The main objectives are to start the process of extending EUROMOD to cover the 10 new Member States and to make EUROMOD easier to use, especially when dealing with 25 systems and datasets. This project involves the European Center and Institute for Social and Economic Research (ISER) at the University of Essex. The European Center is responsible for establishing contacts and working relationships in the 10 new Member States to explore the possibility of bringing them into EUROMOD.

ISER is responsible for improving the model in technical terms, making it easier to use and for the integration of new countries. For more information see: http://www.euro.centre.org/icue and http://www.iser.essex.ac.uk/msu/emod/i-cue.php.

Introduction and objectives

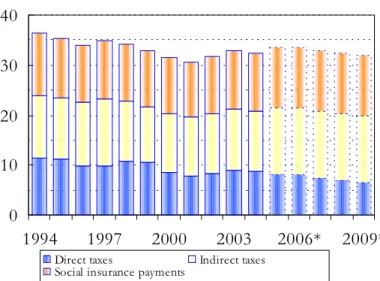

Overview of the historical development of the Estonian Tax-Benefit system

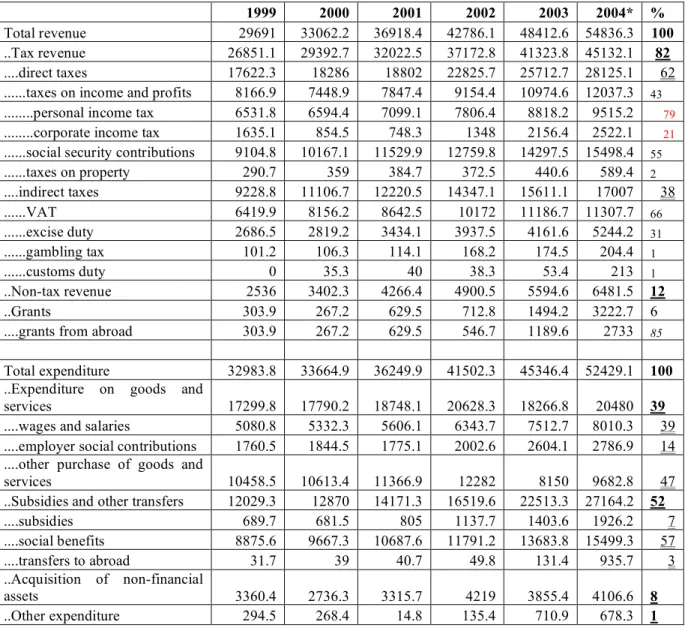

Starting from the year 2000, several changes were introduced in the tax system: first, the above-mentioned inclusion of social taxes and healthcare-related expenses based on social tax revenues in the state budget and second, the abolition of corporate tax on reinvested profits. The latter follows the general principles for the development of taxation accepted by the Ministry of Finance, that is to say, since the late 1990s, various social and economic policy decisions have been taken to improve the economic situation of less insured households.

In 1990–1992, the income and expenditure side of the Estonian pension system was separated from the Soviet pension system. The second major wave of transformation in the pension system took place when the new three-pillar pension system was introduced. The A-kasse system was applied in 2002 in addition to the state unemployment benefit, which has already been in practice since the early 1990s.

Description of the main elements of the Estonian tax-benefit system (as of 30.06.2005)

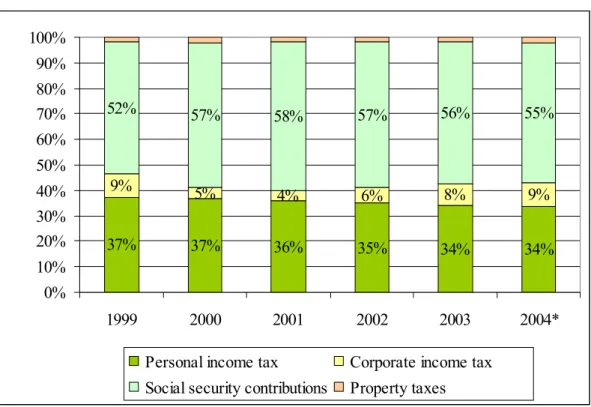

Direct taxes

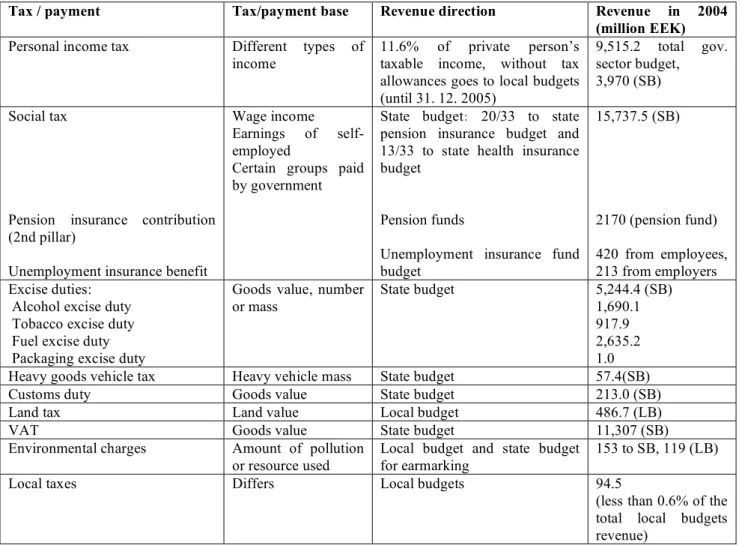

- Income tax

- Social tax

- Pension insurance contribution

- Unemployment insurance contribution

- Property taxes

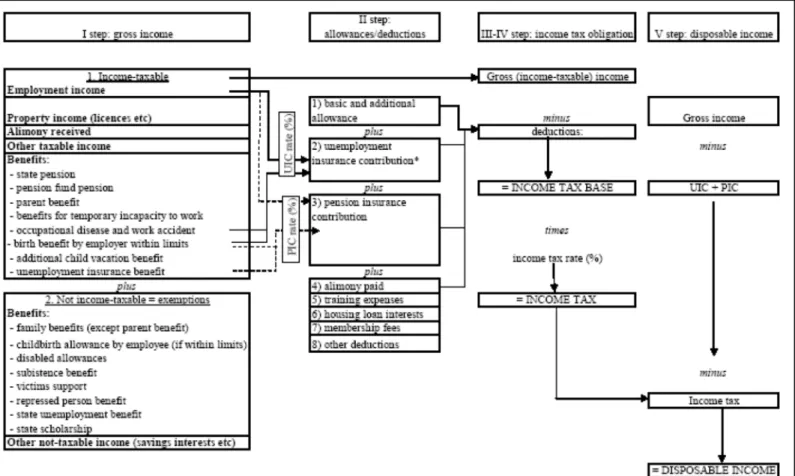

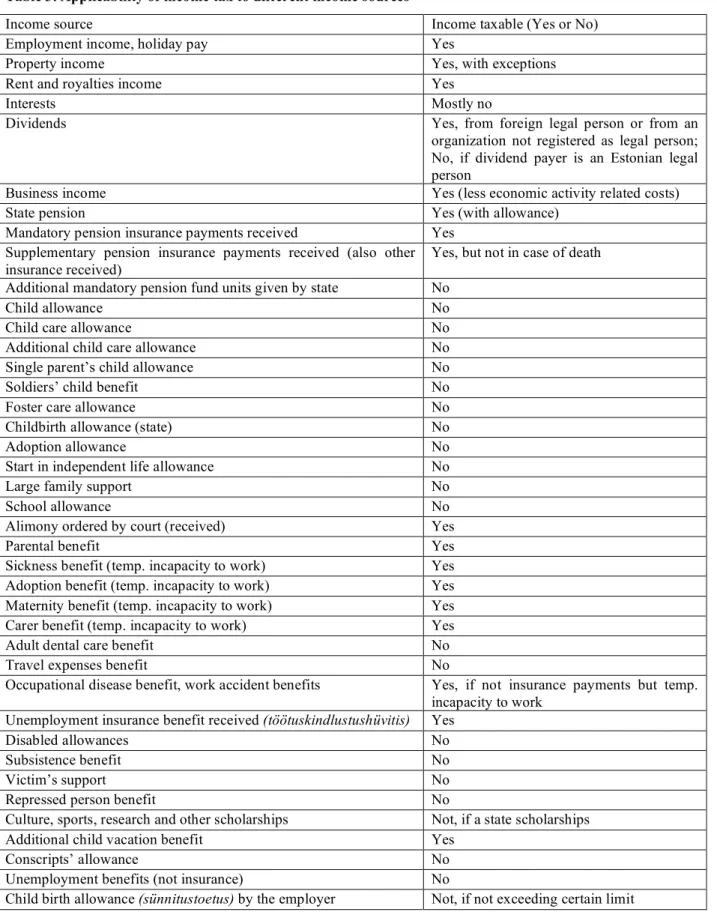

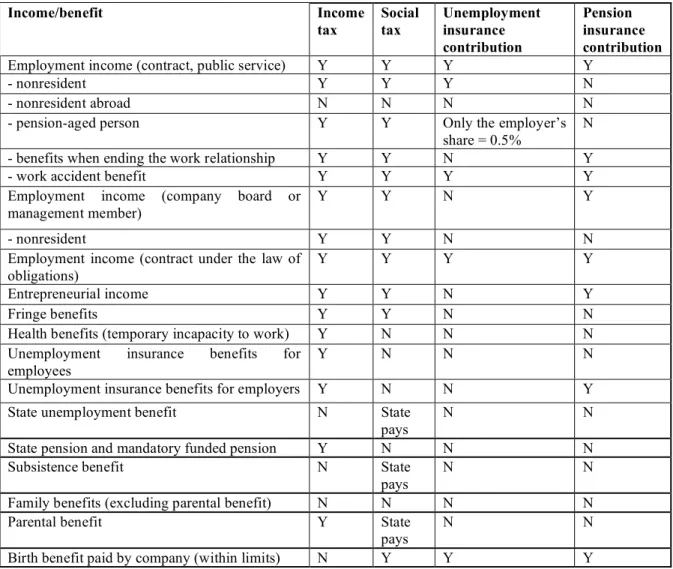

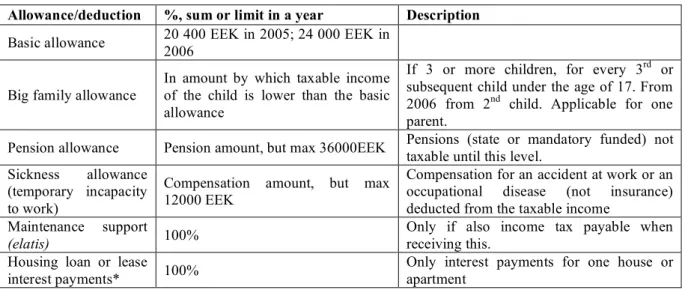

Description of the main elements of the Estonian tax and benefit system (see figure 1 in the appendix). If a resident private person receives a pension paid by the Estonian state or a compulsorily funded pension, an additional allowance can be deducted from the person's income corresponding to these pensions, but not more than 36,000 EEK in a tax period. Income tax is not charged on maternity allowance (sünnitustoetus) which the employer voluntarily pays to the employee or public employees, with an amount that does not exceed 5/12 of the basic exemption granted to a resident private person during a taxation period.

The payments of the unemployment insurance contribution and the compulsory pension insurance contribution can be easily calculated from the income data. However, in the event that the person participates in the 2nd pillar, 4% of the social tax base is moved from the national pension insurance to the 2nd pillar of the private pension scheme and a further 2%. Since the social tax payment is the employer's obligation, it does not directly affect the calculation of the personal disposable income.

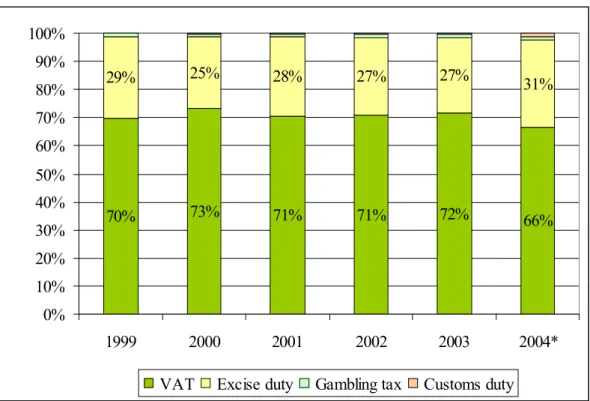

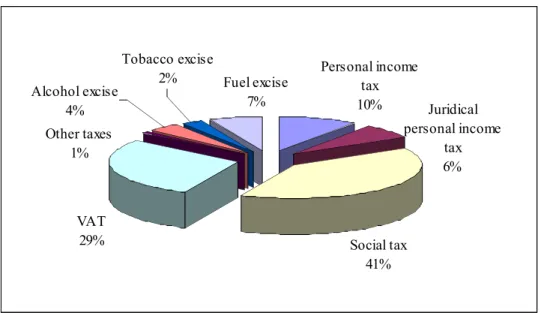

Indirect taxes

- Value added tax

- Excise duties

- Environmental charges

- Local taxes

Simulating the land tax is not possible, because the amount and value of the land owned by the person or family is not known. Alcohol excise duty is imposed on wine, beer, fermented beverages, intermediate products and other alcohol produced in Estonia or brought into Estonia. Tobacco excise duty is imposed on tobacco products (smoking tobacco, cigarettes, cigars, cigars, chewing tobacco) produced in Estonia or brought into Estonia.

Energy taxation in the EU is governed by Directive 2003/96/EC, according to which, in addition to mineral oils, other energy sources such as coal, natural gas and electricity are also taxable. Directive 2004/74/EC grants Estonia transitional periods for the taxation of a number of energy products: to adjust the national level of taxation of gas oil used as motor fuel and unleaded petrol used as motor fuel to the minimum levels specified in the Directive EU on energy taxation. , Estonia may apply a transitional period until 1 January 2010. In addition, until 1 January 2013 it is allowed to apply a reduced rate of taxation of oil shale, provided that this does not result in taxation below 50% of the relevant minimum Community rate from 1 January 2011.

The amount of the packaging excise tax depends on the package type and the recall and reuse of the package later. Excise duties can be simulated with expenditure data from the HBS; However, for this purpose, the excise rates must be converted into a percentage of the product value. 9 Biofuels are produced from biomass, i.e. the biodegradable fraction of products, waste and residues from agriculture (including vegetable and animal substances), forestry and related industries, as well as the biodegradable fraction of industrial and municipal waste.

If such charges are expressed as an amount per product unit (for example EEK/kWh) or as a share of the product price, environmental charges can be considered comparable to excise duties, i.e. environmental charges can be simulated based on the share of taxes on the price of goods. It is important to note that demand elasticities must be included in the microsimulation model when we use it to estimate revenue implications or perform distributional analysis of indirect taxes.

The main reason for the modest use is their incentive effect – the more the local tax revenue accrues to the local budget, the smaller the transfers from the general state budget to the local budget.

Benefits

- Pensions

- Health insurance

- Family benefits

- Unemployment benefits

- Disabled persons social benefits

- Subsistence benefit

- Local benefits

In the next section, we describe each state benefit and the rules for use in more detail. Due to the recent introduction of private pension schemes, payments are not made from these until 2009. Family benefits are regulated on the basis of the National Family Benefits Act, which has been in force since 2002.

One of the parents has the right to receive birth allowance, which is at 25 times the child allowance rate (25 x 150 EEK) for a first child and at 20 times the child allowance rate for each subsequent child. The right to receive parental benefit is for the resident parent, the foster parent, the adopter or the carer of the child. 100% of the previous average monthly wage (up to a ceiling of 3 times the average taxable wage two years ago).

The duration of the unemployment insurance benefit varies from 180 days to 360 days, depending on the length of contribution payments. The payment of unemployment assistance benefits was regulated until October 2000 under the Act on Social Protection of the Unemployed14. The replacement rate of the UA to the average gross wage in Estonia was about 6% (8% to net wage), which is very low. according to international standards.

Based on the rules of UI and UA benefits, the small range of the previous earnings can be imputed from the benefits, and therefore the effect of the change in the parameters can be simulated approximately. There are several social benefits for the disabled, which are calculated on the basis of the social benefit rate set in the State Budget Act – 400 EEK in 2005. None of the disabled benefits can be simulated due to lack of data.

The subsistence level of the second and each subsequent member of a family is 80% of. The provision of a maintenance benefit is based on the income of the benefit applicant and his family members. L = subsistence level, which is 100% of the subsistence rate for the head of the household, 80% of the subsistence rate for each subsequent person in the family;.

Data availability and the other modelling issues

- The input dataset

- Model validation

- Non take-up of benefits

- Tax evasion

A study conducted by Ainsaar et al. 2004) showed that most municipalities provide local benefits related to family and child support. Some of the local benefits can be conditionally simulated; however, not all necessary variables are present in the datasets (eg whether the household is eligible for benefits by being registered in the Population Register as resident in the relevant region). Each family is interviewed twice; the rotation period is 12 months, and each year half of the sample is replaced.

The LIIKMED file contains general information about each household member, but it also contains limited information about children up to the age of 16. For a more detailed comparison of the two data sets, see Table 16, which describes the coverage of the two data sets. 16 The COICOP classification prepared by the Statistical Office of the European Communities (Eurostat) is used for consumption expenditure.

It is possible to obtain data on the annual budgets of the fund or the number of benefit recipients and average amounts.17. In Estonia, most benefits are universal as requirements are met (e.g. number of children, old age, medically certified disability) and very few instruments of the benefit system are means-tested. On the other hand, means-tested benefits are administered by local authorities, and there is a significant degree of discretion for benefit authorities, so that relevant administrators can decide that those who have applied for benefits are ineligible, based on the overall economic situation of the region. household (for example, the presence of assets or real estate) or unwillingness to accept a job.

As mentioned above, one of the main candidates for source data for an Estonian microsimulation model is the Estonian Household Budget Survey. Analysis by Võrk and Paulus (2005) suggests that the research itself may underrepresent the total value of benefits. One option is to use additional information from register data on benefits and some basic socio-economic characteristics of the beneficiaries.

This is higher than in most EU15 countries, where it ranges from 2 to 6%.

Appendix

In the amount by which the child's taxable income is lower than the basic allowance. 100%; entry and membership fees maximum 2% of taxable income less costs related to economic activity in the case of the self-employed, deductions for maintenance interest, housing loan and training expenses and basic allowances; The overall limit for gifts, donations and fees is 5% of the aforementioned amount. Child care allowance for each child aged 3-8 in families with 3 or more children.

For children: . - child benefit, - food support for children of the least insured family, .. not dependent on family income> birth support, "first time at school" support, birthday support; .. depend on family income> living benefit, camp support, medical support etc. For children: . - child support, - food support for the children of less well-off families, . - Allowance for people with disabilities for modification.