9 Note that yj > 0 is an implicitly excessive appreciation of the exchange rate relative to the local currency. As a result, a significant depreciation of the local currency relative to the foreign currency can easily push borrowers into default. Let ω0j denote the currency value of the bank customer's initial wealth (at the time the loan is issued).

Importantly, a devaluation of the local currency relative to the currency causes the currency value of the client's wealth to collapse, i.e. ω0j falls. The expected change in the currency value of the customer's assetsωj from one period to the next is µj = yt,tj+1. Recall from equation 2.1 that this is the implied appreciation of the foreign currency relative to the domestic currency.

2.5) The expression above states that the bank loses interest income on all the fraction of loans that default. 13 Since deposits are liabilities, the appreciation of the currency of the deposit is a loss for the bank. Finally, the inflation rate πy is a cost to the bank as it lowers the nominal value of the repaid loan.

Customer's loan demand and deposit supply functionsγ are described as functions of the interest rates r.

Estimation Results

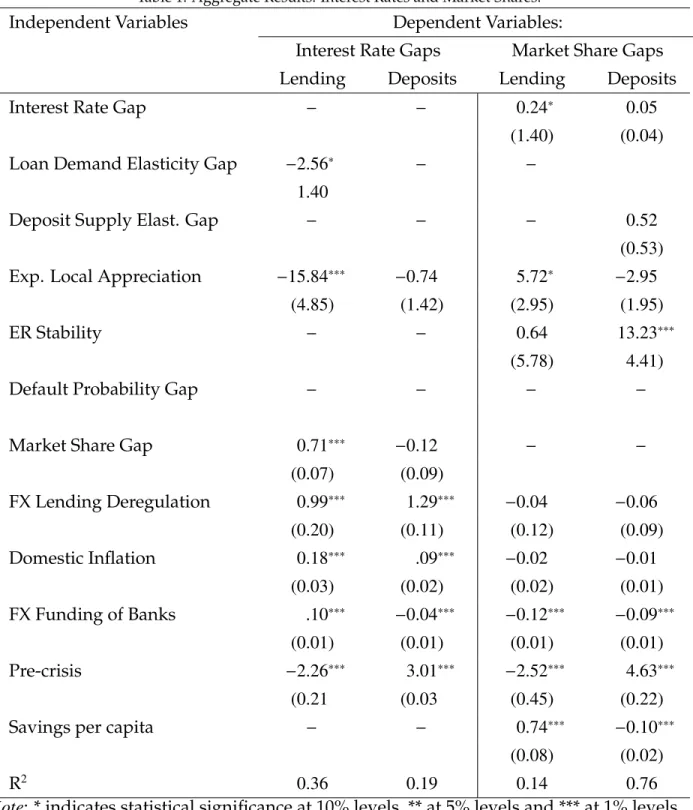

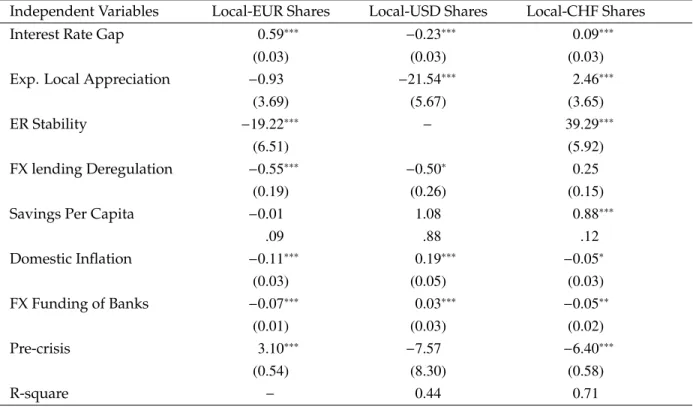

However, this increase of 0.09 percentage points is less than that for loans. A one percentage point increase in the share of currency assets on banks' balance sheets reduces the relative currency lending rate by 0.10 percentage points. Because the sample period covers the global financial crisis, the analysis also includes an indicator variable to capture the potential regime change resulting from the outbreak of the financial crisis.

27 Another potential regime change in the CØEL region is the end of the transition period for the banking system. When the local exchange rate is more stable, bank customers are willing to keep a significantly larger (relative) part of their savings in the form of domestic deposits. The consequence is that customers have become significantly more likely to borrow in the local currency, but have deposits in foreign currency since the beginning of the crisis.

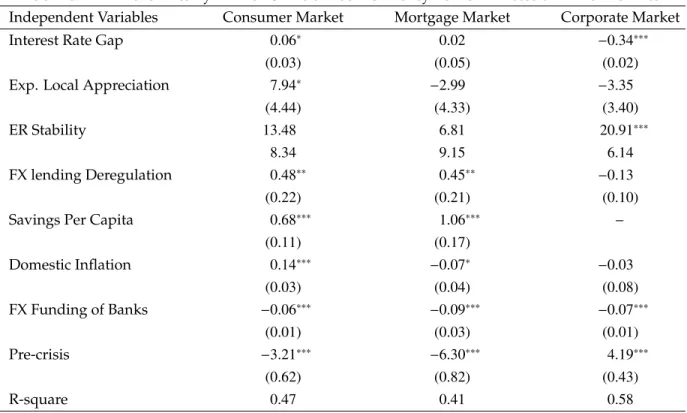

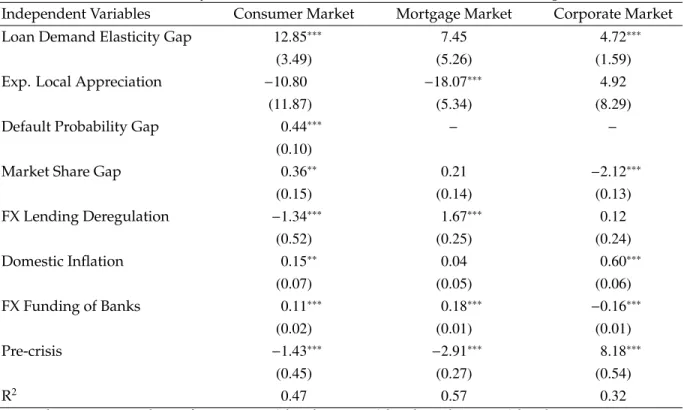

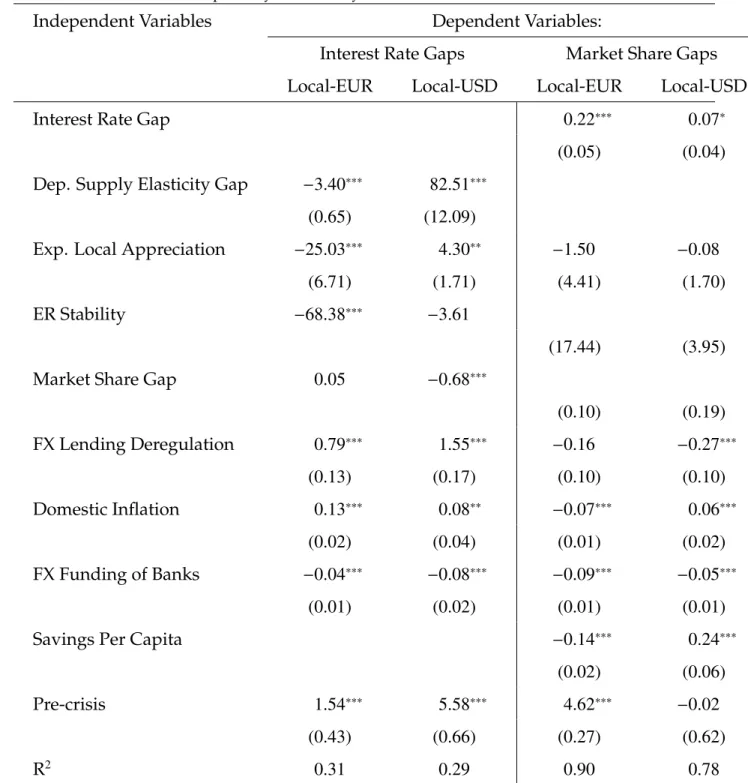

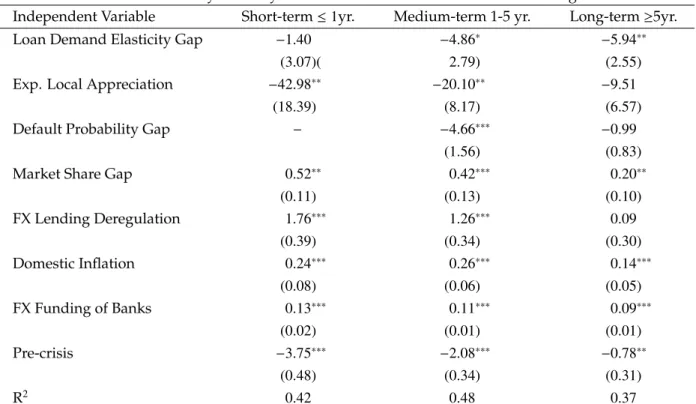

For example, banks charge significantly higher local lending rates when the probability of local lending is higher in the consumer and mortgage markets, but this relationship is reversed in the corporate market (Table 2). While the local - FX lending rate gap has widened since the crisis in the consumer and mortgage markets, this rate spread has shrunk in the corporate market. The results are stronger in the retail market (possibly due to more variation in the data).

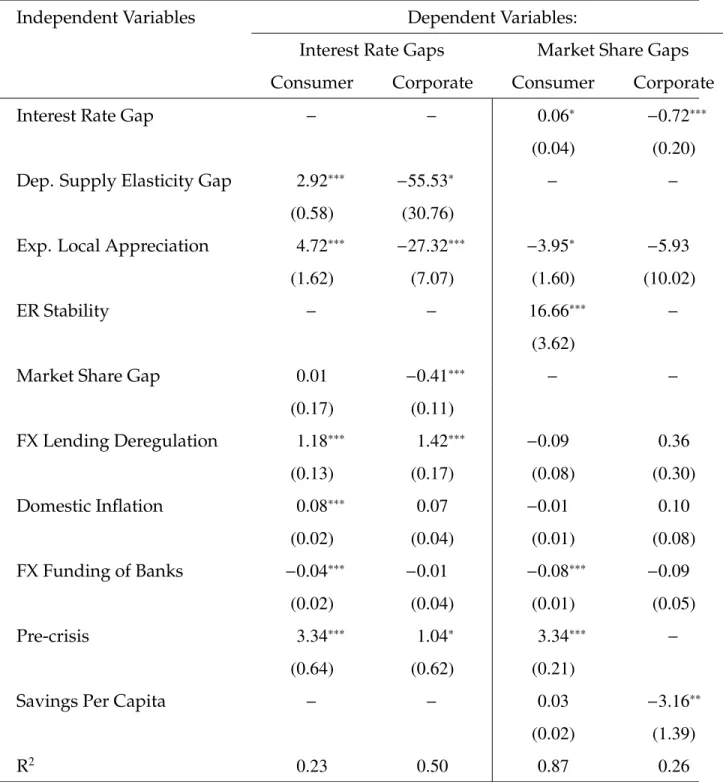

The onset of the financial crisis had a stronger impact on the consumer deposit market, reducing the local exchange rate spread by 3.34 percentage points compared to a 1.04 percentage point drop in the corporate market. Due to the relatively higher local interest rate on deposits, customers are more likely to hold local currency deposits in the consumer market, but not in the corporate market. For example, the increase in the interest rate elasticity of demand for foreign currency loans and the larger market share of local currency loans cause the difference between the local and US dollars to widen significantly, unlike in other foreign exchange markets.

While the post-crisis spreads are 4.18 and 3.84 percentage points larger in the case of the EUR and CHF currencies, the crisis caused a somewhat smaller increase in the USD spread (3.38 percentage points). The underestimation of the exchange rate risk is observed only in the case of loans in euros. Since these factors are time invariant and common across countries, they are captured in the constant (intercept) term of the regressions.

Summary and Conclusion

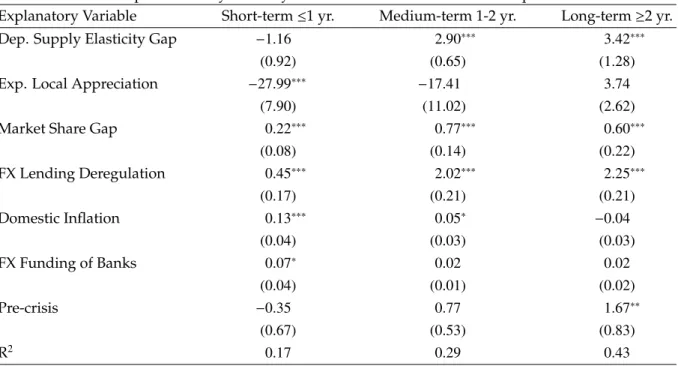

For example, expected appreciation of the domestic currency discourages short-term foreign exchange deposits but encourages long-term ones (coefficients of 13.16 and -7.54, respectively). In relation to previous literature, this study's findings confirm the role of banks' low-cost foreign currency financing from parent banks abroad (Csajbok et al 2010) as a driving force for the spread of foreign currency lending in the CEE region. The results generally do not support the hypothesis from previous literature that a major contributor to the rapid proliferation of currency banks was customers' underestimation of the exchange rate risk involved.

First, in light of the fact that the corporate sector is fundamentally different from the retail and mortgage markets, there is the possibility that the currency- and maturity-specific regressions are biased by the inclusion of this sector. A useful robustness check would therefore be to re-run the analysis excluding industry from all specifications. Second, the simulated standard risk measure in this paper did not provide enough variation to be included in some specifications and produced less than reliable estimates in others.

As a result, a more detailed and thorough analysis and modeling of the interaction between default and credit risk is needed. Foreign currency borrowing: Austrian households as carry traders”, Journal of Banking and Finance, Vol. The Expectation Hypothesis of the Term Structure of Very Short-term Rates: Statistical Tests and Economic Value”, Federal Reserve Bank of St.

Demand Estimation and Consumer Welfare in the Banking Industry,” Journal of Banking & Finance, Vol. Risky Foreign Currency Lending Remains in Eastern Europe", The New York Times, May 7, 2010. The Role of the FX Exchange Market in the Hungarian Financial System", MNB Bulletin (May).

On the Pricing of Corporate Debt: The Risk Structure of Interest Rates", Journal of Finance. The role of foreign exchange in the domestic banking system and the operation of the exchange market during the crisis", MNB Occasional Papers 90. Determinants of borrowing in foreign currency in the new EU member states", Czech Journal of Economics and Finance, Vol. .

Tables

Figures

The difference between domestic and currency nominal loan rates (percentage points) in the CEE region. Difference between domestic and currency nominal deposit rate (percentage points) in the CEE region.