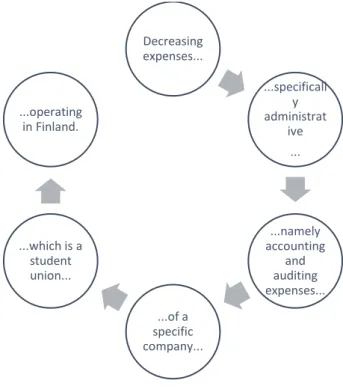

This thesis project is aimed at solving the accounting and auditing problems of the case company, which is a student undertaking. The focus of the thesis will still be on reducing administrative costs, namely the accounting and auditing costs of the case company.

Case company introduction

Throughout the thesis the union is referred to as company X, student union X, or commissar party. Although the union is supported by University funding, it is essential to optimize its expenses and remain profitable.

Project objective (PO) and project tasks (PTs)

The union is partly financed by the UKC to which it belongs, and partly by its own profit-making activities, including the sale of party tickets, overalls, badges, etc.

Scope of the project and demarcation

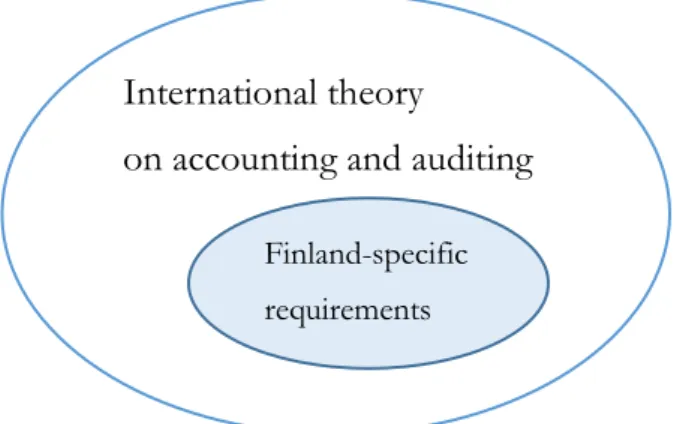

Theory framework

So the juxtaposition of the three components is what the dissertation author focused on when building the theoretical framework. In this thesis, innovative ideas and leading technologies are used to help the author of the thesis in finding solutions for the business case.

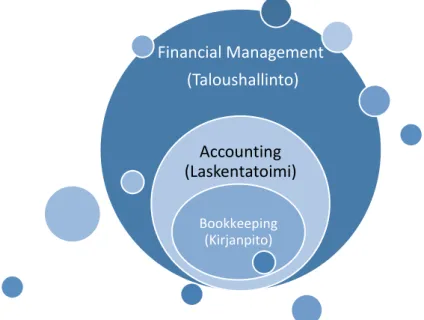

Key concepts

At the managerial level, the author calls for the development of internal accounting practices to increase managers' awareness of the union's financial position. The main result of the project is a final product, which is presented in a form of cost reduction scenarios for the case company.

Project timeline

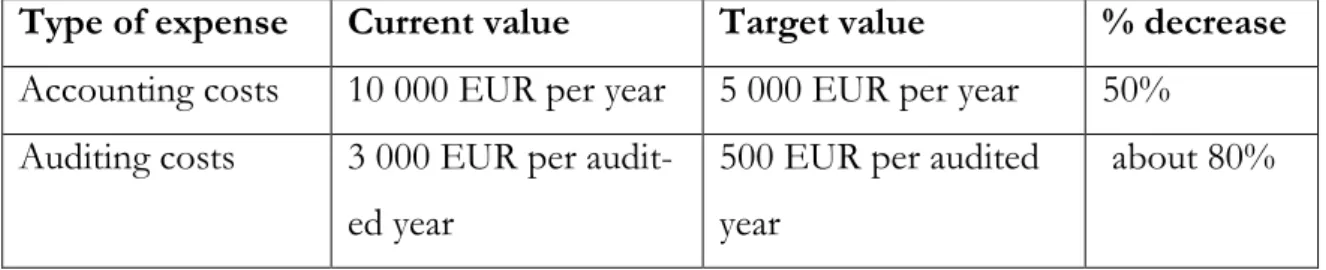

Structurally, the project consists of four tasks and related sub-tasks that must be fulfilled in order to achieve the main objective of reducing accounting and audit costs to the targeted levels. Although the project was defined in such a way as to exclude its implementation phase, the selection of a specific scenario required additional research.

Empirical research component

The fourth and final project task (Solving the audit problem of the trade union) was carried out during May 2013.

Research design and method

This part included a theoretical and a legal study of the audit process and finding solutions to reduce costs. Since the subject area of this thesis is accounting and the main goal of the entire project is to reduce accounting and auditing expenses for the case company, the collection and analysis of quantitative data plays an important role.

Data collection methods

The purpose of the observation was to analyze the current accounting process of the case company. The collection and analysis of secondary data is an important part of the research part of this project.

Data analysis techniques

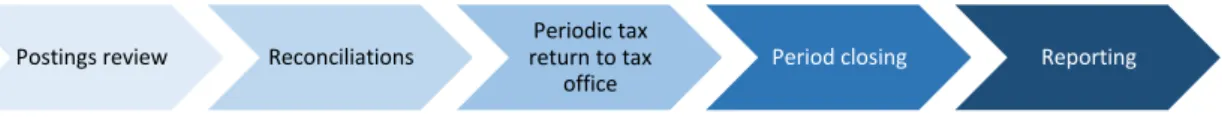

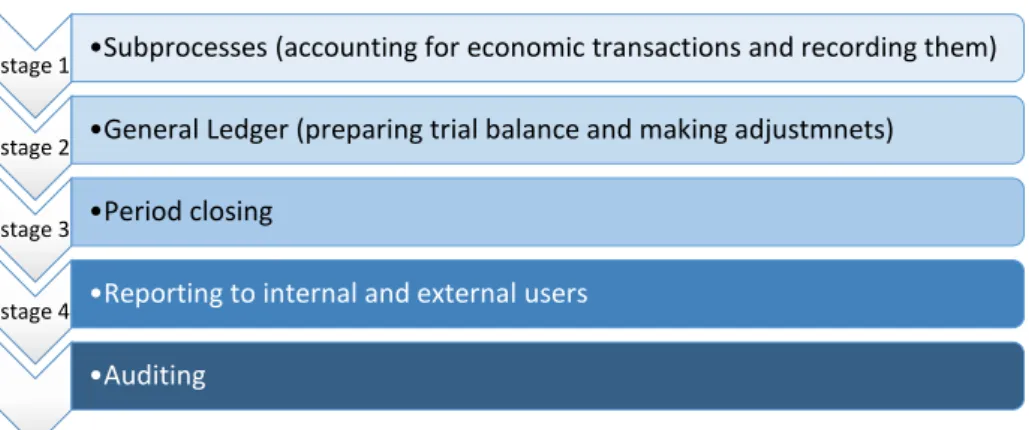

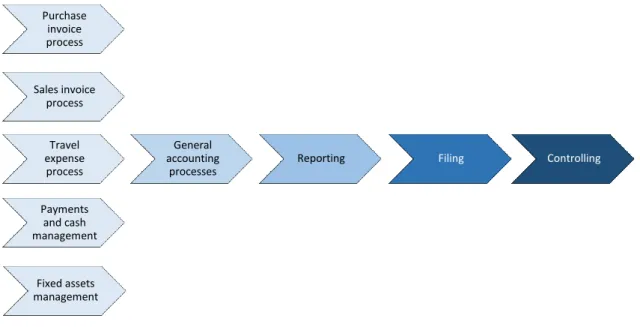

First, it presents a theoretical view of what the accounting process is and the phases it consists of. And finally, an overview of the current accounting process in the case of the company is presented.

Accounting process in theory

The first stage of the accounting process involves acknowledging that a business transaction has taken place. The fourth stage of an accounting process is communicating financial information to internal and external users.

Legal obligation to perform accounting

An accounting process can be studied at several periodic levels: daily, monthly, quarterly, annually, etc. The only exception is the auditing process: auditing is usually performed on an annual basis.

Current accounting process and its costs in case company

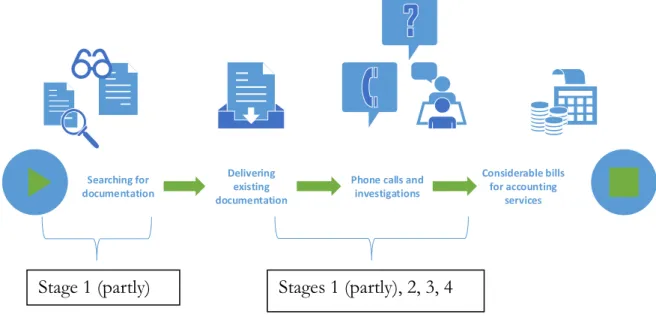

When he took office, the union's accounts were "a mess" – some of it damaged, partially or completely gone. By the time of the first meeting, which was in February 2013, the accounting services company was just finalizing the union's accounts for the year 2011.

Improving current accounting process

It was indicated in the Agreement that the supporting documentation must be delivered in full to the trade union's accountant within 30 days after the end of the month. This will improve control over the use of the union's funds and help the company's management to better understand the company's needs.

Outsourcing accounting

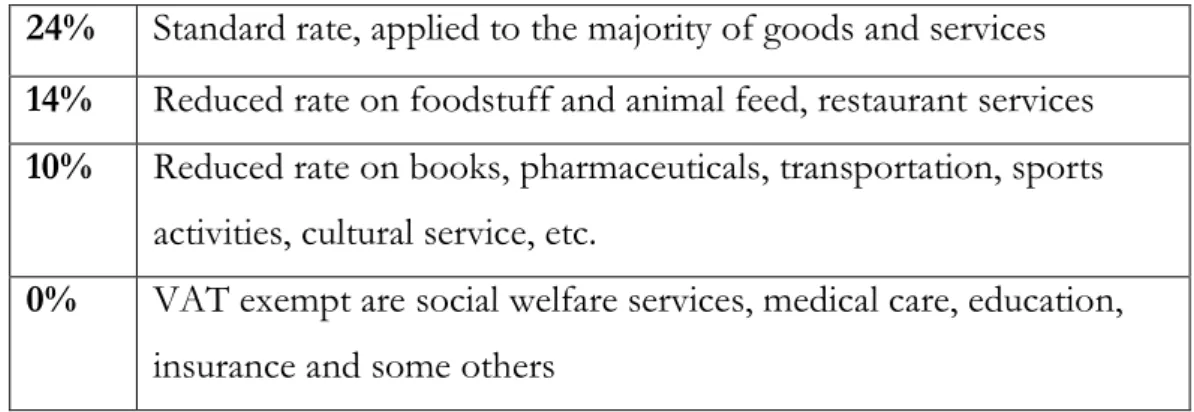

In one of the interviews, the general secretary mentioned that the trade union is not liable for VAT. At one of the meetings with the secretary, there was talk of the possibility of registering the trade union for VAT. One of the possible savings options for the X relationship would be VAT registration.

Changing the accounting service provider

An accounting service provider is a company or a person who performs accounting on behalf of the client. The case company has been using the services of such a provider for the past few years, so most of the union's accounting process has been outsourced. The results of the research revealed that the current accounting service provider charges a relatively high price, compared to what other companies were on the market.

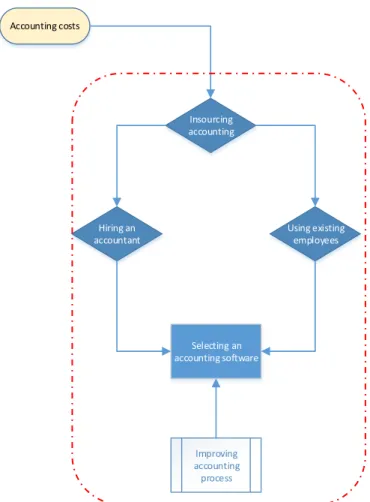

Insourcing accounting option

As specified earlier in this chapter, the main part of the actual accounting process is outsourced to the accounting service provider. However, the General Secretary of the union wanted "a suitable accounting software to be chosen". This prompted deeper research into accounting software, being the next step in the project.

Digital Accounting

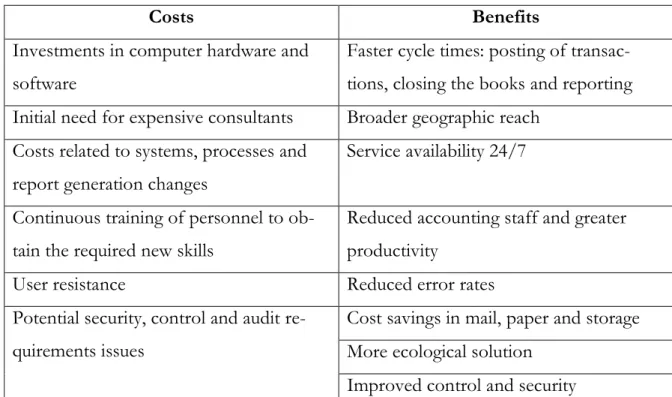

Costs and benefits

To explore the given option, the concept of digital accounting should first be discussed to provide the necessary background for software selection. They made an effort to quantify the potential of digital accounting to reduce administrative costs by 50 percent. It is going too far to say that digital accounting alone is capable of saving 50 percent in administrative costs, but it is certainly a fundamental component.

Development of digital accounting in Finland

The Real Time Economy is a joint project of Tieto, Aditra and Aalto University School of Business. The KMO 50 is the name of their 5th project, which explored the potential to reduce the administrative burden of SMEs by 50 percent through value chain computerization and related services. This particular module explores the ways to use structured data to automate accounting and cash flow of SMEs.

Selection of an accounting software

Theoretical background

An important issue to point out at this point is the delineation process for choosing the accounting software.

Classification of accounting software

Accounting software for a small business

For example, the payroll system, which was one of the software requirements of the case company, was not integrated into that software. The software was not suitable for Finnish companies because it violated local accounting laws. The author contacted a company representative to learn more about the software's price and features.

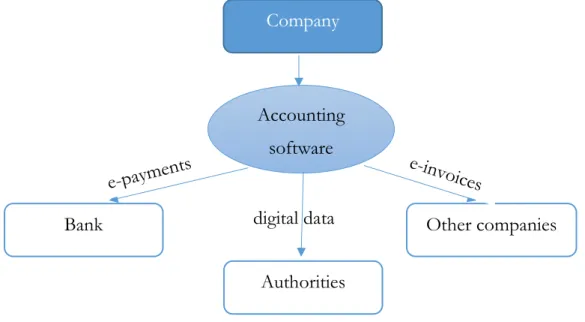

Software for a medium-sized business

The regulations in the Finnish Accounting Act (Chapter 2, Section 8) promote these innovations by allowing the storage of financial information in electronic format. Advanced software enables the user company to interact with banks (by means of payment processing), exchange electronic invoices and provide its financial information digitally directly to authorities (eg tax authorities). All of the software providers listed above offer different packages, depending on business needs.

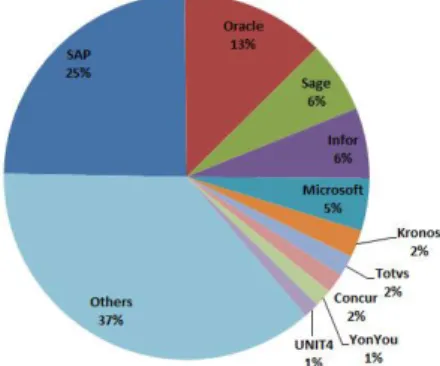

Complex accounting software integrated into ERP systems

The Oracle Corporation (USA) is one of the world's largest computer technology corporations, offering computer hardware and enterprise software products (especially ERP). However, none of the ERP software was selected for the final list of options for the commissioning party. The main reason is that the business of the union is too small to exploit the benefits that ERP systems can offer.

Selection

As the results of the study showed, accounting software targeting different business sizes has different characteristics. Most of the studied software options were available in several modifications, adapted to specific business scales. A Finnish version of this attachment was delivered to the general secretary of the union on 30 April.

Auditing and its function

Therefore, the author's task was to investigate the nature of the costs and come up with a proposal on how they could be reduced. The auditor's role has been described as being a watchdog, rather than a bloodhound." (Chadwick. Troberg describes a typical situation in an organization today (see figure 20): owners are separated from the management body in most companies, so they cannot follow the development of the organization and do not necessarily assess the reliability of the financial statement themselves.

Obligation to conduct an audit

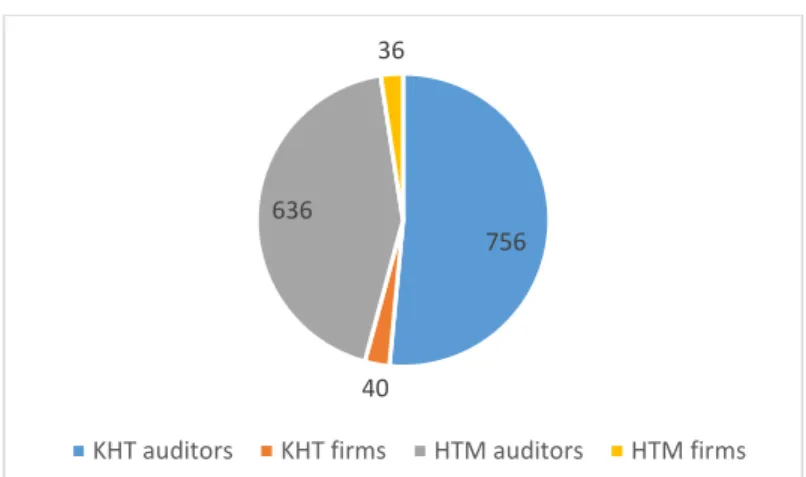

Auditors and their classification in Finland

The choice of an accountant or an accounting firm should normally be based on the degree of complexity of the financial statements in question. All accredited accountants and accounting firms in Finland are listed in the public register. The names and addresses of all KHT and HTM auditors could be found on the web pages of the Finnish audit committee.

Auditing solution for the case company

Traditionally, company size varies in direct proportion to audit costs. When it comes to the audit problem, the selection of alternatives was quite limited compared to the accounting scenarios. This happened mainly due to the fact that the solution was clear and based on improving the company's accounting process.

Project evaluation

These in turn were examined in detail and the final choice was made by the case company during the annual stakeholder meeting. Exploration of the accounting process and its costs for the business company The concept of accounting process has been studied from various theoretical perspectives. A detailed description of the current accounting process in the case company is presented in Chapter 3, based on interviews with the contact person and observations.

Product assessment

However, according to the budgeted plan, the target level of savings is set at 50 percent. For the purpose of introducing another scenario, the author suggests returning to the crossroads of staying with the current service provider and switching to a new one. This makes it inapplicable to estimate how improvements in the accounting process of the case company will affect the price of a new service provider and what the savings will be compared to the current accounting costs.

Discussion of the selected option

Since the direction of this project was strongly influenced by the preferences of the case company, the author suggests a deeper study of this scenario for the following researchers. An important note to make is that it would be wrong to consider only the cost of the software as the total cost of this scenario. The author strongly believes that the primary focus of the case company should be to address this problem as the core problem.

Benefits for the commissioning party and the field

The general secretary concluded that most of the accounting and auditing issues the union had experienced in the past had now been rectified. This is the first year in the union's history when they try to use the revenue recognition concept and allocate dues to the related semesters. Although the findings cannot be directly applied to other companies, there is room for some generalizations of the outcomes.

International aspect

The final chapter of this thesis addresses the international dimension of this work, presents limitations of the project, evaluates reliability and validity of the research component, offers suggestions for further projects and discusses author's own learning. For example, by the decision of the European Commission, all EU-listed companies will have to follow IFRS in their financial reporting from 2005 (Troberg 2013, 18). Regarding VAT in particular, the system works similarly in all EU countries under the regulation of the Tax and Customs Union of the European Com-.

Limitations of the project

As presented in the earlier chapter, Finland has a standard VAT rate of 24 percent and also reduced rates for some products and services. In the context of this thesis, a solution for the client to become VAT registered may not work in the same way in other countries due to differences in local tax regulations. With regard to these specifics of the case company, the proposed solutions may not work the same way for other organizations.

Reliability and validity of the research part of the project

So the author did not try to force the case company into a particular decision. There are a few words to say about the quality and neutrality of literature used by the author. So the author made some modifications and corrections when presenting information from these sources.

Suggestions for further projects

In the case of this thesis, testing scenarios would be an option to improve validity. Some of the sources used by the author are written as advertisements for companies that offer software and accounting services. The author uses a critical approach and carefully evaluates the credibility of this information.

Personal learning

URL: http://www.dw.de/french-telecoms-giant-alcatel-lucent-to-cut-thousands- of-jobs/a-17144394. URL: http://www.forbes.com/sites/louiscolumbus erp-market-share-update-sap-solidifies-market-leadership/.

Project Gantt chart

List of interviews

Periodic tax return form

Cost-cutting scenarios for the case company

Accounting software classification

Software options selected for the case company

Company’s checklist 2013 (Taloushallintoliitto 2013)