMENT IN THE OLÁ

IMPULSE BUSINESS

Paula Sofia Valinha Gomes da Costa

— Nº 15/1178 —OLÁ AND THE ICE CREAM IMPULSE BUSINESS

Olá is an ice cream brand by Unilever that detains 91% market share of the impulse ice cream market. In Portugal, the heart of the impulse ice cream business is on the street (35%), even though restaurants and cafes are also highly relevant (23%). Given the high level of seasonality, it is difficult for ice cream to compete with other impulse snacks. However, the trend is for consumption occasions of ice cream to increase, which is an interesting fact that will be further analysed. Other relevant trends is the rising demand for premium ice cream brands and the rising health consciousness amongst Portuguese consumers. This latter one is shifting the demand from milk-based ice creams to water-based ones, as well as to more fruity flavors.1

Competition – Direct competition include all packaged ice creams (like Olá) as well as non-packaged ice cream (in which scooping and soft ice cream represent the biggest threat to Olá right now). Indirect competition are all the other impulse products that compete for a ‘share of stomach’. These go from food to drinks and from sweet to salty. Regarding competition on visibility, it is quite fierce, but Olá is still the most visible brand in Portugal (3 or 4 times more visible than Coca Cola or Lipton). Olá has been investing consistently between 4-6 million euros on visibility per year in, however in no consistent way.

Business Project Challenge

Our project had two different scopes: one was to find the right assortment per type of customer2

and the other was to explore the role of visibility and find a way to measure in order to optimize the return on investment.

Current assortment model of Olá – Olá has around 52 000 points of sale (POS) that sell impulse ice creams. POS include bar/restaurants, gas stations, beach kiosks, the zoo, etc... Unilever started last year to make the distinction between different POS by classifying them as C1, C2 and C3 based on sales figures. Regarding the Olá portfolio it responds to three needs: nutrition, if consumers are looking for an anytime snacking or have a nourishment goal; refreshment if consumers are looking for a lighter snack/drink; and indulgence, if consumers are craving for a sweet treat or an ultimate pleasure moment. A key success factor on assortment is maintaining desirability, which assures the right portfolio, development of new trendy flavors, innovativeness, surprises and the right advertisement.

Current visibility model of Olá – The visibility strategy is made through the use of POS materials that are distributed according to the potential of the POS (does it have a terrace, where is it located...). This is a big limitation given the subjectivity of the word “potential”. An additional limitation is the dependency on the POS to have the POS materials organized in the

1

Source: Euromonitor International, (2014), “Ice Cream in Portugal”

2

Customer refers to POS owner, while consumer refers to the final consumer of the ice cream itself

best way. POS materials are one of the KPIs of “Perfect stores” (which sell 16% above average) as well as if they are placed in visible places. The functional purpose of POS materials translates in an integrated model of five selling steps: (1) attract attention, (2) arise interest, (3) create desire, (4) build confidence and (5) direct action. Regarding POS material effectiveness, the higher the distance reached, the more visible they are; yet, the higher the investment too. Investment decisions should, thus, be taken carefully. This awakens the need for a systematic way of analyzing if investments should be made or not. The key success factors for visibility are to remain visible to consumers and always at an easy reach (availability).

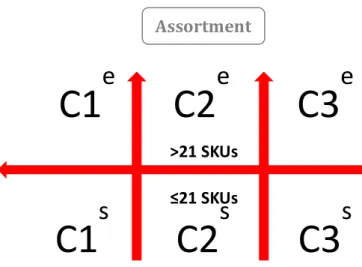

Findings and recommendations – Our research allowed us to gather some critical findings to come up with recommendations. We shall start with assortment. A critical recommendation on assortment was regarding customer segmentation. While visiting different POS, we noticed that there were huge assortment gaps within each customer segment (C1, C2 and C3). C1 had from 16 to 31 SKUs, and the same happened for the other segments. This made us wonder if POS sales figures were enough to segment customers, and hence we suggested a new customer segmentation model that would segment customers further by also considering their assortment completeness. Customers will be thus classified as ‘elaborated’ it they order a wider variety of assortment and as ‘specialized’ if they do not order as much. The 6 new customers will be: C1e,

C1s

, C2e

, C2s

, C3e

and C3s

(see Appendix 1 for further understanding). Also important is that the limited SKUs ordered by POS owners were chosen according to what their consumers usually asked for. We could find a pattern for POS next to schools that usually order more kids SKUs, and POS next to beaches/parks that usually bet on more refreshment SKUs. In this sense, to conciliate these findings, another recommendation was done to improve the price board strategy. There should be 2 Core price boards (1 transversal to ‘elaborated’ POS and 1 transversal to ‘specialized’ POS) and several Add-Ons that can be attached (according to the location of the POS for instance). Since SKUs can now be adapted to the local consumers, the number of consumers that quit on Olá when they don’t find their first option (18%) should decrease.

The challenge regarding visibility was overcame by building an excel tool that assesses POS performance and concludes with how much to invest or not at the POS: we called it the Diamond Model. POS performance consists of 4 variables that should be confronted with each other to build conclusions: POS sales, POS potential (both in terms of sales and visibility), Olá’s Visibility investment and Visibility execution at the POS. On a first stage, sales representatives evaluate the POS and fill in the POS scorecard (an excel grid). This will result in a POS performance overview that gives a visual and more understandable representation of the POS performance. Finally, based on the gaps between each one of the variables, an action plan to invest more or not is developed: a systematic manner to analyze where and on what to invest.

IS THERE A HEALTH-CONSCIOUS SEGMENT IN OLÁ?

Problem definition

Health consciousness is rising amongst Portuguese consumers. The increasing importance of health comes from a worldwide prevalence of overweight, obesity and other affluent problems such as diabetes or coronary heart diseases.

We will look at the sales potential of this growing health conscious segment. Are there any relevant trends that should be considered when analyzing the potential of this segment? How should Olá respond to this trend? The challenge remains the same: to serve the final consumer in the best way in order to increase sales. Are all the consumers being well served? Is there any need that is not yet being fulfilled?

Defining health-consciousness in the Ice Cream Industry

Regarding the definition of health, a study by Amber Ronteltap entitled “Construal levels of healthy eating: Exploring consumers’ interpretation of health in the food context” states that consumers generally value health in their food choices. Now, more than ever, health is one of the most influential motivators for food choice, amongst other less important factors such as familiarity with the product or the mood in which you are when buying it. This study also states that there are different interpretations for health.

When we asked consumers which characteristics would they expect to find in a “healthier ice cream” on the online questionnaire, we could objectively confirm that health does not always mean the same for different individuals. There were various interpretations of the definition, but some were clearly more mentioned: 77% of the respondents said they would expect healthier ice creams to have fewer calories, fat and sugar; 33% claimed that they would expect more nutrients and vitamins; and 22% referred that healthier ice creams were organic or “bio”. A smaller percentage said that healthier ice creams would be those that would not have artificial additives and colorants that are terrible for our health. Surprisingly almost half of the respondents also considered water-based ice creams to be healthier than dairy ice creams. At this level, it makes sense to compare this insight with the Euromonitor report that stated that the increase in health consciousness motivated consumers to shift away from dairy ice cream towards water-based ice cream. Not only they are regarded as healthier than dairy ice creams, but they also have a reputation for aiding digestion after a heavy meal. This has boosted demand for water ice cream, a category that grew in value by 7% during 2013. To further elaborate, a report by Technomic’s on healthy eating consumer trends mentioned that half of consumers say that descriptions such as low fat, salt and sugar clearly signal health.

It is now relevant to come up with a profile for a health-conscious consumer in the scope of this project. On the online survey, 55% of the respondents claimed to be always worried or almost always worried about their health when they choose something to eat or drink. This means they are aware of health issues and do care about their food choices and should be considered health-conscious. However, when choosing an ice cream this concern declines to 21%.

Characteristics such as being water-based and having low calories, fat and sugar are part of a the perceptions of a healthy ice cream and thus, when talking about health conscious consumers, we will be specifically talking about consumers that value these attributes in an ice cream.

Original approach by Olá

Currently, Olá has a portfolio formed of fruity ice creams, water-based ice creams and dairy ice creams. The proportion of SKUs is as follows: 50% on nutrition SKUs, 28% on indulgence and 22% on refreshment. In a general way, this diversity serves consumers that are looking for refreshment, consumers looking for a more complete nutritious snack and consumers looking for an indulgent moment. However, not to disregard is the fact that ice creams that satisfy the two latter needs are generally high on calories and fat, and contain a higher chocolate content; hence, the health conscious segment will not go after these ice creams as often as non health conscious consumers. The most suitable options for health conscious are then water and fruit-based ice creams, which constitute only 22% of the SKUs on the price board plus other low calorie and low fat ice creams like the Epá and the Big Milk.

A relevant point that plays in favor of the original approach (not segmenting health conscious consumers) is that consumers are already educated to restrain their ice cream consumption, and so, given that it is a “once in a while” (very rare) consumption it is not a serious problem if you actually consume a heavier SKU (like a Magnum or a Cornetto) instead of a lighter water-based or fruity SKU. Generally, consumers are already willing to make a short parenthesis on their diet as long as they keep their self-control later.3

This explains the lower concern when consuming ice creams (21%) versus the concern when choosing food and drinks in general.

Limitations to the original approach

Despite the three seemingly satisfied needs, people in general are restraining their consumption of ice creams due to the unhealthiness associated with it. More specifically for the health conscious segment, consumers claimed not to eat as much Olá ice cream as they crave for. More than 50% within this segment said they would not consume ice cream because it makes them fatter and 24% referred to unhealthiness in ice creams as the second factor that hinders them to

have more ice cream (see Annex 3, Table 1 for: Reasons not to consume ice cream more often). In fact, if Olá guaranteed healthier ice creams or ice creams with fewer calories, fat and sugar, health conscious consumers would certainly consume more. 37% of the health conscious segment said they would be interested in having more fruity flavors and water-based options in the Olá price board, as they perceive they could be part of a healthy diet.

At this point, it is relevant to make reference to a trend that regards to the occasions for consumption of ice cream. The Euromonitor report on ice cream trends launched in December 2013 states that consuming ice cream throughout the year is expected to become a more prominent trend in Portugal during 2014. Portuguese consumers are starting to look at ice cream more as a regular dessert than a treat only for hot summer days. This will mark a major shift from consumption patterns of previous periods: consumers will consume ice cream more often. This trend will promote high degrees of research, and will then result in a higher number of new product launches/innovations throughout the year. Furthermore, also part of the prospects for the ice cream market in Portugal, the report mentions a trend for consumers to shift from dairy to water-based ice creams.

To conclude, it seems that there is a gap between demand and supply that has potential to be fulfilled. On the demand side, we have health conscious consumers that do not consume ice creams as often as they would like to because they claim ice creams to be unhealthy and to make them fatter. Still on the demand side, there is a trend for ice cream frequency consumption to increase (ice cream viewed more as a regular dessert than a treat for hot summer days). On the supply side, there is a growing trend for manufacturers to explore fruit and water-based ice creams (because they are perceived as healthier), and to invest on fewer calories, fat and sugar. It seems rather true that there is an unfulfilled need and that supply is ready to explore the options. Shouldn’t they start?

What could be done differently?

This is an opportunity for Olá to better satisfy its consumers, satisfying their sweet tooth without hurting their waistline. Olá should take advantage from the new trend of consumer’s shifting consumption occasions to promote ice creams that can actually be consumed more often. These are the water-based and fruity ones. Promotion of these ice creams to this specific target will be analyzed further. Water ice cream maintains an advantage over other impulse and indulgence products which are popular as snacks, in that it faces less threat from growing consumer health awareness as water ice cream is considered to be a naturally healthy product. As such, it continues to be perceived as the perfect impulse and indulgence snack by many health-conscious Portuguese consumers. Also, refreshing fruit flavours such as mango are very popular among

Portuguese consumers, especially those looking for healthier products such as water ice cream. Premium ice cream brands (which are the most trendy right now) are responding to current consumer needs and their flavor preferences4

; Olá should not fall behind, but rather should keep up with the pace.

An additional reality that could also take advantage from increasing water-based and fruit-based ice creams are lactose intolerant people. These people have trouble digesting the sugar milk caused by the deficiency of an enzyme that would process the lactose. In Portugal, according to Jornal do Centro de Saúde, there are about three million people that suffer from this disease and consequently do not healthily digest lactose.

Who are these health conscious consumers?

Segmentation – Unilever has a very efficient consumer segmentation strategy, but the increasing number of health conscious consumers should not be ignored. Within this segment, the most valuable thing that marketing can do is to provide them with clear benefits of consuming ice cream. Benefit segmentation provides an understanding of why people buy in a market and can aid the identification of opportunities. Benefits sought by these group of people With the same product, ice cream, Olá is already responding to 3 different needs (nutrition, refreshment and indulgence), but this segment brings a new unfulfilled need: to eat a healthier treat more often, not only when it is warm, but as a regular dessert or healthy snacking option for an ordinary afternoon. It is also possible to segment these group of consumers based on their lifestyle. Lifestyle segmentation aims to categorize people in terms of their way of living, which is usually reflected in their attitudes, interests and opinions. An interesting conclusion is that the 55% respondents considered health conscious generally scored higher on the questions regarding healthy daily habits than the remaining interviewees.5

This means that health conscious people have healthier habits than the rest of the interviewees. Lifestyle is also a powerful method of segmentation as particular lifestyles have fairly predicable media habits. We will see further on how this is advantage for successful segmentation.6

Targeting – Before setting the targeting priorities, we should first verify if this segment is capable of assessment on 5 criteria. First of all, it is a measurable segment since it is easy to find some healthier trends on the daily routine of these consumers. They are mainly women, from young adults to adults, and worried about food choices. It is profitable because half of the segment is willing to pay until 20% more to have healthier options and 25% are willing to pay

4

See Annex 3, table 2 for top flavors (Data collected for the Business Project)

5

See Q11 from Annex 5 (online questionnaire)

more than 20%+ than a general ice cream. Thirdly, it is accessible in the sense that the health conscious segment is usually reachable through certain media means. As they are more careful and thoughtful about what to eat, they will be more likely to read magazines/books, watch TV programs or visit websites regarding this topic; hence, they can be reached through these means. In fourth place, they are an effective segment because they have relatively homogeneous needs: eat snacks, yet they should be healthy. And finally, health conscious consumers are actionable because it is possible to fine tune effective marketing programs to use upon them. For instance, 52% said that they would consume more ice cream if they could check the low calorie number next to the ice cream on the price board (or in the package itself).

Now, that the health conscious segment looks like one with high potential, we should analyze the most efficient way to target these customers. When a brand is established in a product category, like Unilever is in the ice cream market, there are three options for growth. Growth may be achieved by (1) targeting current consumers and convincing them to spend more on the brand, (2) targeting competitors’ consumers and persuading them to switch their purchasing to the firm’s brand, and (3) convincing non category users both to consume in the category and when doing so, choosing the firm’s brand.

A natural first step is to target current consumers because they are already aware of the brand. Since this is a low impulse market, retention is low and consumers spread their category spending across multiple brands. Thus, the firm should implement strategies to increase loyalty. For instance, loyalty programs such as a frequent purchase booklets that you fill in with stickers and when you finally achieve the end you gain a bonus ice cream. The second approach, which could also be adopted to target these consumers, is to target consumers of competitor’s brands, who are similar to the current consumers of Olá or have similar AIO to the ones in this segment. When current consumers are targeted, the goal is to retain these consumers and if possible expand their usage. When competitor’s consumers are targeted the goal is to offer a proposition that is sufficiently attractive to overcome switching costs.7

It is refreshing, it is sweet, can be a snack… but still it is healthy.

Positioning – The idea is not to position indefinite healthy SKUs to satisfy the health conscious segment. Also because this would suggest something really unpractical: the deletion of other fundamental SKUs from the price board. The idea, on the other hand, is to reposition some already existent brands as healthier and as possible to consume every day. Repositioning is done for several reasons, but in this case it makes sense to do it given the need to change the perception of specific brands. An efficient marketing mix for the health conscious segment

includes a marketing program that defines products, distribution channels and pricing strategies and communication programs that best suit these people lifestyles.

Products – Given the preferred flavors from consumers (see Annex) and the already referred trends, there are several ice creams that could be relevant to focus on. These are:

- Calippo ALL Fruit: Not only the Mango flavor like previously recommended on the BP, but also the Strawberry flavor, which is the most demanded fruit in our respondents sample from the BP.

- Solero Berry Explosion: 95% of the respondents that said that “being healthy” or “being a ‘diet’ ice cream, low on calories, fat and sugar” was a requirement for consuming an ice cream, also said they would consume ice creams such as Solero if they existed

- Solero Ice Pineapple: Refreshing, healthy treat that allows for weight control since it only has 65 kcal

Place – The way to to distribute these SKUs is common to the other distribution channels of other price board SKUs.

Price – Should remain the same price. However it is relevant to consider that people are willing to pay at least 20% more, if they are healthy.

Promotion8

– Online respondents that we classified as health conscious referred to several measures that would lead them to consume these healthier ice creams more often. (See Annex 3 Table 3 for further understanding). Promotion should also be done in a way that it follows trends for ice cream consumption. This means that promotion should be aligned in the trend of consuming ice cream more often (as a desert or regular afternoon snack). The idea is to incentive a daily consumption of healthy ice creams.

This communication programs should build awareness on the healthiness on these SKUs, but given the low level of involvement of consumers with these products, big masses of information are not well regarded by them. Instead, advertising messages should be short, but with high repetition to enhance learning.9

These short messages should state the benefits of consuming the product, so consumers immediately identify themselves with it and feel curious to try it. Messages should state the fruity benefits of Calippo ALL Fruit (both Strawberry and Mango), their icy, fresh and healthy consistency; the low fat content of ice creams such as the Big Milk and Epa; and how healthy and indulgent can Solero be simultaneously.

Interactive advertisement is something that could also be done to increase the buzz about the healthiness in these brands. Interactive advertisement could be a contest on the nutritional value of these SKUs. Word of mouth is a powerful marketing tool these days and if consumers start talking about how wonderful it is, Olá will definitely take advantage of it.

8

See Annex 4 for Brand Communication Programs

REFLECTION ON LEARNING

a) Previous knowledge learned from my Masters Program

I used the basic marketing model of Segmenting, Targeting and Positioning to analyze the potential of the health conscious segment. Then, after finding out that this segment would be relevant, I did a suitable marketing mix to meet their needs. Gladly I also had some brand management knowledge that served me very good use to structure the last part. If it was not for this class I would not remember that a brand positioning statement is what brand managers would like consumers to know about the brand. And that, based on this, they build marketing and communication programs to convey the message. This is relevant because it allowed me to come up with this fresh and creative way of communicating the healthiness of specific ice creams to consumers.

b) New knowledge that could be applied in the Business Project

The new perspectives that I gained with this project were actually regarding project management practices. Given the short period that we had to make the BP happen and the two huge challenges in front of us, we really had to organize timings and make internal deadlines in order not to fall behind. On a first stage, we were actually falling behind because we didn’t know where to go, but as soon as we developed a BP plan we got on track and, at least, we felt we knew in which direction to go and to what would that lead us. Slowly, by doing field research and talking with every stakeholder (being it a sales representative or a POS owner), we started getting a bigger sense of Olá, and soon we were already doing big creativity brainstorming meetings with the whole group. Of course we thought about solutions and recommendations together, but given the size of the project and time constraints, it was beneficial to split the group in two, so that each one could specialize on a given topic (two on visibility and three on assortment).

c) Personal experience

i. Key strengths and weaknesses

I would say there are three things that I feel to have contributed with. In first place, is my sense of cooperativeness. Since I am committed to what I do, even after dividing tasks where each one should focus on doing theirs, I am always willing to help if someone is having problems, trying to give my insights the best I can. Also, I feel to have been very flexible: not only in time management where I always made myself available, but regarding decisions within the group too. I am firm in my thoughts, and try to defend my ideas once, twice or three times. However, if the others don’t agree, I won’t push them to agree. Lastly, I believe to have contributed with

many creative insights that helped us overcome some challenges posed by Unilever. On the other hand, sometimes this could be understood as inefficient, because discussions may easily loose focus. Another relevant weakness is that I tend not to like people to criticize my work, since I strive to do my best at every moment. It is not a common thing to happen but when it happens I know I don’t like it.

ii. Plan to develop my areas of improvement

I believe the first step to developing areas of improvement is to be aware of which are actually these areas of improvement. In this sense, I would collect all the unfortunate behaviors or weaknesses while working in teams. The next step would be to understand the cause of each inefficiency/negative result. If it is something caused by my personality, I would probably have to think (and educate myself) about alternative positive ways of dealing with it. For instance, while having a discussion on how to solve problems, it could be useful for me to write down the goal/objective of the discussion on a piece of paper in front of me, and constantly look at it in order not to loose focus.

d) Benefit of hindsight

Reflecting on the business project, the most value adding factors were, in first place, the team. There was a lot of discussion in which everyone participated, members listen to each other and communicate constructively. None of us were afraid of being foolish by putting forth a creative thought even if it seems extreme. Everyone was reliable and showed commitment. This resulted in a creative project in which challenges were responded effectively.

Besides some limitations that hindered us to make a better project, such as the time of the year to develop the project, there are certain aspects that we could have controlled more effectively. Misunderstandings are a common happening within groups and, to avoid them, more organization is needed. Starting with the organization of dropbox folders and going all the way to standardized word documents to fill in with meeting summaries, this is something that would have certainly added value. Meeting summaries should have standardized topics such as objectives and conclusions of the meeting.

Despite everything, the Business Project on Improving the Impulse Business Model of Olá, together with my Work Project, allowed me to gather some of the most relevant pieces of information I have ever collected. It was undoubtedly challenging, extremely fun and enjoyable and I consider myself lucky to have had the opportunity to do it. J

ANNEXES

Annex 1 – New Customer Segmentation Model

Figure 1: New segmentation model and respective available assortment (Field research)

Figure 2: New segmentation model >21 SKUs ≤21 SKUs Sales Assortment

C1

s

C1

e

C2

s

C3

e

C2

e

C3

s

C1 C2 C3 31 16 13 32 8 17 C1e C1s C2e C2s C3e C3sAnnex 2 – Visibility Diamond: Case study for a specific POS

Step 1 – Assess if actually the visibility model is being well implemented by the POS. According to the tool, the level of visibility execution is higher than the investment made and so we are able to see that it is.

Step 2 – Firstly, we see if there is space for improvement. Since the POS potential is higher than the sales it means that there is still room for improvement. In that case, how much would it be the necessary to invest and what would be the gain from this. According to the tool, the investment needed in relative terms is increasing in 90% the spending; while on the other hand, the gain from investment would be a marginal increase of 10%.

Step 3 – Since this is not enough, before taking any decision on investment, one must see if actually there should be an investment. In this case, according to the visibility diamond, the ROI is negative and thus, it is not advisable to invest in this POS in specific.

POS _ _ _ _ _ _ _ _ _ _

Sales Representative _ _ _ _ _ _ _ _ _ _

Area _ _ _ _ _ _ _ _ _ _

Address _ _ _ _ _ _ _ _ _ _

Type of POS _ _ _ _ _ _ _ _ _ _

Last Assessment _ _ _ _ _ _ _ _ _ _ Score (1-‐10) POS Sales 4.8 POS Potential 6.4 Visibility Execution 4.4 Visibility Investment 3.6 ACTION PLAN STEP 1 Is Visibility well executed by the POS? YES STEP 2 Is there space for

improvement? YES STEP 2.1 How much investment needed? 3.2

STEP 2.2 What is the gain from investment? 0.4

STEP 3 Should Olá invest? NO

STEP 3.1 ROI -‐0.9 0.0 2.0 4.0 6.0 8.0 10.0 POS Sales POS Potential Visibility Execution Visibility Investment POS PERFORMANCE

Annex 3 – Online questionnaire results

Table 1: Reasons for the health conscious segment not to consume Olá ice cream more often Question: Why don’t you consume more Olá ice creams? Choose the options

that best fit you.

Percenta ge

They make me fatter 52%

They are unhealthy 24%

They are expensive 21%

It is not possible to reserve and consume later 9% Prefer other premium ice cream brands 6%

It is not possible to share 2%

Table 2: Top flavors preferred by online respondents (Data collected for the Business Project)

Table 3: Marketing for health conscious consumers

Question: What would make you eat more ice cream? Percentage Put the calories next to the ice cream on the price board 52%

Write down low-‐fat/low-‐sugar 21%

TV and radio advertisement 13%

Spread billboards around the city 11% Launch a contest where consumers can interact more with healthier

Annex 4 – Brand Communication Programs

Billboards to spread around the city

Billboard 1: Calippo ALL Fruit Mango and Strawberry

Billboards 2: Calippo ALL Fruit Mango

The lighter choice

99% fat free

*No artificial additives and colorants

Have you

snacked

Billboard 3: Solero Berry Explosion

Billboard 5: Epá, only 85 kcal did you know it?

Appendix 5 – Online questionnaire

1. Sexo - Feminino - Masculino 2. Idade - 0-15 anos - 16-30 anos - 31-45 anos - 46-60 anos

3. Preocupo-me com a saúde quando como/bebo: - Sempre

- Quase Sempre

- Nem pouco nem muito (nem sempre nem nunca)

Only 85 kcal

- Quase Nunca - Nunca

4. Preocupo-me com a saúde quando como um gelado - Sempre

- Quase Sempre

- Nem pouco nem muito (nem sempre nem nunca) - Quase Nunca

- Nunca

5. Além do sabor, o que é que procuras quando estás a escolher um gelado da Olá? Escolhe as 2 hipóteses que mais se adaptam a ti.

- Ser crocante/estaladiço - Ser minimamente saudável

- Ser “diet”: Ter menos calorias, gordura e açucar - Ter chocolate

- Ter uma boa textura

- Que dê para variar dos que normalmente escolho - Que dê para partilhar

6. O Solero (gelado de leite e fruta) é considerado um gelado "diet". Outros gelados "diet" da Olá são os gelados de gelo (Calippo, X-Pop, etc...)

Estarias interessado em consumir novos gelados "diet" da Olá? - Sim, só os de fruta (da familia do Solero)

- Sim, só os de gelo (da familia do Calippo) - Sim, experimentaria os de fruta e os de gelo - Não

7. Quanto mais estás disposto a pagar por um gelado "Diet" que não engorde tanto quanto os outros da Olá?

- Estou disposto a pagar até 20% mais (por exemplo: pagar 1,20€ em vez de 1€) - Estou disposto a pagar mais que 20% adicionais

- Não estaria, de todo, disposto a pagar mais - Outro?

8. Para te fazer comer gelados "diet", o que achas que era uma boa campanha de marketing para ti?

- Pôr as calorias ao lado do gelado no cartaz da Olá

- Escrever low-fat e low-sugar ao lado do gelado no cartaz da Olá

- Lançar um concurso sobre estes gelados "diet" para que comeces a ouvir falar deles - Espalhar cartazes de publicidade pela cidade

- Fazer publicidade na TV e na rádio destas inovações - Outra?

9. Porque é que não comes mais gelados da Olá? Seleciona as que mais se adaptam a ti. - Porque são caros

- Porque não são saudáveis - Porque engordam

- Porque não é possível partilhar

- Porque não é possível guardar e consumir mais tarde - Outra?

10. Se te dissessem que agora havia gelados da Olá "mais saudáveis", o que interpretarias? Escolhe de 1 a 2 hipóteses.

- Tem menos calorias, gordura e açucares

- Que iria haver mais gelados de gelo e fruta e menos gelados de leite e chocolate - É orgânico/biológico

- Tem mais nutrientes e vitaminas

- Sem aditivos artificiais, corantes e conservantes - Bons para a dieta das meninas porque não engordam

- Bons para as crianças porque não têm componentes que fazem tanto mal

11. O que é que costumas fazer para seguires um estilo de vida saudável (Sendo 1 Nunca e 4 Sempre)

- Como bem e a horas certas

- Planeio o género de refeiçao: peixe, carne, salada (não como só o que me apetece) - Não salto refeições

- Faço exercicio fisico

- Vou de transportes públicos/carro quando posso - Vou a pé quando posso

- Uso as escadas em vez do elevador quando posso - Procuro alimentos bio/orgânicos

- Procuro opções menos calóricas, com menos gordura ou açucares - Quando como fora procuro alternativas saudáveis

BIBLIOGRAPHY

Articles:

- “Construal levels of healthy eating. Exploring consumers’ interpretation of health in the food context” – Amber Ronteltap, Siet J. Sijtsema, Hans Dagevos, Mariët A. de Winter

- ‘Consumers' ideas of 'healthy' foods changing’ – Nora Simmons

- Euromonitor (launched December 2013), “Ice Cream trends in the Portuguese Market”

Websites:

- http://www.idfa.org/news-views/media-kits/ice-cream/ice-cream-labeling -

Books:

- Kotler, Keller, Brady, Goodman and Hanse (2009), “Marketing Management”, Pearson Education Limited

- Tybout and Calder, “Kellogg on Marketing”, 2nd edition