The theoretical background chapter focuses on describing the origins of start-ups and narrows in on the Finnish technology start-up industry and its adoption in the global economy. The paper then examines lean startup theory as one of the best practices for innovative new ventures. A single, holistic case study is used to observe the start-up and create a business toolbox for further use in business planning.

As a result of this work, the following results are presented to the company in the case: SWOT analysis, business model Canvas, two people and empathy map and current trends in fin-tech (theoretical background). The Business Model Canvas, supplemented with a case study, shows a clear picture of current business activities and guides to further business development. All generated data is transferred to the company for further use in the form of editing templates.

Unique time for Fin-tech start-ups

Today, conservative solutions fail to meet customer needs for flexible, mobile, and cost-effective products. The 2008 financial crisis has shown that the financial markets have no cheap alternative solutions to replace old-fashioned products. Finally, Third World countries suffer from a lack of basic financial infrastructure because traditional financial market players do not view geographic expansion into these areas as risky.

Continuous business planning

Focus of the thesis

Purpose of the thesis

Research questions

Theoretical approach

Framework of the thesis

Start-ups

The primary value proposition of these start-ups is "time to market". Such companies are set up to develop an innovative solution in a particular industry and be sold to a large corporation within a short period of time. These companies are not focused on global expansion, but rather on the development of know-how that can be beneficial to market leaders. Thus, large companies are not taking an image risk by pushing a brand new white label product into the wild market to gather customer responses and needs.

The main goal of these start-ups is to generate a valuable contribution to society and make the world a better place. Since the beginning of the XXI century, start-ups have received tremendous attention from researchers, media, and even international politicians. According to The Economist report (2014, p. 2), the entrepreneurial explosion nowadays is similar to the moment of the "Cambrian explosion" on planet Earth, when life forms began to grow rapidly.

Fin-tech start-ups

The hi-tech revolution, driven by a wave of start-ups with innovative new business and revenue models, new products and services, is changing finance for the better globally. These high-tech companies offer users a range of financial services that were once almost exclusively the business of banks” (Chisti et al., 2016, p. 5). There are a few sub-sectors of Fin-tech where young start-ups have already successfully challenged traditional financial institutions.

Fintech lenders help online and 24/7 due to a high degree of automation and industry-less approach to doing business (Scott-Brings, 2017). Another example: some start-ups develop a platform where people can lend money to others and benefit from interest (Scott-Brings, 2017). The Fintech world has yet to see how wide the scope of mobile payments will become in the future.

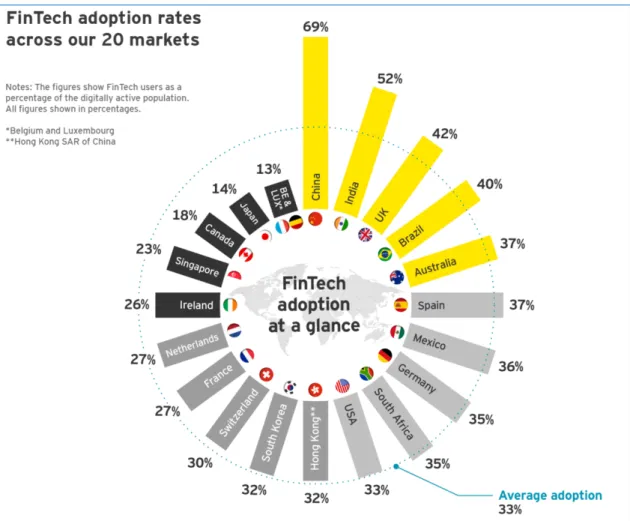

Fin-tech adoption

Neobanks are similar to traditional banks; however, they use the most updated and upgraded IT tools to run the banking business. In the realities of the 21st century, neobanks are conventional banks, but without physical branches (branchless). Neobanks are also sometimes called online banks and challenger banks because the intention of such companies is to attract the segment of customers who are not satisfied with the level of service in the traditional institutions.

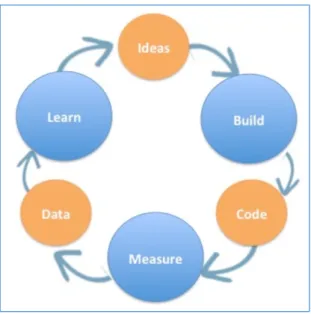

Lean start-up

This policy makes it possible to coordinate and evaluate the initial components and, if necessary, change them in order to be successful in the market and meet the demand of consumers. Instead, Ries (2011) proposes to create a concept, but with clear goals and functions clear to its final consumers and to already place it in the market. This involves obtaining feedback from customers to understand their response, overall response and satisfaction level, as well as proposed suggestions regarding product or service improvements, or changes.

It is called "Learn" which, originating from the meaning of the word, implies the understanding of the possible flows in the product or service and implies a course of actions to be taken to improve them. And, when changed or changed, the product or service appears again in the market. That is why this principle can be called "of the cycle" because it requires continuous construction of the product or service, its measurements from different.

Essential business techniques for start-ups

- SWOT

- Business Model Canvas versus Lean Model Canvas

- Persona and The Empathy Map

- Case study

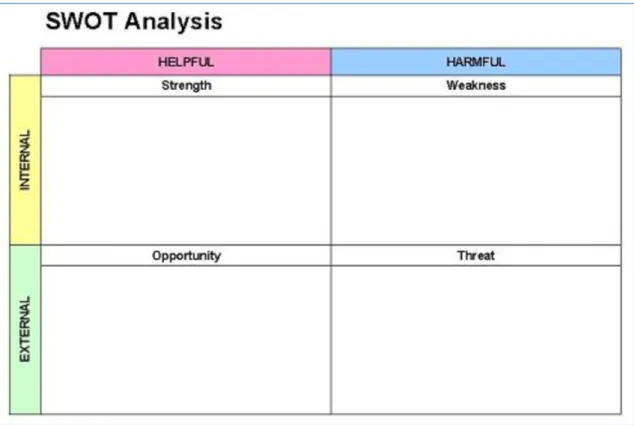

Turning to the understanding, strengths and limitations of the tool, it is necessary to explain how the analysis is carried out. Often, SWOT is presented in the form of a matrix (or table) shown above, where the information (facts, points, etc.) relevant to one of the four parameters is inserted into the appropriate row and column of the table. Further, sometimes the table contains more opinions (which are certainly subjective in nature) than solid facts or evidence.

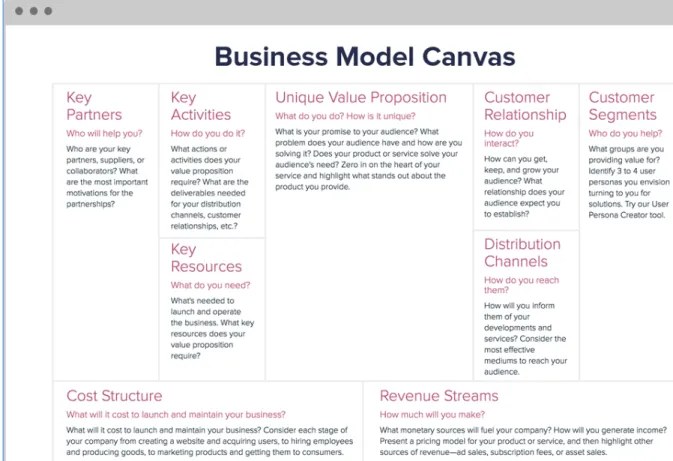

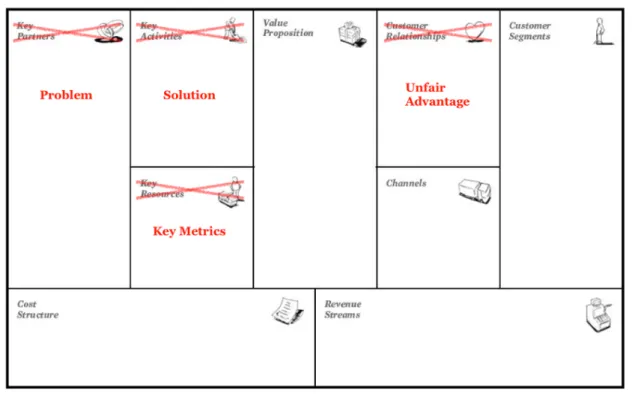

For that reason, SWOT cannot be called an objective instrument and depends to a greater extent on the perception, knowledge and expertise of the person performing the analysis. That's why there are variations of Osterwalder's original BMC today. One of the most suitable derivatives of BMC that is extremely relevant for start-ups is the method called "Lean Canvas", created and developed by Maurya (2012) because it is better adapted to the needs of start-ups.

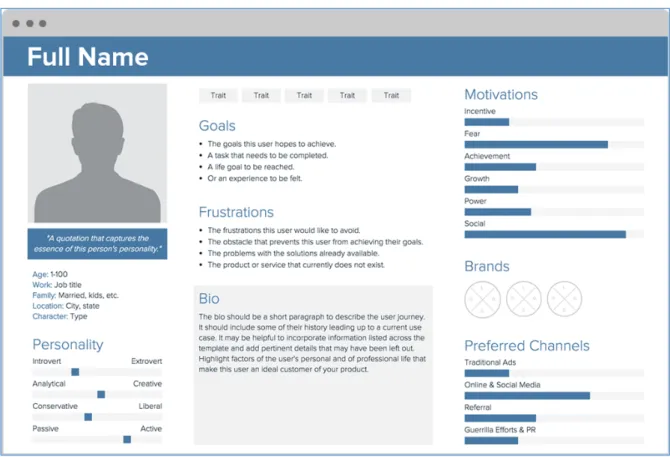

As seen in the table, the Lean Canvas has certain similarities to the original version of the Business Model Canvas. It is a simple problem-solving approach that enables the entrepreneur to develop step-by-step Table 1: Business model Canvas versus Lean Canvas. An analytical tool called Persona was informally developed by Cooper in the 1980s as a way to better understand the behavior patterns and attitudes of the potential user of his product (in Cooper's case, it was software).

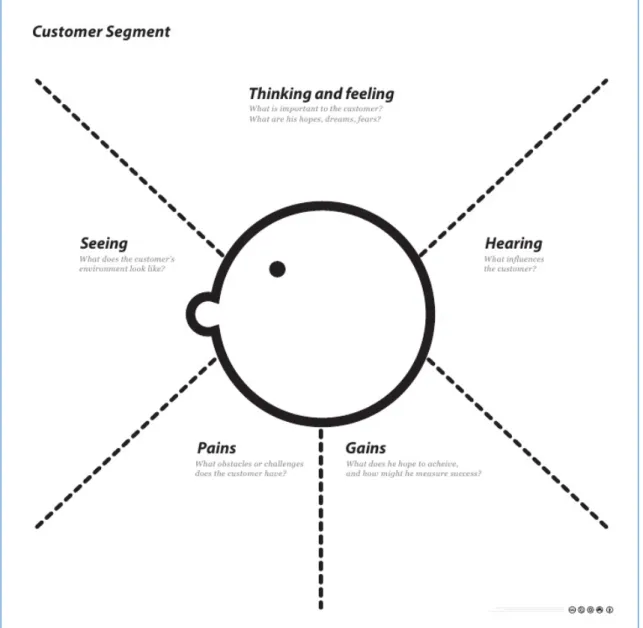

The Persona Principle emphasizes the importance of understanding the nature, desires, motives and attitudes (in general form) of the potential customers or buyers in order to tailor the product or service to their needs. In addition, building Persona profiles helps developers to feel more empathy for their potential users, in other words, see everything through the eyes of their customers and come up with problems that can only occur with customers, not with developers or creators of the product. product. , employ. Like Persona, it captures the client's feelings, motives, and behavior patterns, but unlike Persona, it is more general and a tool that requires a lot of creativity.

Eriksson & Kovalainen (2016) state that the case study is an effective technique in business research due to the availability of presentation of certain issues in a practical and accessible form.

Data sources and collection techniques

Yin (2003) subdivides case studies into four categories depending on a number of case designs and units of analysis.

Case study. SnapSwap International S.A

- Redefinition of the financial industry

- Minimum Viable Product (MVP): Gloneta money messenger

- Business Model Canvas

- SWOT analysis

- The Empathy Map and Personas

- Interview with the founder

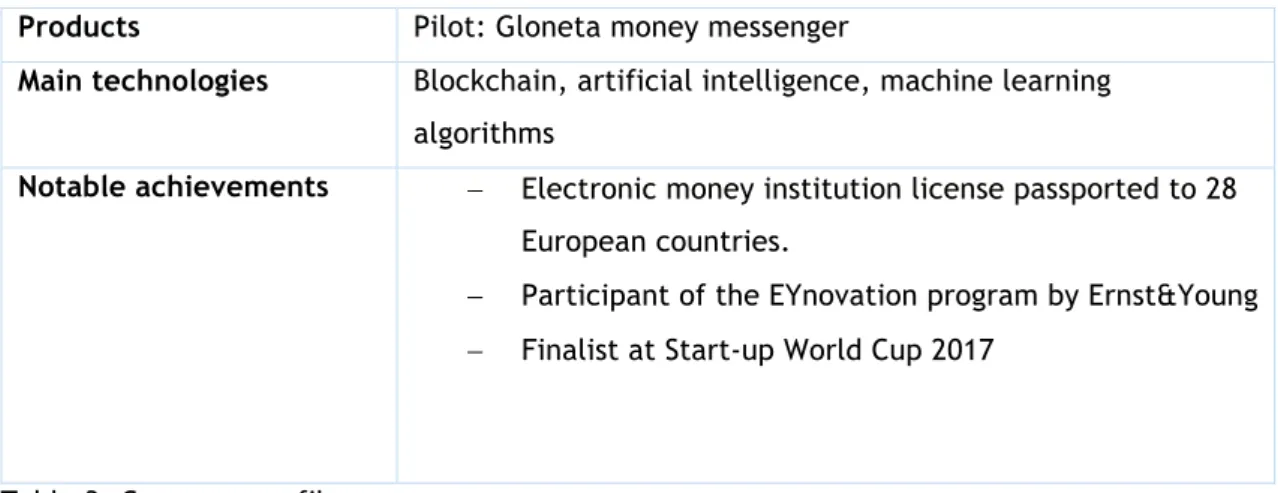

Participant in the EYnovation program of Ernst&Young - Finalist at Start-up World Cup 2017. The company is located in the Lux Future Lab incubator in the city center of Luxembourg. The incubator is backed by BGL BNP Paribas, one of the largest banks in Luxembourg.

As a participant in the startup incubation program, SnapSwap has accessed the bank's expertise and services not available to an outsider. If the balance is not sufficient to carry out a transaction, the money is taken directly from the user's bank account via his previously registered bank card. The company points out that in the modern world of online and social interactions people prefer to make financial transactions as easy and convenient as sending messages online, using a.

As the company has been conducting business development since 2015, the Business Model Canvas has been chosen as a tool to measure the business model for the pilot product from SnapSwap International. To meet the demand for a linked credit card, the company will offer a Gloneta credit card for free with fees subject to certain withdrawal and spending limits. Currently, the company is running a referral campaign that allows you to invite a friend and receive a bonus of 5 EUR.

The company charges for instant top-ups via credit card, multi-currency transactions, premium features of the Gloneta credit card (once it is released). Review of the company and implementation of the Business Model Canvas has created a clear picture of the business phase of the company. The company is based in the LuxFutureLab incubator powered by BNP Paribas, a leading banking group in Europe.

After the financial news, he immediately realized a high potential in blockchain and started thinking about different services based on this technology. Denis: Yes, I started my career in Washington DC at the World Bank, one of the largest financial institutions today. Denis: When we applied for the license with the CSSF, we had started and presented the concept for the application.

Recommendations

Above all, we are interested in promoting the app in Luxembourg and then in the Benelux area.

Conclusion

Available in 28 EU countries - Freemium Gloneta credit card linked to the balance (coming soon) - Multi-currency transactions (EUR-GBP-USD-more to come). Ameli, a 19-year-old business student from Luxembourg is trying to find her place in the metropolitan area. Ameli is one of the students who actually follows new trends in social and digital worlds.

Still, Ameli can't find the right app to share accounts and send money to her friends instantly.