The purpose of issuing a series of working papers is to encourage comments and suggestions on the work being prepared by the National Bank of Hungary. The views expressed are those of the authors and do not necessarily reflect the official position of the bank. In the first step, we forecast foreign demand, and then in the second step, we forecast Hungarian exports using the best result of the first step together with the real exchange rate and the import series.

We found that the foreign demand forecasts by both criteria were significantly better than the ARIMA forecasts. However, in the case of the volume of Hungarian exports, our results were better only in terms of stability properties. Therefore, the choice between the different forecasting methods was not obvious, so an index of "agreement" was also calculated as a weighted average of the different forecasts, where the weights were negative functions of imprecision and instability.

INTRODUCTION

TWO STEPS OF THE FORECASTING PROCEDURE

Some Theoretical and Methodological Considerations

This is an accepted method in the empirical literature, although some information may be lost if seasonality is associated with cyclical movements in the variables. Using the methods of the second group, we detrended the data series and then modeled the relationship between the remaining cyclical components. Forecasts may vary according to the method of deterrence or the method of econometric estimation of cyclical relationships.

Finally, for the forecasts we used neither the bandpass filter, due to its similarity to the results of the HP filter, nor the BN filters due to the perfect correlations between the innovations driving the trend and the cyclical component. When evaluating the predictive accuracy of the different models, we chose the best ARIMA time series forecast as the benchmark. Therefore, a necessary condition for acceptance of any economic model-based prediction is that it is better than the result of the ARIMA model, which does not explicitly address the economic relationship between variables.

Forecasting Foreign Demand

We did not analyze CEFTA and former Soviet Union countries due to the lack of sufficiently long and reliable data. The size of the shift was the number of lags in which the cyclical component of the leading indicator had the greatest correlation with that of GDP. First, we took a subsample—from the start of the entire sample through the third quarter of 1989—and made forecasts on it up to 5 periods ahead.

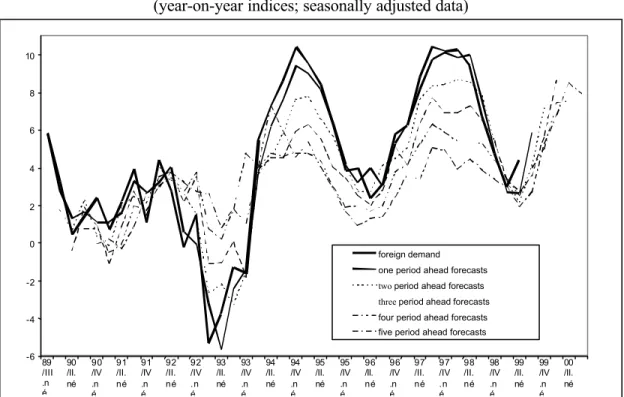

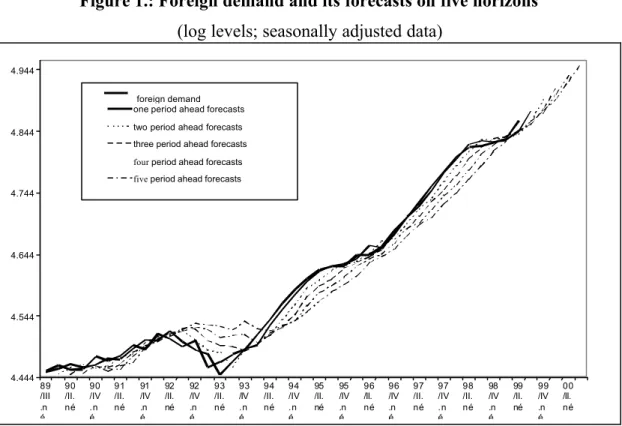

These ex post predictions from the sample are supposed to reveal what predictions the model would have made at a particular point in the past if the prediction had been made based on that period's information set. The first contains forecasts one period ahead, i.e. its first element is the 1989 Q4 forecast based on information available in 1989 Q3, its second element is the 1990 Q1 forecast based on information available in 1989 Q4 and so on. . The second series contains forecasts for two periods and so on, up to the fifth series with forecasts for five periods.

Forecasting Exports

We estimated export and import volumes with an error correction model taking into account the possible long-run relationship between the two variables. A justification of this specification can be the fact that due to the integration process of the Hungarian economy, most of the increase in the volume of imports appeared in the increase in the volume of exports. As can be seen in the tables of Appendix C, the parameters of our export equations have the correct signs and magnitudes.

In the first-order differences equation, the long-run income elasticity of exports is 1.18, which is not significantly different from one. The price elasticity in this equation is 0.21, while that of HP cyclical components is 0.11, both of which are significantly different from zero3. 3 Note that the real exchange rate is the price of a foreign currency measured in the home currency.

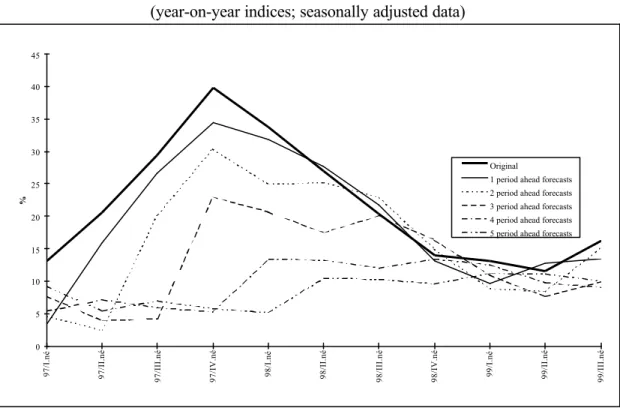

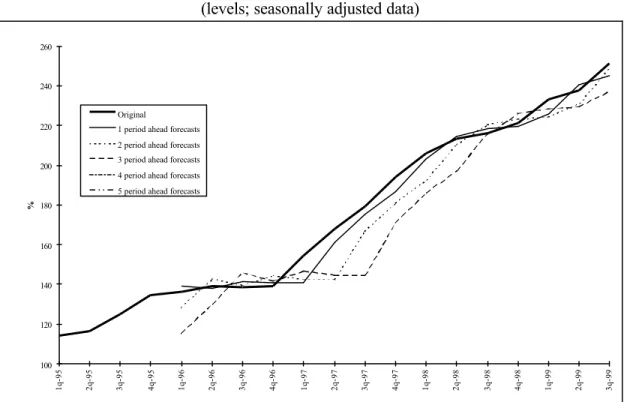

The weights were based on the precision and stability characteristics of the methods (see Section III). As one can see, the smaller the forecast horizon, the greater its accuracy. This is a consequence of the unpredictability (with regard to the methods used) of the extreme growth rates in 1997.

This turning point in the trend was the result of the activities of multinational companies that first moved into the country in 1997. After this shock, in addition to the expansion of the sample, the stability of the series and the accuracy of our forecasts. increasing. Forecasts for 1 period ahead Forecasts for 2 periods ahead Forecasts for 3 periods ahead Forecasts for 4 periods ahead Forecasts for 5 years ahead.

1 period ahead forecasts 2 period ahead forecasts 3 period ahead forecasts 4 period ahead forecasts 5 period ahead forecasts.

COMPARING PREDICTIVE ACCURACY OF THE MODELS

Comparing Forecasts of Foreign Demand

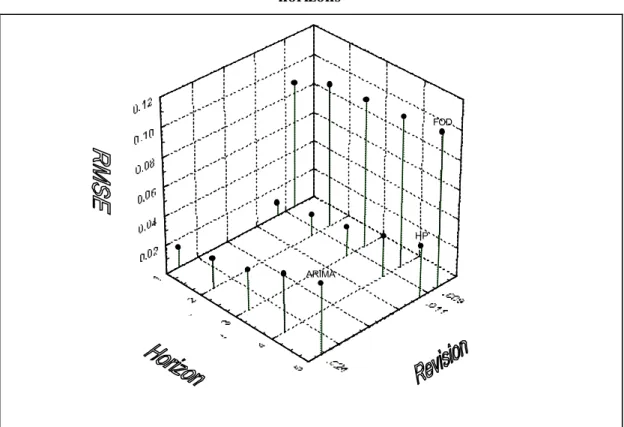

The method mentioned in Part II. which used an HP filter, country-level system of equations estimated by 3SLS) had smaller (by 30% average) forecast error (mean square) at all horizons than the ARIMA model, and this difference was statistically significant by the S2 test. In terms of stability, this method had a significantly lower (by 50%) revision error compared to the ARIMA model. From this it can be concluded that the method can obviously beat ARIMA, but if you compare it with the other models, the difference is not so clear.

If we use differentiation (FOD filtering) instead of HP filtering, and leave other technical details unchanged, the resulting forecasts have significantly the lowest revision error among all methods. This method has the best performance in terms of precision and the second best in terms of stability. On the vertical axis we have the precision measure, while the two horizontal axes show horizon and stability.

In terms of revisions, the FOD method has the lowest errors and this is also a statistically significant result. Note: ARIMA – the simplest statistical model; HP – the model using Hodrick-Prescott filter, 3SLS estimation on a country-level system of comparisons; FOD – same model as the previous one, with differentiation instead of HP filtering.

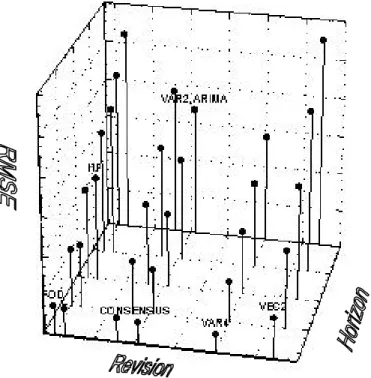

Comparing Export Forecasts

The parameters of ARIMA and VAR2 models are so close that the plots are almost the same. To summarize, we have not been able to find a superior method to predict Hungarian export volume. We have therefore calculated a 'consensus index' based on the weighted average of the various forecasts.

SUMMARY

However, the choice between different export forecasts was not obvious and we did not find an optimal method in both respects. We therefore calculated an export 'consensus' index, which is a weighted average of the various forecasts. The weights are negative functions of the prediction and revision errors, meaning that the greater the accuracy and/or stability of a given method, the greater its weight. 1995), "Measuring Business Cycles: Approximate Band-Pass Filters for Economic Time Series" NBER Working Paper N. 1981), "A New Approach to the Decomposition of Economic Time Series into Permanent and Transitory Component with Particular Attention to the Measurement of the Business Cycle, Journal of Monetary Economics Detrending and Business Cycle Facts” Journal of Monetary Economics Intertemporal Substitution in Import Demand” Journal of International Money and Finance Cointegration, Aggregate Consumption, and the Demand for Imports: A Structural Econometric Investigation” The American Economic Review, vol. 1995), "Effects of the Hodrick-Prescott Filter on Trend and Differential Stationary Time Series: Implications for Business Cycle Research".

S: (1995), "Comparing Predictive Accuracy" Journal of Business and Economic Statistics, Vol. 1994), "Information, Forecasts, and Measurement of the Business Cycle" Journal of Monetary Economics Detrending, Stylized Facts and the Business Cycle" Journal of Applied Econometrics, Vol. 1985), " Trends and Cycles in Macroeconomic Time Series " Journal of Business and Economic Statistics, Vol. 1980), "Post-war US Business Cycles: An empirical Investigation" Journal of Money Credit and Banking, Vol. 1998), "Trade Elasticities for G-7 Countries" International Finance Discussion Papers n. 2000), "Hvor langt er handelsintegration avanceret. National Bank of Hungary, Working Papers Low Frequency Filtering and Real Business Cycles” Journal of Economic Dynamics and Control Time Series Analysis of Export Demand Equations: A Cross Country Analysis” IMF Working Paper/98/149, oktober Murata, K. A System Estimation Approach” OECD Economics Department Working Papers no. 1982), "Trends and Random Walks in Macroeconomic Time Series: Some Evidence and Impplications" Journal of Monetary Economics International handel med tjenester: Putting UK Export Performance in Perspective" NIESR mimeo. 1986), "Theory Ahead of Business Cycle Measurement" Carniege-. 1989), "Valutakursernes rolle i en populær model for international handel. Holder ‘Marshall-Lernel Condition?’” Journal of International Economics Time Series Estimation of Structural Import Demand Equations: A Cross-Country Analysis” IMF Staff Papers, vol.

First Order Differencing (FOD) filter

Hodrick-Prescott (HP) filter

However, applying the difference stationary series filter is not equivalent to high-pass filtering. The HP filter can now be represented as a two-step procedure, first discretizing the series and then smoothing it by an asymmetric moving average. The filter can therefore generate spurious business cycle-like movements that were not present in the original series (Harvey and Jager (1993)). iii) The HP trend is sensitive to the ends of the sample, so there is considerable uncertainty in the predictions.

Band pass (BP) filter

Single Variable Beveridge-Nelson (BN) filter

A possible criticism of this method may be the fact that two ARIMA models with similar short-term prediction properties may differ significantly in long-term prediction.

Multivariate Beveridge-Nelson filter

The brief principles of these tests, which can be found in Diebold and Mariano (1995), are as follows.

S 2 and S 2b tests

MR-test

Unit root test statistics

Model statistics

Forecast statistics

Időszak SC teszt MR teszt S2 teszt MR teszt S2 teszt MR teszt S2 teszt MR teszt S2 teszt MR teszt. Neményi Judit: A tőkebeáramlás, a makrogazdasági egyensúly és a hitelfelvételi folyamat összefüggései a Magyar Nemzeti Bank eredményeivel. Csaibók Attila: A SZELVÉNY HOZAMGÖRBÉNEK ÉRTÉKELÉSE A JEGYBANK SZEMPONTJÁBÓL.

András Mihály Kovács - András Simon: DIE KOMPONENTE VAN DIE REGTE WISSELKOERS IN HONGARYE.