The objective of the thesis was to improve the efficiency of the invoice approval process by increasing the second approvers' knowledge of the process, best practices and related terminology. This thesis will focus on developing the A/P bill approval process to restore efficiency and standards formation.

Thesis topic

The thesis plan also contains a brief description of the selected creditors and invoice approval process related concepts and theories, which will be presented in a broader form later in this thesis. Lack of accuracy and efficiency in the invoice approval process can cause problems that go further than one might expect.

Objective and purpose

What information might other approvers need in order to avoid errors and to make the invoice approval process as clear as possible?”. What are the common problems to avoid in the accounts payable and invoice approval process.

Concepts and theory

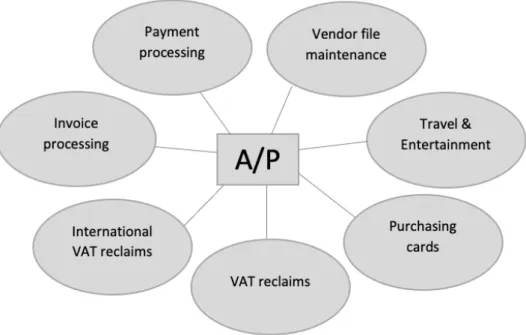

A/P and the approval process

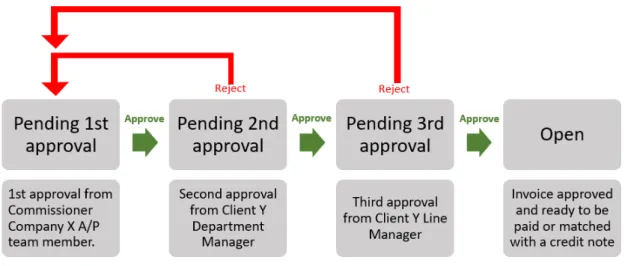

Outsourced Financial Management is followed by a chapter that describes and defines a key part of invoice processing: the approval process. The sub-chapter of the approval process will present the purpose of including the collection of approvals in invoice processing.

Written guidebook for approvers

Writing in an informal style is excluded, since the guide's target group is the customer of company X, which means that a formal writing style is required in communication. The Language Institute of Finland (n.d.) also emphasizes the importance of making the instructions easy to understand.

Methodology

The relevant information extracted from the documents is the content of the approval, override approval, and rejection notes. The interviewer's reactions, comments, or unconscious bias can influence the interviewee's answers.

Thesis process

Accounts payable

The software is also able to filter out duplicates of documents that have already been backed up. When the importance of the A/P function is ignored, a company can face challenges that affect the company's financial success.

Outsourced A/P

Outsourcing can also increase efficiency if, for example, the customer's company has multiple A/P departments in different locations. According to Duening & Click, a success factor is clearly defining not only the responsibilities of the service provider, but also those of the customer.

Approval process

Therefore, the approval process for incoming invoices from Company X's perspective is not based on three-way matching. However, it is highly likely that the second approver will unofficially perform a three-way match to verify the validity and accuracy of the invoice.

Common A/P and approval process problems

The possibility of human error increases the importance of the approvers carefully reviewing both the invoice and the bookkeeping. It may be that the person responsible for the order places an order and provides insufficient billing information to the supplier. The invoice is sent back to A/P, who investigates the correct destination for the invoice and sends it back for approval.

If this process happens to take place during the closing period, there is a change in that there is not enough time to get the invoice into the books of the company it really belongs to. It may be that the due date of the invoice has already passed before the booking and approval process is completed. Approval of invoices and credit notes is often not the first priority of the approvers, as they also have other areas of responsibility (Bragg 2013, 26).

Since the time taken for approval significantly affects the duration of the entire workflow, approvers should be informed in the manual that checking documents as often as possible is of great importance.

Commissioner Company X

Client Y

This chapter will discuss the background of data collection and the process of data collection in more detail. The chapter presents how the data collection was prepared in advance and describes the data collection process.

Collection of interview data

The interview questions were sent to the interviewees about a week in advance, which allowed the interviewees to prepare before the interview, for example, to find examples that support their findings and experience with the issue.

Collection of data from document notes

This chapter focuses on analyzing the interviews conducted with the financial management experts of Company X, who work on the team that handles the accounting and accounts payable of Client Y. For example, the interviewees share what issues cause delays in the approval process and what they think the guide should contain.

Interview with A/P team member

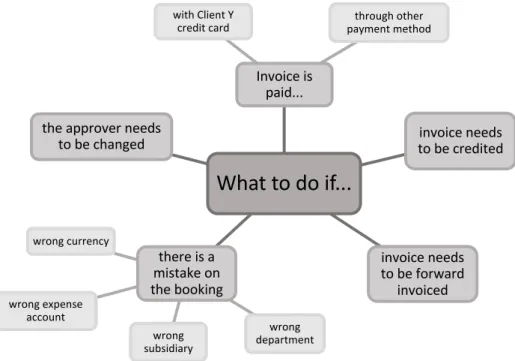

Ignoring instructions can also be a signal that the approver may not understand why the invoice should be accepted even though it has been paid. It appears to the A/P professional that approvers are not passing invoices pending approval often enough. Therefore, she suggested that the guideline should have a guideline on how often pending documents should be checked.

Another aspect the guide should address according to the A/P professional is placing orders with accurate billing information. She cited an example where the approver had rejected the bill saying the bill should be billed upfront. This means that the approver did not check the reservation carefully enough to notice it.

Two key elements she put forward were that the guide should be very simple and as compact as possible.

Interview with accounting team member

Therefore, she agrees with the A/P team member that the manual should include examples of billing address formats. As a good option for them, she sees that the approvers could be instructed to request separate invoices from each company or unit containing only their share. In contrast to the other interviewee, the bookkeeper sees that the second approvers regularly go through invoices and that there are not many documents left to wait.

However, she thinks the guide should include a recommendation on how often pending documents should be checked, preferably on a daily basis. In other words, it may be enough for approvers to just leave an approval note about the changes they request and approve it going forward. In addition, there is a risk that the invoice will be paid before corrections for example with the wrong amount.

All in all, since there are differing views within Company X on this issue, it's no wonder that the approvers aren't sure what the best practice is.

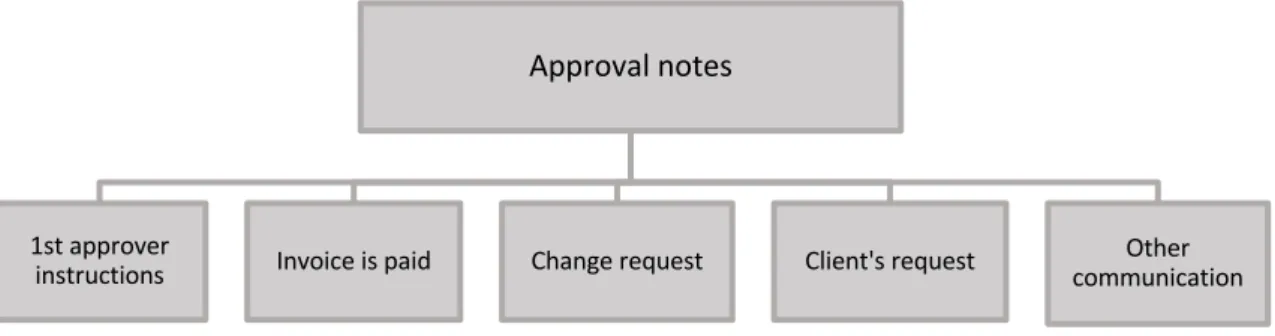

Approval notes

The analysis of approval, rejection and override approval notes began by exporting the search data from the accounting software to an Excel spreadsheet. Each row is then color coded based on the reason the note was left. For example, based on the approval notes, the first approvers instructed the other approvers not to reject an invoice if a credit note came.

That way, Company X employees don't have to instruct each approver individually through approval notes. Some approval notes were classified as internal communications between the second and third approvers because they did not contain clear change requests or instructions. In conclusion, based on the approval notes, the manual should advise the approvers when to approve a document and when to reject it.

They should also be encouraged to continue to inform A/P of paid invoices in approval notes, but only in cases where the invoice is not paid by Customer Y credit card.

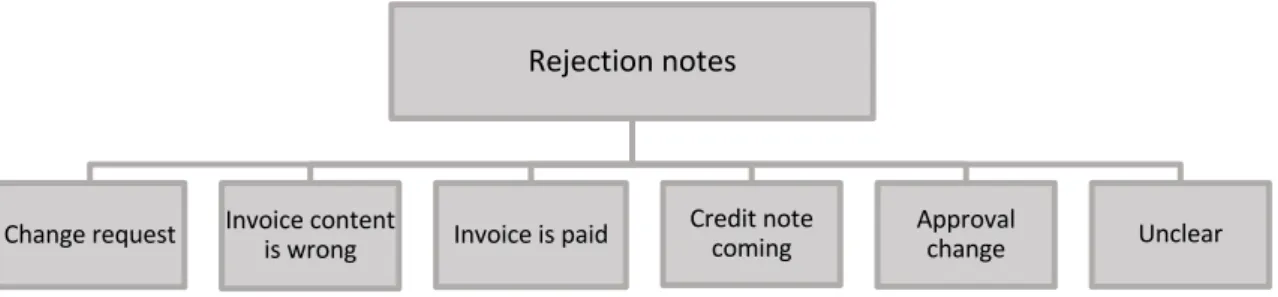

Rejection notes

Additionally, follow-through with clear communication of what approvers want to do with the reservation should be encouraged in the manual. Again, since Company X is not involved in the purchasing process, it is impossible for them to know which services were ordered by which unit. If the billing address is not specific and does not clearly communicate which of the many units in the same franchise it belongs to, it is difficult for both the A/P and the approver to determine who the expense really belongs to.

Apart from the reasons for the rejection note, there were two things that could cause delays in the approval process: The use of Danish language and addressing people by first name or nickname. However, some of the notes did not clearly define which units were to be included in the division. Another correct reason for rejection in the notes was if an approval change was needed.

The guidance must also clarify that it is the responsibility of Customer Y and their employees to communicate with the supplier about incorrect invoices and to initially make the purchase with correct invoicing information.

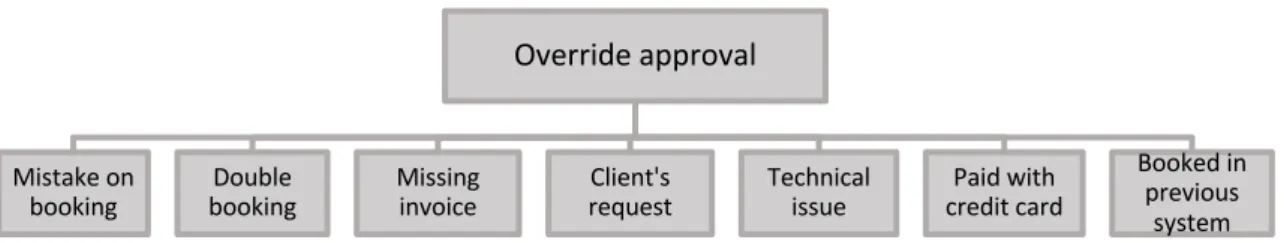

Override approval notes

The correction of errors on reservations or reservations paid by credit card could have been avoided if the approvers were more careful in the approval process. The purpose of the checklist is to generate better accuracy with the approvers when validating the invoice and approving the reservation. The chapter also informs the approvers that Company X's employees can communicate with the approvers by leaving a message in the approval notes.

One of the most important pieces of information given in the chapter is that A/P closes on the fifth business day of every month. In the chapter, the approvers are given guidance in which situations they must approve the document and when they must reject the document. Another justification for including the terminology chapter in the manual is that the approvers are not financial management professionals and may not be sure of the vocabulary.

By learning commonly used terms, approvers would be able to better understand the instructions in the guide and be able to better communicate with Company X. What are some common problems to avoid in the A/P and invoice approval process?” she asked. With the instructions in the guide for these topics, approved ones should be able to replace their unwanted ones.

Interview questions to Company X’s employees

Approvers’ Guidebook