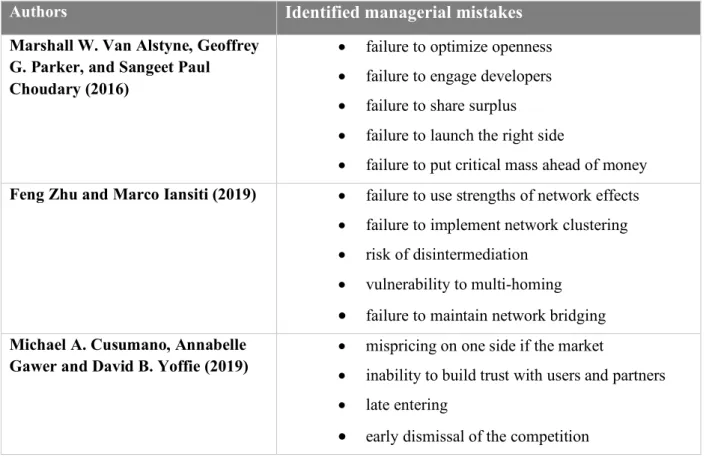

The research highlighted the issue of using traditional methods in the evaluation of platforms; a predicative model was constructed through multiple discriminant analysis, which provides a tool for predicting platform failures based on open source data. However, previous research on platform evaluation is limited and there is no discussion of any hints or premises about platform failures. Most of such papers describe typical management mistakes that lead to platform failures.

Thus, the expected results are 1) to reveal the irrelevance of traditional financial approaches used to evaluate the performance of companies and the probability of collapse in case of platforms, 2) to determine the factors that make the analysis and evaluation of platforms important and help predict the failure of the company of that type. The third chapter aims to determine a combination of factors that can be considered as premises of platform failures through the application of multiple discriminant analysis (MDA).

Platform overview and specifics

Platform definition and typology

Two-sided platforms minimize transaction costs between entities that can benefit from coming together and allow the value-creating exchanges to take place that would not otherwise occur (Evans D., Schmalensee R., 2007). According to Evans (2009), two-sided platforms are the most important form of business organization in many industries. In practice, two-sided platforms often earn most of their incremental profits on one side and can provide services to the other side at prices below incremental costs.

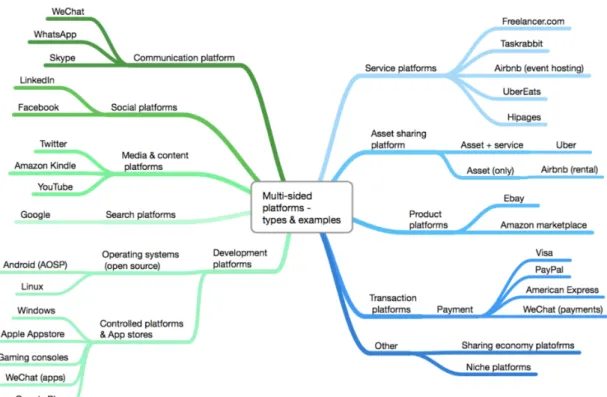

Two-way platforms minimize transaction costs between entities that can benefit from the merger, allowing value-creating exchanges to occur that would not otherwise occur. There are different types of platforms that involve different ways of creating value, figure 1 illustrates the distinct types of multifaceted platforms with examples.

Network effects and multi-sided markets

The total value created by a multi-faceted platform can exceed the sum of its parts, but only if the platform is properly structured.11. Pricing strategy, like investment strategy in a two-sided market, is closely related to network effects between the two sides of the platform. In such markets, the value of the platform for a member of each group is positively related to the number of users on the other side of the platform.

The platform can influence transaction volume by increasing the price on one side of the market and decreasing it on the other. Multi-sided markets work best when supply on one side of a market complements supply on the other side of the market.14.

Comparison between platforms and conventional value chains

A two-sided market can create value by simplifying and speeding up transactions, as well as lowering their costs for the parties that connect them. Two-sided marketplaces have an advantage over traditional one-sided marketplaces (often found in service- or manufacturing-oriented businesses), which at some point experience diminishing returns on market growth (customer acquisition).15. Evans (2009) states that in two-sided market, profit maximization calculations are more complex than those of conventional business.

According to Wright (2004), one-sided markets do not have stable and constant groups of intermediaries unlike two-sided markets. Furthermore, in two-sided and multi-sided markets, firms cannot own any assets to carry out their main activities.

Platform valuation

- Platform strategies

- Assessment of platforms potential

- Issues of platform valuation

- Reasons for platforms failure

This may include identification of the platform's monetization model and its associated strengths and weaknesses in terms of user acquisition and retention (Kasper T. Hessellund, Thor K. Sørensen, 2019). Most platforms are asymmetric in the sense that the two sides (consumers and producers) do not benefit equally from the value of the network. Terminal value: usually the terminal value accounts for more than half of the enterprise value of a mature firm.

Although relative valuation is more simplistic than intrinsic valuation approaches, in the context of young companies both approaches have significant shortcomings – which is why analysts rarely rely on just one of the alternatives (Kasper T. Hessellund, Thor K. Sørensen, 2019). When assessing the potential of the platform business model, as evidenced by the so-called “FANG” companies (Facebook, Amazon, Netflix and Google), venture capital investors needed the actionable price metric to justify the enormous amount of capital. they invest in such companies (Kasper T. Hessellund, Thor K. Sørensen, 2019). Customer Lifetime Value (CLTV) is one of the most important metrics to measure for any growing business.

CLTV provides an understanding of promotion costs, which can further help optimize and budget. Apple and Google, two of the most valuable companies in the world, have seen their share of platform failures. Inability to launch the right side: Platform managers need to determine exactly which side of the platform market to emphasize and when.

Failure of Imagination: One of the most common failings of a platform is that you simply cannot see the platform working at all. Existing platform owners can reduce multihoming by locking up one side of the market (or even both sides). Mispricing on one side of the market: A successful platform often requires a takeover by one side of the market to encourage the other side to participate.

Without that trust, product users must take a leap of faith, which many are unwilling to do. The research described in full describes the factors related to the non-financial characteristics of the firm that lead to failure.

Platforms failure premises determination

- Methodology and data samples

- Key concepts and metrics

- Model and outcomes of quantitative analysis

- Analysis of results

Key metrics of the model are described as in the textbook for SPSS Statistics Handbook on Multivariate Data Analysis Using SPSS.37. Discriminant coefficient: The discriminant function coefficients are partial coefficients that reflect the unique contribution of each variable to the classification of the groups in the dependent variable. Group centroids: Group centroids are the average discriminant scores for each group in the dependent variable for each of the discriminant functions.

Canonical correlation: Canonical correlation is a measure of the association between groups in the dependent variable and the discriminant function. The p-value may depend on the sample size, for large sample the p-value is usually very high. Sample size: As a rule, the sample size of the smallest group should exceed the number of independent variables.

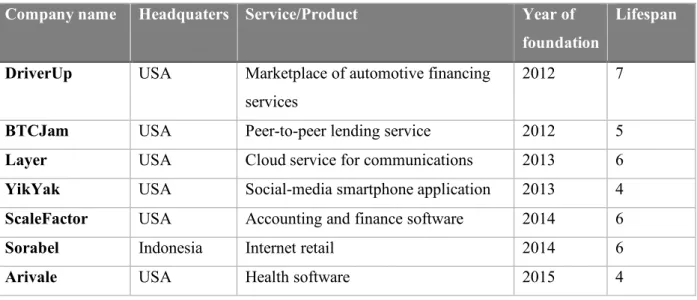

The measurement of competition was considered from two aspects: local market share (%) and global market share (%) that the company gained by the end of the 4th year. Amount of Total Funding: The total funds raised by the end of year 4 was included in the model as one of the important factors. The variance-covariance structure of the independent variables is similar within each group of the dependent variable.

An analysis of previous research has highlighted several factors that can influence a company's performance. The Z-value ranges represent the possibility that a company will fail after 4 successful years or survive in the next 3 years. There is a direct correlation between the Z value and the local market share - the higher the company's share by the end of year 4, the better the company's chance of survival in the next 3 years, which means an increase in value. of these metrics reduces the risk of closure in the forecast period.

But the overall correlation is the following – the higher the financing company travels during the first 3 years, the more chances it has to survive in the nest 4 years. This can be useful to assess the company's current performance and its ability to survive in the next 3 years.

First, given the newness of the technology, platform companies are often young and have little track record or comparable peers. The thorough analysis of the studies on platforms and their valuation showed that previous research on the evaluation of platforms is limited and there is no discussion of any tips or premises of platform failures. The first chapter of this article is devoted to the nature of platforms, characteristics of multi-sided markets and distinction between platform and pipeline types of organizations.

This chapter provides definition and typology of platforms, describes their main characteristic - the network effects and gives a picture of multifaceted markets. Other implications of the research outcomes could be the application of the model by managers of young platforms that reach 3.9-4 years of life. Even the gray zone of Z-value assigned to the company should be a signal for both manager and investor to pay attention to the performance of the company and dig deeper into the possible issues and risks within assessment and valuation.

Those limitations are: size of the sample (the further research must definitely contain the wider lists of both groups of companies analyzed), factors and measures in the model (in the case of activated option to reveal certain private data to the researcher get, other factors must be taken into account and embedded in the model), data availability (the possible overcoming of this limitation would allow much deeper and qualified analysis of platform performance and, more importantly, platforms' failure) and period of forecasting ( more accurate and precise forecasting can be proposed if the forecasting periods are shortened, the sample is enlarged and the number of factors considered is increased). The analysis of mergers involving multifaceted platform businesses //Journal of Competition Law and Economics. ABA Section of Antitrust Law, Market Definition in Antitrust: Theory and Case Studies, forthcoming, available at SSRN: https://ssrn.com/abstract=1396751.

Unlock the value of the platform economy, Master the good, the bad and the ugly. Linking customer and financial metrics to shareholder value: The leverage effect in customer-based valuation //Journal of Marketing. Available at: