We then explore the role of state ownership in the internationalization of post-Soviet emerging markets and then turn to the empirical investigation of Russian state-owned companies. To analyze and systematize the effect of the external environment on the international strategies of companies. Systematize the characteristic features of the phenomenon of state capitalism and its implications in the international strategies of companies;

To investigate the influence of the state ownership on the development of the dynamic capabilities;. To analyze the results and incorporate them into the current debate on the internationalization of the EM SOEs. We have advanced knowledge about the details of the Russian context and the influence of these details on the international strategies of companies.

This article is the first part of the literature review carried out in the framework of the study. We further develop this synergy as a theoretical framework in our empirical study of the internationalization of the Russian state-owned enterprises. Thus, the broader question is as follows: how does state capitalism affect the internationalization of the Russian companies.

The article presents the analysis of theoretical and empirical research on the phenomenon of internationalization of state-owned enterprises (SOEs) from developing market countries. However, it is the synergy of theoretical approaches that can expand knowledge on the internationalization of state-owned enterprises. The issue of the influence of the country's political course on the international strategies of SOEs also remains promising.

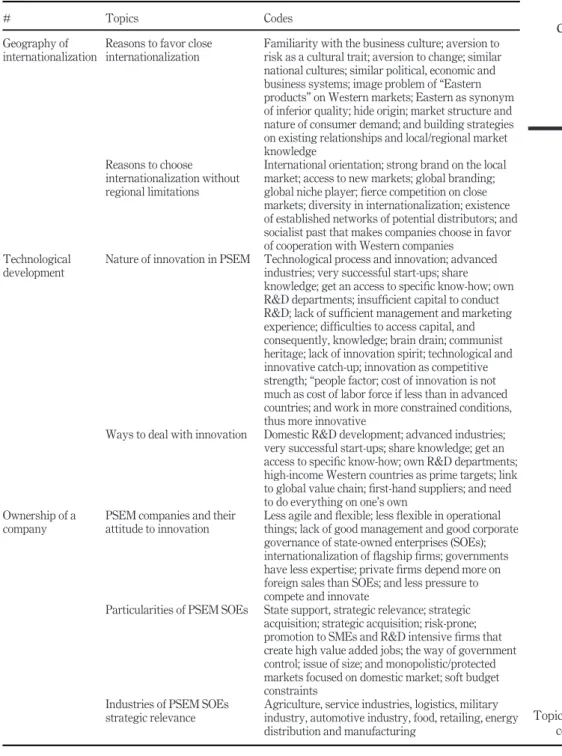

This combination allows for a comprehensive investigation of the DC that enabled the internationalization of PSEM companies. R&D is considered one of the proxies of absorptive capacity (Cohen and Levinthal, 1990), but is not the one who fully understands the essence of the concept (Camison and Forés, 2010). It results in opposition in the host markets, especially if the political regimes of the home and host governments differ.

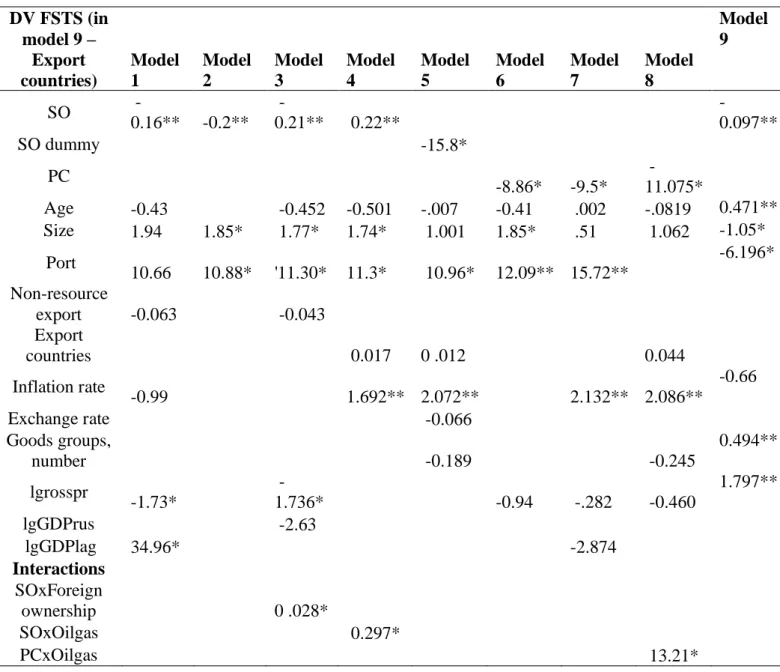

SO hybridization is the phenomenon that causes the spectacular diversity of. The independent variables we use represent the state's interest in the ownership structure of firms. This limitation is based on the general problem with secondary data that researchers of Russian companies acknowledge (Dikova et al., 2016, Puffer, McCarthy, 2011).

The study contributes to the debate on the interplay of political and economic reasons behind the internationalization strategies of Russian state-owned enterprises (Panibratov, Michailova, 2019).

FSTS 1.0000

Export

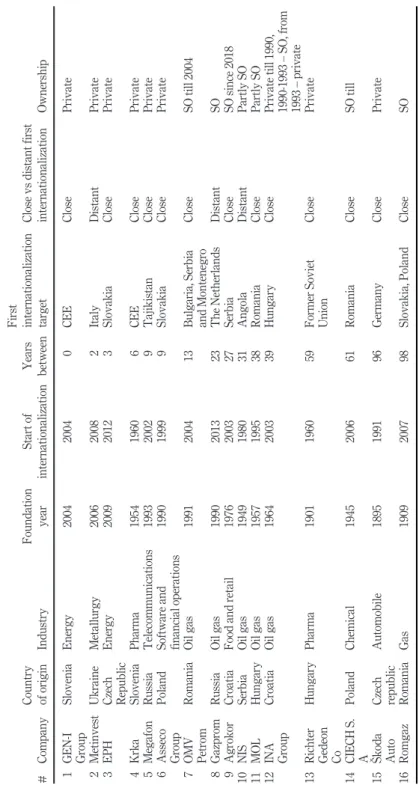

SOEs from emerging markets that internationalize are at the center of a heated debate in international business and management literature. The purpose of this study was to investigate the particularities of EM SOEs' internationalization and to investigate how state ownership of these companies affects the international expansion of these companies, as researchers are far from consensus on this issue. We achieve this goal by examining the theoretical basis of EM SOEs' internationalization, the core of the scientific debate and the current development of the topic, specifications of the emerging market contexts and especially the empirical context of Russia, which we chose as a research environment.

We then study the role of state ownership in the internationalization of post-Soviet emerging markets and then move to the empirical study of the Russian state-owned companies, where we examine how the state affects the internationalization of companies with and without state ownership. We advance knowledge about the internationalization of EM SOEs in two significant ways: We have defined the theories and approaches used when investigating the phenomenon:. institutional theory, transaction cost economics, agency theory, political economy, resource-based view and resource dependence theory, all of which have potential in future studies on the internationalization of EM SOEs. We reveal that institutional theory is a leading theoretical lens that studies how the interplay between state ownership of firms and the institutional environment shapes their international strategies.

We unravel the need to apply theoretical approaches synergistically, to increase knowledge about the interplay of state ownership and internationalization of state enterprises. In this study, we chronologically systematize the theorizing about the internationalization of the EM SOEs and define the most current discussions on this topic. We reveal that in order to understand the influence of the state on corporate internationalization, one must start from the concept of state ownership, transcend the notion of state ownership and become trapped in international science with the phenomenon of state capitalism.

The study expands knowledge about the details of emerging markets and especially the Russian context and the influence of these details on the international strategies of companies. We show empirically and substantiate theoretically that in emerging markets where the role of the state was very viable, state capitalism manifests itself not only through the direct form of ownership of companies, but also through more subtle and less straightforward forms, such as political ties with companies. . We contribute to the international business and management literature by demonstrating that the state ownership and political connections in companies both negatively affect the internationalization activities of Russian companies, although there are moderators in this relationship, namely industrial and foreign ownership in companies.

The effect of state ownership on firms' FDI ownership decisions under institutional pressure: A study of outward-investing Chinese firms. The role of the country in explaining the internationalization of firms in developing markets .British Journal of Management. Retrieved from: https://www.oecd.org/corporate/Ownership-, &-Governance-of-State-Owned-Enterprises-A-Compendium-of-National-Practices.pdf.