Tourists visiting Mexico often get traveler's diarrhea, a disease also known as the revenge of the last Aztec emperor, Montezuma II. In the early stages of colonization, a formidable Spanish army plundered the vast wealth of the Aztec Empire and sent it back to Europe.

Overview

- Fundamental sources of economic growth

- The big push

- The curse of the resources

- Growth failures

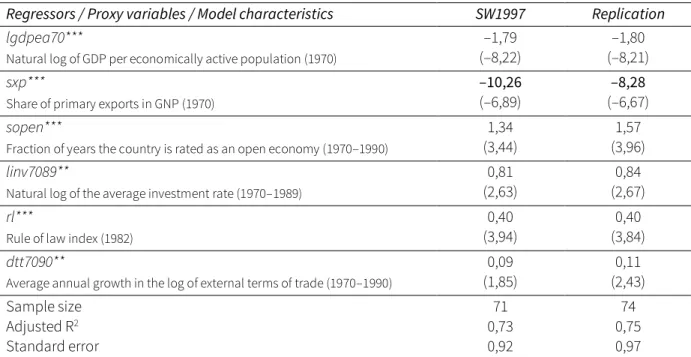

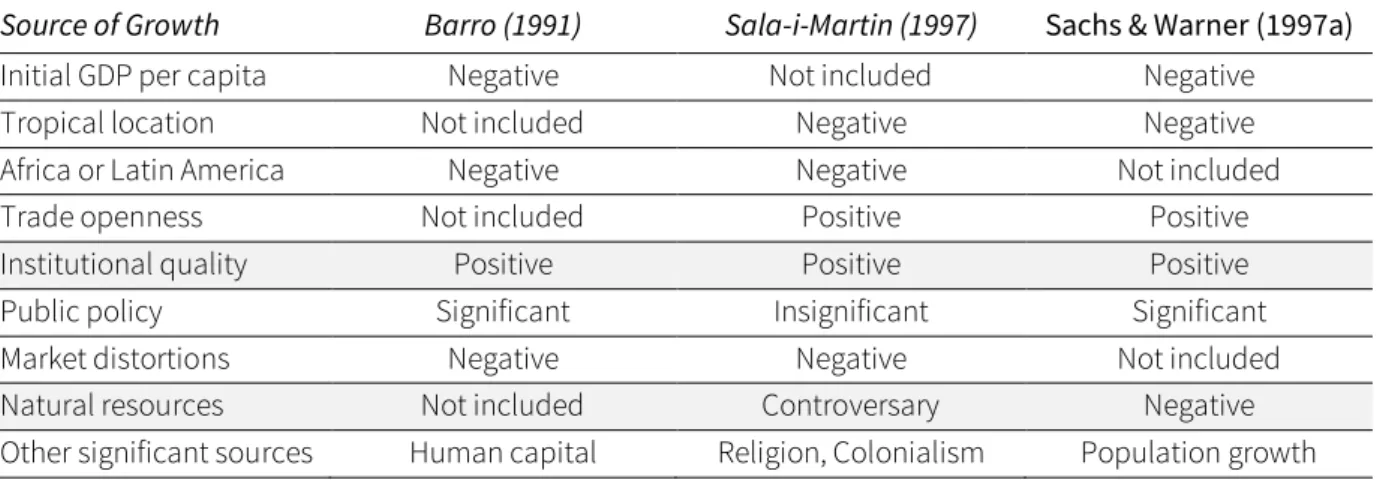

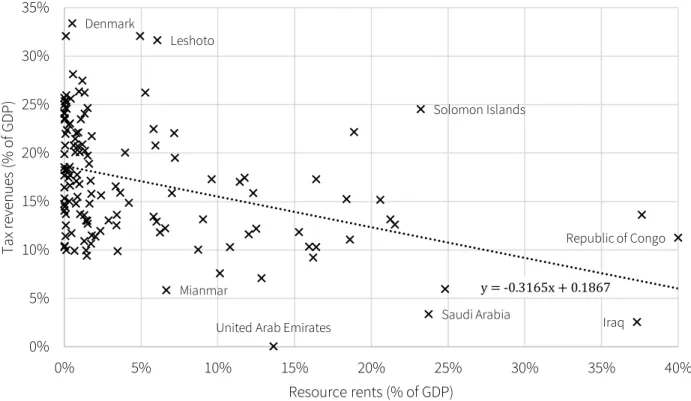

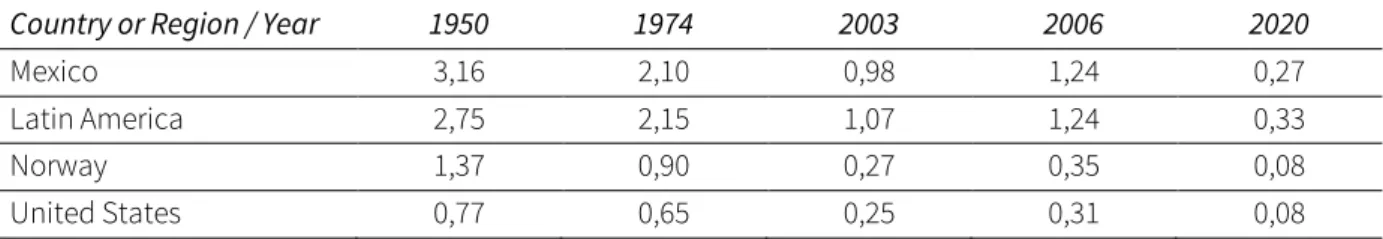

Another interesting feature of the neoclassical growth model is that growth rates tend to be correlated with the initial level of GDP per capita. On the other hand, the dependency interpretation would only suggest that the curse stems from the relative dominance of the extractive sector.

Empirical evidence

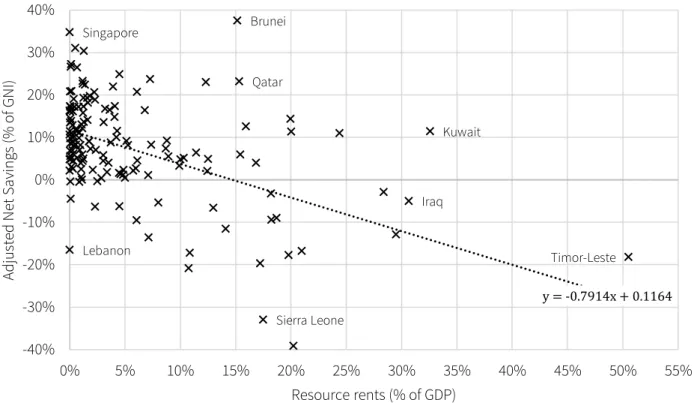

This composite was found to be significantly and negatively related to the share of primary exports, supporting the social aspect of the resource curse theory. Even at fairly high income levels, happiness appears to be endogenous in terms of individual consumption, suggesting that this new layer of the resource curse is closely related to economic growth failures.

Controversies and outliers

Contrary to the SW papers, she found a positive and significant impact of resources during the period from 1970 to 2000 and stated that the resource curse theory was a red herring (Brunnschweiler & Bulte, 2008). Overall, the story behind the resource curse theory seems too complex to be captured by growth regressions alone (Stijns, 2005).

Research hypotheses

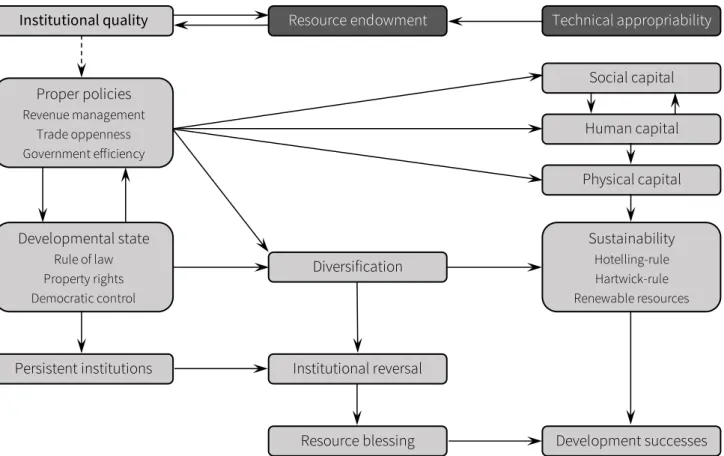

This inconvenient conclusion highlights the stubborn nature of the resource curse: once symptoms develop, there are no internal options for escape. A comparative analysis of these cases (see Chapter 5) confirms my hypothesis about the institutional state (see H2), while the conclusions from the discussion are consistent with the predictions of the proposed model.

Dutch disease

- Original model framework

- Deindustrialization

- The Balassa-Samuelson effect

- Spillover effects

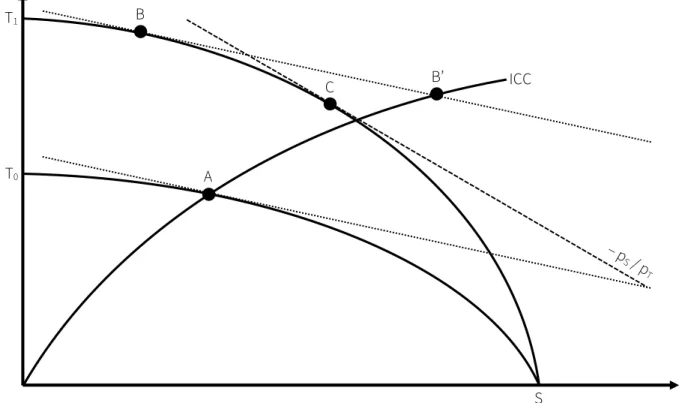

In the goods market (see Figure 10), the final equilibrium arises at point C, where the new price ratio (shown by the dashed line) is equal to the marginal rate of transformation. Compared to the pre-boom equilibrium, output rises in the resource sector and falls in manufacturing, while the impact on services depends on the relative strength of the spending effect.

Crowding-out

- Physical capital

- Human capital

- Social capital

- Financial capital

- Foreign capital

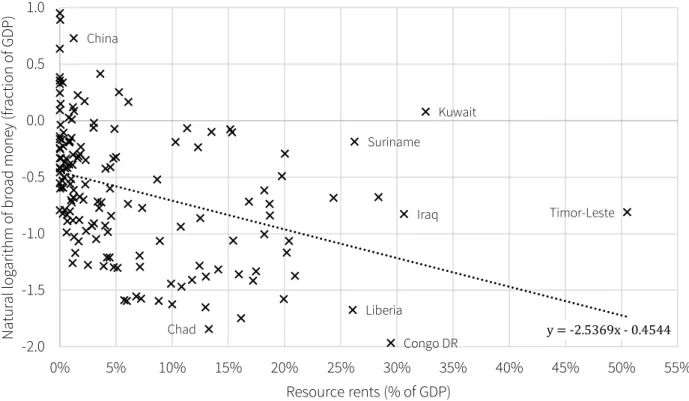

A significant negative relationship supports the concept of crowding out in terms of the maximum. Therefore, in terms of the resource curse theory, financialization is likely to affect natural wealth and increase the crowding out of social capital.

Limitations of classic theories

However, given the well-founded theoretical background and the lack of conflicting evidence, it is likely that "hidden" crowding out of foreign capital will still occur in most resource economies. investment in manufacturing would reduce the resource sector premium and reduce the effect of deindustrialization. This approach allows us to see the resource curse as a management problem and explains why only a handful of countries could turn it into a blessing. Although growth regressions regularly confirm the resource curse at the level of the broad concept, it quickly became apparent that not all countries are affected equally or to the same extent.

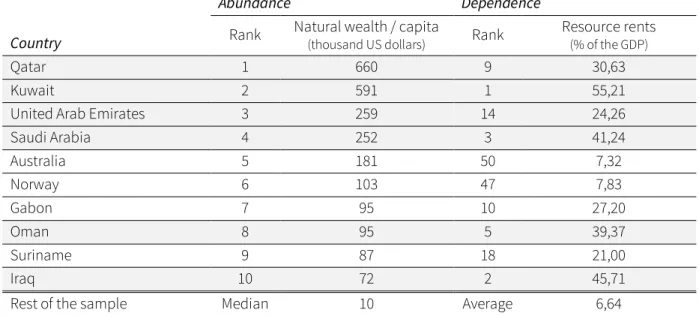

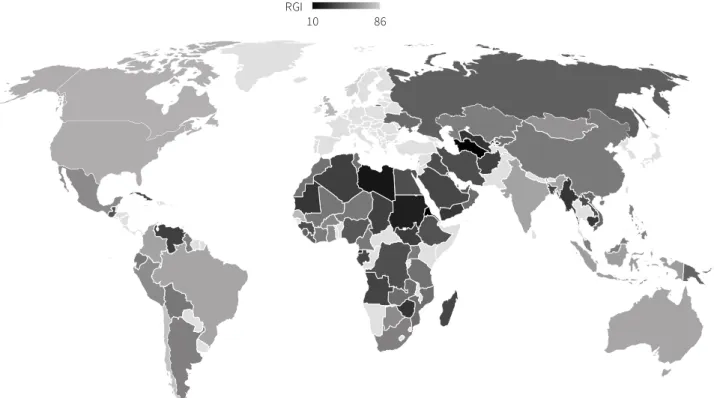

Abundance vs. dependence

Correspondingly, five of the least numerous141 are found in the bottom 10 of the dependency ranking. Furthermore, only four out of the 43 developed countries142 have a higher rank in dependency, while the same applies to all low-income economies. Still, in terms of abundance, these countries are relatively resource-poor, as their natural wealth per capita per capita is much less than the average of the sample.

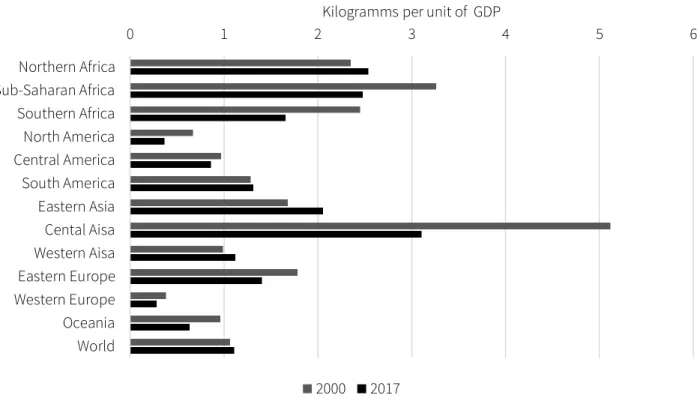

Indirect transmission channels

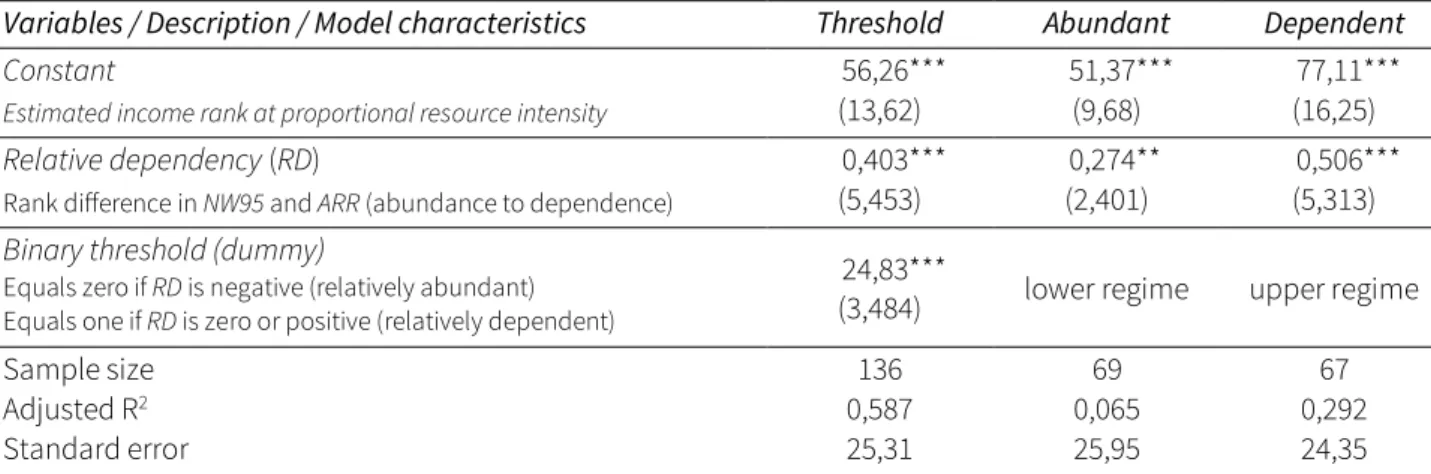

Regardless of this questionable causality, realizing the importance of the distinction between abundance and dependence has greatly improved our understanding of the resource curse. This two-step method first considered the displacement and then its growth effects to calculate the relative importance of each channel as a percentage of the total impact (see table below). Internationally, the most important transmission channel is investment displacement, which accounts for 41% of the indirect negative impact of natural resources.

Threshold effects

This mechanism corresponds with the deindustrialising effect of the Dutch disease, but also with the arguments about the lower willingness to save due to the false sense of security of the windfalls. His analysis became an important piece of evidence, as the introduction of the threshold had doubled the explanatory power of the original model. Answering this question requires an extension of the analysis to the domain of institutional economics, as even the very early literature recognized the importance of these factors in terms of development outcomes.

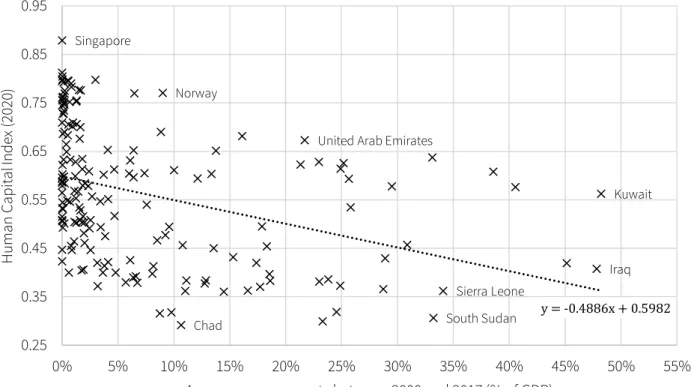

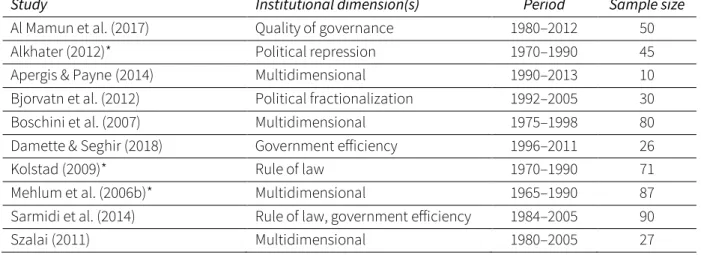

The appropriability hypotheses

A new term, technical resource suitability, was first introduced by Boschini et al. 2007) to describe the potential with which a particular resource can influence economic growth. Growth effects are conditional and non-monotonic due to the interaction of the physical properties of the resource and the institutional environment of its extraction. The interaction was positive and highly significant in the case of the last three, and the coefficient increased with technical adequacy.

Microeconomic foundations

While the surplus from production is unaffected, the rent-seeking curve shifts upward (𝜋G1) as rising resource revenues expand the size of the common pool. This loss offsets the positive income effect of the resource boom and demonstrates the curse directly at the micro level. Without discussing the details, the institutional parameter basically sets the position of the rent-seeking curve (𝜋G in Figure 23) and gives rise to two different equilibria.

Centralized models

The rentier state

Their decision depends on the government's transparency as well as its enforcement policy. 182 Not to be confused with the consumption effect of the Dutch disease model discussed in section 2.1. Furthermore, the model suggests that "the magnitude of this adverse effect is entirely dependent on the extent of repression" (Alkhater, 2012,.

Resources and democracy

They constructed a new historical database to test whether resource booms affect the type of political regime. According to the majority of available statistical evidence, resource abundance has mostly fueled autocratic regimes since the 1970s. Therefore, most of the empirical studies are limited to the oil-democracy relationship and do not involve other natural resources.

Resources and regime survival

Empirical evidence

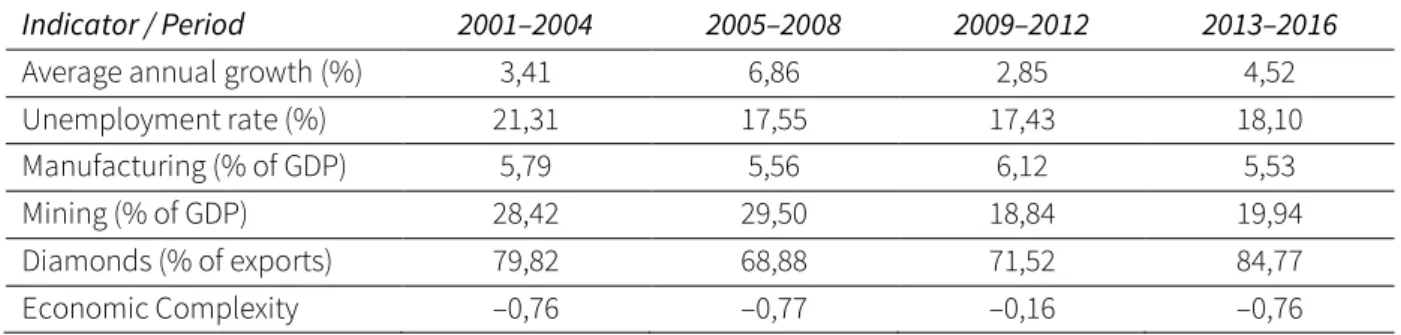

On the other hand, since the first wave of the resource curse literature, we also suspect that natural wealth tends to hinder growth (see Table 5). This approach generated substantial evidence not only for the conditional theory of the resource curse, but also for its institutional reversal. Therefore, the experiment suggests that the reversal of the resource curse is achievable if rich countries focus on the development of their political institutions.

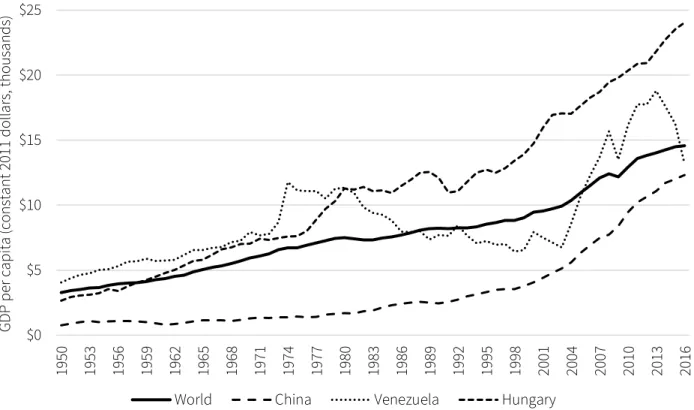

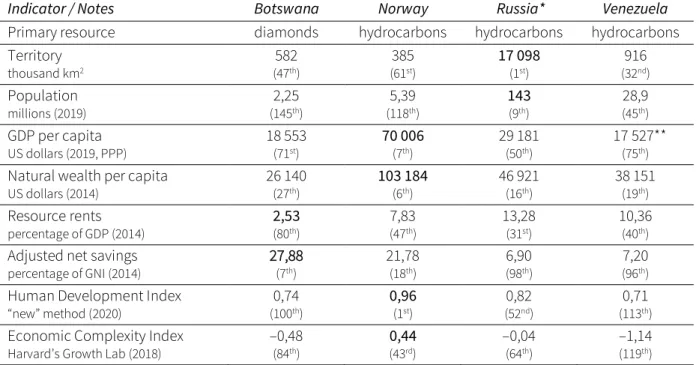

Endogenous institutions

Despite some minor details, I now find it reasonable to argue that the puzzle of the resource curse has been completed at least at the level of the broad concept200. Meanwhile, Russia began the period with almost 10 years of decline due to the collapse of the Eastern Bloc and the Soviet Union itself. 204 Please note that Russia is currently under a partial Western embargo due to its occupation of the Crimean Peninsula.

Botswana

224 The strong increase in trade with Namibia is largely due to the relocation of a diamond sorting plant to Gaborone in 2012. 226 The Republic of South Africa accounts for almost 90% of SACU's total population, GDP and also manufacturing output. In fact, a significant proportion of the diamond windfall is simply pumped through the country in exchange for South African products.

Norway

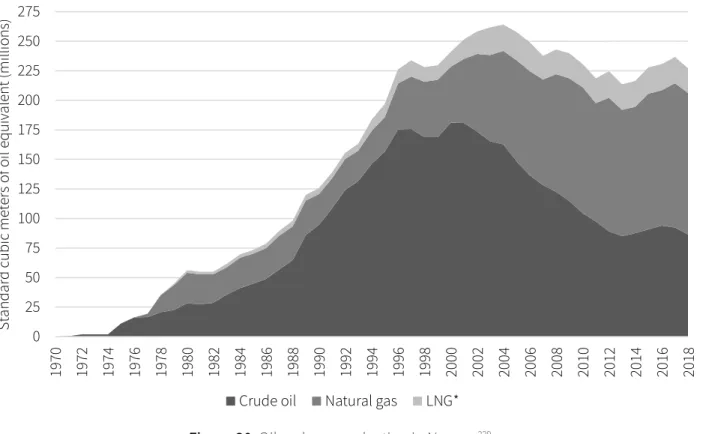

In addition to the return on Equinor shares, the Norwegian state receives most of its oil windfalls through a specific tax system (see Figure 32). Thus, by carefully following fiscal principles, Norwegian governments have managed to contain the domestic aspects of the spending effect. All in all, the Norwegian solution successfully eliminated most of the adverse effects and turned the abundance of resources into a socio-economic boon.

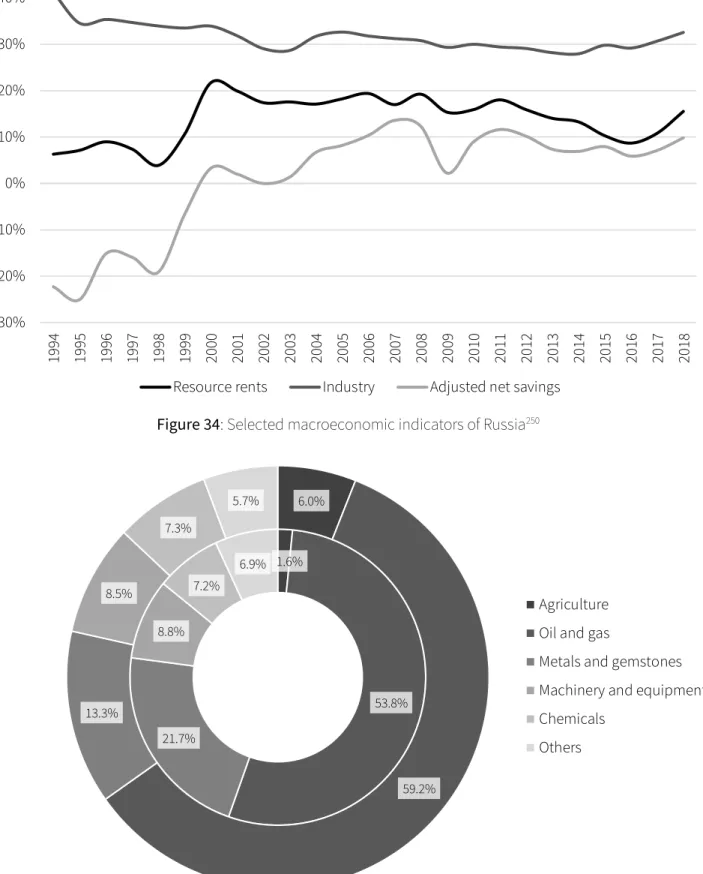

Russia

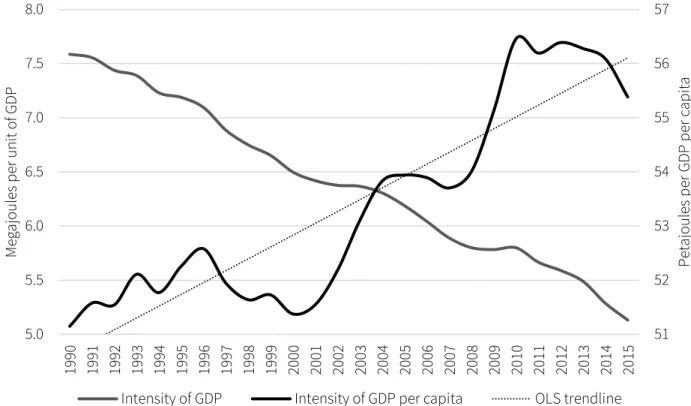

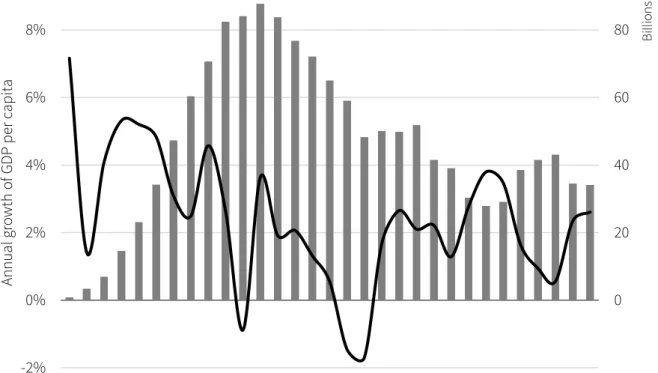

While industrial production had shrunk significantly after the collapse of the Soviet Union248, the politically independent Russian Federation became economically more dependent on resource extraction (see Figure 34). During the transition in the late 1990s, real wealth in Russia was shrinking by about 20% of GNP each year. In addition to being the backbone of the economy, hydrocarbons also play a crucial role in Russian politics, both in domestic and foreign affairs.

Venezuela

In total, private companies had invested almost 11 billion US dollars until the beginning of the Bolivarian Revolution (Monaldi et al., 2021). 261 According to the current constitution, the country's official name is the Bolivarian Republic of Venezuela. In fact, the story of Bolivarian Venezuela stands as a perfect example of power advantage.

Curse or blessing?

Therefore, the resource boon scenario disengages the country from extractive industries by catalyzing productivity improvements in the rest of the economy. This outcome is consistent with the big shock theory (Murphy et al., 1989, see Section 1.1.2) as well as with the predictions of the augmented Solow model. Notwithstanding some open questions about the exact nature, as well as the mathematical modeling of these mechanisms, I argue that the resource curse puzzle is indeed complete, at least at the level of the big picture.

Policy considerations

- Fiscal policy

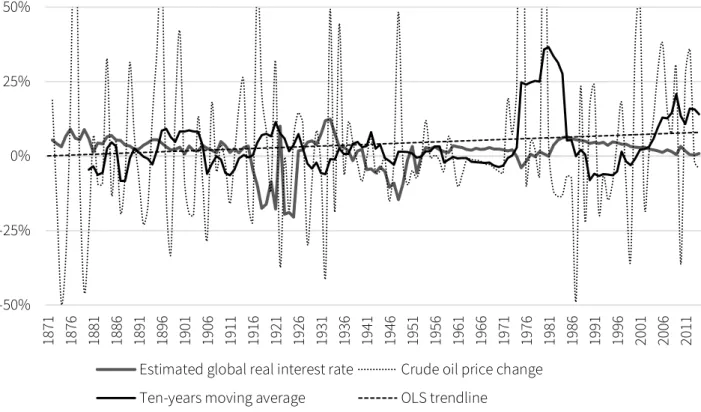

- Monetary policy

- Trade policy

- Transparency and accountability

- Institutional change

Moreover, targeted and controlled government expenditure can also contribute to combating the Dutch disease. This policy has facilitated technology transfer and helped eliminate the resource-movement effect. Hence, natural wealth tends to erode both transparency and accountability, further emphasizing that the resource curse resembles the Gordian Knot problem.

The role of international organizations

If the developed world takes its own rules of the game seriously, it must act against the free trade of stolen goods by imposing an effective resource embargo on exporters with insufficient institutional quality. Military efforts, such as in Iraq or Afghanistan, will never solve the problem, as they spread violence and transfer ownership of natural wealth, but do not provide the means for good governance309. Unfortunately, just as most exporters are trapped in the resource trap, developed economies depend on imports of the same goods.

Outlook: The efficiency of economic aid

Yet most foreign aid programs are far from uniquely successful: as in the case of the original resource curse hypothesis (see Table 7), the empirical evidence related to the development effects of economic aid is also mixed and often controversial. Instead, it had significantly increased public spending and the size of government, suggesting low social returns. 2020) estimated that the rent captured by recipient countries' political elites averages 7.5% of their GDP, suggesting a significant risk of corruption.

Concluding remarks

1996b) Determinants of Economic Growth: A Cross-Country Empirical Study (NBER Working Papers No. 5698) NBER Working Papers. 2015) Political and Commercial Dynamics of Russia's Gas Export Strategy (OIES Papers No. 102) OIES Papers. 2011) "The Natural Resource Curse: An Empirical Survey of the US 2008) Sub-Saharan Africa and the Resource Curse: The Limits of Conventional Wisdom (DIIS Working Paper No. 2008/14).